CLICK:-REGISTER & DISCUSS ECONOMICS CONCEPTS & YOUR UPSC PREPARATION WITH CD MENTORS FOR FREE

Definition of a Bank

A bank is a financial institution which performs the deposit and lending function. A bank allows a person with excess money (Saver) to deposit his money in the bank and earns an interest rate. Similarly, the bank lends to a person who needs money (investor/borrower) at an interest rate. Thus, the banks act as an intermediary between the saver and the borrower.

The bank usually takes a deposit from the public at a much lower rate called deposit rate and lends the money to the borrower at a higher interest rate called lending rate.

The difference between the deposit and lending rate is called ‘net interest spread’, and the interest spread constitutes the banks income.

Essential Features/functions of the Bank

Financial Intermediation

The process of taking funds from the depositor and then lending them out to a borrower is known as Financial Intermediation. Through the process of Financial Intermediation, banks transform assets into liabilities. Thus, promoting economic growth by channelling funds from those who have surplus money to those who do not have desired money to carry out productive investment.

The bank also acts as a risk mitigator by allowing savers to deposit their money safely (reducing the risk of theft, robbery) and also earns interest on the same deposit. Bank provides services like saving account deposits and demand deposits which allow savers to withdraw money on an immediate basis thus, providing liquidity (which is as good as holding cash) with security.

How Banks promote economic growth?

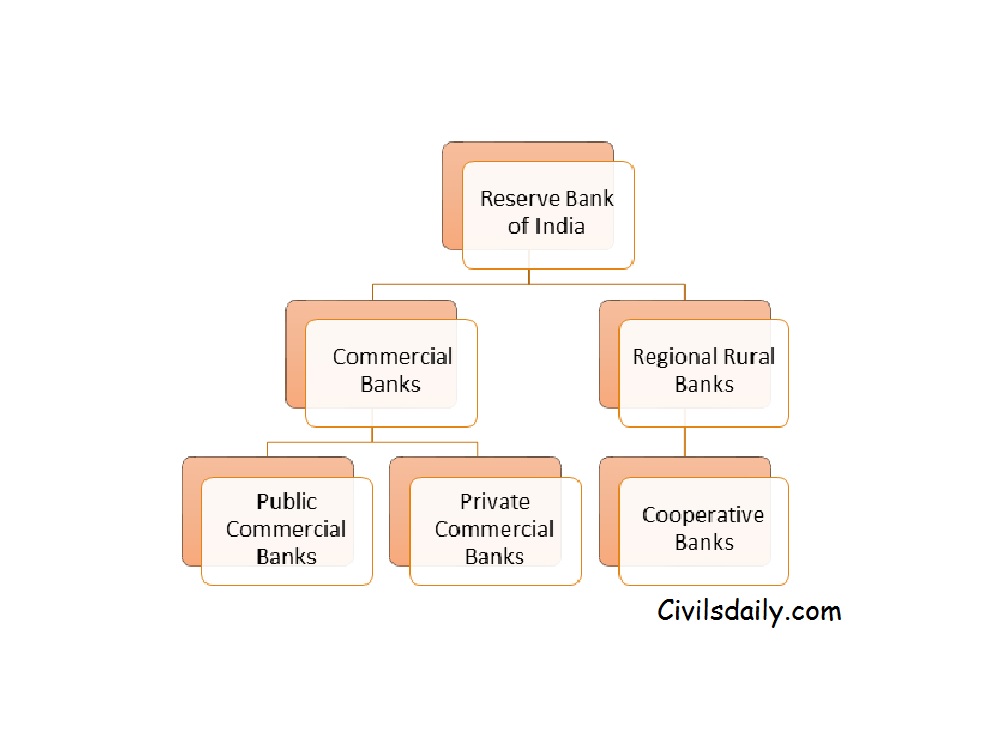

Types/Structure of Banks in India

Scheduled Commercial Banks

- All the commercial banks in India- Scheduled and Non-Scheduled is regulated under Banking Regulation Act 1949.

- By definition, any bank which is listed in the 2nd schedule of the Reserve Bank of India Act, 1934 is considered a scheduled bank. The list includes the State Bank of India and its subsidiaries (like State Bank of Travancore), all nationalised banks (Bank of Baroda, Bank of India etc), Private sector banks, Foreign banks, regional rural banks (RRBs), foreign banks (HSBC Holdings Plc, Citibank NA) and some co-operative banks.

- Till 2017, Scheduled commercial banks in India comprised 26 Public sector banks including SBI and its associates, and 19 Nationalised Bank and IDBI. The creation of Bhartiya Mahaila Bank has increased the total no of Public sector SCB’s to 27, but the recent merger of the Mahaila Bank with SBI had reduced the list back to 26.

- The scheduled private sector bank includes old private sector banks and new private sector banks. There are 13 old private sector banks and 9 new private sector banks including the newly formed IDFC and Bandhan Bank.

- There are also 43 Foreign National Banks operating in India.

- The Regional Rural Banks were started in India back in the 1970s due to the inability of the commercial banks to lend to farmers/rural sectors/agriculture. The governance structure/shareholding of RRBs is as follows:

- Central Government: 50%, State Government: 15% and Sponsor Bank: 35%.

- RBI has kept CRR (Cash Reserve Requirements) of RRBs at 3% and SLR (Statutory Liquidity Requirement) at 25% of their total net liabilities.

Important Facts Relating to Scheduled Commercial Banks

- In terms of Business, Public sector banks dominate the Indian Banking.

- PSB accounts for close to 50% of total assets, 70% of deposits and close to 70% of the advances.

- Amongst the Public-Sector Banks, SBI and its Associates has the highest number of Branches.

- The committee on Regional Rural Bank headed by M Narasimhan recommended the setting up of RRBs for the purpose of providing rural credit.

- An RRB is sponsored by a Public-Sector Bank which also provides a part of its share capital. Example: Maharashtra Gramin Bank (sponsored by the Bank of Maharashtra) and the Himachal Gramin Bank (Sponsored by Punjab National Bank). RRBs were set up to eliminate other unorganized financial institutions like money lenders and supplement the efforts of co-operative banks.

- The Private Commercial banks account for close to 1/4th of the assets of the total banking assets.

Why RRBs Failed to Achieve ITs Objective

The RRB Amendment Bill, 2014

|

Non-scheduled Banks

- Non-scheduled banks by definition are those which are not listed in the 2nd schedule of the RBI Act, 1934.

- Banks with a reserve capital of less than 5 lakh rupees qualify as non-scheduled banks.

- Unlike scheduled banks, they are not entitled to borrow from the RBI for normal banking purposes, except, in emergency or “abnormal circumstances.”

- Jammu & Kashmir Bank is an example of a non-scheduled commercial bank.

Cooperative Banks

- Co-operative banks operate in both urban and non-urban areas. All banks registered under the Cooperative Societies Act, 1912 are considered co-operative banks.

- In the urban centres, they mainly finance entrepreneurs, small businesses, industries, self-employment and cater to home buying and educational loans.

- Likewise, co-operative banks in the rural areas primarily cater to agricultural-based activities, which include farming, livestock’s, diaries and hatcheries etc.

- They also extend loans to small scale units, cottage industries, and self-employment activities like artisanship.

- Unlike commercial banks, who are driven by profit, cooperative banks work on a “no profit, no loss” basis.

- Co-operative Banks are regulated by the Reserve Bank of India under the Banking Regulation Act, 1949 and Banking Laws (Application to Co-operative Societies) Act, 1965.

By

Himanshu Arora

Doctoral Scholar in Economics & Senior Research Fellow, CDS, Jawaharlal Nehru University

Thank you very much for sharing detailed information about the bank. This is a really great article. If anyone wants to check the details of banks then they can check it from usaa routing number.