Note4Students

From UPSC perspective, the following things are important :

Prelims level: Sunehri Masjid

Mains level: NA

Introduction

- The Indian History Congress (IHC), a prominent body of historians, has recently taken a stand against the proposed demolition of the Sunehri Masjid, a late medieval mosque in New Delhi.

- Since 1984, the IHC has consistently advocated for the protection of monuments, emphasizing that all structures over 200 years old should be strictly preserved under the Protection of Monuments Act.

About Sunehri Masjid

|

Details |

| Location |

Chandni Chowk, Old Delhi, India |

| Built By |

Mughal noble Roshan-ud-Daula |

| Construction Period |

1721-1722 |

| Legend |

In 1739, Persian invader Nadir Shah, ordered the invasion and plunder of Delhi city while standing in this mosque. |

| Dedication |

Dedicated to Shah Bhik (spiritual mentor of Roshan-ud-Daula) |

| Architectural Style |

Mughal Architecture |

| Architectural Features |

Three golden-domed turrets, slender minarets, stucco decorations |

| Educational Role |

Hosted Madrasa Aminia in 1897, later relocated to Kashmiri Gate in 1917 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Mumbai Trans Harbour Link

Mains level: Read the attached story

Introduction

- Prime Minister is set to inaugurate the Mumbai Trans Harbour Link (MTHL), officially named the Atal Setu Nhava Sheva Sea Link.

- This 22 km bridge, conceptualized six decades ago, represents a significant development in India’s infrastructure, promising to transform connectivity and economic prospects in the Mumbai Metropolitan Region.

Atal Setu: the Mumbai Trans Harbour Link

- Bridge Specifications: The MTHL is a 22-km-long, six-lane twin-carriageway bridge over the Thane Creek in the Arabian Sea. It connects Sewri in Mumbai to Chirle in Raigad district.

- Components: The structure comprises a 16.5 km sea link and 5.5 km of viaducts on land at both ends.

- Project Objective: Aimed at enhancing connectivity within the Mumbai Metropolitan Region, the MTHL is expected to spur economic growth, reduce travel time, and alleviate congestion on existing routes.

Historical Context and Development

- Initial Proposal: The concept of a bay crossing was first proposed in 1963 by Wilbur Smith Associates but remained dormant for decades.

- Revival and Challenges: The project was revived in the late 90s, with the first tenders floated in 2006. After initial interest from Reliance Infrastructure and subsequent withdrawal, the project faced multiple bidding challenges.

- Funding and Execution: The Mumbai Metropolitan Region Development Authority (MMRDA) partnered with the Japan International Cooperation Agency (JICA) for funding, leading to the commencement of work in early 2018. The project cost totaled Rs 21,200 crore, with a significant loan from JICA.

Impact of the Mumbai Trans Harbour Link

- Travel Time Reduction: A study by MMRDA and JICA predicts that the MTHL will cut the average travel time between Sewri and Chirle from 61 minutes to less than 16 minutes.

- Economic and Connectivity Benefits: The bridge is expected to integrate Navi Mumbai’s economy with Mumbai and improve connectivity to key locations like the Navi Mumbai International Airport, Mumbai Pune Expressway, and the Mumbai-Goa Highway.

- Vehicle Usage: An estimated 40,000 vehicles are expected to use the link daily in its opening year.

Concerns and Challenges

- Accessibility for Commuters: Doubts remain about the bridge’s utility for daily commuters between Mumbai and Navi Mumbai, considering the high toll cost and the distance of landing points from main residential areas.

- Additional Commuting Costs: The toll fee of Rs 250 for a one-way crossing and the bridge’s landing points being over 10 km from major residential zones like Vashi and Nerul may increase commuting expenses.

- Lack of Public Transport Options: As of now, there are no announcements regarding public transport facilities, such as dedicated bus lanes, on the bridge.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Swachh Survekshan

Mains level: Read the attached story

Introduction

- Surat in Gujarat and Indore in Madhya Pradesh have been jointly recognized as the cleanest cities in India at the Union Urban Affairs Ministry’s annual Clean City Awards 2023.

About Swachh Survekshan

- Swachh Survekshan, initiated by the Ministry of Housing and Urban Affairs (MoHUA) in 2016, serves as a competitive framework to promote urban sanitation improvements and citizen participation.

- Over time, Swachh Survekshan has grown to become the world’s largest urban sanitation survey.

- In the 2023 edition (SS 2023), emphasis is placed on source segregation of waste, increasing cities’ waste processing capacity, and reducing waste sent to dumpsites.

- SS 2023 introduces new indicators with added importance, focusing on phased plastic reduction, enhanced plastic waste management, “waste to wonder” parks, and zero-waste events.

- The ranking of wards within cities is encouraged through SS 2023.

- The survey assesses cities on dedicated indicators addressing issues such as ‘Open Urination’ (Yellow Spots) and ‘Open Spitting’ (Red Spots).

Highlights of the Clean City Awards 2023

- Top Rankings: Surat and Indore shared the top spot, with Navi Mumbai securing the third position in the cleanest cities category.

- Indore’s Continued Success: Remarkably, Indore has maintained its status as the cleanest city for the seventh consecutive year.

- Other Top Cities: The list of the top 10 cleanest cities also includes Greater Visakhapatnam, Bhopal, Vijayawada, New Delhi, Tirupati, Greater Hyderabad, and Pune.

State Rankings and Special Categories

- Maharashtra Leads: In the state rankings, Maharashtra emerged as the top performer, followed by Madhya Pradesh and Chhattisgarh.

- Smaller Cities and Cantonnement Boards: In cities with a population of less than one lakh, Sasvad and Lonavala in Maharashtra, and Patan in Chhattisgarh, were top performers. Mhow Cantonment Board in Madhya Pradesh was recognized as the cleanest cantonment board.

- Cleanest Ganga Towns: Varanasi and Prayagraj in Uttar Pradesh won awards for being the cleanest towns along the Ganga river.

Awards and Themes

- Swachh Survekshan Awards: Initiated by the Ministry of Housing and Urban Affairs (MoHUA) in 2016, these awards have become the world’s largest urban sanitation survey.

- Themes: The 2023 survey focused on the theme “Waste to Wealth,” while the upcoming 2024 survey will emphasize “Reduce, Reuse, and Recycle.”

Indore’s Journey to the Top

- Leap in Rankings: Indore’s remarkable journey from ranking 25th in 2016 to consistently holding the top position is noteworthy.

- Key Factors for Success: The city’s success is attributed to a sustainable system of garbage collection, processing, and disposal, along with citizen participation and innovative sanitation measures.

Indore’s Sanitation Initiatives

- Waste Segregation and Disposal: Indore revamped its sanitation and waste collection system, involving NGOs and changing routes for garbage disposal vehicles.

- Legacy Waste Management: The city efficiently cleared and treated large amounts of legacy waste at the Devguradiya ground.

- Infrastructure Development: Funds were allocated for constructing transfer stations and treatment plants for waste management.

- Community Engagement: Efforts were made to build sanitation habits among citizens, including the distribution of free dustbins and imposing fines for littering.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Direct Taxes

Mains level: Read the attached story

Introduction

- India’s net direct tax collections have achieved a significant milestone, reaching ₹14.7 lakh crore by January 10, which is over four-fifths of the fiscal year’s target.

- This performance indicates a robust growth of 19.4% compared to the same period in the previous fiscal year, showcasing the country’s strong economic recovery and efficient tax administration.

Overview of Tax Collection Performance

- Total Collections: The net direct tax collections stood at ₹14.7 lakh crore, marking an achievement of 80.61% of the budget estimates for the fiscal year 2023-24.

- Growth Rate: This represents a 19.41% increase over the net collections for the corresponding period of the last year.

- Gross Collection Growth: The gross direct tax collections rose by 16.77% to ₹17.18 lakh crore, with Personal Income Tax (PIT) inflows increasing by 26.11% and Corporate Income Tax (CIT) by 8.32%.

Detailed Analysis of Tax Collection

- Post-Refund Growth: After adjusting for refunds, the net growth in CIT collections was 12.37%, and PIT collections saw a rise of 27.26%.

- Increase in PIT and STT Receipts: Net of refunds, PIT and Securities Transaction Tax receipts were up by 27.22%.

What are Direct Taxes?

- A type of tax where the impact and the incidence fall under the same category can be defined as a Direct Tax.

- The tax is paid directly by the organization or an individual to the entity that has imposed the payment.

- The tax must be paid directly to the government and cannot be paid to anyone else.

Types of Direct Taxes

The various types of direct tax that are imposed in India are mentioned below:

(1) Income Tax:

- Depending on an individual’s age and earnings, income tax must be paid.

- Various tax slabs are determined by the Government of India which determines the amount of Income Tax that must be paid.

- The taxpayer must file Income Tax Returns (ITR) on a yearly basis.

- Individuals may receive a refund or might have to pay a tax depending on their ITR. Penalties are levied in case individuals do not file ITR.

(2) Wealth Tax:

- The tax must be paid on a yearly basis and depends on the ownership of properties and the market value of the property.

- In case an individual owns a property, wealth tax must be paid and does not depend on whether the property generates an income or not.

- Corporate taxpayers, Hindu Undivided Families (HUFs), and individuals must pay wealth tax depending on their residential status.

- Payment of wealth tax is exempt for assets like gold deposit bonds, stock holdings, house property, commercial property that have been rented for more than 300 days, and if the house property is owned for business and professional use.

(3) Estate Tax:

- It is also called Inheritance Tax and is paid based on the value of the estate or the money that an individual has left after his/her death.

(4) Corporate Tax:

- Domestic companies, apart from shareholders, will have to pay corporate tax.

- Foreign corporations who make an income in India will also have to pay corporate tax.

- Income earned via selling assets, technical service fees, dividends, royalties, or interest that is based in India is taxable.

- The below-mentioned taxes are also included under Corporate Tax:

- Securities Transaction Tax (STT): The tax must be paid for any income that is earned via taxable security transactions.

- Dividend Distribution Tax (DDT): In case any domestic companies declare, distribute, or are paid any amounts as dividends by shareholders, DDT is levied on them. However, DDT is not levied on foreign companies.

- Fringe Benefits Tax: For companies that provide fringe benefits for maids, drivers, etc., Fringe Benefits Tax is levied on them.

- Minimum Alternate Tax (MAT): For zero-tax companies that have accounts prepared according to the Companies Act, MAT is levied on them.

(5) Capital Gains Tax:

- It is a form of direct tax that is paid due to the income that is earned from the sale of assets or investments. Investments in farms, bonds, shares, businesses, art, and homes come under capital assets.

- Based on its holding period, tax can be classified into long-term and short-term.

- Any assets, apart from securities, that are sold within 36 months from the time they were acquired come under short-term gains.

- Long-term assets are levied if any income is generated from the sale of properties that have been held for a duration of more than 36 months.

Advantages of Direct Taxes

The main advantages of Direct Taxes in India are mentioned below:

- Economic and Social balance: The Government of India has launched well-balanced tax slabs depending on an individual’s earnings and age. The tax slabs are also determined based on the economic situation of the country. Exemptions are also put in place so that all income inequalities are balanced out.

- Productivity: As there is a growth in the number of people who work and community, the returns from direct taxes also increase. Therefore, direct taxes are considered to be very productive.

- Inflation is curbed: Tax is increased by the government during inflation. The increase in taxes reduces the necessity for goods and services, which leads to inflation to compress.

- Certainty: Due to the presence of direct taxes, there is a sense of certainty from the government and the taxpayer. The amount that must be paid and the amount that must be collected is known by the taxpayer and the government, respectively.

- Distribution of wealth is equal: Higher taxes are charged by the government to the individuals or organizations that can afford them. This extra money is used to help the poor and lower societies in India.

What are the disadvantages of direct taxes?

- Easily evadable: Not all are willing to pay their taxes to the government. Some are willing to submit a false return of income to evade tax. These individuals can easily conceal their incomes, with no accountability to the law of the land.

- Arbitrary: Taxes, if progressive, are fixed arbitrarily by the Finance Minister. If proportional, it creates a heavy burden on the poor.

- Disincentive: If there are high taxes, it does not allow an individual to save or invest, leading to the economic suffering of the country. It does not allow businesses/industries to grow, inflicting damage to them.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Central Idea:

The article criticizes the Speaker of the Maharashtra Legislative Assembly, Rahul Narwekar, for his decision to recognize Chief Minister Eknath Shinde, who left the Uddhav Thackeray-led Shiv Sena group, as the legitimate leader of the party. The author argues that the Speaker’s decision, influenced by political affiliations, undermines legislative procedures and regulations, creating legal inconsistencies and setting a concerning precedent for future political maneuvering.

Key Highlights:

- Speaker Narwekar’s decision favors Chief Minister Shinde, who defected from the Uddhav Thackeray-led group, causing a split in the Shiv Sena.

- The article points out three major flaws in the Speaker’s decision, including the misinterpretation of majority support, violation of Supreme Court guidelines on the appointment of a whip, and contradictory handling of the Thackeray camp’s violation of the whip.

- The Speaker’s political affiliation with the BJP raises concerns about impartiality and adherence to constitutional principles.

Key Challenges:

- The Speaker’s decision raises questions about the integrity of legislative procedures and the potential influence of political considerations on constitutional matters.

- Legal inconsistencies, including the misinterpretation of majority support and the violation of Supreme Court guidelines, create challenges for maintaining the rule of law.

- The article suggests that the decision might lead to prolonged legal battles and sets a precedent for party splits orchestrated by external political forces.

Key Terms:

- Defection: The act of switching allegiance from one political party to another.

- Whip: An official in a political party responsible for ensuring party members vote in line with party decisions.

- Constitutional Morality: Adherence to ethical and constitutional principles in decision-making.

Key Phrases:

- “Recognition of the split as a textbook example of disregard for legislative procedure.”

- “Craters, not holes, in the Speaker’s order.”

- “Political heavyweights absent during the crucial decision.”

Key Quotes:

- “To hold that it is the legislature party which appoints the whip would be to sever the figurative umbilical cord…”

- “The Speaker’s decision is bound to trigger yet another legal battle.”

- “The BJP has perfected the art of engineering defections.”

Key Statements:

- “Speaker Narwekar’s decision may be seen as a mockery of the Constitution.”

- “The Speaker’s affiliation with the BJP adds to suspicions of bias.”

- “Legal inconsistencies and violations of Supreme Court guidelines are evident in the decision.”

Key Examples and References:

- Chief Minister Shinde’s defection from Shiv Sena and the subsequent split.

- The Speaker’s acceptance of a new whip in violation of Supreme Court guidelines.

- The contradiction in handling the Thackeray camp’s violation of the whip.

Key Facts and Data:

- Speaker Rahul Narwekar is a member of the BJP.

- Chief Minister Shinde initially had 16 out of 55 MLAs when he left Shiv Sena.

- The BJP’s success in engineering defections in Maharashtra is highlighted as a concerning trend.

Critical Analysis: The article criticizes the Speaker’s decision for favoring the ruling party, creating legal loopholes, and potentially setting a precedent for orchestrated party splits. It emphasizes the need for judicial intervention to uphold constitutional morality and address the flaws in the decision.

Way Forward:

- The judiciary should play a proactive role in addressing the legal inconsistencies and potential violations of constitutional principles.

- Political leaders and legislative bodies should prioritize the adherence to established procedures and guidelines.

- Public awareness and scrutiny can contribute to holding political figures accountable for decisions that may undermine democratic values.

In conclusion, the article highlights the importance of upholding constitutional principles in the face of political maneuvering, urging judicial intervention and public vigilance to safeguard the integrity of legislative processes.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: H1 Rule

Mains level: Addressing AMR requires a holistic approach

Central Idea:

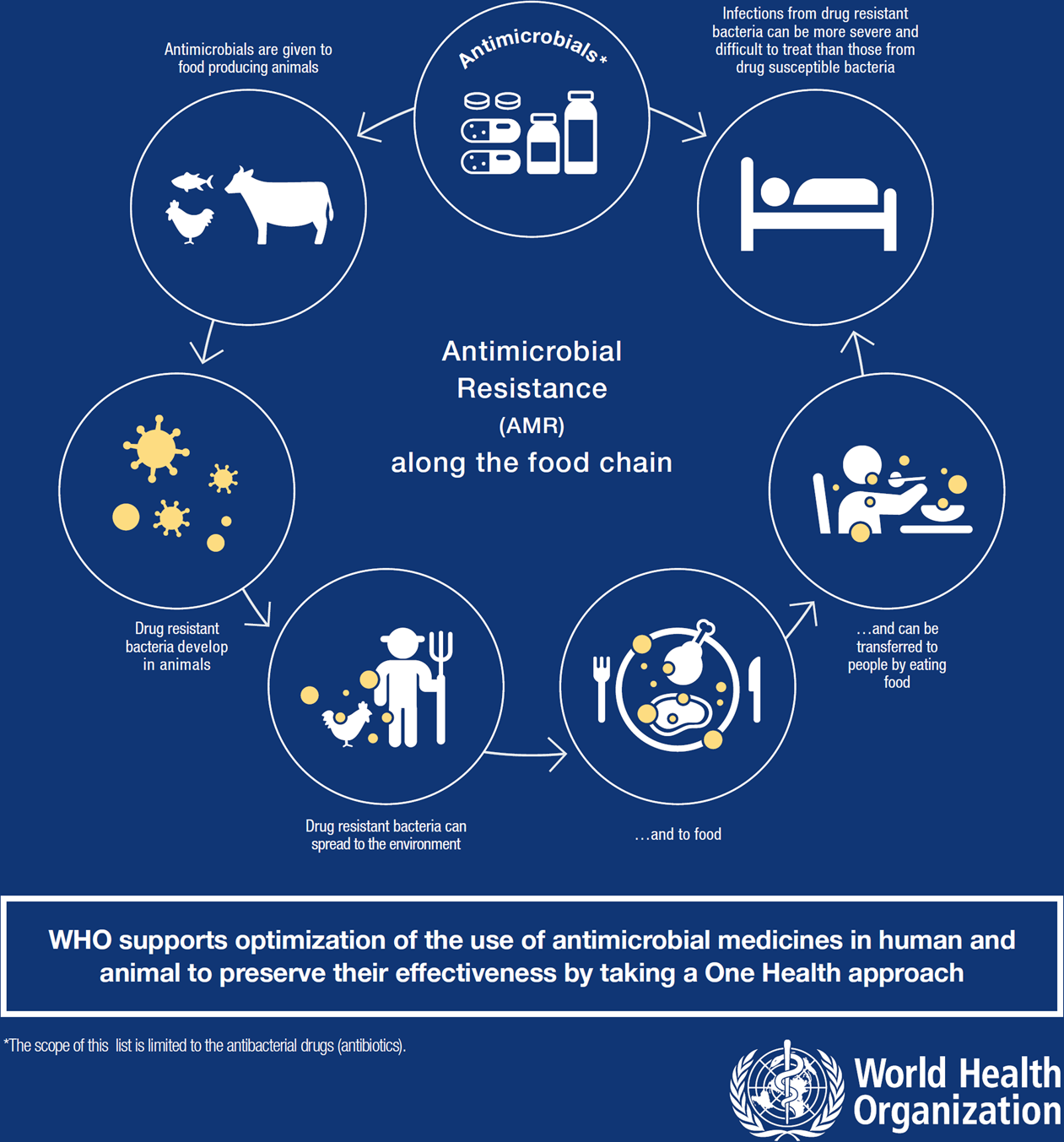

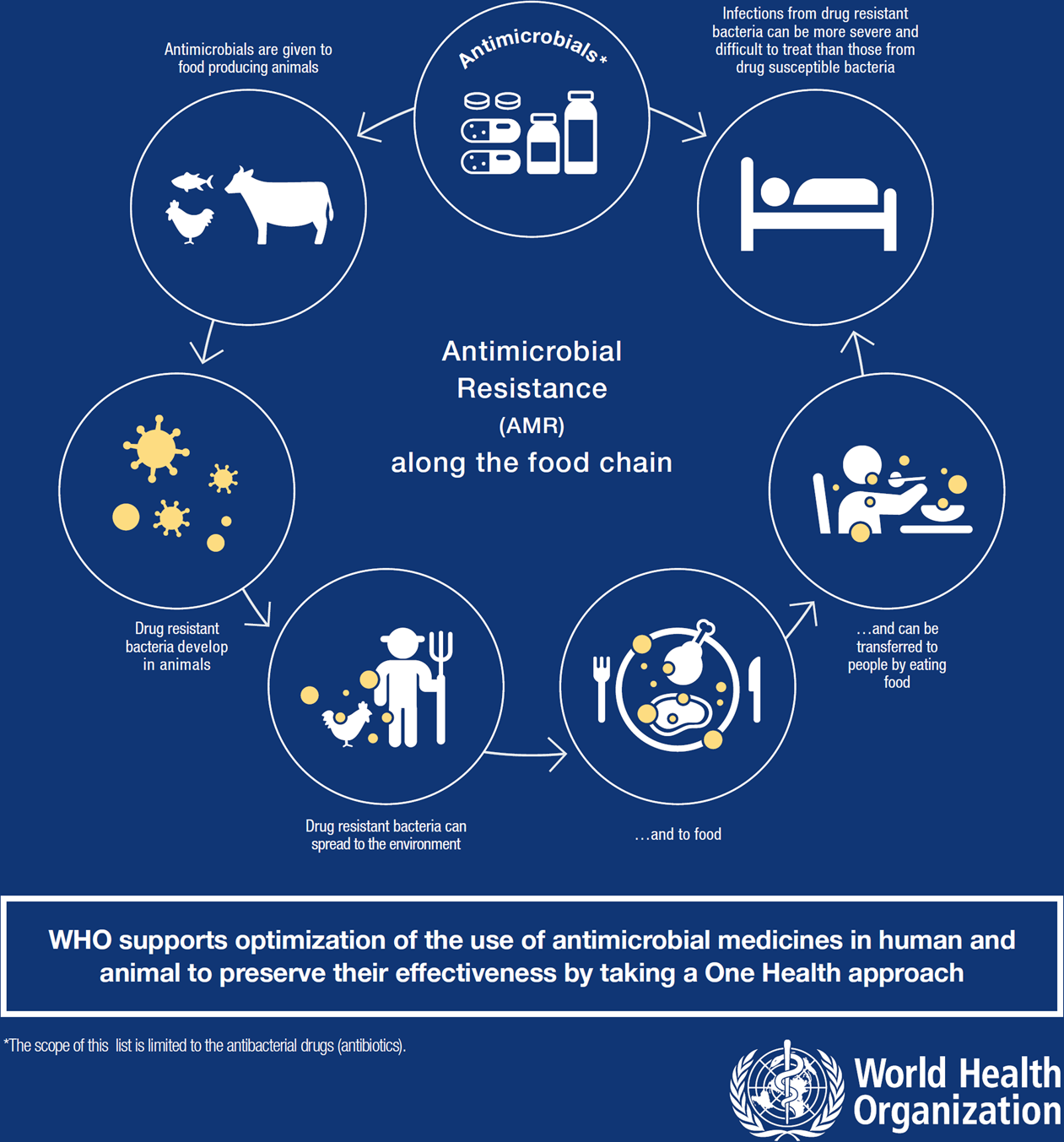

The National Centre for Disease Control (NCDC) conducted a study revealing that over half of the surveyed hospital patients in India were given antibiotics preventively rather than for treatment. This overuse of antibiotics poses a significant risk as India already faces a high burden of drug-resistant pathogens, contributing to antimicrobial resistance (AMR). Experts Sumit Ray and Abdul Ghafur discuss the causes, consequences, and potential solutions to this issue, emphasizing the need for judicious antibiotic use and addressing systemic challenges.

Key Highlights:

- Antimicrobial Resistance (AMR): AMR refers to microorganisms becoming resistant to antibiotics. India is grappling with high levels of drug-resistant bacteria, impacting patient outcomes negatively.

- Factors Leading to AMR: Inappropriate antibiotic use, lack of rapid diagnostics, insufficient training, inadequate monitoring, and pharmaceutical industry incentives contribute to the rise of AMR.

- NCDC Survey Findings: The survey showed that 55% of patients received antibiotics as a preventive measure, indicating a potential over-prescription issue.

- Root Causes of Over-Prescription: Overcrowded hospitals, limited access to rapid diagnostics, and economic factors drive doctors to opt for antibiotics as a quicker and cheaper alternative.

- Immediate Threat: The immediate danger is evident in the survey’s findings, with a significant percentage of patients exhibiting resistance to various generations of antibiotics, leading to poor health outcomes.

- AMR as a Complex Challenge: AMR is not solely a medical issue but a complex challenge involving socio-economic, political, and infrastructural factors.

Key Challenges:

- Over-Prescription: Doctors tend to prescribe antibiotics unnecessarily due to factors like overcrowded hospitals, limited time for examinations, and inadequate diagnostic facilities.

- Lack of Rapid Diagnostics: The absence of quick and affordable diagnostic tools contributes to the inappropriate use of antibiotics.

- Systemic Issues: Weak governance, inadequate sanitation, poverty, and limited access to clean water are interconnected factors contributing to AMR.

- Implementation Gap: Existing guidelines for antibiotic use exist, but there is a gap in their implementation, leading to over-prescription.

- Incentivization in Pharma Industry: The pharmaceutical industry’s encouragement of certain prescribing practices exacerbates the problem.

Key Terms/Phrases:

- Antimicrobial Resistance (AMR): Microorganisms becoming resistant to antibiotics.

- Over-the-Counter Antibiotics: Antibiotics available without a prescription.

- H1 Rule: Regulation prohibiting certain antibiotics without a prescription.

- Colistin: A potent antibiotic, banned for growth promotion in poultry farming.

- Third/Fourth-Generation Antibiotics: Antibiotics of advanced generations, facing resistance in bacterial strains.

Key Quotes:

- “I treat infections in cancer patients, who are the most immuno-compromised patients you can come across. Patients are losing their lives because of AMR.” – Abdul Ghafur

- “What is essential is the linking of labs to all levels of clinical setups and the fast transmission of infection-related data between the lab and the clinician.” – Sumit Ray

Key Examples and References:

- National Centre for Disease Control (NCDC) survey on antibiotic use in Indian hospitals.

- Indian government’s 2019 ban on colistin use in poultry farming.

Critical Analysis:

- Overcrowded hospitals and limited diagnostic access drive over-prescription.

- Addressing AMR requires a holistic approach, considering socio-economic factors.

Way Forward:

- Restrict access to reserve antibiotics to reduce resistance.

- Improve public health systems, delivery, and sanitation to curb AMR.

- Enforce existing laws, such as the ban on over-the-counter antibiotic sales.

In conclusion, addressing the overuse of antibiotics in India requires a multifaceted approach, involving improvements in healthcare infrastructure, diagnostic capabilities, and enforcement of regulations. The goal is to mitigate the immediate threat of AMR and ensure the judicious use of antibiotics for effective treatment.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Westminster system

Mains level: principles of parliamentary democracy and the importance of an effective opposition.

Central Idea:

The article reflects on the recent security breach in the Indian Parliament, drawing attention to the historical debate around the choice of a parliamentary government for India. It explores the importance of having a stable government with effective opposition, emphasizing the parliamentary system’s capacity to accommodate diversity. The author questions the handling of the security breach incident and the subsequent suspension of a significant number of opposition members.

Key Highlights:

- Security lapse in the Indian Parliament in December 2023.

- Historical debate on the choice of a parliamentary government in India.

- Importance of stable government with effective opposition.

- Challenges faced by the ruling party in accommodating opposition.

- Critique of the current leadership’s response to the security breach.

Key Challenges:

- Grappling with the aftermath of a significant security breach.

- Balancing the need for a stable government with the necessity of an effective opposition.

- Managing the paradox of majority endorsement while ensuring constant validation for the common good.

- Ensuring parliamentary committees address security concerns adequately.

- Striking a balance between executive authority and parliamentary dignity.

Key Terms:

- Parliamentary government

- Opposition

- Security breach

- Westminster system

- Presidential system

- Swarajist model

- Indian orthodoxy

- Common good

- Effective representation

- Stability in governance

Key Phrases:

- “Foundational institution of public life.”

- “Parliamentary form of government.”

- “Security lapses and pandemonium.”

- “Doctrinal, ethnic, and cultural pluralisms.”

- “Dialectics of stable support and effective opposition.”

- “Insistent demand of the Opposition.”

- “Suspended members from both Houses.”

- “Ruling party’s ability to defend its course.”

Key Quotes:

- “A parliamentary system marks a better space for minorities.”

- “The ruling party has not found it easy to face a sustained Opposition.”

- “It is not the truth that a ruling dispensation upholds that serves its claim to rule but its ability to defend the course it pursues as the truth.”

Anecdotes:

- Incident involving Jawaharlal Nehru and Speaker Mavalankar’s refusal to go to the Prime Minister’s chamber.

- Reference to historical debates within the Constituent Assembly on the form of government for India.

Key Statements:

- “The security breach is a breach inflicted on the nation as a whole.”

- “The ruling party, despite challenges, has to live with the logic of the parliamentary system.”

- “The suspension of almost the entire Opposition from both the Houses can hardly meet the test of becoming the voice of the nation.”

Key Examples and References:

- Two young men with gas canisters causing pandemonium in the Lok Sabha.

- Historical references to arguments for the presidential, Indian orthodox, and swarajist models.

- Mention of Jawaharlal Nehru’s sensitivity to the absence of an effective opposition.

Key Facts and Data:

- December 2023: Security breach in the Indian Parliament.

- Suspension of 146 members from both Houses.

- Reference to the historical debate within the Constituent Assembly.

Critical Analysis:

The article critically evaluates the current state of the Indian Parliament, questioning the handling of the security breach and the subsequent suspension of opposition members. It emphasizes the importance of a stable government with an effective opposition, highlighting historical debates on the choice of a parliamentary system. The author critiques the leadership’s response and underscores the need for a balance between executive authority and parliamentary dignity.

Way Forward:

- Address the security concerns through parliamentary committees.

- Foster a more collaborative approach between the ruling party and the opposition.

- Uphold the principles of parliamentary democracy and the importance of an effective opposition.

- Prioritize transparency and communication in addressing lapses and challenges.

- Reaffirm the commitment to diversity, pluralism, and the common good in parliamentary governance.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now