Note4Students

From UPSC perspective, the following things are important :

Prelims level: Ex Cambrian Patrol

Mains level: Not Much

A team from Gorkha Rifles which represented the Indian Army at the prestigious Cambrian Patrol Exercise at Brecon, Wales, UK, has been awarded a Gold medal.

Ex Cambrian Patrol

- Organized by the UK Army, this exercise is considered the ultimate test of human endurance, team spirit and is sometimes referred as the Olympics of Military Patrolling.

- The aim of The Cambrian Patrol is to provide a challenging patrols exercise in order to enhance operational capability.

- The event has evolved into a cost-effective, ready-made exercise that Commanding Officers can use to test the basic training standards of their soldiers, in preparation for future operations.

- It is mission-focused and scenario-based with role players used to enhance the training benefit.

How it is conducted?

- During the exercise, teams are assessed for their performance under harsh terrain and inclement cold weather conditions.

- They undergo various challenges in addition to the complex real-world situations painted to them so as to assess their reactions in combat settings.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Coal Mines Nationalisation Act (CMNA)

Mains level: Paper 3- Coal crisis

Context

In India, coal-based power plants have witnessed rapid depletion of coal stocks from a comfortable 28 days at the end of March to a precarious level of four days by the end of September. Coal India Ltd (CIL) has been unfairly attacked, even as it gears up to play a crucial role in fighting the power crisis.

Reasons for crisis

- The reasons for the crisis are structural as well as operational.

- The Coal Mines Nationalisation Act (CMNA) in 1993 enabled the government to take away 200 coal blocks of 28 billion tons from CIL and allocate them to end-users for the captive mining of coal.

- These end-users, mostly in the private sector, failed to produce any significant quantity of coal.

- The cancellation of 214 blocks by the Supreme Court added to the problem.

- Commensurate to the captive mines allocated to the end-user industries, the coal production today should have been at least 500 million tonnes per annum (mtpa).

- In reality, this has never exceeded 60 mtpa.

- On the operational side, power plants are required by the Central Electricity Authority (CEA) to maintain a minimum stock of 15 to 30 days of normative coal consumption.

- The compliance with this directive by power plants has been severely lacking.

- This enhances the vulnerability of power plants.

- The persistent non-payment of coal sale dues by power plants to coal companies has created a serious strain on their working capital position.

- A spurt in imported coal prices, mainly due to a major increase in coal imports by China, acted as a brake on imports of coal.

- This escalated the demand for domestic coal.

- The spurt in demand for coal is being linked to the post-Covid economic recovery.

CIL’s role in mitigating the shortage crisis

- Growth in production in short duration: Despite many constraining factors, it is to the credit of CIL that it has achieved a growth of 14 million tonnes (mt) or 5.8 per cent in coal production during the first half of 2021-22.

- Yet, the offtake was higher than the preceding year by 52 mt or 20.6 per cent.

- This was possible by drawing down on the opening inventory of coal from 100 mt to 42 mt during April to September.

- With the monsoons behind us and the onset of a good productive season, CIL has already stepped up coal offtake to more than 1.5 mt per day.

- With efforts on the part of the railways in moving the coal, the crisis should dissipate in the near future, at least for power plants that pay timely for coal supplies.

- Besides meeting the growing coal demand of power plants, CIL has been able to significantly replace the import of highly expensive thermal coal.

- Cheaper coal: Even after bearing the highest tax and transport cost globally, the landed cost of CIL coal continues to be much cheaper than imported coal at almost all destinations.

- Saving of foreign exchange: The resultant benefits are savings of foreign exchange, and generation of power at affordable tariffs.

- The coal price charged by CIL, expressed in energy units, is at a deep discount of 60-70 per cent of imported coal.

Conclusion

In brief, CIL has been unfairly blamed for the coal crisis. It has played a stellar role, standing like a solid rock between light and darkness. It is striving to build comfortable stocks at the power plants, not in default of payment.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Mains level: Paper 3- Issues with removing the interest rate ceiling for NBFC-MFIs

Context

In June 2021, the Reserve Bank of India (RBI) published a “Consultative Document on Regulation of Microfinance”. The likely impact of the recommendations is unfavourable to the poor.

Background of microfinance in India

- Microfinance lending has been in place since the 1990s.

- In the 1990s, microcredit was given by scheduled commercial banks either directly or via non-governmental organisations to women’s self-help groups.

- But given the lack of regulation and scope for high returns, several for-profit financial agencies such as NBFCs and MFIs emerged.

- The microfinance crisis of Andhra Pradesh led the RBI to review the matter, and based on the recommendations of the Malegam Committee, a new regulatory framework for NBFC-MFIs was introduced in December 2011.

- A few years later, the RBI permitted a new type of private lender, Small Finance Banks (SFBs), with the objective of taking banking activities to the “unserved and underserved” sections of the population.

- Today, as the RBI’s consultative document notes, 31% of microfinance is provided by NBFC-MFIs, and another 19% by SFBs and 9% by NBFCs.

- These private financial institutions have grown exponentially over the last few years.

What are the recommendations in the document?

- The consultative document recommends that the current ceiling on rate of interest charged by non-banking finance company-microfinance institutions (NBFC-MFIs) or regulated private microfinance companies needs to be done away with.

- The paper argues that the interest rate ceiling is biased against one lender (NBFC-MFIs) among the many: commercial banks, small finance banks, and NBFCs.

- It proposes that the rate of interest be determined by the governing board of each agency, and assumes that “competitive forces” will bring down interest rates.

Comparison of rate of interest

- According to current guidelines, the ‘maximum rate of the interest rate charged by an NBFC-MFI shall be the lower of the following: the cost of funds plus a margin of 10% for larger MFIs (a loan portfolio of over ₹100 crores) and 12% for others; or the average base rate of the five largest commercial banks multiplied by 2.75’.

- A quick look at the website of some Small Finance Banks (SFBs) and NBFC-MFIs showed that the “official” rate of interest on microfinance was between 22% and 26% — roughly three times the base rate.

- How does this compare with credit from public sector banks and cooperatives?

- Crop loans from Primary Agricultural Credit Societies (PACS) in Tamil Nadu had a nil or zero interest charge if repaid in eight months.

- Kisan credit card loans from banks were charged 4% per annum (9% with an interest subvention of 5%) if paid in 12 months (or a penalty rate of 11%).

- Other types of loans from scheduled commercial banks carried an interest rate of 9%-12% a year.

- As even the RBI now recognises, the rate of interest charged by private agencies on microfinance is the maximum permissible, a rate of interest that is a far cry from any notion of cheap credit.

- The actual cost of microfinance loans is even higher for several reasons.

- An “official” flat rate of interest used to calculate equal monthly instalments actually implies a rising effective rate of interest over time.

- In addition, a processing fee of 1% is added and the insurance premium is deducted from the principal.

Violations of RBI guidelines

- In line with RBI regulations, all borrowers had a repayment card with the monthly repayment schedules.

- This does not mean that borrowers understood the charges.

- Further, contrary to the RBI guideline of “no recovery at the borrower’s residence”, the collection was at the doorstep.

Conclusion

The proposals in the RBI’s consultative document will lead to further privatisation of rural credit, reducing the share of direct and cheap credit from banks and leaving poor borrowers at the mercy of private financial agencies. This is beyond comprehension at a time of widespread post-pandemic distress among the working poor.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: GHI and its components

Mains level: Paper 2- Low ranking of India on GHI

Context

This year’s Global Hunger Index (GHI) ranks India 101 out of 116 countries for which reliable and comparable data exist.

Government’s stand

- Is India’s performance on hunger as dismal as denoted by the index or is it partly a statistical artefact?

- This question assumes immediacy, especially since the government has questioned the methodology and claimed that the ranking does not represent the ground reality.

- This calls for careful scrutiny of the methodology, especially of the GHI’s components.

Understanding the GHI methodology

- The GHI has four components.

- The first — insufficient calorie intake — is applicable for all age groups.

- The data on deficiency in calorie intake, accorded 33% weight, is sourced from the Food and Agriculture Organization’s Suite of Food Security Indicators (2021).

- The remaining three — wasting (low weight for height), stunting (low height for age) and mortality — are confined to children under five years.

- The data on child wasting and stunting (2016-2020), each accounting for 16.6% of weight, are from the World Health Organization, UNICEF and World Bank, complemented with the latest data from the Demographic and Health Surveys.

- Under-five mortality data are for 2019 from the UN Inter-Agency Group for Child Mortality Estimation.

Issues with GHI

- The GHI is largely children-oriented with a higher emphasis on undernutrition than on hunger and its hidden forms, including micronutrient deficiencies.

- The first component — calorie insufficiency — is problematic for many reasons.

- The lower calorie intake, which does not necessarily mean deficiency, may also stem from reduced physical activity, better social infrastructure (road, transport and healthcare) and access to energy-saving appliances at home, among others.

- For a vast and diverse country like India, using a uniform calorie norm to arrive at deficiency prevalence means failing to recognise the huge regional imbalances in factors that may lead to differentiated calorie requirements at the State level.

Understanding the connection between stunting and wasting and ways to tackling them

- India’s wasting prevalence (17.3%) is one among the highest in the world.

- Its performance in stunting, when compared to wasting, is not that dismal, though.

- Child stunting in India declined from 54.2% in 1998–2002 to 34.7% in 2016-2020, whereas child wasting remains around 17% throughout the two decades of the 21st century.

- Stunting is a chronic, long-term measure of undernutrition, while wasting is an acute, short-term measure.

- Quite possibly, several episodes of wasting without much time to recoup can translate into stunting.

- Effectively countering episodes of wasting resulting from such sporadic adversities is key to making sustained and quick progress in child nutrition.

- Way forward: If India can tackle wasting by effectively monitoring regions that are more vulnerable to socioeconomic and environmental crises, it can possibly improve wasting and stunting simultaneously.

Low child mortality

- India’s relatively better performance in the other component of GHI — child mortality — merits a mention.

- Studies suggest that child undernutrition and mortality are usually closely related, as child undernutrition plays an important facilitating role in child mortality.

- However, India appears to be an exception in this regard.

- This implies that though India was not able to ensure better nutritional security for all children under five years, it was able to save many lives due to the availability of and access to better health facilities.

Conclusion

The low ranking does not mean that India fares uniformly poor in every aspect. This ranking should prompt us to look at our policy focus and interventions and ensure that they can effectively address the concerns raised by the GHI, especially against pandemic-induced nutrition insecurity.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: AT and C losses

Mains level: Paper 3- Salient features of Electricity (Amendment) Bill 2020

Context

Most discoms are deep into the red as high aggregate technical and commercial (AT&C) losses are chipping into their revenues. Against this backdrop, the Electricity (Amendment) Bill of 2020 is a game-changing reform.

Why the Electricity (Amendment) Bill of 2020 is a game-changing reform

- De-licensing power distribution: This will provide the consumers with an option of choosing the service provider, switch their power supplier and enable the entry of private companies in distribution, thereby resulting in increased competition.

- In fact, privatisation of discoms in Delhi has reduced AT&C losses significantly from 55% in 2002 to 9% in 2020.

- Open access for purchasing power: Open access for purchasing power from the open market should be implemented across States and barriers in the form of cross-subsidy surcharge, additional surcharge and electricity duty being applied by States should be reviewed.

- Issue of tariff revision: The question of tariffs needs to be revisited if the power sector is to be strengthened.

- Tariffs ought to be reflective of the average cost of supply to begin with and eventually move to customer category-wise cost of supply in a defined time frame.

- This will facilitate a reduction in cross-subsidies.

- Inclusion in GST: Electrical energy should be covered under GST, with a lower rate of GST, as this will make it possible for power generator/transmission/distribution utilities to get a refund of input credit, which in turn will reduce the cost of power.

- Use of smart meters: Technology solutions such as installation of smart meters and smart grids which will reduce AT&C losses and restore financial viability of the sector.

- The impetus to renewable energy: The impetus to renewable energy, which will help us mitigate the impact of climate change, is much needed.

- Despite its inherent benefits, the segment has shown relatively slow progress with an estimated installed capacity of 5-6 GW as on date, well short of the 2022 target.

- The Bill also underpins the importance of green energy by proposing a penalty for non-compliance with the renewable energy purchase obligations which mandate States and power distribution companies to purchase a specified quantity of electricity from renewable and hydro sources

- Strengthening the regulatory architecture: This will be done by appointing a member with a legal background in every electricity regulatory commission and strengthening the Appellate Tribunal for Electricity.

- This will ensure faster resolution of long-pending issues and reduce legal hassles.

- Authority for contractual obligation: Provision in the Bill such as the creation of an Electricity Contract Enforcement Authority to supervise the fulfillment of contractual obligations under power purchase agreement, cost reflective tariffs and provision of subsidy through DBT are commendable.

Conclusion

Early passage of the Bill is critical as it will help unleash a path-breaking reform for bringing efficiency and profitability to the distribution sector.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Bhutan-China Border Agreement

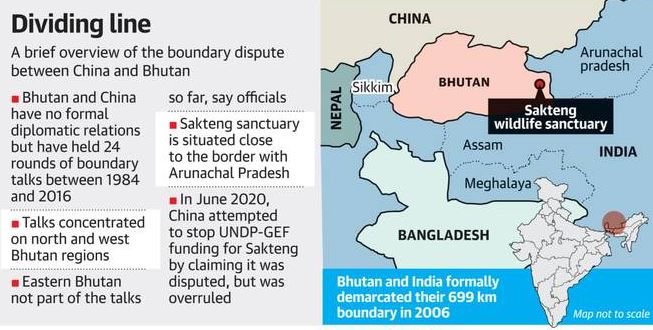

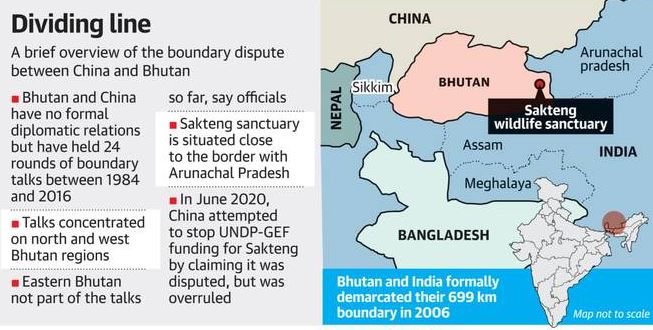

In a step towards resolving their boundary disputes, Bhutan and China signed an agreement on a three-Step roadmap to help speed up talks to “break the deadlock” in negotiations.

Bhutan-China Border Issues

Bhutan shares an over 400-km-long border with China.

- Doklam: China wants to exchange the valleys to the north of Bhutan with the pasture land to the west (including Doklam), totalling 269 square kilometres.

- Jakarlung and Pasamlung valleys: located near Tibet to Bhutan’s North, which measure 495 sq. kms.

- Sakteng Wildlife Sanctuary Project: China claims this area (near to Arunachal Pradesh) in eastern Bhutan as its own.

What is the recent agreement?

- The roadmap “for Expediting the Bhutan-China Boundary Negotiations”, is expected to progress on the boundary talks process that has been delayed for five years.

- It was stalled due to the Doklam standoff in 2017, and then by the Covid Pandemic.

- Although China and Bhutan do not have official diplomatic relations they have engaged in 24 rounds of ministerial-level talks to resolve their border dispute.

Implications for India

The boundary issue between China and Bhutan is special because it not only relates to Bhutan but also has become a negative factor for China-India ties.

- China control much of the Doklam: Since the 2017 stand-off with India, Beijing has already strengthened its de facto control over much of the Doklam plateau, located strategically along the India-China-Bhutan trijunction.

- Bhutan supports it: This agreement has been equally endorsed and appreciated by Bhutan and China.

- Deadlock at LAC talks: Its timing is particularly significant New, given India-China border talks on their 17-month-old standoff at the Line of Actual Control appear to have hit an deadlock.

- India’s strategic risks: This has big implications for India, since the Doklam swap would have given China access to the strategically sensitive “chicken neck” of the Siliguri corridor.

India’s interest

(a) Doklam

- The Doklam plateau remains hugely critical for India due to the Siliguri Corridor that lies to the south of Doklam.

- The corridor, also known as the ‘Chicken’s Neck’, is a 22-km wide major arterial road connecting mainland India with its northeastern states and thus it is a highly sensitive area for China.

(b) Sakteng: the hotspot

- The Sakteng sanctuary adjoins West Kameng district and Tawang disticts in India’s Arunachal Pradesh state.

- Its strategic value lies in its proximity to Arunachal Pradesh, where China claims around 90,000 sq km of Indian territory.

- Tawang, the major bone of contention between India and China in the eastern sector of their border dispute, lies to the northeast of the Sakteng.

Conclusion

- Bhutan has to balance its ties with India as well as China.

- We need to explore channels that India can activate with Bhutan when it comes to the highly sensitive matter of settling the boundary dispute between them and China.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: CoP, UNFCCC

Mains level: Paris Agreement

The UK will host the COP 26 UN Climate Change Conference from October 31 to November 12.

Conference of Parties (CoP): A Backgrounder

- The CoP comes under the United Nations Climate Change Framework Convention (UNFCCC) which was formed in 1994.

- The UNFCCC was established to work towards “stabilisation of greenhouse gas concentrations in the atmosphere.”

- It laid out a list of responsibilities for the member states which included:

- Formulating measures to mitigate climate change

- Cooperating in preparing for adaptation to the impact of climate change

- Promoting education, training and public awareness related to climate change

- The UNFCCC has 198 parties including India, China and the USA. COP members have been meeting every year since 1995.

COP1 to COP25: Key takeaways

COP1: The first conference was held in 1995 in Berlin.

COP3: It was held in Kyoto, Japan, in 1997, the famous Kyoto Protocol (w.e.f. 2005) was adopted. It commits the member states to pursue limitation or reduction of greenhouse gas emissions.

COP8: India hosted the eighth COP in 2002 in New Delhi. It laid out several measures including, ‘strengthening of technology transfer… in all relevant sectors, including energy, transport and R&D, and the strengthening of institutions for sustainable development.

COP21: it is one of the most important that took place in 2015, in Paris, France. Here countries agreed to work together to ‘limit global warming to well below 2, preferably at 1.5 degrees Celsius, compared to pre-industrial levels.’

Significance of COP26

- The event will see leaders from more than 190 countries, thousands of negotiators, researchers and citizens coming together to strengthen a global response to the threat of climate change.

- It is a pivotal movement for the world to come together and accelerate the climate action plan after the COVID pandemic.

COP26 goals

According to the UNFCCC, COP26 will work towards four goals:

- Secure global net-zero by mid-century and keep 1.5 degrees within reach

- The UNFCCC recommends that countries ‘accelerate the phase-out of coal, curtail deforestation, speed up the switch to electric vehicles and encourage investment in renewables’ to meet this goal.

- Adapt to protect communities and natural habitats

- Countries will work together to ‘protect and restore ecosystems and build defences, warning systems and resilient infrastructure and agriculture to avoid loss of homes, livelihoods and even lives.’

- Mobilise finance

- To deliver on first two goals, developed countries must make good on their promise to mobilise at least $100bn in climate finance per year by 2020.

- Work together to deliver

- Another important task at the COP26 is to ‘finalise the Paris Rulebook’. Leaders will work together to frame a list of detailed rules that will help fulfil the Paris Agreement.

What India could do to reach its targets?

- Update NDCs: It is time for India to update its Nationally Determined Contributions or NDCs. (NDCs detail the various efforts taken by each country to reduce the national emissions)

- Effective planning: Sector by sector plans are needed to bring about development. We need to decarbonise the electricity, transport sector and start looking at carbon per passenger mile.

- Energy transition: Aggressively figure out how to transition our coal sector

- Robust legal framework: India also needs to ramp up the legal and institutional framework of climate change.

Try answering this PYQ:

With reference to the Agreement at the UNFCCC Meeting in Paris in 2015, which of the following statements is/are correct?

- The Agreement was signed by all the member countries of the UN and it will go into effect in 2017.

- The Agreement aims to limit the greenhouse gas emissions so that the rise in average global temperature by the end of this century does not exceed 2 degree Centigrade or even 5 degree Centigrade above pre-industrial levels.

- Developed countries acknowledged their historical responsibility in global warming and committed to donate dollar 1000 billion a year from 2020 to help developing countries to cope with climate change.

Select the correct answer using the code given below:

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Post your answers here.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Zeolite

Mains level: NA

To meet the demand of oxygen supply in the country during the peak of pandemic, the Defence Research and Development Organisation (DRDO) had chartered the Air India to import ‘Zeolite’ from different countries.

What are Zeolites?

- Zeolites are highly porous, 3-dimensional meshes of silica and alumina.

- In nature, they occur where volcanic outflows have met water.

- Synthetic zeolites have proven to be a big and low-cost boon.

Uses in Oxygen Concentrator

- One biomedical device that has entered our lexicon during the pandemic is the oxygen concentrator.

- This device has brought down the scale of oxygen purification from industrial-size plants to the volumes needed for a single person.

- At the heart of this technology are synthetic frameworks of silica and alumina with nanometer-sized pores that are rigid and inflexible.

- Beads of one such material, zeolite 13X, about a millimeter in diameter, are packed into two cylindrical columns in an oxygen concentrator.

How does it work?

- Zeolite performs the chemistry of separating oxygen from nitrogen in air.

- Being highly porous, zeolite beads have a surface area of about 500 square meters per gram.

- At high pressures in the column, nitrogen is in a tight embrace, chemically speaking, with the zeolite.

- Interaction between the negatively charged zeolite and the asymmetric nucleus (quadrupole moment) of nitrogen causes it to be preferentially adsorbed on the surface of the zeolite.

- Oxygen remains free, and is thus enriched.

- Once nitrogen is captured, what flows out from the column is 90%-plus oxygen.

- After this, lowering the pressure in the column releases the nitrogen, which is flushed out, and the cycle is repeated with fresh air.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Yudh Abhyas 2021

Mains level: India-US defense ties

The 17th edition of the India-U.S. bilateral exercise, Yudh Abhyas 2021, got underway in mountainous terrain and cold climate conditions of Alaska, US.

Yudh Abhyas 2021

- Exercise Yudh Abhyas is the largest running joint military training and defence cooperation endeavour between India and USA.

- The exercise aims at enhancing understanding, cooperation and interoperability between the two armies.

Why it is significant?

- Interestingly, this is the only India-U.S. service exercise continuing in bilateral format.

- The India-U.S. Malabar naval exercise became trilateral with the addition of Japan in 2015 and further brought in all the Quad partners together with the inclusion of Australia in 2020.

- Similarly, Japan joined the India-U.S. bilateral air exercise, Cope India, as an Observer in 2018 and the plan is to make it trilateral in phases.

- Other than the Malabar, Japan had sent observers for the first time during Cope India 2018 as an Observer in 2018. s

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Issues with NEET

Context

The Tamil Nadu government has passed an Act seeking an exemption from treating NEET as the sole and mandatory requirement for medical admission in the state. The Act, which is yet to get approval from the President.

NEET issue in Tamil Nadu

- The Justice A K Rajan committee was appointed by the state government of Tamil Nadu to examine whether NEET is an equitable method of selection.

- Its report lends credence to the belief that NEET tends to give an advantage to students from privileged backgrounds.

- It also observed that NEET, in terms of orientation, is biased towards the Central Board of Secondary Education (CBSE).

- In the section titled ‘Size of coaching market’, the report brings out two poignant facts.

- One, by inadvertently creating a “market for coaching”, NEET has helped to create an “extractive industry of coaching” as an essential condition for clearing it.

- Two, the coaching fees are not only high, but are beyond the reach of many, especially the poor and marginalised.

- Acting upon the committee’s recommendation, the Tamil Nadu government has passed an Act seeking an exemption from treating NEET.

- The Act, which is yet to get approval from the President.

- An educational intervention which was introduced as a solution to foster equality of opportunity has turned out to be the primary cause of deepening inequality of participation and opportunity.

Important questions

- There are at least two important questions.

- Equality of opportunity: First, does NEET help foster equality of opportunity for everyone without unduly advantaging or disadvantaging anyone?

- Second, is NEET’s bias towards CBSE justifiable in an immensely diverse country like ours, where varied school curricula coexist with a highly unequal access to financial and educational resources and opportunities?

- The question here is: How can NEET promote parity of participation when aspiring first-generation students from marginalised and poor households participate from a highly unequal position in the first place?

- NEET disregards the fact that the terms and conditions of participation are highly unequal and biased.

Way forward

- The National Education Policy (NEP 2020) envisions a curriculum and pedagogy which will promote holistic learning, social responsibility and multilingualism, among other things.

- It is important, therefore, to significantly restructure the focus of NEET keeping in mind the spirit of NEP and varied school curricula in regional languages.

Conclusion

A restructured NEET, which does not require intensive and repeated coaching as a prerequisite and is not biased towards any board, can go a long way in promoting the parity of participation and nourishing the capacity to aspire, especially of the poor and marginalised.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Mapping: Central Asian Countries

Mains level: India-Central Asia Relations

In his speech at the Shanghai Cooperation Organization (SCO) meet last month, PM Modi stressed on commitment for increasing its connectivity with land-locked Central Asia.

What is the Central Asia Region?

- Central Asia is a region in Asia which stretches from the Caspian Sea in the west to China and Mongolia in the east, and from Afghanistan and Iran in the south to Russia in the north.

- It includes the former Soviet republics of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan.

India-Central Asia Ties

- India has decades-old wish to connect with the resource and fuel-rich Central Asian nations.

- Since the emergence of the Central Asian Republics as independent countries in the early 1990s, New Delhi has been trying to establish ties with them.

Trade and collaboration

- India’s trade with the five Central Asian Republics—Kazakhstan, Uzbekistan, Turkmenistan, Kyrgyzstan and Tajikistan—was below $ 2 billion in 2018.

- The potential areas for collaboration include construction, sericulture and pharmaceuticals to IT and tourism.

- Much of this trade was routed through Iran, Russia or the United Arab Emirates (UAE).

Efforts for connectivity

- Turkmenistan–Afghanistan–Pakistan–India (TAPI) Gas Pipeline

- Development of Iran’s Chabahar Port

- Zaranj-Delaram Highway

- International North-South (Transit) Corridor (INSTC)

About INSTC

- In 2000, India, Iran and Russia agreed on a new route for trade that later came to be known as INSTC.

- It was aimed at cutting the costs and time in moving cargo between Russia and India.

- The pact was ratified in 2002 and the original multi-modal route linked Mumbai in India to Bandar Abbas and Bandar-e-Anzali in Iran, then across the Caspian Sea to Astrakhan, Moscow and St. Petersburg in Russia.

- Over the years, more countries joined the INSTC.

- In 2003, India and Iran announced the development of the Chabahar port in the Sistan-Balochistan province.

China’s opportunism: Based on proximity

- China’s trade with Central Asia was $50 billion-$60 billion in the same period.

- The obvious advantage in China’s favour is geographical proximity.

Hurdles for India

- Lack of mutual trust: Unfortunately, many connectivity options are not open to them today due to the lack of mutual trust.

- Pakistan factor: Tensions with Pakistan mean there is no viable land route towards Central Asia.

- Iran and the US sanctions: Efforts to look for a circuitous route via Iran (and Afghanistan) have stalled due to US sanctions on Iran.

Issues in Iran-Afghanistan bypass route

Recent events acquire broader geopolitical relevance for India in this route:

- Taliban takeover of Afghanistan: The takeover of Afghanistan by the Pakistan-backed Taliban has severely set back India’s plans in Central Asia.

- Iran’s bypassing of India: Iran’s overtures has been clearly visible after itself allocating Farzad-B Gas exploration contract to another company bypassing India.

Central Asia’s importance for India

- Fossil fuels: While Central Asia is seen as fuel-rich and, hence, important for an energy-starved India.

- Mineral richness: Central Asian states are also mineral-rich, and Kazakhstan, for one, has been a source of uranium for India’s nuclear power plants.

- Market for India: A country like India which is seen as a major economy has to have a presence in these markets. INSTC also offers a safe and cost-effective route to the EU (European Union) market.

- Convergence against Terrorism: India can forge a common position on terrorism and radicalization, which is a matter of concern to the region as much as it is to India.

India’s recent engagement

- Defence collaboration: In recent years, New Delhi has engaged with Central Asian Republics in the defence sphere through military exercises (say Ex Kazind).

- Engagement at UN: Political and economic engagement is also important, given the imperatives of working together at a body such as the United Nations (UN).

- Technological ties: India has set up universities there—Sharda and Amity are examples.

Scope for expansion

- Dairy Sector: There is scope for collaboration in the dairy sector.

- Pharma: Indian firms have been setting up pharmaceutical units in Russia that can serve these countries as well.

- Info Technology: IT and IT-enabled services are two other areas.

- Cultural connect: Bollywood movies are quite famous in these countries.

Way forward

- India needs to develop into stronger bonds of trade and commercial bonds which will be possible once the INSTC crystallizes.

Conclusion

- The road ahead in the short term is difficult as India doesn’t seem to have any real leverage to get the connectivity projects with Central Asia going.

- India has been negotiating with individual bilateral partners though.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Also read:

[Burning Issue] Ashgabat Agreement

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Gati Shakti Master Plan

Mains level: Infrastructure development measures

The PM has inaugurated the GatiShakti — National Master Plan for infrastructure development aimed at boosting multimodal connectivity and driving down logistics costs.

GatiShakti — National Master Plan

- PM GatiShakti is a digital platform that connects 16 ministries — including Roads and Highways, Railways, Shipping, Petroleum and Gas, Power, Telecom, Shipping, and Aviation.

- It aims to ensure holistic planning and execution of infrastructure projects.

- The objective is to ensure that every department now has visibility of each other’s activities providing critical data while planning and execution of projects.

- Through this, different departments will be able to prioritize their projects through cross-sectoral interactions.

Notable features

- Geospatial data: The portal will offer 200 layers of geospatial data, including on existing infrastructure such as roads, highways, railways, and toll plazas.

- Protected areas management: It would also geographic information about forests, rivers, and district boundaries to aid in planning and obtaining clearances.

- Realtime monitoring: The portal will also allow various government departments to track, in real-time and at one centralized place, the progress of various projects.

Monitoring mechanism

- The National Master Plan has set targets for all infrastructure ministries.

- A project monitoring group under the Department for Promotion of Industry and Internal Trade (DPIIT) will monitor the progress of key projects in real-time.

- It would report any inter-ministerial issues to an empowered group of ministers, who will then aim to resolve these.

Need for such Project

- Avoiding poor infrastructure planning: Examples of poor infrastructure planning included newly-built roads being dug up by the water department to lay pipes.

- Creating a multi-modal network: The government expects the platform to enable various government departments to synchronize their efforts into a multi-modal network.

- Timely completion of infra projects: It is also expected to help state governments give commitments to investors regarding timeframes for the creation of infrastructure.

- Inefficient connectivity: Currently, a number of economic zones and industrial parks are not able to reach their full productive potential due to inefficient multi-modal connectivity.

- Easy clearance: The portal allows stakeholders to apply for these clearances from the relevant authority directly.

Logistics costs in India

- Studies estimate that logistics costs in India are about 13-14% of GDP as against about 7-8% of GDP in developed economies.

- High logistics costs impact cost structures within the economy by making it more expensive for exporters to ship merchandise to buyers.

Benefits offered by PM-GatiShakti

- Collaborative planning: It would incorporate infrastructure schemes under various ministries and state governments, including the Bharatmala and inland waterways schemes, and economic zones.

- Logistics boost: It would boost last-mile connectivity and thus bring down logistics costs with integrated planning and reducing implementation overlaps.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Central Public Sector Enterprises, Its categories

Mains level: Profit making CPSEs

The Centre has accorded ‘Maharatna’ status to the state-owned Power Finance Corporation Ltd (PFC), thus giving PFC greater operational and financial autonomy.

About PFC Ltd.

- Power Finance Corporation Ltd. (PFC) is an Indian financial institution under the ownership of Ministry of Power.

- Established in 1986, it is the financial backbone of Indian Power Sector.

- PFC is the 8th highest profit making Central Public Sector Enterprise (CPSE) as per the Department of Public Enterprises Survey for FY 2017–18.

- It is India’s largest NBFC and also India’s largest infrastructure finance company.

Benefits of Maharatna Status

- This new status will enable PFC to offer competitive financing for the power sector, which will go a long way in making available affordable & reliable ‘Power For All 24×7’.

- This will also impart enhanced powers to the PFC Board while taking financial decisions.

- It can make equity investments to undertake financial joint ventures and wholly-owned subsidiaries and undertake mergers and acquisitions in India and abroad.

- It can also structure and implement schemes relating to personnel and Human Resource Management and Training.

- It can also enter into technology Joint Ventures or other strategic alliances among others.

Back2Basics: Central Public Sector Enterprises

- The CPSEs are run by the Government under the Department of Public Enterprises of Ministry of Heavy Industries and Public Enterprises.

- The government grants the status of Navratna, Miniratna and Maharatna to them based upon the profit made by these CPSEs.

- The Maharatna category has been the most recent one since 2009, other two have been in function since 1997.

|

Maharatna |

Navratna |

Miniratna Category-I |

Miniratna Category-II |

| Eligibility |

Three years with an average annual net profit of over ₹2,500 crore

OR

Average annual Net worth of ₹10,000 crore for 3 years

OR

Average annual Turnover of ₹20,000 crore for 3 years

|

A score of 60 (out of 100), based on six parameters which include net profit, net worth, total manpower cost, total cost of production, cost of services, PBDIT (Profit Before Depreciation, Interest and Taxes), capital employed, etc.,

AND

A company must first be a Miniratna and have 4 independent directors on its board before it can be made a Navratna |

Have made profits continuously for the last three years or earned a net profit of ₹30 crore or more in one of the three years |

Have made profits continuously for the last three years and should have a positive net worth. |

| Benefits for investment |

₹1,000 crore – ₹5,000 crore, or free to decide on investments up to 15% of their net worth in a project |

Up to ₹1,000 crore or 15% of their net worth on a single project or 30% of their net worth in the whole year |

Up to ₹500 crore or equal to their net worth, whichever is lower |

Up to ₹300 crore or up to 50% of their net worth, whichever is lower |

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Mudumalai TR

Mains level: Not Much

P

PC: MapsOfIndia

A tiger believed to have been responsible for the death of two herders in the Mudumalai Tiger Reserve was finally captured.

Read all the tiger reserves in India through this map. Put more focus on South Indian states and the NE region.

Mudumalai Tiger Reserve

- Mudumalai National Park is a national park in the Nilgiri Mountains in Tamil Nadu.

- It is located in the Nilgiri District and shares boundaries with the states of Karnataka and Kerala.

- It is part of the Nilgiri Biosphere Reserve and was declared a tiger reserve in 2007.

- It harbours several endangered and vulnerable species including Bengal tiger, Indian leopard, Indian elephant and gaur.

Try this PYQ:

Q. Recently there was a proposal to translocate some of the lions from their natural habitat in Gujarat to which one of the following sites?

(a) Corbett National Park

(b) Kuno Palpur Wildlife Sanctuary

(c) Mudumalai Wildlife Sanctuary

(d) Sariska National Park

Post your answers here.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Section 139 of the BSF Act

Mains level: Paper 3- BSF powers

Context

The Ministry of Home Affairs recently issued a notification extending the jurisdiction of the Border Security Force from 15 km to a depth of 50 km along the international borders in three states — Punjab, Assam and West Bengal.

Background of the notification about jurisdiction of BSF

- The last notification of the MHA (July 3, 2014), which defined the jurisdiction of the BSF, stated that the force could operate in the entire states of Nagaland, Manipur, Mizoram, Tripura and Meghalaya without any restrictions whatsoever.

- In Gujarat, it had jurisdiction up to a depth of 80 km and in Rajasthan up to 50 km.

- In Punjab, Assam and West Bengal, the BSF jurisdiction was up to a depth of 15 km only.

- Under the latest notification issued on October 11, 2021, there is no change in the northeastern states and Rajasthan.

- In Gujarat, jurisdiction has been reduced from 80 km to 50 km.

- The controversial change is in Assam, West Bengal and Punjab, where the BSF jurisdiction has been extended from 15 km to 50 km.

- It is this part of the notification which has generated controversy, though the criticism has been made by leaders of Punjab and West Bengal.

Why the government of India decided to extend the jurisdiction of BSF?

- Assam, West Bengal and Punjab have international borders.

- Changed threat perception: The threat perception from across the international borders has undergone a sea change in the context of recent developments in the Af-Pak region.

- Efforts to destabilise Punjab: Radical groups of different shades are feeling emboldened and are going to make a determined attempt to destabilise Punjab.

- Pakistan-sponsored terrorist groups, particularly the Lashkar-e-Toiba and Jaish-e-Muhammad, will almost certainly renew their onslaught in the border states.

- West Bengal has already undergone a huge demographic change.

- Assam faces multiple problems of ethnic insurgencies, smuggling, counterfeit currency, drug trafficking, etc.

- Police need assistance: The police across the country are in a state of atrophy and they need the assistance of central armed police forces even for maintaining normal law and order.

- As such, their effectiveness against the emerging trans-border threats is suspect.

Implications for powers of police and federalism

- The home ministry’s latest notification only seeks to reinforce the capabilities of the state police in securing the states under section 139 of the BSF Act, which empowers the members of the force to discharge certain powers and duties within local limits of the areas specified in the schedule.

- The jurisdiction of the state police has neither been curtailed nor its powers reduced in any manner.

- It is just that the BSF will also be exercising powers of search, seizure and arrest in respect of only the Passport Act 1967, Passport (Entry into India) Act 1920 and specified sections of the Criminal Procedure code.

- The power to register FIR and investigate the case remains with the state police.

- The Indian Constitution, no doubt, fulfils some conditions of a federation, but it leans towards a strong Centre.

Conclusion

National security is a paramount consideration. It is unfortunate that the BSF is being dragged into political controversy when it would actually be over-stretching itself to strengthen national security.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Pandora papers

Mains level: Paper 3- Tax evasion and tax avoidance

Context

The Pandora Papers, published on October 3, once again expose the illegal activities of the rich and the mighty across the world.

About the Pandora Papers investigation

- It is “the world’s largest-ever journalistic collaboration, involving more than 600 journalists from 150 media outlets in 117 countries”.

- The International Consortium of Investigative Journalists (ICIJ) has researched and analysed the approximately 12 million documents in order to unravel the functioning of the global financial architecture.

- The Pandora Papers, unlike the previous cases, are not from any one tax haven; they are leaked records from 14 offshore services firms. The data pertains to an estimated 29,000 beneficiaries.

- The 2.94 terabytes of data have exposed the financial secrets of over 330 politicians and public officials, from more than 90 countries and territories.

- These include 35 current and former country leaders.

Role of financial centres and banks

- A large extent of the illicit financial flows have a link to New York City and London, the biggest financial centres in the world that allow financial institutions such as big banks to operate with ease.

- The big financial entities operating from these cities have been prosecuted for committing illegalities.

- In 2012, an investigation into the London Interbank Offered Rate or LIBOR — crucial in calculating interest rates — led to the fining of leading banks such as Barclays, UBS, Rabobank and the Royal Bank of Scotland for manipulation.

- These banks also operate a large number of subsidiaries in tax havens to help illicit financial flows.

Modus operandi

- Tax havens enable the rich to hide the true ownership of assets by using: trusts, shell companies and the process of ‘layering’.

- Financial firms offer their services to work this out for the rich.

- They provide ready-made shell companies with directors, create trusts and ‘layer’ the movement of funds.

- The process of layering involves moving funds from one shell-company in one tax haven to another in another tax haven and liquidating the previous company.

- This way, money is moved through several tax havens to the ultimate destination.

- Since the trail is erased at each step, it becomes difficult for authorities to track the flow of funds.

- It appears that most of the rich in the world use such manipulations to lower their tax liability even if their income is legally earned.

Why funds are moved to the tax havens?

- Even citizens of countries with low tax rates use tax havens.

- Over the three decades, tax havens have enabled capital to become highly mobile, forcing nations to lower tax rates to attract capital.

- This has led to the ‘race to the bottom’, resulting in a shortage of resources with governments to provide public goods, etc., in turn adversely impacting the poor.

- Lowering tax liability: It appears that most of the rich in the world use such manipulations to lower their tax liability even if their income is legally earned.

- Moving funds out of reach of creditors: Revelations suggest that funds are moved out of national jurisdiction to spirit them away from the reach of creditors and not just governments.

- Many fraudsters are in jail but have not paid their creditors even though they have funds abroad.

Challenges in checking the illicit financial flows

- The very powerful who need to be onboard to curb illicit financial flows (as the Organisation for Economic Co-operation and Development, or the OECD is trying) are the beneficiaries of the system and would not want a foolproof system to be put in place to check it.

- Strictly speaking, not all the activity being exposed by the Pandora Papers may be illegal due to tax evasion or the hiding of proceeds of crime.

- The authorities will have to prove if the law of the land has been violated.

- Operators outside the purview of tax authorities: Many Indians have become non-resident Indians or have made some relative into an NRI who can operate shell companies and trusts outside the purview of Indian tax authorities.

- That is why prosecution has been difficult in the earlier cases of data leakage from tax havens.

- The Supreme Court of India-monitored Special Investigation Team (SIT) set up in 2014 has not been able to make a dent.

- Role of organised sector: The Government’s focus on the unorganised sector as the source of black income generation is also misplaced since data indicate that it is the organised sector that has been the real culprit and also spirits out a part of its black incomes.

Way forward

- Global minimum tax: Recent development has been the agreement among almost 140 countries to levy a 15% minimum tax rate on corporates.

- Though it is a long shot, this may dent the international financial architecture.

- Ending banking secrecy: Other steps needed to tackle the curse of illicit financial flows are ending banking secrecy and a Tobin tax on transactions; neither of which the OECD countries are likely to agree to.

Consider the question “How illicits financial flows affect the economies of the nations? What are the challenges in curbing it?”

Conclusion

To curb the illicit financial flows, the global community needs to reach a consensus on several issues and tackle the challege collectively.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Article 312

Mains level: Paper 2- Reforms in bureaucracy

Context

The bureaucracy that took India through the last 75 years can’t be the one to take it through the next 75 — we need a proactive, imaginative, technology-savvy, enabling bureaucracy.

Role of bureaucracy and challenges it faces

- The civil services, and the Indian Administrative Service (IAS) in particular played important role in holding India together post-Independence.

- Much of the impressive nation-building across sectors happened because of their dedication and commitment.

- It is also forgotten that the bureaucracy, unlike the private sector, is a creature of the Constitution and is bound by multiple rules, laws, and procedures.

- Understaffed: As per estimates compiled by the Institute of Conflict Management, the government of India (GOI) has about 364 government servants for every 1,00,000 residents, with 45 per cent in the railways alone.

- About 60 per cent and 30 per cent are in Groups C and D, respectively, leaving a skeletal skilled staff of just about 7 per cent to man critical positions.

- We are grossly understaffed.

- Inaction: Further, faced with extensive judicial overreach reporting to an often rapacious, short-sighted political executive, and a media ever ready to play the role of judge, jury and executioner, the bureaucracy has in large part found comfort in inaction and ensuring audit-proof file work.

Suggestions

- Get out of business: That we need not be in many sectors is well-recognised — leave them to the markets — and politicians must get bureaucrats out of business, in more ways than one.

- Prevent punitive actions: To increase the officers’ willingness to take decisions, one possible solution is to legally prevent enforcement agencies from taking punitive action, like arrest for purely economic decisions without any direct evidence of kickbacks.

- Lateral entry: The toughest challenge is to change an inactive bureaucracy to one that feels safe in taking genuine risks.

- Lateral entry needs to expand to up to 15 per cent of Joint/Additional and Secretary-level positions in GOI.

- Recruitment process: Changes in recruitment procedures, like the interview group spending considerable time with the candidates, along with psychometric tests, will improve the incoming pool of civil servants.

- Evaluation: Most importantly, after 15 years of service, all officers must undergo a thorough evaluation to enable them to move further, and those who do not make it should be put out to pasture.

- Adoption of technology: Every modern bureaucracy in the world works on technology-enabled productivity and collaboration tools.

- India procures about $600 billion worth of goods and services annually — can’t all payments be done electronically?

Consider this question ” The civil services held India together after Independence, but if the country’s potential is to be realised, existing problems of inefficiency and inaction must be fixed. In light of this, examine the factors reasponsible for inefficiency and suggest the reforms.”

Conclusion

India cannot hope to get to a $5-trillion economy without a modern, progressive, results-oriented bureaucracy, one which says “why not?” instead of “why?” when confronted with problems.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: BSF

Mains level: India's border security

The Ministry of Home Affairs (MHA) has extended the jurisdiction of the Border Security Force (BSF) up to 50 km inside the international borders in Punjab, West Bengal and Assam.

Do you know?

BSF currently stands as the world’s largest border guarding force. It has been termed as the First Line of Defence of Indian Territories.

About Border Security Force (BSF)

- The BSF is India’s border guarding organization on its border with Pakistan and Bangladesh.

- It comes under the Ministry of Home Affairs.

- It was raised in the wake of the 1965 War on 1 December 1965 for ensuring the security of the borders of India and for matters connected therewith.

- The BSF has its own cadre of officers but its head, designated as a Director-General (DG), since its raising has been an officer from the Indian Police Service (IPS).

What are the new modifications?

- The MHA has exercised the powers under the Border Security Force Act of 1968.

- It has thus outlined the area of BSF’s jurisdiction.

- While the places marked here are within 50 km of the respective borders, this is not meant to represent the BSF’s jurisdiction.

- At the same time, the Ministry has reduced BSF’s area of operation in Gujarat from 80 km from the border, to 50 km.

Powers exercised by BSF in its jurisdiction

BSFs jurisdiction has been extended only in respect of the powers it enjoys under:

- Criminal Procedure Code (CrPC)

- Passport (Entry into India) Act, 1920 and

- Passport Act, 1967

Arrest and search

- BSF currently has powers to arrest and search under these laws.

- It also has powers to arrest, search and seize under the NDPS Act, Arms Act, Customs Act and certain other laws.

Its powers under these will continue to be only up to 15 km inside the border in Punjab, Assam and West Bengal, and will remain as far as 80 km in Gujarat.

Sanctions behind such powers

- Scarcely populated borders: At that time, border areas were sparsely populated and there were hardly any police stations for miles.

- Trans-border crimes: To prevent trans-border crimes, it was felt necessary that BSF is given powers to arrest.

- Manpower crunch: While police stations have now come up near the border, they continue to be short-staffed.

Various issues at Borders

- Encroachment

- Illegal incursion

- Drug and cattle smuggling

Why has the government extended the jurisdiction?

- The objective of the move is to bring in uniformity and also to increase operational efficiency. Earlier BSF had different jurisdictions in different states.

- BSF often gets information relating to crime scenes that may be out of their jurisdiction.

- The move was also necessitated due to increasing instances of drone-dropping of weapons and drugs.

Impact on State Police jurisdiction

- This move will complement the efforts of the local police. Thus, it is an enabling provision.

- It’s not that the local police can’t act within the jurisdiction of the BSF.

- The state police have better knowledge of the ground. Hence BSF and local Police can act in cooperation.

Criticism of the move

- At a basic level, the states can argue that law and order is a state subject and enhancing BSF’s jurisdiction infringes upon powers of the state government.

- In 2012, then Gujarat CM and the present PM had opposed a central government moves to expand BSF’s jurisdiction.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Bioethanol, Ethanol blending

Mains level: Read the attached story

India is planning to use surplus rice, besides sugarcane, to meet its biofuel target of blending 20% ethanol with petrol.

Could this impede India’s crop diversification goals or worsen nutritional indicators? Let us see!

Govt’s plan to promote ethanol

- India is estimated to achieve about 8.5% blending with petrol by this year, which it plans to increase to a mandatory 20% blending by 2025.

Sources for ethanol

The plan is to divert its excess sugar production to produce ethanol, 3.5 million tonnes in 2021-22 and 6 million tonnes the next year, in addition to grains like rice, corn, and barley.

- Using surplus rice: The government’s food department revealed its plans to divert 17 million tonnes of surplus rice from its food stocks of 90 million tonnes to produce ethanol.

- Sugarcane: This is in addition to the 2 million tonnes of sugar which is already being diverted to produce ethanol.

How would this benefit the country?

- Cost saving: A successful biofuels programme can save India $4 billion or about ₹30,000 crore every year by lowering import of petroleum products.

- Emission cut: Ethanol is also less polluting and offers equivalent efficiency at a lower cost than petrol.

- Biofuel’s policy boost: Rising production of grains and sugarcane and feasibility of making vehicles compliant to ethanol-blended fuel makes its biofuels policy a strategic requirement.

- Early rollout: Towards this, govt has put in place interest subsidies for distilleries to expand capacity while auto firms have agreed to make compatible vehicles.

What are the unintended effects of the policy?

- Unsustainability of cash-crops: Increasing reliance on biofuels can push farmers to grow more water-intensive crops like sugarcane and rice.

- Huge water requirement: Currently use 70% of the available irrigation water, negating some positive impact on the environment of using more ethanol.

- Food and nutrition security: The move could impact India’s hunger situation by limiting the coverage of the food security schemes.

- Food inflation: Diversion of mass consumption grains can also push food prices up.

How will it impact crop diversification?

- Monotonous crops: Although the biofuels policy stresses on using less water-consuming crops, farmers prefer to grow more sugarcane and rice due to price support schemes.

- Water stress: Growing more of them can lead to an adverse impact in water-stressed areas in states.

What about food security?

- It is unethical to use edible grains to produce ethanol in a country where hunger is rampant.

- India is already a poor performer in Global Hunger Index.

- Although about 80 crore people are now receiving subsidized food grains, calculations show that over 10 crore eligible households are still excluded.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Customs Duty, Edible Oil Imports

Mains level: Edible oil scarcity in India

The Union Commerce Minister has announced that the government has decided to waive customs duty on import of crude sunflower, palm and soyabean oil, a move aimed at controlling their prices.

Edible Oil Imports and India

- Given the heavy dependency on imports, the Indian edible oil market is influenced by the international markets.

- Of the 20-21 million tonnes of edible oil that India consumes annually, around 4-15 mt is imported.

- India is second only to China (34-35 mt) in terms of consumption of edible oil.

- Crude and food-grade refined oil is imported in large vessels, mainly from Malaysia, Brazil, Argentina, Indonesia etc.

- Home-grown oilseeds such as soyabean, groundnut, mustard, cottonseed etc find their way to domestic solvent and expellers plants, where both the oil and the protein-rich component is extracted.

Do you know?

Palm oil (45%) is the largest consumed oil, mainly used by the food industry for frying namkeen, mithai, etc, followed by soyabean oil (20%) and mustard oil (10%), with the rest accounted for by sunflower oil, cottonseed oil, groundnut oil etc.

Prices and politics

- Prices of edible oil have been rising across the country since few months.

- Most edible oils are trading between Rs 130-Rs 190/litre.

- Also, the festive season will see increased buying of edible oils.

Impact of the move

- Consumers might not see a drastic reduction immediately in prices of edible oil.

- The reduction in duty is expected to affect the earnings of oilseed growers across the country.

Long-term implications

- Over the last few years, the government has taken a series of steps to remove India’s import dependency on pulses, and tried to do the same for oilseeds through national missions.

- However, frequent market interventions that ultimately bring down prices would backfire on the government and veer farmers away from growing oilseeds.

- We need continuity in prices to help farmers stick to oilseeds or pulses.

Back2Basic: Customs Duty

- Customs duty refers to the tax imposed on goods when they are transported across international borders.

- In simple terms, it is the tax that is levied on import and export of goods.

- Custom duty in India is defined under the Customs Act, 1962, and all matters related to it fall under the Central Board of Excise & Customs (CBEC).

- The government uses this duty to raise its revenues, safeguard domestic industries, and regulate movement of goods.

- The rate of Customs duty varies depending on where the goods were made and what they were made of.

Types of custom duty

- Basic Customs Duty (BCD): It is the duty imposed on the value of the goods at a specific rate at a specified rate of ad-valorem basis.

- Countervailing Duty (CVD): It is imposed by the Central Government when a country is paying the subsidy to the exporters who are exporting goods to India.

- Additional Customs Duty or Special CVD: It is imposed to bring imports on an equal track with the goods produced or manufactured in India.

- Protective Duty: To protect interests of Indian industry

- Safeguard Duty: It is imposed to safeguard the interest of our local domestic industries. It is calculated on the basis of loss suffered by our local industries.

- Anti-dumping Duty: Manufacturers from abroad may export goods at very low prices compared to prices in the domestic market. In order to avoid such dumping, ADD is levied.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now