- The government has embarked on a mission to amalgamate about 40 labour laws into four Labour Codes with a view to rationalise and simplify the provisions and facilitate ease of compliance.

- The Code on Social Security, 2019 was introduced last year in Lok Sabha by the Minister of State for Labour and Employment.

- It replaces nine laws related to social security, including:

- Employees’ Provident Fund Act, 1952,

- Maternity Benefit Act, 1961, and

- Unorganised Workers’ Social Security Act, 2008

What is Social Security?

- Social security is “any government system that provides monetary assistance to people with an inadequate or no income”.

- It refers to the action programs of an organization intended:

- to promote the welfare of the population through assistance measures guaranteeing access to sufficient resources for food and shelter and

- to promote health and well-being for the population at large and potentially vulnerable segments such as children, the elderly, the sick and the unemployed.

- Services providing social security are often called social services.

Why need Social Security?

- India has a very basic social security system catering to a fairly small percentage of the country’s workforce.

- Traditionally, Indians relied on their extended families for support in the event of illness or other misfortunes.

- However, due to migration, urbanization, and higher social mobility, family bonds are less tight and family units much smaller than they used to be.

- So far, neither the state nor private insurance companies have quite stepped up to fill this gap.

Social Security System in India

- India’s social security system is composed of a number of schemes and programs spread throughout a variety of laws and regulations.

- Keeping in mind, however, that the government-controlled social security system in India applies to only a small portion of the population.

- Furthermore, the social security system in India includes not just an insurance payment of premiums into government funds (like in China), but also lump sum employer obligations.

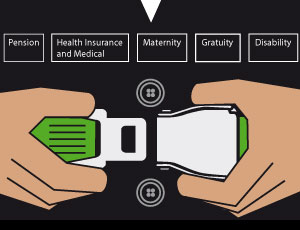

Generally, India’s social security schemes cover the following types of social insurances:

- Pension

- Health Insurance and Medical Benefit

- Disability Benefit

- Maternity Benefit

- Gratuity

While a great deal of the Indian population is in the unorganized sector and may not have an opportunity to participate in each of these schemes, Indian citizens in the organized sector (which include those employed by foreign investors) and their employers are entitled to coverage under the above schemes.

Its loopholes

- With about 22 percent of India’s population living below the poverty line, the “unorganized” sector, i.e. enterprises — mainly in agriculture, which are not legally covered by any form of social security, is disproportionately large.

- Social Security is more than just a retirement program. It provides important life insurance and disability insurance protection as well.

- Retirement benefits aren’t much progressive to keeps up with increasing cost of living.

The Code on Social Security, 2019

Need for an unified Law

- Most of the central labour laws were enacted between the 1920s and 1970s. These codes were created in conformity with the requirements of the workers of that period.

- However, things have changed dramatically today.

- Many of the earlier laws have become archaic which has been creating hurdles for the employers to create new employment opportunities.

- Even the workers find it very difficult to get efficient social security benefits on time.

- The current objective of the bill is to cover each and every worker within a robust social security net. At the same time, Bill aims to help employers in creating new jobs.

- Hence, this bill will create an environment for the employers and workers to come together.

The code has 163 clauses, divided into 14 chapters in addition to six schedules on the procedural aspects. It replaces the existing nine laws on social security. They are-

- Employee’s Compensation Act, 1923;

- Employee’s State Insurance Act, 1948;

- Employees’ Provident Funds and Miscellaneous Provisions Act, 1952;

- Maternity Benefit Act, 1961;

- The Employment Exchanges (Compulsory Notification of Vacancies) Act, 1959;

- Payment of Gratuity Act, 1972;

- Cine Workers Welfare Fund Act, 1981;

- Building and Other Construction Workers Cess Act, 1996;

- Unorganized Workers’ Social Security Act, 2008.

Major Highlights of the Code

Wage definition widened

- The definition of wages has three parts to it –

- an inclusion part,

- specified exclusions with limits and

- benefits in kind

- All remuneration expressed in monetary terms is wage and includes basic pay, dearness allowance and retaining allowance.

- Specific exclusions are statutory bonuses, PF, pension and gratuity, house rent and conveyance allowances etc. which cannot exceed 50 per cent of total remuneration.

- Remuneration provided in-kind will be included to the extent of 15 per cent of total wages.

- Overall this will ensure that wages for social security benefits will be at least 50 per cent of overall compensation.

Social security organisations

- The Code provides for the establishment of several bodies to administer the social security schemes.

- These include:

- a Central Board of Trustees, headed by the Central Provident Fund Commissioner, to administer the EPF, EPS and EDLI Schemes,

- an Employees State Insurance Corporation, headed by a Chairperson appointed by the central government, to administer the ESI Scheme,

- national and state-level Social Security Boards, headed by the central and state Ministers for Labour and Employment, respectively, to administer schemes for unorganised workers, and

- state-level Building Workers’ Welfare Boards, headed by a Chairperson nominated by the state government, to administer schemes for building workers.

Social security fund

- The Bill proposes setting up a social security fund using corpus available under corporate social responsibility.

- This fund will provide welfare benefits such as a pension, medical cover, death and disablement benefits to all workers, including gig workers.

Reducing employee PF contribution

- The bill provides for an option of reducing provident fund contribution (currently at 12% of basic salary) and therefore increases workers take-home pay.

- The rationale for allowing lower employee PF contribution is that higher take-home pay may boost consumption. The Bill, however, retains employers’ PF contribution at 12%.

Gratuity for fixed-term contract workers

- Currently, workers are not entitled to gratuity before completing five years of continuous service. The bill says that fixed-term contract workers will be eligible for gratuity on a pro-rata basis.

- It proposes to offer gratuity to fixed term employees after one year of service on a pro-rata basis as against the current practice of five years.

Exemption

- It will empower the central government to exempt select establishments from all or any of the provisions of the code and makes Aadhaar mandatory for availing benefits under various social security schemes.

Insurance, PF, life cover for unorganized sector employees:

- Central Government shall formulate and notify suitable welfare schemes for unorganised workers on matter relating to life and disability cover; health and maternity benefits; old age protection; and any other benefit as may be determined by the central government.

Gig Workers

- In addition, the central or state government may notify specific schemes for gig workers, platform workers, and unorganised workers to provide various benefits, such as life and disability cover.

- Gig workers refer to workers outside of the traditional employer-employee relationship (e.g., freelancers).

- Platform workers are workers who access other organisations or individuals using online platforms and earn money by providing them with specific services.

- Unorganised workers include home-based and self-employed workers.

Coverage and registration

- The Code specifies different applicability thresholds for the schemes. For example, the EPF Scheme will apply to establishments with 20 or more employees.

- The ESI Scheme will apply to certain establishments with 10 or more employees, and to all establishments which carry out hazardous or life-threatening work notified by the central government.

- These thresholds may be amended by the central government. All eligible establishments are required to register under the Code, unless they are already registered under any other labour law.

Contributions

- The EPF, EPS, EDLI, and ESI Schemes will be financed through a combination of contributions from the employer and employee.

- For example, in the case of the EPF Scheme, the employer and employee will each make matching contributions of 10% of wages, or such other rate as notified by the government.

- All contributions towards payment of gratuity, maternity benefit, cess for building workers, and employee compensation will be borne by the employer.

- Schemes for gig workers, platform workers, and unorganised workers may be financed through a combination of contributions from the employer, employee, and the appropriate government.

Offences and penalties

The Code specifies penalties for various offences, such as:

- the failure by an employer to pay contributions under the Code after deducting the employee’s share, punishable with imprisonment between one and three years, and fine of one lakh rupees, and

- falsification of reports, punishable with imprisonment of up to six months.

Advantages of the unified Law

The Code is a break from numerous and archaic social security laws. Major promising features of the Code are:

- The social safety-related laws had indeed become outdated in today’s environment. For example, online platform workers such as Ola, Uber etc. were not covered in the previous laws. The Social security code Bill, 2019 covers all those workers.

- The ambit of this social security code is truly large as it covers not only the number of employees which an organization has (if it more than 10, it will come under the social security laws) but the workers involved in hazardous nature of work will be also be covered under the act.

- At the same time, through code on social security, the regulatory regime would be less problematic for the employers and employees. For example, an inspector, under the new code, cannot open an EPFO (Employees’ Provident Fund Organisation) record of more than five years.

- Under the Code, the central government may notify various social security schemes for the benefit of workers. These include an Employees’ Provident Fund (EPF) Scheme, an Employees’ Pension Scheme (EPS), and an Employees’ Deposit Linked Insurance (EDLI) Scheme.

Criticisms

- There is no uniform definition of “social security”, nor is there a central fund. The corpus is proposed to be split into numerous small funds creating a multiplicity of authorities and confusion.

- It is not clear how the proposed dismantling of the existing and functional structures, such as the Employees’ Provident Fund Organisation (EPFO) with its corpus of ₹10 lakh crore — which will be handed over to a government-appointed central board — is a better alternative.

- Crucial categories such as “workers”; “wages”; “principal-agent” in a contractual situation; and “organised-unorganised” sectors have not been clearly defined.

- This will continue to impede the extension of key social security benefits such as PF, gratuity, maternity benefits, and healthcare to all sections of workers.

- The Bill welcomes aboard large sections of the workforce — “gig workers” such as those working in taxi aggregate companies like Uber and Ola.

- But how exactly the government proposes to facilitate their access to PF or medical care is not clear.

Conclusion

Social Security protects people against a variety of risks to ensure them a basic floor of income in old age and to enable many people who have struggled all their lives to look forward to a decent standard of comfort and dignity when they retire.

- Though it needs to be passed in the parliament, the Code on Social Security, 2019 is a robust arrangement to effect economy, efficiency, and effectiveness in the working of the social security regime.

- The inclusion of unorganised sector is a welcome step as the economy right now is service sector dominated.

- Further positive changes too must be looked forward as they are in the long run are helpful to the wide sections.

Way Forward

- The Code on Social Security is clearly a move in the right direction to rationalise and consolidate social security related labour laws.

- It is critical for employers to analyse the impact of the Code and the compliances thereunder in order to be able to undertake a smooth transition as and when the Code becomes a law.

- The code is giving a robust and efficient coverage of social security to each and every worker of the country.

- The code gives lot of respite to the employer from the rigidity of laws and whims and wishes from the law enforcement agencies.

- This code takes the labour reforms from the manufacturing sector space to the services sector and this transition will cater to the large section of workers contributing to the share of GDP.

References

https://prsindia.org/billtrack/code-social-security-2019

https://www.india-briefing.com/news/introduction-social-security-system-india-6014.html/

https://vikaspedia.in/social-welfare/social-security?pid=3833&pageno=2&size=10