Note4Students

From UPSC perspective, the following things are important :

Prelims level: BSF

Mains level: India's border security

The Ministry of Home Affairs (MHA) has extended the jurisdiction of the Border Security Force (BSF) up to 50 km inside the international borders in Punjab, West Bengal and Assam.

Do you know?

BSF currently stands as the world’s largest border guarding force. It has been termed as the First Line of Defence of Indian Territories.

About Border Security Force (BSF)

- The BSF is India’s border guarding organization on its border with Pakistan and Bangladesh.

- It comes under the Ministry of Home Affairs.

- It was raised in the wake of the 1965 War on 1 December 1965 for ensuring the security of the borders of India and for matters connected therewith.

- The BSF has its own cadre of officers but its head, designated as a Director-General (DG), since its raising has been an officer from the Indian Police Service (IPS).

What are the new modifications?

- The MHA has exercised the powers under the Border Security Force Act of 1968.

- It has thus outlined the area of BSF’s jurisdiction.

- While the places marked here are within 50 km of the respective borders, this is not meant to represent the BSF’s jurisdiction.

- At the same time, the Ministry has reduced BSF’s area of operation in Gujarat from 80 km from the border, to 50 km.

Powers exercised by BSF in its jurisdiction

BSFs jurisdiction has been extended only in respect of the powers it enjoys under:

- Criminal Procedure Code (CrPC)

- Passport (Entry into India) Act, 1920 and

- Passport Act, 1967

Arrest and search

- BSF currently has powers to arrest and search under these laws.

- It also has powers to arrest, search and seize under the NDPS Act, Arms Act, Customs Act and certain other laws.

Its powers under these will continue to be only up to 15 km inside the border in Punjab, Assam and West Bengal, and will remain as far as 80 km in Gujarat.

Sanctions behind such powers

- Scarcely populated borders: At that time, border areas were sparsely populated and there were hardly any police stations for miles.

- Trans-border crimes: To prevent trans-border crimes, it was felt necessary that BSF is given powers to arrest.

- Manpower crunch: While police stations have now come up near the border, they continue to be short-staffed.

Various issues at Borders

- Encroachment

- Illegal incursion

- Drug and cattle smuggling

Why has the government extended the jurisdiction?

- The objective of the move is to bring in uniformity and also to increase operational efficiency. Earlier BSF had different jurisdictions in different states.

- BSF often gets information relating to crime scenes that may be out of their jurisdiction.

- The move was also necessitated due to increasing instances of drone-dropping of weapons and drugs.

Impact on State Police jurisdiction

- This move will complement the efforts of the local police. Thus, it is an enabling provision.

- It’s not that the local police can’t act within the jurisdiction of the BSF.

- The state police have better knowledge of the ground. Hence BSF and local Police can act in cooperation.

Criticism of the move

- At a basic level, the states can argue that law and order is a state subject and enhancing BSF’s jurisdiction infringes upon powers of the state government.

- In 2012, then Gujarat CM and the present PM had opposed a central government moves to expand BSF’s jurisdiction.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Bioethanol, Ethanol blending

Mains level: Read the attached story

India is planning to use surplus rice, besides sugarcane, to meet its biofuel target of blending 20% ethanol with petrol.

Could this impede India’s crop diversification goals or worsen nutritional indicators? Let us see!

Govt’s plan to promote ethanol

- India is estimated to achieve about 8.5% blending with petrol by this year, which it plans to increase to a mandatory 20% blending by 2025.

Sources for ethanol

The plan is to divert its excess sugar production to produce ethanol, 3.5 million tonnes in 2021-22 and 6 million tonnes the next year, in addition to grains like rice, corn, and barley.

- Using surplus rice: The government’s food department revealed its plans to divert 17 million tonnes of surplus rice from its food stocks of 90 million tonnes to produce ethanol.

- Sugarcane: This is in addition to the 2 million tonnes of sugar which is already being diverted to produce ethanol.

How would this benefit the country?

- Cost saving: A successful biofuels programme can save India $4 billion or about ₹30,000 crore every year by lowering import of petroleum products.

- Emission cut: Ethanol is also less polluting and offers equivalent efficiency at a lower cost than petrol.

- Biofuel’s policy boost: Rising production of grains and sugarcane and feasibility of making vehicles compliant to ethanol-blended fuel makes its biofuels policy a strategic requirement.

- Early rollout: Towards this, govt has put in place interest subsidies for distilleries to expand capacity while auto firms have agreed to make compatible vehicles.

What are the unintended effects of the policy?

- Unsustainability of cash-crops: Increasing reliance on biofuels can push farmers to grow more water-intensive crops like sugarcane and rice.

- Huge water requirement: Currently use 70% of the available irrigation water, negating some positive impact on the environment of using more ethanol.

- Food and nutrition security: The move could impact India’s hunger situation by limiting the coverage of the food security schemes.

- Food inflation: Diversion of mass consumption grains can also push food prices up.

How will it impact crop diversification?

- Monotonous crops: Although the biofuels policy stresses on using less water-consuming crops, farmers prefer to grow more sugarcane and rice due to price support schemes.

- Water stress: Growing more of them can lead to an adverse impact in water-stressed areas in states.

What about food security?

- It is unethical to use edible grains to produce ethanol in a country where hunger is rampant.

- India is already a poor performer in Global Hunger Index.

- Although about 80 crore people are now receiving subsidized food grains, calculations show that over 10 crore eligible households are still excluded.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Customs Duty, Edible Oil Imports

Mains level: Edible oil scarcity in India

The Union Commerce Minister has announced that the government has decided to waive customs duty on import of crude sunflower, palm and soyabean oil, a move aimed at controlling their prices.

Edible Oil Imports and India

- Given the heavy dependency on imports, the Indian edible oil market is influenced by the international markets.

- Of the 20-21 million tonnes of edible oil that India consumes annually, around 4-15 mt is imported.

- India is second only to China (34-35 mt) in terms of consumption of edible oil.

- Crude and food-grade refined oil is imported in large vessels, mainly from Malaysia, Brazil, Argentina, Indonesia etc.

- Home-grown oilseeds such as soyabean, groundnut, mustard, cottonseed etc find their way to domestic solvent and expellers plants, where both the oil and the protein-rich component is extracted.

Do you know?

Palm oil (45%) is the largest consumed oil, mainly used by the food industry for frying namkeen, mithai, etc, followed by soyabean oil (20%) and mustard oil (10%), with the rest accounted for by sunflower oil, cottonseed oil, groundnut oil etc.

Prices and politics

- Prices of edible oil have been rising across the country since few months.

- Most edible oils are trading between Rs 130-Rs 190/litre.

- Also, the festive season will see increased buying of edible oils.

Impact of the move

- Consumers might not see a drastic reduction immediately in prices of edible oil.

- The reduction in duty is expected to affect the earnings of oilseed growers across the country.

Long-term implications

- Over the last few years, the government has taken a series of steps to remove India’s import dependency on pulses, and tried to do the same for oilseeds through national missions.

- However, frequent market interventions that ultimately bring down prices would backfire on the government and veer farmers away from growing oilseeds.

- We need continuity in prices to help farmers stick to oilseeds or pulses.

Back2Basic: Customs Duty

- Customs duty refers to the tax imposed on goods when they are transported across international borders.

- In simple terms, it is the tax that is levied on import and export of goods.

- Custom duty in India is defined under the Customs Act, 1962, and all matters related to it fall under the Central Board of Excise & Customs (CBEC).

- The government uses this duty to raise its revenues, safeguard domestic industries, and regulate movement of goods.

- The rate of Customs duty varies depending on where the goods were made and what they were made of.

Types of custom duty

- Basic Customs Duty (BCD): It is the duty imposed on the value of the goods at a specific rate at a specified rate of ad-valorem basis.

- Countervailing Duty (CVD): It is imposed by the Central Government when a country is paying the subsidy to the exporters who are exporting goods to India.

- Additional Customs Duty or Special CVD: It is imposed to bring imports on an equal track with the goods produced or manufactured in India.

- Protective Duty: To protect interests of Indian industry

- Safeguard Duty: It is imposed to safeguard the interest of our local domestic industries. It is calculated on the basis of loss suffered by our local industries.

- Anti-dumping Duty: Manufacturers from abroad may export goods at very low prices compared to prices in the domestic market. In order to avoid such dumping, ADD is levied.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Small Finance Bank

Mains level: Not Much

The Reserve Bank of India has issued a small finance bank (SFB) license to a consortium of fintech companies BharatPe and Centrum Financial Services Ltd.

What is a SFB?

- Small finance banks (SFBs) are a type of niche banks in India.

- They can be promoted either by individuals, corporate, trusts or societies.

- They are governed by the provisions of Reserve Bank of India Act, 1934, Banking Regulation Act, 1949 and other relevant statutes.

- They are established as public limited companies in the private sector under the Companies Act, 2013.

- Banks with a SFB license can provide basic banking service of acceptance of deposits and lending.

Objectives of setting-up an SFB

- To provide financial inclusion to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganized sector entities

Key features of SFBs

- Existing non-banking financial companies (NBFC), microfinance institutions (MFI) and local area banks (LAB) can apply to become small finance banks.

- The banks will not be restricted to any region.

- 75% of its net credits should be in priority sector lending and 50% of the loans in its portfolio must in ₹25 lakh.

- The firms must have a capital of at least ₹200 crore.

- The promoters should have 10 years’ experience in banking and finance.

- Foreign shareholding will be allowed in these banks as per the rules for FDI in private banks in India.

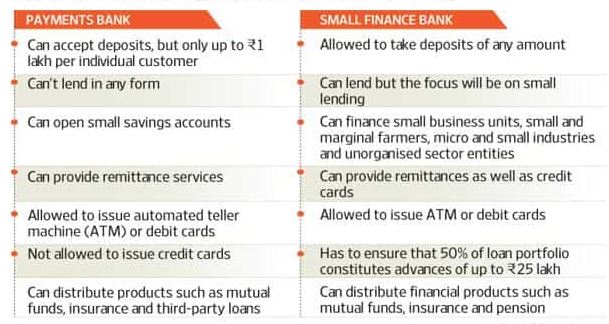

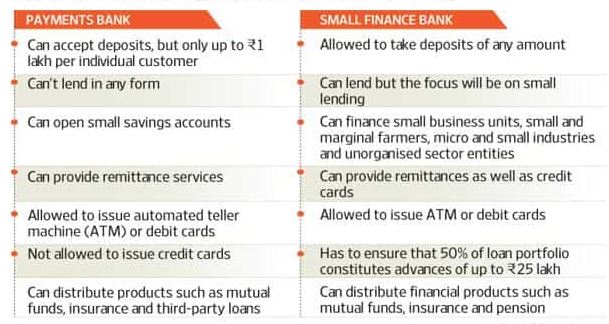

Back2Basics: Small Payments Bank Vs. Payment Bank

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Global Hunger Index

Mains level: Food and nutrition security of India

The Global Hunger Index 2021 has ranked India at 101 positions out of a total 116 countries.

Note the parameters over which the GHI is based and their weightage composition.

Global Hunger Index (GHI)

- The Global Hunger Index is a peer-reviewed annual report, jointly published by Concern Worldwide and Welthungerhilfe.

- It determines hunger on a 100-point scale, where 0 is the best possible score (no hunger) and 100 is the worst.

- It is designed to comprehensively measure and track hunger at the global, regional, and country levels.

- The aim of the GHI is to trigger action to reduce hunger around the world.

For each country in the list, the GHI looks at four indicators:

- Undernourishment (which reflects inadequate food availability): calculated by the share of the population that is undernourished (that is, whose caloric intake is insufficient)

- Child Wasting (which reflects acute undernutrition): calculated by the share of children under the age of five who are wasted (that is, those who have low weight for their height)

- Child Stunting (which reflects chronic undernutrition): calculated by the share of children under the age of five who are stunted (that is, those who have low height for their age)

- Child Mortality (which reflects both inadequate nutrition and unhealthy environment): calculated by the mortality rate of children under the age of five

India’s (poor) performance

- India is among the 31 countries where hunger has been identified as serious.

- Only 15 countries fare worse than India.

- Some of these include Afghanistan (103), Nigeria (103), Congo (105), Mozambique (106), Sierra Leone (106), Timor-Leste (108), Haiti (109), Liberia (110), Madagascar (111) and Somalia (116).

- India was also behind most of the neighbouring countries.

- Pakistan was placed at 92 rank, Nepal at 76 and Bangladesh also at 76.

Reasons for such poor performance

- Poor maternal health: Mothers are too young, too short, too thin and too undernourished themselves, before they get pregnant, during pregnancy, and then after giving birth, during breast-feeding.

- Poor sanitation: Poor sanitation, leading to diarrhoea, is another major cause of child wasting and stunting.

- Food insecurity: Low dietary diversity in India is also a key factor in child malnutrition.

- Poverty: Almost 50 million households in India are dependent on these small and marginal holdings.

- Livelihood loss: The rural livelihoods loss after COVID and lack of income opportunities other than the farm sector have contributed heavily to the growing joblessness in rural areas.

Issues over credibility of GHI

- India has ranked among many African countries while it is among the top 10 food-producing countries in the world.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Geographical Indication

Mains level: Not Much

In Tamil Nadu, the Karuppur kalamkari paintings and the Kallakurichi wood carvings recently received the geographical indication (GI) tags.

[A] Kallakurichi Wood Carvings

- The Kallakurichi wood carvings are a unique form of wood carving practiced in Tamil Nadu.

- It involves the application of ornamentation and designs, derived from traditional styles by the craftsmen.

- They are mainly practiced in Kallakurichi, Chinnaselam and Thirukkovilur taluks of Kallakurichi district.

[B] Karuppur Kalamkari Paintings

- Kalamkari paintings are done on pure cotton cloth, predominantly used in temples for umbrella covers, cylindrical hangings, chariot covers and asmanagiri (false ceiling cloth pieces).

- Documentary evidence shows that kalamkari paintings evolved under the patronage of Nayaka rulers in the early 17th century.

Back2Basics: Geographical Indication

- A GI is a sign used on products that have a specific geographical origin and possess qualities or a reputation that are due to that origin.

- Nodal Agency: Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry

- India, as a member of the World Trade Organization (WTO), enacted the Geographical Indications of Goods (Registration and Protection) Act, 1999 w.e.f. September 2003.

- GIs have been defined under Article 22 (1) of the WTO Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement.

- GI is granted for a term of 10 years in India. As of today, more than 300 GI tags has been allocated so far in India (*Wikipedia).

- The tag stands valid for 10 years.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: UFill

Mains level: NA

The Bharat Petroleum Corporation Limited (BPCL) has launched an automated fuelling technology -UFill- to ensure that its customers have a better experience at outlets.

What is UFill?

- UFill functionality, which has been described as swift, secure and smart, has been launched in 65 cities and will soon be launched across the country.

- It does not need any app download, and is payment app agnostic.

- Customer can use any payment app already downloaded on his/her phone.

- It offers real time QR and voucher code through SMS and is accepted at all BPCL Fuel Stations where the functionality is enabled.

Key features

- UFill aims to improve customer’s turn-around time (TAT) at fuel outlet and increase transactional transparency, thereby providing enhanced retail like experience.

- The technology provides the customer with control of fuelling as well as touch less pre-payment solution.

- There is no need to check zero before fuelling or final reading, the dispensing unit will automatically dispense the exact quantity of fuel.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Impact of funding surge on economy

Mains level: Paper 3- PE funding in India

Human traits driving financial markets

- To imitate and to conform — do what others around us are doing — are common and very powerful human tendencies.

- In financial markets, “herd behaviour” is a warning sign: When markets are doing well, people invest for no other reason than their neighbours having become wealthier (and vice versa).

- There is another human trait that affects markets — success increases risk appetite.

- If someone’s financial investments work, they are very likely to invest more, and ignore safety measures.

Factors driving the private equity investments

- Better physical infrastructure (rural roads, electrification, phone penetration, data access).

- Several layers of innovation (universal bank account access, surging digital payments on the “India Stack”).

- 45 lakh software developers (largest in the world).

- Maturing industries (for example, as research budgets of Indian pharmaceutical manufacturers have grown 10 times in the last 15 years.

- The ecosystem can take on more challenging projects now, versus just generic filings a decade back).

- Strong medium-term economic growth prospects create fertile ground for private equity investments.

- Investors with patient capital (knowing that the businesses will not make money for several years) are now betting on and financing a faster transition to electric vehicles than was earlier anticipated.

- In financial services, innovative methods of lending, insurance underwriting and wealth management are being experimented with, which are likely to only expand the market meaningfully.

- An army of Software-as-a-Service (SaaS) firms have been funded in the hope of revolutionising the development and distribution of software.

- There are also new-age distribution and logistics companies, education technology firms, and branded consumer goods suppliers, in addition to “normal” e-commerce, gaming and food-delivery startups.

Risks involved in a rapid infusion of capital

- Allocation inefficiency: Theoretically, an economy India’s size is capable of absorbing the $52 billion of PE funding seen over the last 12 months, but in practice, such a rapid surge creates allocation inefficiency.

- As investors rush to deploy ever-larger sums of money, they appear to be running out of companies to invest in that can productively deploy this capital.

- The result is companies’ valuations rising manifold within months and small firms getting more capital inflows than they can deploy, often resulting in wasteful business plans.

- When investors rush to deploy funds, the risk of fraud rises — inadequate disclosures and weak due diligence are compounded by incentives to misrepresent financial data.

- The discovery of any such frauds would likely freeze funding for the industry for a few quarters.

Why now?

- India has never lacked entrepreneurs, but lacked risk capital given the low per capita wealth.

- As savers like pension and insurance funds in the developed world responded to record-low interest rates by allocating more to PE as an asset class, private funding markets have grown rapidly in the last 15 years globally.

- In India, PE funding has exceeded public-market fund-raising every year in the past decade.

- While earlier, only a few business groups could muster sizeable amounts of risk capital to establish new businesses and disrupt old ones, entrepreneurs can now lay hands on hundreds of millions of dollars if the idea makes sense.

Conclusion

For now, this flow of funds is a welcome booster for the economy as it recovers from the scars of the pandemic-driven lockdowns. While valuations can be volatile in the near term, we are in the early stages of this reshaping of India’s corporate landscape.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Adaptation Gap Report

Mains level: Paper 3- Climate finance

Context

In the run-up to the 26th UNFCCC media reports have claimed that developed countries are inching closer to the target of providing $100 billion annually. This view has been bolstered by the Organisation for Economic Co-operation and Development (OECD), which claimed that climate finance provided by developed countries had reached $78.9 billion in 2018.

Issue of climate financing and claim of reaching the target of $100 billion

- These claims reaching the target of $100 billion annually is erroneous.

- First, the OECD figure includes private finance and export credits.

- Public finance: Developing countries have insisted that developed country climate finance should be from public sources and should be provided as grants or as concessional loans.

- However, the OECD report makes it clear that the public finance component amounted to only $62.2 billion in 2018, with bilateral funding of about $32.7 billion and $29.2 billion through multilateral institutions.

- Nature of finance: Significantly, the final figure comes by adding loans and grants. Of the public finance component, loans comprise 74%, while grants make up only 20%.

- The report does not say how much of the total loan component of $46.3 billion is concessional.

- Non-concessional loans: From 2016 to 2018, 20% of bilateral loans, 76% of loans provided by multilateral development banks and 46% of loans provided by multilateral climate funds were non-concessional.

- Between 2013 and 2018, the share of loans has continued to rise, while the share of grants decreased.

- The OECD reports on climate finance have long been criticised for inflating climate finance figures.

- In contrast to the OECD report, Oxfam estimates that in 2017-18, out of an average of $59.5 billion of public climate finance reported by developed countries, the climate-specific net assistance ranged only between $19 and $22.5 billion per year.

- The 2018 Biennial Assessment of UNFCCC’s Standing Committee on Finance reports that on average, developed countries provided only $26 billion per year as climate-specific finance between 2011-2016.

Broken commitments from the US on climate financing

- U.S. President Joe Biden recently said that the U.S. will double its climate finance by $11.4 billion annually by 2024.

- It is Congress that will decide on the quantum after all.

- The U.S. also has a history of broken commitments, having promised $3 billion to the Green Climate Fund (GCF) under President Barack Obama, but delivering only $1 billion.

- The future focus of U.S. climate finance is the mobilisation of private sector investment.

- The bulk of the money coming in would be through private funds, directed to those projects judged “bankable” and not selected based on developing countries’ priorities and needs.

Finance skews toward mitigation

- Climate finance has also remained skewed towards mitigation, despite the repeated calls for maintaining a balance between adaptation and mitigation.

- The 2016 Adaptation Gap Report of the UN Environment Programme had noted that the annual costs of adaptation in developing countries could range from $140 to $300 billion annually by 2030 and rise to $500 billion by 2050.

- Currently available adaptation finance is significantly lower than the needs expressed in the Nationally Determined Contributions submitted by developing countries.

Conclusion

Delivering on climate finance is fundamental to trust in the multilateral process. Regrettably, while developing countries will continue to pressure developed countries to live up to their promises, the history of climate negotiations is not in their favour.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Taiwan straight, South China Sea

Mains level: Taiwan as a new global flashpoint

Recently China flew over 100 fighter jets into Taiwan’s air defence identification zone setting off alarm around the world that it was preparing to take over the island by force.

Taiwan: the Republic of China (RoC)

- Taiwan, earlier known as Formosa, a tiny island off the east coast of China, is where Chinese republicans of the Kuomintang government retreated after the 1949 victory of the communists.

- It has since continued as the Republic of China (RoC).

- Although largely unrecognized by other countries as such, self-ruled Taiwan sees itself as no less than an independent nation.

- Its leaders, have vowed to defend its sovereignty against the Chinese goal of “reunification”.

Chinese claims over Taiwan

- Since its establishment in 1949, the PRC has believed that Taiwan must be reunified with the mainland, while the RoC claim to be an independent country.

- The RoC became the non-communist frontier against China during the Cold War, and was the only ‘China’ recognised at the UN until 1971.

- That was when the US inaugurated ties with China through the secret diplomacy under President Richard Nixon.

Independence politics by Taipei

- In 1975, Taiwan got its first democratic reforms. Trade ties with PRC were established.

- As the British prepared to exit Hong Kong in 1999, the “One China, Two Systems” solution was offered to Taiwan as well, but it was rejected by the Taiwanese.

- In 2004, China started drafting an anti-secession law aimed at Taiwan; trade and connectivity, however, continued to improve.

Hurdles for Taiwanese independence

- Taiwan now has massive economic interests, including investments in China, and pro-independence sections worry that this might come in the way of their goals.

- Inversely, the pro-reunification sections of the polity, as well as China, hope that economic dependence and increasing people-to-people contacts will wear out the pro-independence lobbies.

Global significance of Taiwan

- The island is located in the East China Sea, to the northeast of Hong Kong, north of the Philippines and south of South Korea, and southwest of Japan.

- What happens in and around Taiwan is of deep concern to all of East Asia.

Geopolitics: US ties with Taiwan

- Officially, the US has subscribed to PRC’s “One China Policy” which means there is only one legitimate Chinese government.

- The most serious encounter was in 1995-96, when China began testing missiles in the seas around Taiwan, triggering the biggest US mobilization in the region since the Vietnam War.

- Now, the US backs Taiwan’s independence, maintains ties with Taipei, and sells weapons to it.

- Taiwan is entirely dependent on the US for its defense against possible Chinese aggression.

- This is why every spike in military tensions between China and Taiwan injects more hostility into the already strained relationship between Washington and Beijing.

Challenge for the US

- The Biden Administration has declared “rock-solid” commitment to Taiwan after an incursion by Chinese warplanes.

- As tensions rise, the world is watching the US, which is face-saving after exiting from Afghanistan.

- In East and Southeast Asia, several countries including Japan, South Korea, and the Philippines, which are sheltered under the Protective umbrella of the US, are reading the situation.

- The US has also agreed to abide by the “Taiwan Agreement”, under which US support for the “One China Policy” is premised on Beijing not invading Taiwan.

Recent initiatives against China

- The AUKUS pact among the US, UK, and Australia, under which Australia will be supplied with nuclear submarines, has imparted a new dimension to the security dynamics of the Indo-Pacific.

- Taiwan has welcomed the pact, while China has denounced it as seriously undermining regional peace.

Implications for India

- With India facing its own problems with China at the LAC, there have been suggestions that it should review its One China Policy.

- It has in any case long stopped reiterating this officially — and use not just the Tibet card, but also develop more robust relations with Taiwan to send a message to Beijing.

- India and Taiwan currently maintain “trade and cultural exchange” offices in each other’s capitals.

India-Taiwan Ties: A backgrounder

- India and Taiwan both do not maintain any official diplomatic relations.

- India recognizes only the People’s Republic of China (in mainland China) and not Taiwan’s claims of being the legitimate government of Mainland China, Hong Kong, and Macau.

- However, India’s economic and commercial links, as well as people-to-people contacts with Taiwan, have expanded in recent years.

- Major Taiwanese exports to India include integrated circuits, machinery, and other electronic products.

India’s interest

Ans. Semiconductor economy

- Taiwan’s position as a semiconductor superpower opens the door for more intensive strategic-economic cooperation between Delhi and Taipei.

- The talks with Taipei are ongoing to bring a $7.5-billion semiconductor or chip manufacturing plant to India.

- Chips are used in a range of devices from computers to 5G smartphones, to electric cars and medical equipment.

Way forward

- Delhi must begin to deal with Taiwan as a weighty entity in its own right that offers so much to advance India’s prosperity.

- Delhi does not have to discard its “One-China policy” to recognise that Taiwan is once again becoming the lightning rod in US-China tensions.

Conclusion

- As Taiwan becomes the world’s most dangerous flashpoint, the geopolitical consequences for Asia are real.

- Although Delhi has embraced the Indo-Pacific maritime construct, it is yet to come to terms with Taiwan’s critical role in shaping the strategic future of Asia’s waters.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Kunming Declaration, CBD

Mains level: Not Much

The Kunming Declaration was adopted by over 100 countries at the first part of the ongoing virtual 15th meeting of the Conference of the Parties to the United Nations Convention on Biological Diversity.

Kunming Declaration

- It calls upon the parties to “mainstream” biodiversity protection in decision-making and recognise the importance of conservation in protecting human health.

- The theme of the declaration is Ecological Civilization: Building a Shared Future for All Life on Earth.

- By adopting this, the nations have committed themselves to support the development, adoption and implementation of an effective post-2020 implementation plan for the Cartagena Protocol on biosafety.

- Signatory nations will ensure that the post-pandemic recovery policies, programs and plans contribute to the conservation and sustainable use of biodiversity.

About Convention on Biological Diversity (CBD)

- The CBD (wef 1993) known informally as the Biodiversity Convention, is a multilateral treaty.

- The convention has three main goals:

- the conservation of biodiversity

- the sustainable use of its components

- the fair and equitable sharing of benefits arising from genetic resources

- Its objective is to develop national strategies for the conservation and sustainable use of biological diversity, and it is often seen as the key document regarding sustainable development.

- It has two supplementary agreements, the Cartagena Protocol and Nagoya Protocol.

(1) Cartagena Protocol

- It is an international treaty governing the movements of living modified organisms (LMOs) resulting from modern biotechnology from one country to another.

(2) Nagoya Protocol

- It deals with Access to Genetic Resources and the Fair and Equitable Sharing of Benefits Arising from their Utilization (ABS).

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: ISA, OSOWOG

Mains level: Solar Energy

The Union Minister for Power and New and Renewable Energy (MNRE) has addressed the Ministerial session of the Green Grids Initiative-One Sun One World One Grid (OSOWOG) Northwest Europe Cooperative Event.

One Sun, One World, One Grid

- The mega plan of OSOWOG calls for trans-national electricity grid supplying solar power across the globe.

- It will connect 140 countries through a common grid that will be used to transfer solar power.

- The idea was first floated by PM Modi in 2018 during the first assembly of the International Solar Alliance (ISA).

- The vision behind the OSOWOG mantra is “the Sun never sets” and is a constant at some geographical location, globally, at any given point of time.

With India at the fulcrum, the solar spectrum can easily be divided into two broad zones viz:

- Far East: It would include countries like Myanmar, Vietnam, Thailand, Lao, Cambodia and

- Far West: It would cover the Middle East and the Africa Region

Implementation phases of the plan

The plan is divided into three phases:

- Phase 1: It will connect the Indian grid with the Middle East, South Asia and South-East Asian grids to share solar and other renewable energy resources

- Phase 2: It will connect the first phase nations with the African pool of renewable sources

- Phase 3: It will be the concluding step of global interconnection

How novel is the idea?

(1) Scale of the program

- Not limited by national boundaries, it can tackle global challenges linked to energy.

- It will tackle access for underserved people and communities the world over.

- It will enable 3 billion people to access clean drinking water (via solar pumps), give 2 billion women access to clean cooking and bring light to the homes of 750 million people.

(2) Pivotal moment in India’s energy history

- Going back even further, almost a decade ago, the price of solar energy (then INR 15 a unit) had raised question marks about its commercial feasibility.

- Today OSOWOG envisions dispatching surplus electricity at near-zero cost as India produces the cheapest solar-powered electricity anywhere in the world.

(3) Sustainability

- OSOWOG directly tackles two key problems that are emerging as energy systems try to deliver both energy sustainability and access to underserved populations.

- Countries like Singapore or Bangladesh simply may not have enough empty land to generate solar energy.

- Many nations’ policies also prioritise food security (i.e., devoting land to farming) over solar energy. These countries can still benefit from the solar energy dispatched to them via OSOWOG.

(4) India extending leadership

- Having international associations is not a new trend for the energy sector which already has a strong geopolitical organisation such as OPEC.

- Several countries including China have initiated infrastructure projects in other countries, which is seen as a sign of asserting supremacy by several policy experts.

- While India is a partner nation with most trade associations, with ISA and OSOWOG, it is planning to take a leadership position.

Significance of OSOWOG

- Successful ambitious project: It is obviously a very grand and ambitious project with a looming success.

- Pathbreaking idea: It is also clear that a new energy sector paradigm is needed as we are facing a huge inflection point in electricity generation and consumption.

- Green benefits: Potential benefits include widespread scale up in energy access, abatement in carbon emissions, lower cost and improved livelihoods.

- Energy alternative: With battery and storage technology becoming cheaper, electricity consumption at source end is a more feasible idea for solar power.

Limitations of OSOWOG

- Low financial benefits: This may sound a geopolitically a clever strategy. However, it is to be seen if this makes sense, technology-wise and in terms of financial benefits.

- Cost-sharing challenge: The mechanism of cost-sharing will be challenging, given the varied priorities of participating countries depending on their socio-economic orders.

- Pace of progress: The OSOWOG will turn out to be an expensive, complex and very slow progress project.

- Geopolitical issue: Any disruption caused due to any bilateral/multilateral issues can potentially affect critical services in multiple continents and countries.

- Grid parameters: There is a difference in voltage, frequency and specifications of the grid in most regions. Maintaining grid stability with just renewable generation would be technically difficult.

Way forward

- While India has taken baby steps with ISA, a major investment drive is still missing. This is planned to be achieved through OSOWOG.

- India will need a strong coalition of international partners to realise this vision.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: International Solar Alliance

- Officially announced during UN Climate Change Conference in Paris in 2015, the ISA is a partnership of solar-resource rich countries.

- Currently, there are 121 countries that have agreed to be members for ISA.

- Most of these are countries with large participation from Africa, South-east Asia and Europe.

- Pakistan and China are not a part of ISA.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: RE Country Attractiveness Index (RECAI)

Mains level: Renewable Energy in India

India has retained the third rank in the Renewable Energy Country Attractiveness Index released by consultancy firm EY.

RE Country Attractiveness Index (RECAI)

- The RECAI ranks the world’s top 40 markets on the attractiveness of their renewable energy investment and deployment opportunities.

- The rankings reflect assessments of market attractiveness and global market trends.

India’s performance

- India remained at the third position since three consecutive years.

- India’s thriving renewable energy market conditions, inclusive policy decisions, investment and technology improvements focusing on self-reliant supply chains have pushed the transition.

- RECAI highlights that corporate power purchase agreements (PPAs) are emerging as a key driver of clean energy growth.

- A new PPA Index – introduced in this edition of RECAI – focuses on the attractiveness of renewable power procurement and ranks the growth potential of a nation’s corporate PPA market.

- India is ranked sixth among the top 30 PPA markets.

Global scenario

- The US, mainland China and India continue to retain the top three rankings and Indonesia is a new entrant to the RECAI.

- The top-performing markets have held their ground in this latest issue – with no movement into or out of the top eight.

- France (fourth position, up by one) and the UK (fifth position, down by one), while Germany (sixth position, up by one) has edged back ahead of Australia (seventh position, down by one).

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Ethanol Blended Petrol (EBP) Programme

Mains level: Not Much

The Ministry of Road Transport and Highways (MoRTH) has notified mass emission standards for E 12 (12% Ethanol with Gasoline) and E15 (15% Ethanol 12 with gasoline) fuels.

What is the news?

- The ministry has notified test standards for vehicles compliant with ethanol-blended fuel variants E12 and E15.

- The ministry made it mandatory for all automobile manufacturers to put “clearly visible stickers” on every vehicle informing about its compatibility to the level of ethanol blend (E12, E15, E20).

- Currently, India is using E10 fuel (petrol blended with 10% ethanol).

Ethanol Blended Petrol (EBP) Programme

- Ethanol Blended Petrol (EBP) programme was launched in January, 2003 for supply of 5% ethanol blended Petrol.

- The programme sought to promote the use of alternative and environment-friendly fuels and to reduce import dependency for energy requirements.

- OMCs are advised to continue according priority of ethanol from 1) sugarcane juice/sugar/sugar syrup, 2) B-heavy molasses 3) C-heavy molasses and 4) damaged food grains/other sources.

- At present, this programme has been extended to whole of India except UTs of Andaman Nicobar and Lakshadweep islands with effect from 01st April, 2019 wherein OMCs sell petrol blended with ethanol up to 10%.

Why ethanol blending?

- Agricultural waste management: Ethanol blending will solve the problem of agricultural waste as well as sugar rates due to excess production, therefore providing security to sugarcane farmers.

- Reducing emission: It can help accomplish dual goal of strengthening energy security with low carbon emission.

- Enhanced participation: It will enable local enterprises and farmers to participate in the energy economy.

- Reducing import bill: It is another significant benefit. India imports 85% of crude oil.

- Fuel efficiency: Ethanol blending increases octane number thereby increasing fuel quality in terms of anti-knocking tendency (engine sound)

Also read:

[RSTV ARCHIVE] Ethanol Blending: Significance & Road Ahead

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: FAO

Mains level: Paper 3- Reorienting agri-food systems

Context

There is an urgent need for reorientation of the long-term direction of agri-food systems to not only enhance farm incomes but also ensure better access to safe and nutritious foods.

Challenge of malnutrition in India

- The findings from the first round of the Fifth National Family Health Survey suggest that nutrition-related indicators have worsened in most States.

- In addition, findings from the Comprehensive National Nutrition Survey (2016-18) have highlighted the role of micro-nutrient malnutrition.

- Pathways for nutritional security consist of improving dietary diversity, kitchen gardens, reducing post-harvest losses, making safety net programmes more nutrition-sensitive, women’s empowerment, enforcement of standards and regulations, improving Water, Sanitation and Hygiene, nutrition education, and effective use of digital technology.

Agri-food system: Significance and challenges it faces

- The agri-food systems are the most important part of the Indian economy.

- India produces sufficient food, feed and fibre to sustain about 18% of the world’s population (as of 2020). Agriculture contributes about 16.5% to India’s GDP and employs 42.3% of the workforce (2019-20).

- A sustainable agri-food system is one in which a variety of sufficient, nutritious and safe foods are made available at an affordable price to everyone, and nobody goes hungry or suffers from any form of malnutrition.

- However, the country’s agri-food systems are facing new and unprecedented challenges, especially related to economic and ecological sustainability, nutrition and the adoption of new agricultural technologies.

- The edifice of India’s biosecurity remains vulnerable to disasters and extreme events.

Way forward: Reorienting agri-food systems

- There is an urgent need for reorientation of the long-term direction of agri-food systems to not only enhance farm incomes but also ensure better access to safe and nutritious foods.

- Additionally, the agri-food systems need to be reoriented to minimise cost on the environment and the climate.

- This need is recognised by the theme of World Food Day 2021: ‘Our actions are our future. Better production, better nutrition, a better environment and a better life’.

- FAO’s support for the transformation of agri-food systems is rooted in agro-ecology.

- The more diverse an agricultural system, the greater its ability to adapt to shocks.

- Different combinations of integrated crop-livestock-forestry-fishery systems can help farmers produce a variety of products in the same area, at the same time or in rotation.

- In January this year, FAO in collaboration with NITI Aayog and the Ministry of Agriculture convened a National Dialogue to evolve a framework for the transition to a more sustainable agri-food systems by 2030 and identify pathways for enhancing farmers’ income and achieving nutritional security.

Consider the question “What are the challenges facing agri-food systems in India? Suggest the pathways to transform the agri-food system to enhance farm income and ensure food and nutrition security.”

Conclusion

Food systems can help combat environmental degradation or climate change. Sustainable agri-food systems can deliver food security and nutrition for all, without compromising the economic, social and environmental bases.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 3- Issues with free power

Context

With elections around the corner in many States, political parties are competing with one another in promising free power.

Problems with free power

- Supported by state subsidy, electricity tariff to agriculture is low in most States – often less than ₹1/unit – and is free in some States such as Punjab, Tamil Nadu and Karnataka.

- There is inefficient use of electricity and water, neglect of service quality by the distribution companies leading to frequent outages and motor burn outs, and high subsidy burden on the State governments.

- Inflated consumption estimates: Since nearly three-fourth of the agriculture connections in the country are unmetered, consumption estimates are often inflated by distribution companies to increase subsidy demand and project low distribution losses.

- Any metering effort faces resistance as it is perceived as the first step towards levying charges.

- Opting-out schemes are being made but do not seem to have uptake.

- Difficulty in implementing DBT: Free power provision along with issues of metering make implementation of Direct Benefit Transfer difficult.

- All this leaves farmers, distribution companies and State governments frustrated.

- Subsidy burden on Governments: Due to free power in Delhi, the total state subsidy amounts to 11% of the total expenses.

- In Tamil Nadu, where free power is available to households, half of the total subsidy is earmarked for this.

- If there is further increase in number and consumption limits of free power, the subsidy burden on State governments will substantially increase.

- Low adoption of solar power: Roof-top solar and energy efficiency are good environment-friendly options for homes but providing free power to well-off households will discourage them from taking these up.

Way forward

- Free or low-tariff power is at best a short-term relief, which should be provided to those who desperately need it.

- Give fixed rebate: A fixed rebate of up to ₹200/month for residential consumers can be provided in the electricity bill.

- As the rebate is delinked from consumption, distribution companies won’t have an incentive to inflate consumption.

- Rebate for adopting energy-efficient appliances: There can be additional rebates for adopting energy-efficient appliances like refrigerators, combined with State-level bulk procurement programmes to reduce the cost.

- Addressing mutual mistrust: The atmosphere of mutual mistrust between small consumers and distribution companies has to change.

- There should be quick resolution of arrears and one-time offers for settlements.

Conclusion

There is a need to question the wisdom of broad-brush promises such as free power, which cannot be sustained in the long run.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: CAATSA

Mains level: Paper 2- Implications of CAATSA on India-US ties

Context

The delivery of the S-400 Triumf air defence systems from Russia is expected according to schedule. In response, U.S. Deputy Secretary of State Wendy Sherman hoped that both the U.S. and India could resolve the issue.

Background of the CAATSA

- The Countering America’s Adversaries through Sanctions Act (CAATSA) was passed when the U.S. sought to discourage trade in the defence and intelligence sectors of Russia.

- The Act mandates the President to impose at least five of the 12 sanctions on persons engaged in a “significant transaction” with Russian defence and intelligence sectors.

- These sanctions include suspending export licence, banning American equity/debt investments in entities, prohibiting loans from U.S. financial institutions and opposing loans from international finance institutions.

- The Act also built in a safety valve in the form of a presidential waiver.

- The “modified waiver authority” allows the President to waive sanctions in certain circumstances.

- There are a few more provisions including one that allows for sanctions waivers for 180 days, provided the administration certifies that the country in question is scaling back its ties with Russia.

Implications of CAATSA sanctions against India and scope for waiver

- Impact on bilateral relationship: Sanctions have the tremendous potential of pulling down the upward trajectory of the bilateral relationship between the U.S. and India, which now spans 50 sectors, especially in the field of defence.

- India turned sullen over the manner in which the U.S. negotiated the exit deal with the Taliban.

- Quad engagement: Yet, on the strategic plane, India remained on course by agreeing to the upgrading of the Quadrilateral Security Dialogue and sharing the same vision as the U.S. on the Indo-Pacific construct.

- The U.S.’s apprehension is that bringing India under a sanctions regime could push New Delhi towards its traditional military hardware supplier, Russia.

- The U.S. Sanctions can stir up the latent belief in India that Washington cannot be relied upon as a partner.

- While the administration will have to do the heavy lifting, the role of Indian-Americans should be significant just as they rallied around to support the Civil Nuclear Deal in the face of stiff resistance from Democrats opposed to nuclear proliferation.

- Decrease in imports from Russia: India’s import of arms decreased by 33% between 2011-15 and 2016-20 and Russia was the most affected supplier, according to a report by the Stockholm-based defence think-tank SIPRI.

- In recent years, though, there have been some big deals worth $15 billion including S400, Ka-226-T utility helicopters, BrahMos missiles and production of AK-203 assault rifles.

- Increase in defence import from US: On the other hand, over the past decade, government-to-government deals with the U.S. touched $20 billion and deals worth nearly $10 billion are under negotiation.

Conclusion

The CAATSA test will determine the course of the India-U.S. strategic partnership. Whether the Biden administration sail through opposition within his party remains to be seen.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: UDAY scheme

Mains level: Paper 3- Scheme for discoms

Context

In its budget 2021-22, the Union government had announced the launch of a “reforms-based and results-linked” scheme for the distribution sector.

Precarious financial condition of discoms

- Their overall debt burden, despite the implementation of the UDAY scheme, is estimated to increase to around Rs 6 lakh crore in the ongoing financial year.

- Moreover, their annual cash losses are estimated to be about Rs 45,000-50,000 crore (excluding UDAY grants and regulatory income).

- Due to highly subsidised nature of power tariffs towards agriculture and certain sections of residential consumers, the overall subsidy dependence is likely to be roughly Rs 1.30 lakh crore this year at the all-India level.

Revamped Distribution Sector Scheme

- In its budget 2021-22, the Union government had announced the launch of a “reforms-based and results-linked” scheme for the distribution sector.

- Subsequently, the Revamped Distribution Sector Scheme was notified in July with an overall outlay of Rs 3.03 lakh crore.

- Under the scheme, AT&C losses are sought to be brought down to 12-15 per cent by 2025-26, from 21-22 per cent currently.

- Operational efficiencies of discoms are to be improved through smart metering and upgradation of the distribution infrastructure, including the segregation of agriculture feeders and strengthening the system.

- The scheme has two parts — Part A with an outlay of Rs 3.02 lakh crore, pertains to the upgradation of the distribution infrastructure and metering related works.

- Part B, with an outlay of Rs 1,430 crore, is for training and capacity building, besides other enabling and support activities.

- Discoms and their state governments will have to sign a tripartite agreement with the central government in order to avail benefits under the scheme.

- Only those discoms that meet all the pre-qualifying criteria will be eligible for the release of funds.

- A loss-making discom will not be eligible unless it draws up plans to reduce its losses, approved by the state government and filed with the central government.

- As far as the agricultural sector is concerned, the use of solar power projects to supply electricity to these consumers through the agriculture feeder route is likely to result in savings.

- This is because of a combination of high tariff competitiveness offered by solar power, lower technical losses due to proximity to load centres, and the ability to meet demand during the day when sunlight is available.

- In addition, the delicencing initiative proposed by the central government can effect significant changes in the distribution segment, facilitating competition and placing emphasis on the quality and reliability of power supply and consumer services.

Issue of tariff determination

- A continuing area of concern affecting discom finances is the significant delay in the process of tariff determination in many states.

- As of now, only 19 out of 28 states have issued tariff orders for 2021-22, indicating sluggish progress.

- Further, there is upward pressure on the cost of power supply for distribution utilities, considering the dominant share (around 70 per cent) of coal in the fuel mix for energy generation, the strengthening of imported coal prices and the possibility of domestic coal price revisions by Coal India.

- As a consequence, a cost-reflective tariff determination process, coupled with the timely pass-through of power purchase costs, remains critical for the utilities.

Consider the question “Examine the factor that explains the continuing financial woes of state-owned discoms despite implementing several schemes. How Revamped Distribution Sector Scheme seeks to address the issue?”

Conclusion

On the whole, while the focus on improving the operational efficiency, and ensuring the financial sustainability of discoms is indeed welcome, timely implementation of the reforms is critical to achieving the milestones.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Extended Producer Responsibility (EPR)

Mains level: Need for plastic waste management

The Environment Ministry has issued draft rules that mandate producers of plastic packaging material to collect all of their produce by 2024 and ensure that a minimum percentage of it be recycled as well as used in subsequent supply.

What is EPR?

- Extended Producer Responsibility (EPR) means the responsibility of a producer for the environmentally sound management of the product (plastic packaging) until the end of its life.

- India had first introduced EPR in 2011 under the Plastic Waste (Management and Handling) Rules, 2011 and E-Waste Management and Handling Rules, 2011.

What are the new EPR rules for Plastic Waste?

(A) Plastic packaging

- The new EPR guidelines covers three categories of plastic packaging including:

- Rigid plastic

- Flexible plastic packaging of single layer or multilayer (more than one layer with different types of plastic), plastic sheets and covers made of plastic sheet, carry bags (including carry bags made of compostable plastics), plastic sachet or pouches

- Multi-layered plastic packaging which has at least one layer of plastic and at least one layer of material other than plastic.

- It has also specified a system whereby makers and users of plastic packaging can collect certificates — called Extended Producer Responsibility (EPR) certificates — and trade in them.

(B) Ineligible plastics for EPR

- Only a fraction of plastic that cannot be recycled will be eligible to be sent for end-of-life disposal such as road construction, waste to energy, waste to oil and cement kilns.

- Only methods prescribed by the Central Pollution Control Board will be permitted for their disposal.

Targets for recycling

- In 2024, a minimum 50% of their rigid plastic (category 1) will have to be recycled as will 30% of their category 2 and 3 plastic.

- Every year will see progressively higher targets and after 2026-27, 80% of their category 1 and 60% of the other two categories will need to be recycled.

- If entities cannot fulfil their obligations, they will on a “case by case basis” be permitted to buy certificates making up for their shortfall.

Effects on non-compliance

- Non-compliance, however, will not invite a traditional fine.

- Instead, an “environmental compensation” will be levied, though the rules do not specify how much this compensation will be.

Challenges in mandatory EPR

There are several challenges faced by both producers and bulk consumers that hinder proactive participation.

- Consumer awareness: Waste segregation has been the greatest challenge in India owing to lack of consumer awareness.

- Lack of compliance: The plastic producers do not wish to engage in the process holistically and take the effort to build awareness.

- Large scale involvement: The EPR doesn’t take into account the formalization of informal waste pickers, aggregators and dismantlers.

- Lack of recycle infrastructure: These challenges range from lack of handling capacity to illegitimate facilities in the forms of multiple accounting of waste, selling to aggregators and leakages.

Way forward

- Tracking mechanism: What India needs is to develop tracking mechanisms and provide oversight of waste compliance, in order to ensure that the mechanism of waste disposal is streamlined.

- Strict enforcement: While enforcement strictness is of paramount importance, it is also vital to build an incentive structure around this to ensure better complicity by the producers.

- Innovation: The time is ripe for innovators to come up with an alternative for plastics and the strong will of the Government to rid the toxic waste in a sustainable and safe manner.

Try answering this PYQ:

Q.In India, ‘extended producer responsibility’ was introduced as an important feature in which of the following?

(a) The Bio-medical Waste (Management and Handling) Rules, 1998

(b) The Recycled Plastic (Manufacturing and Usage) Rules, 1999

(c) The e-Waste (Management and Handling) Rules, 2011

(d) The Food Safety and Standard Regulations, 2011

Post your answers here.

Also read:

[Burning Issue] Ban on Single Use Plastics

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Forest (Conservation) Act, 1980

Mains level: Issues with forest land diversion

The Ministry for Environment, Forests and Climate Change (MoEFCC) has published proposed amendments to the Forest Conservation Act, 1980.

The Forest (Conservation) Act, 1980

The FCA is the principal legislation that regulates deforestation in the country.

- It prohibits the felling of forests for any “non-forestry” use without prior clearance by the central government.

- The clearance process includes seeking consent from local forest rights-holders and from wildlife authorities.

- The Centre is empowered to reject such requests or allow it with legally binding conditions.

- In a landmark decision in 1996, the Supreme Court had expanded the coverage of FCA to all areas that satisfied the dictionary definition of a forest; earlier, only lands specifically notified as forests were protected by the enforcement of the FCA.

The FCA is brief legislation with only five sections of which-

- Section 1 defines the extent of coverage of the law,

- Section 2 restrictions of activities in forest areas and the rest deals with the creation of advisory committees, powers of rule-making and penalties.

Why is the Act being amended now?

- The current definition of forests has locked land across the country; even private owners cannot utilise their own property for non-forestry purposes.

- The pressure for forest land diversion has been coming from — Ministries such as Rail and Roads.

- Under the Act, any diversion of any forest land for any purpose, including assignment of leases, needs prior approval of the Centre.

What defines ‘Forest’ under this act?

- Previously, the Act had applied largely to reserve forests and national parks.

- In 1996, ruling in T N Godavarman Thirumulpad v Union of India Case, the Supreme Court had expanded the definition and scope of forest land.

- It would thus include all areas recorded as forest in any government record, irrespective of ownership, recognition and classification.

- The court also expanded the definition of forests to encompass the “dictionary meaning of forests”.

- This would mean that a forested patch would automatically become a “deemed forest” even if it is not notified as protected, and irrespective of ownership.

- The Act would also be applicable over plantations in non-forest land.

What are the proposed amendments?

(A) Exemptions for Road and Railways

- The MoEFCC has proposed that all land acquired by the Railways and Roads Ministries prior to 1980 be exempted from the Act.

- Once the lands had been acquired for expansion, but subsequently, forests have grown in these areas, and the government is no longer able to use the land for expansion.

- The Ministries will no longer need clearance for their projects, nor pay compensatory levies to build there.

(B) Relaxation

- It distinguishes individuals whose lands fall within a state-specific Private Forests Act or comes within the dictionary meaning of forest as specified in the 1996 Supreme Court order.

- The government proposes to allow the “construction of structures for bona fide purposes’’ including residential units up to 250 sq m as a one-time relaxation.

(C) Defense and other projects

- Defence projects near international borders will be exempted from forest clearance.

- Oil and natural gas extraction from forested lands will be permitted, but only if technologies such as Extended Reach Drilling are used.

- Strip plantations alongside roads that would fall under the Act will be exempted.

What are the concerns?

- Legalizing private ownership of forests: The rules will facilitate corporate ownership.

- Deforestation: The exemption of forests on private land will lead to the disappearance of large tracts of forests.

- Fragmentation: Exemption for private residences on private forest will lead to fragmentation of forests, and open areas such as the Aravalli mountains to real estate.

- Tribal concerns: The amendments do not address what will happen to tribals and forest-dwelling communities over the cleared lands.

- Threat to wildlife: Exemption for roads and railways on forest land acquired prior to 1980 will be detrimental to forests as well as wildlife – especially elephants, tigers and leopards.

Positives with the amendment

- It has proposed making forest laws more stringent for notified forests, making offences non-bailable with increased penalties including imprisonment of up to one year.

- It has disallowed any kind of diversion in certain forests.

- It has attempt to define and identify forests once and for all — something that has been often ambiguous.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now