Note4Students

From UPSC perspective, the following things are important :

Prelims level: Henley Passport Index

Mains level: Ease of foreign travel for Indians

India now ranks at 83rd position in the Henley Passport Index, climbing seven places from 90th rank last year.

Henley Passport Index

- The Henley & Partners publishes the ranking and the Index of the world’s passports according to the number of destinations their holders can access without a prior visa.

- It was launched in 2005.

- The ranking is based on data from the IATA (International Air Transport Association), a trade association of some 290 airlines, including all major carriers.

- The index includes 199 different passports and 227 different travel destinations.

- The data are updated in real time as and when visa policy changes come into effect.

India’s performance this year

- India is ranked at 83rd position and shares the rank with Sao Tome and Principe in Central Africa, behind Rwanda and Uganda.

- It now has visa-free access to 60 destinations worldwide with Oman and Armenia being the latest additions.

- It has added 35 more destinations since 2006.

Global performance

- Japan and Singapore has topped the list.

- The US and the UK passports regained some of their previous strength after falling all the way to eighth place in 2020.

- The passport of the Maldives is the most powerful in South Asia (58th) enabling visa-free entry to 88 countries.

- In South Asia, Bangladesh (103rd) is ahead of Pakistan (108th) and Nepal (105th).

- Afghanistan undoubtedly stands at the last rank.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: SDGs

Mains level: Paper 3- Integrated approach to social and environmental problems

Context

Ever since the UNDP took up computation of the HDI in 1990, there have been adjustments such as inequality-adjusted HDI. The environment is one such issue now considered to be an essential component to be factored in to measure human development.

Planetary pressure-adjusted Human Development Index

- The purpose of the planetary pressure adjusted HDI, or PHDI, is to communicate to the larger society the risk involved in continuing with existing practices in our resource use and environmental management, and the retarding effect that environmental stress can perpetuate on development.

- When planetary pressure is adjusted, the world average of HDI in 2019 came down from 0.737 to 0.683.

- PHDI of India: In the case of India, the PHDI is 0.626 against an HDI of 0.645 with an average per capita CO2 emission (production) and material footprints of 2.0 tonnes and 4.6 tonnes, respectively.

- India gained in global rankings by eight points (131st rank under HDI and 123rd rank under PHDI), and its per capita carbon emission (production) and material footprint are well below the global average.

India’s twin challenge

- India faces the twin challenges of poverty alleviation and environmental safeguarding.

- India’s natural resource use is far from efficient, environmental problems are growing, and the onslaught on nature goes on unabated with little concern about its fallout.

- At the same time, India has 27.9% people under the Multidimensional Poverty Index ranging from 1.10% in Kerala to 52.50% in Bihar, and a sizable section of them directly depend on natural resources for their sustenance.

India’s performance on SDGs

- The SDGs have acquired high priority in the context of the issue of climate change and its impact on society.

- The Sixth Assessment Report (AR6) of IPCC 2021 laid stress on limiting global temperature rise at the 1.5° C level and strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty.

- ‘No poverty’ and ‘Zero hunger’ are the first and second SDGs.

- According to NITI Aayog (2020-21), out of 100 points set for the grade of Achiever, India scored 60 (Performer grade, score 50-64) for no poverty and 47 (Aspirant grade, score 0-49) for zero hunger, with wide State-level variations.

- India’s score in the SDGs of 8, 9, and 12 (‘Decent work and economic growth’; ‘Industry, Innovation and Infrastructure’ and ‘Responsible Consumption and Production’, respectively) — considered for working out planetary pressure — are 61 (performer), 55 (performer) and 74 (front runner), respectively.

Way forward

- Nature-based solutions: It is now well established that there are interdependencies of earth system processes including social processes, and their relationships are non-linear and dialectic.

- Therefore, the central challenge is to nest human development including social and economic systems into the ecosystem, and biosphere building on a systematic approach to nature-based solutions that put people at the core.

- Integrated perspective and local level involvement: Social and environmental problems cannot be addressed in isolation anymore; an integrated perspective is necessary.

- This can be conceived and addressed at the local level, for which India has constitutional provisions in the form of the 73rd and 74th Amendments.

Conclusion

An integrated perspective is necessary as social and environmental problems cannot be addressed in isolation anymore.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Tax buoyancy

Mains level: Paper 3- GST and issues

Context

In 2020-21, the compensation payment episode plunged the Union-State relationship to a new low, creating humongous mistrust.

Background of the compensation to the States

- To allay the fears of States of possible revenue loss by implementing GST in the short term, the Union government promised to pay compensation for any loss of revenue in the evolutionary phase of five years.

- This was estimated by taking the revenue from the merged taxes in 2015-16 as the base and applying the growth rate of 14% every year.

- To finance the compensation requirements, a GST compensation cess was levied on certain items such as tobacco products, automobiles.

- Period of five years: The agreement to pay compensation for the loss of revenue was for a period of five years which will come to an end by June 2022.

- Mistrust between Centre and the State: In 2020-21, due to the most severe lockdown following the novel coronavirus pandemic, the loss of revenue to States was estimated at ₹3 lakh-crore of which ₹65,000 crore was expected to accrue from the compensation cess.

- Of the remaining ₹2.35 lakh-crore, the Union government decided to pay ₹1.1 lakh-crore by borrowing from the Reserve Bank of India.

- The entire compensation payment episode plunged the Union-State relationship to a new low, creating humongous mistrust.

GST reform is still in transition

- Misuse of input tax credit: The technology platform could not be firmed up for a long time due to which the initially planned returns could not be filed.

- This led to large-scale misuse of input tax credit using fake invoices.

- Revenue uncertainty faced by the States: This is the only major source of revenue for the States.

- Considering their increased spending commitments to protect the lives and livelihoods of people, they would like to mitigate revenue uncertainty to the extent they can.

- They have no means to cushion this uncertainty for the Finance Commission which is supposed to take into account the States’ capacities and needs in its recommendations has already submitted its recommendations.

- Changes needed: More importantly, the structure of GST needs significant changes and the cooperation of States is necessary to carry out the required reforms.

Changes needed in GST structure

- Reducing exemption items: Almost 50% of the consumption items included in the consumer price index are in the exemption list; broadening the base of the tax requires significant pruning of these items.

- Bringing petroleum products, real estate etc under GST: Sooner or later, it is necessary to bring petroleum products, real estate, alcohol for human consumption and electricity into the GST fold.

- Single rate: The present structure is far too complicated with four main rates (5%, 12%, 18% and 28%).

- This is in addition to special rates on precious and semi-precious stones and metals and cess on ‘demerit’ and luxury items at rates varying from 15% to 96% of the tax rate applicable which have complicated the tax enormously.

- Multiple rates complicate the tax system, cause administrative and compliance problems, create inverted duty structure and lead to classification disputes.

Way forward

- Extending the compensation period: Reforming the structure to unify the rates is imperative and this cannot be done without the cooperation of States.

- Thus, extending the compensation payment for the next five years is necessary not only because the transition to GST is still underway but also to provide comfort to States to partake in the reform.

- Reforming the structure is important not only to enhance the buoyancy of the tax in the medium term but also to reduce administrative and compliance costs to improve ease of doing business and minimise distortions.

- New rate of compensation: It has been pointed out by many including the Fifteenth Finance Commission that the compensation scheme of applying 14% growth on the base year revenue provided for the first five years was far too generous.

- The issue can be revisited and the rate of growth of reference revenue for calculating compensation can be linked to the growth of GSDP in States.

Conclusion

The transition to GST is still in progress and an extension will provide comfort to States to help roll out crucial changes.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Free speech vs hate speech

Context

The growing incidence of hate speeches, especially those targeting minorities, in combination with the judicial ambiguity has provided an opportunity to chart legislative reforms.

Current legal provisions to deal with hate speech

- Not defined in legal framework: Hate speech is neither defined in the Indian legal framework nor can it be easily reduced to a standard definition due to the myriad forms it can take.

- The Supreme Court, in Pravasi Bhalai Sangathan v. Union of India (2014), described hate speech as “an effort to marginalise individuals based on their membership in a group” and one that “seeks to delegitimise group members in the eyes of the majority, reducing their social standing and acceptance within society.”

- The Indian Penal Code illegalises speeches that are intended to promote enmity or prejudice the maintenance of harmony between different classes.

- Specifically, sections of the IPC, such as 153A, which penalises promotion of enmity between different groups;

- 153B, which punishes imputations, assertions prejudicial to national integration;

- 505, which punishes rumours and news intended to promote communal enmity, and

- 295A, which criminalises insults to the religious beliefs of a class by words with deliberate or malicious intention.

- Summing up various legal principles, in Amish Devgan v. Union of India (2020), the Supreme Court held that “hate speech has no redeeming or legitimate purpose other than hatred towards a particular group”.

- Lack of established legal standard: Divergent decisions from constitutional courts expose the lack of established legal standards in defining hate speech, especially those propagated via the digital medium.

Suggestions

- The Law Commission of India, in its 267th report, recommended the insertion of two new provisions to criminalise and punish the propagation of hate speech.

- The 189th Report of the Parliamentary Standing Committee on Home Affairs, in 2015, recommended the incorporation of separate and specific provisions in the Information Technology Act to deal with online hate speech.

- Specialised legislation for social media: Much of the existing penal provisions deal with hate speech belong to the pre-Internet era.

- The need of the hour is specialised legislation that will govern hate speech propagated via the Internet and, especially, social media.

- Recognise hate speech as reasonable restriction to free speech: Taking cue from best international standards, it is important that specific and durable legislative provisions that combat hate speech, especially that which is propagated online and through social media.

- Ultimately, this would be possible only when hate speech is recognised as a reasonable restriction to free speech.

Consider the question “What is hate speech? What are the challenges in dealing with hate speech? Suggest a way forward.”

Conclusion

It is important that specific and durable legislative provisions be enacted to combat hate speech.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 3- Issues with India's GDP data

Context

There are three major reasons why the GDP data, and hence any narrative of economic recovery based on it, are questionable.

Background

- The NSO released the current GDP series in 2015, using 2011-12 as its base year.

- Some have argued that the problem in the new series is the real growth rate. This is debatable.

- Scholars have pointed to measurement problems, both in the nominal and real GDP growth rates.

Three issues with the GDP data, and narrative of economic recovery based on it

[1] Double deflation problem

- The new series entailed a shift from a volume-based measurement system to one based on nominal values, thereby making the deflator problem more critical.

- Simply put, the NSO calculates real GDP by gathering nominal GDP data in rupees and then deflating this data using various price indices.

- The nominal data needs to be deflated twice: Once for outputs and once for inputs.

- But the NSO — almost uniquely amongst G20 countries — deflates the nominal data only once.

- It does not deflate the value of inputs.

- To see why this is a problem, consider what happens when the price of imported oil goes down.

- In that case, input costs will fall and the profits recorded by Indian firms will rise.

- This increase in profits is merely the result of a fall in input prices, so it needs to be deflated away.

- But the NSO doesn’t deflate away the increase in profits.

- Since the cost of inputs is measured by the WPI (wholesale price index), a crude measure of the overestimation caused by the absence of “double deflation” is given by the gap between the WPI and the CPI (consumer price index).

- In the 2014-2017 period, oil prices plunged, causing the WPI to fall sharply relative to the CPI.

- This meant that real growth was probably overstated.

- In the last few months, the exact opposite has been happening. WPI inflation is soaring.

- The rapid increase in the WPI relative to the CPI is imparting an upward bias to the deflator.

[2] Sectoral weight not updated

- When it calculates GDP, it takes a sample of activity in each sector, then aggregates the figures by using sectoral weights.

- To make sure that the weights are reasonably accurate, the NSO normally updates them once a decade.

- It has now been more than 10 years since the weights were changed, and there are no signs of a base year revision.

- As a result, the sectoral weights are still based on the structure of the economy in 2010-11, when in particular the information technology sector was much smaller.

[3] Measurement of unorganised sector

- Measurement of the unorganised sector has always been difficult in India.

- Once in a while, the NSO undertakes a survey to measure the size of the sector.

- In the meantime, it simply assumes that the sector has been growing at the same rate as the organised sector.

- However, starting in 2016 the unorganised sector has been disproportionately impacted by a series of shocks.

- In 2018, the NBFC sector reported serious problems, which in turn impacted unorganised sector firms since they were heavily dependent on NBFCs for funds.

- From 2020 onwards, the pandemic has impacted the unorganised sector more than the organised sector enterprises.

- Despite these shocks, the NSO does not seem to have made any adjustments to its methodology for estimating the growth of the unorganised sector.

Consider the question “Elaborate the issues with India’s GDP data. Suggest the way forward.”

Conclusion

There are serious problems with India’s GDP data. Any analysis of recovery or growth forecast based on this data must be taken with a handful of salt.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Read the attached story

Mains level: WTO reforms

China’s status as a ‘developing country’ at the World Trade Organization (WTO) has become a contentious issue with a number of countries raising concerns.

Defining a country’s ‘Development’

- There are no WTO definitions of “developed” or “developing” countries.

- Developing countries in the WTO are designated on the basis of self-selection although this is not necessarily automatically accepted in all WTO bodies.

- The WTO however recognizes as least-developed countries (LDCs) those countries which have been designated as such by the United Nations.

Benefits of ‘Developing Country’ tag

- Special and differential treatment: Certain WTO agreements give developing countries special rights through ‘special and differential treatment’ (S&DT) provisions.

- Preferential treatment: The classification also allows other countries to offer preferential treatment.

- Longer timeframe for pacts: WTO can grant developing countries longer timeframes to implement the agreements and even commitments to raise trading opportunities for such countries.

Issues with Chinese ‘Developing Country’ status

- China has become an upper-middle-income country according to the World Bank.

- It involves in unfair trade practices such as preferential treatment for state enterprises, data restrictions and inadequate enforcement of intellectual property rights.

How has China responded?

- China has consistently maintained that it is the “world’s largest developing economy”.

- It has recently indicated that it may be willing to forego many benefits of being a developing country.

What are the benefits of LDC classification?

- The WTO recognizes LDCs relying on a classification by the UN based on criteria that is reviewed every three years. LDCs are often exempted from certain provisions of WTO pacts.

- Bangladesh, currently classified as an LDC, receives zero duty, zero quota access for almost all exports to the EU.

- It is, however, set to graduate from the LDC status in 2026 as its per capita GDP has risen sharply surpassing that of India in FY21.

Try this question from CS Mains 2018:

Q.What are the key areas of reform if the WTO has to survive in the present context of ‘Trade War’, especially keeping in mind the interest of India?

Reference: https://www.civilsdaily.com/sansad-tv-perspective-wto-reforms/

(Aspirants need not write whole answers. Just a quick summary with keywords would suffice.)

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: CAA

Mains level: Issues with CAA

The Ministry of Home Affairs (MHA) has sought another extension from parliamentary committees to frame the rules of the Citizenship (Amendment) Act (CAA), 2019.

What is Citizenship Amendment Act (CAA), 2019?

- The act is sought to amend the Citizenship Act, 1955 to make Hindu, Sikh, Buddhist, Jain, Parsi, and Christian illegal migrants from Afghanistan, Bangladesh, and Pakistan, eligible for citizenship of India.

- In other words, it intends to make it easier for non-Muslim immigrants from India’s three Muslim-majority neighbours to become citizens of India.

- Under The Citizenship Act, 1955, one of the requirements for citizenship by naturalization is that the applicant must have resided in India during the last 12 months, as well as for 11 of the previous 14 years.

- The amendment relaxes the second requirement from 11 years to 6 years as a specific condition for applicants belonging to these six religions, and the aforementioned three countries.

- It exempts the members of the six communities from any criminal case under the Foreigners Act, 1946 and the Passport Act, 1920 if they entered India before December 31, 2014.

Key feature: Defining illegal migrants

- Illegal migrants cannot become Indian citizens in accordance with the present laws.

- Under the CAA, an illegal migrant is a foreigner who: (i) enters the country without valid travel documents like a passport and visa, or (ii) enters with valid documents, but stays beyond the permitted time period.

- Illegal migrants may be put in jail or deported under the Foreigners Act, 1946 and The Passport (Entry into India) Act, 1920.

Exceptions

- The Bill provides that illegal migrants who fulfil four conditions will not be treated as illegal migrants under the Act. The conditions are:

- they are Hindus, Sikhs, Buddhists, Jains, Parsis or Christians;

- they are from Afghanistan, Bangladesh or Pakistan;

- they entered India on or before December 31, 2014;

- they are not in certain tribal areas of Assam, Meghalaya, Mizoram, or Tripura included in the Sixth Schedule to the Constitution, or areas under the “Inner Line” permit, i.e., Arunachal Pradesh, Mizoram, and Nagaland.

Controversy with the Act

- Country of Origin: The Act classifies migrants based on their country of origin to include only Afghanistan, Pakistan and Bangladesh.

- Other religious minorities ignored: It is unclear why illegal migrants from only six specified religious minorities have been included in the Act.

- Defiance of purpose: India shares a border with Myanmar, which has had a history of persecution of a religious minority, the Rohingya Muslims.

- Date of Entry: It is also unclear why there is a differential treatment of migrants based on their date of entry into India, i.e., whether they entered India before or after December 31, 2014.

Way forward

- India is a constitutional democracy with a basic structure that assures a secure and spacious home for all Indians.

- Being partitioned on religious grounds, India has to undertake a balancing act for protecting the religious minorities in its neighbourhood.

- These minorities are under constant threat of persecution and vandalism.

- India needs to balance the civilization duties to protect those who are prosecuted in the neighbourhood.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Darvaza Gas Crater, TAPI gas pipeline

Mains level: Not Much

Turkmenistan President has ordered experts to find a way to extinguish a fire in a huge natural gas crater, the Darvaza gas crater also known as the ‘Gateway to Hell’.

Darvaza Gas Crater

- Located in the Karakum desert, 260 kilometres away from Turkmenistan’s capital, Ashgabat, the crater has been burning for the last 50 years.

- The crater is 69 metres wide and 30 metres deep.

- While the details of the origin of the crater are contested but it has been said that the crater was created in 1971 during a Soviet drilling operation.

- In 1971, Soviet geologists were drilling for oil in the Karakum desert when they hit a pocket of natural gas by mistake, which caused the earth to collapse and ended up forming three huge sinkholes.

Why is it flamed?

- This pocket of natural gas contained methane, hence to stop that methane from leaking into the atmosphere, the scientists lit it with fire, assuming the gas present in the pit would burn out within a few weeks.

- The scientists seemed to have misjudged the amount of gas present in the pit, because the crater has been on fire for five decades now.

A popular tourist attraction

- The crater has become a significant tourist attraction in Turkmenistan.

- In 2018, the country’s president officially renamed it as the “Shining of Karakum”.

Why did Turkmenistan order to extinguish it?

- Calling it a human-made crater, it has negative effects on both environment and the health of the people living nearby.

- It also ends up losing valuable natural resources for which could fetch significant profits.

How harmful are methane leaks?

- Methane is the primary contributor to the formation of ground-level ozone, a hazardous air pollutant and greenhouse gas, exposure to which causes 1 million premature deaths every year.

- Methane is also a powerful greenhouse gas. Over a 20-year period, it is 80 times more potent at warming than carbon dioxide.

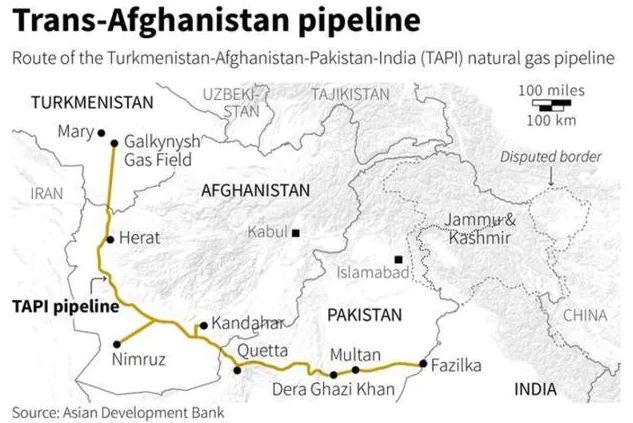

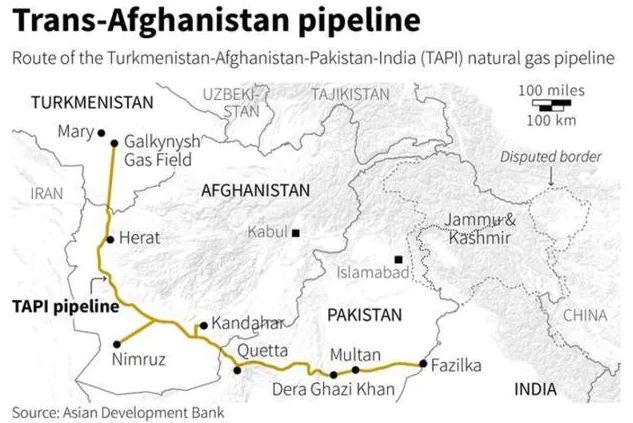

Back2Basics: TAPI Gas Pipeline

- The Turkmenistan–Afghanistan–Pakistan–India (TAPI) Pipeline is a natural gas pipeline being developed with the participation of the Asian Development Bank.

- It will be a 1,814km trans-country natural gas pipeline running across four countries.

- It will transport natural gas from the Galkynysh Gas Field in Turkmenistan through Afghanistan into Pakistan and then to India.

- The plan for the TAPI project was originally conceived in the 1990s to generate revenue from Turkmenistan’s gas reserves by exporting natural gas via Afghanistan to Pakistan and India.

- Construction on the project started in Turkmenistan on 13 December 2015, work on the Afghan section began in February 2018, and work on the Pakistani section was planned to commence in December 2018.

- Presently, the construction work has been stalled due to terror activities of Taliban in Afghanistan since few years.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Red Sanders

Mains level: Illegal trade

Red Sanders (Red Sandalwood) has fallen back into the ‘endangered’ category in the International Union for Conservation of Nature’s (IUCN) Red List.

A recently released and trending Telugu movie plot provides a fictional account of red sandal smuggling.

About Red Sanders

- The species, Pterocarpus santalinus, is an Indian endemic tree species, with a restricted geographical range in the Eastern Ghats.

- It is endemic to a distinct tract of forests in Andhra Pradesh.

- It is mainly found in Chittoor, Kadapa, Nandhyal, Nellore, Prakasam districts of Andhra Pradesh.

- It was classified as ‘near threatened’ in 2018 and has now joined the ‘endangered’ list once again in 2021.

- It is listed under Appendix II of CITES and is banned from international trade.

Status of legal protection in India

- The Union Environment Ministry had decided to keep Red Sanders (red sandalwood) OUT of the Schedule VI of Wild Life Protection Act, 1972, arguing that this would discourage the cultivation of the rare plant species.

- Schedule VI regulates and restricts the cultivation, possession, and sale of a rare plant species.

Significance of listing

- It was a moment of celebration when the species was lifted off from the endangered category for the first time since 1997.

- Over the last three generations, the species has experienced a population decline of 50-80 percent.

- It is also scheduled in appendix II of the CITES and Wildlife Protection Act.

Threats to this species

- Red Sanders are known for their rich hue and therapeutic properties, are high in demand across Asia, particularly in China and Japan.

- They are used in cosmetics and medicinal products as well as for making furniture, woodcraft and musical instruments.

- Its popularity can be gauged from the fact that a tonne of Red Sanders costs anything between Rs 50 lakh to Rs 1 crore in the international market.

Try this question from CSP 2016:

Q.With reference to ‘Red Sanders’, sometimes seen in the news, consider the following statements:

- It is a tree species found in a part of South India.

- It is one of the most important trees in the tropical rain forest areas of South India.

Which of the above statements is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Post your answers here.

Back2Basics: Red List Categories of IUCN

Species are classified by the IUCN Red List into nine groups specified through criteria such as rate of decline, population size, area of geographic distribution, and degree of population and distribution fragmentation. They are:

- Extinct (EX) – beyond reasonable doubt that the species is no longer extant.

- Extinct in the wild (EW) – survives only in captivity, cultivation and/or outside native range, as presumed after exhaustive surveys.

- Critically endangered (CR) – in a particularly and extremely critical state.

- Endangered (EN) – very high risk of extinction in the wild, meets any of criteria A to E for Endangered.

- Vulnerable (VU) – meets one of the 5 red list criteria and thus considered to be at high risk of unnatural (human-caused) extinction without further human intervention.

- Near threatened (NT) – close to being at high risk of extinction in the near future.

- Least concern (LC) – unlikely to become extinct in the near future.

- Data deficient (DD)

- Not evaluated (NE)

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Various air pollutants

Mains level: NAAQ standards

Delhi and most of the other non-attainment cities under the National Clean Air Programme (NCAP) have shown only a marginal improvement, said a new analysis released.

About NCAP

- The NCAP was implemented across India in 2019 to reduce particulate matter levels in 132 cities by 20-30% in 2024.

- Cities are declared non-attainment if they consistently fail to meet the National Ambient Air Quality Standards (NAAQS) over a five-year period.

What are NAAQ standards?

- The mandate provided to the Central Pollution Control Board (CPCB) under the Air (Prevention and Control of Pollution) Act empowers it to set standards for the quality of air.

- Hence the current National Ambient Air Quality Standards were notified in November 2009 by the CPCB.

- Prior to this, India had set Air Quality standards in 1994, and this was later revised in 1998.

- The 2009 standards further lowered the maximum permissible limits for pollutants and made the standards uniform across the nation.

- Earlier, less stringent standards were prescribed for industrial zones as compared to residential areas.

Pollutants covered:

- Sulphur Dioxide (SO2)

- Nitrogen Dioxide (NO2),

- Particulate Matter (size less than 10 µm) or PM 10

- Particulate Matter (size less than 2.5 µm) or PM2.5

- Ozone (O3)

- Carbon Monoxide (CO)

- Ammonia (NH3)

(Air Pollutants that most of us NEVER heard of:)

- Lead

- Benzene (C6H6)

- Benzo(a)Pyrene (BaP)

- Arsenic(As)

- Nickel (Ni)

Source: Arthpaedia

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Samba Cultivation

Mains level: NA

Around four lakh more acres have been brought under the Crop Insurance Scheme for the Samba Cultivation season of 2021-22 in Tamil Nadu.

What is Samba Cultivation?

- It is a Tamil name for paddy cultivation season.

- Other paddy seasons in Tamil Nadu include:

- Kuruvai: June-July

- Samba: August

- Late Samba / Thaladi: September- October

- Navarai: December- January

Back2Basics: Major crop seasons

(1) Kharif Crop

- Kharif crops, monsoon crops, or autumn crops are cultivated and harvested in the monsoon season.

- The farmers sow seeds at the beginning of the monsoon season and harvest them at the end of the season. i.e., between September and October.

- Kharif crops need a lot of water and hot weather for proper growth.

- Examples: Rice, Maize, Millet, Soybean, Arhar, Cotton. etc.

(2) Rabi Crop

- Rabi means spring in Arabic. Crops grown in the winter season [October to December] and harvested in the spring season [Aril-May] are called Rabi crops.

- These crops require a warm climate for germination and maturation of seeds and need a cold environment for their growth.

- Rain in winter spoils the Rabi crop but is good for the Kharif crop.

- Examples: Wheat, Gram, Barley, Peas, Oats, Chickpea, Linseed, Mustard, etc.

(3) Zaid Crop

- Zaid crops are grown between Kharif and Rabi Seasons, i.e., between March to June.

- They require warm, dry weather as a vital growth period and longer day length for flowering.

- Zaid crop is significant for farmers as it gives fast cash to the farmers and is also known as gap-filler between two chief crops, Kharif and Rabi.

- Examples: Cucumber, Pumpkin, Bitter gourd, Watermelon, Muskmelon, Sugarcane, Groundnut, Pulses, etc.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Model BIT

Mains level: Paper 3- Reviev of BITs

Context

The report of the Standing Committee on External Affairs on ‘India and bilateral investment treaties (BITs)’ was presented to Parliament last month.

Factor’s that necessitated the review of India’s BITs

- Investor’s started suing India frequently: Since 2011, when India lost its first investment treaty claim in White Industries v. India, foreign investors have sued India around 20 times for alleged BIT breaches.

- This made India the 10th most frequent respondent-state globally in terms of investor-state dispute settlement (ISDS) claims from 1987 to 2019 (UNCTAD).

- Adoption of new Model BIT: India adopted a new Model BIT in 2016, which marked a significant departure from its previous treaty practice.

- Negotiating new BITs: India is in the process of negotiating new investment deals (separately or as part of free trade agreements) with important countries such as Australia and the U.K.

Recommendations of the Committee

- 1] Speed of the existing negotiations: India has signed very few investment treaties after the adoption of the Model BIT.

- It recommends that India expedite the existing negotiations and conclude the agreements at the earliest because a delay might adversely impact foreign investment.

- 2] Sign more BIT’s in core sector: The committee recommends that India should sign more BITs in core or priority sectors to attract FDI.

- Generally, BITs are not signed for specific sectors.

- It will require an overhauling of India’s extant treaty practice that focuses on safeguarding certain kinds of regulatory measures from ISDS claims rather than limiting BITs to specific sectors.

- 3] Fine-tune Model BIT: Model BIT gives precedence to the state’s regulatory interests over the rights of foreign investors.

- The Model BIT should be recalibrated keeping two factors in mind:

- a) tightening the language of the existing provisions to circumscribe the discretion of ISDS arbitral tribunals.

- b) striking a balance between the goals of investment protection and the state’s right to adopt bonafide regulatory measures for public welfare.

- 4] Improve the capacity of government officials: The committee recommends bolstering the capacity of government officials in the area of investment treaty arbitration.

- While the government has taken some steps in this direction through a few training workshops, more needs to be done.

- What is needed is an institutionalised mechanism for capacity-building through the involvement of public and private universities.

- The government should also consider establishing chairs in universities to foster research and teaching activities in international investment law.

Need to improve poor governance

- A very large proportion of ISDS claims against India is due to poor governance.

- This includes changing laws retroactively which led to Vodafone and Cairn suing India.

- Annulling agreement in the wake of imagined scam which resulted in taking away S-band satellite spectrum from Devas.

- The judiciary’s fragility in getting its act together (sitting on the White Industries case for enforcement of its commercial award for years).

Suggestions

- The Committee could have emphasised on greater regulatory coherence, policy stability, and robust governance structures to avoid ISDS claims.

- The government should promptly assemble an expert team to review the Model BIT.

Consider the question “India is one of the most frequent respondent-state globally in terms of investor-state dispute settlement (ISDS) claims. In context of this, examine the reasons for such frequent disputes and suggest the way forward.”

Conclusion

The committee’s report on India’s BITs have novel suggestions, but it is lacking in several aspects.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Back2Basics: ISDS mechanism

- Investor-state dispute settlement (ISDS) is a mechanism in a free trade agreement (FTA) or investment treaty that provides foreign investors, with the right to access an international tribunal to resolve investment disputes.

- ISDS promotes investor confidence and can protect against sovereign or political risk.

- If a country does not uphold its investment obligations, an investor can have their claim determined by an independent arbitral tribunal, usually comprising three arbitrators.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Centrality of Central Asian region for India

Context

When Prime Minister Narendra Modi hosts the five Central Asia leaders at the Republic Day Parade on January 26, it will send a strong signal — of the new prominence of the Central Asian region in India’s security calculations.

Why India needs effective continental policy

- Factors intensifying geopolitical competition: China’s assertive rise, withdrawal of forces of the United States/North Atlantic Treaty Organization (NATO) from Afghanistan, the rise of Islamic fundamentalist forces, the changing dynamics of the historic stabilising role of Russia (most recently in Kazakhstan) and related multilateral mechanisms — the Shanghai Cooperation Organization (SCO), the Collective Security Treaty Organisation, and the Eurasian Economic Union — have all set the stage for a sharpening of the geopolitical competition on the Eurasian landmass.

- Progress in ties: India’s continental strategy, in which the Central Asian region is an indispensable link, has progressed intermittently over the past two decades — promoting connectivity, incipient defence and security cooperation, enhancing India’s soft power and boosting trade and investment.

- It is laudable, but as is now apparent, it is insufficient to address the broader geopolitical challenges engulfing the region.

- To meet this challenge, evolving an effective continental strategy for India will be a complex and long-term exercise.

Leveraging maritime power

- India’s maritime vision and ambitions have grown dramatically during the past decade, symbolised by its National Maritime Strategy, the Security and Growth for All in the Region (SAGAR) and major initiatives relating to the Indo-Pacific and the Quad, in which maritime security figures prominently.

- It was also a response to the dramatic rise of China as a military power.

- Importance: Maritime security is important to keeping sea lanes open for trade, commerce and freedom of navigation, resisting Chinese territorial aggrandisement in the South China Sea and elsewhere, and helping littoral states resist Chinese bullying tactics in interstate relations.

- However, maritime security and associated dimensions of naval power are not sufficient instruments of statecraft as India seeks diplomatic and security constructs to strengthen deterrence against Chinese unilateral actions and the emergence of a unipolar Asia.

- Bulwarks against Chinese maritime expansionist gains are relatively easier to build and its gains easier to reverse than the long-term strategic gains that China hopes to secure on continental Eurasia.

- Centrality of Central Asia: Like Association of Southeast Asian Nations (ASEAN) centrality is key to the Indo-Pacific, centrality of the Central Asian states should be key for Eurasia.

Challenges for India

1] Connectivity challenge

- Connectivity means nothing when access is denied through persistent neighbouring state hostility contrary to the canons of international law.

- India has been subject for over five decades to a land embargo by Pakistan that has few parallels in relations between two states that are technically not at war.

- Lack of alternative route: Difficulties have arisen in operationalising an alternative route — the International North-South Transport Corridor on account of the U.S.’s hostile attitude towards Iran.

- With the recent Afghan developments, India’s physical connectivity challenges with Eurasia have only become harder.

- The marginalisation of India on the Eurasian continent in terms of connectivity must be reversed.

2] India must be aware of the limitations of the US

- The ongoing U.S.-Russia confrontation relating to Ukraine, Russian opposition to future NATO expansion and the broader questions of European security including on the issue of new deployment of intermediate-range missiles, following the demise of the Intermediate-Range Nuclear Forces (INF) treaty will have profound consequences for Eurasian security.

- The U.S. would be severely stretched if it wanted to simultaneously increase its force levels in Europe and the Indo-Pacific.

- A major conflict — if it erupts in Central Europe, pitting Russia, Ukraine and some European states — will stall any hopes of a substantial U.S. military pivot to the Indo-Pacific.

- India should be cognisant of the limitations of geography, obvious gaps between strategic ambition and capacity but also the inherently different standpoints of how major maritime powers view critical questions of continental security.

- India is unique as no other peer country has the same severity of challenges on both the continental and maritime dimensions.

Way forward for India

- India would need to acquire strategic vision and deploy the necessary resources to pursue our continental interests without ignoring our interests in the maritime domain.

- This will require a more assertive push for our continental rights — namely that of transit and access, working with our partners in Central Asia, with Iran and Russia, and a more proactive engagement with economic and security agendas ranging from the SCO, Eurasian Economic Union (EAEU) and the Collective Security Treaty Organization (CSTO).

- Striking the right balance between continental and maritime security would be the best guarantor of our long-term security interests.

Conclusion

India will need to define its own parameters of continental and maritime security consistent with its own interests. In doing so, at a time of major geopolitical change, maintaining our capacity for independent thought and action will help our diplomacy and statecraft navigate the difficult landscape and the choppy waters that lie ahead.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- China challenge

Context

Nearly 20 months after the border crisis began in Ladakh, China has pressed on with aggressive diplomatic and military gestures against India.

Recent anti- India moves by China

- Beijing recently renamed 15 places in Arunachal Pradesh, following the six it had done in 2017.

- China justifies the renaming as being done on the basis of its historical, cultural and administrative jurisdiction over the area — these old names existed since ancient times which had been changed by India with its “illegal occupation”.

- On January 1, 2022, Beijing’s new land border law came into force, which provides the People’s Liberation Army (PLA) with full responsibility to take steps against “invasion, encroachment, infiltration, provocation” and safeguard Chinese territory.

India’s response

- Delhi has run out of proactive options against Beijing that will force the Chinese leadership to change course on its India policy.

- The two countries have an increasingly lopsided trade relationship driven by Indian dependency on Chinese manufacturing, a situation further worsened by the Government’s mishandling of the novel coronavirus pandemic.

- To restore the status quo ante on the LAC as of April 2020, India undertook internal balancing of its military from the Pakistan border to the China border and external rebalancing through a closer partnership with the United States in the Indo-Pacific.

- Because of the China factor, the U.S. is currently looking away even as India mistreats its minorities and its democracy stands diminished.

- India’s difficult diplomatic and military engagement with China is going to leave it more dependent on U.S. support, rendering India more vulnerable to American pressure on ‘shared values’.

- With a rising China as its neighbour and a more self-centred U.S. – which is uncomfortable with India’s reliable partner, Russia — as its friend, Delhi continues to face difficult choices.

Conclusion

Put under the harsh glare, India has been found wanting in its ability to deal with future challenges. The immediate challenge, however, remains China. It cannot be wished away and must be tackled.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Issues with the Personal Data Protection Bill

Context

The Joint Committee report on the Bill has failed to provide robust draft legislation ensuring the privacy of citizens.

Background of the Personal Data Protection Bill

- The Puttaswamy judgment held that the right to privacy is a fundamental right.

- The Puttaswamy judgment and the Justice B.N. Srikrishna committee report led to the Personal Data Protection Bill of 2019.

- The Joint Committee report on the Bill has failed to provide a robust draft legislation ensuring the privacy of citizens.

Issues with the Joint Committee report on Personal Data Protection Bill

- Division into Government and private domains: The report has divided the digital world into two domains — government and private.

- This division is based on the presumption that the question of right to privacy emerges only where operations and activities of private entities are concerned.

- Exemption to government and government agencies: Clause 12 of the Bill provides exemptions for the government and government agencies and Clause 35 exempts government agencies from the entire Act itself.

- Clause 12, which says personal data can be processed without consent for the performance of any function of the state, is an umbrella clause that does not specify which ministries or departments will be covered.

- The issue with the defining harm: The Bill says, “harm includes any observation or surveillance that is not reasonably expected by the data principal”.

- This means if you install any software in your computer and the software violates the principle of privacy and data get leaked, the complaint of the data principal will not be legally tenable as the defence will be that ‘once you have installed the software, you should have reasonably expected this level of surveillance’.

- The government can use these provisions as a means of control and surveillance.

- The Committee has failed to provide formidable firewalls to protect the privacy of individuals and has also carved out a mechanism for government control over personal data.

- Against the Supreme Court judgement: The provisions are ultra vires of the judgment on privacy.

- Inclusion of non-personal data harms the economy: By including non-personal data within the ambit of the Bill, the Joint Committee has put a huge compliance burden on the economy.

- This will hit the MSME sector and small businesses harder as technical processes involving data-sharing are very expensive.

- The government-constituted panel headed by S. Gopalkrishnan also opposed the idea of including non-personal data in the Bill.

- Mandatory data localisation, it is estimated, will squeeze the economy by 0.7-1.7%.

- Hamper the smooth cross-border flow of data: This may also invite similar measures by other sovereign countries which will hamper smooth cross-border flow of data.

Concerns with the Data Protection Authority

- For compliance with the provisions of the Act, a data protection authority (DPA) has to be appointed.

- It is doubtful whether a single authority will be able to discharge so many functions in an efficient manner.

- Concern with appointment: Unlike the Justice Srikrishna committee report which provided for a judicial overlook in the appointments of the DPA, the Bill entrusts the executive with the appointments.

- Although the Joint Committee report expanded the committee, the power to appoint the panelists vests with the Central government.

- Lack of independence: Clause 86 says, “Authority should be bound by the directions of the Central Government under all cases and not just on questions of policy”.

- This weakens its independence and gives the government excessive control.

- Violation of federalism: There is internal data flow and the States are key stakeholders in the process.

- Even if the proposed central authority issues directions to allow processing of data on the grounds of ‘public order’, it is important to note that ‘public order’ is an entry in the State List.

Consider the question “What are the issues with the provision in the Personal Data Protection Bill, 2019? Suggest the way forward.”

Conclusion

The report has raised more questions than it has solved. At the time of passage of the Bill, loopholes must be plugged so that India can have a robust data protection law.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Online abuse of Women

Taking cognizance of multiple complaints that photographs of women had been posted on a mobile app (with a very informal slang name) for fake auctions, the police in Delhi and Mumbai have registered cases.

What is the controversy?

- Hundreds of women in India including journalists, social workers, and other prominent personalities found their images and derogatory content about them on a new app.

- The app was created on hosting platform Github, offered an online “auction” of women (esp from a particular community).

- This controversy is part of the routine harassment women faced on social media in an increasingly polarized communal environment.

Online Abuse of Women

- Online abuse includes a diversity of tactics and malicious behaviors ranging from:

- Sharing embarrassing and cruel content about a person to impersonation

- Stalking and electronic surveillance

- Nonconsensual use of photography

- Violent threats and hate speech

- Defamation

- Flaming- use of vitriolic and hostile messages including threats, insults

- Trolling

- The online harassment of women, sometimes called Cybersexism or cybermisogyny, is specifically gendered abuse targeted at women and girls online.

- It incorporates sexism, racism and religious prejudice.

Recent controversy: A critical case of abuse

- The app is clearly an example of online trolling where the dignity and modesty of a woman is highly downgraded.

- This has not been the very first time. Earlier, no arrests were ever made showing Police inaction.

- The authorities were using the Mutual Legal Assistance Treaty (MLAT) to obtain information about the creators of such apps from California-based GitHub.

Legal provisions against such Crimes

For making arrests, the police have invoked Sections 153A, 153B, 295A, 354D, 500 and 509 of the Indian Penal Code (IPC) and Section 67 of the Information Technology Act.

- Section 153A pertains to the offence of promoting enmity between different groups on grounds of religion, etc., and doing acts prejudicial to the maintenance of harmony

- Section 153B relates to imputations, assertions prejudicial to national-integration

- Section 295A provides punishment for deliberate and malicious acts intended to outrage religious feelings

- Section 354D provides that any man who monitors the use by a woman of the internet, email or any other form of electronic communication with malintent, commits the offence of stalking.

- Section 500 defines the punishment for defamation

- Section 509 addresses the offence of word, gesture or act intended insulting the modesty of a woman

- Section 67 of the IT Act lays down the punishment for publishing or transmitting obscene material in electronic form

Penalty for such crime

- The first conviction attracts imprisonment up to three years and fine up to ₹5 lakh and the second or subsequent conviction may lead to imprisonment up to five years and fine that may extend to ₹10 lakh.

What are the other provisions related to cybercrimes?

- Section 66E of the IT Act prescribes punishment for violation of privacy.

- Also, sections 354A (sexual harassment and punishment for sexual harassment) and 354C (voyeurism) of the IPC were introduced along with sections 354B and 354D in 2013.

- These may also be applied in conjunction with the relevant IT Act provisions, based on the nature of the offence.

What are the responsibilities of intermediaries like social media platforms?

- As of now, the intermediaries are not liable for any third-party data or communication link hosted or stored by them.

- They are required to retain the requisite data for duration as prescribed by the Government and supply the same to the authorities concerned, as and when sought.

- Any contravention attracts punishment as prescribed under the IT Act.

Additional steps been taken

- The Ministry of Electronics and Information Technology notified the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021.

- Its provision —“Due diligence by intermediaries and grievance redressal mechanism” —requires them to inform their users not to host, display, upload, modify, publish, transmit, store, update or share any illegal information.

- They include contents that are defamatory, obscene, pornographic, paedophilic, invasive of another’s privacy, insulting or harassing on the basis of gender, libellous, racially or ethnically objectionable, etc.

- The intermediaries, on the direction of the court or appropriate government agency, are prohibited from hosting, storing or publishing any information declared unlawful.

- Within 24 hours from the receipt of a complaint from, or on behalf of, an individual about any offensive content, they are required to take all reasonable and practicable measures to remove or disable access to it.

Way forward

- The government can take action beyond passing and enforcing platform regulations.

- It can promote digital education to recognize and report inappropriate online conduct and to communicate respectfully online.

- Social media companies have the primary responsibility to prevent the amplification of online abuse and disinformation.

Conclusion

- Gender-based harassment is marked by the intent of the harasser to denigrate the target on the basis of sex.

- But this proliferation of online harassment of women has now incorporated religious polarization.

- This is very harmful for the existing communal harmony of the nation in the long run.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Read the attached story

Mains level: States Legislature

The Election Commission of India has announced dates for Assembly elections in Uttar Pradesh, Uttarakhand, Punjab, Goa and Manipur.

Why conduct elections even during COVID outbreak?

- Article 172(1) of the Constitution sets a five-year term for each Assembly.

- Any postponement of Assembly elections may result in a situation that denies people of that State the right to elect an accountable government of their choice.

States Legislature : A detail background

- The State Legislative Assembly is a legislative body in the states and union territories of India.

- In the 28 states and 3 union territories with a unicameral state legislature, it is the sole legislative body and in 6 states it is the lower house of their bicameral state legislatures with the upper house being Legislative Council.

- 5 UTs are governed directly by the Union Government of India and have no legislative body.

Term of reference

- Each Member of the Legislative Assembly (MLA) is directly elected to serve 5 year terms by single-member constituencies.

- The Constitution of India states that a State Legislative Assembly must have no less than 60 and no more than 500 members.

- However an exception may be granted via an Act of Parliament as is the case in the states of Goa, Sikkim, Mizoram and the union territory of Puducherry which have fewer than 60 members.

- A State Legislative Assembly may be dissolved in a state of emergency, by the Governor on request of the Chief Minister, or if a motion of no confidence is passed against the ruling majority party or coalition.

State Executive

- State Executive consists of Governor and the Council of Ministers with the Chief Minister as its head.

- Executive power of the state is vested in Governor.

- He/She is appointed by the President for a term of five years and holds office during his pleasure.

- Only Indian citizens above 35 years of age are eligible for appointment to this office.

- The Chief Minister is appointed by the Governor, who also appoints other ministers on the advice of the CM.

Powers and Functions

State legislature has exclusive powers over subjects enumerated in the State List and Concurrent Lists (List II of the Seventh Schedule) of the Constitution and concurrent powers over those enumerated in sub List III.

(1) Regarding Ordinary Laws

- Ordinary bills can be introduced in either of the two houses in case the State Legislature is bicameral, however, the Money Bill has to initially be introduced in the Vidhan Sabha.

- The State Legislature can formulate laws on the subject of State and Concurrent Lists.

- However, in case there is any contradiction between the Union and State law, the law decided by the Parliament shall prevail.

(2) Financial Powers

- Financial powers of legislature include authorization of all expenditure, taxation and borrowing by the state government.

- The Legislative Assembly alone has the power to originate money bills.

- The Legislative Council can only make recommendations in respect of changes it considers necessary within a period of fourteen days of the receipt of money bills, which can accept or reject these recommendations.

Role of Governor

- The Governor of a state may reserve any Bill for the consideration of the President.

- No Bills seeking to impose restrictions on inter-state trade can be introduced in a state legislature without the previous sanction of the President.

Try this PYQ:

Q. Which one of the following suggested that the Governor should be an eminent person from outside the State and should be a detached figure without intense political links or should not have taken part in politics in the recent past?

(a) First Administrative Reforms Commission (1966)

(b) Rajamannar Committee (1969)

(c) Sarkaria Commission (1983)

(d) National Commission to Review the Working of the Constitution (2000)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Inner Line Permit System

Mains level: Issues with ILP system

A petition has been filed in the Supreme Court opposing the implementation of the Inner Line Permit System (ILPS) in Manipur.

What is Inner Line Permit?

- A concept drawn by colonial rulers, the Inner Line separated the tribal-populated hill areas in the Northeast from the plains.

- The concept originates from the Bengal Eastern Frontier Regulation Act (BEFR), 1873.

- To enter and stay for any period in these areas, Indian citizens from other areas need an Inner Line Permit (ILP).

- Arunachal Pradesh, Nagaland and Mizoram are protected by the Inner Line, and lately, Manipur was added (in December last year).

Its’ Inception

- The policy of exclusion first came about as a response to the reckless expansion of British entrepreneurs into new lands which threatened British political relations with the hill tribes.

- The BEFR prohibits an outsider’s — “British subject or foreign citizen” — entry into the are beyond the Inner Line without a pass and his purchase of land there.

- On the other hand, the Inner Line also protects the commercial interests of the British from the tribal communities.

- After Independence, the Indian government replaced “British subjects” with “Citizen of India”.

- Today, the main aim of the ILP system is to prevent settlement of other Indian nationals in the States where the ILP regime is prevalent, in order to protect the indigenous/tribal population.

Why need ILP?

- Despite the fact that the ILP was originally created by the British to safeguard their commercial interests, it continues to be used in India.

- It aims to protect tribal cultures in northeastern India.

- There are different kinds of ILP’s, one for tourists and others for people who intend to stay for long-term periods, often for employment purposes.

- ILP’s valid for tourism purposes are granted as a matter of routine.

Issues with ILP

- It has been extensively used to restrict the entry of tribals.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: EWS Quota

Mains level: Hurdles to EWS quota

The government has accepted the report by a committee under the Ministry of Social Justice and Empowerment, which examined the income criteria for determining who are to be included among the EWS.

EWS Quota: A Backgrounder

- On July 29 last year, the Centre had issued a notification for implementing 10% reservation for EWS along with 27% for OBC within these courses.

- Following the petitions, the Supreme Court has stayed counseling for admission until the matter is decided.

- The NEET notification followed the same criteria for determining EWS as mentioned in a notification from the Department of Personnel and Training (DoPT).

Inception of EWS Quota

- EWS reservation was granted based on the recommendations of a commission headed by Major General (retd) S R Sinho.

- The Commission for Economically Backward Classes was constituted by the then UPA government in 2005, and submitted its report in July 2010.

- Based on this, the Cabinet in January 2019 decided to amend the Constitution (103rd Amendment) to provide reservation to EWS.

Prime basis: Income criteria

- The criteria include a Rs 8 lakh income ceiling for inclusion in EWS — which is the same as the criterion for deciding the “creamy layer” among the OBCs (those who are not in government).

- The notification said income shall include income from all sources i.e. salary, agriculture, business, profession, etc for the financial year prior to the year of application.

- Another criterion is that a person whose family owns or possesses 5 acres of agricultural land or more will be excluded from EWS.

Why was the new committee constituted?

- The committee aimed to revisit the criteria for determining the economically weaker sections in terms of the provisions of the explanation to Article 15 of the Constitution.

- It followed the Supreme Court’s observation that the income criterion for determining EWS was “arbitrary”.

- The Supreme Court is presently hearing a number of petitions, including a special leave petition filed by the Centre against a Madras HC order on EWS and OBC reservation in the all-India quota for NEET.

Key recommendations

- The report says that the “threshold of Rs 8 lakh of annual family income, in the current situation, seems reasonable for determining EWS”.

- The committee has recommended that EWS may, however, exclude, irrespective of income, a person whose family has 5 acres of agricultural land and above.

- The committee has removed the criteria that excluded some categories from EWS:

- Owners of residential properties of 1,000 sq ft and above

- Residential plots of 100 sq yards and above in notified municipalities

- Residential plots of 200 sq yards and above in areas other than the notified municipalities

How does it address the questions raised by the Supreme Court?

- The Supreme Court has earlier questioned the basis of Rs 8 lakh criteria and termed it arbitrary without any substantiation.

- It asserted that this criteria is similar to that of Creamy Layer in OBCs.

What did the committee say on Income Criteria?

- The committee’s report now states the two sets of criteria are significantly different despite both using the Rs 8 lakh cut-off and that the criteria for the EWS.

- EWS criteria are much more stringent than those for the OBC creamy layer.

- The report justifies this income limit, stating that Rs 8 lakh cut off also has a link with the income tax exemption limit.

- It would, therefore, be logical to use the income tax exemption limit to determine the threshold for EWS.

Tap here to read more about:

[Sansad TV] Perspective: Defining EWS

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Draft Regional Plan 2041

Mains level: Issues with the plan

Many environment analysts and activists has offered objections to the Draft Regional Plan-2041 for National Capital Region (NCR).

Draft Regional Plan 2041

- The National Capital Region Planning Board had sought objections and suggestions to the Draft RP-2041 from public.

- Under the NCRPB plan, Delhi, two districts of Rajasthan, eight districts of Uttar Pradesh and 14 districts of Haryana are covered. In all, it covers an area of around 55,083 square kilometres.

- The plan paves the way for a future-ready and slum-free NCR comprising of facilities like air ambulance, high-speed connectivity by means of rail, road, Heli taxis, and inland waterways.

Key provisions

- This plan puts special impetus on 30-minute connectivity by means of super-fast trains within major cities of NCR.

- It also proposes to explore feasibility of 30-minute Mass Transit Rail System (MTRS) from boundaries of NCR to Delhi.

- The plan seeks to make NCR a smart connected region by improving connectivity using bullet trains, smart roads, and helitaxi services.

- It will evolve the region into an economically prosperous region comprising of citizen centric harmonious infrastructure.

- It laid emphasis on circular economy of water & air quality improvements, improving environment conservation.

Need for the plan

- There was a need to ease out traffic congestions and create more integrated, accessible, user-centric and affordable transportation system.

Various objections with the Plan

- The plan excludes the terms “Aravalli” and “forest areas” from the Natural Conservation Zone (NCZ).

- The Aravallis were an integral part of the NCZ in the current Regional Plan-2021.

- This has left Aravallis open to unlimited real estate construction.

- Similarly, the phrase “forest areas” has been deleted from the NCZ also. This will drastically reduce the forest cover that is eligible for NCZ zoning protection.

Why Aravallis matters?

- The Aravallis are home to over 400 species of native trees, shrubs and herbs, more than 200 native and migratory bird species, and wildlife that includes leopards, jackals, hyenas, mongoose and civet cats.

- They are crucial to groundwater recharge, which is significant given the water scarcity the region faces during harsh summer months.

- The thick forest cover helps to naturally purify air in a region plagued by high levels of vehicular and industrial pollution through the year.

Back2Basics: Aravali Range

- The Aravali is a mountain range in Northwestern India, running approximately 670 km in a southwest direction, starting near Delhi, passing through southern Haryana and Rajasthan, and ending in Gujarat.

- The highest peak is Guru Shikhar at 1,722 meters.

- The Aravalli Range, an eroded stub of ancient mountains, is the oldest range of fold mountains in India.

- The natural history of the Aravalli Range dates back to times when the Indian Plate was separated from the Eurasian Plate by an ocean.

- Three major rivers and their tributaries flow from the Aravalli, namely Banas and Sahibi rivers which are tributaries of Yamuna, as well as Luni River which flows into the Rann of Kutch.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now