This theme will be covered in 2 parts. You are reading the Part 1.

Recently, China devalued its currency and there was so much hue and cry across the world markets. Let us try to understand these complex processes, and the implications of Chinese move.

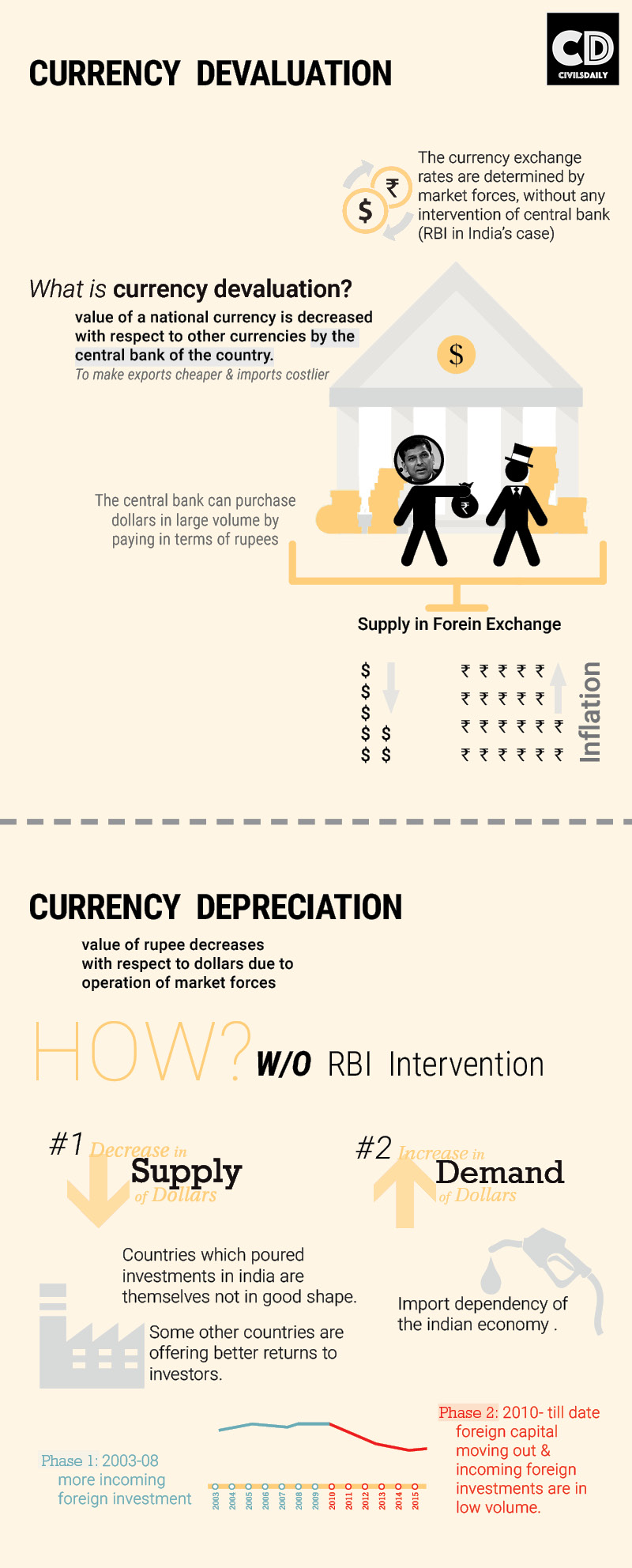

Broadly speaking, what is currency devaluation?

Under currency devaluation, the value of a national currency is decreased with respect to other currencies by the central bank of the country.

Before, we delve into the concept of devaluation, lets explore how does currency exchange rates are determined normally. The currency exchange rates are determined by market forces, without any intervention of central bank (RBI in India’s case). <Central Bank and RBI will be used interchangeably in India’s case>

Now, we will try to understand the process of Devaluation, how it actually happens.

So, the basic condition for devaluation to happen is that RBI has to become a player in the foreign exchange market.

Before, we move further, lets explore who all are the players in the forex market. They are importers, exporters, investors & some dealers who deal in foreign exchange (for example exchange banks).

What will central bank do in the foreign exchange market ?

The central bank will change the supply of dollars in the market.

How does it change the supply of dollars in the market?

The central bank goes to these exchange banks & it will purchase the dollars in large volume by paying in terms of rupees. This will lead to decrease in supply of dollars.

Now, lets understand the negative implications of such a move.

As RBI paid in terms of rupees while purchasing dollars, it will increase the money supply in the market, leading to inflation.

Therefore, devaluation is accompanied with selling of govt. securities.

RBI can devalue rupee by selling it to purchase dollars in the forex market. It makes exports cheaper & imports costlier & therefore a solution to BOP crisis.

CURRENCY DEPRECIATION:

It is a market driven process , determined by market forces.

Under this, the value of rupee decreases with respect to dollars due to operation of market forces.

How do the market forces act?

There are two ways/ causes for currency depreciation :

#1. Decreases in supply of dollars – without RBI intervention

This is a very realistic situation that india faced over last few years , when the foreign capital was moving out & foreign investment were not coming in huge volume.

What could be the reasons? Countries which poured investments in india are themselves not in good shape. Some other countries are offering better returns to investors.

Phase 1 : 2003-08 – more incoming foreign investment

Phase 2 : 2010- till date – foreign capital moving out & incoming foreign investments are in low volume.

#2. Increase in demand of dollars without RBI intervention

The basic reason behind this is the import dependency of the indian economy .

This is a traditional reason for depreciation of our currency , since we have been a net import based economy from long time.

PS: There is another interesting blog on the same topic, written by an economics professor @Civilsdaily – Nursery Rhymes, SDRs and Devaluation of the Yuan

While you are at it, you might want to read this as well – The Great Fall of China