Having discussed how to read Economic Survey earlier, we now start our series on economic survey chapter by chapter. We shall follow a standard pattern across all chapters. We shall begin by highlighting ‘quotable quotes’ or observations which might not otherwise come for discussion but nevertheless very important for general understanding, general studies papers and essay. We shall then present some very basic statistics from the chapter and move to discuss broad themes of the chapter. In the end, important reading from the chapter shall be recommended.

I have hyperlinked text with articles previously covered. So go back in time and read the articles if any doubt. Take this opportunity to revise the economy section of syllabus.

So let’s get started

- It’s futile to expect “Big Bang” reforms because of two reasons

- dispersed nature of power in India, too many veto centers

- the absence of that impelling driver—crisis

Note that reform of 1991 was in response to major crisis, SEBI was given statutory backing in response to major scam in stock market and recent merger of Forward Market Commission (FMC) with SEBI was also a response to major scam.

Therefore, “persistent, creative and encompassing incrementalism” will be the key.

2. Being pro industry and pro market or pro competition is not one and the same

- India has moved away from being reflexively anti-markets and uncritically pro-state to being pro-entrepreneurship and skeptical about the state

- But being pro industry must evolve into being genuinely pro competition, and the legacy of the pervasive exemptions Raj and corporate subsidies highlights why favoring business (and not markets) can actually impede competition

- Similarly, skepticism about the state must translate into making it leaner, without delegitimizing its essential roles and indeed by strengthening it in important areas

3. Amid the world economy which is full of turbulence and volatility, India is a refuge of stability and an outpost of opportunity

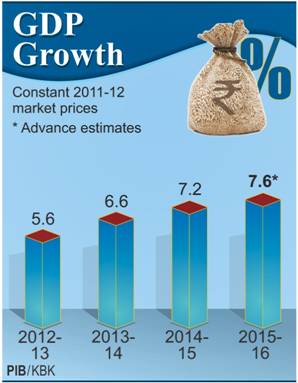

- Survey projects GDP growth of 7-7.75% for the financial year (FY) 17

- For FY16, GDP growth is estimated to be 7.6%

- Forex reseves have risen to >350b$

Let’s now discuss some broad issues

India becoming more and more intertwined with global growth

- the correlation between India’s growth rate and that of the world has risen sharply to .42 from .2 for the period 1991- 2002 i.e. 1 % decrease in the world growth rate # 0.42 % decrease in Indian growth rates

- India’s exports of manufactured goods and services now constitute about 18 percent of GDP, up from about 11 percent a decade ago

Realizing long term potential growth of 8-10% requires a push on at least three fronts-

- Creating genuinely pro competitive market by allowing inefficient firms to exit (Chakravyuha challenge) – Govt response- new bankruptcy code, rehabilitation of stalled projects, Kelkar Committee guidelines on PPP renegotiation

- major investments in people— health and education- to exploit India’s demographic dividend.

- Don’t neglect agriculture as 42% of Indian households derive the bulk of their income from farming. Smaller farmers and landless laborers especially are highly vulnerable to productivity, weather, and market shocks changes that affect their incomes. Govt response – PM Fasal Bima Yojana

Evolution of relative role of centre and states in the delivery of services-

- With increased devolution of resources (courtesy 14th Finance commission), states need to expand their capacity and improve the efficiency of service delivery.

- shift the focus from outlays to outcomes, and to learn by monitoring, innovating, and even erring.

- the Centre should focus on improving policies, strengthening regulatory institutions, and facilitating cooperative and competitive federalism

- while the states mobilize around implementing programs and schemes to ensure better service delivery

How does competitive federalism help?

States that perform well are increasingly becoming “models and magnets.”

- Successful experiments in one state are models for others states to emulate by showing what can be done and stripping away excuses for inaction and under-performance.

- They are also magnets because they attract resources, talent and technology away from the lagging states, forcing change via channel of exit.

Twin Balance Sheet Challenge

What are twin balance sheets – Bank balance sheet and corporate balance sheet

Basically both are interlinked, as asset on bank balance sheet is liability on corporate balance sheet and if corporate does not repay debt, asset turns bad (Non Performing Asset or NPA) and both balance sheets get stretched. It results in banks not lending and corporate not investing resulting in vicious circle.

Solution-

What has been done so far– Indradhanush scheme, Strategic Debt Restructuring (SDR) scheme, 5:25 scheme

What needs to be done– 4Rs

- Recognition- Banks must value their assets as far as possible close to true value i.e. recognize NPAs as NPAs

- Recapitalization– capital position must be safeguarded via infusions of equity

- Resolution– the underlying stressed assets in the corporate sector must be sold or rehabilitated

- Reform– future incentives for the private sector and corporates must be set right to avoid a repetition of the problem

But where would resources for recapitalization would come from given that government is committed to the path of fiscal consolidation?

- Divest govt. equities in non financial companies and invest in PSBs

- Dilute RBI’s capital to capitalize banks

- govt can dilute its equity in banks to raise resources from the market

What should be the stance of fiscal consolidation?

Learn Various types of Budget Deficits here- Budget Deficits Explained

Govt announced revised FRBM timeline last year with fiscal deficit target of 3.9% for FY16 and 3.5% for FY17. In this context question arises whether or not we remain committed to the same path of fiscal consolidation.

Arguments for accelerated fiscal consolidation –

- debt ratio of the consolidated government (Centre plus states), 67 per cent of GDP is high compared to some countries in Emerging Asia

- would reinforce govt’s credibility

- also why such a commitment should be abandoned when the economy is growing at more than 7 per cent

- Higher deficits may increase short term interest rates and thus hurt corporate investment and increase govt spending on interest

Arguments against-

- 7th Pay commission award will increase expenditure by about .5% of GDP, to maintain same fiscal deficit, govt might need to slash capital expenditure

- Public investment may need to be increased further to address a pressing backlog of infrastructure needs

- current global environment is fraught with risks and India should not take chances against growth

In this context it is important that government utilizes resources available to it to increase capital expenditure in roads, railways, ports etc which increases overall productivity and competitiveness of economy.

Update- Government chose prudence and stuck to fiscal deficit target of 3.5% of GDP in the budget announced today.

India and WTO

Two issues in agriculture-

- Special safeguard mechanism (SSM) which came for discussion in Nairobi ministerial meeting . The question which arises is whether India even needs such protection

- We are already allowed tariff from 40 per cent to 100 per cent (India’s modal rate in agriculture) to 150 per cent.

- In a preponderance of tariff lines, there is a considerable gap between applied tariffs and the level of tariff binding

- India’s only real need for SSM arises in relation to a small fraction of its tariff lines—some milk and dairy products, some fruits, and raw hides—where its tariff bindings are in the range of about 10-40 percent, uncomfortably close to India’s current tariffs, limiting India’s options in the event of import surges

India should call for a discussion of SSMs not as a generic issue of principle but as a pragmatic negotiating objective covering a small part of agricultural tariffs.

2. Food security/ stockholding issue

- The particular policies (MSP) which are being defended are those that India intends to move out of in any case because of their well-documented impacts:

- decline in water tables, over-use of electricity and fertilizers (causing health harm), and rising environmental pollution, owing to post-harvest burning of husks

- the government is steadfastly committed to providing direct income support to farmers and crop insurance which will not be restricted by WTO rules

The way forward in WTO on agriculture

India should consider offering reduction in its very high tariff bindings and instead seek more freedom to provide higher levels of domestic support: this would be especially true for pulses going forward where higher minimum support prices may be necessary to incentivize pulses production

India’s “big-but-poor” dilemma

- India’s self-perception as a poor country translates into a reluctance to recognize and practice reciprocity (give-and-take) in trade negotiations

- India’s policies have a significant impact on global markets and it has become a large economy in which partner countries have a legitimate stake in seeking market access

Net effect- India is unable to play reciprocal game in trade negotiations and WTO is fast becoming irrelevant (not good for India)

Cost of reluctant engagement-

- India is excluded from Trans Pacific Partnership (TPP) and it is shaped in a way that do not take into account India’s important interests (the rules on intellectual property)

- If and when India joins, it will be not on India’s terms but on terms already cast in stone, terms that India could not influence because of being perceived as not engaged fully

What should be India’s response-

We should use our growing markets as leverage to attain our own market interests abroad, including the mobility of labor and engage in reciprocal game to strengthen WTO.

How should trade policy deal with ongoing stress?

Chinese dumping, weak global environment, protectionist measures abroad, beggar thy neighbor policies etc .

Broad principle- resist calls to seek recourse in protectionist measures, especially in relation to items that could undermine the competitiveness of downstream firms and industries. For instance– imposing higher duty on imported steel hurts domestic manufacturers such as cycle manufacturers and lead to inverted duty structure.

Three sets of responses-

- Exchange rate. Keep rupee’s value fair, avoid strengthening using some combination of monetary relaxation, allow gradual declines in the rupee if capital flows are weak, intervention in foreign exchange markets if inflows are robust.

- India should strengthen procedures that allow WTO-consistent and hence legitimate actions against dumping (anti-dumping), subsidization (countervailing duties), and surges in imports (safeguard measures) to be taken expeditiously and effectively.

- India should eliminate all the policies that currently provide negative protection for Indian manufacturing and favor foreign manufacturing. Implement GST asap.

What you have to read for yourself-

- All the boxes- read especially Box 1.5: El Niño, La Niña and Forecast for FY 2017 Agriculture

- Open all the hyperlinks. Learn, understand and revise.

Ask all your doubts in the comment section below or in doubts clearing forum . all your suggestions, criticism and feedback is most welcome.

Suggested Reading

- Economic Survey For IAS | Chapter 02

- Economic Survey For IAS | Chapter 03

- Economic Survey For IAS | Chapter 04