Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Growth in most Southern States is concentrated in a few districts

Why in the News?

Economic growth in southern states lagged behind India’s overall growth in 2023-24. Despite a large working population, unemployment rates in these states remain a major concern, as seen in their Budget and Economic Surveys.

What are the key reasons behind the economic growth of southern states lagging behind India’s overall growth in 2023-24?

- Lower Growth Rates Compared to National Average – While India’s economy grew at 9.2%, southern states like Tamil Nadu (8.2%) and Telangana (7.4%) recorded slower growth, with Karnataka, Kerala, and Andhra Pradesh growing at over 6%.

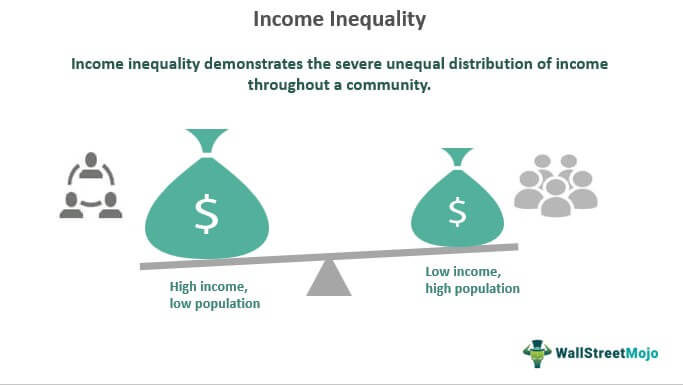

- Regional Income Disparities – Economic advantages are concentrated in select districts, limiting broad-based growth. For example, only 8 of 38 districts in Tamil Nadu and 3 of 33 in Telangana had higher per capita income than their state averages.

- Unemployment and Labour Force Challenges – Despite a significant working population, labour force participation rates (LFPR) in Tamil Nadu (58.8%), Karnataka (56.8%), and Kerala (56.2%) were below the national average of 60.1%, affecting economic output.

- Shift Towards Self-Employment – There is a decline in casual labour and an increase in self-employment, often in household enterprises, leading to a lack of stable wage employment. Example: In Telangana, self-employment rose by 8% to 55.9%, while casual labour fell by 5.7% to 18.7%.

- Slower Industrial and Manufacturing Growth – Despite industrial pushes, manufacturing contributes less than 20% of southern states’ economies, limiting their overall economic expansion.

Which southern state has the most equitable distribution of per capita income across its districts?

- More Even Income Spread: Kerala has 7 out of 14 districts with a per capita income above the state average, making it the most balanced among southern states. In contrast, Tamil Nadu (8 out of 38), Telangana (3 out of 33), and Karnataka (4 out of 31) show higher income concentration in a few districts.

- Unlike Telangana, where Rangareddy district’s per capita income is more than three times the state average, Kerala’s income distribution is less skewed, ensuring better regional development and social welfare across the state.

Why is this significant?

- Reduced Regional Disparities: A more balanced income distribution ensures that economic benefits are spread across districts, preventing excessive wealth concentration in urban centers. Example: Unlike Telangana, where Rangareddy dominates income levels, Kerala’s development is more uniform, reducing economic inequalities.

- Better Social and Human Development Indicators: Equitable income distribution translates into better education, healthcare, and infrastructure across all districts, improving overall quality of life. Example: Kerala consistently ranks high in Human Development Index (HDI) due to its statewide access to education and healthcare.

- Sustainable and Inclusive Growth: A well-distributed economy supports long-term stability by ensuring that no district lags significantly behind, leading to lower migration pressures and balanced urbanization. Example: Unlike Tamil Nadu, where Chengalpattu’s income is double the state average, Kerala’s economy avoids overburdening specific urban hubs, leading to sustainable development.

Why is unemployment still a pressing concern in southern states?

- Higher Labour Force Participation but Fewer Job Opportunities – While more people are seeking work, the availability of stable, well-paying jobs remains limited. Example: In 2023-24, Tamil Nadu (58.8%), Karnataka (56.8%), and Kerala (56.2%) had labour force participation rates lower than the national average (60.1%), indicating fewer employment opportunities relative to job seekers.

- Shift from Casual Labour to Self-Employment Without Formal Jobs Growth – More people are moving away from casual labour towards self-employment, but the growth of regular salaried jobs remains stagnant. Example: In Telangana, the self-employed workforce increased by 8% (to 55.9%), while casual labour declined by 5.7%, reflecting a lack of structured employment.

- Dominance of the Services Sector with Limited Manufacturing Growth – The services sector contributes over 50% of economic output, but it often lacks the capacity to absorb large numbers of workers, especially in lower-income groups. Example: In Tamil Nadu, despite an industrial push, manufacturing has not significantly increased its share in the state economy, limiting job creation in this sector.

What role does the services sector play in the economies of southern states?

- Primary Driver of Economic Growth – The services sector contributes over 50% of economic output in most southern states, making it the main engine of economic expansion. Example: In Karnataka and Telangana, the IT and software services industry significantly boosts state GDP, with Bengaluru and Hyderabad being major global tech hubs.

- Uneven Job Creation Across Skill Levels – While the services sector creates high-value jobs in IT, finance, and healthcare, it does not generate enough employment for lower-skilled workers, contributing to persisting unemployment. Example: Kerala, despite its strong service-driven economy (tourism, healthcare, remittances), struggles with high unemployment rates due to a lack of blue-collar service jobs.

Way forward:

- Diversify Economic Growth Beyond Services – Strengthen manufacturing and industrial sectors to create stable, large-scale employment opportunities, especially for lower-skilled workers. Example: Expanding MSMEs and industrial corridors in Tamil Nadu and Karnataka can boost job creation.

- Enhance Skill Development and Labour Market Reforms – Improve vocational training and upskilling programs to align with industry demands, ensuring better job-market absorption. Example: Kerala can integrate its educated workforce into high-value sectors like healthcare and renewable energy.

Mains PYQ:

Question: What is regional disparity? How does it differ from diversity? How serious is the issue of regional disparity in India? (UPSC 2024)

Reason: This question’s demand is directly linked with the regional inequality, which explains why economic growth is concentrated in certain parts of a state. Understanding this helps us see why some districts develop faster than others.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

What the recent GDP data revisions reveal

From UPSC perspective, the following things are important :

Mains level: GDP Growth;

Why in the News?

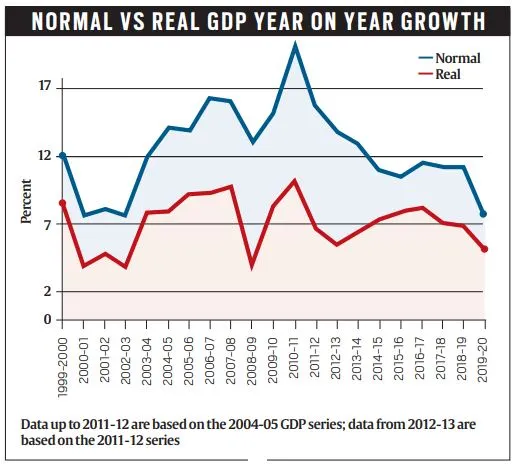

The rise in real and nominal growth rates is expected to impact future economic growth plans and long-term strategies.

Recently, the National Statistical Office (NSO) has provided two types of data.

|

Why have the real and nominal growth rates been revised upwards?

- Improved Sectoral Performance: Significant upward revisions in key sectors like manufacturing (by 2.4 percentage points) and financial, real estate, and related services (by 1.9 percentage points) contributed to higher GDP estimates.

- Higher Investment Contributions: Increased gross capital formation (GCF) in 2023-24 (10.5% growth) led to stronger economic activity, positively impacting overall GDP figures. Example: Real investment rate (Gross Fixed Capital Formation to GDP ratio) reached 33.4% in 2024-25.

- Stronger Consumption Demand: A rebound in Private Final Consumption Expenditure (PFCE) contributed to the upward revision, especially in sectors like trade and hospitality. Example: PFCE contribution to GDP increased to 5.3 percentage points in Q4, reflecting stronger consumer spending.

Which sectors experienced the maximum upward revision in growth?

- Manufacturing Sector: Revised upward by 2.4 percentage points, reflecting improved industrial production and better capacity utilization. Example: Manufacturing growth increased from 2.1% in Q2 to 3.5% in Q3 of 2024-25, indicating a gradual recovery.

- Financial, Real Estate, and Related Services: Revised upward by 1.9 percentage points, driven by increased financial activities and a stronger real estate market. Example: The growth in these services contributed significantly to the overall 9.2% GDP growth in 2023-24, up from the previous estimate of 8.2%.

What are the key challenges in achieving the implied fourth-quarter GDP growth of 7.6% for 2024-25?

- Weak Private Final Consumption Expenditure (PFCE) Growth: The required PFCE growth for achieving 7.6% GDP growth is 9.9%, which is historically high and challenging to sustain. Example: PFCE contribution fell from 4.3 percentage points in Q1 to 3.3 percentage points in Q2, leading to slower GDP growth of 5.6%.

- Insufficient Government Capital Expenditure: The government needs to spend ₹2.61 lakh crore in the last two months to meet the revised target of ₹10.18 lakh crore, which is significantly higher than the recent trend. Example: Average government capital expenditure during February-March (2021-24) was ₹1.81 lakh crore, making the target difficult to achieve.

- Slow Recovery in Manufacturing Sector: Despite some improvement, manufacturing growth remains sluggish at 3.5% in Q3, limiting its contribution to overall GDP. Example: Manufacturing growth in Q2 was only 2.1%, indicating continued structural weaknesses and reduced industrial output.

- Decline in Investment Contribution: The contribution of investment to GDP growth fell from 2.3 percentage points in Q1 to 1.8 percentage points in Q3, reducing overall economic momentum. Example: Gross capital formation growth dropped from 10.5% in 2023-24 to 5.8% in 2024-25, reflecting lower private sector investments.

- Global Economic Uncertainty: External factors like geopolitical tensions and fluctuating global demand can negatively impact exports and foreign investments. Example: Persistent global uncertainties in energy markets and supply chains may hinder India’s export-led growth in Q4.

What are the present policies of the Government in this regard?

|

Way forward:

- Enhance Private Sector Participation: Implement targeted incentives and streamline regulatory processes to boost private investments in critical sectors like manufacturing and infrastructure. Example: Expanding the Production-Linked Incentive (PLI) scheme to emerging industries can drive long-term growth.

- Strengthen Consumption and Export Demand: Promote domestic consumption through targeted tax relief and social welfare programs while enhancing export competitiveness by supporting value-added manufacturing and reducing trade barriers. Example: Implementing sector-specific export promotion schemes can mitigate global uncertainties.

Mains PYQ:

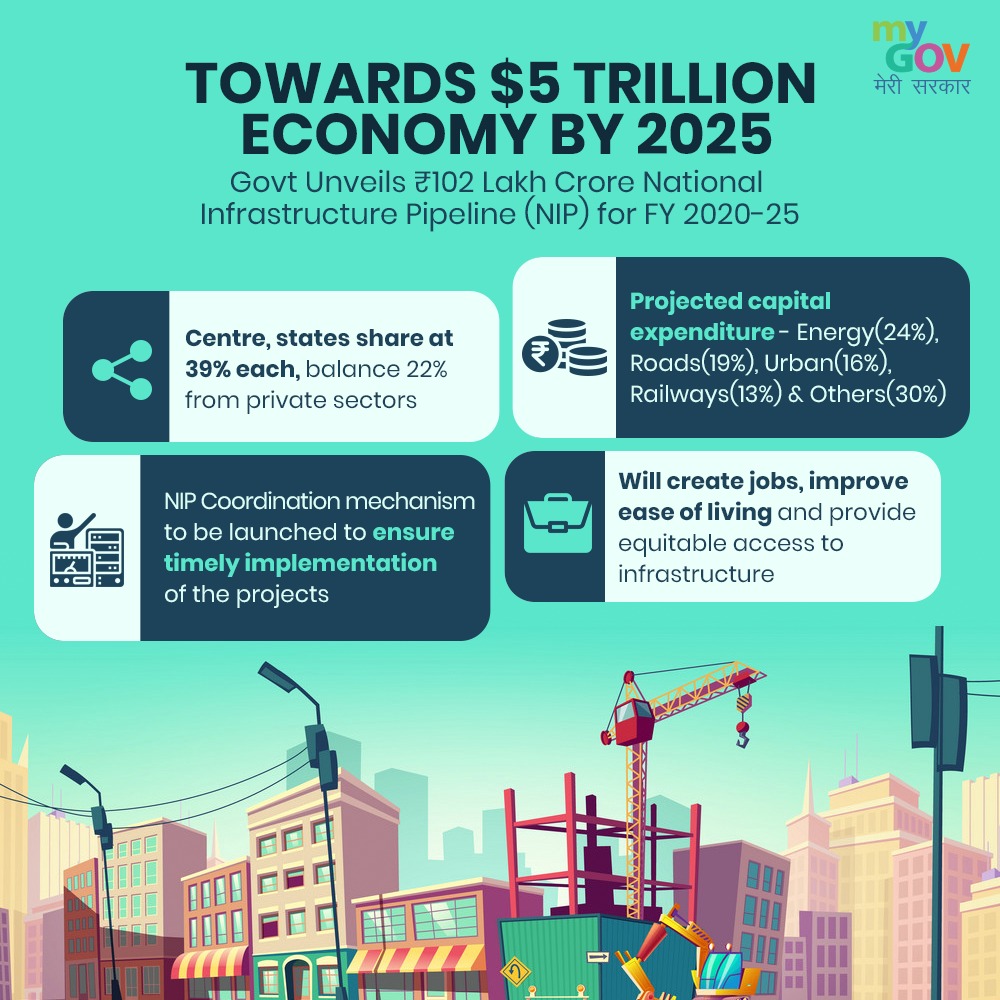

Q Investment in infrastructure is essential for more rapid and inclusive economic growth.”Discuss in the light of India’s experience. (2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Income levels of salaried class have stagnated in recent years

From UPSC perspective, the following things are important :

Mains level: Issues related to employment;

Why in the News?

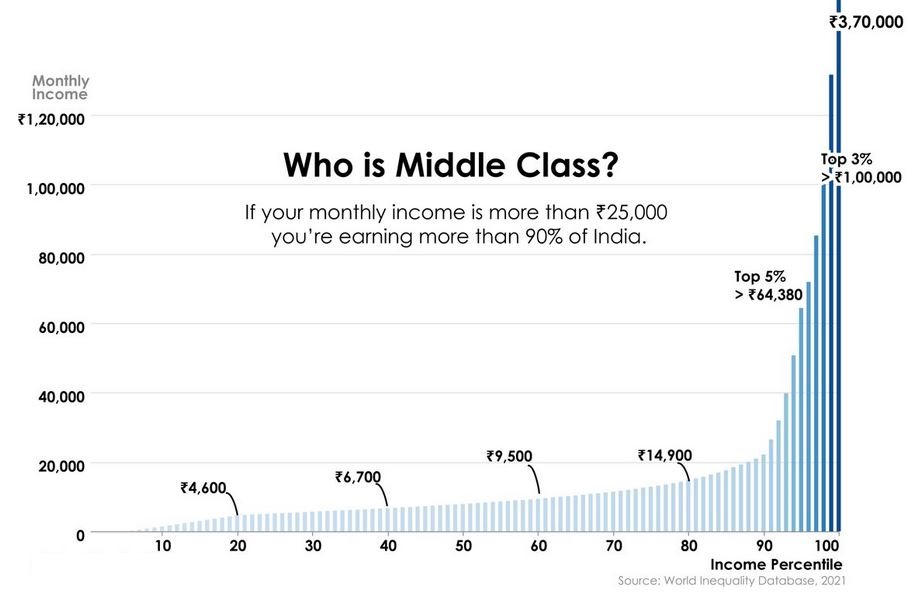

According to PLFS reports, employment in India is increasing, but the real wages of salaried workers have remained unchanged since 2019.

What are the key reasons behind the stagnation of real wages for salaried workers in India since 2019?

- Inflation Outpacing Wage Growth: Rising consumer prices (CPI) have eroded the purchasing power of salaries despite nominal wage increases. For example, Real wages for salaried workers in India were 1.7% lower in the June 2024 quarter compared to the June 2019 quarter (PLFS data).

- Excess Labour Supply and Declining Returns to Education: An oversupply of qualified workers has reduced the premium for higher education, limiting salary growth. For example, the share of self-employed workers increased from 53.5% in 2019-20 to 58.4% in 2023-24, indicating a shift from salaried roles due to a lack of opportunities.

- Depressed Private Sector Investment: Reduced corporate investment leads to slower job creation and wage stagnation. For example, India’s private sector investment-to-GDP ratio declined from 28% in 2011-12 to 21.1% in 2022-23 (Reserve Bank of India).

- Policy Shocks (Demonetisation and GST Impact): Economic disruptions from demonetisation (2016) and GST (2017) weakened small and medium enterprises (SMEs), affecting formal employment. For example, Formal employment fell, and salaried employment as a share of total workers dropped from 22.9% in 2019-20 to 21.7% in 2023-24 (PLFS data).

- Shift Toward Informal and Contractual Work: Companies increasingly rely on temporary and gig workers, offering lower pay and fewer benefits. For example, Casual labour wages increased by 12.3% (real terms) between 2019 and 2024, while salaried wages stagnated, reflecting a rise in informal work.

Why is the increase in wages for casual labour not considered a net positive for the economy?

- Lower Productivity Contribution: Casual labour typically involves low-skilled, irregular work with limited productivity gains. While wages may rise, the overall economic output does not grow proportionately.

- For example, the agriculture sector, which employs a large share of casual labour, contributed only 16% to India’s GDP in 2023-24 despite employing over 45% of the workforce (Economic Survey 2023-24).

- Informal Nature of Work: Casual jobs lack social security, health benefits, and job stability, leading to long-term economic insecurity despite wage increases.

- In India, 93% of the workforce remains in the informal sector with minimal social protection, contributing to economic vulnerability (ILO report, 2023).

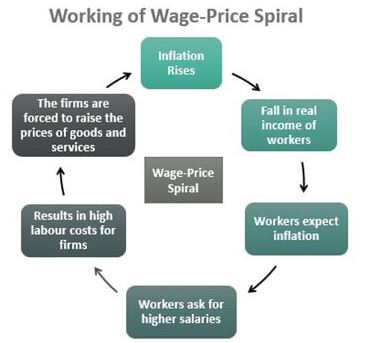

- Wage-Price Spiral Risk: Rising wages in low-skilled sectors can increase the cost of goods and services, driving inflation without improving living standards.

- For instance, wage increases for casual farm labour contribute to higher food prices, intensifying retail inflation (CPI rose by 7.44% in July 2024, RBI).

- Limited Skill Development and Upward Mobility: Casual work offers fewer opportunities for training or career advancement, trapping workers in low-wage cycles despite nominal wage growth.

- The Periodic Labour Force Survey (2023-24) shows that only 2.4% of India’s workforce received formal vocational training, limiting skill-based upward mobility.

- Depressed Consumption and Savings Rates: Casual labourers typically earn subsistence-level wages, leaving little room for savings or significant consumption, which hampers long-term economic growth.

- Household savings as a share of GDP declined from 23.6% in 2011-12 to 18.1% in 2022-23, reflecting weak wage-driven consumption (RBI report).

When did real wages for self-employed workers begin to recover after the pandemic?Real wages for self-employed workers in India began to recover after the pandemic in the quarters. Despite this recovery, as of the June 2024 quarter, real wages remained 1.5% lower than in the June 2019 quarter.

|

How have policy decisions like demonetization and the implementation of GST affected wage growth and employment patterns?

- Disruption of Informal and Small-Scale Enterprises: Both demonetisation and GST disrupted cash-dependent small and medium enterprises (SMEs), leading to job losses and reduced wage growth in the informal sector. Example: The share of salaried workers declined from 22.9% in 2019-20 to 21.7% in 2023-24 (PLFS data), indicating a shift away from formal employment.

- Shift Toward Informal and Gig Work: Policy shocks accelerated the transition from stable salaried jobs to informal, gig-based, and self-employed work, which generally offers lower pay and fewer benefits. Example: The share of self-employed workers increased from 53.5% in 2019-20 to 58.4% in 2023-24, reflecting a rise in informal employment (PLFS data).

- Slower Wage Growth and Employment Stagnation: Compliance burdens from GST and cash shortages from demonetisation constrained business operations, leading to slower wage increases across sectors. Example: Real wages for salaried workers were 1.7% lower in June 2024 compared to June 2019 (PLFS data), indicating stagnant wage growth despite economic recovery.

Way forward:

- Enhance Formal Employment and Skill Development: Promote labour-intensive sectors and incentivize formal job creation through targeted tax benefits and reduced compliance burdens.

- Strengthen Social Security and Wage Policies: Implement comprehensive social protection schemes for informal workers to ensure income stability and healthcare benefits.

Mains PYQ:

Q Besides the welfare schemes, India needs deft management of inflation and unemployment to serve the poor and the underprivileged sections of the society. Discuss. (UPSC IAS/2022)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

[21st February 2025] The Hindu Op-ed: Is consumption enough to drive growth?

PYQ Relevance:Q) Explain the difference between the computing methodology of India’s Gross Domestic Product (GDP) before the year 2015 and after the year 2015. (UPSC CSE 2021) |

Mentor’s Comment: UPSC mains have always focused on India’s Gross Domestic Product (2021), and India from realizing its potential GDP (2020).

An economy grows through two key factors: supply (production of goods and services) and demand (spending on these goods and services). Among demand sources, investment is crucial as it creates a multiplier effect, boosting jobs and income. Consumption follows growth but cannot drive it alone, as sustainable expansion requires strong investment and production.

Today’s editorial talks about India’s GDP growth factors based on demand and supply. This content would help in GS Paper 3 mains Paper.

_

Let’s learn!

Why in the News?

An economy’s growth is like navigating two interconnected boats—one representing the supply or production of goods and services.

Is consumption enough to drive growth?Consumption plays a crucial role in driving economic growth, but it is not sufficient on its own for sustainable long-term growth.

|

Why is economic growth dependent on two factors?

- Balanced Growth Requires Both Supply & Demand: Economic growth happens when goods and services are produced (supply) and purchased (demand) in a balanced manner.

- Example: A country increasing factory production (supply) must also have enough consumers to buy the products (demand), ensuring sustainable growth.

- Mismatch Leads to Economic Problems

-

- If demand > supply, inflation rises due to excessive spending with limited goods.

- If supply > demand, businesses suffer from unsold stock, leading to job losses.

- Example: Post-pandemic, supply chain disruptions led to high demand but low supply, causing inflation.

- Investment Drives Long-Term Growth: Investment in infrastructure, industries, and technology increases production capacity (supply) while also creating jobs, which boosts spending power (demand).

- Example: China’s high investment in infrastructure and manufacturing led to rapid economic growth by expanding both supply and demand.

- Government Policies Impact Both Sides: Fiscal and monetary policies help balance supply-side growth (e.g., industrial incentives) and demand-side expansion (e.g., tax cuts or subsidies).

- Example: India’s Production-Linked Incentive (PLI) scheme boosts manufacturing (supply), while government social schemes increase purchasing power (demand).

- Exports and Imports Affect Domestic Growth: A strong export sector increases supply, bringing foreign exchange, while controlled imports ensure domestic industries remain competitive.

- Example: India’s IT exports generate revenue (supply), while consumer imports like electronics influence domestic demand.

What role does investment play in economic growth?

- Boosts Production Capacity: Investment in factories, infrastructure, and technology increases the ability to produce goods and services, leading to higher GDP. Example: China’s heavy investment in manufacturing and infrastructure helped it become the world’s largest exporter.

- Creates Employment Opportunities: New industries and infrastructure projects generate jobs, increasing income and overall demand in the economy. Example: India’s road and metro projects have created millions of direct and indirect jobs, boosting economic activity.

- Multiplier Effect on Demand & GDP: Investment leads to increased income, which in turn increases consumption and demand, further driving growth. Example: A ₹100 investment in building highways can create ₹125 in overall economic output due to increased business activities along the route.

- Encourages Private Sector Confidence: When the government invests in key sectors, it builds confidence among private businesses to invest further. Example: India’s Production-Linked Incentive (PLI) scheme for electronics manufacturing has attracted global tech firms to set up production units.

- Leads to Technological and Industrial Development: Investments in research, innovation, and new industries enhance productivity and global competitiveness. Example: South Korea’s investment in R&D and technology made it a leader in electronics and automobile industries.

How have India and China experienced changes in per capita income?

- Similar Per Capita Incomes in the Early 1990s: In the early 1990s, India and China had nearly equal per capita incomes, with both countries being 1.5% of the U.S. average. Example: In 1992, both nations were considered low-income economies with similar economic structures.

- China’s Investment-Led Growth Model: China prioritized high investment rates, focusing on infrastructure, state-owned enterprises, and manufacturing. Example: In 1992, China’s investment rate was 39.1% of GDP, much higher than India’s 27.4%.

- Diverging Growth Post-2000s: India’s investment rate rose to 35.8% in 2007, almost matching China’s, but declined after 2012 due to policy uncertainty and global economic slowdown.Example: By 2013, China’s investment rate increased to 44.5%, while India’s fell to 31.3%.

- China’s Faster Rise in Per Capita Income: By 2023, China’s per capita income was 5 times India’s in nominal terms and 2.4 times higher in purchasing power parity (PPP). Example: As a percentage of U.S. per capita income in 2023: China: 15%, India: 3%.

- India’s Consumption-Driven Growth Model: India’s economic growth has been mainly driven by domestic consumption, while China maintained higher investment levels. Example: In 2023, consumption was 60.3% of India’s GDP, compared to 39.1% in China.

- Long-Term Impact on Growth and Inequality: India’s lower investment and trade deficits have led to slower per capita income growth, affecting job creation and economic equality. Example: China’s investment rate in 2023 was 41.3%, whereas India’s was only 30.8%, limiting economic expansion.

What measures has the Indian government taken to promote investment in India?

|

Way forward:

- Enhancing Investment-Led Growth: India should focus on increasing capital formation by boosting infrastructure, industrial productivity, and R&D investments. Strengthening public-private partnerships (PPPs) and expanding the PLI scheme to emerging sectors can accelerate long-term economic growth.

- Balancing Consumption and Supply-Side Expansion: While consumption remains a key driver, policies should encourage domestic manufacturing and export competitiveness to reduce reliance on imports. Strengthening skill development and labour market reforms will enhance productivity and job creation.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

India to be part of UN’s 63rd session of Commission for Social Development 2025

From UPSC perspective, the following things are important :

Mains level: Social Cohesion; Solidarity;

Why in the News?

India participated in the 63rd session of the Commission for Social Development (CSoCD) from February 10 to 14, 2025, in New York, USA. The Indian delegation was led by Smt. Savitri Thakur, Minister of State for Women and Child Development.

What is Social cohesion?

|

What are the Dimensions of the Social Cohesion?

- Social Inclusion & Equity: Ensures equal access to opportunities, resources, and rights for all individuals, reducing discrimination and marginalization. Example: India’s JAM Trinity (Jan Dhan, Aadhaar, Mobile) has enabled financial inclusion for disadvantaged communities, particularly women and rural populations.

- Trust in Institutions & Social Capital: Building confidence in governance, law enforcement, and civic institutions to enhance cooperation and stability. Example: Sweden’s transparent governance and welfare policies result in high public trust in government institutions.

- Participation & Civic Engagement: Encouraging individuals and communities to actively engage in decision-making and democratic processes. Example: Rwanda’s high female political representation (over 60% in Parliament) fosters inclusive and equitable policymaking.

- Solidarity & Shared Identity: Promoting unity while respecting cultural diversity and fostering a common sense of belonging. Example: Canada’s multicultural policies encourage immigrant integration while maintaining cultural heritage.

- Economic Inclusion & Opportunity: Providing equal access to economic resources, employment, and skill development to ensure upward mobility. Example: Germany’s dual vocational education system equips young people with job-ready skills, reducing unemployment and income inequality.

What is the virtuous cycle?

|

What are the roles of Social Cohesion in the Virtuous cycle?

- Promotes Inclusive Economic Growth: Social cohesion ensures equal access to economic opportunities, reducing disparities and fostering shared prosperity. Example: In Germany, strong social policies and labor rights have contributed to stable economic growth and low unemployment rates.

- Enhances Trust in Institutions and Governance: When citizens feel included and represented, they trust public institutions, leading to political stability and effective governance. Example: Scandinavian countries like Sweden and Norway have high levels of trust in governance due to inclusive decision-making and welfare policies.

- Encourages Social Mobility and Equal Opportunities: A cohesive society provides fair access to education, healthcare, and social protection, enabling upward mobility for all. Example: Singapore’s education system focuses on meritocracy, ensuring students from all backgrounds have access to quality education and career opportunities.

- Strengthens Community Participation and Civic Engagement: Social cohesion encourages people to engage in local governance, volunteerism, and community development initiatives. Example: Japan’s neighborhood associations play a crucial role in disaster response, fostering collective responsibility and mutual support.

- Reduces Social Conflicts and Crime: By addressing inequalities and fostering a sense of belonging, social cohesion minimizes tensions and crime rates. Example: New Zealand’s restorative justice programs emphasize reconciliation and community involvement, reducing recidivism rates.

What are the Key Recommendations to promote Social Cohesion? (Way forward)

- Inclusive Policies and Equal Opportunities: Ensure access to quality education, healthcare, and employment for all, reducing social and economic disparities. Example: Finland’s education system provides free, high-quality education, ensuring equal opportunities for all children, regardless of socioeconomic background.

- Community Engagement and Trust Building: Promote civic participation, intergroup dialogue, and local governance to strengthen social bonds and mutual respect. Example: South Africa’s Truth and Reconciliation Commission (TRC) helped heal racial divides by addressing historical injustices through public dialogue.

- Economic and Social Safety Nets: Implement strong social protection systems like universal healthcare, unemployment benefits, and targeted welfare programs. Example: Brazil’s Bolsa Família program reduced poverty and inequality by providing conditional cash transfers to low-income families, improving education and health outcomes.

Mains PYQ:

Q An independent and empowered social audit mechanism is an absolute must in every sphere of public service, including judiciary, to ensure performance, accountability and ethical conduct. Elaborate. (UPSC IAS/2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

A pragmatic picture: Economic Survey

Why in the News?

The Budget session of Parliament has started at a time when India’s economic situation is shifting. After four years of strong growth following the pandemic, the economy is slowing down.

What are the key projections for India’s economic growth in FY 2024-25?

- Projected GDP Growth: The National Statistical Office (NSO) has estimated that India’s GDP will grow by 6.4% in FY 2024-25. This figure marks a decline from the 8.2% growth recorded in FY 2023-24 and is lower than earlier forecasts which ranged from 6.5% to 7%.

- Sectoral Performance: The slowdown is attributed to weaker performance in sectors such as manufacturing and services. The first half of FY 2024-25 is expected to see a growth rate of around 6%, necessitating a stronger performance of 6.8% in the second half to meet the annual target.

- Comparative Estimates: While the NSO’s estimate stands at 6.4%, other organizations like the International Monetary Fund (IMF) have projected a slightly higher growth rate of 7%, reflecting differing outlooks on economic recovery and consumer demand.

How does the Economic Survey address challenges such as inflation and global uncertainties?

- Food Inflation Concerns: Despite the overall decline in inflation, food inflation remains a challenge, rising from 7.5% in FY24 to 8.4% in the same period due to supply chain disruptions and adverse weather conditions.

- The survey emphasizes the need for improved agricultural practices and climate-resilient crops to manage these risks effectively.

- Inflation Trends: The survey reports a reduction in retail inflation from 5.4% in FY24 to 4.9% during April-December 2024, indicating a positive trend towards achieving the RBI’s target of around 4% by FY26, contingent on stable global commodity prices and favorable domestic agricultural output.

- Global Economic Uncertainties: The survey highlights that ongoing geopolitical tensions and global trade risks pose significant challenges to inflation management, necessitating careful policy interventions to mitigate potential impacts on the domestic economy.

- Policy Recommendations: To address these challenges, the Economic Survey advocates for strategic policy measures, including enhancing supply chain resilience, improving data collection for better price monitoring, and fostering an environment conducive to investment and growth.

What structural reforms are recommended to enhance long-term economic stability?

- Deregulation and Ease of Doing Business: The Economic Survey advocates for significant deregulation to foster a more conducive business environment. It stresses that the government should “get out of the way” of businesses by minimizing micro-management and enhancing accountability among regulators.

- Empowering Small Firms: Recommendations include empowering small enterprises, enhancing economic freedom, and ensuring a level playing field across sectors to stimulate growth and investment.

- Focus on Domestic Demand: The budget is expected to prioritize boosting domestic demand through increased government spending, particularly in infrastructure and capital projects, as a countermeasure against global uncertainties and inflationary pressures.

Way forward:

- Strengthen Domestic Resilience – Focus on boosting domestic consumption and investment through targeted fiscal measures, infrastructure expansion, and support for MSMEs to counter global uncertainties.

- Enhance Inflation Management – Implement climate-resilient agricultural policies, improve supply chain efficiency, and strengthen monetary-fiscal coordination to maintain stable inflation and ensure sustainable growth.

Mains PYQ:

Q Is inclusive growth possible under market economy? State the significance of financial inclusion in achieving economic growth in India.(UPSC IAS/2022)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

India is heading into a middle income trap

From UPSC perspective, the following things are important :

Mains level: Middle-income trap;

Why in the News?

Ahead of the Union Budget, the Congress released a report on January 30, 2025, saying that India is at risk of getting stuck in the middle-income trap.

What is the classification of Countries given by the World Bank?The World Bank classifies countries into four income groups based on their Gross National Income (GNI) per capita.

|

What factors contribute to India being at risk of falling into a middle-income trap?

- Low GDP Growth: India’s projected GDP growth rate for 2024-25 is around 6.4%, significantly lower than the 8% needed to leverage its demographic dividend effectively, indicating a slowdown in economic momentum.

- Food Inflation Concerns: Despite the overall decline in inflation, food inflation remains a challenge, rising from 7.5% in FY24 to 8.4% in the same period due to supply chain disruptions and adverse weather conditions.

- Private Sector Investment: Despite corporate tax cuts, private sector investment has not significantly increased. The Economic Survey 2024-25 indicates that Gross Fixed Capital Formation (GFCF), a crucial indicator of investment activity, slowed to 5.4% in the recent quarter, reflecting a decline in private capital expenditure.

- Government Capital Expenditure: The survey notes that government capital expenditure utilization was only 37.3% in the first half of FY25, down from 49% the previous year, which has contributed to the overall slowdown in investments.

- Low Incomes: A significant portion of India’s population lives on extremely low incomes, with estimates suggesting that about 50% of the population earns between ₹100 and ₹150 per day. This level of income severely limits consumer spending capacity and economic growth potential.

How does the current economic policy framework address the challenges? (Way forward)

- Next-Generation Reforms: The Union Budget 2024-25 emphasizes “Next Generation Reforms” aimed at enhancing productivity and market efficiency across various sectors.

- This includes a comprehensive Economic Policy Framework that focuses on improving factors of production land, labour, capital, and entrepreneurship while leveraging technology to reduce inequality and boost economic growth.

- Deregulation and Economic Freedom: The Economic Survey highlights the need for deregulation and grassroots reforms to enhance the competitiveness of the economy. It advocates for greater economic freedom, allowing individuals and organizations to pursue legitimate economic activities without excessive regulatory burdens.

- Public-Private Partnerships and Infrastructure Investment: The framework encourages public-private partnerships (PPPs) in infrastructure projects, facilitating greater collaboration between the government and private sector.

- By removing policy hurdles and providing upfront support for long-term projects, the government aims to attract patient capital necessary for sustainable development, which is critical for addressing current economic challenges

Mains PYQ:

Q Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (UPSC IAS/2019)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

McKinsey released Report on Demographic Transition and Depopulation

From UPSC perspective, the following things are important :

Prelims level: Demographic Transition Theory

Why in the News?

The report, ‘Dependency and Depopulation? Confronting the Consequences of a New Demographic Reality’, released by McKinsey Global Institute, provides a detailed comparative analysis of demographic dynamics in developed (first wave) and developing (later wave) countries.

IMPORTANT: What is Demographic Transition Theory?

Demographic transition describes changes in birth and death rates and population age structure as societies develop economically and technologically.

|

Key Highlights of the McKinsey Report

- Two-thirds of humanity now live in countries with fertility rates below the replacement level of 2.1 children per family.

- Age structures are shifting from pyramids to obelisks, with a growing elderly population and a shrinking youth demographic.

- Populations in some major economies are projected to decline by 20%-50% by 2100 (UN).

- The global support ratio (working-age individuals per senior aged 65 or older) is projected to decline from 6.5 today to 3.9 by 2050.

- In India, the ratio will fall from 10 workers per senior in 1997 to 4.6 in 2050 and just 1.9 by 2100, similar to Japan’s current levels..

- Consumption Patterns in India:

- India’s share in global consumption is projected to rise from 9% today to 16% by 2050, while shares of advanced economies are expected to remain flat or decline.

- By 2050, the share of consumption by seniors aged 65 and older will rise from 8% to 15%, reflecting changing consumer demographics.

- The percentage of hours worked by seniors is projected to increase from 2.9% to 5.4% by 2050 under current trends.

About India’s Diminishing Demographic Dividend

- India has 33 years to fully capitalize on its demographic dividend before its support ratios align with those of advanced economies.

- From 1997 to 2023, India’s favorable demographics added 0.7 percentage points per year to its GDP per capita growth.

- This contribution is expected to shrink to 0.2 percentage points per year through 2050 as the population ages.

- India’s support ratio (working-age individuals per senior) is projected to decline significantly, creating greater dependency on fewer workers to support older populations.

- By 2050, there will be only 4.6 workers per senior, down from 10 workers per senior in 1997.

- India’s GDP per capita is currently 18% of the World Bank’s high-income threshold, emphasizing the need for faster economic progress to “get rich before it gets old.”

- Increasing labor force participation, particularly among women, and improving worker productivity are critical to sustaining economic growth.

- Despite rapid progress, India’s worker productivity remains at $9 per hour, significantly lower than the $60 per hour average in high-income countries.

PYQ:[2012] Consider the following specific stages of demographic transition associated with economic development:

Select the correct order of the above stages using the codes given below: (a) 1, 2, 3 (b) 2, 1, 3 (c) 2, 3, 1 (d) 3, 2, 1 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Why is rupee weakening against dollar?

From UPSC perspective, the following things are important :

Mains level: Rupee depreciation;

Why in the News?

In the last week of December 2024, the rupee dropped below 85 against the U.S. dollar, hitting a new low of 85.81. The rupee fell by about 3% in 2024, continuing its long-term decline against the dollar.

What has caused the currency to depreciate?

- Exit of Foreign Investors: A significant driver of the rupee’s depreciation has been the exit of foreign portfolio investors (FPIs) from Indian markets. In 2024, FPIs pulled out substantial amounts from equities, leading to increased selling pressure on the rupee.

- Widening Trade Deficit: India’s trade deficit has widened due to high imports, particularly of crude oil and gold, compared to its exports. This increased demand for foreign currencies (like the U.S. dollar) to pay for these imports has contributed to the rupee’s weakening.

- Monetary Policy Differences: The Reserve Bank of India’s relatively looser monetary policy compared to the U.S. Federal Reserve has resulted in higher inflation rates in India. This inflation differential makes Indian assets less attractive to foreign investors, further reducing demand for the rupee.

- Global Economic Factors: Geopolitical tensions, such as the Russia-Ukraine war and rising global crude oil prices, have created volatility in the markets, leading to capital outflows from emerging markets like India.

- The other reason is that the strengthening U.S. dollar amid higher U.S. bond yields has made investments in the U.S. more attractive compared to India.

What could be the impact of Rupee depreciation?

- Increased Import Costs: A weaker rupee raises the cost of imports, particularly for essential goods such as crude oil, fertilizers, and edible oils. This increase in import bills can lead to a higher overall trade deficit, which reached an all-time high of $37.8 billion in November 2024, exacerbating economic vulnerabilities.

- Inflationary Pressures: The rising costs of imported goods contribute to inflation, making everyday goods more expensive for consumers. This can lead to higher living costs and reduced purchasing power, as seen with the increased prices of food and fuel due to higher import expenses.

- Impact on Economic Growth: The combination of rising inflation and increased costs can dampen economic growth. Higher import bills can create upward pressure on interest rates, making borrowing more expensive and potentially slowing down investment and consumption.

Why made the central bank to intervene?

- Stabilizing Currency Value: The Reserve Bank of India (RBI) intervened in the forex market to stabilize the rupee and prevent excessive volatility that could disrupt economic stability. By selling dollars from its reserves, the RBI aimed to support the rupee’s value against the dollar.

- Preventing Inflationary Pressures: A depreciating rupee increases the cost of imports, particularly essential commodities like crude oil, which can exacerbate inflation domestically. The RBI’s intervention seeks to mitigate these inflationary pressures by maintaining a more stable exchange rate.

- Maintaining Investor Confidence: By actively managing the currency’s value, the RBI aims to instill confidence among investors regarding India’s economic stability and attractiveness as an investment destination. This is crucial for sustaining foreign investment inflows and supporting economic growth.

Way forward:

- Diversify Export Markets and Reduce Dependence on Imports: India should focus on enhancing its exports to non-traditional markets while exploring alternatives to reduce dependence on high-cost imports, especially crude oil and gold.

- Monetary Policy Coordination and Strengthening Fundamentals: The RBI should work towards aligning its monetary policy with global trends while ensuring domestic inflation remains under control.

Mains PYQ:

Q How would the recent phenomena of protectionism and currency manipulations in world trade affect macroeconomic stability of India? (UPSC IAS/2018)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Chhattisgarh first state to link Forest Ecosystem with Green GDP

From UPSC perspective, the following things are important :

Prelims level: Green GDP

Why in the News?

For the first time in India, Chhattisgarh has introduced an innovative framework that integrates the ecosystem services of its forests into the calculation of Green Gross Domestic Product (Green GDP). This initiative highlights the critical role forests play in supporting both environmental sustainability and economic growth.

Highlights of the Chhattisgarh’s Plan

|

About Green GDP

- Green GDP is an alternative metric for assessing economic growth that includes the environmental costs of economic activities.

- It subtracts the value of natural resource depletion and environmental degradation from traditional GDP to provide a more accurate picture of economic well-being.

- Introduced in the 1993 United Nations Handbook of National Accounting: Integrated Environmental and Economic Accounting under the System of Environmental-Economic Accounting (SEEA) framework.

- Key Features:

- Aims to measure the sustainability of economic growth.

- Focuses on valuing ecosystem services like carbon sequestration, soil conservation, and water resources.

- Provides insights into the trade-offs between economic growth and environmental conservation.

- Calculation:

- Green GDP = Traditional GDP – Costs of Environmental Degradation – Costs of Resource Depletion.

- Challenges: Incomplete environmental data, reliance on subjective assumptions, difficulty in valuing ecosystem services, and the absence of a universal calculation framework, often oversimplifying nature’s intrinsic worth.

Government Initiatives for Green GDP Accounting

- Green National Account Framework: It integrates environmental considerations into national accounting systems. It captures the value of natural resources, costs of pollution, and benefits of ecosystem services like clean air and water.

- System of Environmental-Economic Accounting, 2012 (SEEA): It was adopted by India under UN guidelines to create databases for natural capital accounting and informed policymaking.

- RBI Estimates: Green GDP for 2019 was ₹167 trillion, reflecting a 10% adjustment from traditional GDP. It is supported by organizations like TERI and Indian Statistical Institute to refine valuation methodologies.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Household Consumption Expenditure Survey, 2023-24

From UPSC perspective, the following things are important :

Prelims level: Household Consumption Expenditure Survey, 2023-24

Why in the News?

The Household Consumption Expenditure Survey (HCES) 2023-24 highlights key trends in consumption patterns across India. It is conducted by the National Statistical Office (NSO) every 5 years.

Important Highlights of HCES, 2023-24:

- Rural Spending: Monthly per capita consumption expenditure (MPCE) increased by 9.3% to ₹4,122 in 2023-24 (from ₹3,773 in 2022-23); significantly higher than ₹1,430 in 2011-12.

- Urban Spending: MPCE rose by 8.3% to ₹6,996 (from ₹6,459 in 2022-23); up from ₹2,630 in 2011-12.

- Rural-Urban Gap: Narrowed to 69.7% in 2023-24, compared to 71.2% in 2022-23 and 83.9% in 2011-12.

- Food Expenditure: Share increased to 47.04% in rural and 39.68% in urban households, reversing a decades-long decline.

- Rural households spent most on beverages and processed food (11.09%), followed by milk products (8.44%) and vegetables (6.03%).

- Urban households spent most on beverages and processed food (9.84%), milk products (7.19%), and vegetables (4.12%).

- Decline in expenditure on sugar and salt, with rising spending on beverages and processed foods, signaling dietary shifts.

- Non-Food Expenditure: Accounted for the majority in both rural (52.96%) and urban areas (60.32%).

- Major rural non-food expenses: Conveyance (7.59%), medical expenses (6.83%), and clothing & bedding (6.63%).

- Major urban non-food expenses: Conveyance (8.46%), entertainment (6.92%), and durable goods (6.87%).

– Regional Variations:

- Highest MPCE: Sikkim (Rural – ₹9,377; Urban – ₹13,927) and Chandigarh (Rural – ₹8,857; Urban – ₹13,425).

- Lowest MPCE: Chhattisgarh (Rural – ₹2,739; Urban – ₹4,927).

- States with largest rural-urban gaps: Meghalaya (104%), Jharkhand (83%), and Chhattisgarh (80%).

- Consumption Inequality: Gini coefficient declined from 0.266 to 0.237 in rural areas and 0.314 to 0.284 in urban areas, indicating reduced income disparity.

Features and Significance

- Consumption Trends: Indicates rising food expenditure driven by inflation and evolving post-pandemic behaviors.

- Narrowing Rural-Urban Gap: Highlights improved rural consumption growth outpacing urban areas.

- Changing Diet Patterns: Increased preference for beverages and processed foods in both rural and urban households reflects dietary shifts.

- Regional Disparities: Offers insights into high- and low-spending regions, aiding targeted interventions.

- Policy Implications: Highlights the need for price stabilization for essentials, rural infrastructure investments, and urban employment growth to address income disparities and rising expenses.

PYQ:[2019] In a given year in India, official poverty lines are higher in some States than in others because: (a) poverty rates vary from State to State |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Architect of Indian Economic Reforms passes way

From UPSC perspective, the following things are important :

Mains level: Economic reforms;

Why in the News?

People around the world paid tribute to Dr. Manmohan Singh, known for opening up India’s economy and making it a global player, who passed away at the age of 92.

How did Manmohan Singh’s reforms transform India’s economic landscape?

- 1991 Economic Liberalization (LPG): He abolished the “License Raj,” which required businesses to seek government approvals for setting up industries.

- Example: The IT sector flourished, with companies like Infosys and Wipro gaining international prominence.

- Tax Reforms and Currency Devaluation: Singh’s government implemented substantial tax cuts and devalued the Indian rupee to enhance competitiveness.

- Example: Corporate tax was reduced from 50% (pre-1991) to around 35% by the mid-1990s, boosting business sentiment.

- Welfare Schemes: Alongside economic liberalisation, Singh’s administration introduced welfare initiatives aimed at sharing the benefits of growth with the rural poor, thereby addressing socio-economic disparities.

- Introduced schemes like MGNREGA (2005) and expanded rural credit, improving employment and poverty alleviation.

- Poverty rates dropped from 37.2% (2004-05) to 21.9% (2011-12), and India’s middle class expanded significantly due to higher income levels.

- Economy growth: As Finance Minister, in 1991 economic reforms addressed the balance-of-payments crisis by reducing the fiscal deficit from 8.4% of GDP (1991) to 5.7% (1993) and reviving GDP growth from 1.1% (1991-92) to 5.3% (1992-93) through measures such as dismantling industrial licensing, devaluing the rupee, and encouraging foreign investment.

How did he left a lasting imprint on external relations?

- US-India Civil Nuclear Deal (2008): He played a pivotal role in finalising the Civil Nuclear Agreement, which ended India’s nuclear isolation and strengthened strategic ties with the United States.

- It also marked a shift in global recognition of India as a responsible nuclear power.

- Strengthening India’s Strategic Partnerships: Deepened ties with major global powers, including the US, EU, Japan, and Russia, enhancing India’s diplomatic and economic engagement globally.

- Championing India’s Role in Global Governance: Advocated for reforms in international institutions like the UN, IMF, and World Bank to reflect the rising stature of emerging economies, particularly India.

- His leadership elevated India’s voice in global forums like G20 and BRICS.

- Focus on Regional and Economic Integration: Fostered closer economic and diplomatic ties with ASEAN, SAARC nations, and other Asian neighbours, reinforcing India’s position in regional trade and security frameworks.

- His outreach contributed to India’s Act East Policy and improved relations with key partners in the Indo-Pacific region.

Conclusion: The Indian government should embrace Dr. Manmohan Singh’s legacy by prioritizing bold economic reforms, fostering global partnerships, and championing inclusive growth. Emphasizing strategic investments in infrastructure, skilling, and technology while deepening ties with regional and global partners can sustain long-term growth, reduce disparities, and solidify India’s leadership in global governance.

Mains PYQ:

Q Has the Indian governmental system responded adequately to the demands of Liberalization, Privatization and Globalization started in 1991? What can the government do to be responsive to this important change? (UPSC IAS/2016)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Looking at 2025, The Economy: Some positives, some concerns

From UPSC perspective, the following things are important :

Prelims level: Indian economy;

Why in the News?

The Finance Minister describes the slowdown in Q2 growth as a “temporary blip,” while the RBI has revised its GDP growth forecast for 2024-25 downward, from 7.2% to 6.6%.

Why RBI has revised its GDP growth forecast for 2024-2025 downward, from 7.2% to 6.6%?

What are the expected growth rates for major economies in 2025?

|

How will inflation and monetary policy evolve?

- Inflation Persistence: Inflation in India remains at the upper end of the permissible range, with food prices nearing double digits. This persistent inflation strengthens the argument for maintaining high interest rates, complicating the Reserve Bank of India’s (RBI) monetary policy decisions as they balance growth with inflation control.

- Monetary Policy Adjustments: The RBI may need to reconsider its previous projections of GDP growth, which could lead to adjustments in interest rates. If inflation continues to be a concern, the RBI might maintain or even increase rates longer than necessary which impacts investment and economic activity.

- Investment and Economic Recovery: A slowdown in corporate investments and a decline in household financial savings have been observed, which could hinder economic recovery.

- The RBI’s ability to stimulate growth through monetary policy will depend on addressing these investment challenges and ensuring that fiscal measures effectively support economic activity without exacerbating inflation.

What are the key risks and uncertainties facing the global economy?

- Investment Slowdown: A significant challenge is the sluggish performance of corporate investments, exacerbated by high food inflation and muted urban demand. This trend poses risks for growth and job creation.

- Savings-Investment Gap: A decline in household financial savings down to 5.3% of GDP from 7.3% coupled with rising household debt (5.8% of GDP) presents a risk to economic stability1.

- Credit Growth Decline: Falling credit growth, particularly in household borrowing for home purchases and limited industrial appetite for new projects, indicates a tightening economic environment.

- Fiscal Challenges: Increased state expenditures on subsidies may strain fiscal resources, potentially affecting overall economic sustainability and growth prospects.

What should be done by the government? (Way forward)

- Balanced Fiscal and Monetary Coordination: Governments should prioritize targeted fiscal measures to stimulate investment and demand while ensuring fiscal discipline, complemented by a flexible monetary policy that carefully balances inflation control with growth stimulation.

- Boosting Household Savings and Investments: Implement policies to encourage higher household financial savings and incentivize corporate investments through tax reforms, reduced regulatory barriers, and support for credit access in productive sectors.

Mains PYQ:

Q The nature of economic growth in India in recent times is often described as jobless growth. Do you agree with this view? Give arguments in favour of your answer. (UPSC IAS/2015)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

A Study of Budgets of 2024-25 (Fiscal Reforms by States) Report released by RBI

From UPSC perspective, the following things are important :

Prelims level: RBI, Key highlights of the report

Why in the News?

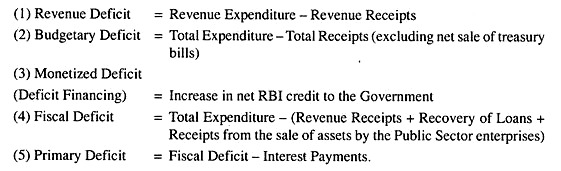

- According to the RBI report on state finances, India’s fiscal deficit has increased from 2.8% of GDP in FY22 to a projected 3.2% in FY24, signaling that fiscal consolidation is being side-lined in favor of increasing expenditure.

- Capital expenditure (capex) has risen from 2.2% of GDP in FY23 to a budgeted 3.2% in FY24, indicating increased investment in assets for future growth.

Fiscal position of the States as per the Report

- Fiscal Deficit:

-

- The Gross Fiscal Deficit (GFD) of states is projected to rise from 2.7% of GDP in FY2022-23 to 2.9% of GDP in FY2023-24.

- This rise indicates that fiscal consolidation has been put on hold, with states continuing to spend more than their revenues.

- Many states have budgeted for fiscal deficits above the 3% of GSDP mark, including Andhra Pradesh, Himachal Pradesh, Madhya Pradesh, and West Bengal, among others.

- Revenue Expenditure:

-

- Revenue Expenditure is expected to increase to 14.6% of GDP in FY2025, up from 13.5% in FY2024, indicating a rise in the current expenditure of states.

- Capital Expenditure (Capex):

-

- States have ramped up their capital expenditure (spending on creating assets), which has increased from 2.2% of GDP in FY2023 to 3.2% of GDP in FY2024.

- This increase is in line with the government’s focus on infrastructure and long-term growth.

- State Revenue:

-

- State revenues are projected to increase from 13.3% of GDP in FY2024 to 14.3% in FY2025, driven by improved tax collections.

- There has been a marked improvement in own tax revenue buoyancy compared to the pre-Covid period.

- Debt-to-GDP Ratio:

-

- The debt-to-GDP ratio for states has increased slightly to 28.8% in FY2024, from 28.5% in FY2023.

- States with high fiscal deficits tend to have debt-to-GDP ratios above the national average, which suggests they have been sustaining deficits for a longer time.

- Borrowing Trends:

-

- States have shifted significantly towards market borrowings.

- The share of market borrowings in financing the fiscal deficit has increased from 17% in 2005-06 to 79% in FY2024-25.

- Recommendations:

-

- The report suggests prudent management of subsidies, rationalization of centrally sponsored schemes, debt consolidation, and the adoption of climate and outcome budgeting to improve state fiscal health.

PYQ:[2018] Consider the following statements:

Which of the statements given above is/are correct? (a) 1 only |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

The issue of India’s economic growth versus emissions

From UPSC perspective, the following things are important :

Mains level: Sustainable Development; Green Economy;

Why in the News?

The Economic Survey (2023-24) claims that India has managed to grow its economy without significantly increasing its greenhouse gas emissions. This claim has sparked the debate about actual sustainable growth in India.

What does the Economic Survey (2023-24) say about GHG emissions?

- Relative Decoupling Achieved: Between 2005 and 2019, India’s GDP grew at a 7% CAGR, while GHG emissions increased by 4%.

- Emission Intensity Reduction: India reduced emission intensity by 33% from 2005 levels, achieving its 2030 NDC target 11 years early.

- Carbon Sink Expansion: India aims to add a 2.5–3 billion tonne carbon sink by 2030, building on the 1.97 billion tonnes achieved (2005–2019).

- Investment Needs: Achieving NDC targets requires $2.5 trillion by 2030, with a focus on domestic resources, affordable finance, and technology access.

Has India decoupled its economic growth from GHG emissions?

- Arguments against decoupling:

-

-

- The Economic Survey does not clarify whether the observed decoupling is absolute (declining emissions with GDP growth) or relative (emissions rising slower than GDP).

- India has achieved economy-wide relative decoupling since 1990, with GDP growing six-fold while GHG emissions have only tripled. However, absolute decoupling has not been achieved, as emissions continue to rise.

- Agriculture and manufacturing, major contributors to India’s GHG emissions, require detailed sectoral analysis.

-

- Argument in favour of decoupling:

-

- The Economic Survey indicates that between 2005 and 2019, India’s GDP grew at a compound annual growth rate (CAGR) of approximately 7%, while GHG emissions grew at a CAGR of only 4%.

- India has successfully reduced its emission intensity by 33% from 2005 levels, achieving its initial Nationally Determined Contribution (NDC) target for 2030 eleven years ahead of schedule. This reduction indicates that India is managing to grow economically while lowering the emissions per unit of GDP.

- India is on track to create an additional carbon sink of 2.5 to 3.0 billion tonnes (installed electricity generation capacity reaching 45.4% by May 2024) through tree and forest cover by 2030, building on a carbon sink of 1.97 billion tonnes established from 2005 to 2019.

What are the steps taken by the Government?The Economic Survey 2023-24 outlines several key steps taken by the Indian government to address greenhouse gas (GHG) emissions and promote sustainable development:

|

What efforts must be continued by India? (Way forward)

- Pursuit of Absolute Decoupling: To achieve long-term climate commitments and sustainability goals, India must strive toward absolute decoupling, where economic growth continues alongside a reduction in emissions.

- This requires comprehensive policies focused on renewable energy adoption, emission mitigation strategies, and sustainable development initiatives.

- Investment in Renewable Energy and Climate Resilience: Continued efforts are necessary to enhance investments in renewable energy sources and technologies, alongside measures to improve energy efficiency and reduce reliance on fossil fuels.

Mains PYQ:

Q Describe the major outcomes of the 26th session of the Conference of the Parties (COP) to the United Nations Framework Convention on Climate Change (UNFCCC). What are the commitments made by India in this conference? (UPSC IAS/2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

GDP was lower than expected. Here’s how to move ahead

From UPSC perspective, the following things are important :

Mains level: Challenges related to GDP;

Why in the News?

India has been growing well even with global challenges. After growing by 8.2% in 2023-24 and 6.7% in the first quarter of 2024-25, growth slowed down to 5.4% in the second quarter.

Is the Slowdown in GDP Growth a Temporary Setback or a Sign of a Longer-Term Trend?

- Current Growth Trends: India’s GDP growth decelerated to 5.4% in the second quarter of FY 2024-25, down from 6.7% in the previous quarter and 8.1% in the same quarter last year. This sharp decline has raised concerns about the sustainability of growth, particularly given that industrial performance has been poor, especially in the mining, manufacturing, and electricity sectors.

- Sectoral Performance: The industrial sector’s growth slowed to 3.6% from 8.3%, indicating significant challenges in manufacturing and mining.

- While agriculture has shown recovery due to good Kharif harvests, and the services sector remains robust, the overall industrial slowdown suggests vulnerabilities that could impact future growth.

- Expectations for Recovery: Despite the current slowdown, there are expectations for GDP growth to rebound in the latter half of the fiscal year due to improved government expenditure and rural consumption. However, this recovery is contingent upon various factors, including global economic conditions and domestic consumption patterns.

- Long-Term Concerns: Analysts caution that while some recovery is anticipated, the overall GDP growth for FY 2024-25 is projected to be lower at around 6.5%, which is a decrease from the 7-8% range seen in previous years.

Measures to Stimulate Consumer Sentiment and Boost Household Spending

- Tax Benefits for Households: The government could consider implementing tax incentives aimed at increasing disposable income for households, thereby encouraging spending. This could involve direct tax cuts or enhanced deductions for certain expenditures.

- Job Creation Initiatives: A strong focus on job creation, especially in sectors vulnerable to automation, could bolster household incomes and consumer confidence. Initiatives could include skill development programs and incentives for businesses that hire more workers.

- Support for Agriculture: Given the positive impact of agricultural performance on rural consumption, enhancing support for farmers through subsidies or better access to markets could further stimulate spending in rural areas.

- Addressing Inflation Concerns: Moderating food inflation through effective supply chain management and price controls could help ease consumer spending pressures. Ensuring stable prices for essential commodities would improve overall consumer sentiment.

- Incentives for Private Investment: Encouraging private sector investment through favorable policies and easing regulatory burdens can lead to increased economic activity and job creation.

How Should Policymakers Respond to Current Economic Challenges? (Way forward)

- Enhance Public Investment: Policymakers should prioritize increasing government capital expenditure (capex), which has been weak due to election-related restrictions. A robust public investment strategy can stimulate economic activity and create jobs.

- Focus on Deregulation: Continued efforts to deregulate sectors can improve business confidence and attract private investments, fostering a more conducive environment for growth.

- Monitor Global Developments: Policymakers need to remain vigilant regarding global economic trends that could impact India’s economy, including potential trade wars or geopolitical tensions. Preparing contingency plans will be crucial in mitigating risks associated with global volatility.

- Strengthen Domestic Demand: Given the uncertain global environment, strengthening domestic demand through targeted fiscal policies will be essential for sustainable growth. This includes measures that directly enhance consumer spending power.

- Long-Term Growth Strategy: A comprehensive strategy focusing on enhancing productivity across sectors, investing in infrastructure, and fostering innovation will be critical for raising India’s potential GDP growth over the long term.

Mains PYQ:

Q Despite India being one of the countries of Gondwanaland, its mining industry contributes much less to its Gross Domestic Product (GDP) in percentage. Discuss. (UPSC IAS/2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

Can India get rich before growing old?

From UPSC perspective, the following things are important :

Mains level: Demographic dividend in the context of Indian economy;

Why in the News?

Since liberalization opened up new opportunities, there has been a lot of excitement about India’s demographic dividend, which is the advantage of having a large working-age population but there are major challenges like the middle-income trap.

Can India leverage its sustained economic growth?

- Harnessing the Demographic Dividend: With a large working-age population, India has a potential advantage, but it must ensure that this workforce is employed in productive sectors, particularly by shifting labor from low-productivity agriculture to higher-productivity manufacturing and services.

- Strengthening the Manufacturing Sector: The manufacturing sector, especially labor-intensive industries like textiles, has the potential to create millions of jobs. By addressing barriers such as complex regulations, high tariffs, and infrastructure constraints, India can boost manufacturing growth, empower women, and drive economic mobility.

- Reforming Infrastructure and Business Environment: Improving ease of doing business, simplifying trade and labor regulations, and increasing investment in infrastructure are critical for unlocking India’s potential for sustained growth. These reforms will enable large-scale job creation and enhance India’s global competitiveness.

Challenges arising due to the middle-income trap

- Declining Demographic Dividend: The proportion of working-age individuals in India’s population is set to decline in the coming decade, marking the potential end of the demographic dividend. Fertility rates have dropped across various states, which means India may face an aging population sooner than expected.

- Stagnation in Key Sectors: India has struggled to reduce its agricultural workforce in the same way China did after liberalisation, making it harder to transition people to higher-productivity industries. Despite some growth in the services sector, manufacturing has stagnated and failed to generate the necessary number of jobs, especially in labor-intensive industries.

- Limited Economic Mobility: High levels of youth unemployment and the lack of opportunities for individuals to move up the economic ladder have hindered India’s economic progress. The country’s labor force participation rate (LFPR) remains low, particularly among women, and urban job creation has not been sufficient to absorb the growing population.

- Infrastructure and Regulatory Bottlenecks: The business environment is constrained by complex regulations, high tariffs, cumbersome licensing procedures, and a lack of access to land, all of which prevent the manufacturing sector from thriving. India’s slow regulatory reforms have stifled growth in manufacturing, which is essential for absorbing the workforce.

How the Manufacturing sector can help India grow?

- Job Creation: Manufacturing, especially in labour-intensive sectors like textiles and apparel, can create large numbers of jobs. This is vital for absorbing the surplus labour from agriculture and providing employment opportunities for the youth.

- For example, the textile and apparel industry employs 45 million people compared to just 5.5 million in IT-BPM, highlighting its potential for mass employment.

- Women’s Empowerment: Manufacturing, particularly industries like textiles, offers significant employment to women (60-70% of factory workers), helping reduce gender disparities in the labour force.

- Economic Mobility: By creating better job opportunities, manufacturing helps people transition from low-productivity agricultural jobs to higher-wage, more stable positions in the industrial and service sectors. This transition is key to achieving sustained economic growth and avoiding the middle-income trap.

- Global Competitiveness: Reducing barriers to manufacturing — such as simplifying business licensing, lowering tariffs on inputs, improving access to land, and streamlining trade regulations — can help India increase its competitiveness globally. Expanding market access through free trade agreements and making the business environment more conducive to manufacturing can unlock the potential of this sector.

Steps taken by the government:

- “Make in India” Initiative: Launched in 2014, this initiative aims to transform India into a global manufacturing hub by promoting domestic production, reducing regulatory hurdles, and attracting foreign direct investment (FDI) in key manufacturing sectors such as electronics, textiles, and automobiles.

- Atmanirbhar Bharat (Self-reliant India): This program focuses on reducing dependence on imports by boosting local manufacturing, especially in strategic sectors like defense, electronics, and pharmaceuticals.

- It includes initiatives such as the Production-Linked Incentive (PLI) scheme, which offers incentives for manufacturing and exporting specific products like electronics, textiles, and solar panels.

Way forward:

- Enhance Skill Development and Workforce Transition: India must invest in targeted skill development programs to equip its labor force, particularly those transitioning from agriculture, with the necessary skills for higher-productivity manufacturing and services sectors.

- Accelerate Regulatory and Infrastructure Reforms: To unlock the full potential of the manufacturing sector, India should expedite regulatory reforms, simplify land acquisition processes, and enhance infrastructure.

Mains PYQ:

Q Can the strategy of regional-resource-based manufacturing help in promoting employment in India? (UPSC IAS/2019)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

India’s SDG focus and its Human Development issues

From UPSC perspective, the following things are important :

Mains level: Key initiatives to achieve SDG;

Why in the News?

On September 9-10, 2023, New Delhi hosted the G-20 Summit, where participants committed to enhancing the implementation of the UN Agenda 2030 for Sustainable Development.

How effectively is India progressing towards achieving the SDGs by 2030?

- Current Status: India is classified in the “medium human development” category, with an HDI value of 0.644 and a rank of 134 out of 193 countries.

- Improvement Over Time: India saw an increase of 48.4% in HDI value from 1990 (0.434) to 2022 (0.644), indicating positive long-term trends despite recent stagnation and slight declines due to factors such as the COVID-19 pandemic.

- SDG Interconnections: India’s HDI dimensions directly align with several SDGs, including SDG-3 (good health), SDG-4 (quality education), and SDG-5 (gender equality). Progress in these areas is critical for achieving broader SDG targets.

- Rank Improvements: From 2015 to 2022, India improved its HDI ranking by four places, while neighboring countries such as Bangladesh and Bhutan improved their rankings by 12 and 10 places, respectively, highlighting the need for India to enhance its efforts.

What are the key human development challenges that India faces?

- Gender Inequality: India has one of the largest gender gaps in the Labor Force Participation Rate (LFPR), with a stark difference of 47.8 percentage points between women (28.3%) and men (76.1%). The GDI indicates significant disparities in HDI achievements between genders, which undermines development.

- Income Inequality: India experiences high income inequality, with the richest 1% holding 21.7% of total income, significantly higher than many neighboring countries and above global averages. This poses a barrier to sustainable development and equitable growth.

- Education and Health: The impact of the COVID-19 pandemic has negatively affected education and health sectors, leading to increased vulnerabilities among poorer and marginalized populations.

- Urban-Rural Divide: There is a notable disparity in female labour force participation between rural (41.5%) and urban areas (25.4%), suggesting that urban policy initiatives may not adequately support women’s employment.

What strategies can be implemented? (Way forward)

- Strengthening Gender Equality: Implement gender-transformative approaches to enhance women’s participation in the labour force and address systemic barriers. This includes policies promoting work-life balance, flexible work arrangements, and targeted skill development programs.

- Enhancing Education and Skill Development: Invest in quality education, vocational training, and lifelong learning opportunities that cater to both genders, particularly in rural areas.

- Promoting Social Protection: Expand social safety nets and anticipatory social protection programs that target vulnerable populations, particularly women and marginalized groups.

- Reducing Income Inequality: Implement progressive taxation and wealth redistribution policies to address the concentration of income.

- Multi-Stakeholder Engagement: Foster collaboration between government, civil society, and the private sector to implement sustainable development initiatives.

Mains PYQ:

Q National Education Policy 2020 isin conformity with the Sustainable Development Goal-4 (2030). It intends to restructure and reorient education system in India. Critically examine the statement. (UPSC IAS/2020)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc