Note4Students

From UPSC perspective, the following things are important :

Prelims level: Blue economy overview, Matsya Sampada Yojana and other such initiatives

Mains level: Blue economy, India's fisheries sector

Central Idea

- The neglect of the fishing industry by India and Sri Lanka has resulted in an ongoing dispute over fishing rights in the Palk Strait. Developing the fishing industry could help resolve the conflict and boost the economies of both countries.

What is Blue Economy?

- Origin of the concept: Gunter Pauli’s book, “The Blue Economy: 10 years, 100 innovations, 100 million jobs” (2010) brought the Blue Economy concept into prominence.

- A project to find best nature inspired and sustainable technologies: Blue Economy began as a project to find 100 of the best nature-inspired technologies that could affect the economies of the world. While sustainably providing basic human needs potable water, food, jobs, and habitable shelter.

- Inclusive approach and objective: This is envisaged as the integration of Ocean Economy development with the principles of social inclusion, environmental sustainability and innovative, dynamic business models

- Environment friendly maritime infrastructure: It is creation of environment-friendly infrastructure in ocean, because larger cargo consignments can move directly from the mothership to the hinterland through inland waterways, obviating the need for trucks or railways

Indo-Sri Lankan dispute over fishing rights in Palk Strait

- Maritime boundary agreement: The maritime boundary agreements signed in 1974 and 1976 allowed fishermen of both nations to fish in each other’s waters as they traditionally did.

- Absence of physical demarcation: Lack of physical demarcation of maritime boundaries resulted in Indian fishermen encroaching into Sri Lankan waters during the civil war.

- Rising conflicts: The Sri Lankan fishing community sought to reclaim their rights after the end of hostilities, leading to conflict with Indian fishers. Sri Lankan Navy’s intervention has resulted in arrests and even fatal shootings of Indian fishermen.

Neglect of the fishing industry by India and Sri Lanka

- India’s marine fishery: India’s marine fishery has been dominated by the artisanal sector, which can afford only small sailboats or canoes to fish for subsistence.

- Lack of investment: India’s fisheries are being transformed into a commercial enterprise, but lack of investment in a deepwater fleet results in most fishing taking place in coastal waters, leading to competition with neighboring countries.

- Underexploited resources: Rich resources in India’s Exclusive Economic Zone remain underexploited, with much of the catch from India’s fishing grounds taken away by better-equipped fishing fleets of other Indo-Pacific countries indulging in illegal, unregulated, and unreported fishing.

- Growing tensions: Neglect of the fishing industry has resulted in dwindling fish stocks, rising fuel costs, and growing tensions between India and Sri Lanka.

Development of the fishing industry

- China: China has mobilized its fishing industry to meet rising demand for protein in the Chinese diet and is now a fishery superpower.

- India: India needs to invest in a deepwater fleet to exploit rich fishing grounds in its Exclusive Economic Zone and compete with other countries in the Indo-Pacific region.

- India must focus on modernisation: India should focus on mechanization and modernization of fishing vessels, developing deep-water fishing fleets, building a DWF fleet around the mother ship concept, and developing modern fishing harbours.

- PM Matsya Sampada Yojana is a scheme launched by the Government of India in 2020, with the aim of boosting the fisheries sector in the country. The scheme has a total outlay of Rs. 20,050 crores and is implemented over a period of five years from 2020-21 to 2024-25. The scheme is focused on four key areas of intervention, which include:

- Development of infrastructure and modernization of the fisheries sector: This involves the creation of new fishing harbours, fish landing centres, cold chain facilities, and other related infrastructure.

- Fisheries management and regulatory framework: This involves strengthening the regulatory framework for fisheries and aquaculture, promoting sustainable fishing practices, and conserving marine biodiversity.

- Fisheries post-harvest operations and value chain: This involves promoting the processing and value addition of fish and fishery products, and improving market access for fishermen and fish farmers.

- Aquaculture development: This involves promoting the development of inland fisheries and aquaculture, including the creation of new fish farms, and supporting the adoption of modern technologies for fish farming.

Conclusion

- Neglect of the fishing industry by India and Sri Lanka has resulted in an ongoing dispute over fishing rights in the Palk Strait. Developing the fishing industry could help resolve the conflict and boost the economies of both countries. The government’s Pradhan Mantri Matsya Sampada Yojana could be used to form an Indo-Sri Lankan Fishing Corporation to provide a huge boost to the fishing industries of both nations and remove an unwanted irritant in bilateral relations.

Mains Question

Q. It is said that fishing industry has been overly neglected by India and Sri Lanka. Development of the fishing industry is crucial to boost the economy for both the countries. Discuss.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Innovations In AI and tools

Mains level: AI's diverse potential and its application for better governance

Central Idea

- Artificial Intelligence (AI) has gained worldwide attention, and many mature democracies are using it for better legislative procedures. In India, AI can be used to assist parliamentarians in preparing responses for legislators, enhancing research quality, and obtaining information about any Bill, legislative drafting, amendments, interventions, and more. However, before AI can work in India, there is a need to codify the country’s laws, which are opaque, complex, and face a huge translation gap between law-making, law-implementing, and law-interpreting organizations.

- AI is a constellation of technologies that enable machines to act with higher levels of intelligence and emulate the human capabilities of sense, comprehend and act.

- The natural language processing and inference engines can enable AI systems to analyze and understand the information collected.

- An AI system can also take action through technologies such as expert systems and inference engines or undertake actions in the physical world.

- These human-like capabilities are augmented by the ability to learn from experience and keep adapting over time.

- AI systems are finding ever-wider application to supplement these capabilities across various sectors

Need to Codify Laws

- Current laws are complex and opaque: Current laws in India pose many challenges, such as their complexity, opaqueness, and lack of a single source of truth.

- The India Code portal does not provide complete information: The India Code portal is not enough to provide complete information about parent Acts, subordinate legislation, and amendment notifications.

- AI can be used to provide comprehensive information: There is a need to make laws machine-consumable with a central law engine, which can be a single source of truth for all acts, subordinate pieces of legislation, gazettes, compliances, and regulations. AI can use this engine to provide information on applicable acts and compliances for entrepreneurs or recommend eligible welfare schemes for citizens.

Assisting Legislators

- Potential of AI for legislators: AI can help Indian parliamentarians manage constituencies with a huge population by analysing citizens’ grievances and social media responses, flagging issues that need immediate attention and assisting in seeking citizen inputs for public consultation of laws and preparing a manifesto.

- AI-powered assistance: Many Parliaments worldwide are now experimenting with AI-powered assistants.

- For instance:

- Netherlands’s Speech2Write system: The Speech2Write system in the Netherlands House of Representatives, which converts voice to text and translates voice into written reports.

- AI tools Japan: Japan’s AI tool assists in preparing responses for its legislature and helps in selecting relevant highlights in parliamentary debates.

- Brazil: Brazil has developed an AI system called Ulysses, which supports transparency and citizen participation.

- NeVA portal India: India is also innovating and working towards making parliamentary activities digital through the ‘One Nation, One Application’ and the National e-Vidhan (NeVA) portal.

Simulating Potential Effects of Laws

- Dataset modelling: AI can simulate the potential effects of laws by modelling various datasets such as the Census, data on household consumption, taxpayers, beneficiaries from various schemes, and public infrastructure.

- Flag outdated laws: In that case, AI can uncover potential outcomes of a policy and flag outdated laws that require amendment.

- For example: During the COVID-19 pandemic, ‘The Epidemic Diseases Act, 1897’ failed to address the situation when the virus overwhelmed the country. Several provisions in the Indian Penal Code (IPC) are controversial and redundant, such as Article 309 (attempted suicide) of the IPC continues to be a criminal offense. Many criminal legislation pieces enacted more than 100 years ago are of hardly any use today.

Conclusion

- The COVID-19 pandemic has given a strong thrust to the Digital India initiative, and a digitization of services needs to be kept up in the field of law, policy-making, and parliamentary activities, harnessing the power of AI. However, the use of AI must be encouraged in an open, transparent, and citizen-friendly manner, as AI is a means to an end, not an end in itself. Therefore, it is necessary to address the current challenges faced by India’s laws before AI can be effectively used to assist parliamentarians in their legislative duties.

Mains Question

Q. Artificial Intelligence (AI) has gained worldwide attention, and many mature democracies are using it for better legislative procedures. In this light evaluate the potential of AI in assisting Indian parliamentarians.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Private Space companies in news

Mains level: India's space sector and role pf private companies and startups

Central Idea

- India needs an enabling policy and regulatory environment to tap into the potential of the Second Space Age and its rapidly growing space economy.

What is mean by the Second Space Age?

- Commercialization: The Second Space Age refers to the recent era of increased commercialization and private sector involvement in space exploration, which began in the early 2000s.

- Emergence of private space companies: This period has been marked by the emergence of private space companies like SpaceX, Blue Origin, and Virgin Galactic, who are investing heavily in space technology and infrastructure.

- Today’s space domain has many more actors once dominated by US and USSR: Compared to the First Space Age dominated by the US and the USSR, today’s space domain has many more actors, with a majority being private companies. Private companies account for 90% of global space launches since 2020, and India is no exception

- Increasing involvement of non-spacefaring nations: The Second Space Age is also characterized by the increasing involvement of non-spacefaring nations in space exploration and the development of technologies that enable greater access to space for both commercial and scientific purposes.

- Exploration: The hope is that this new era will lead to breakthroughs in areas like space tourism, asteroid mining, and Mars colonization, among others.

- India’s journey in space began modestly in the 1960s.

- Societal objectives: Over the decades, the Indian Space Research Organisation (ISRO) prioritized societal objectives and benefits, such as developing satellite technology for mass communication, remote sensing for weather forecasting, resource mapping of forests, agricultural yields, groundwater and watersheds, fisheries and urban management, and satellite-aided navigation.

- Enhanced launch capabilities: ISRO also developed satellite launch capabilities, beginning with the SLV-1 in the 1980s, followed by the PSLV series, which has become its workhorse with over 50 successful launches.

Facts for prelims

| Steps taken to promote the space industry in India |

Resulting Outcome

|

| Creation of Indian Space Research Organisation (ISRO) in 1969 |

Establishment of a strong foundation for space research and exploration in India |

| Launch of Aryabhata satellite in 1975 |

First satellite successfully launched by India |

| Establishment of the Vikram Sarabhai Space Centre (VSSC) in 1972 |

Development of technologies for rocket and satellite launch |

| Launch of Rohini satellite in 1983 |

First satellite launched using an Indian-made launch vehicle |

| Launch of Polar Satellite Launch Vehicle (PSLV) in 1993 |

Capability to launch smaller satellites into orbit |

| Launch of Geosynchronous Satellite Launch Vehicle (GSLV) in 2001 |

Capability to launch larger and heavier satellites into orbit |

| Successful Mars Orbiter Mission (MOM) in 2014 |

India became the first country to successfully launch a spacecraft to Mars in its first attempt |

| Formation of NewSpace India Limited (NSIL) in 2019 |

Increased involvement of private sector in space activities and commercialization of space technologies |

| Announcement of Gaganyaan mission in 2018 |

Development of human spaceflight capabilities in India |

India’s Space Potential

- Economy and employment: India’s space economy, estimated at $9.6 billion in 2020, is expected to be $13 billion by 2025. However, with an enabling policy and regulatory environment, the Indian space industry could exceed $60 billion by 2030, directly creating more than two lakh jobs.

- Downstream activities: Downstream activities such as satellite services and associated ground segment are dominant, accounting for over 70% of India’s space economy.

- Media and entertainment segment: Media and entertainment account for 26% of India’s space economy, with consumer and retail services accounting for another 21%.

The Growing Role of the Private Sector

- Increasing space start ups: The Indian private sector is responding to the demands of the Second Space Age, with over 100 space start-ups today. From less than $3 million in 2018, investment in the sector has doubled in 2019 and crossed $65 million in 2021.

- Potential of multiplier effect on economy: The sector is poised for take-off, as a transformative growth multiplier like the IT industry did for the national economy in the 1990s.

Way ahead: Creating an Enabling Environment

- ISRO needs to focus on research and collaborate with the Indian private sector, which has different needs and demands.

- To create an enabling environment for the private sector, India needs a space activity act that provides legal grounding, sets up a regulatory authority, and enables venture capital funding into the Indian space start-up industry.

- Although a series of policy papers have been circulated in recent years, legislation is needed to provide legal backing and create an enabling environment for private sector growth.

Conclusion

- India’s space industry has enormous potential, but realizing it requires an enabling policy and regulatory environment that encourages private sector growth. With a space activity act that provides legal backing, sets up a regulatory authority, and enables venture capital funding, India can take advantage of the Second Space Age and become a major player in the global space economy.

Mains Question

Q. What do you understand by mean Second Space Age? Highlight potential of India’s space industry and growing role of private sector

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Finance Commission

Mains level: Read the attached story

The Union government is gearing up to constitute the Sixteenth Finance Commission in November this year to recommend the formula for sharing revenues between the Centre and the States for the five-year period beginning 2026-27.

What is the Finance Commission?

- The Finance Commission (FC) was established by the President of India in 1951 under Article 280 of the Indian Constitution.

- It was formed to define the financial relations between the central government of India and the individual state governments.

- The Finance Commission (Miscellaneous Provisions) Act, 1951 additionally defines the terms of qualification, appointment and disqualification, the term, eligibility and powers of the Finance Commission.

- As per the Constitution, the FC is appointed every five years and consists of a chairman and four other members.

- Since the institution of the First FC, stark changes in the macroeconomic situation of the Indian economy have led to major changes in the FC’s recommendations over the years.

Constitutional Provisions

Several provisions to bridge the fiscal gap between the Centre and the States were already enshrined in the Constitution of India, including Article 268, which facilitates levy of duties by the Centre but equips the States to collect and retain the same.

Article 280 of the Indian Constitution defines the scope of the commission:

- Who will constitute: The President will constitute a finance commission within two years from the commencement of the Constitution and thereafter at the end of every fifth year or earlier, as the deemed necessary by him/her, which shall include a chairman and four other members.

- Qualifications: Parliament may by law determine the requisite qualifications for appointment as members of the commission and the procedure of selection.

- Terms of references: The commission is constituted to make recommendations to the president about the distribution of the net proceeds of taxes between the Union and States and also the allocation of the same among the States themselves. It is also under the ambit of the finance commission to define the financial relations between the Union and the States. They also deal with the devolution of unplanned revenue resources.

Important functions

- Devolution of taxes: Distribution of net proceeds of taxes between Center and the States, to be divided as per their respective contributions to the taxes.

- Grants-in-aid: Determine factors governing Grants-in-Aid to the states and the magnitude of the same.

- Augment states fund: To make recommendations to the president as to the measures needed to augment the Fund of a State to supplement the resources of the panchayats and municipalities in the state on the basis of the recommendations made by the finance committee of the state.

- Any financial function: Any other matter related to it by the president in the interest of sound finance.

Members of the Finance Commission

- The Finance Commission (Miscellaneous Provisions) Act, 1951 was passed to give a structured format to the finance commission and to bring it to par with world standards.

- It laid down rules for the qualification and disqualification of members of the commission, and for their appointment, term, eligibility and powers.

- The Chairman of a finance commission is selected from people with experience of public affairs. The other four members are selected from people who:

- Are, or have been, or are qualified, as judges of a high court,

- Have knowledge of government finances or accounts, or

- Have had experience in administration and financial expertise; or

- Have special knowledge of economics

Key challenges ahead for 16th FC

- Overlap with GST Council: A key new challenge for the 16th FC would be the co-existence of another permanent constitutional body, the GST Council.

- Conflict of interest: The GST Council’s decisions on tax rate changes could alter the revenue calculations made by the Commission for sharing fiscal resources.

- Feasibility of recommendations: Centre usually takes the Commission’s recommendations on States’ share of tax devolution and the trajectory for fiscal targets into account, and ignores most other suggestions.

Major outstanding recommendations

- Creating a Fiscal Council: The 15th FC has suggested creating a Fiscal Council where Centre and States collectively work out India’s macro-fiscal management challenges, but the government has signalled there is no need for it, he pointed out.

- Creating a non-lapsable fund for internal security: The centre accepted to set up a non-lapsable fund for internal security and defense ‘in principle’, its implementation still has to be worked out.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Article 371, 371F

Mains level: Special provisions for some States

Former Sikkim CM claimed that the Sikkimese people feel betrayed as Article 371F, which guarantees special provisions for Sikkim, was “violated”.

What is Article 371F?

- Article 371F is a special provision in the Constitution of India that was created to provide for the unique status of Sikkim, a state located in the northeastern part of India.

- Sikkim was an independent kingdom until 1975, when it became the 22nd state of India.

- Article 371F was included in the Constitution to ensure that Sikkim’s distinct identity and cultural heritage were protected and preserved after its merger with India.

Special provisions for Sikkim

Under Article 371F, Sikkim has been granted several special provisions that are not available to other states in India. Some of the key provisions of Article 371F are:

- Protection of Sikkimese people: Only the descendants of Sikkim subjects (those who lived in the state before its merger with India) whose names were mentioned in the 1961 register are considered Sikkimese and are entitled to certain benefits, such as the right to own land and get state government jobs. They are also exempted from paying income tax.

- Legislative powers: The Governor of Sikkim has special powers with respect to the Sikkim Legislative Assembly, including the power to nominate one member to the Assembly and the power to give his or her assent to certain bills.

- Constitutional safeguards: Certain constitutional safeguards have been provided to the people of Sikkim to protect their distinct identity and cultural heritage.

- Formation of Committees: The Central Government has the power to appoint a committee of experts to advise on matters related to Sikkim, and the State Government can also appoint committees to examine issues related to the protection of Sikkim’s unique identity.

Why in news?

- The Financial Bill, 2023 redefined Sikkimese as any Indian citizen domiciled in Sikkim, which would extend these benefits to a broader population.

- This move is seen as a violation of Article 371F, which was the basis for Sikkim’s merger with India in 1975.

Concerns highlighted

- The leader claimed that the people of Sikkim feel betrayed by the violation of Article 371F.

- He alleged that Sikkim has become a hotbed for political violence.

- He claimed that unrest in a sensitive border state like Sikkim is not good for national security.

Back2Basics: Article 371

- It is a provision in the Constitution of India that grants special provisions and autonomy to certain states in India.

- It is a set of temporary and transitional provisions that were included in the Constitution to address the specific needs and aspirations of various regions and communities in the country.

- The provisions of Article 371 differ from state to state, depending on the specific needs and demands of the region. For instance:

- Maharashtra and Gujarat: Article 371 provides for special provisions for the states of Maharashtra and Gujarat, which grants certain rights and privileges to the people of the Marathi-speaking areas of Maharashtra and the Gujarati-speaking areas of Gujarat.

- Nagaland: Article 371A provides for special provisions and autonomy for the state of Nagaland. It grants the Nagaland Legislative Assembly special powers with respect to lawmaking, and prohibits outsiders from acquiring land in the state.

- Assam: Article 371B provides for special provisions for the state of Assam, which includes the establishment of a regional council for the state and grants the council certain legislative and executive powers.

- Manipur: Article 371C provides for special provisions for the state of Manipur. It gives the Manipur Legislative Assembly the power to enact laws related to land, forests, and minerals, and also provides for the protection of the rights of the hill tribes in the state.

- Andhra Pradesh: Article 371D provides for the establishment of a special committee to oversee the development of backward regions in the state of Andhra Pradesh.

- The provisions are aimed at promoting the development and welfare of the people in these states, while preserving their unique cultural and linguistic identity.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Rare earth elements

Mains level: Not Much

Scientists at the National Geophysical Research Institute (NGRI) in Hyderabad have discovered the presence of rare-earth elements (REEs) in Anantapur district, Andhra Pradesh.

What are Rare-Earth Elements?

- Rare-earth elements (REEs) are a group of 17 elements, including lanthanum, cerium, praseodymium, neodymium, yttrium, hafnium, tantalum, niobium, zirconium, and scandium.

- These elements are widely used in modern electronics, such as smartphones, computers, jet aircraft, and other products, due to their unique magnetic, optical, and catalytic properties.

- These elements are crucial components in various electronic devices and have industrial applications in sectors like imaging, aerospace, and defense.

SHORE Project and discovery of REEs

- The discovery was part of a study funded by the Council of Scientific and Industrial Research (CSIR) under a project called ‘Shallow subsurface imaging Of India for Resource Exploration’ (SHORE).

- NGRI scientists found enriched quantities of REEs in “whole rock analyses”.

- Drilling for at least a kilometer deep will help ascertain the consistency of the elements’ presence underground.

Significance of the discovery

- The discovery of REEs in Anantapur district is significant as these elements are in high demand worldwide, and their supply is limited.

- REEs have become a subject of geopolitical concern due to their increasing demand and limited supply.

- China is currently the world’s largest producer and exporter of rare-earth elements (REEs), accounting for more than 80% of global production.

- The country has significant reserves of REEs and has invested heavily in mining and processing infrastructure.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: LIGO

Mains level: Gravitational waves study

India has given the final approval to build its biggest scientific facility, Laser Interferometer Gravitational-Wave Observatory (LIGO), in the Hingoli district of Maharashtra. The facility will join the global project to detect and study gravitational waves.

Gravitation and General Theory of Relativity

- Newton’s law of gravitation, proposed by Sir Isaac Newton in the 17th century, explains that the force that makes an object fall to the ground is also responsible for making heavenly bodies go around in their orbits.

- However, the theory did not explain the existence of an attractive force between any two bodies or the instantaneous propagation of the gravitational force over large distances.

- In 1915, Albert Einstein proposed the General Theory of Relativity, which altered our understanding of gravitation. Einstein proposed that space-time interacted with matter, was influenced by it, and in turn, and influenced events.

- The curvature in space-time produced by matter was the reason other smaller bodies in the vicinity felt the gravitational pull.

- General Relativity also predicted that moving objects would generate gravitational waves in space-time.

|

What is LIGO?

|

What is it?

|

Laser Interferometer Gravitational-Wave Observatory (LIGO) |

| Purpose |

Detect and study gravitational waves |

| Cause |

Ripples in spacetime caused by violent and energetic events in the universe |

| Location |

Livingston, Louisiana and Hanford, Washington |

| Detector |

Michelson interferometer |

| Function |

Measure changes in length caused by passing gravitational waves |

| Benefits |

Improving our understanding of the universe and its origins |

| Discovery |

Detected gravitational waves for the first time in 2015 |

| Significance |

Confirmed a prediction made by Albert Einstein’s theory of general relativity |

| Field |

Gravitational wave astronomy |

| Discoveries |

Many exciting discoveries about the nature of the universe |

About LIGO-India

- LIGO-India will be the fifth node of this international network of gravitational wave observatories, and possibly the last.

- The instrument is so sensitive that it can easily get influenced by events like earthquakes, landslides, or even the movement of trucks, and produce a false reading.

- That is why multiple observatories are needed to revalidate the signals.

- India’s involvement in LIGO is crucial to demonstrating its intent and capability to pull-off complex science projects independently.

Significance

- The detection and study of gravitational waves could help in understanding the universe’s structure, the origin of the universe, and the functioning of black holes.

- The LIGO project also has huge spin-off benefits for India’s science and technology sector.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Uranium isotopes, Radioactivity

Mains level: NA

Physicists in Japan have discovered a new isotope of uranium, with atomic number 92 and mass number 241.

Uranium

- Uranium is a naturally occurring chemical element with the symbol U and atomic number 92.

- It is a heavy metal that is radioactive and found in small quantities in rocks and soils worldwide.

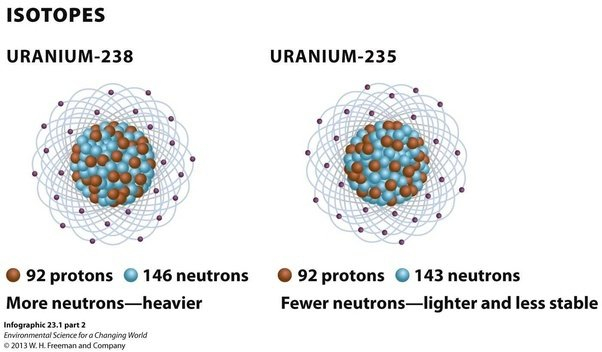

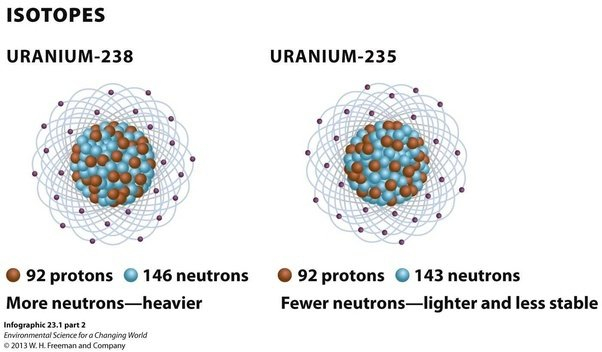

- Uranium has several isotopes, which are atoms that have the same number of protons but different numbers of neutrons.

Isotopes of Uranium

The most common isotopes of uranium are uranium-238 and uranium-235.

- Uranium-238: It is the most abundant isotope of uranium, accounting for over 99% of natural uranium. It has 92 protons and 146 neutrons in its nucleus. It is not fissile, which means it cannot sustain a nuclear chain reaction. However, it is fertile, which means it can absorb neutrons and undergo radioactive decay to produce other isotopes such as plutonium-239, which is fissile.

- Uranium-235: It is the second most abundant isotope of uranium, accounting for less than 1% of natural uranium. It has 92 protons and 143 neutrons in its nucleus. Unlike uranium-238, it is fissile, which means it can sustain a nuclear chain reaction. It is used as fuel in nuclear reactors and as the primary material for nuclear weapons.

How are isotopes created?

- Isotopes can be created through natural processes or artificial processes in a laboratory.

- Isotopes are created through natural processes such as radioactive decay, cosmic ray interactions, and nuclear fusion reactions in stars.

- For example, carbon-14 is created in the Earth’s upper atmosphere when cosmic rays interact with nitrogen atoms.

- Isotopes can also be created artificially through nuclear reactions.

- This involves bombarding atoms with particles such as protons, neutrons, or alpha particles, which can change the number of protons and/or neutrons in the nucleus.

How uranium-241 was found?

- To find uranium-241, the researchers accelerated uranium-238 nuclei into plutonium-198 nuclei using the KEK Isotope Separation System (KISS).

- In a process called multinucleon transfer, the two isotopes exchanged protons and neutrons, resulting in nuclear fragments with different isotopes.

- The researchers identified uranium-241 and measured the mass of its nucleus using time-of-flight mass spectrometry.

- Theoretical calculations suggest that uranium-241 could have a half-life of 40 minutes.

Significance of the discovery

- The discovery is significant because it refines our understanding of nuclear physics, particularly the shapes of large nuclei of heavy elements and how often they occur.

- This information helps physicists to design models for nuclear power plants and exploding stars.

Also, what are Magic numbers?

- There is a particular interest in ‘magic number’ nuclei, which contain a certain number of protons or neutrons that result in a highly stable nucleus.

- Lead (82 protons) is the heaviest known ‘magic’ nucleus, and physicists have been trying to find the next element with magic numbers.

- The researchers hope to extend their systematic mass measurements towards many neutron-rich isotopes, at least to neutron number 152, where a new ‘magic number’ is expected.

Conclusion

- The discovery of the new neutron-rich uranium isotope is a major breakthrough in nuclear physics, as it provides essential information for understanding the behavior of heavy elements.

- The researchers’ aim to extend their measurements to other neutron-rich isotopes reflects their commitment to exploring the frontiers of nuclear science and to improve our understanding of the universe.

- Discovering new magic number nuclei through these measurements could have practical applications in designing safer and more efficient nuclear power plants and understanding the properties of exploding stars.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: CR Rao

Mains level: Not Much

Central idea: Indian-American statistician Calyampudi Radhakrishna Rao has been awarded the 2023 International Prize in Statistics, which is considered the Nobel Prize for statistics. He is 102 YO.

Who is C. R. Rao?

- R. Rao, is an Indian-American mathematician and statistician.

- He is currently professor emeritus at Pennsylvania State University and Research Professor at the University at Buffalo.

- Rao has been honoured by numerous colloquia, honorary degrees, and festschrifts and was awarded the US National Medal of Science in 2002.

- The American Statistical Association has described him as “a living legend whose work has influenced not just statistics, but has had far reaching implications for fields as varied as economics, genetics, anthropology, geology, national planning, demography, biometry, and medicine.”

- The Times of India listed Rao as one of the top 10 Indian scientists of all time.

Rao’s Groundbreaking Paper

- The research paper, “Information and accuracy attainable in the estimation of statistical parameters,” was published in 1945 in the Bulletin of the Calcutta Mathematical Society.

- The paper provided a lower limit on the variance of an unbiased estimate for a finite sample, which has since become a cornerstone of mathematical statistics.

Key outcomes of his research

Rao’s 1945 paper has three outcomes-

- Cramer-Rao inequality: It provides a lower limit on the variance of an unbiased estimate for a finite sample.

- Rao-Blackwell Theorem: It provides a method to improve an estimate to an optimal estimate.

- Information geometry: It is a new interdisciplinary area called “information geometry,” which integrated principles from differential geometry into statistics, including the concepts of metric, distance, and measure.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now