The budget 2015-16 had announced 3 Social Security Schemes:

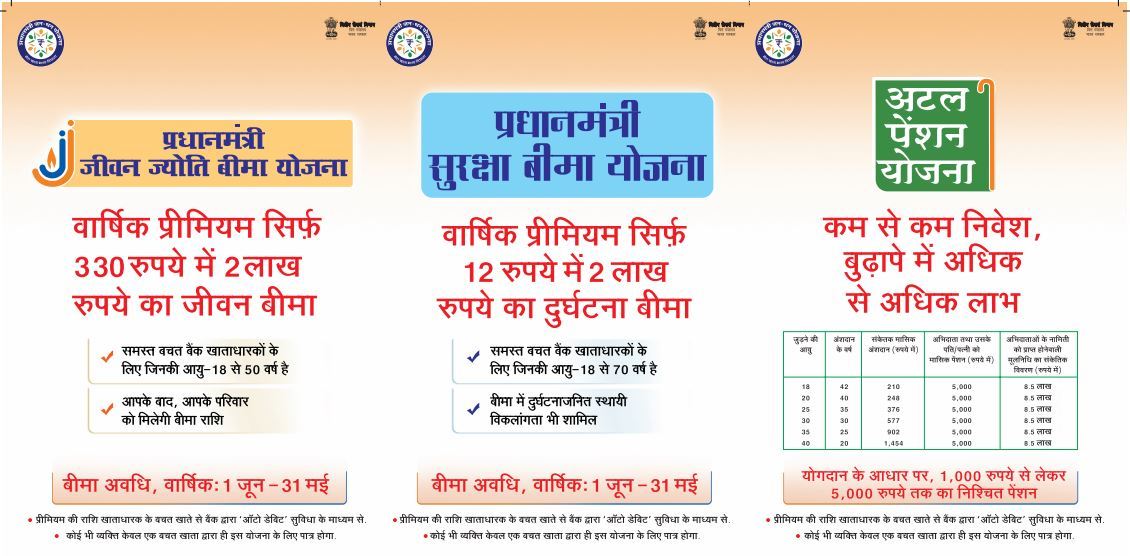

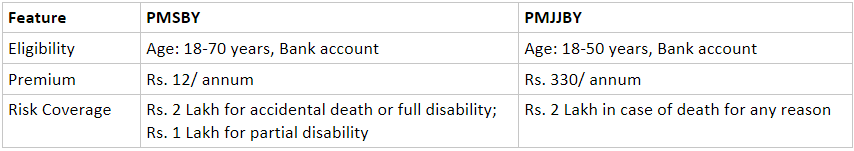

#1. Pradhan Mantri Suraksha BimaYojna (PMSBY)

#2. Pradhan MantriJeevan Jyoti Bima Yojana (PMJJBY)

#3. Atal Pension Yojana (APY)

Why the schemes?

- India faces the biggest challenge of providing banking facilities and insurance coverage to all

- Having access to institutional finance has so far remained a far cry to a vast chunk of rural population

- As of May 2015, only 20% of India’s population has any kind of insurance and only 11% has any kind of pension scheme

- Insurance is a way of managing risks & give necessary protections in case of financial loss

- When one has an insurance policy, certain rights and protections are derived out of it to the person and his family

- There is a dire need for providing social security at a very nominal cost to the millions and economic empowerment of the poor <what is social security? Why is it lacking in our country? Answer in comments.>

- PMJDY is a major step to bring people across the country closer to institutionalized finance, and save them from the clutches of informal financiers

- However, most of the PMJDY accounts had zero balance initially. The government aims to reduce the number of such zero balance accounts by using these schemes <what is the proportion of zero balance account now? Answer in comments.>

PMSBY & PMJJBY:

- Implementation: The scheme will be offered by all Public Sector General Insurance Companies and all other insurers who are willing to join the scheme and tie-up with banks for this purpose

- Govt Contribution: Various Ministries can co-contribute premium for various categories of their beneficiaries from their budget or from Public Welfare Fund created in this budget from unclaimed money

- Auto-debit: The premium amount will be auto debited from subscriber’s bank account

- The schemes will be linked to the bank accounts opened under the Pradhan Mantri Jan Dhan Yojana scheme

Criticisms of PMSBY:

- Private banks have complained that the Govt should focus on upper middle class instead of the poorer section

- Western scholars have argued that financial inclusion is a myth and serving such large number of people would only increase the burden and work-load of public sector

Criticisms of PMJJBY:

- The banks have complained that revenue received will be very low

- Some bankers have claimed that amount they are receiving is not sufficient to cover the service costs

- Insurers have also pointed out that no health certificate or information of pre-existing disease is required for joining

Atal Pension Yojana

- It focuses on the unorganized sector where nearly 400 million employees representing more than 80% of all employees are engaged <what is unorganized sector? differentiate b/w informal and unorganized? Answer in comments.>

- The aim is to make sure that needy people could get fixed amount when they get old

- It is the improved version of Swavalamban scheme, launched in 2010-11, which has been found lacking in clarity with regard to pension benefits at the age after 60

Features:

- All citizen of India aged between 18-40 years are eligible

- A guaranteed minimum monthly pension will be provided to the subscribers varying from Rs. 1000 to Rs. 5000 per month

- The pension amount depends on contribution by subscriber

- Government of India will guarantee the minimum benefit of pension

- Most interesting part of the scheme is that the government will contribute 50% of the contribution made by the subscriber or Rs. 1000 whichever is lower

- However, contribution by the govt is available for only those who are not income tax payers and are not covered by any Statutory Social Security Schemes

- Bank account holder of Any Bank account is eligible

Suraksha Bandhan drive- Spreading the social security message

- Aim: To take forward the Govt’s objective of creating a universal social security system in the country, targeted especially at the poor and the under-privileged

- Participating Banks supported by the participating Insurance Companies are carrying out local outreach, awareness building and enrolment facilitation under the drive

- Public service organizations supported by peoples representatives are participating in these efforts through various outreach activities such as enrolment drives, camps etc. in large numbers during this period

Published with inputs from Swapnil