Note4Students

From UPSC perspective, the following things are important :

Prelims level: Indian Forest and Wood Certification Scheme

Mains level: Not Much

Central Idea

- The Ministry of Environment, Forests and Climate Change has introduced the Indian Forest & Wood Certification Scheme to promote sustainable management of forests and trees outside forests.

Understanding Forest Certification

- Definition: Forest certification is a process for evaluating the quality of timber, wood, pulp products, and non-timber forest products against set standards.

- Purpose: It ensures that forest products are sourced from responsibly managed forests or recycled materials.

Forest and Wood Certification Scheme

- Voluntary Certification: The scheme offers voluntary third-party certification to encourage sustainable forest management and agroforestry.

- Certification Types: Includes Forest Management Certificates, Trees outside Forest Management Certificate, and chain of custody certification.

- Standards: The Forest Management certification is based on the Indian Forest Management Standard, which includes 8 criteria, 69 indicators, and 254 verifiers.

Implementation and Oversight

- Scheme Operating Agency: The Indian Institute of Forest Management, Bhopal, will manage the scheme.

- Accreditation Body: The Quality Council of India will accredit certification bodies to assess adherence to the standards.

- Advisory Council: The Indian Forest and Wood Certification Council, comprising members from various eminent institutions and ministries, will oversee the scheme.

Significance of Forest Certification

- Buyer Assurance: Helps buyers identify products sourced from well-managed forests or recycled materials.

- Discouraging Illegal Sources: Aims to reduce the use of supplies from illegal sources.

- Holistic Benefits: Ensures that forest activities contribute to environmental, social, and economic benefits.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Saiga Antelope

Mains level: NA

Central Idea

- The Saiga Antelope has been reclassified from ‘Critically Endangered’ to ‘Near Threatened’ by the International Union for Conservation of Nature (IUCN).

About Saiga Antelope

|

Details |

| Scientific Name |

Saiga tatarica |

| Physical Characteristics |

Notable for its distinctive bulbous nose; relatively small, with a thin build and long, thin legs |

| Habitat |

Primarily found in the steppe region of Central Asia and Eastern Europe |

| Population Distribution |

Predominantly in Kazakhstan and Russia, with smaller populations in Uzbekistan, Turkmenistan, and Mongolia |

| Conservation Status |

IUCN Red List: Near Threatened

CITES: Appendix II |

| Major Threats |

Poaching for horns (used in traditional medicine), habitat loss, and disease outbreaks like pasteurellosis |

| Diet |

Herbivorous, feeding on a variety of grasses and plants |

| Breeding |

Known for its rapid population growth under favorable conditions; breeds in large herds |

| Migration |

Notable for long-distance seasonal migrations |

| Cultural Significance |

Featured in the folklore and culture of the local steppe communities |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Goods and Services Tax (GST)

Mains level: Read the attached story

Central Idea

- The government has revived its focus on Goods and Services Tax (GST) rate rationalization by reconstituting the ministerial group of the GST Council.

About Goods and Services Tax (GST)

- Launch and Purpose: GST, implemented on 1 July 2017, is a comprehensive indirect tax across India, replacing multiple cascading taxes levied by the central and state governments.

- Consumption-Based Tax: It is charged at the point of supply and is based on the destination of consumption, benefiting the state where the goods or services are consumed.

GST Slabs and Their Distribution

- Tax Slabs: GST in India is categorized into five main slabs: 0%, 5%, 12%, 18%, and 28%, with an additional cess on certain luxury and ‘sin’ goods.

- Product and Service Coverage: The GST system covers over 1300 products and 500+ services, categorized under these slabs.

- Periodic Revision: The GST Council revises the slab rates periodically, ensuring essential items are taxed lower, while luxury items attract higher rates.

- 28% Slab and Cess: The highest slab of 28% is reserved for demerit goods like tobacco and luxury automobiles, with an additional cess for revenue generation.

Issues with the Current GST Structure

- Complexity: The multi-slab structure and varying rates lead to confusion and increased compliance costs for businesses.

- Rate Heterogeneity: Diverse rates across different goods and services complicate the tax system.

- Dual GST System: The coexistence of CGST and SGST adds to the complexity and compliance burden.

- Cascading Effect: Despite being a value-added tax, GST sometimes leads to cascading taxation, increasing the cost of goods and services.

- Lack of Transparency: Invoicing under GST often lacks clarity on tax breakdown, affecting consumer awareness.

- Collection Infrastructure: Inadequate infrastructure for GST collection leads to administrative challenges and delays.

Rationale behind GST Rationalization

- Simplifying Tax Structure: Reducing the number of slabs can simplify the tax system, making it easier for businesses to comply.

- Addressing Aberrations: Rationalization can correct anomalies where inputs are taxed higher than final products.

- Revenue Concerns: Merging slabs like 12% and 18% could lead to revenue loss, necessitating careful consideration.

Benefits of GST Rationalization

- Easier Compliance: A simplified GST structure would ease the compliance burden on businesses.

- Equitable Tax Distribution: Rationalization ensures a fair distribution of tax burden and efficient use of revenue.

- Improved Tax Collection: Streamlining GST slabs can lead to more efficient tax collection and reduced compliance costs.

Conclusion

- Need for Reform: Rationalizing GST rates is crucial for enhancing the efficiency of the tax regime.

- Expected Outcomes: A reformed GST system is anticipated to be simpler, leading to easier compliance, better revenue collection, and overall efficiency in the taxation system.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: COP28

Mains level: CCS and CCD

Central Idea

- At the COP28 climate talks in Dubai, discussions have centered on carbon capture and storage (CCS) and carbon-dioxide removal (CDR) technologies.

- The interpretation of ‘abatement’ is crucial in understanding the role and limitations of CCS and CDR in climate action.

Understanding CCS and CDR

- CCS: This involves capturing CO₂ emissions at their source, such as in the fossil fuel industry and industrial processes, and storing them to prevent atmospheric release.

- CDR: Encompasses natural methods like afforestation and technological approaches like direct air capture for absorbing and storing atmospheric CO₂.

- COP28 Discussions: The term “unabated fossil fuels” in the draft texts refers to fossil fuel combustion without CCS. The texts advocate phasing out such fuels and enhancing emission removal technologies.

Scale and Efficacy of CCS and CDR

- IPCC’s AR6 Report: Heavily reliant on CDR for meeting the 1.5 degrees C temperature limit, assuming significant CO₂ sequestration by 2040.

- Challenges: Direct mitigation to reduce emissions is daunting, making CDR crucial.

- CCS Limitations: Effective CCS requires high capture rates, permanent storage, and minimal methane leakage from upstream processes.

Concerns and Implications of CCS and CDR

- Land Use for CDR: Large-scale CDR methods, especially technological ones, require significant land, raising equity, biodiversity, and food security concerns.

- Impact on the Global South: CDR projects in the Global South could infringe on indigenous land rights and compete with agricultural land use.

- Financial and Ethical Questions: The cost and responsibility of implementing CDR at scale raise questions about who should bear these burdens.

Pitfalls of CCS and CDR

- Potential for Increased Emissions: CCS and CDR could inadvertently create leeway for continued or increased greenhouse gas emissions.

- IPCC Emission Scenarios: To limit warming to 1.5 degrees C, significant reductions in coal, oil, and gas use are required by 2050, with or without CCS.

- Gas Emissions Pathways: Higher reliance on CCS and CDR could lead to emission pathways with a greater contribution from gas.

Conclusion

- Critical Decade Ahead: The next decade is pivotal in determining the viability and scalability of CDR methods.

- Balancing Act: While CCS and CDR offer potential solutions for emission reduction, their implementation must be carefully managed to avoid unintended consequences and ensure equitable and effective climate action.

- Future of Climate Negotiations: The discussions and decisions at COP28 regarding CCS and CDR will significantly influence the trajectory of global climate action and the pursuit of the 1.5 degrees C target.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Bhagat Singh

Mains level: Read the attached story

Central Idea

- A serious security breach occurred in the Indian Parliament when two individuals jumped into the Lok Sabha chamber, releasing yellow smoke.

- Police sources indicated that the act, involving a total of six individuals, was apparently inspired by the revolutionary Bhagat Singh.

Bhagat Singh’s Historic Act in 1929

- Central Assembly Incident: Over 94 years ago, Bhagat Singh, along with Batukeshwar Dutt, threw bombs and pamphlets in Delhi’s Central Assembly, challenging the British Empire.

- Objective: Their act was not aimed at causing harm but to protest against the lack of autonomy under the Montague-Chelmsford Reforms and to voice against repressive measures.

1929 ‘Indian Parliament’ and Revolutionary Motives

- Political Climate: The period saw Indian nationalists dissatisfied with the limited power under British rule, leading to revolutionary movements.

- HSRA’s Stance: The Hindustan Socialist Republican Army (HSRA), led by Chandrashekhar Azad and involving Bhagat Singh, sought to oppose the facade of an Indian Parliament run by the British.

- Pamphlet’s Message: The HSRA aimed to ‘make the deaf hear’, using their act as a symbolic protest against the British administration.

Fateful Day: April 8, 1929

- Viceroy’s Proclamation: The incident coincided with the Viceroy’s enactment of controversial bills, despite opposition in the Assembly.

- Well-Planned Action: Bhagat Singh and Dutt conducted reconnaissance and executed their plan while dressed in khaki, throwing bombs and pamphlets into the Assembly.

- Immediate Arrest: Following their slogan-shouting and bomb-throwing, both revolutionaries were arrested as per their plan.

Aftermath: Trial and Sentencing

- Response to Criticism: Bhagat Singh and Dutt defended their actions, emphasizing the sanctity of human life and the moral justification of their cause.

- Trial and Sentencing: A month later, both were sentenced to life imprisonment. Bhagat Singh later faced additional charges leading to his execution in 1931.

Conclusion

- Echoes of History: The recent security breach in the Lok Sabha, inspired by Bhagat Singh’s act, reflects a continued legacy of protest in India.

- Legacy of Bhagat Singh: The incident serves as a reminder of Bhagat Singh’s enduring influence in Indian history, symbolizing resistance and the fight for justice.

- Contemporary Relevance: While the motives of the recent perpetrators are still under investigation, their actions highlight ongoing issues in India, from regional concerns to farmers’ rights, resonating with Bhagat Singh’s revolutionary spirit.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Dubai Consensus , COP 28

Mains level: Read the attached story

Central Idea

- The Dubai Consensus, a significant resolution towards reducing fossil fuel dependency, was adopted in COP 28, Dubai.

Dubai Consensus

- Key Clause: The resolution emphasizes transitioning away from fossil fuels to achieve net-zero emissions by 2050, aligning with scientific recommendations to limit global temperature rise.

- Balance between Countries: The text reflects a compromise between developed and developing nations on climate action and responsibility.

- Dilution of Language: Earlier drafts with terms like ‘phase-out’ were softened due to opposition from oil-dependent countries.

- Coal Usage: The final text moderated its stance on coal, crucial for countries like India, calling for a phase-down rather than a rapid phase-out.

- Methane Emissions: The consensus introduces a focus on reducing methane emissions by 2030, a potent greenhouse gas.

- Natural Gas as a ‘Transition Fuel’: The text’s reference to natural gas as a transitional fuel could favor gas-producing countries and overlook the need for developed countries to close the finance gap in climate adaptation.

New Funding Commitments and Future Goals

- Diverse Opinions: While some nations expressed dissatisfaction with the agreement’s scope, others highlighted the lack of financial support for developing countries.

- Financial Pledges: COP 28 saw commitments to the Loss and Damage Fund and pledges to decarbonize the global economy.

- Focus on Renewable Energy: The resolution signals a move towards phasing out fossil fuels and boosting renewable energy and efficiency.

India’s Historical Position on Climate Change

- Emission Statistics: India, a major developing country, has historically contributed 3% of greenhouse gases (1850-2019), compared to higher percentages from the US and EU.

- Per Capita Emissions: India’s per capita emissions are below the global average, but its development needs and population growth have made it the third-largest emitter.

- Balancing Development and Emissions: India has been navigating the pressure to reduce emissions while addressing its developmental needs, particularly its reliance on coal.

India’s Commitments and Challenges

- Net Zero by 2070: India has committed to achieving a net-zero state by 2070, alongside expanding its renewable energy capacity.

- Glasgow COP 2021 Agreement: Under pressure, India agreed to a ‘phase-down’ of coal use, highlighting the need for equitable treatment of all fossil fuels, including oil and gas.

- Import Dependency: As a net importer of oil and gas, India has raised concerns about the focus on coal while other fossil fuels remain under-addressed.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Countervailing Duties (CVDs), RODTEP Scheme

Mains level: Read the attached story

Central Idea

- The US and the European Union have imposed countervailing duties (CVDs) on select Indian products such as paper file folders, common alloy aluminum sheet, and forged steel fluid end blocks.

- These measures are in retaliation against India’s Remission of Duties and Taxes on Export Products (RoDTEP) scheme, initiated in January 2021.

About Countervailing Duties (CVDs)

|

Details |

| Definition |

Tariffs imposed to neutralize the adverse effects of subsidies provided by a foreign government to their export industries. |

| Purpose |

To protect domestic industries from unfair competition due to imports subsidized by the exporting country’s government. |

| Investigation & Imposition |

Requires a domestic investigation to confirm the presence of subsidies and their impact on domestic industries. |

| WTO Compliance |

Imposition of CVDs must comply with World Trade Organization rules. |

| Types of Subsidies |

Includes direct transfers of funds, tax concessions, loan guarantees, and provision of goods/services at a discount. |

| Calculation |

The duty amount is typically equivalent to the value of the foreign subsidy. |

| Duration |

Not permanent; imposed for a specific period and subject to review and removal. |

| Global Use |

Frequently used by countries like the United States, European Union, Canada, and India. |

| Controversy and Disputes |

Can lead to trade disputes, viewed by some as protectionist or unjustified. |

| Impact on Prices |

May result in higher prices for affected goods in the importing country due to increased import costs. |

India’s Response to the Duties

- Government and Exporters’ Defense: The Indian government and affected exporters have actively defended against the subsidy allegations. Their defense covered various programs and schemes at both the Central and State levels in India.

- Method of Defense: The defense was presented through written and oral responses during the investigations.

Potential WTO Dispute

- India’s Stance on Dispute Resolution: Minister of State for Commerce and Industry indicated India’s openness to bilateral resolution.

- WTO Dispute Settlement Mechanism: Any party could approach the WTO Dispute Settlement mechanism if they believe a WTO member has adopted measures inconsistent with WTO agreements.

Conclusion

- Growing Trade Tensions: The imposition of CVDs by the US and EU signifies escalating trade tensions with India, particularly concerning the RoDTEP scheme.

- Impact on Indian Exports: These duties could potentially impact Indian exporters, affecting trade dynamics between India and these global economic powers.

- Prospect of WTO Involvement: The possibility of this dispute reaching the WTO highlights the complexities of international trade laws and the need for careful navigation of global trade policies.

Back2Basics: RoDTEP Scheme

|

Details |

| Introduction |

Announced in 2020, replacing the Merchandise Exports from India Scheme (MEIS). |

| Objective |

To refund taxes and duties on exported products not covered under any other scheme, enhancing export competitiveness. |

| Scope and Coverage |

Covers various sectors, beneficial for a wide range of industries, including those not covered under MEIS. |

| Rebate Rates |

Varies based on the taxes and duties incurred on the production and distribution of the exported product. |

| Eligibility |

Exporters must comply with criteria including the condition that goods must be manufactured in India. |

| Claim Process |

Rebate claimed as a transferable duty credit/electronic scrip, maintained in an electronic ledger. |

| Implementation |

Implemented by the Directorate General of Foreign Trade (DGFT) and Customs Department. |

| Impact |

Aims to make Indian exports more competitive globally by offsetting domestic taxes and levies. |

| Compliance with WTO |

Designed to comply with India’s commitments under the WTO framework. |

| Process |

Fully digital and transparent process for claiming rebates, reducing the compliance burden on exporters. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: BNSS

Mains level: need for fundamental transformations in the criminal justice system

Central idea

The article critiques the withdrawal and reintroduction of criminal law bills in India, highlighting concerns over civil liberties, overcriminalisation, and expanded police powers. It emphasizes the alarming increase in police custody duration and the absence of a transformative vision in the proposed legislations.

Key Highlights:

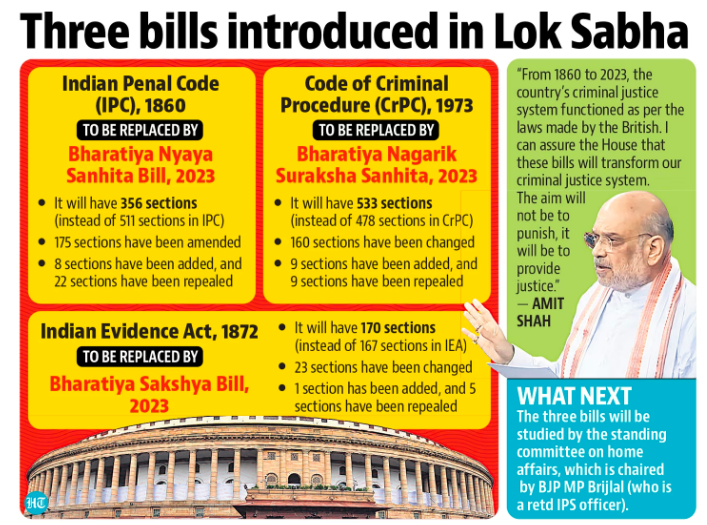

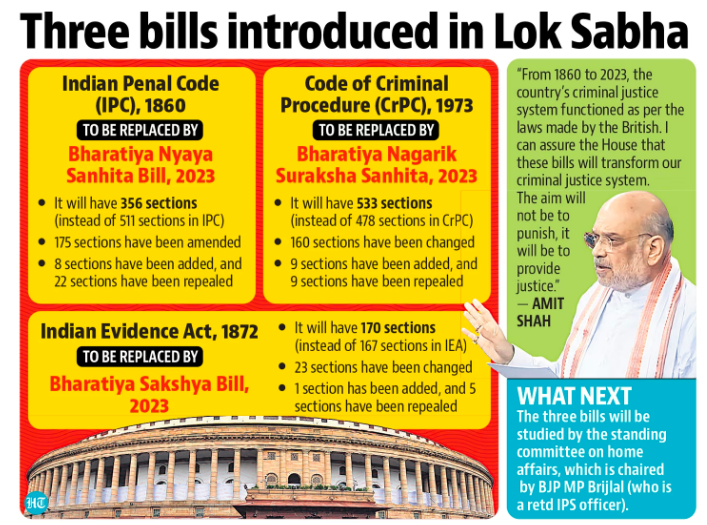

- Legislative Changes: The government withdraws and reintroduces criminal law bills, including Bharatiya Nyaya Sanhita (BNS-II), Bharatiya Nagarik Suraksha Sanhita (BNSS-II), and Bharatiya Sakshya Bill (BSB-II), reflecting potential shifts in the criminal justice system.

- Concerns Over State Control: The bills raise concerns about the expansion of state control, overcriminalisation, and enhanced police powers, potentially compromising civil liberties and increasing the risk of police excesses.

- Police Custody Duration: The BNSS proposes a significant increase in the maximum duration of police custody, from 15 days to 60 or 90 days, raising concerns about potential exposure to abuse and coercion.

Key Challenges:

- Risk of Overcriminalisation: The bills introduce broadly worded offenses, especially related to the security of the state, potentially leading to overcriminalisation and ambiguous legal provisions.

- Expanded Police Powers: The BNSS’s expansion of police custody duration, combined with vague offenses, raises concerns about the potential for misuse of power and coercive tactics.

- Lack of Transformative Vision: The bills lack a transformative vision for criminal law and justice, potentially entrenching colonial-era logic and emphasizing state control over citizen liberties.

Key Terms and Phrases:

- Bharatiya Nyaya Sanhita (BNS-II): A proposed legislation to replace the Indian Penal Code (IPC, 1860), reflecting potential changes in criminal law.

- Bharatiya Nagarik Suraksha Sanhita (BNSS-II): A bill aimed at replacing the Criminal Procedure Code (CPC, 1973) with potential implications for civil liberties and police powers.

- Bharatiya Sakshya Bill (BSB-II): Legislation seeking to replace the Indian Evidence Act (IEA, 1872), indicating potential shifts in the criminal justice system.

Key Quotes and Statements:

- “The expansion under the proposed BNSS heightens the risk of exposure to police excesses… a shocking expansion of police powers.”

- “These Bills present a missed opportunity to correct the entrenched injustices of our criminal justice system.”

Key Examples and References:

- Overcriminalisation Concerns: The bills introduce broadly framed offenses, including criminalizing misinformation, raising fears of overcriminalisation and potential misuse.

- Expansion of Police Custody: The BNSS proposes a substantial increase in the duration of police custody, contributing to concerns about potential abuse and coercive practices.

Key Facts and Data:

- Duration of Police Custody: The BNSS proposes expanding the maximum limit of police custody from 15 days to either 60 or 90 days, depending on the nature of the offense.

Critical Analysis:

- Missed Opportunity: The bills are criticized for not addressing deep-seated issues in the criminal justice system and potentially entrenching colonial-era logic without a transformative vision.

- Efficiency vs. Fairness: Emphasizes that goals of speedy justice and effective investigation, while important, cannot be achieved without addressing structural barriers and ensuring fairness.

Way Forward:

- Comprehensive Regulatory Ecosystem: Advocates for a regulatory framework ensuring fairness, transparency, and accountability, especially in the context of expanded police powers and overcriminalisation.

- Structural Reforms: Emphasizes the need for fundamental transformations in the criminal justice system, addressing issues like judicial vacancies, infrastructure, and scientific validity of forensic methods.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Na

Mains level: Consultocracy

Central idea

The article explores into the growing reliance on consulting firms for policy formulation and program implementation in Indian government projects. It raises concerns about potential downsides, such as the hollowing out of government capabilities, excessive dependence, and the risk of lobbying and corruption scandals. While acknowledging the benefits, the author calls for a balanced approach, emphasizing the necessity of a regulatory framework to ensure fairness, transparency, and knowledge transfer.

Key Highlights:

- Rise of Consulting in Government: Government projects, including major initiatives like Ganga cleaning and Swachh Bharat, heavily rely on consulting firms for policy formulation and program implementation.

- Proliferation of Global Consulting Firms: Reports reveal that Indian ministries paid around Rs 5,000 million in fees to global consulting firms in the last five years, prompting the finance ministry to seek details of these engagements.

- Concerns Over Dependence: There are concerns about a potential hollowing out of government capabilities due to excessive reliance on consultants, leading to mission creep, repeated redeployment, and potential lobbying for repeat work.

Key Challenges:

- Hollowing of Government Capabilities: The unbridled use of consulting firms raises concerns about a decline in the skills and capabilities of government officials, potentially infantilizing government institutions.

- Mission Creep and Dependence: Excessive dependence on consulting teams may result in mission creep, where routine functions are outsourced, and officials become overly reliant on consultants, risking a loss of institutional knowledge and skills.

- Consulting-Related Corruption: The global trend of consulting firms influencing policy directions and engaging in lobbying raises concerns about corruption scandals and the distortion of public policy objectives.

Key Terms and Phrases:

- Programme Management Units: Consulting firms often establish these units with broad mandates, attached to senior officials, leading to potential mission creep and dependence.

- Consultocracy: A term coined to describe the permeation of consultants into the core of government, diminishing the traditional role and capabilities of public servants.

- Digitisation of Public Service Delivery: The increasing complexity of public service delivery, including initiatives like the Direct Benefit Transfer program, demands specialized technical expertise.

Key Quotes and Statements for mains value addition:

- “There is a tendency to farm out even routine functions like preparing file notes and letters.”

- “The unbridled use of consultants reduces the skills and capabilities of officials, thus infantilising government.”

Key Examples and References:

- Global Consulting Influence: Books like “The Big Con” and “When McKinsey Comes to Town” highlight concerns about the influence of consulting firms, even leading governments down amoral pathways.

- Consulting in Indian Ministries: Reports indicate that Indian ministries paid substantial fees to global consulting firms in the last five years, prompting regulatory scrutiny.

Key Facts and Data:

- Financial Transactions: Indian ministries paid approximately Rs 5,000 million in fees to global consulting firms over the last five years.

Critical Analysis:

- Balancing Act: Acknowledges the benefits of consulting expertise in tackling complex challenges but emphasizes the need for a regulatory framework to prevent overdependence and potential pitfalls.

Way Forward:

- Regulatory Ecosystem: Advocates for a comprehensive regulatory ecosystem addressing fairness, transparency, curbing rent-seeking behaviors, and ensuring knowledge transfer to government.

- Calibrated Onboarding: Suggests a carefully calibrated onboarding of expertise from the private sector within a normative and transparent regulatory framework to enhance public service delivery.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: na

Mains level: Insaniyat, Jamhooriyat, and Kashmiriyat

Note for students: This article is written by our prime minister hence it becomes very important from UPSC Perspective.

Central idea

The text discusses the historic Supreme Court judgment upholding the abrogation of Articles 370 and 35(A) in Jammu and Kashmir. It highlights the positive impact of this decision, emphasizing a shift towards grassroots democracy and renewed focus on development in the region. The author advocates for continued engagement, national integration, and sustained efforts to address historical challenges.

Key Highlights:

- Historic Supreme Court Judgment: Upheld the abrogation of Articles 370 and 35(A), emphasizing India’s sovereignty.

- Long-standing Issues: Jammu, Kashmir, and Ladakh faced violence and instability for seven decades.

- Leadership Perspective: The author expresses commitment to addressing people’s aspirations and removing perceived injustices.

- Articles 370 and 35(A) as Obstacles: Seen as major hindrances to development and rights in Jammu and Kashmir.

- Development Initiatives: Government implemented various initiatives, including a 2015 special package, to address infrastructure, job creation, tourism, and handicraft industry support.

- Grassroots Democracy: Last four years witnessed renewed focus, improving representation for women, SCs, STs, and marginalized sections.

- Positive Impact of Abrogation: Visible development, improved infrastructure, increased tourist inflows, and a boost to various government schemes.

Key Challenges:

- Historical Confusion: Stemming from centuries of colonization, leading to a lack of clarity on basic issues.

- Violence and Instability: Jammu, Kashmir, and Ladakh experienced the worst forms of violence and instability for seven decades.

- Initial Choice at Independence: The narrative suggests a choice between a fresh start for national integration and continuing with a confused approach.

Key Terms and Phrases:

- Articles 370 and 35(A): Constitutional provisions abrogated to enhance constitutional integration.

- Karyakarta: Term referring to a political worker or activist.

- Insaniyat, Jamhooriyat, and Kashmiriyat: A message emphasizing humanity, democracy, and the unique cultural identity of Kashmir.

- Fit India Dialogues: Dialogues promoting fitness and well-being.

- Panchayat Polls: Elections at the grassroots level for local self-governance.

Key Quotes and Statements:

- “August 5, 2019, is etched in the hearts and minds of every Indian.”

- “The people of J&K want development and they want to contribute to the development of India based on their strengths and skills.”

- “The success of Panchayat polls indicated the democratic nature of the people of J&K.”

Key Examples and References:

- Afshan Ashiq: Mentioned as a talented footballer symbolizing positive change from stone-pelting to sports.

- Dr. Syama Prasad Mookerjee: Quoted for quitting the Nehru Cabinet over the Kashmir issue, becoming a source of inspiration.

- Atal ji’s “Insaniyat, Jamhooriyat, and Kashmiriyat” message: Referenced as a source of great inspiration.

Key Facts and Data:

- Over 150 ministerial visits from May 2014 to March 2019: Highlighting the government’s effort to interact directly with the people of Jammu and Kashmir.

- Special assistance of Rs 1,000 crore announced in 2014 for rehabilitation after floods: Demonstrating the government’s commitment during crises.

- Saturation of key central government schemes: Mentioned in sectors like Saubhagya, Ujjwala, housing, tap water connections, and financial inclusion.

Critical Analysis:

- Positive Impact of Abrogation: The author emphasizes the positive changes and development in Jammu, Kashmir, and Ladakh post the abrogation of Articles 370 and 35(A).

- Renewed Faith in Grassroots Democracy: The text suggests a positive shift towards grassroots democracy, with increased representation for marginalized sections.

- Historical Confusion and Choices: The narrative criticizes historical confusion and advocates for a clearer approach at the time of independence.

Way Forward:

- Continued Development: Continue the focus on development, infrastructure, and addressing the aspirations of the people.

- Sustained Grassroots Engagement: Maintain engagement at the grassroots level, ensuring representation for all sections of society.

- National Integration: Strengthen the spirit of “Ek Bharat, Shreshtha Bharat” for unity and good governance.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Central Civil Service (CCS)

Mains level: necessity of academic freedom in fostering critical thinking for societal benefit

Central idea

The article explores the global challenges to academic freedom, accentuated by the Israeli-Palestinian conflict’s impact on protests in the West and restrictive measures in India. It emphasizes the practical and misunderstood nature of academic freedom, highlighting the crucial role it plays in fostering critical thinking within the academic community and the threats posed by government interference.

Key Highlights:

- Israeli-Palestinian Conflict Impact: The Israeli-Palestinian conflict sheds light on the challenges to academic freedom in the West, with protests facing severe threats and legal consequences.

- Global Restrictions on Dissent: The credibility of academic freedom faces a global crisis, as European governments pass laws punishing dissent against the state of Israel, mirroring actions taken in the West.

- Indian Context: In India, authorities align with Western counterparts, stifling protests, banning events, and demanding apologies from speakers critical of the Israeli state.

Key Challenges:

- Threats and Challenges in the West: Protests in American universities against the Israeli-Palestinian conflict provoke threats from donors, alumni, and administrators, showcasing the fragility of academic freedom.

- Public Misunderstanding: The public perceives academic freedom as a privilege for already pampered professors, undermining its significance and practical application.

- Government Interference in India: Indian authorities pre-empt protests, ban events, and cancel talks, aligning with Western counterparts and limiting academic freedom.

Key Terms and Phrases:

- Academic Freedom: Autonomy granted to the practice of academics, allowing the pursuit of ideas and knowledge without external constraints.

- Aam Aadmi: The common person’s perspective on academic freedom as a perk for professors, contributing to a misunderstanding of its true nature.

- Central Civil Service (CCS) Rules: Government regulations governing officials, potentially threatening academic freedom if applied to academics.

Key Quotes and Statements:

- “The credibility of this idea is in tatters today as protests against the war in American universities provoke threats from donors, alumni and administrators…”

- “Each of its two words misleads in its own way. ‘Academic’ suggests something obscure and impractical, far removed from the everyday world…”

- “But despite the global attention it is now receiving, academic freedom remains a much misunderstood idea.”

Key Examples and References:

- Israeli-Palestinian Conflict Impact: The conflict serves as a catalyst for threats against academic freedom in the West, revealing global implications.

- Indian Authorities’ Actions: Actions such as pre-empting protests, banning events, and canceling talks illustrate restrictions on academic freedom in India.

Key Facts and Data:

- Instances of protests in American universities facing threats from donors, alumni, and administrators highlight the vulnerabilities of academic freedom.

- European governments passing laws to defund and punish academic or artistic activities critical of Israel contribute to the global erosion of academic freedom.

- The University Grants Commission (UGC) directive in India, suggesting the installation of “selfie points” with the Prime Minister’s picture, showcases government interference.

Critical Analysis:

- Misunderstood Practicality: Academic freedom is portrayed as misunderstood, practical, and down-to-earth, yet specific to the academic world.

- Scrutiny Within Academic Community: The article emphasizes the scrutiny and criticism within the academic community, balancing autonomy with adherence to academic norms.

- Impact of Government Control: Potential consequences of government control, as seen in the threat to universities under Central Civil Service (CCS) rules, are discussed.

Way Forward:

- Fostering Critical Thinking: Emphasize the practicality and necessity of academic freedom in fostering critical thinking for societal benefit.

- Resisting Government Interference: Advocate for the protection of academic autonomy, resisting government interference that could stifle questioning and research.

- Promoting Public Awareness: Promote public awareness and understanding of academic freedom to counter misconceptions and ensure its preservation.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now