Context

- China and the United States have been engaged in a trade war through increasing tariffs and other measures since 2018.

- The US is non-surprisingly the first to impose tariffs on Chinese goods to press demands for an end to policies that Washington says hurt US companies competing with Chinese firms.

- China too responded with its own tit-for-tat tariffs on US goods.

- This exacerbates the uncertainty in the global trading environment, affects global sentiment negatively, and adds to risk aversion globally.

Background

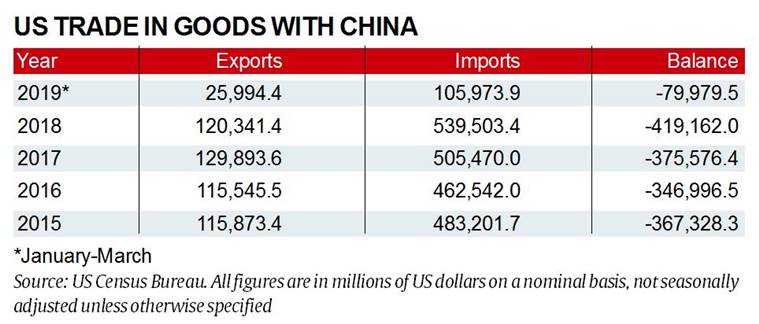

- The dispute escalated after US demanded China to reduce its $375 billion trade deficit with the US, and introduce “verifiable measures” for protection of IPRs, technology transfer, and more access to American goods in Chinese markets.

- Chinese devaluation of Yuan further fuelled the situation.

- These tensions are now yielding in an increasingly fragmented global trading framework, weakening the rules-based system that has underpinned global growth, particularly in Asia.

Differences being vented out through trade war

- A major cause of these tensions is the growing battle between China and the U.S. for global economic and technological dominance.

- US alleges China for the economic damage caused through alleged theft of intellectual property.

- US has accused China of either stealing American intellectual property and military technology or adopting and enforcing policies.

- This in turn puts U.S. patent holders at a disadvantage in Chinese markets by forcing foreign companies to engage in joint ventures with Chinese companies which in turn gives Chinese companies illicit access to their technologies

- The Chinese government has denied forced transfer of IP is a mandatory practice, and acknowledged the impact of R&D performed in China.

Trade war: A bluff for Protectionism?

- Even with a trade war, US investment in China during January 2019 reportedly doubled, with foreign capital in China’s hitech industry increasing by 41%.

- Trump has started dragging India to the ongoing situation by saying that the two were no longer “developing nations” and were “taking advantage” of the WTO tag.

Getting ahead with Clouds of a global recession

- Trade and geopolitical uncertainties have hit all major economies.

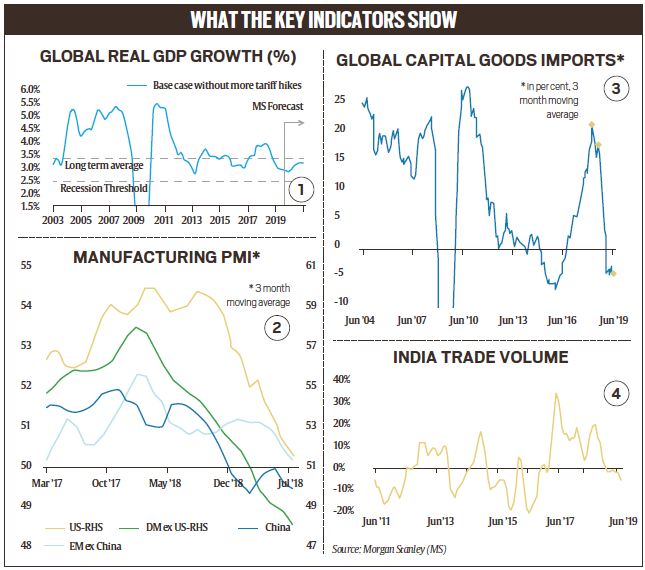

- Earlier this month, researchers at Morgan Stanley, a leading investment bank, warned that if the US and China continue to raise tariff and non-tariff barriers over the next few months, the global economic growth rate will fall to a seven-year low of 2.8%.

- The world economy could enter a recession within the next three quarters.

- The last massive downward spiral in the global economy happened in the wake of the great financial crisis of 2008, and continued until 2010.

What has triggered the alarm?

- Earlier this month, the US declared China a “currency manipulator”.

- In other words, it accused Beijing of deliberately weakening the yuan to make Chinese exports to the US more attractive and undercut the effect of increased US tariffs.

- The intensifying trade war between the two has the potential to derail already weak global growth, and the signs are evident.

- For instance, the global manufacturing Purchasing Managers’ Index (chart 2) and new orders sub-index have contracted for the second consecutive month in July; they are already at a seven-year low.

- Further, the global capital expenditure cycle has “ground to a halt” (chart 3); since the start of 2018, there’s been a sharp fall-off in nominal capital goods imports growth.

How can this lead to a global recession?

- The German slowdown is a very good example. The absolute volume of global trade has stagnated and, in terms of percentage change, trade is contracting.

- Higher tariffs are not only likely to douse demand but, crucially, hit business confidence.

- The apprehension is global trade uncertainties could start a negative cycle, wherein businesses do not feel confident enough to invest more, given the lower demand for consumer goods.

- Reduced capital investment would reflect in fewer jobs, which, in turn, will show up in reduced wages and, eventually, lower aggregate demand in the world.

What about India?

- As chart 4 shows, India’s trade is already suffering, and jobs are being lost.

- For an economy that is struggling to find a domestic growth lever — government and businesses are overextended and household (that is, private family-level) consumption is down — exports could have provided a respite.

Where does India stand in this trade war?

- There is a lot of uncertainty with respect to how the ongoing retaliatory tariff impositions between the US and China.

- There could be a short-term impact on the stock markets.

- Several economists have indicated the possibility of India benefiting through increasing exports to the US and a shift of foreign direct investment (FDI) to India.

- India is among a handful of economies that stand to benefit from the trade tensions between the world’s top two economies, a/c to the UN.

- However, to substantively benefit from this situation, India requires a strategic approach to convert this opportunity into a major gain.

- India needs to focus on becoming a new powerhouse as a global hub for exports, with a major positive impact on competitiveness and job creation.

Impact on merchandise exports

- China’s merchandise exports are almost the same as India’s GDP.

- Even a 10% shift from Chinese exports to Indian exports would imply over 75% increase in Indian exports. India needs to develop a strategy and vision for itself and the world to make this a reality.

- Its recent tepid export performance suggests that investment from large global companies is the transformative path for India, provided certain key points are kept in mind.

India’s exports

- India’s domestic market is large, but the focus of most large firms with major international brands and global presence is on exports and maintaining their global value chains (GVCs).

- China’s 2018 exports to the US at $560 billion were nearly double of India’s total exports.

India on global scenario

- India’s aspirations to double its exports and create jobs depend on its success to link up effectively with GVCs.

- As the seventh largest global economy and the 20th largest goods exporter, India is not yet a significant presence in GVCs.

- To establish domestic capacity for export hubs and GVCs, strong presence of ‘lead firms’ that manage the GVCs becomes essential.

Enhancing competence to reap benefits

- For competing with other nations to attract major investments away from China, India needs to emphasise and improve implementation of support policies, with a new flagship programme, ‘India: Making for the World’.

- Major global companies make investment decisions significantly based on ease of operational conditions and stable policy regimes.

- All alternative countries under consideration focus on creating and effectively implementing investment-friendly regimes — that is, taking a step beyond policy announcement.

Focusing on champion sectors

- To give specific focus, certain selected sectors significant for employment, technology and exports should be identified for launching the programme.

- These ‘champion’ sectors could be textiles and apparel, automotive products and electronics (with emphasis on mobiles), to be supplemented with a few other sectors later.

- These three sectors in India are likely to contribute over $1 trillion by 2025.

Way Forward

- We should not forget that our exports plus imports of goods and services constitute around 42% of GDP.

- Also, we have a current account deficit dependent on external capital inflows for financing.

- There is no question that economic growth and asset markets will be badly hurt by a full-blown trade war.

- The more important issue is the current global economic order is in danger of being dismantled, brick by brick.

- The ramifications will go far beyond trade—the impact on geopolitics, for instance, could be far more serious.

- In trade conflicts, there are no winners. Too much protectionism ultimately constricts global growth.

please, get the topics proof read before finalizing for up loading. In title itself, it should be impact on India