Meaning and history of the term SCS

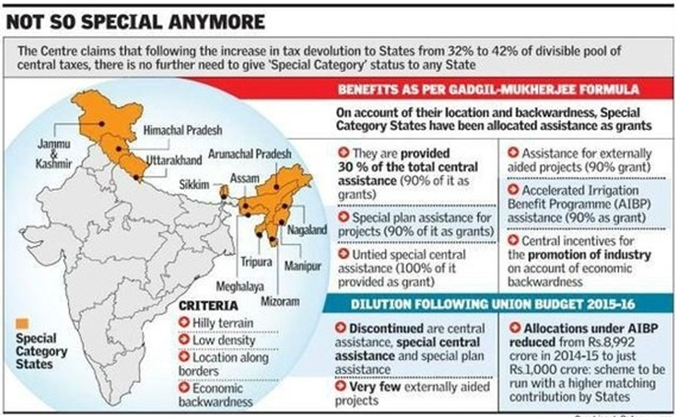

- SCS is a classification given by Centre to assist in the development of those states that face geographical & socio-economic disadvantages like hilly terrains, strategic international borders, economic & infrastructural backwardness and non-viable state finances.

- Introduced in 1969.

- 5th Finance Commission sought to provide certain disadvantaged states with preferential treatment in the form of central assistance and tax breaks.

- National Development Council grants the status of Special Category States.

- Initially three states Assam, Nagaland and Jammu & Kashmir.

- Since then eight more have been included – Arunachal Pradesh, Himachal Pradesh, Manipur, Meghalaya, Mizoram, Sikkim, Tripura and Uttarakhand.

- Direct transfers subsequently abolished in 2013–14.

- In 2013, Centrally Sponsored Schemes (CSS) were restructured into 66 schemes, including 17 flagship programmes with significant outlays.

- In 2016, CSS restructured into only 28 schemes.

- From 2017–18, the distinction between plan and non-plan expenditure removed,

- Therefore the Gadgil formula is a thing of the past

The criteria for granting special status:

- Hilly and difficult terrain

- Low population density or sizeable share of tribal population

- Strategic location along borders with neighbouring countries

- Economic and infrastructural backwardness

- Non-viable nature of state finances.

Advantages of getting special category status

- Preferential treatment in federal assistance and tax break

- Significant excise duty concessions.

- An interest-free loan with a rationalization of public expenditure based on the growth enhancing sectoral allocation of resources.

- SCS don’t have a hard budget constraint as the central transfer is high.

- SCSs avail the benefit of debt swapping and debt relief schemes (through the enactment of Fiscal Responsibility and Budget Management Act) which facilitate reduction of the average annual rate of interest.

- 30% of the Centre’s gross budget goes to the SCSs.

- In centrally sponsored schemes and external aid special category states get it in the ratio of 90% grants and 10% loans.

- Income tax holidays for 10 years for setting up new industries, extendable by a further period of five years upon “substantial expansion” of the existing units.

- Unspent money does not lapse and gets carry forward.

Concerns regarding SCS

- In the absence of the market, infrastructure, especially power, entrepreneurial skills and local resources, these incentives had hardly helped these states to industrialise.

- Not much economic progress has been noticed among SCS.

- Overwhelmingly dependent on central funding.

- Benefits flow regularly without any accountability or performance monitoring of the states.

- The amount of proceeds that states receive has increased after the 14th finance commission. So the structure does not seem to have any specific relevance in present context.

- SCS has been reduced to a political rallying point.

- Benefit of SCS may act as a stimulus but rest depends on the individual state policy.

14th Finance Commission on SCS

- The 14th FC does not make any mention of SCS.

- Its recommendations have been inferred as removing SCS.

- FC provided a fixed share of states in the net proceeds of the shareable central taxes at 42%.

- It has been interpreted as removing the distinction between general states and SCS and grant funds on the basis of backwardness of states.

- The interstate inequalities to be addressed through adequate tax devolutions and grants.

- Only SCS status was restricted to the states of North-east and three hill states.

- Under FC, some states to receive revenue deficit grants.

- States now have much more fiscal space to spend on their own priorities, instead of depending on the centre.

Fiscal Cooperative Federalism

- The taxes are divided among the states on the principles of equity and efficiency.

- From the 6th FC onwards, the FCs recommended only non-plan grants.

- The plan component was under the Planning Commission.

- Most of the discretionary transfers were made via the centrally sponsored schemes (CSS)

- Large part of the total transfers were made outside the state budgets, by direct transfer of funds from the Consolidated Fund of India to the implementing agencies in the states.

- Discretionary direct transfers have been abolished now.

- CSS reduced in number and restructured

- The distinction between plan and non-plan expenditure is no more.

- The NCA has also since been done away with.

Criticism received by the 14th FC

- The 14th FC attracted severe criticisms on grounds of equity and efficiency.

- Equalisation, equity and efficiency have always guided FC transfers

- It ensured that same standards of delivery of public services extended to all states

- This practice was aimed to prevent economic migrations across states.

- But there are now no efficiency criteria for the transfers.

- States, especially poor states, that have kept within their Fiscal Responsibility and Budget Management Act (FRBM) limits, have been made to suffer a cut in their shares instead of being rewarded for maintaining fiscal discipline.

- Even when these states controlled spending at the cost of limiting their capital

borrowings despite huge infrastructure deficits. - But there were no rewards for resisting populism.

But are SCSs really suffering?

- Whether there has been a reduction in the resources of SCSs?

- Whether SCSs have managed to retain their relative advantages vis-a-vis other states?

- For the SCSs as a whole, the total transfers during the first year under the XIV-FC over the previous year had actually increased by 24.7%, more than most other states.

- The tax devolutions for the SCS increased by almost 90%.

- The shares of SCS did not suffered any cut.

- They had in fact registered much higher increases than under the previous commissions

- Regarding the relative advantages enjoyed by the SCS, the latest restructuring of the CSS had made an important distinction between these and the other states, in terms of the funding pattern of these schemes.

- For the “core of the core” schemes, it envisaged that the existing funding patterns would continue, which is 90:10 for the SCS between the centre and states, while other states have to bear a higher proportion of expenditure on their own.

- For the “core” schemes, the restructured CSS states that the 90:10 formula between the centre and states would apply “for the 8 North Eastern States and 3 Himalayan States,” while it would be 60:40 for the other states.

- Thus, the SCS continue to retain their relative advantages over the other states.

- In other words, the category is far from being a thing of the past.

Revisiting Special Category

- The benefits of SCS are still there

- Therefore it is important to correct the flaws in the mechanism.

- There is a need to address the deep-rooted structural weaknesses that afflicted SCSs.

- Re-examine the continuation of the SCS a state in perpetuity.

- Adopting a target-based, time-bound arrangement that is focused on accountability, performance, and monitoring of achievements, with specific performance goals to be achieved by the beneficiary states for the benefits to continue.

- We need a strategy in which funding would be just one essential element and not the most important part.

- SCSs need supporting institutional set-up adequate to guide them towards predefined goals.

- Monitoring and accountability and granting of the SCS to a state should be through performance expectation.