Note4Students

From UPSC perspective, the following things are important :

Prelims level: SSLV, PSLV, GSLV

Mains level: Not Much

The Indian Space Research Organisation (ISRO) is hoping to have all three development flights planned for its ‘baby rocket’ — the Small Satellite Launch Vehicle (SSLV) — in 2022 itself.

What is SSLV?

- The SSLV is a small-lift launch vehicle being developed by the ISRO with payload capacity to deliver:

- 600 kg to Low Earth Orbit (500 km) or

- 300 kg to Sun-synchronous Orbit (500 km)

- It would help launching small satellites, with the capability to support multiple orbital drop-offs.

- In future a dedicated launch pad in Sriharikota called Small Satellite Launch Complex (SSLC) will be set up.

- A new spaceport, under development, near Kulasekharapatnam in Tamil Nadu will handle SSLV launches when complete.

- After entering the operational phase, the vehicle’s production and launch operations will be done by a consortium of Indian firms along with NewSpace India Limited (NSIL).

Vehicle details

(A) Dimensions

- Height: 34 meters

- Diameter: 2 meters

- Mass: 120 tonnes

(B) Propulsion

- It will be a four stage launching vehicle.

- The first three stages will use Hydroxyl-terminated polybutadiene (HTPB) based solid propellant, with a fourth terminal stage being a Velocity-Trimming Module (VTM).

SSLV vs. PSLV: A comparison

- The SSLV was developed with the aim of launching small satellites commercially at drastically reduced price and higher launch rate as compared to Polar SLV (PSLV).

- The projected high launch rate relies on largely autonomous launch operation and on overall simple logistics.

- To compare, a PSLV launch involves 600 officials while SSLV launch operations would be managed by a small team of about six people.

- The launch readiness period of the SSLV is expected to be less than a week instead of months.

- The SSLV can carry satellites weighing up to 500 kg to a low earth orbit while the tried and tested PSLV can launch satellites weighing in the range of 1000 kg.

- The entire job will be done in a very short time and the cost will be only around Rs 30 crore for SSLV.

Significance of SSLV

- SSLV is perfectly suited for launching multiple microsatellites at a time and supports multiple orbital drop-offs.

- The development and manufacture of the SSLV are expected to create greater synergy between the space sector and private Indian industries – a key aim of the space ministry.

Back2Basics:

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: International Cyber Engagement Strategy

Mains level: Paper 2- India-Australia relations

Context

Western and media attention may be focused on the conflict between Russia and Ukraine, but countries have not taken their eye off the Indo-Pacific where there is clear evidence of the changing world order.

India and Australia faces a common threat to cyber security

- The India-Australia ECTA is a concrete example of the bilateral faith in common values, and understanding of threats and goals.

- A reflection of this is cooperation in cyber security.

- China is accused of having amassed a large number of cyber weapons and has allegedly carried out sophisticated operations aimed at espionage, theft of intellectual property, and destructive attacks on internet resources of some countries.

- Advanced Persistent Threat (APT) groups: Australia and India have been at the receiving end of several such campaigns by the so-called Advanced Persistent Threat (APT) groups, supported by or assumed to be located in China.

Steps toward cooperation in cyber security

- At the June 2020 virtual bilateral summit, Prime Minister Narendra Modi and his Australian counterpart Scott Morrison elevated the bilateral relationship to a Comprehensive Strategic Partnership.

- New cyber security framework: The new cyber framework includes a five-year plan to work together on the digital economy, cybersecurity and critical and emerging technologies.

- Bilateral research: This will be supported by a $9.7 million fund for bilateral research to improve regional cyber resilience.

- An annual Cyber Policy Dialogue, a new Joint Working Group on Cyber Security Cooperation and a joint working group on ICTs have been established.

- An annual India-Australia Foreign Ministers Cyber Framework Dialogue will be held.

- India to be part of International Cyber Engagement Strategy: India will now be included in a core Australian initiative called the International Cyber Engagement Strategy — it began in 2017 to actively conduct capacity-building arrangements in Indonesia, Singapore and Thailand, and support similar activities in Malaysia, Vietnam and Cambodia.

- A joint Centre of Excellence for Critical and Emerging Technology Policy, to be located in Bengaluru, will be set up.

Steps taken by India to improve cyber security

- India has set up the office of the National Cybersecurity Coordinator, a national Computer Emergency Response Team (CERT-IN), a national Critical Information Infrastructure Protection Agency (NCIIPC), and made appropriate amendments to the Information Technology Act and Rules to enhance its cyber security posture.

- This has upped India’s rank to 10th in the Global Cyber Security Index (GCI) 2020, from 47th just two years earlier.

- India has capable cybersecurity professionals.

Conclusion

Deepening cooperation can develop avenues for mutual learning and create complementary markets in cyber tools and technologies, boosting bilateral business and strategic commitments on both continents.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Importance of Mission Antyodaya

Context

This article argues that given the right momentum, the ‘Mission Antyodaya’ project bears great promise to eradicate poverty in its multiple dimensions among rural households.

Background of Mission Antyodaya

- The ‘Mission Antyodaya’ project was launched by the Government of India in 2017-18.

- The Ministry of Panchayati Raj and the Ministry of Rural Development act as the nodal agents to take the mission forward.

- Key goals: The main objective of ‘Mission Antyodaya’ is to ensure optimum use of resources through the convergence of various schemes that address multiple deprivations of poverty, making gram panchayat the hub of a development plan.

- Annual survey: This planning process is supported by an annual survey that helps to assess the various development gaps at the gram panchayat level, by collecting data regarding the 29 subjects assigned to panchayats by the Eleventh Schedule of the Constitution.

- Also, data regarding health and nutrition, social security, good governance, water management and so on are also collected.

- The idea of the Ministry of Panchayati Raj to identify the gaps in basic needs at the local level, and integrating resources of various schemes, self-help groups, voluntary organisations and so on to finance them needs coordination and capacity-building of a high order.

- If pursued in a genuine manner, this can foster economic development and inter-jurisdictional equity.

Infrastructural gaps as pointed out by the Mission Antyodaya Survey

- The ‘Mission Antyodaya’ survey in 2019-20 for the first time collected data that shed light on the infrastructural gaps from 2.67 lakh gram panchayats, comprising 6.48 lakh villages with 1.03 billion population.

- The maximum score values assigned will add up to 100 and are presented in class intervals of 10.

- While no State in India falls in the top score bracket of 90 to 100, 1,484 gram panchayats fall in the bottom bracket.

- Even in the score range of 80 to 90, 10 States and all Union Territories do not appear.

- The total number of gram panchayats for all the 18 States that have reported adds up only to 260, constituting only 0.10% of the total 2,67,466 gram panchayats in the country.

- If we consider a score range of 70-80 as a respectable attainment level, Kerala tops but accounts for only 34.69% of gram panchayats of the State, the corresponding all-India average is as low as 1.09%.

- The composite index data, a sort of surrogate for human development, are also not encouraging.

- Although only 15 gram panchayats in the country fall in the bottom range below 10 scores, more than a fifth of gram panchayats in India are below the 40 range.

- The gap report and the composite index show in unmistakable terms that building ‘economic development and social justice’ remains a distant goal even after 30 years of the decentralisation reforms and nearly 75 years into Independence.

Way forward

- Converge resources: Given the ‘saturation approach’ (100% targets on select items) of the Ministry of Panchayati Raj, the possibilities of realising universal primary health care, literacy, drinking water supply and the like are also immense.

- But there is no serious effort to converge resources (the Mahatma Gandhi National Rural Employment Guarantee Act, the National Rural Livelihood Mission, National Social Assistance Programme, Pradhan Mantri Awas Yojana, etc.) and save administrative expenses.

- Deploy the data to India’s fiscal federalism: Another lapse is the failure to deploy the data to India’s fiscal federalism, particularly to improve the transfer system and horizontal equity in the delivery of public goods in India at the sub-State level.

- The constitutional goal of planning and implementing economic development and social justice can be achieved only through strong policy interventions.

Conclusion

The policy history of India has been witness to the phenomenon of announcing big projects and failing to take them to their logical consequence. ‘Mission Antyodaya’ is a striking case in recent times.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: 91st Amendment

Mains level: Read the attached story

Recently a politician in Goa was accorded the lifetime status of the rank of Cabinet Minister who was, a six-time Chief Minister of Goa and a legislator for a full 50 years. Hence a PIL has been filed in the High Court of Bombay at Goa.

What is the “Lifetime Status of the rank of Cabinet minister”?

- The former Chief Minister and former Speaker (of the Goa Legislative Assembly) had completed 50 years as a legislator.

- The Cabinet decided that in future also, those who complete 50 years and hold posts like CM and Speaker will be given the Cabinet status even after their retirement.

What is the PIL against this designation?

- The PIL has urged the High Court to quash the notification of the government under which the person was conferred with the “lifetime status”.

- It has contended that Goa has a 12-member Cabinet, and the conferment of Cabinet status results in the number of Cabinet ranks rising to 13, which exceeds the ceiling mandated by the Constitution.

- This ceiling was mandated by the 91st Amendment which aimed to prevent jumbo Cabinets and the resultant drain on the public exchequer.

How the 91st Amendment Act does relates here?

- The Constitution (91st Amendment) Act, 2003 inserted clause 1A in Article 164.

- It says the total number of Ministers, including the Chief Minister, in the Council of Ministers in a State shall not exceed 15% of the total number of members of the Legislative Assembly of that State.

- It provided a condition that the number of Ministers, including the Chief Minister in a State shall not be less than twelve.

- There are 40 seats in the unicameral Goa Assembly.

Why is the designation problematic?

- A cabinet minister for life would be entitled to 12 staff members – OSDs, support staff, peons, driver – which would cost the exchequer Rs 90 lakh a year.

- The ‘Cabinet’ rank would also entitle him to government accommodation, vehicle and unlimited free travel for him and his spouse.

- This is just none other case but political self-appeasement.

Back2Basics: 91st Constitutional Amendment Act, 2003

- It made the provisions to limit the size of Council of Ministers, to debar defectors from holding public offices, and to strengthen the anti-defection law.

- The total number of ministers, including the Prime Minister, in the Central Council of Ministers shall not exceed 15% of the total strength of the Lok Sabha.

- A member of either house of Parliament belonging to any political party who is disqualified on the ground of defection shall also be disqualified to be appointed as a minister.

- The total number of ministers, including the Chief Minister, in the Council of Ministers in a state shall not exceed 15% of the total strength of the legislative Assembly of that state.

- But, the number of ministers, including the Chief Minister, in a state shall not be less than 12.

- A member of either House of a state legislature belonging to any political party who is disqualified on the ground of defection shall also be disqualified to be appointed as a minister.

- The provision of the Tenth Schedule (anti-defection law) pertaining to exemption from disqualification in case of split by one-third members of legislature party has been deleted.

- It means that the defectors have no more protection on grounds of splits.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: US's Anti-India lobby

In its 2022 Annual report, the United States Commission on International Religious Freedom (USCIRF) has recommended that India be designated a ‘Country of Particular Concern’ (CPC).

What is the USCIRF and how is it constituted?

- The USCIRF is an independent, bipartisan body created by the International Religious Freedom Act, 1998 (IRFA) of the US.

- It has a mandate to monitor religious freedom violations globally and make policy recommendations to the President, the Secretary of State, and the Congress.

- It is a congressionally created entity and not an NGO or advocacy organisation.

- It is led by nine part-time commissioners appointed by the President and the leadership of both political parties in the House and the Senate.

Why in news now?

- USCIRF wants India to be designated under the CPC category of governments performing most poorly on religious freedom criteria.

- It has called for “targeted sanctions” on individuals and entities responsible for severe violations of religious freedom by freezing those individuals’ or entities’ assets and/or barring their entry” into the US.

What does a ‘Country of Particular Concern’ (CPC) designation mean?

- IRFA requires the USCIRF to annually identify countries that merit a CPC designation.

- As per IRFA, CPCs are countries whose governments either engage in or tolerate “particularly severe violations” of religious freedom.

- Such freedoms are defined as systematic, ongoing, egregious violations of the internationally recognized right to freedom of religion.

- The other designation, for less serious violations, is Special Watch List (SWL)

Which other countries have been designated as CPCs?

- For 2022, based on religious freedom conditions in 2021, a total of 15 countries have been recommended for the CPC designation.

- They include India, Pakistan, Burma, China, Eritrea, Iran, North Korea, Russia, Saudi Arabia, Tajikistan, Afghanistan, Nigeria, Syria and Vietnam.

- Countries recommended for a SWL designation include Algeria, Cuba, Nicaragua, Azerbaijan, Central African Republic, Egypt, Indonesia, Iraq, Kazakhstan, Malaysia, Turkey, and Uzbekistan.

Why does USCIRF want India to be designated as a CPC?

- The USCIRF, in its annual report, states that in 2021, religious freedom conditions in India significantly worsened.

- It has noted that the Indian government escalated its promotion and enforcement of policies —including those promoting a Hindu-nationalist agenda.

- This negatively affects Muslims, Christians, Sikhs, Dalits, and other religious minorities.

- It highlighted the use of the Unlawful Activities Prevention Act (UAPA) against those documenting religious persecution and violence.

- It also criticised the spate of fresh anti-conversion legislations, noting that “national, State and local governments demonised and attacked the conversion of Hindus to Christianity or Islam.”

Are USCIRF recommendations binding on the US government?

- No, they are not. The USCIRF typically recommends more countries for a CPC label than the State Department will designate.

- This happens because the USCIRF is concerned solely with the state of religious freedom when it makes a recommendation.

- However, the US State Department also takes into account other diplomatic, bilateral and strategic concerns before making a decision on a CPC designation.

Is this the first time India is being designated as a CPC by the USCIRF? What has been India’s reaction?

- This is the third year in a row that India has received a CPC recommendation.

- India has in the past pushed back against the grading, questioning the locus standi of USCIRF.

- In 2020, External Affairs Minister S. Jaishankar called the Commission an “Organisation of Particular Concern.”

- US needs to introspect itself on the HR violations by the state authorities on the basis of racism, ethnocentrism and religion (particularly Sikhs).

What is the likely impact of the USCIRF’s recommendation?

- The US State Department hasn’t acted on such recommendations so far.

- But India may come under greater pressure this time, given its divergence from the American position on the Ukraine war and refusal to endorse US-backed resolutions against Russia at the UN.

- Hence the USCIRF is another force of Anti-India lobby in the US to bully other nations by countering an accusation with another.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: UNSC, Veto

Mains level: Veto Power

The 193 members of the United Nations General Assembly adopted by consensus a resolution requiring the five permanent members of the Security Council to justify their use of the veto.

Why such move?

- The push for reform was driven by Russia’s invasion of Ukraine.

- The measure is intended to make veto-holders United States, China, Russia, France and Britain “pay a higher political price” when they use the veto to strike down a Security Council resolution.

- For years Russia (and the US) has used its veto power to block UNSC resolutions — which, unlike General Assembly resolutions, are enforceable under international law.

What is the Veto Power at the UN?

- The UN Security Council veto power is the power of the five permanent members of the UN Security Council to veto any “substantive” resolution.

- They also happen to be the nuclear-weapon states (NWS) under the terms of the Treaty on the Non-Proliferation of Nuclear Weapons (NPT).

- However, a permanent member’s abstention or absence does not prevent a draft resolution from being adopted.

- This veto power does not apply to “procedural” votes, as determined by the permanent members themselves.

- A permanent member can also block the selection of a Secretary-General, although a formal veto is unnecessary since the vote is taken behind closed doors.

Issues with Veto Power

- The veto power is controversial. Supporters regard it as a promoter of international stability, a check against military interventions, and a critical safeguard against US domination.

- Critics say that the veto is the most undemocratic element of the UN, as well as the main cause of inaction on war crimes and crimes against humanity.

- It effectively prevents UN action against the permanent members and their allies.

Back2Basics: United Nations Security Council

- The UNSC is one of the six principal organs of the United Nations and is charged with the maintenance of international peace and security.

- Its powers include the establishment of peacekeeping operations, the establishment of international sanctions, and the authorization of military action through Security Council resolutions.

- It is the only UN body with the authority to issue binding resolutions to member states.

- The Security Council consists of fifteen members. Russia, the United Kingdom, France, China, and the United States—serve as the body’s five permanent members.

- These permanent members can veto any substantive Security Council resolution, including those on the admission of new member states or candidates for Secretary-General.

- The Security Council also has 10 non-permanent members, elected on a regional basis to serve two-year terms. The body’s presidency rotates monthly among its members.

Also read

Explained: India at United Nations Security Council

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Indirect Taxes

Mains level: Recovery of the economy after the Pandemic

India’s net direct tax collections amounted to ₹14,09,640.83 crore for FY22, which is the highest collection ever.

What are Direct Taxes?

- A type of tax where the impact and the incidence fall under the same category can be defined as a Direct Tax.

- The tax is paid directly by the organization or an individual to the entity that has imposed the payment.

- The tax must be paid directly to the government and cannot be paid to anyone else.

Why in news?

- The surge in direct tax collection signals that the Indian economy has bounced back after two years of the pandemic.

Rise in direct tax collection

- As against ₹14.09 lakh crore this year, our collection in 2020-21 was only ₹9.45 lakh crore.

- In a single year, the economy has moved upward by nearly ₹4.5 lakh crore, registering a growth of 49%.

- The collection is the best-ever as far as income tax and corporation tax are concerned.

What about direct tax-to-GDP ratio?

- The direct tax-to-GDP ratio is around 12%.

- The Central Board of Direct Taxes (CBDT) was working to raise the ratio to 15-20% in 5-10 years.

Why is it significant?

- A tax-to-GDP ratio is a gauge of a nation’s tax revenue relative to the size of its economy as measured by gross domestic product (GDP).

- The ratio provides a useful look at a country’s tax revenue because it reveals potential taxation relative to the economy.

- It also enables a view of the overall direction of a nation’s tax policy, as well as international comparisons between the tax revenues of different countries.

Back2Basics: Types of Direct Taxes

The various types of direct tax that are imposed in India are mentioned below:

(1) Income Tax

- Depending on an individual’s age and earnings, income tax must be paid.

- Various tax slabs are determined by the Government of India which determines the amount of Income Tax that must be paid.

- The taxpayer must file Income Tax Returns (ITR) on a yearly basis.

- Individuals may receive a refund or might have to pay a tax depending on their ITR. Penalties are levied in case individuals do not file ITR.

(2) Wealth Tax

- The tax must be paid on a yearly basis and depends on the ownership of properties and the market value of the property.

- In case an individual owns a property, wealth tax must be paid and does not depend on whether the property generates an income or not.

- Corporate taxpayers, Hindu Undivided Families (HUFs), and individuals must pay wealth tax depending on their residential status.

- Payment of wealth tax is exempt for assets like gold deposit bonds, stock holdings, house property, commercial property that have been rented for more than 300 days, and if the house property is owned for business and professional use.

(3) Estate Tax

- It is also called Inheritance Tax and is paid based on the value of the estate or the money that an individual has left after his/her death.

(4) Corporate Tax

- Domestic companies, apart from shareholders, will have to pay corporate tax.

- Foreign corporations who make an income in India will also have to pay corporate tax.

- Income earned via selling assets, technical service fees, dividends, royalties, or interest that is based in India is taxable.

- The below-mentioned taxes are also included under Corporate Tax:

- Securities Transaction Tax (STT): The tax must be paid for any income that is earned via security transactions that are taxable.

- Dividend Distribution Tax (DDT): In case any domestic companies declare, distribute, or are paid any amounts as dividends by shareholders, DDT is levied on them. However, DDT is not levied on foreign companies.

- Fringe Benefits Tax: For companies that provide fringe benefits for maids, drivers, etc., Fringe Benefits Tax is levied on them.

- Minimum Alternate Tax (MAT): For zero tax companies that have accounts prepared according to the Companies Act, MAT is levied on them.

(5) Capital Gains Tax:

- It is a form of direct tax that is paid due to the income that is earned from the sale of assets or investments. Investments in farms, bonds, shares, businesses, art, and home come under capital assets.

- Based on its holding period, tax can be classified into long-term and short-term.

- Any assets, apart from securities, that are sold within 36 months from the time they were acquired come under short-term gains.

- Long-term assets are levied if any income is generated from the sale of properties that have been held for a duration of more than 36 months.

Advantages of Direct Taxes

The main advantages of Direct Taxes in India are mentioned below:

- Economic and Social balance: The Government of India has launched well-balanced tax slabs depending on an individual’s earnings and age. The tax slabs are also determined based on the economic situation of the country. Exemptions are also put in place so that all income inequalities are balanced out.

- Productivity: As there is a growth in the number of people who work and community, the returns from direct taxes also increases. Therefore, direct taxes are considered to be very productive.

- Inflation is curbed: Tax is increased by the government during inflation. The increase in taxes reduces the necessity for goods and services, which leads to inflation to compress.

- Certainty: Due to the presence of direct taxes, there is a sense of certainty from the government and the taxpayer. The amount that must be paid and the amount that must be collected is known by the taxpayer and the government, respectively.

- Distribution of wealth is equal: Higher taxes are charged by the government to the individuals or organizations that can afford them. This extra money is used to help the poor and lower societies in India.

What are the disadvantages of direct taxes?

- Easily evadable: Not all are willing to pay their taxes to the government. Some are willing to submit a false return of income to evade tax. These individuals can easily conceal their incomes, with no accountability to the law of the land.

- Arbitrary: Taxes, if progressive, are fixed arbitrarily by the Finance Minister. If proportional, it creates a heavy burden on the poor.

- Disincentive: If there are high taxes, it does not allow an individual to save or invest, leading to the economic suffering of the country. It does not allow businesses/industry to grow, inflicting damage to them.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: SDGs

Mains level: Paper 2- Energy security of South Asia

Context

Given that a 0.46% increase in energy consumption leads to a 1% increase in GDP per capita, electrification not only helps in improving lifestyle but also adds to the aggregate economy by improving the nation’s GDP.

Widening electricity coverage in South Asian nations

- The electricity policies of South Asian countries aim at providing electricity to every household.

- The issues these policies address include generation, transmission, distribution, rural electrification, research and development, environmental issues, energy conservation and human resource training.

- Bangladesh has achieved 100% electrification recently while Bhutan, the Maldives, and Sri Lanka accomplished this in 2019.

- For India and Afghanistan, the figures are 94.4% and 97.7%, respectively, while for Pakistan it is 73.91%.

- Bhutan has the cheapest electricity price in South Asia (U.S.$0.036 per kilowatt hour, or kWh) while India has the highest (U.S.$0.08 per kWh.)

- South Asia is reinforcing its transmission and distribution frameworks to cater to growing energy demand not only through the expansion of power grids but also by boosting green energy such as solar power or hydroelectricity.

Adapting to renewable

- Geographical differences between these countries call for a different approach depending on resources.

- India leads South Asia in adapting to renewable power, with its annual demand for power increasing by 6%.

- India’s pledge to move 40% of total energy produced to renewable energy is also a big step.

- Prime Minister Narendra Modi in his ‘net-zero by 2070’ pledge at COP26 in Glasgow asserted India’s target to increase the capacity of renewable energy from 450GW to 500GW by 2030.

- The region is moving towards green growth and energy as India hosts the International Solar Alliance.

- South Asia has vast renewable energy resources — hydropower, solar, wind, geothermal and biomass — which can be harnessed for domestic use as well as regional power trade.

Steps toward SDGs

- Solar power-driven electrification in rural Bangladesh is a huge step towards Sustainable Development Goal 7.

- Access to electricity improves infrastructure i.e., SDG 9 (which is “build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation”).

- Energy access helps online education through affordable Internet (SDG 4, or “ensure inclusive and equitable quality education and promote lifelong learning opportunities for all”), more people are employed (SDG 1: “no poverty”), and are able to access tech-based health solutions (SDG 3, or “ensure healthy lives and promote well-being for all at all ages”).

Regional energy trade

- The South Asian Association for Regional Cooperation (SAARC) prepared the regional energy cooperation framework in 2014, but its implementation is questionable.

- Energy trade agreements: There are a number of bilateral and multilateral energy trade agreements such as the India-Nepal petroleum pipeline deal, the India-Bhutan hydroelectric joint venture, the Myanmar-Bangladesh-India gas pipeline, the Bangladesh-Bhutan-India-Nepal (BBIN) sub-regional framework for energy cooperation, and the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline, rumoured to be extended to Bangladesh.

- Challenges: ‘South Asia’s regional geopolitics is determined by the conflation of identity, politics, and international borders.

- The current participation in cross-border projects has been restricted to respective tasks, among Bhutan and India or Nepal and India.

- It is only now that power-sharing projects among the three nations, Nepal, India, and Bangladesh, have been deemed conceivable.

Way forward

- Energy framework: Going forward, resilient energy frameworks are what are needed such as better building-design practices, climate-proof infrastructure, a flexible monitory framework, and an integrated resource plan that supports renewable energy innovation.

- Public-Private Partnership: Government alone cannot be the provider of reliable and secure energy frameworks, and private sector investment is crucial.

Conclusion

While universal coverage can catalyse the region’s economic growth, energy trade must be linked to peace building.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Inflation expectations

Mains level: Paper 3- Understanding inflation anchoring

Context

The RBI released the Inflation Expectations Survey of Households (IESH) for March 2022 on April 8. The survey results present interesting behavioural insights for public policy, particularly from a gender perspective.

Significance of inflation expectations

- The impact of inflation — the overall increase in the prices in an economy — is felt by everyone.

- High inflation adversely affects the poor.

- Individuals, therefore, form expectations about how prices will behave in the future to take precautions.

- If they anticipate high inflation, they negotiate wages or rents to compensate against a potential fall in their purchasing power.

- Self-fulfilling: Increased wages increase the cost of production, making expectations self-fulfilling and, therefore, playing a pivotal role in determining inflation.

- Anchoring inflation expectations: Central banks raise interest rates to ‘anchor’ high inflationary expectations when temporary price shocks, on account of drought or disruption in global supply chains, entail the risk of getting transmitted into actual inflation.

What shapes inflation expectations of individuals?

- A recent study carried out by Acunto et al., 2020, validates that what agents frequently purchase, instead of those purchased infrequently, shape their perception of the general level of inflation.

- Factors shaping individual’s perception: A significant factor shaping perceptions on inflation are the prices that individuals observe in their daily lives, originally posited by Robert Lucas in his seminal Islands model.

- Therefore, generalising aggregate inflation expectations for making general views of prices in the economy could be misleading.

- This insight has implications for gender-based differences in anticipating inflation in the future.

- Existing literature shows that women have higher inflationary expectations compared to men.

- However, a new study reveals that it is not the innate characteristics as much as the traditional gender roles that explain this divergence.

Natural experiments

- To test its validity, trends of Inflation Expectations Survey of Households (IESH) before and after the lockdown period present itself as a crude ‘natural experiment’.

- The authors hypothesise that if traditional gender roles are the primary reasons behind the gender inflation expectation gap, then the lockdown-imposed work-from-home (WFH) arrangements or loss of employment should contribute in closing this gap.

- The logic: during the lockdown, people in urban areas lost jobs or remained at home, taking a relatively equal share in the frequent day-to-day purchases.

- Two categories of occupations are studied here: homemakers (assumed to be dominated by women) and financial sector employees (assumed to be dominated by men).

- Looking at the trends of the RBI surveys for the period between March 2018 and March 2020, homemakers report higher inflation expectations than financial sector employees.

- However, this gap has narrowed over the last two years and has almost converged in March 2022.

- A possible explanation of closing of the gap could be the gradual ‘experience effect’ of male-dominated financial sector employees.

- Experience effect, contrary to Rational Expectations Theory that assumes individuals base their decisions on the information available to them, is based on the premise that actual personal experiences shape behaviour more than being informed about the outcome of the event.

Conclusion

Focus could be shifted more on the microfoundations — understanding macroeconomic outcomes by studying factors that shape individual behaviour and decision making — for making better policy decisions concerning macroeconomic phenomena.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- India's engagement with Europe and factors shaping it

Context

The re-election of Emmanuel Macron as the president of France on Sunday has sent a sigh of relief across Europe and North America. Delhi too is pleased with the return of Macron, who laid a strong foundation for India’s strategic partnership with France.

Why France election matters to the regional and domestic order in Europe

- Unlike the Soviet Union, which sought to shape European politics though left-wing parties, Russia today influences European politics through right-wing parties.

- Victory for Marine Le Pen, Macron’s opponent, would have dramatically complicated the geopolitics of Europe.

- Le Pen, like so many other right-wing leaders in Europe, has close ties to Vladimir Putin.

- Le Pen’s victory would have not only altered France’s international trajectory, but also shaken the EU to its political core.

Three factors shaping the transformation of India’s ties with Europe

- Russia’s threat to the regional and domestic order in Europe is among multiple factors shaping Delhi’s intensifying engagement with Brussels.

- Three major external factors are facilitating the transformation of India’s ties with Europe.

1] Russian Question

- For India, a normal relationship between Russia and the West would have been ideal.

- But Russia’s confrontation with the West comes during India’s rapidly expanding economic and political ties to Europe and America.

- Delhi might be sentimental about India’s historic Russian connection but it is not going to sacrifice its growing ties to the West on that altar.

- Russia’s declining economic weight and growing international isolation begins to simplify India’s choices.

- During the last few weeks, Delhi has insisted that its silence is not an endorsement of Russian aggression.

- India’s position has continued to evolve.

- Delhi’s repeated emphasis on respecting the territorial integrity of states is a repudiation of Russia’s unacceptable aggression.

- Meanwhile, geographic proximity and economic complementarity have tied Europe even more deeply to Russia.

- The EU’s annual trade with Russia at around $260 billion is massive in comparison to India’s $10 billion.

- Putin’s reckless invasion of Ukraine has compelled Europe to embark on a costly effort to disconnect from Russia.

- The war in Ukraine has certainly presented a major near-term problem that needs to be managed by Delhi and Brussels.

2] China Question

- Moscow has been deepening ties with Beijing for more than two decades triggering many anxieties in Delhi.

- In February, Putin travelled to Beijing to announce a partnership “without limits”.

- India has no option but to manage the consequences of the Russian decision.

- In the last two decades, China has emerged as a great power and now presents a generational challenge for Indian policymakers.

- That challenge has been made harder by Putin’s alliance with Xi Jinping.

- As Delhi strives to retain a reasonable relationship with Moscow, Europe emerges as an important partner in letting India cope with the China challenge.

- Thanks to the growing problems of doing business with Xi’s China, Beijing’s geopolitical alliance with Moscow, and the rapid deterioration of Sino-US relations, Brussels is ready to invest serious political capital in building purposeful strategic ties with India.

3] American Question

- Until recently it appeared that Europe’s calls for “strategic autonomy” from the US were in sync with India’s own worldview.

- But the Ukraine crisis has underlined the US’s centrality in securing Europe against Russia.

- In Asia, Chinese assertiveness has brought back the US as a critical factor in shaping peace and security.

- Washington wants a strong Europe taking greater responsibility for its own security; it would like Delhi to play a larger role in Asia and become a credible provider of regional security.

- Above all, America wants India and Europe to build stronger ties with each other.

Conclusion

For the first time since independence, India’s interests are now aligning with those of Europe. Together, Delhi and Brussels can help reshape Eurasia as well as the Indo-Pacific.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: BIFR

Mains level: Paper 3- Performance of IBC

Context

The performance of the Insolvency and Bankruptcy Code (IBC) has been under intense scrutiny.

Basis for the criticism of IBC

- The Code has been mainly criticised on three counts:

- 1] Delay in resolution: There are inordinate delays in the resolution procedure.

- 2] Liquidation: There have been more liquidations than resolutions.

- 3] Low recovery amount: The recovery amounts under IBC are not substantial, making it more of a talking point than an effective structural reform.

Is the criticism about the delay justified?

- Assessing IBC based only on the average time taken to resolve successful cases does a substantial disservice to how much more efficient the IBC is compared to the previous regimes.

- It is calculated by taking a simple average of time taken on each completed case.

- This is one of the metrics used by the Insolvency and Bankruptcy Board of India (IBBI) to compare the IBC regime with the earlier Board of Industrial and Financial Reconstruction (BIFR) regime.

- However, the performance of a bankruptcy resolution should ideally be evaluated along at least three dimensions:

- The average time taken to resolve a case, the fraction of cases resolved within a given timeframe, and the recovery rate conditional on resolution.

- Focusing on any single parameter may result in a gross under (over) estimation of the IBC’s (BIFR’s) performance.

- By examining the fraction of cases that are resolved within a specific timeframe, we see that for any fraction of the total cases resolved under each scheme, the IBC took considerably less time than BIFR.

- Total number of cases solved: Since its inception in 1987, the BIFR has resolved less than 3,500 cases while the IBC, since it was launched in 2016, resolved about 1,178 cases until it was suspended at the onset of the COVID pandemic.

- Most analyses of IBC’s performance overlook the important fact that many of the legacy BIFR cases were subsumed by IBC, and these were often zombie firms that were kept alive due to massive evergreening of loans between 2008-2015.

Conclusion

The bottom line is straightforward: The IBC has significantly outperformed the earlier BIFR regime in terms of the speed of resolution.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: BaaS

Mains level: Batter Swapping

The NITI Aayog has released a draft battery-swapping policy targeted at electric two- and three-wheelers as the government think tank aims to expedite large-scale adoption of EVs.

What is Battery Swapping?

- Battery swapping is a mechanism that involves exchanging discharged batteries for charged ones.

- This provides the flexibility to charge these batteries separately by de-linking charging and battery usage, and keeps the vehicle in operational mode with negligible downtime.

- Battery swapping is generally used for smaller vehicles such as two-wheelers and three-wheelers with smaller batteries that are easier to swap, compared to four-wheelers and e-buses, although solutions are emerging for these larger segments as well.

What is BaaS?

- Battery-as-a-service (BaaS) is seen as a viable charging alternative.

- Manufacturers can sell EVs in two forms: Vehicles with fixed or removable batteries and vehicles with batteries on lease.

- If you buy an electric scooter with battery leasing, you do not pay for the cost of the battery—that makes the initial acquisition almost 40% cheaper.

- Users can swap drained batteries for a fully charged one at a swap station. The depleted batteries are then charged on or off-site.

- The advantages of swapping include low downtimes for commercial fleets, reduced space requirements, and lower upfront costs.

- It is also a viable solution for those who don’t have parking spots at home.

Draft Battery Swapping Policy: Key Proposals

- Rationalizing taxes on battery: The draft policy has suggested that the GST Council consider reducing the differential across the tax rates on Lithium-ion batteries and electric vehicle supply equipment. Currently, the tax rate on the former is 18 per cent, and 5 per cent on the latter.

- Incentivization for swapping enabled vehicles: The policy also proposes to offer the same incentives available to electric vehicles that come pre-equipped with a fixed battery to electric vehicles with swappable batteries. The size of the incentive could be determined based on the kWh (kilowatt hour) rating of the battery and compatible EV.

- Terms of contracts for battery providers: The government will specify a minimum contract duration for a contract to be signed between EV users and battery providers to ensure they continue to provide battery swapping services after receiving the subsidy.

- Public battery charging stations: The policy also requires state governments to ensure public battery charging stations are eligible for EV power connections with concessional tariffs. It also proposes to install battery swapping stations at several locations like retail fuel outlets, public parking areas, malls, kirana shops and general stores etc.

- Tariff rationalization: It also proposes to bring such stations under existing or future time-of-day (ToD) tariff regimes, so that the swappable batteries can be charged during off-peak periods when electricity tariffs are low.

- Registration ease: Transport Departments and State Transport Authorities will be responsible for easing registration processes for vehicles sold without batteries or for vehicles with battery swapping functionality.

- Unique identification number (UIN): The policy also proposes to assign a UIN to swappable batteries at the manufacturing stage to help track and monitor them. Similarly, a UIN number will be assigned to each battery swapping station.

- Locations: The NITI Aayog has proposed that all metropolitan cities with a population of more than 40 lakh will be prioritized for the development of battery swapping networks under the first phase, which is within 1-2 years of the draft policy getting finalized.

Why hasn’t BaaS taken off yet?

- Hefty taxes: There are economic and operational constraints. Energy service providers offering swapping solutions have to charge 18% goods and services tax (GST) for swapping, compared to 5% GST on the purchase of an EV.

- No incentives yet: Additionally, the government’s FAME-II incentives are not offered to vehicles sold with BaaS or swap station operators.

- Lack of interoperability infrastructure: While these are economic disadvantages compared to direct charging solutions, the lack of a dense and interoperable battery swap infrastructure has also hindered the roll-out.

Does the draft policy talk about EV safety?

- To ensure a high level of protection at the electrical interface, a rigorous testing protocol will be adopted, the draft said, to avoid any unwanted temperature rise at the electrical interface.

- The battery management system, which is a software that controls battery functions, will have to be self-certified and open for testing to check its compatibility with various systems, and capability to meet safety requirements.

- This particularly assumes significance given the recent incidents of electric two-wheelers bursting into flames.

Issues with BaaS

- Standardization of specifications: There is a need for standardization of safety specifications as well as the battery.

- Safety hazard: Swapping in the various permutations and combinations of batteries at a station where they have not been tested for compatibility could lead to safety hazards.

- Non-competitive nature: Also, mandating only one type of battery to be eligible for concessions would be disadvantageous to many players.

Significance of battery swapping

- High Cost of EVs: An EV, by industry standards, is 1.5-2x costlier than IC Engine counterpart and at least half the cost is from the battery pack.

- Cost reduction: Many manufacturers are offering batteries separately from a vehicle, reducing the cost. In that case, a fleet owner can buy vehicles without battery and utilize battery swapping.

- Range Anxiety: Another major reason stopping people from buying EVs is range anxiety, or in simple terms, the fear of battery getting empty without finding a charging station.

- Inadequate charging infrastructure: Unlike petrol pumps, EV charging stations are rare to spot and that further increases the range anxiety exponentially, especially while going on a road trip.

- Hazard management: In case of a Swapping Station, one can simply locate a station, go and replace the empty battery with a new one.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: DSA

Mains level: India's IT Rules 2021

The European Parliament and European Union (EU) Member States announced that they had reached a political agreement on the Digital Services Act (DSA).

What is DSA?

- DSA is a landmark legislation to force big Internet companies to act against disinformation and illegal and harmful content, and to “provide better protection for Internet users and their fundamental rights”.

- The Act, which is yet to become law, was proposed by the EU Commission (anti-trust) in December 2020.

- As defined by the EU Commission, the DSA is “a set of common rules on intermediaries’ obligations and accountability across the single market”.

- It seeks to ensure higher protection to all EU users, irrespective of their country.

- The proposed Act will work in conjunction with the EU’s Digital Markets Act (DMA), which was approved last month.

Whom will the DSA apply?

- Intermediaries: The DSA will tightly regulate the way intermediaries, especially large platforms such as Google, Facebook, and YouTube, function when it comes to moderating user content.

- Abusive or illegal content: Instead of letting platforms decide how to deal with abusive or illegal content, the DSA will lay down specific rules and obligations for these companies to follow.

- Ambit platforms: The legislation brings in its ambit platforms that provide Internet access, domain name registrars, hosting services such as cloud computing and web-hosting services.

- Very large platforms: But more importantly, very large online platforms (VLOPs) and very large online search engines (VLOSEs) will face “more stringent requirements.”

- 45 million monthly users-base: Any service with more than 45 million monthly active users in the EU will fall into this category. Those with under 45 million monthly active users in the EU will be exempt from certain new obligations.

Key features

A wide range of proposals seeks to ensure that the negative social impact arising from many of the practices followed by the Internet giants is minimised or removed:

- Faster removal of illicit content: Online platforms and intermediaries such as Facebook, Google, YouTube, etc will have to add “new procedures for faster removal” of content deemed illegal or harmful. This can vary according to the laws of each EU Member State.

- Introduction of Trusted Flaggers: Users will be able to challenge these takedowns as well. Platforms will need to have a clear mechanism to help users flag content that is illegal. Platforms will have to cooperate with “trusted flaggers”.

- Imposition of duty of care: Marketplaces such as Amazon will have to “impose a duty of care” on sellers who are using their platform to sell products online. They will have to “collect and display information on the products and services sold in order to ensure that consumers are properly informed.”

- Annual audit of big platforms: The DSA adds an obligation for very large digital platforms and services to analyse systemic risks they create and to carry out risk reduction analysis. This audit for platforms like Google and Facebook will need to take place every year.

- Promoting independent research: The Act proposes to allow independent vetted researchers to have access to public data from these platforms to carry out studies to understand these risks better.

- Ban ‘Dark Patterns’ or “misleading interfaces: The DSA proposes to ban ‘Dark Patterns’ or “misleading interfaces” that are designed to trick users into doing something that they would not agree to otherwise.

- Transparency of Algorithms: It also proposes “transparency measures for online platforms on a variety of issues, including on the algorithms used for recommending content or products to users”.

- Easy cancellation of subscription: Finally, it says that cancelling a subscription should be as easy as subscribing.

- Protection of minors: The law proposes stronger protection for minors, and aims to ban targeted advertising for them based on their personal data.

- Crisis mechanism clause: This clause will make it “possible to analyse the impact of the activities of these platforms” on the crisis, and the Commission will decide the appropriate steps to be taken to ensure the fundamental rights of users are not violated.

- Others: Companies will have to look at the risk of “dissemination of illegal content”, “adverse effects on fundamental rights”, “manipulation of services having an impact on democratic processes and public security”, “adverse effects on gender-based violence, and on minors and serious consequences for the physical or mental health of users.”

Bar over Social Media

- It has been clarified that the platforms and other intermediaries will not be liable for the unlawful behaviour of users.

- So, they still have ‘safe harbour’ in some sense.

- However, if the platforms are “aware of illegal acts and fail to remove them, they will be liable for this user behaviour.

- Small platforms, which remove any illegal content they detect, will not be liable.

Are there any such rules in India?

- India last year brought the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021.

- These rules make the social media intermediary and its executives liable if the company fails to carry out due diligence.

- Rule 4 (a) states that significant social media intermediaries — such as Facebook or Google — must appoint a chief compliance officer (CCO), who could be booked if a tweet or post that violates local laws is not removed within the stipulated period.

- India’s Rules also introduce the need to publish a monthly compliance report.

- They include a clause on the need to trace the originator of a message — this provision has been challenged by WhatsApp in the Delhi High Court.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: National Edible Oil Mission-Oil Palm (NEOM-OP)

Mains level: India's import dependece for edible oils

The abrupt ban on palm oil exports by Indonesia, its biggest exporter, is expected to rock household economics globally.

Indonesia curbs palm oil export

- Indonesia has clamped down on exports starting 28 April primarily because of soaring inflation in the country.

- This is not the first time the South East Asian country decided to arrest local prices by banning exports—it had announced limited curbs in January too.

- However, brokerages suggest that the ban will probably be a temporary measure of two to three weeks, as Indonesia cannot afford to lose out on exports for long.

- Indonesia’s president Joko Widodo has stated that he would ensure that the availability of cooking oil in the domestic market becomes “abundant and affordable”.

How will this ban affect India?

- Palm oil is among the world’s most-used cooking oils, and India’s dependence on Indonesia is expected to deal a supply-side shock.

- The export ban could send food inflation soaring as India is the largest importer of palm oil from Indonesia.

- It imports about 8 million tonnes of palm oil annually; the commodity accounts for nearly 40% share of India’s overall edible oil consumption basket.

- Edible oil prices could surge as much as 100-200% in India if the government fails to find a new source of palm oil.

- Cooking oil prices are already at record levels as the Ukraine war disrupted shipments of sunflower oil.

- Prior to the war, the Black Sea region made up over 75% of global sunflower oil exports.

How could it impact packaged goods firms?

- Since palm oil and its derivatives are used in the production of several household goods, the impact of the ban could eat into the margins of Indian packaged consumer goods players.

- Analysts said listed firms such as Hindustan Unilever Ltd, Godrej Consumer Products Ltd, Britannia Industries Ltd, and Nestle SA could feel the impact of the ban in the near term.

What are India’s import options?

- India is most likely to turn to Malaysia, the second-biggest palm oil exporter, to plug the gap.

- But Malaysia is also facing a labour shortage owing to the pandemic which has resulted in a production shortfall.

- Hence Malaysia is unlikely to be able to plug the gap.

- Also the bilateral ties have soured since few years due to unwarranted comments by its former PM Mahathir Mohammed on Kashmir.

- India could also explore importing from Thailand and Africa—they produce three million tonnes each.

How can India mitigate the impact of the ban?

- Palm oil prices rose by nearly 5% over the weekend after the announcement of the export ban. Finding an immediate solution is going to be a challenge.

- Even if India manages to find an alternative source, prices will be high as a major exporter is now out of the calculation.

- The industry expects India to engage with Indonesia on an urgent basis, before the ban comes into effect on 28 April.

- Besides, the Centre is likely to negotiate with other oil-supplying nations in Latin America and Canada.

Back2Basics:

National Edible Oil Mission (OP)

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Assam's border disputes with its each neighbours

Less than a month after the Union government gave the seal of approval to an agreement to partially resolve the disputed sectors on the Assam-Meghalaya border, Arunachal Pradesh CM and his Assam counterpart decided to form district-level committees for settling their inter-state boundary disputes.

Arunachal-Assam Boundary Dispute

- Assam has had boundary disputes with all the north-eastern states that were carved out of it.

- While Nagaland became a State in 1963, Meghalaya first became an Autonomous State in 1970 and a full-fledged State in 1972.

- Arunachal Pradesh and Mizoram were separated from Assam as Union Territories in 1972 and as States in 1987.

- None of the new States accepted the “constitutional boundary” that they said was dictated by the partisan administration of undivided Assam without consulting the tribal stakeholders.

- They also claimed that the disputed areas were traditionally under the control of tribal chieftains before Assam, post-India’s independence, inherited the “imaginary boundaries” drawn during British rule.

- The issue with Arunachal Pradesh has more to do with a 1951 report prepared by a sub-committee headed by Assam’s first Chief Minister, Gopinath Bordoloi.

Genesis of the dispute

- Arunachal Pradesh and Assam have disputes at about 1,200 points along their 804 km boundary.

- The disputes cropped up in the 1970s and intensified in the 1990s with frequent flare-ups along the border.

- However, the issue dates back to 1873 when the British government introduced the inner-line permit vaguely separating the plains from the frontier hills.

- This area became the North-East Frontier Agency (NEFA) in 1954, three years after a notification based on the 1951 report saw 3,648 sq. km of the “plain” area of Balipara and Sadiya foothills being transferred to the Darrang and Lakhimpur districts of Assam.

- Arunachal has been celebrating its statehood with an eye on China since 1987, but what has been causing resentment is the inability of the people living in the transferred patches.

- Leaders in Arunachal Pradesh claim the transfer was done arbitrarily without consulting its tribes who had customary rights over these lands.

- Their counterparts in Assam say the 1951 demarcation is constitutional and legal.

Earlier attempts for resolving dispute

- There were several efforts to demarcate the boundary between Assam and NEFA/Arunachal Pradesh between 1971 and 1974.

- To end the stalemate, a high-powered tripartite committee involving the Centre and the two States was formed in April 1979 to delineate the boundary based on Survey of India maps.

- About 489 km of the inter-state boundary north of the Brahmaputra River was demarcated by 1984, but Arunachal did not accept the recommendations and staked claim to much of the areas transferred in 1951.

- Assam objected and approached the Supreme Court in 1989, accusing Arunachal Pradesh of “encroachment”.

- The apex court-appointed a local boundary commission in 2006 headed by one of its retired judges.

- In its September 2014 report, this commission recommended that Arunachal Pradesh should get back some of the areas transferred in 1951. However, this did not work out.

Way forward

- Following the model adopted in the exercise to resolve the dispute with Meghalaya, Assam and Arunachal Pradesh have agreed to form district-level committees.

- They will be tasked with undertaking joint surveys in the disputed sectors to find tangible solutions to the long-pending issue based on historical perspective, ethnicity, contiguity, people’s will and administrative convenience.

- The two States have decided to form 12 such committees involving the districts sharing the boundary. Assam has eight districts touching the boundary with Arunachal Pradesh, which has 12 such districts.

Conclusion

- The Assam-Meghalaya boundary agreement has raised hopes of the Assam-Arunachal boundary dispute being resolved.

- This is especially in light of egging the north-eastern States to end their territorial issues once and for all by August 15, 2022, when the country celebrates 75 years of independence.

- Moreover, there is a general belief that the region’s sister-States are in a better position to fast-track the resolution since they are ruled by the present regime with the same dispensation at the Centre.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Chancellor, Vice Chancellor, Article 254

Mains level: Issues with role of Governor

The Tamil Nadu Assembly has adopted two Bills that seek to empower the government to appoint Vice-Chancellors (VCs) to 13 State universities under the aegis of the Higher Education Department by amending the respective Acts.

Role of Governors in State Universities

- In most cases, the Governor of the state is the ex-officio chancellor of the universities in that state.

- Its powers and functions as the Chancellor are laid out in the statutes that govern the universities under a particular state government.

- Their role in appointing the Vice-Chancellors has often triggered disputes with the political executive.

Who is a Chancellor of a University?

- In India, almost all universities have a chancellor as their titular head whose function is largely ceremonial.

- The governor of the state, appointed as the union’s representative of state by the president, is the honorary chancellor of all State owned universities.

- The de facto head of any government university is the vice-chancellor.

- In private non-profit universities, normally the head of the foundation who has established the university is the chancellor of the university and is the head of the university.

What about Central Universities?

- Under the Central Universities Act, 2009, and other statutes, the President of India shall be the Visitor of a central university.

- With their role limited to presiding over convocations, Chancellors in central universities are titular heads, who are appointed by the President in his capacity as Visitor.

- The VCs too are appointed by the Visitor from panels of names picked by search and selection committees formed by the Union government.

- The Act adds that the President, as Visitor, shall have the right to authorize inspections of academic and non-academic aspects of the universities and also to institute inquiries.

What are the highlights of the TN Bills?

- The Bills passed in Tamil Nadu stress that “every appointment of the Vice-Chancellor shall be made by the Government from out of a panel of three names” recommended by a search-cum-selection committee.

- Currently, the Governor, in his capacity as the Chancellor of state universities, has the power to pick a VC from the shortlisted names.

- The Bills also seek to empower the state government to have the final word on the removal of VCs, if needed.

- Removal will be carried out based on inquiries by a retired High Court judge or a bureaucrat who has served at least as a Chief Secretary, according to one of the Bills.

Are other states trying to curtail the Governor’s role in appointing VCs?

- In December, the Maharashtra Assembly passed a Bill amending the Maharashtra Public Universities Act, 2016.

- Under the original Act, the Maharashtra government had no say in the appointment of VCs.

- If the changes take effect, the Governor will be given two names to choose from by the state government.

- In 2019, the West Bengal government took away the Governor’s authority in appointing VCs to state universities.

- It has also hinted at removing the Governor as the Chancellor of the universities.

- But all such motives have been challenged by the University Grants Commission (UGC).

What is at the root of the differences?

- In West Bengal, Maharashtra and Tamil Nadu, the elected governments have repeatedly accused the Governors of acting at the behest of the Centre on various subjects, including education.

- The regulations, which differ from state to state, are often open to interpretation and disputes are routine.

- In fact, the TN Bills make a case for giving the state government the upper hand in the VC appointment process by citing the examples of Gujarat and Telangana.

- In Karnataka, Jharkhand and Rajasthan, state laws underline the need for concurrence between the state and the Governor.

- The terms “concurrence” or “consultation” are absent from state legislation in most cases.

What is the UGC’s role in this?

- Education comes under the Concurrent List.

- But entry 66 of the Union List states — “coordination and determination of standards in institutions for higher education or research and scientific and technical institutions”.

- This gives the Centre substantial authority over higher education.

- The UGC plays that standard-setting role, even in the case of appointments in universities and colleges.

- According to the UGC Regulations, 2018, the “Visitor/Chancellor” — mostly the Governor in states — shall appoint the VC out of the panel of names recommended by search-cum-selection committees.

- Higher educational institutions, particularly those that get UGC funds, are mandated to follow its regulations.

- These are usually followed without friction in the case of central universities, but are sometimes resisted by the states in the case of state universities.

Judicial observations in this regard

- A Bench of Justices M R Shah and B V Nagarathna said “any appointment as a VC contrary to the provisions of the UGC Regulations can be said to be in violation of the statutory provisions, warranting a writ of quo warranto”.

- It said every subordinate legislation of the UGC, in this case the one on minimum standards on appointments, flows from the parent UGC Act, 1956.

- Therefore, being a subordinate legislation, UGC Regulations become part of the Act.

- In case of any conflict between state legislation and central legislation, central legislation shall prevail by applying the rule/principle of repugnancy as enunciated in Article 254 of the Constitution.

- It reiterated that the subject ‘education’ is in the Concurrent List of the Seventh Schedule of the Constitution.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: India's defence exports, Atmanirbharta in defence

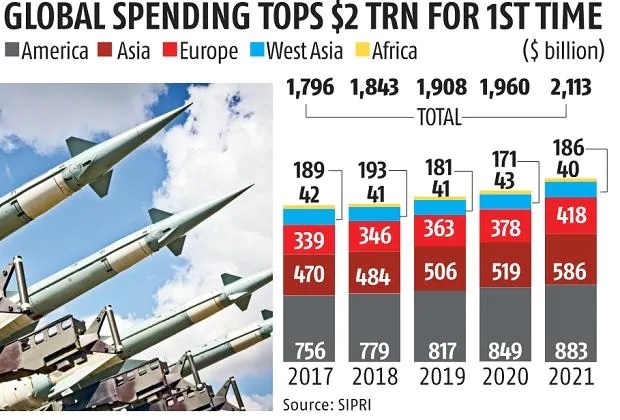

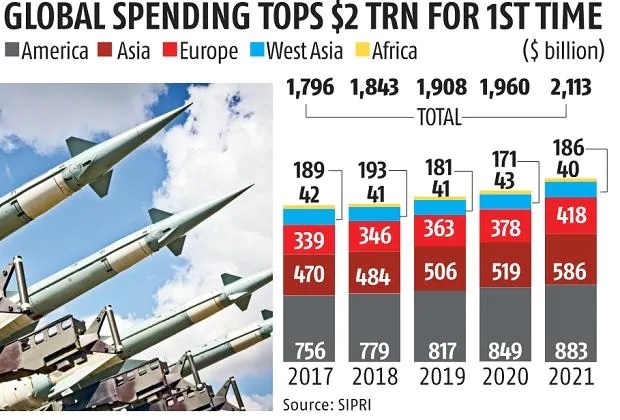

World military spending continued to grow in 2021, reaching a record $2.1 trillion despite the economic fallout of the pandemic, according to new data on global military spending published by the Stockholm International Peace Research Institute (SIPRI).

Top defence spenders in 2021

- The five largest spenders in 2021 were the U.S., China, India, the U.K. and Russia, together accounting for 62% of expenditure.

- The U.S. and China alone accounted for 52%.

India’s defence expenditure

- India’s military spending of $76.6 billion ranked third highest in the world.

- This was up by 0.9% from 2020 and by 33% from 2012.

- Amid ongoing tensions and border disputes with China and Pakistan that occasionally spill over into armed clashes, India has prioritised the modernisation of its armed forces and self-reliance in arms production, the report said.

What about Russia and Ukraine?

- Russia increased its military expenditure by 2.9% in 2021, to $65.9 billion, at a time when it was building up its forces along the Ukrainian border.

- On Ukraine, the report remarked that as it had strengthened its defences against Russia, its military spending “has risen by 72% since the annexation of Crimea in 2014”.

- Spending fell in 2021, to $5.9 billion, but still accounted for 3.2% of the country’s GDP.

Also read-

[Sansad TV] Perspective: Self-Reliance in Defence

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Kuril Islands

Mains level: Not Much

Japan has recently described the Kuril Islands (which Japan calls the Northern Territories and Russia as the South Kurils) as being under Russia’s “illegal occupation”.

Note the Islands of Japan in North to South Direction: Hokkaido, Honshu , Shikoku, and Kyushu

What are the Kuril Islands/ Northern Territories?

- These are a set of four islands situated between the Sea of Okhotsk and the Pacific Ocean near the north of Japan’s northernmost prefecture, Hokkaido.

- Both Moscow and Tokyo claim sovereignty over them though the islands have been under Russian control since the end of World War II.

- The Soviet Union had seized the islands at the end of World War II and by 1949 had expelled its Japanese residents.

- Tokyo claims that the disputed islands have been part of Japan since the early 19th century.

Why in news?

- This is the first time in about two decades that Japan has used this phrase to describe the dispute over the Kuril Islands.

- Japan had been using softer language since 2003, saying that the dispute over the islands was the greatest concern in Russia-Japan bilateral ties.

What lies behind the dispute?

- Japan’s sovereignty over the islands is confirmed by several treaties since 1855.

- Russia, on the other hand, claims the Yalta Agreement (1945) and the Potsdam Declaration (1945) as proof of its sovereignty.

- It argues that the San Francisco Treaty of 1951 is legal evidence that Japan had acknowledged Russian sovereignty over the islands.

- Under Article 2 of the treaty, Japan had “renounced all right, title and claim to the Kuril Islands.”

- However, Japan argues that the San Francisco Treaty cannot be used here as the Soviet Union never signed the peace treaty.

Continuing the WW2

- In fact, Japan and Russia are technically still at war because they have not signed a peace treaty after World War II.

- In 1956, during Japanese PM Ichiro Hatoyama’s visit to the Soviet Union, it was suggested that two of the four islands would be returned to Japan once a peace treaty was signed.

- However, persisting differences prevented the signing of a peace treaty though the two countries signed the Japan-Soviet Joint Declaration, which restored diplomatic relations between the two nations.

- The Soviet Union later hardened its position, even refusing to recognise that a territorial dispute existed with Japan.

- It was only in 1991 during Mikhail Gorbachev’s visit to Japan that the USSR recognised that the islands were the subject of a territorial dispute.

Have there been attempts at resolution?

- Since 1991, there have been many attempts to resolve the dispute and sign a peace treaty.

- The most recent attempt was under PM Shinzo Abe when joint economic development of the disputed islands was explored.

- In fact, both countries had agreed to have bilateral negotiations based on the 1956 Japan-Soviet Joint Declaration.

- Russia was even willing to give back two islands, the Shikotan Island and the Habomai islets, to Japan after the conclusion of a peace treaty as per the 1956 declaration.

- Japan’s attempt to improve ties with Russia was driven by its need to diversify energy sources and Russia by its need to diversify its basket of buyers and bring in foreign investments.

- But nationalist sentiments on both sides prevented resolution of the dispute.

Implications for Japan

- Soon after the Russian invasion of Ukraine, Japan made its unhappiness with Russia clear.

- Japan has been among the most steadfast of Western allies in denouncing Russian aggression and punishing it with sanctions.

- Japan has probably been spurred by its fears of a Russia-China alliance as Japan itself has territorial disputes and an uneasy history with China.

- Secondly, Japan might have felt that this is a good opportunity to further isolate Russia and paint it as a “habitual offender” of international law.

- Finally, Tokyo might have been prompted to take this position as it feels that the invasion of Ukraine proves that getting back the Kuril Islands is a lost cause.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)