Note4Students

From UPSC perspective, the following things are important :

Prelims level: White Goods, PLI Scheme

Mains level: Success of the PLI Scheme

A total of 52 companies have filed their application with a committed investment of Rs 5,866 crore under the PLI scheme to incentivize the domestic manufacturing of components of White Goods.

What are White Goods?

- White goods refer to heavy consumer durables or large home appliances, which were traditionally available only in white.

- They include appliances such as washing machines, air conditioners, stoves, refrigerators, etc. The white goods industry in India is highly concentrated.

Why PLI scheme for white goods?

- Indian appliance and consumer electronics (ACE) market reached INR 76,400 crore (~$10.93 bn) in 2019.

- Appliances and consumer electronics industry is expected to double to reach INR 1.48 lakh crore (~$21.18 bn) by 2025.

- The PLI Scheme on White Goods is designed to create complete component ecosystem for Air Conditioners and LED Lights Industry in India and make India an integral part of the global supply chains.

- Only manufacturing of components of ACs and LED Lights will be incentivized under the Scheme.

What is PLI Scheme?

- As the name suggests, the scheme provides incentives to companies for enhancing their domestic manufacturing apart from focusing on reducing import bills and improving the cost competitiveness of local goods.

- PLI scheme offers incentives on incremental sales for products manufactured in India.

- The scheme for respective sectors has to be implemented by the concerned ministries and departments.

Criteria laid for the scheme

- Eligibility criteria for businesses under the PLI scheme vary based on the sector approved under the scheme.

- For instance, the eligibility for telecom units is subject to the achievement of a minimum threshold of cumulative incremental investment and incremental sales of manufactured goods.

- The minimum investment threshold for MSME is Rs 10 crore and Rs 100 crores for others.

- Under food processing, SMEs and others must hold over 50 per cent of the stock of their subsidiaries, if any.

- On the other hand, for businesses under pharmaceuticals, the project has to be a greenfield project while the net worth of the company should not be less than 30 per cent of the total committed investment.

What are the incentives offered?

- An incentive of 4-6 per cent was offered last year on mobile and electronic components manufacturers such as resistors, transistors, diodes, etc.

- Similarly, 10 percent incentives were offered for six years (FY22-27) of the scheme for the food processing industry.

- For white goods too, the incentive of 4-6 per cent on incremental sales of goods manufactured in India for a period of five years was offered to companies engaged in the manufacturing of air conditioners and LED lights.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: NITI Aayog

Mains level: Evolving concept of urban development

NITI Aayog has launched a report titled ‘Reforms in Urban Planning Capacity in India’ on measures to ramp up urban planning capacity in India.

Reforms in Urban Planning

- The report has been developed by NITI Aayog, in consultation with concerned ministries and eminent experts in the domain of urban and regional planning.

- It underscores urban challenges, including town planning and emphasizes need greater policy attention in our country.

Why such report?

- India is home to 11% of the total global urban population.

- By 2027, India will surpass China as the most populous country in the world.

- Unplanned urbanization, however, exerts great strain on our cities. In fact, the Covid-19 pandemic has revealed the dire need for the planning and management of our cities.

- The existing urban planning and governance framework is complex, which often leads to ambiguity and lack of accountability.

Highlights of the report

The report makes several recommendations that can unblock bottlenecks in the value chain of urban planning capacity in India. Some of them are:

Programmatic Intervention for Planning of Healthy Cities:

- Every city must aspire to become a ‘Healthy City for All’ by 2030.

- The report recommends a Central Sector Scheme ‘500 Healthy Cities Programme’, for a period of 5 years, wherein priority cities and towns would be selected jointly by the states and local bodies.

Programmatic Intervention for Optimum Utilization of Urban Land:

- All the cities and towns under the proposed ‘Healthy Cities Programme’ should strengthen development control regulations based on scientific evidence to maximize the efficiency of urban land (or planning area).

- The report recommends a sub-scheme ‘Preparation/Revision of Development Control Regulations’ for this purpose.

Ramping Up of Human Resources:

- To combat the shortage of urban planners in the public sector, the report recommends that the states/UTs may need to a) expedite the filling up of vacant positions of town planners.

- It asks to additionally sanction 8268 town planners’ posts as lateral entry positions.

Ensuring Qualified Professionals for Undertaking Urban Planning:

- State town and country planning departments face an acute shortage of town planners.

- This is compounded by the fact that in several states, ironically, a qualification in town planning is not even an essential criterion for such jobs.

- States may need to undertake requisite amendments in their recruitment rules to ensure the entry of qualified candidates into town-planning positions.

Re-engineering of Urban Governance:

- The report recommends the constitution of a high-powered committee to re-engineer the present urban-planning governance structure.

- The key aspects that would need to be addressed in this effort are:

- clear division of the roles and responsibilities of various authorities, appropriate revision of rules and regulations, etc.,

- creation of a more dynamic organizational structure, standardisation of the job descriptions of town planners and other experts, and

- extensive adoption of technology for enabling public participation and inter-agency coordination.

Revision of Town and Country Planning Acts:

- Most States have enacted the Town and Country Planning Acts, that enable them to prepare and notify master plans for implementation.

- However, many need to be reviewed and upgraded.

- Therefore, the formation of an apex committee at the state level is recommended to undertake a regular review of planning legislations (including town and country planning or urban and regional development acts or other relevant acts).

Demystifying Planning and Involving Citizens:

- While it is important to maintain the master plans’ technical rigour, it is equally important to demystify them for enabling citizens’ participation at relevant stages.

- Therefore, the committee strongly recommends a ‘Citizen Outreach Campaign’ for demystifying urban planning.

Steps for Enhancing the Role of Private Sector:

- The report recommends that concerted measures must be taken at multiple levels to strengthen the role of the private sector to improve the overall planning capacity in the country.

- These include the adoption of fair processes for procuring technical consultancy services, strengthening project structuring and management skills in the public sector, and empanelment of private sector consultancies.

Steps for Strengthening Urban Planning Education System:

- The Central universities and technical institutions in all the other States/UTs are encouraged to offer PG degree programmes (MTech Planning) to cater to the requirement of planners in the country.

- The committee also recommends that all such institutions may synergize with Ministry of Rural Development, Ministry of Panchayati Raj and respective state rural development departments.

Measures for Strengthening Human Resource and Match Demand–Supply:

- The report recommends the constitution of a ‘National Council of Town and Country Planners’ as a statutory body.

- Also, a ‘National Digital Platform of Town and Country Planners’ is suggested to be created within the National Urban Innovation Stack of MoHUA.

- This portal will enable self-registration of all planners and evolve as a marketplace for potential employers and urban planners.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: National Development Council

Mains level: Paper 3- Dealing with the recession

Context

The Centre is facing a serious financial crisis because of the exigencies created by the pandemic and its own policies. However, monetising assets and cutting down funds to states could aggravate the crisis.

3 Policies aggravating the crisis

1) NMP and disinvestment

- Union Finance Minister, while announcing the National Monetisation Pipeline (NMP), said that asset monetisation is based on the philosophy of creation through monetisation and is aimed at “tapping private sector investment for new infrastructure creation”.

- Loss of dividend: Disinvestment of profitable Navratna companies will result in a loss of dividend, a major source of income for the Centre.

- Loss due to tax exemptions: Tax exemptions to the investors will take away another major share of income.

- Central funds will be squeezed and this, in turn, will have a bearing on state finances.

- NMP will seriously hurt the interests of the country.

2) Cutting down funds to States

- Kerala’s case: The state was getting about 3.92 per cent from the divisible pool in the 1970s and 1980s.

- It came down to 2.66 per cent and 2.34 per cent in the awards of the 12th and 13th Finance Commissions.

- The 14th Finance Commission award increased it to 2.45 (2.50) per cent.

- Now, the 15th Finance Commission has reduced it to 1.92 per cent.

- This arbitrary cut is a result of the adoption of certain new yardsticks by the commission without considering the state government’s views

- The 15th Finance Commission’s special grant (RD grant) of Rs 19,800 crore for this year will no longer be available in the coming years.

- Karnataka and many other states have also suffered because of the policy to reduce the divisible pool share.

3) Tax exemptions and surcharge

- Exemptions amounting to Rs 99,842.06 crore were extended to corporate houses in 2019-20.

- Many taxes on goods were reduced because of electoral compulsions. This reduced central revenues.

- Along with such tax exemptions, the increased use of cesses and surcharges is responsible for the shrinking of the shareable pool.

- The shareable resources with the Centre was around Rs 6.8 lakh crore in 2019-20 which has come down to Rs 5.5 lakh crore in 2020-21.

- All the cesses and surcharges that are not shared with states come to about 20 per cent of the total revenues of the Centre.

- States have been demanding that this money should be shared with them, particularly while fighting a pandemic.

- States complaining for resources does not augur well for cooperative federalism.

Way forward

- Developing basic infrastructure and the production sector is the only way to face an economic crisis.

- That should not be done by selling or handing over public assets to private individuals and corporations.

- We need massive public investment that will help people to form cooperatives and collectives in agriculture and industrial production.

- Parliament, the National Development Council and the GST Council should discuss this unprecedented situation.

Conclusion

We need to find a way out collectively. Handing over the rights on public properties to private individuals will take the country back to the colonial era. This must not be allowed.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: New Development Bank

Mains level: Paper 2- India-China relations

Context

Deng Xiaoping had told then-Indian Prime Minister Rajiv Gandhi in 1988 that the 21st century would be “India and China’s century”, the current Chinese leadership has no patience for such pablum. They believe — indeed believe they know — that it is destined to be China’s century alone.

The policy of side-stepping contentious issues and encouraging bilateral economic relations

- There have always been political tensions, both over each country’s territorial claims over land controlled by the other, and China’s alliance with Pakistan, and India’s hospitality to the Dalai Lama.

- But neither country had allowed these tensions to overwhelm them:

- China had declared that the border dispute could be left to “future generations” to resolve.

- India had endorsed the “One China” policy, refusing to support Tibetan secessionism while limiting official reverence for the Dalai Lama to his status as a spiritual leader.

- India actions and statements have usually been designed not to provoke, but to relegate the border problem to the back burner while enabling trade relations with China (now worth close to $100 billion) to flourish.

- India made it clear that it was unwilling to join in any United States-led “containment” of China.

- From negligible levels till 1991, trade with China had grown to become one of India’s largest trading relationships.

- India engages with China diplomatically in the BRICS as well as conducting annual summits of RIC (Russia-India-China).

- India is an enthusiastic partner in the Chinese-led Asian Infrastructure Investment Bank and the New Development Bank (NDB).

- However, it has become increasingly apparent that the policy of side-stepping contentious issues and encouraging bilateral economic relations has played into Chinese hands.

Chinese strategy in Galwan

- In the Galwan clash, the Chinese troops seem to have been engaged in a tactical move to advance their positions along areas of the LAC that it covets, in order to threaten Indian positions and interdict patrols.

- They are threatening India’s construction of roads, bridges and similar infrastructure on undisputed Indian territory, a belated effort to mirror similar Chinese efforts near the LAC in Tibet.

- They have established a fixed presence in these areas well beyond China’s own ‘Claim Line’.

- The objective seems to be to extend Chinese troop presence to the intersection of the Galwan river and the Shyok river, which would make the Galwan Valley off bounds to India.

- The Chinese have constructed permanent structures in the area of their intrusion and issued statements claiming that sovereignty over the Galwan valley has “always belonged” to China.

- Consolidation of LOC: China’s strategy seems to be to consolidate the LAC where it wants it, so that an eventual border settlement — that takes these new realities into account — will be in its favour.

- Implications for India: In the meantime, border incidents keep the Indians off-balance and demonstrate to the world that India is not capable of challenging China, let alone offering security to other nations.

India’s options

- India has reinforced its military assets on the LAC to prevent deeper incursions for now.

- And hopes to press the Chinese to restore the status quo ante through either diplomatic or military means.

- Chinese and Indian officials are currently engaged in diplomatic and military-to-military dialogue to ease tensions, but de-escalation has been stalled for months.

- Economic options: India has responded with largely symbolic acts of economic retaliation.

- India has also reimposed tighter limits on Chinese investment in projects such as railways, motorways, public-sector construction projects, and telecoms.

Limits to India’s economic retaliation

- India is far too dependent on China for vital imports — such as pharmaceuticals, and even the active ingredients to make them, automotive parts and microchips that many fear it will harm India if it acted too strongly against China.

- Imports from China have become indispensable for India’s exports to the rest of the world.

- Various manufacturing inputs, industrial equipment and components, and even some technological know-how come from China; eliminating them could have a seriously negative effect on India’s economic growth.

- And there are limits to the effectiveness of any Indian retaliation: trade with China may seem substantial from an Indian perspective, but it only represents 3% of China’s exports.

- Drastically reducing it would not be enough to deter Beijing or cause it to change its behaviour.

Consider the question “State of India-China relationship hardly indicate the 21st Century being the “India and China’s century”. In light of this, examine the factors responsible for this and suggest the way forward for India.”

Conclusion

This range of considerations seems to leave only two strategic options. Playing second fiddle to an assertive China or aligning itself with a broader international coalition against Chinese ambitions. Since the first is indigestible for any democracy, is China de facto pushing India into doing something it has always resisted — allying with the West?

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: GST

Mains level: Paper 3- Changes needed in GST

Context

After one and a half years of dispute, and with the economy showing signs of recovery, a path forward for the GST finally seems visible. This opportunity needs to be seized to strike the Centre-State bargain.

How GST performed so far

- The contributors are many but the critical one has been simply a lack of revenues.

- Initially, the GST performed well, with collections soaring to Rs 11.8 lakh crore in the first full year of implementation in 2018-19.

- But in 2019-20, the growth rate decelerated sharply. And in 2020-21, collections actually fell.

- As future collections became uncertain, a gap opened up between the amount that the Centre felt it could afford to promise and the minimum that the states felt they needed and were entitled to.

- More recently, however, confidence in GST has improved.

- Collections have revived, averaging Rs 1.1 lakh crore in the first five months of the current fiscal year, exceeding even pre-pandemic levels.

What explains the weak revenue performance of the GST?

- Slowing economy: The GST’s past performance now seems much better than it once did.

- We now know that after 2018-19, nominal GDP growth slowed from 10.5 per cent in 2018-19 to 7.8 per cent the next year and -3 per cent in 2020-21.

- Effective rate cuts: The RBI has pointed out, the effective tax rate has fallen by nearly 3 percentage points because of rate cutting in 2019, in which both the Centre and states were complicit.

- Thus the weak revenue performance of the GST now seems attributable to wider economic difficulties and policy actions, rather than problems with the tax itself.

Necessary changes: Opportunity for striking bargain for Centre and States

1) Principle of compensation must be re-cast: Create revenue buffer

- As the GST was a new tax, so states were guaranteed against the teething troubles that would inevitably arise for the next five years.

- Five years on, this logic is less compelling.

- The GST as tax reform has reached maturity, well understood by producers, consumers, and tax officials.

- At the same time, the last few years have exposed the vulnerability of the states to shocks such as Covid-19 pandemic.

- Way forward: To prevent this situation from recurring, the authorities should create a revenue buffer that could be tapped in a time of need.

- In sum, there is a bargain waiting to be struck: The states give up their demand for an extension of the compensation mechanism, while the Centre offers a new counter-cyclical buffer.

- As the figure shows, in good economic times, GST revenues will be robust but it is against downturns that states need protection.

- The shift to revenue insurance, in turn, should allow the compensation cess to be abolished.

2) The GST structure needs to be simplified and rationalised

- The GST structure needs to be simplified and rationalised, as recommended by the Fifteenth Finance Commission and the Revenue Neutral Rate report.

- New rate structure: A new structure should have one low rate (between 8 and 10 per cent), one standard rate (between 16 and 18 per cent) and one rate for all demerit goods.

- The single rate on demerit goods also requires eliminating the cesses with all their complexity.

3) The GST Council’s working needs changes

- Consensus-based decision making in GST Council can be sustained only if there is a shared sense of participatory and inclusive governance.

- Nearly two decades ago, when the VAT was being introduced, Yashwant Sinha established a culture of consensual discussions on indirect taxes.

- He did this by requiring the Empowered Committee of State Finance Ministers to be headed by a finance minister from an Opposition-run state government.

- The spirit of this idea could be translated to the GST Council.

Consider the question “Inherent importance of GST and its significance for the cooperative federalism underline the necessity for the Centre and the States to strike the win-win bargain. In light of this, examine the issues with the GST and suggest the way forward to deal with these issuef.”

Conclusion

Cooperative federalism is not a gesture or one-off outcome. It is, above all, a disposition, resulting from quotidian democratic practice. By rehabilitating cooperative federalism’s finest achievement — the GST — the Centre and states can help restore India’s broader economic prospects.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Issues with the NEET

The Tamil Nadu Assembly has passed a bill exempting the State from the National Eligibility-cum-Entrance Test (NEET) for admission to undergraduate (UG) medical courses.

About NEET

The NEET has replaced the formerly All India Pre-Medical Test (AIPMT).

It is an all-India pre-medical entrance test for students who wish to pursue undergraduate medical (MBBS), dental (BDS) and AYUSH (BAMS, BUMS, BHMS, etc.) courses.

The exam is conducted by National Testing Agency (NTA).

TN law: Permanent Exemption for NEET

- The Bill exempts medical aspirants in Tamil Nadu from taking NEET examination for admission to UG degree courses in Indian medicine, dentistry and homeopathy.

- Instead, it seeks to provide admission to such courses on the basis of marks obtained in the qualifying examination, through “Normalization methods”.

- The aim of the Bill is to ensure “social justice, uphold equality and equal opportunity, protect all vulnerable student communities from being discriminated”.

- It seeks to bring vulnerable student communities to the “mainstream of medical and dental education and in turn ensure a robust public health care across the state, particularly the rural areas”.

Why TN is against NEET?

- Non-representative: TN opposes because NEET undermined the diverse societal representation in MBBS and higher medical studies.

- Disfavors the poor: It has favored mainly the affordable and affluent sections of the society and thwarting the dreams of underprivileged social groups.

- Exams for the elite: It considers NEET not a fair or equitable method of admission since it favored the rich and elite sections of society.

- Healthcare concerns: If continued, the rural and urban poor may not be able to pursue medical courses.

Can any state legislate against NEET?

- Admissions to medical courses are traceable to entry 25 of List III (Concurrent List), Schedule VII of the Constitution.

- Therefore, the State can also enact a law regarding admission and amend any Central law on admission procedures.

Views of the stakeholders appointed by TN

- A majority of stakeholders were not in favor of the NEET requirement.

- NEET only worked against underprivileged government school students, and had profited coaching centres and affluent students.

- NEET had not provided any special mechanism for testing the knowledge and aptitude of the students.

- The higher secondary examination of the State board itself was an ample basis for the selection of students for MBBS seats.

A move inspired by a SC Judgement

- This thinking of the State may be due to the observation made by the Supreme Court in the selection process of postgraduate (PG) courses in medicine.

- The Medical Council of India (MCI) had prescribed certain regulations providing reservations for in-service candidates.

- The Supreme Court struck down regulation 9(c) made by the MCI on the ground of the exercise of power beyond its statute.

Not a similar case

- It must be remembered that the Supreme Court was only dealing with a regulation framed by the MCI.

- The requirement of NEET being a basic requirement for PG and UG medical courses has now been statutorily incorporated under Section 10D of the Indian Medical Council (IMC) Act.

- When the Tamil Nadu government issued an order in 2017 providing for the reservation of 85% of the seats for students passed out from the State board it was struck down by the Madras High Court.

- The introduction of internal reservation for government school students is under challenge before the Madras High Court. Similarly, NEET as a requirement is also pending in the Supreme Court.

- Unless these two issues are decided, NEET cannot be removed by a State amendment.

The bill cannot be passed

- The present move to pass a fresh Bill on the same lines is most likely to meet the same fate.

- The President refused to give his assent to this bill.

- It is significant that no other State in India has sought an exemption from NEET and, therefore, exempting Tamil Nadu alone may not be possible.

- Even among the seats allotted to the State, there is no bar for students from other States from competing or selecting colleges in Tamil Nadu.

The bigger question

- The question is not whether the State government can amend a law falling under the Concurrent List.

- The question is whether the State government can exempt Section 10D of the IMC Act, which is a parliamentary law that falls under the Central List (Entry 66).

- Moreover, the Supreme Court has also upheld NEET as a requirement.

- Mere statistics highlighting that a majority of the stakeholders do not want NEET in Tamil Nadu is not an answer for exempting the examination.

Again, it is State and Centre are at crossroads

- Normally, a Bill requires assent from the Governor to become a law. Stalin’s contention is that this Bill deals with education, which is a Concurrent List subject.

- Admissions to medical courses fall under Entry 25 of List III, Schedule VII of the Constitution, and therefore the state is competent to regulate the same.

- Yet, as far as matters relating to the determination of standards for higher education are concerned, the central government has the power to amend a clause or repeal an Act.

- So, just the passing of the Bill doesn’t enable the students to get exempted from writing NEET.

- Already, Union Higher Education Secretary Amit Khare has held that if any State wants to opt out of the exam, it has to seek permission from the Supreme Court.

Options for Tamil Nadu

- Data is necessary only when there is power to legislate on the subject concerned.

- Since the Bill, which will become an Act only after the President’s nod, will come into effect only from the next academic year, the battle for and against the NEET requirement will continue in courts.

- Hopefully, the courts will determine the legality and have a definite solution to the question of medical admissions within the next year.

- Till such time, students who wrote NEET will fill the seats under the State quota.

Way forward: Preventing Commercialization of Medical Education

- The time may also have come to examine whether NEET has met its purposes of improving standards and curbing commercialization and profiteering.

- Under current norms, one quite low on the merit rank can still buy a medical seat in a private college, while those ranked higher but only good enough to get a government quota seat in a private institution can be priced out of the system.

- The Centre should do something other than considering an exemption to Tamil Nadu.

- It has to conceive a better system that will allow a fair admission process while preserving inter se merit and preventing rampant commercialization.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: AUKUS, Quad

Mains level: Maritime cooperations for Indo-Pacific

The Biden administration has announced a new trilateral security partnership for the Indo-Pacific, between Australia, the U.K., and the U.S. (AUKUS).

What is AUKUS?

- AUKUS, as the partnership is being called, will strive over the next 18 months to equip Australia with nuclear propulsion technology.

- As part of this, Australia will acquire nuclear-powered submarines with help from the UK and the US.

- It will also involve a new architecture of meetings and engagements between the three countries, as well as cooperation across emerging technologies (applied AI, quantum technologies and undersea capabilities).

- Australia’s nuclear-powered submarines, when they deploy, will be armed with conventional weapons only and not nuclear weapons.

Why such an alliance?

- Tensions have been high between Australia and an increasingly assertive China, its largest trade partner.

- Australia banned Chinese telecom giant Huawei in 2108 and its PM called for an investigation into the origins of COVID-19 last year.

- China retaliated by imposing tariffs on or capping Australian exports.

Not to substitute Quad or others

- This alliance does not and will not supersede or outrank existing arrangements in the Indo-Pacific region such as the Quad, which the US and Australia form with India and Japan, and ASEAN.

- AUKUS will complement these groups and others.

Significance

- There has been only one other time that the US has shared as “extremely sensitive” submarine propulsion technology — more than 60 years ago, back in 1958, with Great Britain.

- The US is working to move past the 20-year war in Afghanistan and the chaotic U.S. exit from Kabul.

- The Biden Administration has put countering China at the center of his economic and national security efforts, describing it as the biggest challenge of this era.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: AGR

Mains level: Stress in the telecom sector

In big bang reforms, the Union Cabinet approved a relief package for the telecom sector that includes a four-year moratorium on payment of statutory dues by telecom companies as well as allowing 100% foreign investment through the automatic route.

What is AGR?

- Adjusted Gross Revenue (AGR) is the usage and licensing fee that telecom operators are charged by the Department of Telecommunications (DoT).

- It is divided into spectrum usage charges and licensing fees, pegged between 3-5 per cent and 8 per cent respectively.

Why is AGR important?

- The definition of AGR has been under litigation for 14 years.

- While telecom companies argued that it should comprise revenue from telecom services, the DoT’s stand was that the AGR should include all revenue earned by an operator, including that from non-core telecom operations.

- The AGR directly impacts the outgo from the pockets of telcos to the DoT as it is used to calculate the levies payable by operators.

- Currently, telecom operators pay 8% of the AGR as licence fee, while spectrum usage charges (SUC) vary between 3-5% of AGR.

Why do telcos need to pay out large amounts?

- Telecom companies now owe the government not just the shortfall in AGR for the past 14 years but also an interest on that amount along with penalty and interest on the penalty.

- While the exact amount telcos will need to shell out is not clear, as in a government affidavit filed in the top court, the DoT had calculated the outstanding licence fee to be over ₹92,000 crore.

- However, the actual payout can go up to ₹1.4 lakh crore as the government is likely to also raise a demand for shortfall in SUC along with interest and penalty.

- Of the total amount, it is estimated that the actual dues is about 25%, while the remaining amount is interest and penalties.

Is there stress in the sector?

- The telecom industry is reeling under a debt of over ₹4 lakh crore and has been seeking a relief package from the government.

- Even the government has on various occasions admitted that the sector is indeed undergoing stress and needs support.

- Giving a ray of hope to the telecom companies, the government recently announced setting up of a Committee of Secretaries to examine the financial stress in the sector, and recommend measures to mitigate it.

Issue of lower tariff

- Currently, telecom tariffs are among the lowest globally, driven down due to intense competition following the entry of Reliance in the sector.

- The TRAI examines the merits of a “minimum charge” that operators may charge for voice and data services.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Tarballs

Mains level: Oil spills and the threats posed

A beach in South Mumbai, saw black oil-emanating balls lying on the shore.

What are Tarballs?

- Tarballs are dark-coloured, sticky balls of oil that form when crude oil floats on the ocean surface.

- Tarballs are formed by weathering of crude oil in marine environments.

- They are transported from the open sea to the shores by sea currents and waves.

- Tarballs are usually coin-sized and are found strewn on the beaches. Some of the balls are as big as a basketball while others are smaller globules.

- However, over the years, they have become as big as basketballs and can weigh as much as 6-7 kgs.

How are tarballs formed?

- Wind and waves tear the oil slick into smaller patches that are scattered over a much wider area.

- Various physical, chemical and biological processes (weathering) change the appearance of the oil.

Why are tarballs found on the beaches during the monsoon?

- It is suspected that the oil comes from the large cargo ships in the deep sea and gets pushed to the shore as tarballs during monsoon due to wind speed and direction.

- All the oil spilt in the Arabian sea eventually gets deposited on the western coast in the form of tarballs in the monsoon season when wind speed and circulation pattern favour transportation of these tarballs.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Hybodont Shark

Mains level: Not Much

In a rare discovery, teeth of new species of Hybodont shark of Jurassic age have been reported for the first time from Jaisalmer by a team of officers from the Geological Survey of India (GSI).

Hybodont Shark

- Hybodonts, an extinct group of sharks, was a dominant group of fishes in both marine and fluvial environments during the Triassic and early Jurassic time.

- However, hybodont sharks started to decline in marine environments from the Middle Jurassic onwards until they formed a relatively minor component of open-marine shark assemblages.

- They finally became extinct at the end of the Cretaceous time 65 million years ago.

Significance of the fossil

- The newly discovered crushing teeth from Jaisalmer represents a new species named by the research team as Strophodusjaisalmerensis.

- These sharks have been reported for the first time from the Jurassic rocks (approximately, between 160 and 168 million years old) of the Jaisalmer region of Rajasthan.

- The genus Strophodus has been identified for the first time from the Indian subcontinent and is only the third such record from Asia, the other two being from Japan and Thailand.

- It opens a new window for further research in the domain of vertebrate fossils.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

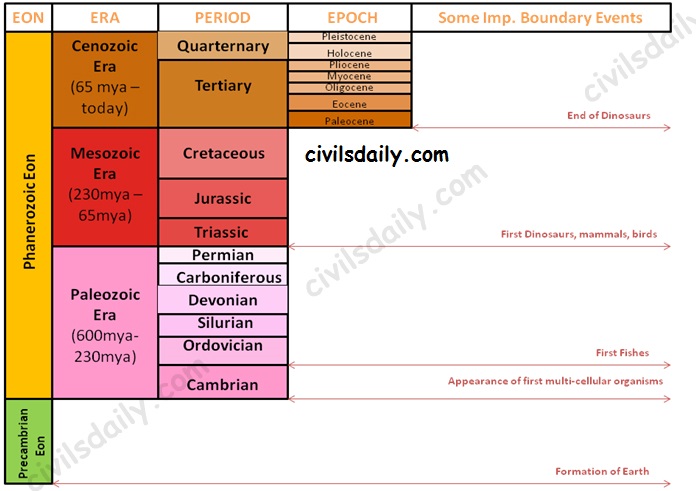

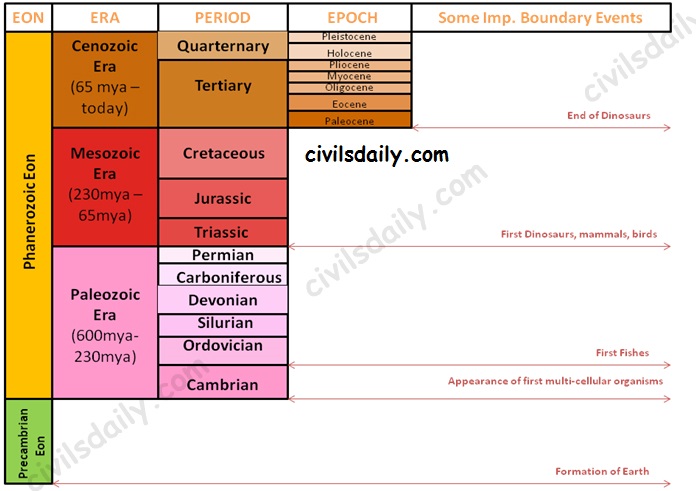

Back2Basics: Geological time-scale

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Malabar naval exercise

Mains level: Paper 2- India-Australia relations

Context

A few days ago, India’s Defence Minister and External Affairs Minister held the inaugural ‘2+2’ talks with their Australian counterparts.

Transforming relations between India-Australia

- Both are vibrant democracies which have respect for international laws and a belief in the equality of all nations irrespective of their size and strength.

- Both draw their congruence from a rule-based international order, believe in inclusive economic integration in the Indo-Pacific region, and face challenges from a belligerent China.

- Prime Minister Narendra Modi and Australian Prime Minister Scott Morrison elevated their bilateral strategic partnership to a Comprehensive Strategic Partnership in June 2020.

- Growing convergence on issues: There is a growing convergence of views on geo-strategic and geo-economic issues.

- The convergence is backed by a robust people-to-people connection.

- Both countries have stepped up collaborations through institutions and organisations on many issues in bilateral, trilateral, plurilateral and multilateral formats.

- Bilateral security cooperation: Given their common security challenges and in order to enhance regional security architecture, both countries have intensified bilateral security cooperation.

- Further, elevation of their ‘2+2’ Foreign and Defence Secretaries’ Dialogue to the ministerial level emphasises the positive trajectory of their transforming relations.

- They have also stepped up security dialogue with key partner-countries to deepen coordination in areas where security interests are mutual.

- The Malabar naval exercise by the Quad (Australia, India, Japan, the U.S.) is a step in this direction.

- Partnership with like-minded countries: Beyond bilateralism, both countries are also entering into partnerships with like-minded countries, including Indonesia, Japan and France, in a trilateral framework.

- Trade ties: Trading between India and Australia has seen remarkable growth in recent years.

- Two-way trade between them was valued at $24.4 billion in 2020.

- Trade is rapidly growing and encompasses agribusiness, infrastructure, healthcare, energy and mining, education, artificial intelligence, big data and fintech.

- An early harvest agreement by December will pave the way for an early conclusion of a bilateral Comprehensive Economic Cooperation Agreement between both countries.

Issues in deeper economic integration

- High tariff on agri products in India: India has a high tariff for agriculture and dairy products which makes it difficult for Australian exporters to export these items to India.

- Non-tariff barrier in Australia: At the same time, India faces non-tariff barriers and its skilled professionals in the Australian labour market face discrimination.

Consider the question “A growing convergence of views on geo-strategic and geo-economic issues between Indian and Australia makes it imperative to forge a partnership guided by principles with a humane approach. Comment.”

Conclusion

The Quad has gained momentum in recent months. The time is ripe for these countries to deliberate on a ‘Quad+’ framework. The geo-political and geo-economic churning in international affairs makes it imperative for India and Australia to forge a partnership guided by principles with a humane approach.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: V-Dem rating

Mains level: Paper 2- Declining democratic values

Context

India has performed poorly in every major global democracy report in the past few years.

India’s declining performance

- The Freedom House Index for 2021 pushed India down four points from last year, bringing its score from 71 to 67.

- V-Dem, the world-renowned think-tank from Sweden, has similarly downgraded India.

- It has labelled India an “electoral autocracy”.

- The Economist Intelligence Unit (EIU) study has shown India’s ranking has taken a nosedive from 27 to 53 out of 167 countries.

- The Reporters without Borders’ Press Freedom Report has placed India 167th out of 183 countries.

- Freedom House has also given India a score of 2 out of 4 in terms of press freedom.

Factors pointed out by the rating agencies

- The country has seen increased pressure being put on human rights organisations and civil rights groups.

- Journalists and activists have been intimidated and incarcerated, and minorities have been specifically targeted.

- Hate and polarisation are rampant.

- The most worrying trend has been the crackdown on freedom of speech, with statistics showing a 165 per cent increase in sedition cases between 2016 and 2019.

Issues with rejecting of global democratic indexes

- Indian government sought to challenge the rating of EIU after it released its 2021 report earlier this year.

- An offer made by the Indian government to supply ‘accurate’ data pertaining to the democratic index was firmly refused by the EIU.

- Shooting the messenger: This seeming retraction of Indian democratic values in global reports and the Indian indignation regarding it seems to be a clear case of shooting the messenger.

- Harming democracy: The Indian refusal to acknowledge and remedy them is irreparably harming its democracy.

- Trying to influence the rating agencies to doctor data to suit us is reprehensible.

- Difficulty for policymakers: Kaushik Basu, formerly the chief economist of the World Bank, commenting on this episode has said that the tendency of fabricating data to present an alternative image has beset the Indian administration.

- Not showcasing actual data is making it difficult for policymakers to attempt to remedy the situation.

Way forward

- A committee of secretaries’ meeting on January 30, 2020 discussed how India fared on various important parameters based on 32 internationally recognised indices in order to improve the performance on these indices.

- The desire to introspect and analyse what needs to be done to improve is correct and laudable.

- Let NITI Aayog and all concerned organisations focus on improving our performance in all the declining indicators.

Consider the question “Ranking of the various agencies shows the declining trend of democratic values in India. What are the reasons for such decline?vSuggest the steps to arrest this decline.”

Conclusion

Instead of denying these rankings and the reports of these agencies, India must work on fixing them.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: SCO

Mains level: Role of SCO in Afghan Peace

On the face of it, the summit meeting of the Shanghai Cooperation Organisation (SCO) this week in Dushanbe, Tajikistan, is well placed to lead the stabilization of Afghanistan after the American retreat.

About SCO

- After the collapse of the Soviet Union in 1991, the then security and economic architecture in the Eurasian region dissolved and new structures had to come up.

- The original Shanghai Five were China, Kazakhstan, Kyrgyzstan, Russia and Tajikistan.

- The SCO was formed in 2001, with Uzbekistan included. It expanded in 2017 to include India and Pakistan.

- Since its formation, the SCO has focused on regional non-traditional security, with counter-terrorism as a priority.

- The fight against the “three evils” of terrorism, separatism and extremism has become its mantra. Today, areas of cooperation include themes such as economics and culture.

India’s and the SCO

- India and Pakistan both were observer countries.

- While Central Asian countries and China were not in favor of expansion initially, the main supporter — of India’s entry in particular — was Russia.

- A widely held view is that Russia’s growing unease about an increasingly powerful China prompted it to push for its expansion.

- From 2009 onwards, Russia officially supported India’s ambition to join the SCO. China then asked for its all-weather friend Pakistan’s entry.

Afghanistan and SCO

- Afghanistan has been engaged with the SCO for over 15 years.

- In 2012, Afghanistan became an observer in the SCO when then-Afghan president Hamid Karzai visited China.

- In 2015, Kabul applied for full membership in the group.

- Kabul sought to be a member of the SCO as it believes that it is a natural candidate.

- Geographically, Afghanistan is a part of the SCO region.

Limited (or No) progress made by SCO

- For all the political hype, the SCO has not deepened regionalism in Central Asia.

- Two decades after its formation — it was set up just weeks before the 9/11 attacks on New York and Washington — the institutional promise of the SCO remains just that — a promise.

- Seen from the subcontinent, the SCO certainly looks better than the South Asian Association of Regional Cooperation (SAARC).

- That India and Pakistan, whose differences have prevented even regular meetings of SAARC, are actively participating in the SCO, would point to its attractiveness.

- But then SAARC is such a low bar.

Opportunities for role-play in Afghanistan

The crisis in Afghanistan presents a major opportunity for the SCO to realize its regional ambitions.

- Involvement of regional superpowers: The SCO’s importance for Afghanistan seems self-evident when you look at its sponsors and members. Its founding leaders are the two great powers of the east — Russia and China.

- Neighborhood are members: Its other initial members were Uzbekistan, Tajikistan, Kyrgyzstan, and Kazakhstan to the north and northeast of Afghanistan.

- Observers vested interest: Besides Afghanistan, Iran, Belarus and Mongolia are observers. Iran is said to be on track for full membership.

- Many dialogue partners: The SCO has a number of “dialogue partners”. They include Armenia and Azerbaijan from the neighboring Caucasus region and Turkey a step further to the West. Nepal and Sri Lanka from the subcontinent and Cambodia from southeast Asia are also dialogue partners.

Issues with SCO

- China centrism: For an organization that bears the name of Shanghai, but is focused on Central Asia, its associates look disparate.

- Lack of coherence: The Central Asian members of the SCO have quarrels of their own, and have struggled to develop collective approaches to their common regional security challenges.

- Dint go beyond dialogues: As it broadened its membership, the SCO has, unsurprisingly, struggled to deepen institutional cooperation.

- Not comprehensive: There is also one important country missing in the mix. It is Turkmenistan, which shares an 800 km border with Afghanistan and a 1,150 km border with Iran.

- Neutrality of members: The organizing principle of Turkmenistan rulers is absolute “neutrality” — think of it as an extreme form of “non-alignment”. It refuses to join any regional institution, political or military.

- Individual interests: Russia’s effort to build a regional institution in its Central Asian periphery ran parallel to its plans for the so-called “strategic triangle” with China and India. India and Pakistan, needless to say, are poles apart on the Taliban.

No common interest in Afghan Peace

- The US military retreat from Afghanistan has brought cheer to both Moscow and Beijing, although publicly they criticize President Joe Biden’s hasty retreat.

- The US retreat might weaken the glue that binds Moscow and Beijing in Central Asia or tightens it.

- Although Russia and China are closer to each other than ever before, their interests are not entirely the same in Central Asia.

Russian alternatives to SCO

(1) Central Security Treaty Organisation

- While military confidence-building measures have grown under the SCO banner, Russia had its own security organisation for the region, called the Central Security Treaty Organisation (CSTO).

- Three of the SCO members — Kazakhstan, Kyrgyzstan, and Tajikistan — along with Armenia and Belarus are members of the CSTO.

- Russia sees itself as the sole protector of the former Soviet Republics and may not be ready to share that role with China — “yes” to coordination, but “no” to a Sino-Russian security dyarchy.

(2) Eurasian Economic Union

- Moscow also appears reluctant to back Chinese proposals to promote trade integration under the SCO banner; it prefers the Eurasian Economic Union (EAEU) under its own leadership.

- China is not a member of either CSTO or EAEU. This is one reason for the weakness of SCO regionalism.

Other deterrents

(1) Affinity with Taliban

- China has openly admitted to cooperating with the Taliban by restoring all formal diplomatic ties. It is the first such country to acknowledge the Taliban.

- Turkmenistan too, which is not part of SCO, has been quite open to engaging the Taliban in sync with its principles of neutrality.

- Some Russian analysts see Turkmenistan as the potential weak link in the defense against the Taliban’s potential threats to the region.

- Uzbekistan seems open to a cautious engagement with the Taliban.

(2) Iranian aspirations for unwarranted interference (just like Turkey does regarding Kashmir)

- Iran, which has ethnic and linguistic links with the Persian-speaking Tajiks, appears equally worried about the Taliban’s policies towards minorities.

- As Moscow and Beijing, Tehran was happy to see the Americans leave in humiliation and appeared hopeful of a positive engagement with the Taliban.

- Those hopes may have been suspended for now, if not discarded.

What can the SCO do now?

- The Afghanistan debacle presents an opportunity for the SCO to play a constructive role in meeting the region’s burgeoning security challenge.

- Providing humanitarian relief, tending to refugees, facilitating an inclusive dialogue and national reconciliation constitute immediate and long-term goals in which the organization can fill a role.

- The SCO can also pressure the Taliban to share power with other domestic actors and refrain from providing sanctuary to foreign terror organizations (through foreign funds from Saudi*).

- It can suspend Afghanistan’s observer status, curtail border traffic or withhold recognition, investments, and aid, should Kabul be found wanting.

Way forward

- While the SCO is not an impressive regional institution, it remains an important diplomatic forum.

- India has sought to make full use of the SCO’s diplomatic possibilities without any illusions about its effectiveness.

- At the SCO summit this week, PM Modi would remind other leaders of the “three evils” that the SCO set out to defeat — terrorism, extremism, and separatism.

- Few would disagree that the Taliban embodied all the three sins in the past. Today, the Taliban and its mentor Pakistan say the sinner wants to become a saint.

- India must focus on finding common ground with those members of the SCO who do share India’s concerns about Afghanistan.

Conclusion

- Given this divergence, it is unlikely that the SCO can come up with a “regional solution” for the Afghan crisis.

- The only real Afghan convergence today is between Pakistan and China.

- Expect them to try and nudge the SCO towards a positive engagement with the Taliban.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: GST Council

Mains level: Commodities left out of GST purview

The GST Council might consider taxing petrol, diesel and other petroleum products under the single national GST regime.

About GST Council

- The GST Council is a constitutional body that aims to bring together states and the Centre on a common platform for the nationwide rollout of the indirect tax reform.

- It is an apex member committee to modify, reconcile or to procure any law or regulation based on the context of goods and services tax in India.

- It dictates tax rate, tax exemption, the due date of forms, tax laws, and tax deadlines, keeping in mind special rates and provisions for some states.

- The predominant responsibility of the GST Council is to ensure to have one uniform tax rate for goods and services across the nation.

How is the GST Council structured?

- The GST is governed by the GST Council. Article 279 (1) of the amended Indian Constitution states that the GST Council has to be constituted by the President within 60 days of the commencement of Article 279A.

- According to the article, the GST Council will be a joint forum for the Centre and the States. It consists of the following members:

- The Union Finance Minister will be the Chairperson

- As a member, the Union Minister of State will be in charge of Revenue of Finance

- The Minister in charge of finance or taxation or any other Minister nominated by each State government, as members.

Terms of reference

- Article 279A (4) specifies that the Council will make recommendations to the Union and the States on the important issues related to GST, such as the goods and services will be subject to or exempted from the Goods and Services Tax.

- They lay down GST laws, principles that govern the following:

- Place of Supply

- Threshold limits

- GST rates on goods and services

- Special rates for raising additional resources during a natural calamity or disaster

- Special GST rates for certain States

Why bring Petro/Diesel under GST?

- GST is being thought to be a solution for the problem of near-record high petrol and diesel rates in the country, as it would end the cascading effect of tax on tax.

- The state VAT is being levied not just on the cost of production but also on the excise duty charged by the Centre on such output.

Why were they left out of GST?

- When a national GST subsumed central taxes such as excise duty and state levies like VAT on July 1, 2017, five petroleum goods – petrol, diesel, ATF, natural gas and crude oil – were kept out of its purview.

- This is because both central and state government finances relied heavily on taxes on these products.

- Since GST is a consumption-based tax, bringing petroleum under the regime would have mean states where these products are sold get the revenue and not the producer ones.

- Simply put, Uttar Pradesh and Bihar with their huge population and a resultant high consumption would get more revenues at the cost of states like Gujarat.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Input Tax Credit

Mains level: Not Much

The Supreme Court has confirmed a Madras High Court judgment which upheld a fiscal formula included in the Central Goods and Service Tax Rules to execute refund of unutilized Input Tax Credit (ITC) accumulated on account of input services.

What is Input Tax Credit?

- Input credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs.

- Say, you are a manufacturer – tax payable on output (FINAL PRODUCT) is Rs 450 tax paid on input (PURCHASES) is Rs 300 You can claim INPUT CREDIT of Rs 300 and you only need to deposit Rs 150 in taxes. See here:

Pc: Cleartax.in

The case in discussion

- The apex court Bench led, by Justice D.Y. Chandrachud, passed the judgment in the face of two contradicting judgments of Gujarat and Madras High Courts on the validity of Rule 89(5) of the Central GST Rules, 2017.

- Rule 89(5) provides a formula for the refund of ITC, in “a case of refund on account of inverted duty structure”.

- The Gujarat High Court had held that by prescribing a formula in sub-Rule (5) of Rule 89 to execute refund of unutilized ITC accumulated on account of input services.

- The Madras High Court, while delivering its judgment declined to follow the view of the Gujarat High Court.

Answer this PYQ in the comment box:

Consider the following items:

- Cereal grains hulled

- Chicken eggs cooked

- Fish processed and canned

- Newspapers containing advertising material

Which of the above items is/are exempt under GST (Goods and Services Tax)?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4

Post your answers here

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: States reorganization

Mains level: Not Much

The Meghalaya Assembly has given an indigenous touch to the National Anthem ahead of the 50th anniversary of Meghalaya’s Statehood in 2022.

About Meghalaya

- Meghalaya meaning “abode of clouds” was formed by carving out two districts from the state of Assam: the United Khasi Hills and Jaintia Hills, and the Garo Hills on 21 January 1972.

- It was previously part of Assam, but on 21 January 1972, the districts of Khasi, Garo and Jaintia hills became the new state of Meghalaya.

- It is the wettest region of India, with the wettest areas in the southern Khasi Hills recording an average of 12,000 mm (470 in) of rain a year.

- About 70 percent of the state is forested.

- The Meghalaya subtropical forests ecoregion encompasses the state; its mountain forests are distinct from the lowland tropical forests to the north and south.

Note the chronology of reorganization states in India

| State |

Formation Year |

Status prior to the formation |

| Andhra |

1953 |

Part of the state of Madras |

| Gujarat |

1960 |

Part of the state of Bombay |

| Maharashtra |

1960 |

Part of the state of Bombay |

| Kerala |

1956 |

State of Travancore and Cochin |

| Nagaland |

1963 |

Union territory |

| Haryana |

1966 |

Part of Punjab |

| Karnataka |

1956 |

State of Mysore was formed in 1953, enlarged Mysore in 1956 which was renamed in 1973. |

| Himachal Pradesh |

1971 |

Union Territory |

| Manipur, Tripura |

1972 |

Union Territories |

| Meghalaya |

1972 |

Autonomous state within state of Assam |

| Sikkim |

1975 |

Associate state since 1974 and a protectorate of India before that. |

| Mizoram |

1987 |

District of Assam till 1972 and Union Territory from 1972 to 1987. |

| Arunachal Pradesh |

1987 |

Union Territory |

| Goa |

1987 |

Union Territory |

| Uttarakhand |

2000 |

Part of Uttar Pradesh |

| Chhattisgarh |

2000 |

Part of Madhya Pradesh |

| Jharkhand |

2000 |

Part of Bihar |

| Telangana |

2014 |

Part of Andhra Pradesh |

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Pilibhit Tiger Reserve

Mains level: Not Much

A herd of around 25 elephants from Nepal’s Shuklaphanta National Park reached the tiger reserve in Uttar Pradesh almost a month back.

Pilibhit Tiger Reserve

- Pilibhit Tiger Reserve is located in Pilibhit district of Uttar Pradesh and was notified as a tiger reserve in 2014.

- It is one of the few well-forested districts in Uttar Pradesh.

- It forms part of the Terai Arc Landscape in the upper Gangetic Plain along the India-Nepal border.

- The habitat is characterized by sal forests, tall grasslands and swamp maintained by periodic flooding from rivers.

- The Sharda Sagar Dam extending up to a length of 22 km is on the boundary of the reserve.

- The tiger reserve got the first international award TX2 for doubling the tiger population in a stipulated time.

Try answering this PYQ:

Q.Consider the following protected areas:

- Bandipur

- Bhitarkanika

- Manas

- Sunderbans

Which of the above are declared Tiger Reserves?

(a) 1 and 2 only

(b) 1, 3 and 4 only

(c) 2, 3 and 4 only

(d) 1, 2, 3 and 4

Post your answers here.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 3- Challenges in financial inclusion

Context

There are 63.4 million MSMEs in India and 99 per cent of which are micro-enterprises with less than Rs 10 lakh in investment. Financial inclusion and integration is key to bring these businesses into the formal economy.

Financial integration

- What is Financial inclusion? On the front of “financial inclusion”, which refers to the accessibility of banking and availability of credit, we have made significant progress.

- Financial integration: The journey from inclusion to integration is not only about making products available and accessible, but also about making them relevant, applicable, and acceptable.

Demand size challenges

1) Gap between demand and supply of capital

- Due to a limited risk appetite, low or thin-file data on customers and challenging regulatory oversight, capital remains a constraint in designing bespoke products.

- Way forward: For India to overcome these challenges, the existing infrastructure must be adapted to our new purpose, providing easy-to-use, customer-centric experiences.

2) Accessibility

- Greater accessibility has major benefits for not only the customer but also the supplier.

- For example, in rural India, people tend to save in the post office, because of village postal agents collect their savings from their doorstep.

3) Intelligent product design and delivery

- Products must be designed and delivered intelligently to meet the customer where they are, and by keeping in mind that they use products to reach their goals.

- This involves tailoring the products to the needs and income profile of the customer, including being cognisant of their environment, geography, and demography.

4) Lowering the operating costs

- In the traditional financial system, the design and distribution cost on financial products at sachet size is high.

- Financial service providers are consequently dissuaded from attempting to reach rural, financially excluded groups.

- By using the power of machine learning and cloud infrastructure, we can significantly lower operating costs while offering customers affordable, bespoke financial products.

5) Demand-side issues: Financial literacy and technology readiness

- Financial literacy and technology readiness are two critical issues on the demand size.

- Financial education assists people in making sound financial decisions.

Consider the question “Benefits of the financial inclusion remain unrealised without financial integration. In light of this, examine the challenge in financial integration in India and suggest the way forward”

Conclusion

It is our responsibility to create an ecosystem for them to deploy this capital of courage.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Article 25 and 26

Mains level: Paper 2- Evolution of rights-bases jurisprudence

Context

On August 14, 2021, the Tamil Nadu government appointed 24 trained archakas (priests) in temples across the State. In the weeks since, a series of writ petitions have been filed before the Madras High Court assailing these appointments.

Administration of Hindu temples in Tamil Nadu by government and challenges to it

- The Hindu Religious and Charitable Endowments (HR&CE), 1959, is the governing law on the administration of Hindu temples and religious institutions.

- In 1971, Section 55 of the HR&CE Act was amended to abolish hereditary priesthood.

- Removal of caste-based discrimination: In 2006, the amendment provided for the appointment of sufficiently trained Hindus irrespective of their caste as archakas to Hindu temples by the government.

- Challenges in the Court: Challenges to both amendments were taken to the Supreme Court, which upheld the law, as amended.

- In Seshammal v. Union (1972), the Supreme Court observed that the amendment to the HR&CE Act abolishing hereditary priesthood did not mean that the government intended to bring about any “change in the rituals and ceremonies”.

- Constitutional legitimacy: In Adi Saiva Sivachariyargal v. Govt. of Tamil Nadu (2015), the Supreme Court observed that “the constitutional legitimacy, naturally, must supersede all religious beliefs or practices”.

- The Court further went on to state that appointments should be tested on a case-by-case basis and any appointment that is not in line with the Agamas will be against the constitutional freedoms enshrined under Articles 25 and 26 of the Constitution.

Judicial balancing of the various rights by the Supreme Court

- In Indian Young Lawyers’ Association v. State of Kerala (the Sabarimala case) and Joseph Shine v. Union of India (2018), the Supreme Court reiterated the need to eliminate “historical discrimination which has pervaded certain identities”’, “systemic discrimination against disadvantaged groups”.

- In these cases the Supreme Court rejected stereotypical notions used to justify such discrimination.

- In all these cases, the Court prioritised judicial balancing of various constitutional rights.

- The constitutional order of priority: In the Sabarimala case, it held that “in the constitutional order of priorities, the individual right to the freedom of religion was not intended to prevail over but was subject to the overriding constitutional postulates of equality, liberty and personal freedoms recognised in the other provisions of Part III”.

Way forward

- Building on the Sabrimala case: The constitutional courts will now be called upon to build on the gains of the Sabarimala case when it comes to administration of temples, insofar as it concerns matters that are not essentially religious.

- Dealing with the gender bias: The Supreme Court, in Navtej Singh Johar v. Union of India (2018), interpreted Article 15 as being wide, progressive and intersectional.

- Today, while most of the debate is around whether men from all caste groups can become archakas, we have failed to recognise the gender bias inherent in these discussions.

Consider the question “We have been witnessing the evolution of rights-based jurisprudence in the various judgements of the Supreme Court. This will help to eliminate “systemic discrimination against disadvantaged groups”, and reject stereotypical notions used to justify such discrimination. Comment.”

Conclusion

At once, caste orthodoxy and patriarchy entrenched within the realm of the HR&CE Act can be eliminated and supplanted with a vision of a just, equal and dignified society.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Autonomous districts, Sixth Schedule

Mains level: Issues related to Assymetric Federalism in India

As a normative idea and an institutional arrangement that supports the recognition and provision of an expansive ‘self-rule’ for territorially concentrated minority groups, asymmetric federalism has recently received bad press in India.

India’s Federalism: A backgrounder

- Nations are described as ‘federal’ or ‘unitary’, depending on the way in which governance is organised.

- In a unitary set-up, the Centre has plenary powers of administration and legislation, with its constituent units having little autonomy.

- In a federal arrangement, the constituent units are identified on the basis of region or ethnicity and conferred varying forms of autonomy or some level of administrative and legislative powers.

- In India, the residuary powers of legislation, that is the power to make law in a field not specified in the Constitution, is vested in Parliament.

- Hence India has a quasi-federal framework.

Why is it said that India has asymmetric federalism?

- The main forms of administrative units in India are the Centre and the States.

- Just as the Centre and the States do not have matching powers in all matters, there are some differences in the way some States and other constituent units of the Indian Union relate to the Centre.

- This creates a notable asymmetry in the way Indian federalism works.

- But there are other forms, too, all set up to address specific local, historical and geographical contexts.

The asymmetric structure

- Besides the Centre and the States, the country has Union Territories with a legislature, and Union Territories without a legislature.

- When the Constitution came into force, the various States and other administrative units were divided into Parts A, B, C and D.

- Part A States were the erstwhile provinces, while Part B consisted of erstwhile princely states and principalities. Part C areas were the erstwhile ‘Chief Commissioner’s Provinces’.

- They became Union Territories, and some of them initially got legislatures and were later upgraded into States.

- Himachal Pradesh, Manipur, Tripura, Mizoram, Arunachal Pradesh and Goa belong to this category.

Power apparatus in these asymmetries: Sixth Schedule

- The Sixth Schedule to the Constitution contains provisions for the administration of tribal areas in Assam, Meghalaya, Tripura and Mizoram.

- These create autonomous districts and autonomous regions.

- Any autonomous district with different Scheduled Tribes will be divided into autonomous regions.

- These will be administered by District Councils and Regional Councils.

- These Councils can make laws with respect to allotment, occupation and use of land, management of forests other than reserve forests and water courses.

- Besides they can regulate social customs, marriage and divorce and property issues.

An integrationist approach adopted by the Constituent Assembly

- Post-independence, India was criticized for arguably becoming a ‘homogenous Hindu nation’ after Partition.

- To counter this, the Gopinath Bordoloi Committee, a sub-committee of the Constituent Assembly sought to accommodate the distinctive identity, culture and way of life of tribal groups in the NE by envisioning ‘self-rule’.

- This distinctive constitutional status to territorially concentrated minorities fosters centrifugal tendencies.

- Asymmetric federalism fosters subversive institutions, political instability and breakup of States.

Curious case of Manipur: Recent developments

- Article 371 gives expansive constitutional powers to Manipur’s Hill Areas Committee (Article 371C) over tribal identity, culture, development and local administration, are exemplars.

- The integrationist approach resonates powerfully in two recent attempts by Manipur’s government to

- stall the introduction and passage of the Manipur (Hill Areas) Autonomous District Council (Amendment) Bill, 2021, and

- induct nine Assembly members from the valley areas into the Hill Areas Committee.

- This move is being perceived as a “malicious” and “direct assault” on the Hill Areas Committee and the constitutional protection accorded to the Hill Areas of Manipur under Article 371C.

A determined move

- These moves marks a calculated initiative to use this as a double-edged sword to simultaneously set apace electoral agenda for the upcoming Assembly elections in early 2022 and reclaim its agency to fortify state-level constitutional asymmetry.

- The attempt to increase membership of the six district councils to 31 members each and secure more powers to the councils by giving more developmental mandate are welcome.

Managing HAC: A difficult task

- If history is any guide, the task of reclaiming the Hill Areas Committee’s agency is not going to be easy.

- Its members often leverage tribe/party loyalty over-commitment to protect constitutional asymmetry and common tribals’ cause.

- How the HAC and various tribal groups strategically navigate their politics to offset the majoritarian impulse to manipulate the legal and political process to dilute/dissolve extant constitutional asymmetry remains to be seen.

Way forward

- There should be sincere commitment to promote tribal development, identity and culture that Article 371C seeks to bridge.

- Recognizing and institutionally accommodating tribal distinctiveness is not just as a matter of political convenience

- This valuable and enduring good will be key to promote the State’s integrity, stability and peace in the long run.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now