Corruption Challenges – Lokpal, POCA, etc

More signs of overhauling the compliance framework

From UPSC perspective, the following things are important :

Mains level: Corruption, Red-tapism;

Why in the News?

Despite ongoing efforts to fight corruption, bureaucratic delays and bribery continue to be major obstacles to business growth in India.

What are the key sectors in India most affected by corruption and red-tapism, according to the “India Business Corruption Survey 2024”?

|

What are the four new labour codes?

- Code on Wages (2019): Standardizes wage-related laws, including minimum wages, timely payments, and equal pay for equal work.

- Industrial Relations Code (2020): Simplifies rules on trade unions, industrial disputes, and employment terms, allowing fixed-term employment.

- Occupational Safety, Health, and Working Conditions Code (2020): Ensures safe working environments, better health standards, and welfare for all workers across industries.

- Code on Social Security (2020): Expands social security benefits like provident funds, insurance, and maternity benefits, including gig and platform workers.

Why is the implementation of the four new labour codes crucial for India’s business environment?

- Simplification of Labour Laws: The four labour codes consolidate 29 existing laws, reducing complexity and making it easier for businesses to understand and comply with legal requirements. For instance, companies no longer need to navigate multiple regulations for wages, as the Code on Wages standardizes definitions and payment rules across sectors.

- Enhancing Ease of Doing Business: By reducing regulatory overlaps and streamlining compliance, the labour codes cut down bureaucratic delays and corruption risks. For example, under the Occupational Safety, Health and Working Conditions Code, a single license can cover multiple locations, simplifying operations for large businesses.

- Greater Workforce Flexibility: The new codes allow for fixed-term employment, enabling businesses to manage workforce needs based on demand without lengthy contractual obligations. For instance, manufacturing firms can now hire temporary workers for seasonal production spikes without facing penalties under outdated laws.

- Ensuring Social Security for Workers: The Social Security Code extends benefits like provident funds and health insurance to gig and platform workers, expanding the safety net. For example, delivery personnel working for online platforms now qualify for social welfare schemes, improving job security and worker welfare.

How can a digital-first approach, such as the ‘One Nation, One Business’ identity system, reduce bureaucratic inefficiencies and corruption in India?

- Simplified Business Registrations and Compliance: Currently, businesses need multiple identifiers like PAN, GSTIN, CIN, and state-specific licenses, leading to duplication and delays.

- A ‘One Nation, One Business’ system would unify these into a single digital identity, reducing the need for repetitive filings and lowering the chances of officials demanding bribes for faster processing.

- Reduced Human Discretion and Corruption: Digital systems provide automated checks and real-time tracking of applications, minimizing manual intervention.

- Businesses applying for pollution control certificates or labour permits could do so online, reducing face-to-face interactions where unofficial payments are often demanded to expedite approvals.

- Faster Approvals and Increased Transparency: A unified digital platform, similar to DigiLocker, could store pre-verified documents accessible to all regulatory bodies.

- This would enable faster processing of approvals like property registrations or drug licenses, reducing the delays and informal payments typically required to move applications through bureaucratic bottlenecks.

What lessons can India learn from global governance models, such as the United States’ Department of Government Efficiency (DOGE)?

- Streamlined Regulatory Processes: The DOGE focuses on simplifying government procedures by reducing redundant regulations and consolidating compliance requirements.

- India could adopt a similar approach by rationalizing overlapping laws and implementing a single-window clearance system to minimize delays and reduce the scope for corruption.

- Enhanced Digital Integration: The DOGE promotes digital platforms for real-time monitoring and automated decision-making. India could enhance its Digital Public Infrastructure (DPI) by integrating regulatory databases.

- Performance Accountability: The DOGE enforces outcome-based assessments to measure the efficiency of public officials. India could implement performance metrics for government departments.

Way forward:

- Adopt a Unified Digital Governance Framework: Implement a National Business Identity System to integrate all regulatory processes (e.g., taxation, labour compliance, environmental clearances) under a single digital platform.

- Strengthen Institutional Accountability and Oversight: Establish an Independent Regulatory Oversight Body to monitor public service delivery using performance-based metrics.

Mains PYQ:

Q In the integrity index of Transparency International, India stands very low. Discuss briefly the legal, political, economic, social and cultural factors that have caused the decline of public morality in India. (UPSC IAS/2016)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Corruption Perceptions Index, 2024

From UPSC perspective, the following things are important :

Prelims level: Corruption Perceptions Index, 2024

Why in the News?

India has ranked 96 out of 180 countries in the Corruption Perceptions Index (CPI) 2024, released by Transparency International on February 11, 2025.

About the Corruption Perceptions Index (CPI), 2024

- The CPI is an annual ranking published by Transparency International, assessing public sector corruption perceptions across 180 countries and territories.

- The CPI score ranges from 0 to 100:

- 0 = Highly Corrupt

- 100 = Very Clean

- The index is based on expert analysis and business surveys from reputable institutions such as the World Bank and World Economic Forum.

- It highlights trends in corruption levels worldwide, enabling comparisons between countries and regions.

Significance of the CPI:

- The CPI helps assess the effectiveness of anti-corruption policies across countries.

- Corruption affects foreign investment, ease of doing business, and economic growth.

- The CPI 2024 emphasizes corruption as a major threat to climate action.

- Funds for climate mitigation and adaptation are often misused, delaying environmental progress.

- Countries with low scores face pressure to strengthen anti-corruption laws.

India’s Ranking in CPI, 2024:

- Overall Performance:

- India ranked 96 out of 180 countries, with a CPI score of 38 (dropping from 39 in 2023 and 40 in 2022).

- The decline highlights ongoing governance challenges, enforcement gaps, and institutional corruption issues.

- Comparison with Other Countries:

- China (76), Sri Lanka (121), Pakistan (135), and Bangladesh (149) ranked below India.

- Denmark remains the least corrupt nation, while over two-thirds of countries scored below 50, indicating widespread corruption.

- Challenges & Areas for Improvement:

- Weak enforcement of anti-corruption laws, regulatory loopholes, and opacity in political funding remain concerns.

- Strengthening institutional accountability, judicial independence, and transparency in governance is essential.

PYQ:[2017] With reference to the ‘Prohibition of Benami Property Transactions Act, 1988 (PBPT Act)’, consider the following statements:

Which of the statements given above is/are correct? (a) 1 only |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Lokpal and Lokayukta

From UPSC perspective, the following things are important :

Prelims level: Lokpal and Lokayukta; Powers and Functions

Why in the News?

12 years after its enactment, the Lokpal and Lokayukta Act, 2013, has seen limited impact, with the Lokpal ordering just 24 investigations and granting 6 prosecution sanctions.

History of Lokpal:

|

About Lokpal and Lokayukta

| Lokpal | Lokayukta | |

| About |

|

|

| Powers and Functions |

|

|

| Structural Mandate |

|

|

PYQ:[2013] ‘A national Lokpal, however strong it may be, cannot resolve the problems of immorality in public affairs’. Discuss. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Section 107 of the BNSS

From UPSC perspective, the following things are important :

Prelims level: BNSS, Section 107

Why in the News?

- The Bharatiya Nagarik Suraksha Sanhita (BNSS), 2023 introduced Section 107, which focuses on properties classified as “proceeds of crime”.

- Previously, this term was associated with laws like the Prevention of Money Laundering Act (PMLA), 2002 or within the Code of Criminal Procedure (CrPC) under provisions for attachment and forfeiture.

About Section 107 of the BNSS

|

Its significance

- Empowers Law Enforcement: It allows attachment of property during investigations, preventing criminals from hiding or transferring assets.

- Faster Relief for Victims: It enables quick distribution of proceeds of crime to affected persons even before the trial concludes.

- Stronger Deterrence: It acts as a deterrent by allowing the forfeiture of criminally acquired assets, impacting offenders financially.

- State-Level Enforcement: It empowers State governments to manage proceeds of crime, providing more localized control.

PYQ:[2021] Discuss how emerging technologies and globalisation contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Supreme Court to review PMLA verdict

From UPSC perspective, the following things are important :

Prelims level: Prevention of Money Laundering Act, 2002 (PMLA);

Mains level: Review power of Supreme Court;

Why in the news?

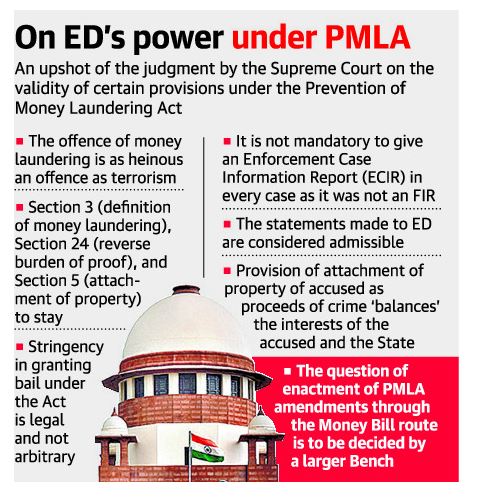

The Supreme Court has postponed its review of the decision to uphold key provisions of the Prevention of Money Laundering Act, 2002 (PMLA) to August 28.

Prevention of Money Laundering Act, 2002 (PMLA)

- The Prevention of Money Laundering Act, 2002 (PMLA) is a crucial legislative framework in India aimed at combating money laundering and related financial crimes.

- The PMLA was enacted by the Parliament of India and came into force on July 1, 2005. It was introduced to prevent money laundering and provide for the confiscation of property derived from or involved in money laundering.

- The main objectives of the PMLA are:

-

- To prevent and control money laundering.

- To confiscate and seize property obtained from laundered money.

- To address issues connected with money laundering in India.

What is the Case?

- On July 27, 2022, the Supreme Court upheld key provisions of the Prevention of Money Laundering Act, 2002 (PMLA) in the case of “Vijay Madanlal Choudhary v. Union of India”.

- The 540-page ruling accepted the government’s arguments on all challenged aspects, including reversing the presumption of innocence for bail, passing amendments as a Money Bill, and defining the Enforcement Directorate’s (ED) powers.

- On August 25, 2022, a different three-judge bench agreed to hear a review petition filed by Congress MP Karti Chidambaram. The petition raised concerns about at least two issues from the Madanlal decision.

What are the Grounds for Review?

- The Supreme Court’s verdict in Madanlal upheld stringent bail conditions for economic offences, imposing a reverse burden of proof on the accused.

- Petitioners argue that, without essential documents like an FIR, charge sheet, case diary, and prosecution documents, an accused cannot adequately present their case.

- The Madanlal verdict upheld Section 50 of the PMLA, allowing ED officials to record statements under oath, admissible in court. It distinguished ED officers from police officers, classifying their investigations as “inquiries.” Petitioners argue that the verdict overlooked provisions granting penal powers to the ED.

How is a Judgment Reviewed?

- The Supreme Court can review its judgments or orders under Article 137 of the Constitution.

- A review petition must be filed within 30 days of the judgment. Typically, review petitions are heard through written submissions (“circulation”) by the same judges who passed the original verdict, rather than in open court.

- Reviews are granted on narrow grounds to correct grave errors causing a miscarriage of justice. One common ground is “a mistake apparent on the face of the record,” which must be glaring and obvious, such as reliance on invalid case law.

Way forward:

- Enhanced Transparency and Documentation: To address concerns about the adequacy of case presentation by the accused, there should be a mandate for providing all essential documents such as FIRs, charge sheets, case diaries, and prosecution documents to ensure a fair trial process.

- Clarification of ED’s Powers and Procedures: Amendments to the PMLA should clearly define the scope and limits of the Enforcement Directorate’s powers, ensuring that ED officers are given appropriate procedural guidelines and oversight mechanisms to prevent misuse of penal powers and uphold due process.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Why Centre filed an application to modify 2G spectrum scam judgement

From UPSC perspective, the following things are important :

Prelims level: Spectrum

Mains level: What is the 2G scam case?

Why in the news?

Attorney General R Venkataramani, on April 22, mentioned an application filed by the Centre to modify the Supreme Court’s 2012 judgement in the 2G spectrum scam case.

What is the 2G scam case?

- In 2008, under then Telecom Minister A Raja, the Department of Telecommunications (DoT) issued 2G spectrum licenses to specific telecom operators on a first-cum-first-serve basis.

- In 2009 ,the Central Vigilance Commission directed the CBI to investigate claims that there were illegalities in the allocation of licenses, following which the CBI filed a first information report against unknown officers of the DoT, private persons and companies.

- In the meantime, the Centre for Public Interest Litigation and Subramanian Swamy filed petitions at the Supreme Court alleging a Rs 70,000 crore scam in the grant of telecom licenses in 2008.

- In 2010, the Comptroller and Auditor General of India (CAG) filed a report claiming that the allocation had caused a loss of Rs 1.76 lakh crores to the public exchequer. Raja resigned shortly after.

- In 2011 the CBI filed its first chargesheet, in which Raja was an accused.

- In February 2012, the Supreme Court cancelled the 122 licenses granted during Raja’s tenure. The court found that Raja had allocated licenses in 2008 based on 2001 prices in order to benefit specific private telecom operators.

Why is the Centre seeking a modification of the apex court’s decision?

- Need for Non-commercial Use: The Centre highlights that spectrum allocation is essential not only for commercial telecommunication services but also for public interest functions such as security, safety, and disaster preparedness. These functions may not always align with the profit-oriented nature of auction processes.

- Situational Preferences: The Centre argues that there are situations where auctions are not technically or economically preferred or optimal. This could include scenarios where there is a one-time or sporadic use of spectrum, which may not justify the complexities and costs associated with conducting auctions.

- Court’s Clarification on Auctions: The Centre refers to the Supreme Court’s clarification in September 2012, stating that the auction method prescribed in 2012 was not a constitutional principle and not an absolute or blanket statement applicable across all natural resources. The Court expressed respect for the executive’s discretion in such matters.

- Seeking Clarity for Administrative Process: In light of the Court’s clarification, the Centre seeks clarity on whether it can allocate 2G spectrum in the future through an administrative process if determined through due process and in accordance with the law. This indicates a desire for flexibility in spectrum allocation methods based on situational considerations and public interest needs.

Conclusion:

Need to implement transparent processes for the allocation of public resources such as spectrum. Clearly outline the criteria, procedures, and timelines for allocation, and ensure that these are accessible to all stakeholders.Establish independent oversight bodies or regulatory agencies to monitor and audit the allocation process.

Mains PYQ:

Q What is mean by public interest? What are the principles and procedures to be followed by the civil servants in public interest? (UPSC IAS/2018)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Adjudication Process under the Prevention of Money Laundering Act (PMLA)

From UPSC perspective, the following things are important :

Prelims level: PMLA, 2002; Adjudication Process under PMLA, ED, FIU

Mains level: NA

Why in the news?

- The Adjudicating Authority under the Prevention of Money Laundering Act, 2002 (PMLA) has confirmed the attachment of assets worth Rs 751.9 crore linked to a politician family.

- The Enforcement Directorate (ED) had provisionally attached these properties in PMLA case.

About Prevention of Money Laundering Act (PMLA), 2002

| Details | |

| Precursor | Enacted to fulfill India’s global commitments to combat money laundering, aligning with international conventions such as:

|

| What is it? |

|

| Amendments | Amended in the year 2005, 2009 and 2012. |

| Objectives |

|

| Regulating Authorities |

|

| Salient Features |

|

In news: Adjudicating Authority under PMLA

- The ED, empowered by Section 5 of the PMLA, provisionally attaches assets suspected to be acquired through criminal proceeds.

- These provisional orders, valid for 180 days, require confirmation by the Adjudicating Authority within the stipulated period to maintain legal validity.

- Role of the Adjudicating Authority:

- The Adjudicating Authority, appointed by the central government, reviews the attachment orders to ensure compliance with legal standards and procedural requirements.

- Failure to confirm the attachment within the prescribed timeline results in automatic release of the attached property.

- Legal Ramifications Post-Confirmation:

- Once confirmed, the accused retains the right to challenge the order within 45 days at the PMLA’s Appellate Tribunal.

- If the order is upheld, the accused may pursue further legal avenues, while the attached property remains inaccessible until the conclusion of legal proceedings.

- Impact on Property Owners and Enforcement Agencies:

- Confirmed attachments may lead to the ED taking possession of residential properties, compelling owners to evacuate.

- Attached properties, including vehicles, may deteriorate over time as legal battles prolong, with significant financial implications for both parties.

PYQ:

[2013] Money laundering poses a serious security threat to a country’s economic sovereignty. What is its significance for India and what steps are required to be taken to control this menace?

[2019] Consider the following statements: 1. The United Nations Convention against Corruption (UNCAC) has a ‘Protocol against the Smuggling of Migrants by Land, Sea and Air’. 2. The UNCAC is the ever-first legally binding global anti-corruption instrument. 3. A highlight of the United Nations Convention against Transnational Organized Crime (UNTOC) is the inclusion of a specific chapter aimed at returning assets to their rightful owners from whom they had been taken illicitly. 4. The United Nations Office on Drugs and Crime (UNODC) is mandated by its member States to assist in the implementation of both UNCAC and UNTOC. Which of the statements given above are correct? (a) 1 and 3 only (b) 2, 3 and 4 only (c) 2 and 4 only (d) 1, 2, 3, and 4 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Corruption has risen over the past five years, say 55% of respondents

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: ARC report;

Why in the news?

In the run-up to elections, political parties make allegations of corruption against their rivals to reach out to voters and influence voting patterns. So, let’s see about the corruption trend in India.

What is Corruption?Corruption refers to dishonest or unethical conduct by individuals or institutions, often involving the misuse of entrusted power or resources for personal gain. It can take various forms, including bribery, embezzlement, fraud, nepotism, cronyism, and favoritism. Corruption undermines the principles of fairness, integrity, and accountability in both public and private sectors. |

Corruption in India (Pre-poll survey of 2024 compared with 2019 Survey):

- Increase in Corruption: According to a pre-poll survey, more than half (55%) of respondents believe that corruption has increased in the past five years.

- The proportion of respondents believing that corruption has decreased has declined significantly, from 37% in 2019 to 19% in 2024.

- Causes for Corruption in India: A majority of respondents (56%) hold both Union and State governments responsible for the increase in corruption, with a higher proportion blaming the Union government specifically.

- Across Spatial Consistency: Regardless of whether respondents live in villages, towns, or cities, the perception of increased corruption is widespread.

- Opinion of Respondents: Both rich and poor respondents largely agree that corruption has increased, though there is a slight increase in the perception of decreased corruption among richer respondents.

What does the 2nd Administrative Reforms Commission (ARC) report say?

- Lack of Transparency: The opacity of government processes and decision-making provides opportunities for corruption.

- Regulatory Environment: Cumbersome and complex regulations create opportunities for rent-seeking behavior by officials and bureaucrats.

- Political Interference: Politicization of administrative processes and appointments leads to patronage networks and favoritism, fostering corruption.

- Lack of Whistleblower Protection: The absence of robust mechanisms to protect whistleblowers discourages individuals from reporting corruption. Fear of retaliation and inadequate legal safeguards inhibit the exposure of corrupt practices.

- Weak Enforcement Mechanisms: Inadequate enforcement of laws and regulations allows corrupt practices to thrive.

Conclusion: To combat rising corruption in India, comprehensive measures including enhancing transparency, simplifying regulations, strengthening enforcement, depoliticizing administration, and implementing robust whistleblower protection are imperative for fostering integrity and accountability in governance.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

The legal issues surrounding Arvind Kejriwal’s arrest | Explained

From UPSC perspective, the following things are important :

Prelims level: Prevention of Money-Laundering Act, 2002 Act

Mains level: Application of Prevention of Money-Laundering Act, 2002 Act

Why in the news?

A Delhi Court on Thursday extended the Enforcement Directorate’s (ED) custody of Delhi Chief Minister Arvind Kejriwal till April 1 in the money laundering case

Context

Mr Kejriwal was arrested on March 21, hours after his plea for interim protection from arrest was rejected by the Delhi High Court. This is the first instance of a Chief Minister in India being put behind bars while still in office.

ED’s allegations against the Chief Minister

- Influence on Elections: The ED contends that Money received by AAP leaders from operators of alcohol businesses were used to influence the 2022 Assembly elections in Punjab and Goa.

- Favours to South Group: The excise policy was allegedly drafted with the intention of granting favors to the South Group

Legal issues

- Potential Involvement of AAP: If Kejriwal’s vicarious liability (This principle holds a person responsible for the actions of others, based on the concept of agency) is established, AAP could be impleaded as an accused in the case. This could lead to the attachment or confiscation of the party’s assets under the provisions of the Prevention of Money Laundering Act, 2002 (PMLA).

- Application of Section 70 of the PMLA: This section is often invoked to investigate companies involved in money laundering offenses. It holds individuals responsible if they were in charge or responsible for the company at the time of the offense. However, individuals may not be prosecuted if they can prove lack of knowledge or due diligence to prevent the offense.

- Definition of “Company”: Explanation 1 of Section 70 of the PMLA defines “company” broadly to include any body corporate, firm, or association of individuals. This could potentially encompass a political party under the definition, as per the Representation of the People Act, 1951.

What is (PML) Prevention of Money-Laundering Act, 2002 Act?

An Act to prevent money-laundering and to provide for confiscation of property derived from, or involved in, money-laundering and for matters connected therewith or incidental thereto.

Reliance on approver’s testimony

- Definition of an Approver testimony: An approver is someone who has been charged with a crime but later confesses and agrees to testify for the prosecution.

- Potential Consequences of False Deposition: An approver who provides false testimony can be retried for the offense for which the pardon was granted, according to Section 308 of the CrPC. This provision acts as a deterrent against perjury by the approver.

- Caution in Reliance: Courts exercise caution when relying on the testimony of an approver due to its inherently suspect nature. The testimony of an accomplice is considered tainted, and courts are wary of potential biases or falsehoods.

- Corroboration Requirement: To ensure the reliability of the approver’s testimony, corroboration from independent evidence is typically required.

- Judicial Precedents: The Supreme Court, in cases like Mrinal Das and Ors. v. State of Tripura (2011), has emphasized the importance of corroborative evidence in convicting the accused based on the testimony of an approver.

- Judicial Scrutiny: Courts meticulously scrutinize the testimony of an approver and assess its credibility in light of corroborative evidence and other factors.

Conclusion

Arvind Kejriwal’s arrest in a money laundering case raises legal complexities, including potential involvement of AAP, application of PMLA, and reliance on approver’s testimony, necessitating cautious judicial scrutiny.

Mains PYQ

Q Money laundering poses a serious security threat to a country’s economic sovereignty. What is its significance for India and what steps are required to be taken to control this menace? (UPSC IAS/2013)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Section 120B of the Indian Penal Code (IPC)

From UPSC perspective, the following things are important :

Prelims level: Prevention of Money Laundering Act (PMLA), 2002

Mains level: NA

Why in the news?

- The Supreme Court has rejected review petitions challenging its ruling on the initiation of proceedings under the Prevention of Money Laundering Act (PMLA).

- The judgment clarified that Section 120B of the Indian Penal Code cannot be invoked for PMLA proceedings unless the alleged conspiracy pertains to a scheduled offence.

Prevention of Money Laundering Act (PMLA), 2002

Penalties under PMLA:

Authorities for investigation under PMLA:

|

What is Article 120 of Indian Penal Code (IPC)?

- Section 120 of the Indian Penal Code (IPC) deals with the concept of “Conspiracy to commit an offense”.

- It states that when two or more persons agree to do, or cause to be done, an illegal act, or an act which is not illegal by illegal means, such an agreement is designated a criminal conspiracy.

- Section 120A defines “criminal conspiracy” as when two or more persons agree to do, or cause to be done, an illegal act or an act which is not illegal by illegal means.

- Section 120B prescribes the punishment for criminal conspiracy, with death, imprisonment for life, or rigorous imprisonment for a term of two years or upwards, shall be punished in the same manner as if he had abetted such offense.

Punishment for Criminal Conspiracy

- Nature of Conspiracy: IPC 120B categorizes conspiracy based on the gravity of the offense and prescribes punishments accordingly.

- Serious Offenses: Conspiracy to commit serious crimes punishable by death, life imprisonment, or rigorous imprisonment for 2 years or more warrants severe punishment equivalent to the offense committed.

- Other Offenses: Conspiracy for illegal acts not falling under the serious category incurs imprisonment for up to six months, a fine, or both, as per Section 120B.

Practice MCQ:Which of the following statements are correct regarding ‘Prevention of Money Laundering Act 2002 (PMLA)’? 1. Enforcement Directorate (ED) is responsible for investigating offences under the PMLA 2. The Act enables government authorities to confiscate property earned through money laundering. Select the correct answer using the code given below: (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

SC ends Immunity for Legislators taking Bribes

From UPSC perspective, the following things are important :

Prelims level: Parliamentary Privileges

Mains level: Vote for cash issue

In the news

- A seven-judge Constitution Bench of the Supreme Court, headed by Chief Justice of India DY Chandrachud, delivered a significant judgment regarding parliamentary privilege and criminal prosecution.

- The verdict overturned a 1998 ruling in PV Narasimha Rao Case that granted immunity to lawmakers accepting bribes if they subsequently voted or spoke in the House

Also read:

What are Parliamentary Privileges?

| Details | |

| Definition | Special rights, immunities, and exemptions enjoyed by Parliament, its committees, and members.

Defined in Article 105 of the Indian Constitution. |

| Scope | Applies to Parliament, committees, and members. |

| Freedom of Speech | Guaranteed under Article 105(1).

Subject to rules and procedures of Parliament (Article 118). |

| Limitations to Free Speech | Speech must comply with constitutional provisions.

Cannot discuss judges’ conduct (Article 121), except for motions for their removal. |

| Freedom from Arrest | Immunity from arrest in civil cases 40 days before and after sessions.

House permission needed for arrest within Parliament limits. |

| Notification of Arrest | Chairman/Speaker must be informed of any member’s arrest. |

| Right to Prohibit Publication | No liability for publishing reports, discussions under member’s authority (Article 105(2)). |

| Right to Exclude Strangers | Members have power to exclude non-members from proceedings. |

Immunity against Bribe: Constitutional Provisions Examined

- Article 105(2): This article grants immunity to members of Parliament from court proceedings concerning their actions (speech or votes) in Parliament.

- Article 194(2): Similarly, this article extends immunity to members of state assemblies.

Court’s Review and Interpretation

- PV Narasimha Rao Case: In 1998, the Supreme Court ruled with a 3:2 majority that MPs and MLAs were immune from prosecution in bribery cases as long as they fulfilled their end of the bargain.

- Judicial Scrutiny of Privilege: The Court revisited the interpretation of Articles 105(2) and 194(2), challenging the traditional understanding of absolute immunity for lawmakers.

- Historical Context: It noted that India’s parliamentary privileges stem from statutory and constitutional sources, unlike the UK’s House of Commons, which has ancient and undoubted rights.

Key Findings and Interpretations

- Necessity Test Applied: The Court applied a “necessity test” to determine the legitimacy of claims to parliamentary privilege, emphasizing that accepting bribes cannot be deemed necessary for lawmakers to discharge their duties.

- Emphasis on Probity: The ruling underscored the importance of probity in public life, highlighting the corrosive impact of corruption on democratic ideals.

- Interpretation of Offense: It clarified that the act of accepting a bribe constitutes an offense, regardless of subsequent actions by the lawmaker in the House.

Conclusion

- The Supreme Court’s ruling represents a significant departure from past precedent, affirming the principle that no individual, including legislators, is above the law.

- By asserting the judiciary’s role in scrutinizing claims of parliamentary privilege, the Court reaffirmed the primacy of constitutional values and accountability in governance.

- This landmark judgment underscores the judiciary’s commitment to upholding the rule of law and combating corruption, thereby bolstering India’s democratic foundations.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Legislators Immunity against Criminal Prosecution

From UPSC perspective, the following things are important :

Prelims level: Articles 194(2) (for MLAs) and 105(2) (MPs)

Mains level: Vote for cash issue

In the news

- The Supreme Court is set to decide if legislators (MPs and MLAs) enjoy immunity from bribery charges in connection with votes made in Parliament and Legislative Assemblies.

Legislators Immunity: Background and Context

- Constitutional Provisions: Articles 194(2) (for MLAs) and 105(2) (MPs) of the Constitution grant legislators immunity from legal proceedings concerning their speeches and votes in Parliament and Legislative Assemblies.

- P.V. Narasimha Case: In 1998, the Supreme Court upheld this immunity in the case of P.V. Narasimha Rao v State (CBI/SPE), ruling that legislators are shielded from criminal prosecution for bribery linked to their parliamentary actions.

Reasons for Reconsideration

- Sita Soren’s Case: The appeal by JMM MLA Sita Soren, accused of accepting bribes during Rajya Sabha elections, prompted a reevaluation of the Narasimha verdict.

- Interpretation Issues: Concerns were raised about the broad interpretation of immunity and its implications for combating bribery in legislative bodies.

Arguments Supporting Immunity

- Absolute Protection: Advocates contend that legislators enjoy complete immunity from legal action under constitutional provisions. They argue that the Speaker holds authority to address moral infractions through expulsion.

- Interpretation of Articles: The dissenting opinion in Narasimha sought to narrow the scope of immunity, but proponents stress adherence to the literal interpretation of constitutional language.

Arguments against

- Completion of Offence: Critics argue that the offence of bribery is consummated upon acceptance of the bribe, irrespective of subsequent actions. They advocate holding legislators accountable from the moment the bribe is accepted.

- Legitimate Legislative Actions: Distinguishing between legitimate and illegitimate actions, advocates assert that actions stemming from criminal conduct, such as vote-buying, should not be shielded by immunity.

Legal Interpretation and Statutory Compliance

- Prevention of Corruption Act, 1988: Critics highlight inconsistencies between the Narasimha ruling and the provisions of the PCA, emphasizing the need for alignment with anti-corruption legislation.

- Intent and Performance: Solicitor General Mehta underscored the disconnect between the Narasimha verdict and the intent of the Prevention of Corruption Act, particularly regarding the timing of criminal liability.

P.V. Narasimha Case (1998) AnalogyJudgement protects bribe-takers after there is “performance” (a speech or vote is given based on the bribe), even though Section 7 of the PCA specifically punishes public servants who accept bribes “to” or “as a reward for” performing their public duty improperly or dishonestly. |

Way Forward

- Balancing Integrity and Immunity: The court’s ruling will determine the delicate balance between upholding legislative immunity and ensuring accountability for criminal acts.

- Interpretative Scrutiny: A nuanced interpretation of constitutional provisions is essential to address the evolving complexities of legislative conduct and accountability.

Conclusion

- The Supreme Court’s forthcoming decision on legislators’ immunity from bribery charges holds significant ramifications for India’s legal landscape.

- Balancing constitutional provisions, legislative intent, and anti-corruption imperatives, the court’s ruling will shape the accountability framework for lawmakers and the integrity of the legislative process.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Ex-SC Judge Justice A M Khanwilkar appointed Lokpal Chairperson

From UPSC perspective, the following things are important :

Prelims level: Lokpal: Powers, Functions, Exceptions

Mains level: NA

In the news

- Former Supreme Court judge Justice Ajay Manikrao Khanwilkar has been appointed as the chairperson of Lokpal, the anti-corruption ombudsman of India.

- Justice Khanwilkar retired from the Supreme Court in July 2022, bringing a wealth of judicial experience to his new role.

About Lokpal

- Establishment: Lokpal is a statutory body established under the Lokpal and Lokayuktas Act of 2013.

- Mandate: It is tasked with investigating allegations of corruption against certain public functionaries and related matters.

- Organisational Structure:

- The Lokpal comprises a chairperson and a maximum of 8 members.

- The chairperson must be a former Chief Justice of India, a former Supreme Court judge, or an eminent person meeting eligibility criteria.

- Half of the members must be judicial members, either former Supreme Court judges or former Chief Justices of High Courts.

- At least 50% members must be from SC / ST / OBC / Minorities and women.

- Members serve a term of 5 years or until they turn 70, whichever is earlier.

- Perks and Benefits: The salary, allowances, and other conditions of service for the chairperson are equivalent to those of the CJI, while members receive benefits similar to Supreme Court judges.

Appointment Process:

- The President of India appoints the chairperson and members based on the recommendation of a selection committee.

- The selection committee includes the PM as Chairperson, the Speaker of Lok Sabha, the Leader of Opposition in Lok Sabha, the Chief Justice of India or a nominated judge, and one eminent jurist.

Jurisdiction:

- Lokpal has jurisdiction to investigate allegations of corruption against Prime Ministers, Union Ministers, Members of Parliament, and officials of the Union Government.

- It extends to individuals associated with government-funded entities and those receiving substantial foreign contributions.

Exceptions for Prime Minister:

- Lokpal cannot probe allegations against the PM related to certain sensitive areas like international relations, security, public order, atomic energy, and space without the approval of at least 2/3rds of its members.

- A full Lokpal bench must consider initiating inquiries into complaints against the PM.

Powers of Lokpal:

- Lokpal exercises superintendence over and provides directions to the Central Bureau of Investigation (CBI) in corruption cases.

- It can authorize the CBI for search and seizure operations linked to such cases.

- The Lokpal’s Inquiry Wing possesses powers akin to a civil court.

- It can recommend the transfer or suspension of public servants implicated in corruption allegations.

- Lokpal is empowered to prevent the destruction of records during preliminary inquiries and confiscate assets obtained through corruption.

Reporting and Accountability

- Annually, Lokpal submits a report on its activities to the President, which is then presented to both Houses of Parliament for scrutiny.

Try this PYQ from CS Mains 2013

Q.‘A national Lokpal, however strong it may be, cannot resolve the problems of immorality in public affairs’. Discuss.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

India ranks 93 out of 180 countries in Corruption Perceptions Index 2023

From UPSC perspective, the following things are important :

Prelims level: Corruption Perception Index

Mains level: Not Much

Introduction

- Transparency International has released its Corruption Perceptions Index for 2023, ranking countries based on their perceived levels of corruption in the public sector.

- India’s position in the ranking has shifted, but the change is minimal.

About Corruption Perceptions Index (CPI)

| Details | |

| Introduction | Introduced by Transparency International in 1995. |

| Frequency | Published annually. |

| Purpose | Ranks countries based on perceived corruption. |

| Data Sources | Expert assessments and surveys of business leaders and residents. |

| Global Impact | Widely recognized and used by governments, policymakers, businesses, and researchers. |

| Data Focus | Primarily assesses perceived corruption within government and bureaucracy. |

India’s Corruption Scorecard

- India’s Global Rank: In the 2023 index, India is placed 93rd out of 180 countries, a small decline from its 85th position in 2022.

- Corruption Score: India’s overall corruption score for 2023 is 39, down slightly from the 40 it scored in 2022.

- Limited Change: The report highlights that India’s score fluctuations are minor, making it challenging to draw definitive conclusions about any significant changes. However, it points out that there have been actions narrowing civic space in India, including the passage of a telecommunications bill that could threaten fundamental rights.

South Asia’s Corruption Landscape

- Pakistan and Sri Lanka: In South Asia, Pakistan (133) and Sri Lanka (115) are grappling with debt burdens and political instability. Still, strong judicial oversight in these countries helps keep the government accountable. Pakistan’s Supreme Court expanded citizens’ right to information, while Sri Lanka continues to face a crackdown on the press.

- Bangladesh: As Bangladesh (149) moves away from its least developed country status and experiences economic growth, it faces challenges in providing public sector information due to a crackdown on the press.

Regional Insights

- China’s Anti-Corruption Efforts: China (76) has made headlines for its aggressive anti-corruption campaign, resulting in punishments for millions of public officials over the last decade. However, doubts linger about the long-term effectiveness of these measures, which heavily rely on punishment rather than institutional checks.

- Asia Pacific Region: The report notes that the Asia Pacific region is gearing up for a significant election year in 2024, with several countries holding elections. However, the 2023 CPI suggests little to no meaningful progress in curbing corruption in the region.

Top and Bottom Performers

- Top-Scoring Countries: Nations like New Zealand (3) and Singapore (5) maintain their positions at the top of the index due to robust corruption control mechanisms. Other countries in the region with strong control measures include Australia (14), Hong Kong (14), Japan (16), Bhutan (26), Taiwan (28), and South Korea (32).

- Struggling States: The lower end of the index includes fragile states with authoritarian regimes, such as North Korea (172) and Myanmar (162). Afghanistan (162) continues to grapple with one of the worst humanitarian crises in history.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

FATF Mutual Evaluation of India

From UPSC perspective, the following things are important :

Prelims level: Financial Action Task Force (FATF)

Mains level: Not Much

Central Idea

- A team from the Financial Action Task Force (FATF) is currently conducting a mutual evaluation in India.

- India’s mutual evaluation report is expected to be discussed during the FATF plenary meeting in June 2024.

About Financial Action Task Force (FATF)

- Foundation: FATF was founded in 1989 through the initiative of the G7 nations.

- Secretariat: The FATF Secretariat is headquartered at the OECD headquarters in Paris, France.

- Plenary Meetings: FATF conducts three Plenary meetings during each of its 12-month rotating presidencies.

- Membership: As of 2019, FATF consists of 37 member jurisdictions.

India’s Engagement with FATF

- Observer Status: India became an Observer at FATF in 2006, marking the beginning of its association with the organization.

- Full Membership: On June 25, 2010, India officially became the 34th country to attain full membership in FATF, signifying its active participation and commitment to the organization’s objectives.

Understanding the Mutual Evaluation Process

- Review Framework: The mutual evaluation process is an essential mechanism through which FATF assesses a country’s legal and institutional framework to combat money laundering and terrorist financing. It also evaluates the country’s implementation of measures to prevent these financial crimes.

- Compliance Assessment: During this process, FATF scrutinizes a country’s adherence to its 40 recommendations regarding anti-money laundering and counter-terrorism financing. It also evaluates the practical effectiveness of these measures.

- Outcome and Rating: The outcome of the mutual evaluation is documented in a report. This report highlights the country’s strengths, identifies weaknesses, and suggests areas for improvement. A rating is assigned based on the level of compliance and effectiveness.

FATF’s Evaluation of India

- Comprehensive Assessment: FATF’s evaluation of India encompasses various aspects, including the nation’s legal framework, regulatory system, law enforcement efforts, and international collaboration.

- Alignment with Global Standards: Central agencies in India have been actively working to ensure that the country’s anti-money laundering and counter-terrorism financing laws align with international standards and that their practical implementation is effective.

Significance of FATF Evaluation

- Report Impact: The evaluation results in a comprehensive report detailing India’s strengths, weaknesses, and areas requiring improvement. This report includes a rating based on compliance and effectiveness.

- Global Anti-Financial Crime Efforts: The mutual evaluation process is a crucial tool in the worldwide fight against money laundering and terrorist financing.

- Financial Implications: The outcome can significantly affect a country’s access to international financial markets and its standing in the global community.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Money Laundering Probe against a Political Party

From UPSC perspective, the following things are important :

Prelims level: PMLA

Mains level: Money Laundering

Central Idea

- The Enforcement Directorate (ED) is contemplating adding a political party as an accused in a money laundering probe linked to the now-defunct Excise Policy of the Delhi government.

Booking a Political Party for Money Laundering

- Applicable Law: Section 70 of the Prevention of Money Laundering Act (PMLA) addresses offences by companies, and it can be invoked in this case.

- Definition of “Company”: While a political party isn’t a ‘company’ under the Companies Act, the PMLA includes an explanation that broadens the scope to include ‘associations of individuals,’ potentially encompassing political parties.

Precedent for such Cases

- If pursued, this action could set a significant precedent in India’s legal landscape.

- Previously, political parties have been investigated under the Income Tax Act.

- Trusts and NGOs are already within the purview of the PMLA, as per a notification by the Finance Ministry.

Connection between Charges and Political Party

- The central allegation by the ED is that the political party received the proceeds of crime in the excise scam.

- An additional explanation in Section 70 of the PMLA specifies that a “company may be prosecuted, notwithstanding whether the prosecution or conviction of any legal juridical person shall be contingent on the prosecution or conviction of any individual.”

- This implies that even if cases involving party members fail, the party can still be prosecuted for money laundering separately.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

UAPA invoked against Media agency

From UPSC perspective, the following things are important :

Prelims level: UAPA

Mains level: Read the attached story

Central Idea

- Allegations against NewsClick: The FIR against NewsClick alleges illegal funding from China, routed through the United States.

- UAPA Provisions: The FIR invokes various sections of the Unlawful Activities (Prevention) Act (UAPA), with a primary focus on Section 16, which deals with punishment for terrorist acts.

Understanding UAPA Provisions

*Section 15 – Definition of “Terrorist Act”

- Section 15 of the UAPA defines “terrorist act” and prescribes imprisonment for at least five years to life. In cases where the act results in death, the punishment is either death or imprisonment for life.

- This section encompasses serious and violent acts with the potential to threaten India’s unity, integrity, security, economic security, or sovereignty.

- It includes actions such as the use of explosives, causing death or damage to property, disruption of essential services, and damaging monetary stability through counterfeiting.

Other UAPA Provisions Invoked

- Section 13 – Unlawful Activities: This section deals with unlawful activities and their consequences.

- Section 17 – Raising Funds for Terrorist Acts: It addresses raising funds for terrorist activities.

- Section 18 – Conspiracy: This section covers conspiracy related to terrorist acts.

- Section 22 (C) – Offences by Companies, Trusts: This provision pertains to offenses committed by companies and trusts.

- IPC Sections Invoked: Additionally, the FIR includes IPC sections 153 A (promoting enmity between different groups) and 120B (criminal conspiracy).

Understanding the UAPA Framework

- Unique Criminal Law Framework: The UAPA provides an alternative criminal law framework that differs from the general principles of criminal law.

- Enhanced State Powers: Compared to the Indian Penal Code (IPC), the UAPA grants the state greater powers.

- Bail Provisions: The UAPA has stringent conditions for bail and relaxes timelines for the state to file chargesheets.

- Denying Bail: To deny bail under the UAPA, the court must establish a “prima facie” case against the accused.

- Prima Facie Definition: In 2019, the Supreme Court defined “prima facie” narrowly, meaning that the court must not analyze evidence or circumstances but must consider the “totality of the case” presented by the state.

- Section 43D(5): This section specifies that a person accused of an offense under Chapters IV and VI of the UAPA shall not be released on bail or their own bond if the Public Prosecutor hasn’t been heard on the application for release.

- Court’s Opinion: The court may deny bail if it finds reasonable grounds to believe that the accusation against the accused is prima facie true.

Conclusion

- The FIR against NewsClick under the UAPA underscores the seriousness of the allegations and the complex legal framework surrounding such cases.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Explained: Immunity of Legislators from Bribery Charges

From UPSC perspective, the following things are important :

Prelims level: Parliamentary Immunities

Mains level: Read the attached story

Central Idea

- Important Question: The Supreme Court of India is trying to answer a significant question: Can lawmakers be prosecuted in criminal courts for taking or offering bribes despite the legal protection they enjoy under Articles 105(2) and 194(2) of the Constitution?

- Background: This question arises from a need to re-evaluate a past Supreme Court ruling in the 1998 PV Narasimha Rao vs. State case, which said that lawmakers can’t be prosecuted for bribery related to their speeches or votes in Parliament.

Understanding Lawmaker Immunity

- Constitutional Safeguard: Constitution provides special protection for lawmakers through Articles 105(2) and 194(2). These articles deal with the powers and privileges of Parliament and state legislatures, and they say that lawmakers can’t be taken to court for anything they say or vote on in these bodies.

- What It Means: This means lawmakers are safe from legal action for their words and actions inside the Parliament or state legislatures. For example, they can’t be sued for defamation for something they say during a debate.

Current Case in the Supreme Court

- How It Started: This matter began when, a member of Jharkhand politician, was accused of taking a bribe in exchange for her vote in the 2012 Rajya Sabha elections.

- Legal Journey: Soren asked for her case to be dropped, saying she was protected by Article 194(2). But the Jharkhand High Court disagreed in 2014. So, she approached the Supreme Court.

- Referral to a Bigger Panel: During the case, it was clear that the issue was very important. In 2019, a Supreme Court Bench suggested that it should be heard by more judges (a larger Bench) because it relates to the 1998 Narasimha Rao decision.

- What the Supreme Court Just Did: On September 20, 2023, a five-judge Bench, led by Chief Justice DY Chandrachud, decided to send this issue to a seven-judge Bench for a fresh look. They said it’s vital to reconsider the PV Narasimha Rao ruling because it impacts our country’s politics.

Why Lawmaker Immunity Matters

- Protecting Lawmakers: Articles 105(2) and 194(2) aim to make sure lawmakers can speak and vote freely in Parliament and state legislatures without worrying about legal trouble.

- Not a Get-Out-Of-Jail Card: But remember, these rules don’t mean lawmakers are above the regular laws of our country. They just make sure lawmakers can do their job without fear.

Reviewing the 1998 PV Narasimha Rao Decision

- The Big Case: The PV Narasimha Rao case is all about the 1993 JMM bribery scandal. The politician, who is related to the petitioner in this case, and some MPs were accused of taking money to vote against a no-confidence motion.

- Different Opinions: Some judges thought immunity shouldn’t cover bribery cases. But most judges thought lawmakers should be protected to make sure they can talk and vote freely.

- What Happened: The 1998 ruling in the Narasimha Rao case made it hard to prosecute lawmakers for bribery linked to their work in Parliament.

Conclusion

- Big Legal Question: The Supreme Court’s decision to send this issue to a seven-judge Bench shows how important it is. They want to decide if lawmakers can be prosecuted for bribery without affecting their ability to do their job.

- Keeping Democracy Running: Articles 105(2) and 194(2) are here to make sure our Parliament and state legislatures work smoothly. They let lawmakers speak without fear, but they don’t mean lawmakers can break the law.

- Balancing Act: What the bigger Bench decides will shape how lawmakers can be prosecuted for bribery, a matter that’s incredibly important for India’s democracy.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

$1.8 billion recovered under Fugitive Economic Offenders Act

From UPSC perspective, the following things are important :

Prelims level: Fugitive Economic Offenders Act, 2018

Mains level: Not Much

Central Idea

- Assets worth over $12 billion have been attached since 2014 under the Prevention of Money Laundering Act (PMLA).

- Additionally, assets exceeding $1.8 billion have been recovered in the past four years under the Fugitive Economic Offenders Act (FEOA), 2018.

About the Fugitive Economic Offenders Act, 2018

- The FEOA is a significant legal instrument designed to address the issue of economic offenders who flee the country to evade criminal prosecution or refuse to return to face charges.

- This act empowers authorities to confiscate the ill-gotten gains of these individuals and bar them from filing or defending civil claims, among other provisions.

Key Provisions of the Fugitive Economic Offenders Act:

(1) Definition of Fugitive Economic Offender:

- A “fugitive economic offender” is an individual against whom an arrest warrant has been issued for committing an offense listed in the Act, and the value of the offense is at least Rs. 100 crore.

- Offenses listed in the act include counterfeiting government stamps or currency, cheque dishonor, money laundering, and transactions defrauding creditors.

(2) Declaration of a FEO:

- After considering an application, a special court (designated under the Prevention of Money Laundering Act, 2002) may declare an individual as a fugitive economic offender.

- The court may confiscate properties that are proceeds of crime, benami properties, or any other property, whether in India or abroad.

- Upon confiscation, all rights and titles of the property vest in the central government, free from encumbrances.

- The central government may appoint an administrator to manage and dispose of these properties.

(3) Bar on Filing or Defending Civil Claims:

- The Act allows any civil court or tribunal to prohibit a declared fugitive economic offender from filing or defending any civil claim.

- Furthermore, any company or limited liability partnership where such an individual is a majority shareholder, promoter, or a key managerial person may also be barred from filing or defending civil claims.

- Authorities may provisionally attach properties of an accused while the application is pending before the Special Court.

(4) Powers:

- The authorities under the Prevention of Money Laundering Act, 2002, will exercise powers conferred upon them by the Fugitive Economic Offenders Act.

- These powers are akin to those of a civil court and include the search of persons in possession of records or proceeds of crime, the search of premises upon belief that a person is a fugitive economic offender, and the seizure of documents.

Other laws related to FEOs

- The existing laws under which such fugitive economic offenders are tried include:

- Recovery of Debts Due to Banks and Financial Institutions Act (RDDBFI),

- Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, (SARFESI) and

- Insolvency and Bankruptcy Code (IBC).

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Independence of Constitutional Authorities Is An Important Issue

From UPSC perspective, the following things are important :

Prelims level: Constitutional bodies

Mains level: Independence of Constitutional bodies and independent appointments

Central Idea

- The recent comments made by the Supreme Court regarding the independence of constitutional authorities in India is an important issue. The need for independent institutions and a system of checks and balances is essential to prevent the arbitrary use of power by the government. The appointment process of key constitutional positions needs to be safeguarded from the whims of the executive.

Need for Independent Institutions

- Executive interference: The Constituent Assembly of India had recognized the need for independent institutions to regulate sectors of national importance without any executive interference.

- Constitutional bodies: Various constitutional authorities such as the Public Service Commission, the Comptroller and Auditor General of India (CAG), the Election Commission of India (ECI), the Finance Commission, and the National Commissions for Scheduled Castes (SC), Scheduled Tribes (ST) and Backward Classes (BC) have been set up for this purpose.

- Need complete independence: Such constitutional bodies must be provided complete independence to enable them to function without fear or favor and in the larger interests of the nation.

Appointment Process for Constitutional Authorities

- Appointments are critical for independence: The appointment of individuals heading these institutions is critical to ensuring their independence.

- Safeguarded from the whims of the executive: While empowering the President of India to appoint all constitutional authorities, the Constitution-makers had kept in mind those institutions whose independence is of paramount importance to the country and the manner in which the independence of these authorities could be safeguarded from the whims of the executive

Appointment of Judges and Other Constitutional Positions

- The Constitution provides for certain conditions to be fulfilled by those who may be considered for such appointments.

- Role of governors: The appointment of Judges of the Supreme Court and the High Court, the CAG of India, and Governors are to be kept free from political or executive pressure.

- For instance, appointment of the CAG:

- In the draft Constitution, the article for the appointment of the CAG had provided that, there shall be an Auditor General who shall be appointed by the President. The Constituent Assembly further discussed that The Auditor-General should be always independent of either the legislature or the executive.

- The process of selecting a person to be appointed as the CAG of India should begin by appointing a committee consisting of the Speaker of the Lok Sabha, the Chief Justice of India, and the Chairman of the Public Accounts Committee to shortlist names to be considered for appointment as the CAG of India; and a panel of three names should be forwarded to the President for him to make the final selection as in Article 148 of the Constitution of India.

Supreme court on appointment of CEC, EC’s and Governor

- Appointment of CEC and EC’s: The Supreme Court has taken an important step in ensuring the independence of the Election Commission of India by divesting the executive of its sole discretion in appointing the Chief Election Commissioner (CEC) and Election Commissioners (ECs) by forming a committee to suggest suitable names to man these constitutional posts.

- Appointment of Governors: The Court expressed serious concern over the active role being played by Governors in State politics, observing that Governors becoming part of political processes is disconcerting. The appointment process for Governors needs to be unrestricted and unfettered to ensure that the President is free from the influence of the Legislature.

Conclusion

- It is necessary to ensure the independence of constitutional authorities to enable them to function without fear or favor and in the larger interests of the nation. The appointment process for key constitutional positions must be safeguarded from the whims of the executive. The recent comments of the Supreme Court regarding the independence of constitutional authorities in India are a reminder of the need to ensure that the appointment process for such positions is free from political or executive pressure.

Mains Question

Q. The issues over the independence of constitutional authorities in India is often in the headlines. In this light discuss why is it necessary to ensure the independence of constitutional authorities, and what are the implications of failing to do so?

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

SC to examine if Electoral Bond pleas need to be referred to Constitution Bench

From UPSC perspective, the following things are important :

Prelims level: Electoral Bond Scheme

Mains level: Transparency in election funding

The Supreme Court will examine whether petitions challenging the validity of the electoral bonds scheme need to be referred to a Constitution Bench.

What is a Constitution Bench?

Constitution benches are set up when the following circumstances exist:

|

What are Electoral Bonds?

- Electoral bonds are banking instruments that can be purchased by any citizen or company to make donations to political parties, without the donor’s identity being disclosed.

- It is like a promissory note that can be bought by any Indian citizen or company incorporated in India from select branches of State Bank of India.

- The citizen or corporate can then donate the same to any eligible political party of his/her choice.

- An individual or party will be allowed to purchase these bonds digitally or through cheque.

About the scheme

- A citizen of India or a body incorporated in India will be eligible to purchase the bond

- Such bonds can be purchased for any value in multiples of ₹1,000, ₹10,000, ₹10 lakh, and ₹1 crore from any of the specified branches of the State Bank of India

- The purchaser will be allowed to buy electoral bonds only on due fulfillment of all the extant KYC norms and by making payment from a bank account

- The bonds will have a life of 15 days (15 days time has been prescribed for the bonds to ensure that they do not become a parallel currency).

- Donors who contribute less than ₹20,000 to political parties through purchase of electoral bonds need not provide their identity details, such as Permanent Account Number (PAN).

Objective of the scheme

- Transparency in political funding: To ensure that the funds being collected by the political parties is accounted money or clean money.

Who can redeem such bonds?

- The Electoral Bonds shall be encashed by an eligible Political Party only through a Bank account with the Authorized Bank.

- Only the Political Parties registered under Section 29A of the Representation of the People Act, 1951 (43 of 1951) and which secured not less than one per cent of the votes polled in the last General Election to the Lok Sabha or the State Legislative Assembly, shall be eligible to receive the Electoral Bonds.

Restrictions that are done away

- Earlier, no foreign company could donate to any political party under the Companies Act

- A firm could donate a maximum of 7.5 per cent of its average three year net profit as political donations according to Section 182 of the Companies Act.

- As per the same section of the Act, companies had to disclose details of their political donations in their annual statement of accounts.

- The government moved an amendment in the Finance Bill to ensure that this proviso would not be applicable to companies in case of electoral bonds.

- Thus, Indian, foreign and even shell companies can now donate to political parties without having to inform anyone of the contribution.

Issues with the Scheme

- Opaque funding: While the identity of the donor is captured, it is not revealed to the party or public. So transparency is not enhanced for the voter.

- No IT break: Also income tax breaks may not be available for donations through electoral bonds. This pushes the donor to choose between remaining anonymous and saving on taxes.

- No anonymity for donors: The privacy of the donor is compromised as the bank will know their identity.

- Differential benefits: These bonds will help any party that is in power because the government can know who donated what money and to whom.

- Unlimited donations: The electoral bonds scheme and amendments in the Finance Act of 2017 allows for “unlimited donations from individuals and foreign companies to political parties without any record of the sources of funding”.

Way ahead

- The worries over the electoral bond scheme, however, go beyond its patent unconstitutionality.

- The concern about the possibility of misuse of funds is very pertinent.

- The EC has been demanding that a law be passed to make political parties liable to get their accounts audited by an auditor from a panel suggested by the CAG or EC. This should get prominence.

- Another feasible option is to establish a National Election Fund to which all donations could be directed.

- This would take care of the imaginary fear of political reprisal of the donors.

Are you an IAS Worthy Aspirant? Get a reality check with the All India Smash UPSC Scholarship Test

Get upto 100% Scholarship | 900 Registration till now | Only 100 Slots Left

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

Government amends KYC to add non-profit organisations, ‘politically exposed persons’

From UPSC perspective, the following things are important :

Prelims level: PMLA, PEPs, FATF

Mains level: Recent changes in PMLA

Central idea: The Finance Ministry has amended the Prevention of Money Laundering (Maintenance of Records) Rules for widening the scope of Know your Customer (KYC) norms to include Politically Exposed Persons (PEPs), non-profit organisations (NPOs) and those dealing in virtual digital assets (VDA) as reporting entities.

Who are Politically Exposed Persons (PEP)?

- According to the modified PML Rules, the Finance Ministry has defined PEPs as-

- Individuals who have been entrusted with prominent public functions by a foreign country

- Includes heads of states or governments, senior politicians, senior government or judicial or military officers, senior executives of state-owned corporations, and important political party officials.

- Banks and financial institutions must maintain records of financial transactions of PEPs and share them with the Enforcement Directorate as and when sought.

Other key changes introduced

Recording of financial transactions of NPOs/NGOs

- The financial institutions must register the details of their NGO clients on the Darpan portal of the Niti Aayog.

- They are required to maintain the record for five years after the business relationship between a client and a reporting entity has ended or the account has been closed, whichever is later.

Tightening of the definition of beneficial owners

- The amendment to the PMLA rules includes the tightening of the definition of beneficial owners under the anti-money laundering law.

- As per the amendments, any individual or group holding 10 per cent ownership in the client of a ‘reporting entity’ will now be considered a beneficial owner against the ownership threshold of 25 per cent applicable earlier.

- The reporting entities include banks and financial institutions, firms engaged in real estate and jewellery sectors, intermediaries in casinos and crypto or virtual digital assets.

Collection of information from clients

- Reporting entities such as banks and crypto platforms are mandated to collect information from their clients under the anti-money laundering law.

- So far, these entities were required to maintain KYC details or records of documents evidencing the identity of their clients, as well as account files and business correspondence relating to clients.

- They will now have to also collect the details of the registered office address and principal place of business of their clients.

- Additionally, they are required to maintain a record of all transactions, including the record of all cash transactions of more than Rs 10 lakh.

Why such move?

- FATF assessment: The amendments assume significance ahead of India’s proposed FATF assessment, which is expected to be undertaken later this year.

- Risk-management: In one of its 40 recommendations, FATF recommends that financial institutions have risk-management systems to identify domestic and international PEPs.

- Remove ambiguities: The broader objective is to bring in legal uniformity and remove ambiguities before the FATF assessment.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Corruption Challenges – Lokpal, POCA, etc

SC raps govt on plea on ED chief’s term

From UPSC perspective, the following things are important :

Prelims level: ED

Mains level: Issues with working of ED

The Supreme Court has sharply reacted over tenure extensions granted to Enforcement Directorate Director by the government to subvert ongoing investigations against their leaders.

What is Enforcement Directorate (ED)?

- ED was formed in 1957 to look into cases of foreign exchange-related violations, a civil provision.

- It goes back to May 1, 1956, when an ‘Enforcement Unit’ was formed in the Department of Economic Affairs.

- Now, the ED falls under the finance ministry’s Department of Revenue.

- But in 2002, after the introduction of the PMLA, it started taking up cases of financial fraud and money laundering, which were of criminal nature.

- It was then tasked for handling Exchange Control Laws violations under the Foreign Exchange Regulation Act (FERA).

- Today, it is a multi-dimensional organisation investigating economic offences under the:

- Prevention of Money Laundering Act (PMLA)

- Fugitive Economic Offenders Act

- Foreign Exchange Management Act

- Foreign Exchange Regulation Act (FERA)

Its establishment

- When proceeds of crime (property/money) are generated, the best way to save that money is by parking it somewhere, so one is not answerable to anyone in the country.

- Therefore, there was a need to control and prevent the laundering of money.

- The PMLA was brought in for this exact reason in 2002, but was enacted only in 2005.

- The objective was to prevent parking of the money outside India and to trace out the layering and the trail of money.

- So as per the Act, the ED got its power to investigate under Sections 48 (authorities under act) and 49 (appointment and powers of authorities and other officers).

At what stage does the ED step in when a crime is committed?

- Whenever any offence is registered by a local police station, which has generated proceeds of crime over and above ₹1 crore, the investigating police officer forwards the details to the ED.

- Alternately, if the offence comes under the knowledge of the Central agency, they can then call for the First Information Report (FIR) or the chargesheet if it has been filed directly by police officials.

- This will be done to find out if any laundering has taken place.

What differentiates the probe between the local police and officers of the ED?

Case study:

- If a theft has been committed in a nationalised bank, the local police station will first investigate the crime.

- If it is learnt that the founder of the bank took all the money and kept it in his house, without being spent or used, then the crime is only theft and the ED won’t interfere because the amount has already been seized.

- But if the amount which has been stolen is used after four years to purchase some properties, then the ill-gotten money is brought back in the market.

- Or if the money is given to someone else to buy properties in different parts of the country, then there is ‘laundering’ of money.

- Hence the ED will need to step in and look into the layering and attachment of properties to recover the money.

- If jewellery costing ₹1 crore is stolen, police officers will investigate the theft. The ED, however, will attach assets of the accused to recover the amount of ₹1 crore.

Roles and functions of the ED