This is a key topic for UPSC aspirants, as understanding the types of inflation in India is essential for economics and current affairs sections.

Types of Inflation In India

In India, inflation can be classified into the following types:

-

Demand-Pull Inflation: This happens when there’s excessive demand for goods and services, often due to increased consumer spending, economic expansion, or government spending, driving prices up as supply struggles to keep pace.

-

Cost-Push Inflation: Rising production costs, such as higher wages or increased raw material prices, lead to cost-push inflation. Producers pass these costs onto consumers, resulting in higher prices across the economy.

-

Stagflation: A rare phenomenon where inflation and unemployment rise simultaneously, stagflation is marked by slow economic growth, often making it challenging for policymakers to manage both inflation and stagnation.

-

Structural Inflation: Caused by structural challenges in the economy, such as supply chain inefficiencies, market rigidities, or outdated infrastructure, structural inflation often requires long-term policy changes to address root causes.

Each type requires targeted measures, making inflation management in India complex and multifaceted.

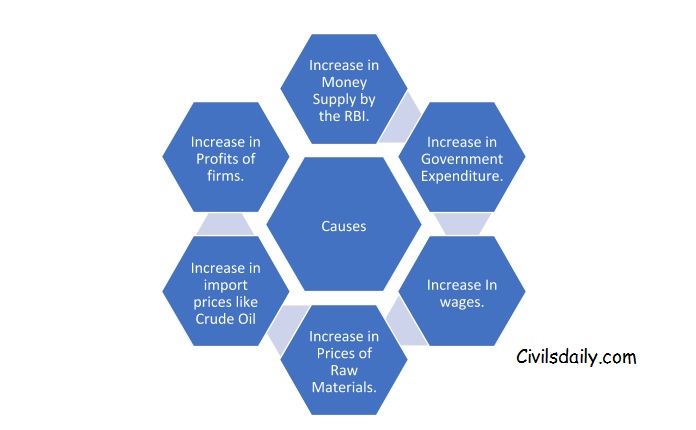

Causes of Inflation

Inflation is mainly caused either by demand Pull factors or Cost Push factors. Apart from demand and supply factors, Inflation sometimes is also caused by structural bottlenecks and policies of the government and the central banks. Therefore, the major causes of Inflation are:

- Demand Pull Factors (when Aggregate Demand exceeds Aggregate Supply at Full employment level).

- Cost Push Factors (when Aggregate supply increases due to increase in the cost of production while Aggregate demand remains the same).

- Structural Bottlenecks (Agriculture Prices fluctuations, Weak Infrastructure etc.)

- Monetary Policy Intervention by the Central Banks.

- Expansionary Fiscal Policy by the Government.

Demand and Supply factors can be further sub divided into the following:

Demand Pull Inflation

- Demand Pull Inflation is mainly due to increase in Aggregate demand. The increase in Aggregate demand mainly comes from either increase in Government Expenditure (Expansionary Fiscal Policy) or by an increase in expenditure from Households and Firms.

- The root cause of demand pull inflations is- Aggregate demand > Aggregate Supply. This simply means that the firms in the economy are not capable of producing the goods and services demanded by the households in the present time period. The shortages of goods and services due to increase in demand fuels inflation.

- Imagine what happened when there was an outbreak of swine flu in India. Due to the outbreak of swine flu epidemic in India, the government notified a warning that people should wear Breathing Masks to protect them from the infection. As a result, the demand for mask had risen to a very high level, but the supply being limited as the producers of the mask had no anticipation of the swine flu epidemic. Due to the high demand and limited supply of masks, the prices had risen manifold. The case above captures the mechanism of demand pull inflation.

- The above example only captures the mechanism of Demand led inflation and that too for a particular product. What happens at Macro level? What fuels inflation in the entire economy? Before answering the question. Let’s understand some basic concept related to the economy:

- Full Employment Level: Full employment is an economic situation in which all the available resources of the economy are fully utilised, and there exists no further scope of improvement in the economy. The Full employment level represents that economy is operating at its maximum potential. The level of unemployment is minimum, the prices in the economy are stable, resources are fully utilised, whatever firms are producing is getting sold, and there exist no shortages in the economy.

Inflationary Gap

The Inflationary gap is a situation which arises when Aggregate demand in an economy exceeds the Aggregate supply at the full employment level.

Inflation in a Demand-Pull scenario is basically caused by a situation whereby the Aggregate demand for goods and services in the economy rises and exceeds the available supply of the goods and services. In such a situation, the excessive pressure on demand will fuel the inflation in the economy.

Deflationary Gap

Deflationary Gap is a situation which arises when Aggregate demand in the economy falls short of Aggregate Supply at the full employment level.

Cost Push Inflation

- There exists a situation in an economy where inflation is fuelled up, not because of increase in Aggregate Demand but mainly due to increase in the cost of producing goods and services.

- The cost can be increased mainly due to three factors:

| Wage Push Inflation | Profit Push Inflation | Raw Material Push Inflation |

| When the employees push for an increase in wages which are not justifiable either on the grounds of employee productivity or increase in the cost of living. In such scenarios, an unwarranted wage increase leads to increase in the cost of production and hence cost push inflation. | The firms sometimes decide to increase their profit margins and starts charging higher prices for their product. This phenomenon pushes the price upward and results in Profit Push Inflation. | The raw material push inflation also known as supply shock inflation is the main and the most important reason for cost push inflation.

If for any reason the economy under goes a supply shock in the form of a rise in the price of essential raw materials like crude oil, it will fuel inflation due to rise in the cost of production. |

| Wage Push Inflation generally happens during high growth periods. During which workers anticipate a hike in their wages due to rising cost of living. The employer responds to their demand by increasing wages in the hope that he will pass them on to the consumers in the form of higher prices. | The Profit Push Inflation generally happens when there are few of single producer producing the goods for the entire market. | For Example, during the 1970s, the OPEC countries decided to increase the price of crude oil, this acted as a supply shock for the entire World economy and price of petroleum products (an essential raw material) went up, fuelling inflation. |

Let’s understand Cost Push Inflation with an Example

Suppose, Indian economy is operating at its maximum potential. Prices are stable, resources are fully utilised, everyone who is willing to work is getting the work (unemployment is at its minimum). In such a scenario people will form the expectation that the future of the economy is good and they planned their saving and investment decision accordingly.

However, one day the USA decides to attack Iran in order to dismantle their nuclear weapons. As a repercussion of the attack, the crude oil prices around the world start moving up. India who imports 90 percent of its oil imports suddenly find itself in trouble. The rise in crude oil price puts a break on booming Indian economy and cost of essential products start rising (crude oil is a key input for many industries and is a lifeline of transport economy). As a result of increase in cost of production, the manufacturers decide to increase the price of their product. Hence fuelling first round of cost push inflation (Raw material).

After a lag of sometime, the final consumer gets to know that the prices of the product have increased. The consumer expectations about the future movement of prices will change as he expects prices to rise further in future. To compensate himself against the future price rise, he starts demanding more wages from his/her employer. This will fuel the second round of cost push inflation (wage push).

Cost Push Inflation/Supply Shock

Stagflation

The most important difference between the Demand Pull and Cost Push Inflation is that while in the case of Demand Pull Inflation the overall output in the economy does not fall. Whereas, in case of Cost Push Inflation, along with an increase in prices the output level of the economy also falls.

The fall in output will cause employment to fall in the economy along with fall in growth. The falling growth along with rising prices makes cost push inflation more dangerous than the demand-pull inflation. The situation of rising prices along with falling growth and employment is called as stagflation.

Hyperinflation

Hyperinflation is a situation when inflation rises at an extremely faster rate. The rate of inflation can increase from 50 times to 300 times.

The effects of hyperinflation can be devastating for the economy. The situation can lead to total collapse of the value of the currency of the economy along with economic crisis and rising external debt and fall in purchasing power of money.

The major causes of the hyperinflation are; government issuing too much currency to finance its deficits; wars and political instabilities and unexpected increase in people’s anticipation of future inflation.

When people anticipate that future inflation will rise at a very fast pace, they start consuming more goods and services due to the fear that higher inflation in the future will destroy the purchasing power of money. As a result of this, the demand for goods and services rises and fuels further inflation. The cycle continues and results in a hyperinflation scenario.

Structural Inflation

- Structural Inflation is another form of Inflation mostly prevalent in the Developing and Low-Income Countries.

- The Structural school argues that inflation in the developing countries are mainly due to the weak structure of their economies.

- They further argue that increase in money supply and government expenditure could explain the inflationary scenario only partially.

- The Structuralist argues that the economies of developing countries like, Latin America and India are structurally underdeveloped as well as highly volatile due to the existence of weak institutions and imperfect working of markets.

- As a result of these imperfections, some sectors of the economy like agriculture will witness shortages of supply, whereas some sectors like consumer goods will witness excessive demand. Such economies face the problem of both shortages of supply, under utilisation of resources as well as excessive demand in some sectors.

- Example: In India, let’s assume that the farmer produces fruits and vegetables at 10000 per quintal. But the final consumer gets the same at 20000 per quintal. The huge disparity between what farmer receives and consumer pays is due to infrastructure and agriculture bottlenecks. The bottleneck arises mainly due to lack of roads, highways, cold chains and underdeveloped agriculture markets. All these increases the cost of transporting goods from farmers to consumers leading to inflation.

- The major bottlenecks/road blocks of developing economies that fuels Structuralist form of inflation are:

Deflation versus Disinflation

Deflation: Deflation is when the overall price level in the economy falls for a period of time.

Disinflation: Disinflation is a situation in which the rate of inflation falls over a period of time. Remember the difference; disinflation is when the inflation rate is falling from say 5% to 3%.

Deflation is when, for instance, the price of a basket of goods has fallen from Rs 100 to Rs 80. It’s the reduction in overall prices of goods.

Reaganomics

Reaganomics is a popular term used to refer to the economic policies of Ronald Reagan, the 40th U.S. president (1981–1989), which called for widespread tax cuts, decreased social spending, increased military spending and the deregulation of domestic markets. These economic policies were introduced in response to a prolonged period of economic stagflation that began under President Gerald Ford in 1976.

Back to Basics:

Headline Inflation versus Core Inflation

The headline inflation measure demonstrates overall inflation in the economy. Conversely, the core inflation measures exclude the prices of highly volatile food and fuel components from the inflation index.

The inflation process in India is dominated to a great extent by supply shocks. The supply shocks (e.g., rainfall, oil price shocks, etc.) are temporary in nature and hence produce only temporary movements in relative prices. The headline CPI inflation in India tends to increase whenever there is a surge in food and fuel prices. Since monetary policy is a tool to manage aggregate demand pressures, the response of the policy to such temporary shocks is least warranted according to traditional wisdom.

Core inflation excludes the highly volatile food and fuel components and therefore represents the underlying trend inflation. The trend inflation drives the future path of overall inflation. Hence, even when food and fuel inflation moderates over time, persistently high inflation in non-food, non-fuel components pose an upward risk to overall future inflation, creating challenges to monetary policy.

How to Control Inflation

Let’s understand some basic relationship before proceeding further.

Money Supply and Interest Rate

The Money supply in an economy is controlled by the Central Banks. Whenever there is a threat of Inflation, the central bank intervenes to control the money supply to control the inflation.

The mechanism through which the central banks controls inflation depends on interest rate. Interest Rate and Money supply moves in opposite directions. As money supply is increased the interest has the tendency to fall and vice versa.

But why does it happen?

Suppose at any given point in time, the economy is suffering from low growth. The central bank intervenes by using its monetary policy tools (Bank Rate, Repo Rate, Statutory Liquidity Rate). The result of such loose monetary policy is increase in money supply in the economy.

The increased money supply means at any given point in time, there will be excess money in the economy than what the people are willing to hold. What will happen to this excess money? People will not want the excess money to be kept idle in their wallets. So they will try to invest it in alternative financial instruments like Bonds.

As a result of this, the demand for financial assets (Bonds) will increase which will lead to increase in the price of the bonds. An established relation in financial economics is, as bond price rises, Interest will fall.

A Fall in interest rate>>> Increase in Investment>>> Increase in output/production>>> increase in employment and national income. Hence end of slowdown.

- Government Spending and Interest Rate.

Fiscal policy affects equilibrium income and the interest rate. An increase in government spending (expansionary fiscal policy) to boost economic activity will lead to increase in interest rate. This happens because, at any given point in time, the economy will have limited saving capacity. When the government increase its spending, it competes with the private sector for these limited saving. In the process, this tend to put upward pressure on the interest rate.

Monetary Policy and Inflation

Fiscal Policy and Inflation

The Relationship Between Inflation and Interest Rate.

In order to understand the relationship between Inflation and Interest Rate, it is necessary to understand the distinction between Real interest rate and nominal Interest rate.

Back to Basics: Example, if you decide to deposit all your money (Rs 1 Lakh) in a Bank as Fixed Deposit, Banks will pay you Interest rate @ say 10%. The rate of interest that banks pay you is Nominal Interest Rate. Going by this logic, you will be expected to earn Rs 10,000 as interest on your Fixed deposit in a year. In the second year, you will be having Rs 1,10,000 in your bank account.

But what about the value or purchasing power of your deposit? Is the money worth Rs 1,10,000 is sufficient for you to buy the same basket of goods that you were purchasing last year? Will Rs 1,10,000 will buy you the same amount of goods, less amount of goods or more amount of goods will all depend on the rate of inflation in the economy.

Let’s say, the inflation rate in the economy during the period is 20%. What will be the value of your deposit at 20% inflation rate?

The real value in terms of goods that can be purchased from Rs 1,10,000 is actually much less than what it used to be a year ago. The basket of goods that had cost Rs 10,0000 in the previous year is now costing Rs 1,20,000. But the bank has paid you only Rs 1,10,000 in return. The interest rate of the bank has failed to beat the inflation in the economy. Therefore, the real interest adjusted after inflation that the banks have paid you on your deposit is actually negative 10%.

Real Interest Rate= Nominal Interest Rate – Inflation Rate.

-10 = 10 – 20

FAQs

By

Himanshu Arora

Doctoral Scholar in Economics & Senior Research Fellow, CDS, Jawaharlal Nehru University

after reading this i feel i have becme an economist .!!hahah.! 🙂 …. nicely explained with easy to understand examples … thanks

Thanks for the brilliant and didactic article.