The Mineral Laws (Amendment) Bill, 2020 has been passed by both the Houses of Parliament and is waiting for Presidents assent.

About the Bill

The Bill seeks to amend:

- The Mines and Minerals (Development and Regulation) Act, 1957 (MMDR Act) and

- The Coal Mines (Special Provisions) Act, 2015 (CMSP Act)

Background

MMDR Act

- The MMDR Act, 1957 forms the basic framework of mining regulation in India. It regulates the overall mining sector in India.

- This act is applicable to all mineral except minor minerals and atomic minerals. It details the process and conditions for acquiring a mining or prospecting licence in India.

- Mining minor minerals comes under the purview of state governments. River sand is considered a minor mineral.

- For mining and prospecting in forest land, prior permission is needed from the Ministry of Environment, Forests and Climate Change.

CMSP Act

- The CMSP Act provides for the auction and allocation of mines whose allocation was cancelled by the Supreme Court in 2014.

- Schedule I of the Act provides a list of all such mines; Schedule II and III are sub-classes of the mines listed in the Schedule I.

- Schedule II mines are those where production had already started then, and Schedule III mines are ones that had been earmarked for a specified end-use.

At present, who gives the permits in the mining sector?

- The State governments provide permits for mining, which are called mineral concessions, for all the minerals located within their respective jurisdictions.

- This comes under the provisions of the Mines & Minerals (Development and Regulation) Act, 1957 and Mineral Concession Rules, 1960.

- However, for minerals specified under the Schedule I of the Mines & Minerals (Development and Regulation) Act, 1957, the Centre’s approval is necessary before granting the mineral concession.

- Minerals specified under the Schedule I include hydrocarbon, atomic minerals and metallic minerals like iron ore, bauxite, copper ore, lead, precious stones, zinc and gold.

Features of the Mineral Laws (Amendment) Bill, 2020

1) Removal of restriction on end-use of coal

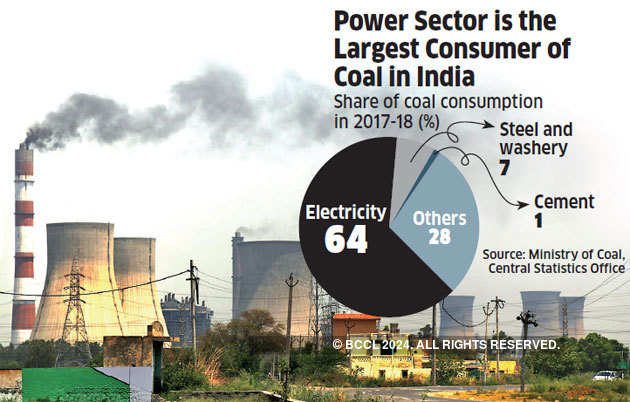

- Currently, companies acquiring Schedule II and Schedule III coal mines through auctions can use the coal produced only for specified end-uses such as power generation and steel production.

- The Bill removes this restriction on the use of coal mined by such companies.

- Companies will be allowed to carry on coal mining operation for own consumption, sale or for any other purposes, as may be specified by the central government.

2) Eligibility for auction of coal and lignite blocks

- The Bill clarifies that the companies need not possess any prior coal mining experience in India in order to participate in the auction of coal and lignite blocks.

- Further, the competitive bidding process for auction of coal and lignite blocks will not apply to mines considered for allotment to

- a government company or its joint venture for own consumption, sale or any other specified purpose; and

- a company that has been awarded a power project on the basis of a competitive bid for the tariff.

3) Composite license for prospecting and mining

- Currently, separate licenses are provided for prospecting and mining of coal and lignite, called prospecting license, and mining lease, respectively.

- Prospecting includes exploring, locating, or finding mineral deposit.

- The Bill adds a new type of license, called prospecting license-cum-mining lease (PL-cum-ML).

- This will be a composite license providing for both prospecting and mining activities.

4) Non-exclusive reconnaissances permit holders to get other licenses

- Currently, the holders of non-exclusive reconnaissance permit for exploration of certain specified minerals are not entitled to obtain a prospecting license or mining lease.

- Reconnaissance means preliminary prospecting of a mineral through certain surveys.

- The Bill provides that the holders of such permits may apply for a prospecting license-cum-mining lease or mining lease.

- This will apply to certain licensees as prescribed in the Bill.

5) Transfer of statutory clearances to new bidders

- Currently, upon expiry, mining leases for specified minerals (minerals other than coal, lignite, and atomic minerals) can be transferred to new persons through auction.

- This new lessee is required to obtain statutory clearances before starting mining operations.

- The Bill provides that the various approvals, licenses, and clearances given to the previous lessee will be extended to the successful bidder for a period of two years.

- During this period, the new lessee will be allowed to continue mining operations. However, the new lessee must obtain all the required clearances within this two-year period.

6) Reallocation after the termination of the allocations

- The CMSP Act provides for the termination of allotment orders of coal mines in certain cases.

- The Bill adds that such mines may be reallocated through auction or allotment as may be determined by the central government.

- The central government will appoint a designated custodian to manage these mines until they are reallocated.

7) Prior approval from the central government

- Under the MMDR Act, state governments require prior approval of the central government for granting reconnaissance permit, prospecting license, or mining lease for coal and lignite.

- The Bill provides that prior approval of the central government will not be required in granting these licenses for coal and lignite, in certain cases.

- These include cases where: (i) the allocation has been done by the central government, and (ii) the mining block has been reserved to conserve a mineral.

8) Advance action for auction

- Under the MMDR Act, mining leases for specified minerals (minerals other than coal, lignite, and atomic minerals) are auctioned on the expiry of the lease period.

- The Bill provides that state governments can take advance action for auction of a mining lease before its expiry.

Significance of the Bill

1) Seamless coal mining

- The pl-and-ml licences will increase the availability of coal and lignite blocks and provide for an allocation of different grades of coal blocks in wide geographical distribution.

- Environmental clearances will be automatically transferred to the new owners of the mineral blocks along with other clearances for two years.

- This will allow the new owners to continue with the hassle-free mining operations.

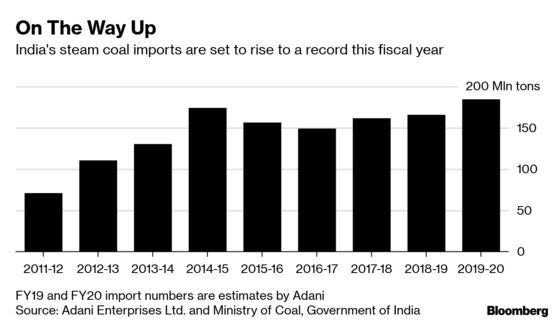

2) Reduced dependence on Imports

- The Bill provides that the companies do not need to possess any coal mining experience in India to participate in the auction of coal and lignite blocks. This will allow 100% FDI in the sector via automatic route.

- It ensures an increase in investments and boosts in domestic coal production to reduce the dependence on imports of coal.

3) End of CIL monopoly

- The Bill put an end to Coal India Ltd’s monopoly in the mining sector as it increases the scope for the private sector.

- This amendment is a welcome step towards liberalisation of the mining sector and attracting the much-needed foreign investment.

- Two crucial aspects – liberalizing the eligibility criteria for participating in the auction and removal of end-use restriction – will attract investment in the sector and foreign direct investment too.

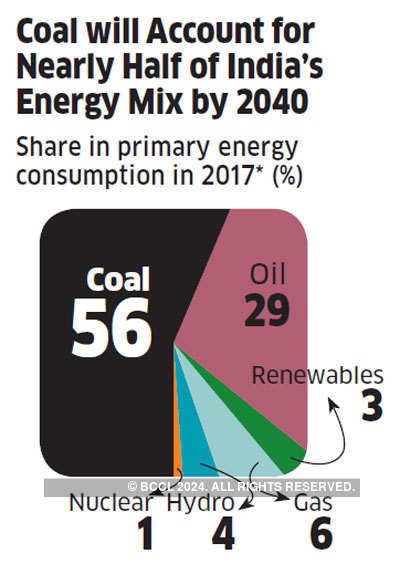

4) Addresses energy demand

- The demand for coal within the country is increasing exponentially in recent times as the government is expanding the capacity to generate power.

- The increase in the production of the easiest and cheapest source of electricity, coal, especially domestic coal, can back the government’s bid to provide electricity for all citizens.

- Without an increase in coal production, it would be difficult to achieve this objective.

5) Multi-sectoral development

- Overall, this move will create an efficient energy market and bring in more competition as well as reduce coal imports.

- It would also help India gain access to high-end technology for underground mining used by miners across the globe.

- It will also increase demand in other sectors such as mining equipment, heavy commercial vehicle industries etc.

Issues with this Bill: Putting the environment at stake

- While many countries are moving away from fossil fuels, especially coal, to combat climate change, India is boosting its demand in this sector, putting the environment at risk.

- This Bill provides for an increase in the competition in the mining sector, paving the way for the rise in the chances of over-exploitation of resources.

- Promoting the growth of coal sector jeopardizes India’s commitments in the Paris Agreement.

Way Forward

- The corresponding rules and bidding guidelines must be assessed in detail to ensure that the proposed law is implemented and given full effect.

- While promoting coal mining, the government must also ensure an increase in the investments in green energy so that it can reduce its dependence on thermal energy.

- There must be an increase in monitoring of the mining activities so that the private players are not tempted towards over-exploitation of resources and labourers.

- Regulations must be strictly monitored and enforced so that there is no adverse impact on either the environment or human beings because of the increase in mining activities.

References

https://www.prsindia.org/billtrack/mineral-laws-amendment-bill-2020

https://pib.gov.in/newsite/PrintRelease.aspx?relid=117513