Note4Students

From UPSC perspective, the following things are important :

Prelims level: Article 16

Mains level: Paper 2- Reservation in jobs for locals

Context

Last week, the Punjab and Haryana High Court admitted a petition challenging the constitutionality of the Act, and stayed the implementation until it heard the case.

Laws raises constitutional questions

- There are at least three important constitutional questions that arise from this Act.

[1] Violation of Article 19(1)(g)

- Article 19(1)(g) of the Constitution guarantees freedom to carry out any occupation, trade or business.

- There may be reasonable restrictions “in the interests of the general public”, and in particular related to specifying any professional or technical qualifications, or to reserve a sector for government monopoly.

- This Act, by requiring private businesses to reserve 75% of lower end jobs for locals, encroaches upon their right to carry out any occupation.

- In 2005, in the P.A. Inamdar case, Supreme Court said that reservation cannot be mandated on educational institutions that do not receive financial aid from the state, as that would affect the freedom of occupation.

[2] Violation of Article 16

- The provision of reservation by virtue of domicile or residence may be unconstitutional.

- Article 16 of the Constitution specifically provides for equality of opportunity for all citizens in public employment.

- It prohibits discrimination on several grounds including place of birth and residence.

- However, it permits Parliament to make law that requires residence within a State for appointment to a public office.

- This enabling provision is for public employment and not for private sector jobs.

- And the law needs to be made by Parliament, and not by a State legislature.

[3] Breaching of 50% limit

- In the Indra Sawhney case in 1992, the Supreme Court capped reservations in public services at 50%.

- It however said that there may be extraordinary situations which may need a relaxation in this rule.

- It also specified that “in doing so, extreme caution is to be exercised and a special case made out”.

- That is, the onus is on the State to make a special case of exceptional circumstances, for the 50% upper limit on reservations to be relaxed.

- It stated that the 50% limit is “to fulfil the objective of equality”, and that to breach the limit “is to have a society which is not founded on equality but on caste rule”.

- The Haryana Act does not further “caste rule” as it is for all residents of the State irrespective of caste but it breaches the notion of equality of all citizens of India.

[4] Against the conception of India as a one nation

- The Constitution conceptualises India as one nation with all citizens having equal rights to live, travel and work anywhere in the country.

- These State laws go against this vision by restricting the right of out-of-State citizens to find employment in the State.

- This restriction may also indirectly affect the right to reside across India as finding employment becomes difficult.

- If more States follow similar policies, it would be difficult for citizens to migrate from their State to other States to find work.

[5] Economic implications

- The move may potentially increase the costs for companies.

- There may also be an increase in income inequality across States as citizens of poorer States with fewer job opportunities are trapped within their States.

Conclusion

The courts, while looking at the narrow questions of whether these laws violate fundamental rights, should also examine whether they breach the basic structure of the Constitution that views India as one nation which is a union of States, and not as a conglomeration of independent States.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: GHG from agriculture

Mains level: Paper 3- Moving toward net-zero agriculture

Context

In the backdrop of the 2070 carbon neutrality target set by India at the CoP26 in Glasgow, the Union Budget for 2022-23 has listed “climate action” and “energy transition” as one of the four priorities for the Amrit Kaal.

Climate related announcement in Budget 2022-23

- An additional allocation of Rs 19,500 crore for solar PV modules has been made.

- The finance minister also talked of co-firing of 5-7 per cent of biomass pellets in thermal power plants, “sovereign green bonds” and a “battery-swapping policy”.

- These are positive steps towards making the energy and transport sectors less polluting.

How agriculture impact environement

- Agriculture contributes 73 per cent of the country’s methane emissions.

- Third largest emitter: India has kept away from the recent EU-US pledge to slash methane emissions by 30 per cent by 2030, despite the country being the world’s third largest emitter of methane.

- As per the national GHG inventory, the agriculture sector emits 408 MMT of carbon-dioxide equivalent and rice cultivation is the third highest source (17.5 per cent) of GHG emissions in Indian agriculture after enteric fermentation (54.6 per cent) and fertiliser use (19 per cent).

- Paddy fields are anthropogenic sources of atmospheric nitrous oxide and methane, which have been reckoned as 273 and 80-83 times more powerful than carbon dioxide in driving temperature increase in 20 years’ (Sixth Assessment Report IPCC 2021).

- Moreover, paddy fields require about 4,000 cubic metres of water per tonne of rice for irrigation.

- There is scientific evidence that intermittent flooding reduces water and methane emissions but increases nitrous oxide emissions.

- Thus, lowering of methane emissions through controlled irrigation does not necessarily mean net low emissions.

- Role of subsidies and procurement policies: The environmental damage caused by agriculture is largely a result of the various kinds of subsidies — on urea, canal irrigation and power for irrigation — as well as the minimum support prices (MSP) and procurement policies concentrated on a few states and largely on two crops, rice, and wheat.

Excess rice and wheat stock

- As of January 1, the stocks of wheat and rice in the country’s central pool were four times higher than the buffer stocking requirement.

- Rice stocks with the Food Corporation of India (FCI) are seven times the buffer norms for rice.

- The financial value of these excessive grain stocks is Rs 2.14 lakh crore, of which Rs 1.66 lakh crore is because of excess rice stocks — as per the economic cost of rice and wheat given by the FCI.

- All this does not just reflect inefficient use of scarce capital, the amount of greenhouse gases (GHG) embedded in these stocks is also large.

Way forward

- Carbon tax: According to the IMF, the world needs a carbon tax of $ 75 per tonne by 2030 to reduce emissions to a level consistent with a 2 degree Celsius warming target.

- India does not have an explicit carbon-price yet, but many countries have begun to implement carbon pricing.

- Revisiting policies: The Economic Survey 2021-22 points out that the country is over-exploiting its ground water resource (see map), particularly in the northwest and some parts of south India.

- This calls for revisiting policies to subsidise power and fertilisers, MSP and procurement and reorient them towards minimising GHG emissions.

- Farmer groups and the private sector can be mobilised to develop carbon markets in agriculture, both at the national and international levels, which can reward farmers in cash for switching from carbon-intensive crops to lower GHG emissions.

Consider the question “Elaborate on the impact of agriculture on the environment. Suggest the changes needed in Indian agriculture policies to reduce the impact.”

Conclusion

Such a move towards “net-zero” agriculture will give India a “climate smart” agriculture in Amrit Kaal. And, if we can protect productivity levels with a low-carbon footprint, it will help India to access global markets too.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Life Insurance Corporation of India (LIC)

Mains level: Disinvestment in India

The Union government has filed a draft document with the stock market regulator for selling 5% of its shares in the Life Insurance Corporation (LIC) of India.

Details of the IPO

- The IPO is a 100% OFS [offer for sale] by the Government of India and entails no fresh issue of shares by LIC.

- 6 Crore shares are on offer representing 5% of the government’s equity in the firm.

- As much as 10% of the offer could be reserved for LIC policyholders, as per the regulatory filing, and another 5% of the shares may be reserved for employees.

About Life Insurance Corporation of India (LIC)

- LIC is an Indian state-owned insurance group and investment corporation owned by the Government of India.

- It was founded in 1956 when the Parliament of India passed the Life Insurance of India Act that nationalized the insurance industry in India.

- Over 245 insurance companies and provident societies were merged to create the state-owned LIC.

Why LIC?

- LIC is India’s largest financial institution.

- When listed on stock exchanges, it could easily emerge as the country’s top listed company in terms of market valuation, overtaking current leaders Reliance and TCS.

- It is also the largest investor in government securities and stock markets every year.

- On average, LIC invests Rs 55,000 crore to Rs 65,000 crore in stock markets every year and emerges as the largest investor in Indian stocks.

- LIC also has huge investments in debentures and bonds besides providing funding for many infrastructure projects.

Impacts of listing of LICs

- Profit-making for govt: The government is trying to make the most of the brand value of LIC, given that it is one of the few remaining profit-making entities owned by the state.

- Better returns: Listing will boost LIC’s efficiency and thereby policy returns.

- Reforming the insurance sector: LIC will also become more competitive. This will put pressure on its peers to innovate, benefitting policyholders in terms of pricing, product features, and services.

- Better financial position: Less govt interference will be a positive for LIC’s financial health.

- Risk-free: As long as a sovereign guarantee over the maturity proceeds and the sum assured to continue, policyholders won’t perceive any risk.

Various challenges

- Structural challenges: LIC can even evolve into a bank like many of its global peers like Axa, Berkshire, and Munich Re.

- Market hurdles: LIC’s own issues are not the only challenge the company would face in going public. It also remains to be seen if the Indian share market is ready to absorb such a large public issue.

- Impact on growth: The size of the IPO will determine the extent of liquidity it will suck out, but Indian markets do not have the depth to take the issue of a very size.

- Fears of disclosure: The Company’s books and operations have been opaque for far too long but it is trusted by 250 million policyholders.

- Investors trust at risk: Being one of the biggest financial institutions of the country, the move to privatize LIC will shake the confidence of the common man and will be an affront to our financial sovereignty.

Way Forward

- Over the years, LIC has become the lender of last resort to the Government of India.

- Confronted with an unprecedented fiscal deficit and worried by an economy in crisis, the government has to find resources.

- This disinvestment is also a preferred option for ideological and practical reasons.

- The government could utilize the money gained by selling off its stakes to improve services in public goods like infrastructure, health, and education.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Various articles mentioned in news

Mains level: Need for UCC

Poll-bound Uttarakhand CM’s announcement to prepare a draft of the Uniform Civil Code (UCC) in the State, raises questions over whether an individual State can bring its own family law code.

What is a Uniform Civil Code?

- A Uniform Civil Code is one that would provide for one law for the entire country, applicable to all religious communities in their personal matters such as marriage, divorce, inheritance, adoption, etc.

- Article 44, one of the directive principles of the Constitution lays down that the state shall endeavor to secure a Uniform Civil Code for the citizens throughout the territory of India.

- These, as defined in Article 37, are not justiciable (not enforceable by any court) but the principles laid down therein are fundamental in governance.

Why need UCC?

- UCC would provide equal status to all citizens

- It would promote gender parity in Indian society.

- UCC would accommodate the aspirations of the young population who imbibe liberal ideology.

- Its implementation would thus support the national integration.

Hurdles to UCC implementation

- There are practical difficulties due to religious and cultural diversity in India.

- The UCC is often perceived by the minorities as an encroachment on religious freedom.

- It is often regarded as interference of the state in personal matters of the minorities.

- Experts often argue that the time is not ripe for Indian society to embrace such UCC.

UCC vs. Right to Freedom of Religion

- Article 25 lays down an individual’s fundamental right to religion;

- Article 26(b) upholds the right of each religious denomination or any section thereof to “manage its own affairs in matters of religion”;

- Article 29 defines the right to conserve distinctive culture.

- An individual’s freedom of religion under Article 25 is subject to “public order, health, morality” and other provisions relating to FRs, but a group’s freedom under Article 26 has not been subjected to other FRs.

- In the Constituent Assembly, there was division on the issue of putting UCC in the fundamental rights chapter. The matter was settled by a vote.

- By a 5:4 majority, the fundamental rights sub-committee headed by Sardar Patel held that the provision was outside the scope of FRs and therefore the UCC was made less important.

Enacting and Enforcing UCC: A reality check

- Fundamental rights are enforceable in a court of law.

- While Article 44 uses the words “the state shall endeavor”, other Articles in the ‘Directive Principles’ chapter use words such as “in particular strive”; “shall, in particular, direct its policy”; “shall be an obligation of the state” etc.

- Article 43 mentions “state shall endeavor by suitable legislation” while the phrase “by suitable legislation” is absent in Article 44.

- All this implies that the duty of the state is greater in other directive principles than in Article 44.

What are more important — fundamental rights or directive principles?

- There is no doubt that fundamental rights are more important.

- The Supreme Court held in Minerva Mills (1980): Indian Constitution is founded on the bedrock of the balance between Parts III (Fundamental Rights) and IV (Directive Principles).

- To give absolute primacy to one over the other is to disturb the harmony of the Constitution.

- Article 31C inserted by the 42nd Amendment in 1976, however, lays down that if a law is made to implement any directive principle, it cannot be challenged on the ground of being violative of the FRs under Articles 14 and 19.

What about Personal Laws?

- Citizens belonging to different religions and denominations follow different property and matrimonial laws which are an affront to the nation’s unity.

- If the framers of the Constitution had intended to have a UCC, they would have given exclusive jurisdiction to Parliament in respect of personal laws, by including this subject in the Union List.

- But “personal laws” are mentioned in the Concurrent List.

Various customary laws

- All Hindus of the country are not governed by one law, nor are all Muslims or all Christians.

- Muslims of Kashmir were governed by a customary law, which in many ways was at variance with Muslim Personal Law in the rest of the country and was, in fact, closer to Hindu law.

- Even on registration of marriage among Muslims, laws differ from place to place.

- In the Northeast, there are more than 200 tribes with their own varied customary laws.

- The Constitution itself protects local customs in Nagaland. Similar protections are enjoyed by Meghalaya and Mizoram.

- Even reformed Hindu law, in spite of codification, protects customary practices.

Minority opinion in the Constituent Assembly

- Some members sought to immunize Muslim Personal Law from state regulation.

- Mohammed Ismail, who thrice tried unsuccessfully to get Muslim Personal Law exempted from Article 44, said a secular state should not interfere with the personal law of people.

- B Pocker Saheb said he had received representations against a common civil code from various organizations, including Hindu organizations.

- Hussain Imam questioned whether there could ever be uniformity of personal laws in a diverse country like India.

- B R Ambedkar said, “no government can use its provisions in a way that would force the Muslims to revolt”.

- Alladi Krishnaswami, who was in favor of a UCC, conceded that it would be unwise to enact UCC ignoring strong opposition from any community.

- Gender justice was never discussed in these debates.

Conclusion

- Article 44 of the Constitution creates an obligation upon the State to endeavour to secure for citizens a Uniform Civil Code throughout the country.

- The purpose behind UCC is to strengthen the object of “Secular Democratic Republic” as enshrined in the Preamble of the Constitution.

- This provision is provided to effect the integration of India by bringing communities on the common platform on matters which are at present governed by diverse personal laws.

- Hence UCC should be enforced taking into confidence all the sections of Indian society.

- Goa’s Portuguese Civil Code of 1867 is an example of a common family law existing in harmony.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Drones

Mains level: Ban on drone import

The Government has banned the import of drones barring for R&D, defense, and security purposes.

Why in news?

- To promote Make-in-India drones.

- Before this order, the import of drones was “restricted” and needed prior clearance of the Directorate General of Civil Aviation (DGCA) and an import license from DGFT.

India’s sources of Imports

- For its defense needs, India imports from Israel and the US.

- Consumer drones such as those used for wedding photography come from China and drones for light shows also come from China apart from Russia.

Why need drones?

- Indian drone manufacturers and service providers arrange drones for a variety of use cases such as survey and mapping, security and surveillance, inspection, construction progress monitoring, and drone delivery.

What does the order say?

- The Directorate General of Foreign Trade (DGFT) issued an order prohibiting with immediate effect the import of drones in Completely-Built-Up (CBU), Semi-knocked-down (SKD), or Completely-Knocked-down (CKD) forms.

- Import of drones by government entities, educational institutions recognized by the Central or State governments, government-recognized R&D entities, and drone manufacturers for R&D purposes as well as for defense and security purposes will be allowed.

- For this, there has to be an import authorization obtained from the DGFT.

- The import of drone components is “free”, implying that no permission is needed from the DGFT allowing local manufacturers to import parts like diodes, chips, motors, lithium-ion batteries, etc.

Steps taken to promote indigenous drone manufacturing

- In August last year, the Government brought out liberalized Drone Rules, 2021 which reduced the number of forms to be filled to seek authorization from 25 to five.

- They also dispensed with the need for security clearance before any registration or issuance of the license.

- R&D entities too have been provided blanket exemption from all kinds of permissions, and restrictions on foreign-owned companies registered in India have also been removed.

- The Government has also announced a production-linked incentive scheme for drones and drone components with the aim to make India a “global drone hub by 2030”.

- Foreign manufacturers will be encouraged to set up assembly lines in India.

Why such a blanket ban?

- Most drone manufacturers in India assemble imported components in India, and there is less manufacturing.

- The import ban will ensure that an Indian manufacturer has control of the IP, design, and software which gives him or her a total understanding and control of the product.

- Over a period of time, this can enable further indigenization.

Possible repercussions of the ban

- The ban is likely to hurt those who use drones for photography and videography for weddings and events.

- These drones primarily come from China because they are cheaper and easy to use and India still has a lot of catching up to do in manufacturing them.

Also read

[Sansad TV] Perspective: Keeping Drones in Check

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Modernization of Police Forces Scheme

Mains level: Police reforms in India

The Union government has approved the continuation of a police modernization scheme for five years up to 2025-26 with a financial outlay of ₹26,275 crores.

What is the Modernization of Police Forces Scheme?

- Police’ and ‘law and order’ fall under the category of subjects within the domain of the State as per Entry 2 of List II of the VIIth Schedule in the Constitution of India.

- Thus, the principal responsibility for managing these subjects lies with the State Governments.

- However, the States have not been able to fully modernize and equip their police forces up to the desired level due to financial constraints.

- It is in this context that the Ministry of Home Affairs (MHA) has been supplementing the efforts and resources of the States, from time to time, by implementing the MPF Scheme since 1969-70.

Objectives:

- The focus of the scheme is to strengthen police infrastructure at cutting edge level by constructing secure police stations, training centers, police housing (residential), equipping the police stations with the required mobility, modern weaponry, communication equipment, and forensic set-up, etc.

Components of the scheme

- The scheme included security-related expenditure in J&K, northeastern States, and Maoist-affected areas, for raising new battalions, developing high-tech forensic laboratories and other investigation tools.

- Provisions have been made under the scheme for internal security, law and order, and the adoption of modern technology by the police.

- Assistance will be given to the States for narcotics control and strengthening the criminal justice system by developing a robust forensic setup in the country.

Funding pattern

- Under the Scheme, the States are grouped into two categories, namely Category ‘A’ and Category ‘B’ for the purpose of funding both under ‘Non-Plan’ and Plan.

- Category ‘A’ States, namely, J&K and 8 North Eastern States including Sikkim will be eligible to receive financial assistance on a 90:10 Centre: State sharing basis.

- The remaining States will be in Category ‘B’ and will be eligible for financial assistance on a 60:40 Centre: State sharing basis.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Capital Gains Tax

Mains level: Not Much

The capital gains tax structure in India is complicated, and it is time for a relook since the union budget has provisions for 30% tax on cryptocurrency.

What is Capital Gains Tax?

- Capital gains tax is levied on the profits made on investments.

- It covers real estate, gold, stocks, mutual funds, and various other financial and non-financial assets.

Types

- It is divided into long-term capital gains tax (LTCG) and short-term capital gains tax (STCG) depending on how long you have held the investment in question.

- Unlike income tax, the percentage of tax does not change on the basis of your overall tax slab.

- The LTCG tax, excluding surcharge, on equity is the same for gains of ₹10 lakh or ₹10 crore.

- There is also a separate set of deductions that apply to LTCG, which do not apply to ordinary income.

Why is it so complicated?

Capital gains tax is complicated for a few primary reasons.

- First, the rate changes from asset to asset. LTCG tax on stocks and equity mutual funds is 10% but on debt mutual funds is 20% with indexation.

- Second, holding period changes from asset to asset. The holding period for LTCG tax is two years in real estate, one year for stocks, and three years for debt mutual funds and gold.

- Third, exemptions available against it come with their own complex conditions. For instance, buying a house after selling one can get you an exemption, but the new house must be bought in two years or built in three years of the sale.

Is cryptocurrency taxed as capital gains?

- The 2022 budget has proposed a 30% tax on cryptocurrency, which is higher than capital gains tax in many cases.

- Besides, under capital gains tax, investors can adjust profits and losses on different investments against each other or against profits/losses in the future.

- However, this cannot be done with cryptocurrency.

What distortions does it create?

- As capital gains tax is the same regardless of your overall income it can compound inequality.

- For instance, a person with a salary of ₹40 lakh will pay 30% tax on it but just 10% LTCG tax on gains from stock trading.

- A person with a salary of ₹5 lakh will pay a 5% tax on it but the same 10% LTCG tax on stock trading.

- Second, the smaller one-year qualifying period for LTCG in stocks compared to three years in debt mutual funds may encourage short-term trading in equity.

What can be done to fix these anomalies?

- The government can bring about uniformity in rates and holding periods for various assets to ensure that the tax for one asset is not more attractive than another.

- A uniform and long holding period to qualify for LTCG can also discourage short-term trading and speculative behavior in assets such as stocks.

- The exemptions for LTCG such as reinvestment in another house property or capital gains bonds can also be made simpler, with fewer conditions.

- Small investors can also be given relief by reducing rates of capital gains.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Earth Observation Satellites (EOS)

Mains level: Not Much

After a disappointing 2021 which saw just one successful launch, ISRO is getting back to business with the EOS-04, an earth observation satellite.

What are EOS?

- An EOS or Earth remote sensing satellite is a satellite used or designed for Earth observation (EO) from orbit.

- It includes spy satellites and similar ones intended for non-military uses such as environmental monitoring, meteorology, cartography, and others.

- The most common type is Earth-imaging satellites that take satellite images, analogous to aerial photographs.

- Some EOS may perform remote sensing without forming pictures, such as in GNSS radio occultation.

What is EOS-04 all about?

- The EOS-04 is fourth in a series of earth observation satellites that are being launched under a new generic name.

- It is designed to provide high-quality images for applications such as agriculture, forestry, and plantations, flood mapping, soil moisture, and hydrology.

- It will complement the data from Resourcesat, Cartosat and RISAT-2B series of satellites that are already in orbit.

Why such different nomenclature?

- Two years ago, ISRO had moved to a new naming system for its earth observation satellites which till then had been named thematically, according to the purpose they were meant for.

- The Cartosat series of satellites were meant to provide data for land topography and mapping, while the Oceansat satellites were meant for observations overseas.

- Some INSAT-series, Resourcesat series, GISAT, Scatsat, and a few other earth observation satellites were named differently for the specific jobs they were assigned to do, or the different instruments that they.

- All these would now become part of the new EOS series of satellites.

What other satellites are being launched?

- Besides EOS-04, two other small satellites —INSPIREsat-1 and INS-2TD — will ride on the heaviest version of the PSLV rocket in the early hours from the Sriharikota launch range.

- The other co-passenger, INS-2TD, is a technology demonstrator for the first India-Bhutan joint satellite that is scheduled to be launched next month.

- The two countries had signed a space agreement last year, and its first outcome would be the launch of Bhutan-Sat, or INS-2B, on a PSLV rocket.

How many satellites does India have in space?

- India currently has 53 operational satellites, of which 21 are earth observation ones and another 21 are communication-based.

- EOS-4 launch would be the 54th flight of the PSLV rocket, and the 23rd of its most powerful XL-version that has six strap-on boosters.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: World Food Programme (WFP)

Mains level: NA

India signed an agreement with the United Nation’s World Food Programme (WFP) for the distribution of 50,000 tonnes of wheat that it has committed to sending Afghanistan as part of humanitarian assistance.

What is WFP?

- The WFP is the food-assistance branch of the United Nations (UN).

- It is the world’s largest humanitarian organization focused on hunger and food security, and the largest provider of school meals.

- Founded in 1961, it is headquartered in Rome and has offices in 80 countries.

- In addition to emergency food relief, WFP offers technical assistance and development aid, such as building capacity for emergency preparedness and response, managing supply chains and logistics, etc.

- The agency is also a major provider of direct cash assistance and medical supplies and provides passenger services for humanitarian workers.

Feats achieved

- As of 2020, it served 115.5 million people in 80-plus countries, the largest since 2012.

- The WFP was awarded the Nobel Peace Prize in 2020 for its efforts to provide food assistance in areas of conflict and to prevent the use of food as a weapon of war and conflict.

WFP in Afghanistan

- The wheat will be taken through Pakistan to the Afghan border crossing and handed over to WFP officials in Kandahar.

- The WFP runs its own logistics network inside Afghanistan, partnering with civil society groups.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

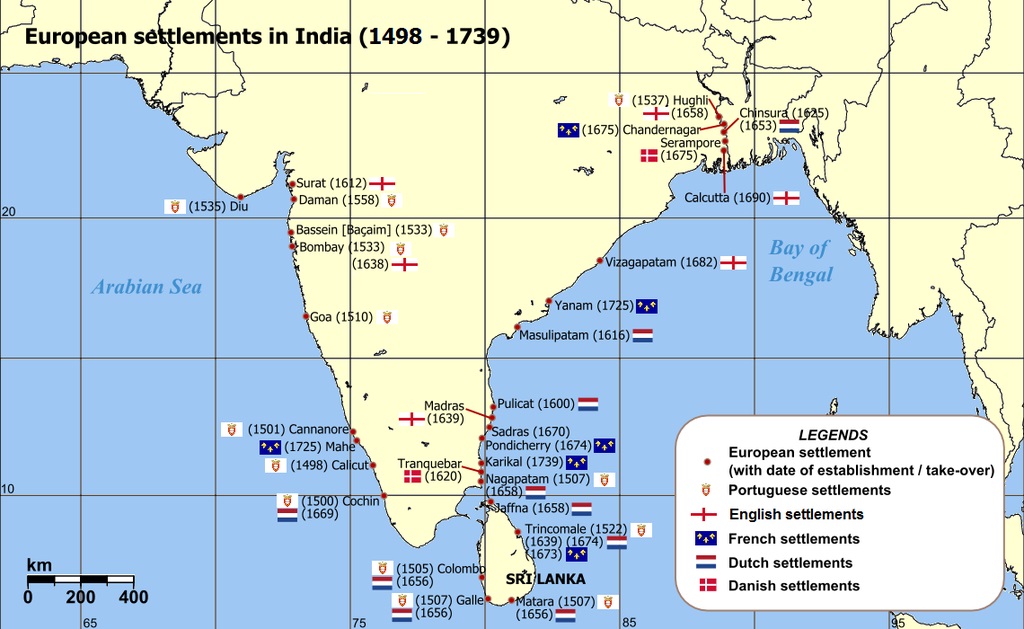

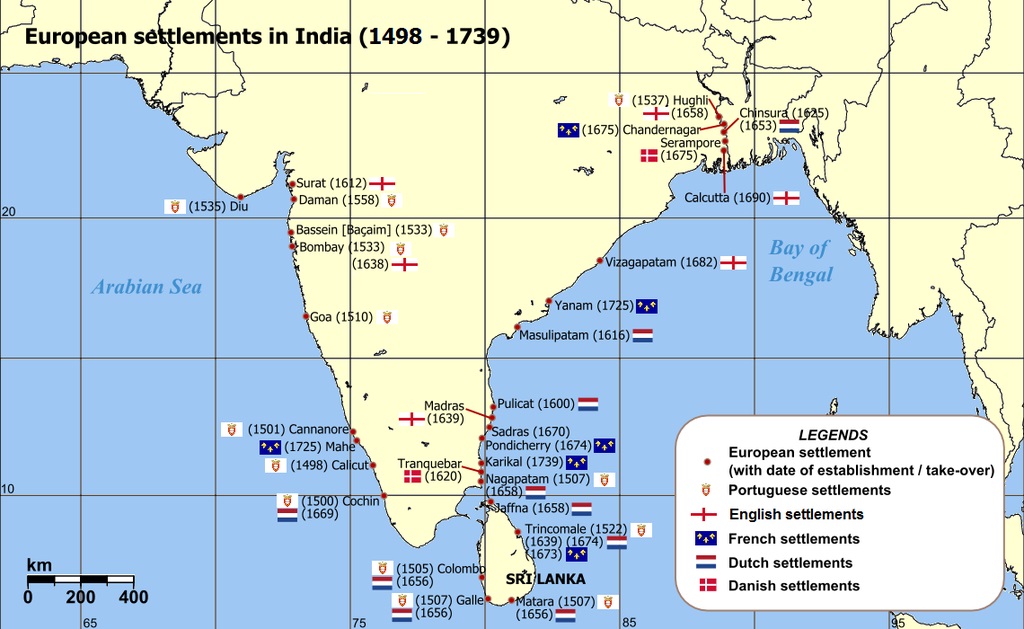

Prelims level: Chandernagore

Mains level: Colonization of India

The Registry Building, a two-storey structure at Chandernagore built in 1875 and a symbol of French settlement of the colonial town, has been awaiting restoration for a long time.

French in India

- France was the last of the major European maritime powers of the 17th century to enter the East India trade.

- The French settlement in India began in 1673 with the purchase of land at Chandernagore from the Mughal Governor of Bengal.

- The next year they acquired Pondicherry from the Sultan of Bijapur. Both became the centers of maritime commercial activities of the French in India.

- Joseph Francois Dupleix who was initially appointed as Intendent of Chandernagore in 1731, sowed the seeds of colonization.

- The village, which hitherto was engaged in maritime commerce along with Pondicherry, got fortified by him.

Significance of Chandernagore

- Chandernagore, though a part of French colonies in India, was unique in many ways.

- It was very active in spearheading the freedom movement against the British. Due to its close proximity to Calcutta, it became a safe haven for freedom fighters of all hues.

- Even Aurobindo Ghosh who was one of the accused in the Alipore Bomb case of 1909, was acquitted unconditionally and after a short stay at Chandernagore moved to Pondicherry.

- Since the partition of Bengal in 1905, Chandernagore was in the thick of activities of freedom fighters against the British and produced several martyrs including Kanailal Dutt.

Merger into India

- As the British decided to hand over powers to the people of India by August 15, 1947, the people living under French rule in Pondicherry, Chandernagore, Karaikal, Mahe and Yanam were eager to join their homeland.

- But the French were yet to learn their lessons. They tried all the tricks in the book to avert this.

- Facing the onslaught from the people under their rule and the British and Indian rulers, the French declared Chandernagore as free city in 1947.

- In June 1948, they conducted a referendum in which an overwhelming majority of 97 per cent people opted for a merger with India.

- After so many legal hurdles, it became a part of India on October 2, 1955.

Back2Basics: European Colonies in India

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now