UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

With rising power demands in the domestic sector, Indian utilities are facing a severe shortage of coal, which is the primary fuel powering 70 percent of India’s energy consumption. More than half of the country’s 135 coal-fired power plants are running on fumes – as coal stocks run critically low. India’s thermal power plants currently have an average of four days worth of coal stock against a recommended level of 15-30 days, with a number of states highlighting concerns about blackouts as a result of the coal shortage.

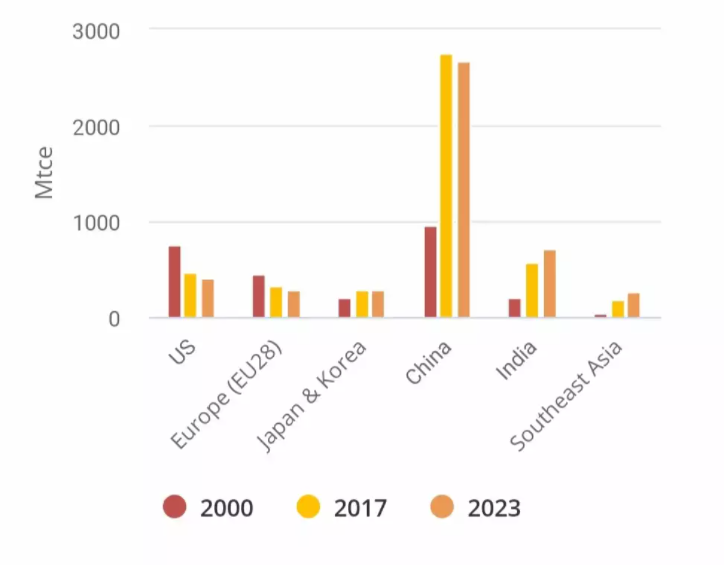

Coal has become a priceless commodity of late in a white-hot market with an over 100 percent jump in prices, which is driven mainly by China and India – the two largest consumers of thermal coal globally.

What is the extent of the current coal crisis?

A number of states including Delhi, Punjab, and Rajasthan have raised concerns about potential blackouts as a result of low coal inventory at thermal power plants and have already reported load shedding. India is the world’s second-largest importer of coal despite also being home to the fourth-largest coal reserves in the world.

Increase in power demand

- The shortage in coal is a result of a sharp uptick in power demand as the economy recovered from the effects of the pandemic.

Global factors

- A sharp increase in the international prices of coal due to a shortage in China have also contributed to the coal shortage.

- Unseasonal rains in Indonesia, Covid-induced production cuts in Australia have ensured a once-in-a-lifetime bull run in coal prices.

- A balance is possible if and when the global supply chain – both in terms of prices as well as availability – improves.

- China consumes nearly half of the coal produced globally and Indonesia and Australia happen to be two of the largest exporters.

- India sources 43 per cent of its imported coal from Indonesia and 26 per cent from Australia.

Low accumulation of stocks by Thermal power plants

- Low accumulation of stock by thermal power plants has contributed to the coal shortage in India.

- Heavy rains in coal bearing areas had also led to a slowdown in the supply of coal to thermal plants.

- Coal and lignite fired thermal power plants account for about 54 per cent of India’s installed power generation capacity but currently account for about 70 per cent of power generated in the country.

Increase in the price of the other fuels

- Incidentally, the demand for coal has also gone up because other sources of generating power – natural gas, for instance – have become even costlier.

- The price of natural gas, too, has increased nearly 100 per cent in 2021 alone.

- This has hampered the plan to grow the share of renewable energy as well.

Legacy issues

- Legacy issues of heavy dues of coal companies from certain states viz., Maharashtra, Rajasthan, Tamil Nadu, UP, Rajasthan and Madhya Pradesh also contributed to this coal shortage.

- Power plants that usually rely on imports are now heavily dependent on Indian coal, adding further pressure to already stretched domestic supplies.

Why is the demand for natural gas surging?

- Nations across the world are committed to reducing carbon emissions. China has committed to becoming carbon neutral by 2060.

- To reduce its emissions, China needs to give up coal, reduce consumption of other dirty fossil fuels and adopt cleaner energy such as natural gas and renewables.

- The country is also taking harsh measures to reduce pollution in Beijing before the February 2022 Winter Olympics and thus display its commitment to decarburization.

- The targets China has set for itself is seen to have escalated the current energy crisis in the nation where two-thirds of the electricity was generated from burning coal.

- European Union has targeted to become carbon neutral by 2050 and reduce greenhouse gas emissions by 55% by 2030 compared to 2005 levels.

Why are prices between domestic and global coal widening?

- Domestic coal prices in India are largely decided by Coal India. An increase in coal prices generally has a knock on effect on power prices and inflation..

- Coal India has kept prices steady over the last year despite global coal prices rising steeply in the same period.

- Meanwhile, Asia’s coal price benchmarks have hit record highs in the recent times, buoyed by global demand for power generation fuels as economies open up.

- A major power crisis in China is the latest event driving global demand for the fuel.

Why are utilities unable to pass on higher costs?

- India’s power tariffs, set by the respective states, are among the lowest in the world as state-run distribution companies have absorbed higher input costs to keep tariffs steady.

- This has left many of these companies deeply indebted, with cumulative liabilities running into billions of dollars.

- This triggered delayed payments to power producers, often affecting cash flows and disincentivising further investment in the electricity generation sector.

- Indian power producers locked in long-term agreements with distribution utilities often cannot pass on higher input costs unless clauses are included in their contracts.

What does the deepening energy crisis mean for India?

- The sharp rise in global coal prices came as a boon for domestic suppliers such as Coal India.

- As the supply crunch in the key overseas markets grew and prices soared, the demand for coal from domestic sources climbed. Coal India and other producers increased output, yet supply remains quite tight.

- Over 70% of India’s power is generated from burning coal while the share of natural gas is just about 5%. Thus, rising natural gas prices had a limited impact on the cost of power generation in India.

- India, however, suffered a scare when the inventory of coal with power plants reached critically low levels, as demand surged about 11%. The situation was resolved by diverting coal away from non-power uses.

- The power demand is set to climb higher when more restrictions are eased, including those on cinema halls and multiplexes.

- While efforts are on to provide an uninterrupted supply of coal to power plants, non-power users are likely to suffer.

- Indian households were more affected by the rise in prices of petroleum products as consumption of cooking gas, petrol and diesel grew.

What does it mean for global recovery?

- Higher fuel prices are only one part of the problem. Temporary closures of factories in China will slow the repair of global value chains that broke down last year when countries locked down their economies.

- These shutdowns will lead to another round of disruption in the supply of parts to makers of various goods across the globe.

- The temporary shutdowns also mean missed deadlines for delivery of merchandise ahead of the November-January holiday season sales in many parts of the world.

- When power rationing was ordered, factories in China were racing to meet the global and domestic demand for everything from apparel to mobile phones and other gadgets.

- Higher fuel prices and shortages will add to inflationary pressures in the global economy and hurt the recovery of demand in lower-income economies.

What are the recent Reforms in Coal Sector?

- Commercial mining of coal allowed, with 50 blocks to be offered to the private sector.

- Entry norms will be liberalized as it has done away with the regulation requiring power plants to use “washed” coal.

- Coal blocks to be offered to private companies on revenue sharing basis in place of fixed cost.

- Coal gasification/liquefaction to be incentivized through rebate in revenue share.

- Coal bed methane (CBM) extraction rights to be auctioned from Coal India’s coal mines.

Challenges posed

- The desire to cut its reliance on heavily polluting coal burning power plants has been a major challenge for the government in recent years.

- The question of how India can achieve a balance between meeting demand for electricity from its almost 1.4bn people has to be answered.

Way Forward

Ramp-up domestic coal production

- The efforts are being taken to fill the shortage of coal from domestic mines and to do so the government is working closely with coal producing companies to ramp up domestic production of coal.

Reduce demand-supply mismatches

- Load shading is not new to India. Rationing of power supply in rural and semi-urban areas will be the immediate solution for the power distress in industrial areas.

Rationalize the coal imports

- India will need to amplify its imports despite the financial cost. The gap in the coal demand after domestic production has to be filled by the imports from Indonesia and Australia.

Focus on Hydro-power generation and natural gal

- India has the immense potential in the Hydro-power generation and is among the most important sector for generating electricity after thermal power plants.

- The sector performs at its peak around the rainy season which typically extends from June to October.

- There could be a larger role for natural gas to play, even with global prices currently surging.

Increasing the share of Renewable energy

- Experts advocate a mix of coal and clean sources of energy as a possible long-term solution.

- It’s not completely possible to transition and it’s never a good strategy to transition 100% to renewables without a backup.

- Long term investment in multiple power sources aside a crisis like the current one can be averted with better planning.

Increased coordination

- There is need for closer coordination between Coal India Limited – the largest supplier of coal in the country and other stakeholders.

- For now, the government is working with state-run enterprises to ramp up production and mining to reduce the gap between supply and demand.

Decentralized power generation

- The main issue is that we are dependent on large, centralized power generation.

- The only way our power sector can absorb shocks better is if large power plants are augmented by decentralized generation sources at village level.

- This can be a template for better resilience to future power crises.

Coal stocking norms

- To avoid such a crisis situation in future, the Ministry of Power has worked out a strategy which includes tweaking the coal stocking norms. If the power plants do not follow them, then there will be a penal provision.

- To overcome the storage issue in the generation of electricity from renewable sources, the government is working on a provision for creating more storage facilities in the grid.

Conclusion

India can learn a lesson from Europe’s power crisis. While Europe has gas power plants to stand in, India doesn’t have similar options. As we move more towards greening our power sources, we need to provision for paying for standby thermal generation to avoid a mega-crisis. Adequate liquidity for backup reserve capacity needs to be planned and provisioned for.

Probably, the present situation is a good opportunity to rethink and fine-tune the energy policy without further delay. Bits and pieces reforms will not work anymore, as the chain has to been broken and a complete overhaul is required.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)