Note4Students

From UPSC perspective, the following things are important :

Prelims level: Snow Leopard

Mains level: NA

Central Idea

- Kyrgyzstan, a Central Asian country, has declared the snow leopard as its national symbol.

About Snow Leopard

|

Details |

| Habitat |

Mountainous regions of Central and Southern Asia; in India: western and eastern Himalayas. |

| Indian Geographical Range |

Western Himalayas (J&K, Ladakh, Himachal Pradesh, Uttarakhand) and Eastern Himalayas (Sikkim, Arunachal Pradesh). |

| Project Snow Leopard (2009) |

Aims to strengthen wildlife conservation in the Himalayan high altitudes, involving local communities. |

| Conservation Status |

IUCN Red List: Vulnerable

CITES: Appendix I

Wildlife (Protection) Act, 1972 (India): Schedule I |

| India’s Conservation Efforts |

Flagship species for high altitude Himalayas.

Part of GSLEP Programme since 2013.

Himalaya Sanrakshak community programme (2020).

National Protocol on Snow Leopard Population Assessment (2019)

SECURE Himalaya project (GEF-UNDP funded).

Listed in 21 critically endangered species for recovery by MoEF&CC.

Conservation breeding at Padmaja Naidu Himalayan Zoological Park. |

| GSLEP Programme |

Inter-governmental alliance of 12 snow leopard countries (India, Nepal, Bhutan, China, Mongolia, Russia, Pakistan, Afghanistan, Kyrgyzstan, Kazakhstan, Tajikistan, and Uzbekistan), focusing on ecosystem value awareness. |

| Living Himalaya Network Initiative |

WWF’s initiative across Bhutan, India (North-East), and Nepal for conservation impact in the Eastern Himalayas. |

Significance of the Snow Leopard

- The snow leopard symbolizes the health and stability of mountain ecosystems, which cover a significant portion of the global territory.

- The snow leopard has been a totem animal in ancient Kyrgyz culture, associated with the legendary figure Manas.

- The harmony between humans and nature, symbolized by the snow leopard, is portrayed in Chyngyz Aitmatov’s novel “When Mountains Fall.”

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Free Movement Regime

Mains level: Read the attached story

Central Idea

- On January 2, the Indian government announced plans to scrap the Free Movement Regime (FMR) along the Myanmar border.

- Residents in border areas, previously able to cross freely, will now require visas.

About Free Movement Regime

- Initiated in the 1970s, the FMR allowed people living within 16 km of the India-Myanmar border to travel up to 16 km into the other country without a visa.

- India shares a 1,643 km-long border with Myanmar, which passes through the States of Arunachal Pradesh (520 km), Nagaland (215 km), Manipur (398 km), and Mizoram (510 km).

- This regime recognized the deep-rooted familial and ethnic connections between communities on either side of the unfenced border.

- The FMR was last revised in 2016, aligning with India’s Act East policy. However, it was suspended in Manipur since 2020 due to the COVID-19 pandemic.

Reasons for the Policy Shift

- Security and Illegal Activities: The FMR has been under scrutiny for facilitating illegal immigration, drug trafficking, and insurgency.

- Refugee Influx Post-Coup: Following Myanmar’s military coup in February 2021, over 40,000 refugees entered Mizoram, and around 4,000 entered Manipur, exacerbating security concerns.

- Local Government Stance: Manipur’s Chief Minister urged the Ministry of Home Affairs to cancel the FMR and complete border fencing, linking ethnic violence in the state to the free movement across the border.

Implications of Scrapping the FMR

- Impact on Local Communities: Ending the FMR could significantly affect the daily lives of border residents, who depend on cross-border access for various needs.

- Cultural and Social Disruption: The policy change might strain the cultural and social fabric of communities with shared ethnicities across the border.

Way forward

- Border Fencing: The government plans to fence about 300 km of the border, with a tender expected soon.

- Regulatory Revisions: Experts suggest refining the FMR to better regulate movement while maintaining cross-border ties.

- Infrastructure and Trade: Enhancing infrastructure and formalizing trade at designated entry points could mitigate some negative impacts.

- Community Engagement: Involving border communities in decision-making is crucial for effective and sensitive border management.

Conclusion

- Balancing Security and Community Needs: The decision to end the FMR requires a nuanced approach that considers both national security and the rights of border communities.

- Diplomatic Engagement: Strengthening diplomatic relations with Myanmar is key to managing this transition effectively.

- Future Challenges: As India navigates this policy change, it faces the challenge of securing its borders while respecting the socio-economic realities of border populations.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Collegium system

Mains level: backlog of cases, appointment of judges based on perceived proximity to political power

![Burning Issue] Judiciary in Times of COVID-19 Outbreak - Civilsdaily](https://d18x2uyjeekruj.cloudfront.net/wp-content/uploads/2020/05/jud-300x188.jpg)

Central Idea:

The author highlights the challenges faced by the Indian judiciary, emphasizing the need for unbiased judges and a political system that separates religion from politics. The use of religious sentiments for divisive purposes is criticized, calling for a transparent and merit-based judicial appointment system.

Key Highlights:

- Judicial challenges in handling a growing population and increasing litigations.

- Delayed justice in the Supreme Court, impacting the relevance of decisions.

- Concerns about the quality of judges and perceived ideological alignments in appointments.

- Critique of the current collegium system and its lack of transparency.

Key Challenges:

- Overburdened judiciary with a rising number of cases.

- Delayed justice affecting the effectiveness of legal decisions.

- Perceived ideological biases in judicial appointments.

- Lack of a transparent and merit-oriented system for judge selection.

Key Terms:

- Collegium System: The system of appointing judges through a committee of senior judges.

- Ideological Alignment: Alleged connections between judges and specific political or religious ideologies.

- Judicial Hierarchy: The levels of the judicial system, with the Supreme Court being the highest.

Key Phrases:

- “Bedevilled with challenges”: Describing the complex issues faced by the judiciary.

- “Divide and rule”: Criticizing the use of religious emotions for political manipulation.

- “Seminal issues”: Highlighting the critical issues decided by the Supreme Court.

Key Quotes:

- “India needs judges who deliver justice unconcerned with majoritarian sentiments.”

- “The collegium system has failed us.”

- “For the judiciary to regain its glory, it needs to do more than just decide on cases.”

Key Examples and References:

- Reference to the Chief Justice addressing dormant cases but acknowledging the urgency needed.

- Critique of the appointment of judges based on perceived proximity to political power.

Key Facts and Data:

- Increase in litigants seeking justice due to a burgeoning population.

- Delayed hearings and decisions in the Supreme Court.

- Issues with the current system of appointing judges.

Critical Analysis:

The author criticizes the judiciary’s current state, highlighting issues of delayed justice, ideological biases, and the failure of the collegium system. Emphasis is placed on the need for transparency and merit in the appointment process.

Way Forward:

- Reforming the judicial appointment process to ensure transparency and meritocracy.

- Addressing the backlog of cases to expedite justice delivery.

- Advocating for a political system that separates religion from politics to avoid divisive agendas.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Article 155

Mains level: conduct of Governors in Opposition-ruled States

Central Idea:

The conduct of Governors in Opposition-ruled States, exemplified by the recent actions of Kerala’s Governor, raises concerns about adherence to constitutional morality, necessitating a reevaluation of their roles and legal consequences.

Key Highlights:

- Kerala’s Governor, Arif Mohammed Khan, faced criticism for instructing the removal of posters and accusing the Chief Minister of supporting activists against him.

- Breaches of protocol, such as an unannounced tour of Kozhikode, added to the growing trend of Governors’ controversial actions.

- While the Constitution outlines functions, powers, and duties of Governors, the concept of constitutional morality should guide their public behavior.

- Reference to NCT of Delhi v. Union of India highlights the responsibility of individuals occupying constitutional offices.

- Article 361 provides limited immunity for Governors, exempting them from court scrutiny for official acts.

- Rameshwar Prasad v. Union of India establishes judicial review for cases of Governor’s motivated and whimsical conduct, suggesting accountability.

- Kaushal Kishor v. State of Uttar Pradesh clarifies that public functionaries’ freedom of expression is subject to reasonable restrictions.

- Ministers can be held personally liable for statements inconsistent with government views, emphasizing personal responsibility.

- Sarkaria Commission Report (1988) criticized Governors for lacking impartiality and becoming agents of the Union, emphasizing the need for detachment.

- Justice M.M. Punchhi Commission (2010) recommended restricting Governors from roles not envisaged by the Constitution, citing potential controversies.

Key Challenges:

- Governors’ failure to display impartiality and sagacity, engaging in local politics and controversies.

- Lack of adherence to recommendations for detached roles and limitations on Governors’ powers.

Key Terms and Phrases:

- Constitutional morality

- Limited immunity (Article 361)

- Judicial review

- Chancellorship of universities

- Sarkaria Commission

- Punchhi Commission

- Democratic legitimacy

- Raj Bhavans

Key Quotes:

- “Constitutional morality places responsibilities and duties on individuals who occupy constitutional institutions and offices.” – NCT of Delhi v. Union of India (2018)

- “Some Governors have failed to display the qualities of impartiality and sagacity expected of them.” – Sarkaria Commission Report (1988)

- “The Governor should be a detached figure and not too intimately connected with the local politics of the State.” – Justice M.M. Punchhi Commission report (2010)

Key Statements:

- Judicial review possible for Governor’s misbehavior unconnected with official duty.

- Sarkaria and Punchhi Commission reports emphasize the need for Governors’ impartiality and limited involvement in local politics.

- Kerala Assembly’s attempt to abolish Governor’s chancellorship raises concerns about democratic legitimacy.

Critical Analysis:

- The Governor’s actions in Kerala highlight a deviation from democratic norms and raise questions about the democratic legitimacy of gubernatorial decisions.

- Commission reports expose longstanding issues with Governor appointments and their roles, calling for systemic changes.

Way Forward:

- Future regimes should consider amending Article 155 to ensure Chief Minister consultation in Governor appointments, addressing recommendations from the Sarkaria report.

- Establishment of an independent body for Governor selection, with input from the Chief Justice of India, may enhance the quality of the selection process.

- Legal prohibitions against Governors’ further rehabilitation in official capacities could contribute to improving the functioning of Raj Bhavans.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: BOP Crisis, LPG Reforms

Mains level: Read the attached story

Central Idea

- S. Venkitaramanan, former Governor of the Reserve Bank of India (RBI), passed away, leaving behind a legacy of significant contributions.

- His tenure is marked by crucial interventions during India’s economic crises and a commitment to open dialogue and innovative policies.

Navigating the Balance of Payments Crisis

- Economic Turbulence in 1990: India faced a severe balance of payments crisis due to reduced remittances and increased oil prices.

- Critical Measures: Under Venkitaramanan’s leadership, the RBI took bold steps, including pledging gold reserves, to avert a default on international payments.

- Impact of Gold Pledging: This move, though criticized domestically, was crucial in maintaining India’s international credibility and financial stability.

Role in Economic Reforms

- Import Compression Strategy: Venkitaramanan initiated a program of import compression, significantly reducing the current account deficit.

- Foundation for Future Reforms: These measures laid the groundwork for the economic reforms introduced by the Narasimha Rao government and Dr. Manmohan Singh.

Challenges and Controversies

- The Harshad Mehta Scam: Venkitaramanan’s tenure was marred by the securities scandal involving Harshad Mehta, overshadowing his earlier achievements.

- Public Perception: Despite his significant contributions, the public memory often overlooks his role in steering India through economic turmoil.

Remarkable Openness and Inclusivity

- Engagement with Diverse Opinions: Venkitaramanan was known for his openness to different viewpoints, engaging with economists and critics alike.

- Innovative Approach to Policy Making: His willingness to consider varied perspectives contributed to more inclusive and effective economic policies.

Legacy in the RBI and Beyond

- Establishment of the Development Research Group: Venkitaramanan’s vision led to the creation of this group, aiming to foster interaction between the RBI and independent economists.

- Influence on Current Economic Policies: His belief in relying on India’s intellectual resources continues to influence the RBI’s approach, though challenges like inflation management persist.

Conclusion

- Enduring Impact: S. Venkitaramanan’s tenure as RBI Governor was marked by courageous decisions and a commitment to intellectual openness.

- Remembering His Contributions: While his term had its challenges, his role in safeguarding India’s economy and fostering a culture of dialogue and research within the RBI remains a significant part of his legacy.

- Inspiration for Future Leaders: His approach to economic policy and management continues to serve as an inspiration for current and future leaders in the field.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Electoral Bond Scheme

Mains level: Read the attached story

Central Idea

- The government has announced a fresh tranche of electoral bond sales for a 10-day period starting through the authorised branches of State Bank of India across the country.

About the Electoral Bond Scheme

| Definition |

Banking instruments for political party donations with donor anonymity. |

| Launch |

2017-18 Union Budget |

| Purchase Method |

Available to Indian citizens and Indian-incorporated companies from select State Bank of India branches. Can be bought digitally or via cheque. |

| Donation Process |

Purchasers can donate these bonds to eligible political parties of their choice. |

| Denominations |

Available in multiples of ₹1,000, ₹10,000, ₹10 lakh, and ₹1 crore. |

| KYC Requirements |

Purchasers must fulfill existing KYC norms and pay from a bank account. |

| Lifespan of Bonds |

Bonds have a 15-day life to prevent them from becoming a parallel currency. |

| Identity Disclosure |

Donors contributing less than ₹20,000 need not provide identity details like PAN. |

| Redemption |

Electoral Bonds can be encashed only by eligible political parties through an Authorized Bank. |

| Eligibility of Parties |

Only parties meeting specific criteria, including securing at least 1% of votes in the last General Election, can receive Electoral Bonds. |

| Restrictions Lifted |

Foreign and Indian companies can now donate without disclosing contributions as per the Companies Act. |

| Objective |

To enhance transparency in political funding and ensure funds collected by political parties are accounted or clean money. |

Also read:

Challenging the Electoral Bond Scheme

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Psychoanalysis

Mains level: Read the attached story

Central Idea

- The Delhi Police’s use of psychoanalysis for assessing motives in the Parliament breach incident highlights its contemporary relevance.

Origins of Psychoanalysis

- Development by Freud: Sigmund Freud, a Viennese psychiatrist, developed psychoanalysis as a modern Western system of psychotherapy.

- Evolution over Time: Initially a treatment for unexplained symptoms, psychoanalysis has evolved, influenced by various scientific disciplines.

- Goal of Psychoanalysis: It aims to enhance self-awareness by uncovering unconscious wishes and defenses.

Concept of the Unconscious

- Freud’s Central Theory: The unconscious contains memories and impulses inaccessible to conscious awareness due to their threatening nature.

- Mechanisms of Repression: Repression plays a key role in psychoanalysis, involving the unconscious forgetting of painful ideas to protect the psyche.

- Id, Ego, and Superego: Freud’s model of the psyche includes the instinct-driven id, the rational ego, and the normative superego.

Fantasies, Defenses, and Resistance in Psychoanalysis

- Role of Fantasies: Fantasies, according to Freud, fulfill psychic needs and provide imaginary wish fulfillment.

- Defense Mechanisms: Intrapsychic processes like projection, reaction formation, and rationalization help avoid emotional pain.

- Concept of Resistance: Freud observed resistance in clients reluctant to engage in therapy, leading to the practice of free association.

Transference and Countertransference

- Transference Dynamics: Clients often project past relational templates onto the therapist, offering insights into their behavior.

- Countertransference Issues: Therapists’ unresolved conflicts can affect their feelings towards clients, necessitating self-analysis.

Psychoanalysis as a Therapeutic Tool

- Dream Interpretation: Freud viewed dreams as forms of wish fulfillment, central to psychoanalytic therapy.

- Making the Unconscious Conscious: The goal is to bring unconscious drives into awareness to understand self-defeating behaviors.

- Therapeutic Relationship: The therapist-client relationship can provide new relational experiences, challenging maladaptive models.

Contemporary Psychoanalytic Practice

- Shift to Shorter Sessions: Modern psychoanalysis often involves fewer sessions per week, adapting to practical and individual needs.

- Long-Term vs. Short-Term Therapy: While some issues require long-term treatment, contemporary practice accommodates shorter, more focused consultations.

Conclusion

- Enduring Relevance: Despite its evolution, psychoanalysis remains a vital tool for understanding human behavior and mental health.

- Adaptation and Integration: Modern psychoanalytic practice has adapted to contemporary needs while retaining core principles.

- Broader Applications: Beyond therapy, psychoanalysis offers insights into various aspects of human behavior, as evidenced by its use in legal and investigative contexts.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Kharsawan Massacre

Mains level: Read the attached story

Central Idea

- On January 1, 1948, the town of Kharsawan in present-day Jharkhand witnessed a massacre reminiscent of what happened in Jallianwala Bagh in 1919.

- Police opened fire at a crowd gathered for a protest and the weekly haat (market), killing hundreds, or by some accounts, thousands of Adivasis.

Kharsawan Massacre: A Background

- Since the creation of the Bihar and Orissa Province in 1912, Adivasis in the region sought a separate state, reflecting their unique culture and grievances.

- This demand gained momentum over the years, with the Simon Commission acknowledging the distinct nature of the region in 1930.

- In 1938, the Adivasi Mahasabha was established to further this cause, led by prominent leader Jaipal Singh Munda.

Kharsawan’s Merger Controversy

- Merger with Orissa: In 1947, Kharsawan, a princely state with a significant Odia-speaking population, decided to join Orissa during India’s princely states’ integration.

- Adivasi Opposition: However, most Adivasis opposed this merger, desiring a separate state instead.

The Massacre

- Protest Gathering: On January 1, 1948, a large gathering was organized in Kharsawan to protest the merger, coinciding with the weekly market day. Over 50,000 people, including those from distant villages, assembled, many to see Jaipal Munda, who was expected but did not arrive.

- Police Open Fire: The large crowd and tense atmosphere led the Orissa military police to open fire, resulting in a massacre. The exact number of casualties remains unclear, with estimates ranging from a few dozen to several thousand.

- Aftermath: The bodies were disposed of in a well and the jungle, and many injured were left untreated. The incident remains a dark and unresolved chapter in Indian history.

Legacy

- Uncertain Death Toll: Official records state 35 deaths, but other sources, like P.K. Deo’s “Memoir of a Bygone Era,” suggest numbers as high as 2,000.

- Lack of Accountability: No definitive report or accountability for the massacre has been established.

- Memorial and Remembrance: A memorial in Kharsawan serves as a reminder of this tragedy, with political leaders often visiting to pay respects.

Conclusion

- The Kharsawan massacre is a poignant reminder of the complexities and tragedies during India’s transition to independence, particularly for marginalized communities like the Adivasis.

- It underscores the unresolved issues of tribal rights and recognition in India’s history.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Earthquakes in Japan

Mains level: Read the attached story

Central Idea

- On January 1, 2024, a 7.5-magnitude earthquake hit Ishikawa prefecture in Japan, triggering tsunami waves over a meter high.

Japan’s Geographical Vulnerability

- Japan’s geographical vulnerability, particularly concerning plate tectonics, is a critical aspect of its environmental and disaster management challenges.

- The country’s location at the convergence of several major tectonic plates makes it highly susceptible to seismic activities.

Here’s a detailed look at how plate tectonics contribute to Japan’s geographical vulnerability:

[1] Convergent Plate Boundaries:

- Pacific Ring of Fire: Japan is located on the Pacific Ring of Fire, an area with a high level of seismic activity due to the presence of numerous tectonic plate boundaries.

- Plates Involved: The primary tectonic plates interacting near Japan are the Pacific Plate, the Philippine Sea Plate, the Eurasian Plate, and the North American Plate.

- Subduction Zones: The Pacific and Philippine Sea plates are subducting beneath the Eurasian and North American plates. This subduction process is a significant source of seismic activity, including powerful earthquakes and volcanic eruptions.

[2] Earthquake Activity:

- Frequent Earthquakes: The movement of these plates results in frequent earthquakes. Japan experiences thousands of tremors annually, ranging from minor to catastrophic.

- Major Earthquakes: Historical events like the 2011 Great East Japan Earthquake and the 1995 Great Hanshin Earthquake demonstrate the potential for massive destruction and loss of life due to Japan’s tectonic setting.

[3] Tsunami Risk:

- Generation of Tsunamis: Earthquakes occurring under the sea or along the coast can displace large volumes of water, leading to tsunamis. The 2011 tsunami, triggered by a massive undersea earthquake, caused widespread devastation and the Fukushima nuclear disaster.

- Coastal Impact: Japan’s extensive coastline makes it particularly vulnerable to tsunamis, which can arrive within minutes of an undersea earthquake, leaving little time for evacuation.

[4] Volcanic Activity:

- Volcanic Eruptions: The subduction of the Pacific and Philippine Sea plates not only causes earthquakes but also contributes to significant volcanic activity. Magma generated by the melting of the subducted plate rises to the surface, leading to volcanic eruptions.

- Active Volcanoes: Japan has over 100 active volcanoes, a direct result of its tectonic setting. Eruptions pose risks to nearby populations and can disrupt air travel and local economies.

[5] Geological Complexity:

- Intersecting Faults: The interaction of multiple tectonic plates creates a complex network of faults, increasing the unpredictability and variability of seismic events.

- Diverse Seismic Phenomena: This complexity leads to a range of seismic phenomena, including deep-focus earthquakes, which occur at greater depths and can affect broader areas.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Virtual Digital Assets (VDAs)

Mains level: Read the attached story

Central Idea

- The Financial Intelligence Unit India (FIU IND) issued notices to offshore virtual digital asset service providers (VDA SPs) for non-compliance with the Prevention of Money Laundering Act, 2002 (PMLA).

- A request was made to the Ministry of Electronics and Information Technology to block URLs of these entities.

About Virtual Digital Assets (VDAs)

- Digital Value: Virtual Digital Assets are digital forms of value like cryptocurrencies and tokens. They are secured using cryptography and blockchain technology.

- Intangible and Digital: These assets exist only in digital form and can be used for transactions, investments, or as a store of value.

- Decentralized: They usually operate independently of central authorities, which makes them attractive but also prone to risks like money laundering. This has led to calls for regulation and oversight.

Premise of Non-Compliance with PMLA

- Regulatory Changes in 2023: VDA SPs were brought under anti-money laundering and counter-terrorism financing regulations in March 2023.

- Mandatory Compliance: These regulations required VDA SPs to register, verify client identities, and maintain records of financial transactions.

- Non-Registration Issue: Non-compliant entities continued to serve Indian users without registration, evading the AML and CFT framework.

Purpose of PMLA Compliance

- Monitoring Financial Transactions: The PMLA aims to track financial transactions to prevent money laundering and terror financing.

- Selective Compliance Advocacy: Legal experts suggest that FIU IND should enforce compliance only on entities fitting the March 2023 notification parameters.

- KYC Benefits: Adherence to KYC mandates is seen as beneficial for VDA SPs, addressing concerns about anonymity and unlawful use of crypto assets.

Global Efforts and Indian Enforcement

- India’s Global Advocacy: India’s enforcement aligns with its global efforts for cryptocurrency regulation, including proposed frameworks by the IMF and the Financial Stability Board.

- G-20 Influence: India’s role in the G-20 has been pivotal in advocating for global cryptocurrency regulation.

International Regulatory Landscapes

- Dubai’s VARA Model: Dubai’s Virtual Assets Regulatory Authority (VARA) provides a comprehensive licensing framework, emphasizing consumer protection and AML-CFT compliance.

- EU’s MiCA Regulation: The Markets in Crypto-Assets Regulation (MiCA) in the EU focuses on transparency, disclosure, and supervision, requiring service providers to be authorized.

- U.S. Regulatory Framework: The U.S. lacks a comprehensive nationwide framework but covers digital assets under existing regulations like the Bank Secrecy Act.

Considerations in Regulating Virtual Digital Assets (VDAs)

- Policy Options by BIS: The Bureau for International Settlements (BIS) outlines three policy options: outright ban, containment, and regulation.

- Challenges of an Outright Ban: An outright ban may be unenforceable due to the pseudo-anonymous nature of crypto markets.

- Containment Strategy: Containment involves controlling flows between crypto and traditional financial systems but may not address inherent vulnerabilities.

- Regulatory Motivations: The motivation to regulate varies, with the need to ensure regulatory benefits outweigh costs.

- Focus Areas for Emerging Markets: Emerging market economies (EMEs) need to define regulatory authority, scope of regulation, and fill data gaps to understand technology interconnections.

Conclusion

- Balancing Act: Regulating virtual digital assets presents a complex balancing act between innovation, consumer protection, and financial stability.

- Global Coordination: The varied approaches across jurisdictions highlight the need for global coordination and harmonization in VDA regulations.

- India’s Proactive Stance: India’s recent actions reflect a proactive stance in aligning with global standards while addressing local concerns.

- Future Challenges: As the virtual asset landscape evolves, regulators worldwide will continue to face challenges in adapting their frameworks to ensure effective oversight without stifling innovation.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: POLIX’s beryllium disc

Mains level: detection of lower-energy X-rays

Central idea

Key Highlights:

- ISRO successfully launched XPoSat, an X-ray Polarimeter Satellite, on New Year’s Day in 2024.

- The indigenous instrument, POLIX, built at Raman Research Institute, is a crucial step for Indian astronomers.

- POLIX aims to study X-ray polarization, providing insights into celestial magnetic fields.

Key Challenges:

- Collecting X-rays from space is challenging due to their high energy, making traditional focusing methods impossible.

- Earth’s atmosphere absorbs most X-rays, complicating the study of cosmic X-rays.

Key Terms and Phrases:

- XPoSat: X-ray Polarimeter Satellite.

- POLIX: Indian X-ray Polarimeter.

- Pulsars: Exotic stars emitting X-rays with strong magnetic fields.

- IXPE: NASA’s X-ray Polarimeter Explorer.

- XSPECT: Instrument on XPoSat for studying timing and spectral properties.

Key Quotes:

- “The instrument, totally indigenous in design and fabrication, will herald yet another milestone for Indian astronomers.”

- “Measuring the polarisation of X-rays would enable astronomers to gauge the directions of magnetic fields in celestial objects.”

Key Statements:

- POLIX, a cubical cylinder with a beryllium disc, detects X-rays and works on the principle of polarization after scattering.

- XPoSat, complementing NASA’s IXPE, will provide valuable information about pulsars and black holes.

Key Examples and References:

- Pulsars, city-sized stars with immense mass, often shine in X-rays and have powerful magnetic fields.

- POLIX’s beryllium disc allows the probing of lower energy X-rays compared to NASA’s instrument.

Key Facts and Data:

- POLIX measures roughly half a meter and weighs nearly 200 kilograms.

- XPoSat focuses on studying the timing and spectral properties of X-ray-emitting objects.

Critical Analysis:

- POLIX’s unique design using beryllium enhances the detection of lower-energy X-rays, providing a significant advantage.

- The launch of XPoSat signifies a major advancement in Indian X-ray astronomy, offering a valuable complement to NASA’s efforts.

Way Forward:

- Anticipation surrounds XPoSat’s data collection, expected to deepen our understanding of pulsars and black holes.

- Ongoing collaboration and advancements in X-ray astronomy will likely lead to further discoveries.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Non-Nuclear Aggression Agreement

Mains level: Pakistan's prospected economic default and collapse

Central Idea

- India and Pakistan has exchanged a list of their nuclear installations that cannot be attacked in case of an escalation in hostilities.

Non-Nuclear Aggression Agreement

- The Non-nuclear aggression agreement is a bilateral and nuclear weapons control treaty between India and Pakistan, on the reduction (or limitation) of nuclear arms.

- Both pledged not to attack or assist foreign powers to attack on each others nuclear installations and facilities.

- The treaty was drafted in 1988, and signed by PM Rajiv Gandhi and his counterpart Benazir Bhutto on 21 December 1988; it entered into force on January 1991.

- The treaty barred its signatories from carrying out a surprise attack (or to assist foreign powers to attack) on each other’s nuclear installations and facilities.

- Starting in January 1992, India and Pakistan have annually exchanged lists of their respective military and civilian nuclear-related facilities.

Need for the treaty

- In 1986-87, the massive exercise, ‘Brasstacks’ was carried out by the Indian Army, raising fears of an Indian attack on Pakistan’s nuclear facilities.

- Since then, the Foreign ministries of both countries have been negotiating to reach an understanding towards the control of nuclear weapons.

Significance of the agreement

- The treaty barred its signatories from carrying out a surprise attack (or to assist foreign powers to attack) on each other’s nuclear installations and facilities.

- The treaty provides a confidence-building security measure environment.

Other: Sharing of Prisoners information

- Both nations simultaneously share the list of prisoners in each other’s custody.

- These lists are exchanged under the provisions of the Agreement on Consular Access signed in May 2008.

- Under this pact, the two countries should exchange comprehensive lists on January 1 and July 1 every year (i.e. twice a year).

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Employees’ Provident Fund Organisation

Mains level: revisiting the pension computation methodology

Central idea

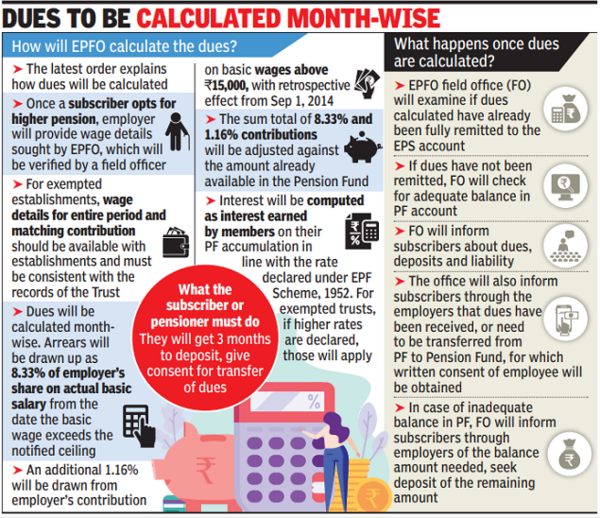

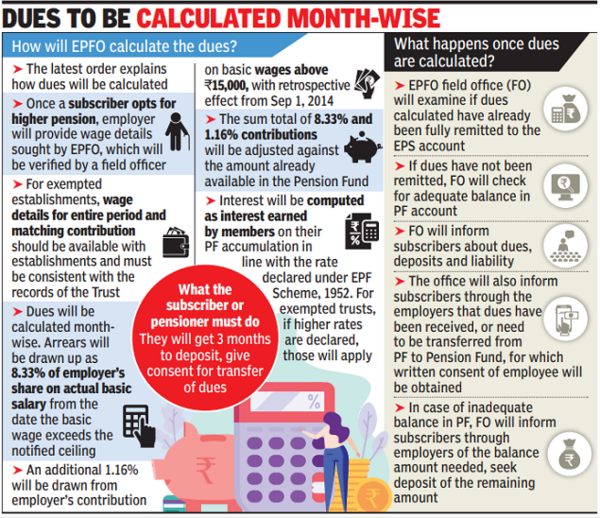

The EPFO’s recent clarification on the 2022 Supreme Court verdict regarding higher PF pension has sparked concerns among pensioners due to ambiguity in pension computation methods. Challenges include discrepancies for pre-2014 and post-2014 retirees, with a demand for increased minimum monthly pension.

Key Highlights:

- The EPFO’s clarification on the 2022 Supreme Court verdict on higher PF pension has raised concerns among pensioners and PF members.

- The Court approved higher pension payments with certain conditions, including amendments to the pensionable salary cap and contribution rules.

- The clarification introduces ambiguity by tying pension computation to the “date of commencement of pension.”

Key Challenges:

- Pre-2014 retirees choosing pension post-amendments receive lower pensions due to the calculation based on the average pay of 60 months.

- Post-2014 retirees face ambiguity and discrepancies in the revised pension amounts, seeking clarity through a worksheet.

- Lack of incorporation of interest rate component in pension calculations.

- Long-standing demand to increase the minimum monthly pension beyond ₹1,000, with calls for linking it to the cost of living index.

Key Terms:

- EPFO: Employees’ Provident Fund Organisation

- EPS: Employees’ Pension Scheme

- Pensionable salary cap: ₹15,000/month

- Amendments (2014): Raised pensionable salary cap, altered contribution rules, and changed computation basis.

- Date of commencement of pension: Controversial factor in pension calculation.

Key Quotes:

- “There is also a demand for incorporating the component of interest rate… the pension amount would at least see a rise of ₹2,300 per month.” – MP M. Shanmugam

- “The government’s contributions should increase… to achieve a durable social security system for contributors to the economy.”

Key Statements:

- The clarification’s reliance on the “date of commencement of pension” has created confusion and dissatisfaction among pensioners.

- Ambiguity in post-2014 retirees’ pension calculations prompts the need for a clearer worksheet.

Way Forward:

- Address concerns by revisiting the pension computation methodology.

- Consider increasing the minimum monthly pension, as demanded by various stakeholders.

- Enhance government contributions to ensure a robust social security system.

- Provide clear guidelines and a comprehensive worksheet for post-2014 retirees to understand and verify their pension calculations.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: COVID-19 subvariants

Mains level: Continuous tracking of virus variants is challenging due to the unpredictable nature of genetic changes.

Central idea

Dr. Chandrakant Lahariya discusses the emergence of the JN.1 sub-variant of SARS-CoV-2, highlighting its classification as a Variant of Interest (VoI). He emphasizes the need for ongoing genomic sequencing and data tracking while reassuring that, as of now, there’s no evidence of increased severity or immune escape. The central idea is to approach COVID-19 like any respiratory illness, maintaining standard preventive measures and avoiding unnecessary concerns.

Key Highlights:

- Dr. Chandrakant Lahariya, a medical doctor with extensive WHO experience, addresses the emergence of the JN.1 sub-variant of the Omicron variant of SARS-CoV-2.

- Over 1,000 subvariants have been reported since the novel coronavirus outbreak in 2019.

- The designation of JN.1 as a Variant of Interest (VoI) prompts increased genomic sequencing for monitoring.

Key Challenges:

- Continuous tracking of virus variants is challenging due to the unpredictable nature of genetic changes.

- Distinguishing between inconsequential and significant genetic alterations requires careful assessment by international agencies and experts.

Key Terms:

- SARS-CoV-2: Severe Acute Respiratory Syndrome Coronavirus-2.

- VoI: Variant of Interest.

- VoC: Variant of Concern.

- Hybrid Immunity: Combined immunity from natural infection and vaccination.

Key Phrases:

- “Silent wave”: JN.1 circulated without causing a significant increase in reported or clinical cases.

- “Genetic material changes”: Variants and subvariants result from alterations in the virus’s genetic structure.

Key Quotes:

- “Designating a variant as VoI does not automatically mean there is a reason to worry.”

- “JN.1 is not a new virus but a sub-variant of BA.2.86, itself a subvariant of Omicron.”

- “There is no scientific evidence to support having a fourth shot of COVID-19 vaccines.”

Key Statements:

- WHO declared the end of the COVID-19 pandemic in May 2023 but emphasized the need for ongoing virus and variant tracking.

- JN.1, as a VoI, requires heightened genomic sequencing and data tracking but doesn’t indicate an immediate cause for concern.

Key Examples and References:

- JN.1 is a subvariant of BA.2.86, part of the Omicron variant of SARS-CoV-2.

- Waste-water surveillance in some Indian cities suggested JN.1 circulated widely without a significant increase in reported cases.

Key Facts:

- Since 2019, more than 1,000 subvariants and recombinant sub-lineages of SARS-CoV-2 have been reported.

- Immunologically, current evidence supports continued protection from COVID-19 vaccines against subvariants.

Key Data:

- Average daily deaths due to respiratory diseases and tuberculosis in India are 50 to 60 times higher than COVID-19 deaths.

Critical Analysis:

- Dr. Lahariya emphasizes the need for nuanced government responses, responsible citizen behavior, and clear science communication.

- The spike in COVID-19 cases may be due to increased testing, and deaths attributed to COVID-19 might be incidental in already sick individuals.

Way Forward:

- Handle SARS-CoV-2 like any other respiratory illness, focusing on standard public health measures.

- Individual and community levels should maintain routine activities, and school closure should not be considered in response to a COVID-19 case surge.

- Continuous surveillance, waste-water monitoring, and improved health facility services are essential for effective response.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Read the attached story

Mains level: Not Much

Central Idea

- On December 30, 1971, two pivotal laws were enacted, reshaping the administrative landscape of Northeast India.

- These laws marked a transition from the traditional unit of Assam to the broader concept of ‘Northeast India’.

Formation and Composition of Northeast India

- States in the Northeast: The region officially includes Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, and Tripura, under the North-Eastern Council.

- Pre-Independence Structure: Before Independence, Arunachal Pradesh, Assam, Meghalaya, Nagaland, and Mizoram were part of colonial Assam. Manipur and Tripura were princely states with British political officers, while Sikkim, under British paramountcy, became an independent country in 1947 and was annexed by India in 1975. Sikkim joined the North-Eastern Council in 2001.

Colonial Context and Frontier Province Dynamics

- Assam as a Frontier Province: Colonial Assam was a frontier province in British India, akin to the North West Frontier Province (now Khyber Pakhtunkhwa, Pakistan).

- Administrative Divisions: The province was divided into ‘settled districts’ (like present-day Assam and Sylhet in Bangladesh) and ‘excluded areas’ or ‘Hill areas’ (like modern-day Arunachal Pradesh and parts of Nagaland).

The North Eastern Council (NEC) is composed of the following members:

- Governors and Chief Ministers of the Member States: Each of the eight states in the North Eastern region, including Assam, Arunachal Pradesh, Meghalaya, Mizoram, Tripura, Sikkim, Nagaland, and Manipur, is represented by their respective Governors and Chief Ministers. These members are ex-officio members of the Council.

- Chairman: The Chairman is also a member of the Council, although the specific identity of the Chairman is not mentioned in the provided sources.

- Three Members Nominated by the President: The President of India nominates three additional members to the Council. These members are also part of the NEC

Post-Independence Security and Administrative Shifts

- Unique Post-1947 Challenges: After 1947, the region’s borders became largely international, with a narrow land corridor connecting it to the rest of India.

- Creation of Nagaland: The state of Nagaland was created in 1963, following the Sino-Indian War of 1962, as part of efforts to integrate the Naga people into the Indian state.

North-Eastern Areas (Reorganisation) Act of 1971

- Statehood and Union Territories: Manipur and Tripura were elevated to statehood, Meghalaya was formed from Assam, and Mizoram and Arunachal Pradesh were established as union territories, later becoming states in 1987.

- Strategic Reorganization: This Act represented a strategic shift from the colonial frontier governance to a modern state structure.

Concept and Implications of ‘Northeast India’

- Directional Naming and Identity: The term ‘Northeast India’ highlights the region’s distinct identity and its hierarchical relation to the Indian heartland.

- Racial and Cultural Dimensions: The term ‘Northeasterner’ has often led to racial stereotyping and issues of identity and recognition.

Conclusion

- Complex Administrative Evolution: The formation of Northeast India is a testament to the region’s complex history and the Indian state’s response to unique geopolitical challenges.

- Continued Struggle for Recognition: Despite legislative milestones, Northeast India continues to face challenges in national integration, identity politics, and equitable development.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Genomic Medicine

Mains level: Read the attached story

Central Idea

- Over the past two decades, genomics and the use of genetic information in healthcare have undergone significant transformations.

- Once limited to major research centers, personal genome sequencing has become widely accessible, empowering individuals with detailed knowledge of their genetic makeup.

What is genome sequencing?

- Genome sequencing is the process of determining the complete DNA sequence of an organism’s genome.

- The genome is the entire set of genetic material (DNA in the case of most organisms) that provides the instructions for building, maintaining, and functioning of the organism.

- Genome sequencing involves identifying the order of nucleotides (adenine, thymine, cytosine, and guanine) in an organism’s DNA.

Applications of Personal Genome Sequencing

- Disease Risk Assessment: Personal genome sequencing can identify genetic variants associated with an increased risk of certain diseases, such as cardiovascular conditions, cancer, and neurodegenerative disorders.

- Pharmacogenomics: Personal genome sequencing helps predict how an individual will respond to specific medications, allowing for the customization of drug prescriptions based on genetic factors.

- Cancer Genomics: Personal genome sequencing of cancer cells helps identify specific mutations driving tumor growth.

- Rare Genetic Disorders: Personal genome sequencing is a powerful tool for diagnosing rare genetic disorders, particularly in cases where traditional diagnostic methods may be inconclusive.

- Reproductive Health: Couples planning to have children can undergo personal genome sequencing to assess the risk of passing on genetic conditions to their offspring.

- Forensic Identification: Personal genome sequencing can be used in forensics for human identification and the resolution of criminal investigations.

- Research and Scientific Discovery: Aggregated personal genomic data from large populations contribute to ongoing research, advancing our understanding of the genetic basis of diseases and human biology.

Case Study: Iceland’s Genetics Research

- Iceland’s Unique Demographics: Iceland’s historical demographic isolation and early initiation of population-level genome sequencing have made it a focal point in genetics research.

- Research on Lifespan and Genetic Variants: A study in Iceland suggested that actionable incidental genetic variants could potentially improve lifespan, with significant findings related to cancer-related genotypes.

Future of Genome Sequencing and Healthcare

- Increasing Accessibility: As genome sequencing becomes more accessible and affordable, regular population-scale sequencing and newborn sequencing initiatives are becoming more feasible.

- Benefits for Population Health: Widespread implementation of these programs could provide medically actionable insights, enabling proactive and effective disease treatment and prevention.

- Advancements in Technology: Current genome sequencing technologies, often referred to as second-generation sequencing, have limitations in handling repetitive sequences and resolving structural variations. Third-generation sequencing technologies, such as single-molecule sequencing, are expected to overcome these challenges and provide longer read lengths, improving the accuracy and completeness of genome sequences.

Conclusion

- The advancements in genomics are paving the way for a more proactive and personalized approach to healthcare, with significant potential for disease prevention and management.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Health Tax

Mains level: Read the attached story

Central Idea

- Public health researchers recommend a health tax of 20% to 30% on sugar, sugar-sweetened beverages (SSBs), and high-fat, salt, and sugar (HFSS) products, in addition to the existing GST.

- The recommendation stems from a UNICEF-funded project, aiming to influence policies to reduce sugar consumption.

Study Insights and Recommendations

- Targeting Bulk Consumers: The study suggests taxing bulk consumers like confectionery manufacturers, rather than household sugar purchases.

- Definition of Sugar: The study includes all forms of refined, unrefined sugar, and gur (brown cane sugar) used by manufacturers.

- Impact on Manufacturers: Manufacturers, who buy up to 55% of India’s annual sugar production, are expected to be more price-sensitive than households.

Tax Implications and Demand Reduction

- Niti Aayog’s Interest: Niti Aayog is exploring the impact of health taxes and warning labels on food products to promote healthy eating in India.

- Current and Proposed Tax Rates: Sugar is currently taxed at 18% GST. The proposed additional tax could raise the total tax to 38-48%.

- Price Elasticity Metric: The study uses ‘Price Elasticity’ to estimate demand reduction. A 10% price increase could lead to a 2% demand reduction for households and a 13-18% reduction for manufacturers.

- Health Tax on Beverages and HFSS Products: A 10-30% health tax on SSBs could decrease demand by 7-30%, while a similar tax on HFSS products might lead to a 5-24% decline.

Government Revenue and Public Health Impact

- Increase in Tax Revenues: Additional taxes could boost government revenues by 12-200% across different scenarios.

- Current Tax Rates on Products: Sugar attracts 18% GST, SSBs 28% GST plus 12% cess, and HFSS products 12% GST.

- Public Health Benefits: Higher taxes on unhealthy foods could reduce obesity, diabetes, cardiovascular diseases, and certain cancers.

India’s Sugar Consumption and Health Risks

- India’s Sugar Intake: India is the world’s largest sugar consumer, with an average consumption of 25 kg per person per year, exceeding WHO recommendations.

- Rise in Sugar-Related Health Issues: There has been a significant increase in the sale of aerated drinks and HFSS food products, contributing to obesity and diabetes.

Taxation and Reformulation

- Encouraging Product Reformulation: The proposed tax rate is linked to sugar volume, encouraging manufacturers to reduce sugar content in products.

- Taxing Sugar Replacements: The study also recommends taxing artificial sweeteners to prevent manufacturers from switching to cheaper, unhealthy alternatives.

Global Precedents and Outcomes

- Health Tax Implementation Worldwide: Over 70 countries, including Mexico, Chile, and South Africa, have implemented health taxes on sugar and related products.

- Positive Outcomes in Mexico: In Mexico, the taxation on SSBs led to decreased consumption of taxed beverages and a reduction in mean BMI among younger age groups.

Conclusion

- Potential for Health Improvement: Imposing a health tax on sugar and related products could significantly contribute to public health improvement in India.

- Consideration of Economic Factors: The success of such a policy will depend on balancing health benefits with economic impacts on consumers and manufacturers.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: OTT Regulation

Mains level: Read the attached story

Central Idea

- The Centre’s new draft Broadcasting Services (Regulation) Bill, 2023, aims to revamp the regulatory framework for the broadcasting sector in India.

- The Bill extends regulatory oversight from conventional television services to OTT platforms, digital content, and emerging technologies.

Key Provisions of the Draft Bill

- Single Legal Framework: The Bill seeks to establish a unified legal structure for various broadcasting services, replacing the three-decade-old Cable Television Networks (Regulation) Act.

- Mandatory Registration and Self-Regulation: It introduces mandatory registration for broadcasting services, the creation of content evaluation committees for self-regulation, and establishment of programme and advertisement codes.

- Three-Tier Regulatory Mechanism: The Bill proposes a three-tier regulatory structure, including self-regulation by broadcasters, self-regulatory organizations, and a Broadcast Advisory Council.

Government’s Objectives and Concerns Raised

- Ease of Doing Business: The government claims the Bill will enhance ease of doing business and update the regulatory framework to match the sector’s evolving needs.

- Freedom of Speech Concerns: However, there are apprehensions about potential censorship and infringement on freedom of speech, especially for digital media.

Specifics of the Draft Bill

- Intimation of Operations: The Bill requires formal registration or intimation to the government for broadcasting services, with exceptions for entities like Prasar Bharati.

- Modern Broadcasting Definitions: It includes definitions for broadcasting, broadcasting networks, and network operators, encompassing internet broadcasting networks like IPTV and OTT services.

- Content Quality and Accessibility: Broadcasters must adhere to yet-to-be-defined Programme and Advertisement Codes and classify their content for viewer discretion. The Bill also emphasizes accessibility for persons with disabilities.

Self-Regulation and Government Oversight

- Content Evaluation Committees: Broadcasters must establish committees with diverse representation for content certification, except for shows exempted by the government.

- Broadcast Advisory Council: An advisory council will oversee regulation implementation, with the power to make recommendations to the government.

Inspection, Seizure, and Penalties

- Inspection Rights: The Centre and authorized officers can inspect broadcasting networks and services, raising concerns about government overreach.

- Penalties for Non-Compliance: The Bill includes penalties like removal of shows, apologies, off-air periods, or cancellation of registration for non-compliance.

Concerns and Critiques

- Digital Rights and Free Speech: Organizations like the Internet Freedom Foundation express concerns about the Bill’s impact on online free speech and creative expression.

- Ambiguity and Rule-Making: The Bill’s numerous instances of “as may be prescribed” or “as notified by the Government” create uncertainty for stakeholders.

- Impact on Digital Platforms: Experts highlight the need for careful consideration of the Bill’s impact on online content creators and the digital space’s dynamism.

Conclusion

- The bill, represents a significant shift in India’s broadcasting sector regulation, aiming to encompass modern digital platforms while raising critical questions about content regulation, freedom of expression, and government oversight.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Census of India

Mains level: Read the attached story

Central Idea

- Initially planned for 2020, the Census exercise is now postponed to at least October 2024, considering the time required for preparatory activities post-boundary setting.

- The delay also postpones the implementation of the law reserving 33% of seats for women in Parliament and State Assemblies, which is contingent on Census completion.

About the Census of India

- The decennial Census of India has been conducted 16 times, as of 2021.

- While it has been undertaken every 10 years, beginning in 1872 under British Viceroy Lord Mayo, the first complete census was taken in 1881.

- Post 1949, it has been conducted by the Registrar General and Census Commissioner of India under the Ministry of Home Affairs.

- All the censuses since 1951 were conducted under the Census of India Act, 1948.

- The last census was held in 2011, whilst the next was to be held in 2021.

Background of Women’s Reservation Delay

- 128th Constitutional Amendment Act, 2023: Known as the Nari Shakti Vandan Adhiniyam, this Act mandates one-third reservation for women, effective post-delimitation based on the latest Census.

- Presidential Assent and Delimitation: The Act, receiving Presidential assent in September 2023, awaits the delimitation exercise, which depends on the new Census data.

Census Delays and COVID-19 Impact

- Historical Consistency: India has conducted a Census every decade since 1881, with the latest phase initially set for April 2020.

- COVID-19 Pandemic Disruption: The pandemic necessitated the postponement of the Census, leading to continued reliance on 2011 data for policy and subsidy decisions.

- Lack of Clarity in Recent Notifications: Recent notifications have not specified reasons for the delay, moving away from earlier attributions to the pandemic.

Census Preparation and Questionnaire Status

- Houselisting and Housing Schedule: The first phase questionnaire was notified in January 2020, including 31 questions.

- Population Enumeration Phase: The second phase, with 28 finalized questions, awaits official notification.

Delay in Vital Statistics Reports

- Non-Release of Recent Reports: The RGI and Census Commissioner’s office have not released reports on births, deaths, and causes of deaths for 2021, 2022, and 2023.

- Importance of Vital Statistics: These reports are crucial for planning and evaluating health care, family planning, and educational programs.

- Last Released Reports: The latest available reports cover up to the year 2020, including new codes for COVID-19 related deaths.

Conclusion

- Evidence-based policymaking amidst delays: The extended timeline for the Census necessitates strategic planning to ensure accurate data collection and analysis.

- Awaiting Women’s Reservation Implementation: The delay underscores the need for adaptive measures to implement the women’s reservation law effectively once the Census is completed.

- Broader Implications for Governance: The postponement affects various aspects of governance and policy-making, highlighting the importance of timely and accurate demographic data.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Finance Commission

Mains level: Read the attached story

Central Idea

- The Centre has appointed Arvind Panagariya, a renowned trade economist and former Niti Aayog vice chairman, as the chairman of the Sixteenth Finance Commission.

Who is Arvind Panagariya?

- Panagariya is a professor at Columbia University.

- He served as the first vice chairman of the Niti Aayog from 2015 to 2017, succeeding the Planning Commission.

About Finance Commission

- Establishment: The Finance Commission (FC) of India was established by the President in 1951 under Article 280 of the Indian Constitution.

- Purpose: Its primary role is to define and regulate the financial relations between the central government and the individual state governments.

- Legislative Framework: The Finance Commission (Miscellaneous Provisions) Act, 1951, further outlines the qualifications, appointment, disqualification, term, eligibility, and powers of the Finance Commission.

- Composition: Appointed every five years, the FC comprises a chairman and four other members.

- Evolution: Since the First FC, changes in India’s macroeconomic landscape have significantly influenced the Commission’s recommendations.

Constitutional Provisions

- Article 268: Facilitates the levy of duties by the Centre, with collection and retention by the States.

- Article 280: Outlines the FC’s composition, qualifications for members, and its terms of reference. It mandates the FC to recommend the distribution of net tax proceeds between the Union and States and the allocation among States. It also addresses the financial relations between the Union and States and the devolution of unplanned revenue resources.

Key Functions of the Finance Commission

- Tax Devolution: Recommends how net tax proceeds should be distributed between the Center and States.

- Grants-in-Aid: Determines the principles governing these grants to States.

- Augmenting State Funds: Advises on measures to enhance the States’ Consolidated Funds to support local bodies and panchayats, based on State Finance Commissions’ recommendations.

- Other Financial Functions: Addresses any other financial matters referred by the President.

Members of the Finance Commission

- Structure and Standards: The Finance Commission (Miscellaneous Provisions) Act, 1951, provides a structured format and global standards for the FC.

- Qualifications and Powers: Specifies rules for members’ qualifications, disqualification, appointment, term, eligibility, and powers.

- Composition: The Chairman is chosen for their experience in public affairs. The other members are selected based on their judicial experience, knowledge of government finances, administrative and financial expertise, or special economic knowledge.

Challenges for the 16th Finance Commission

- Overlap with GST Council: The coexistence with the GST Council, a permanent constitutional body, presents a new challenge.

- Conflict of Interest: Decisions by the GST Council on tax rates could impact the FC’s revenue-sharing calculations.

- Feasibility of Recommendations: While the Centre often adopts the FC’s suggestions on tax devolution and fiscal targets, other recommendations may be overlooked.

Major Outstanding Recommendations

- Fiscal Council Creation: The 15th FC proposed a Fiscal Council for collective macro-fiscal management, but the government has shown reluctance.

- Non-Lapsable Fund for Internal Security: Though the Centre agreed ‘in principle’ to establish this fund, its implementation details are pending.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

![Burning Issue] Judiciary in Times of COVID-19 Outbreak - Civilsdaily](https://d18x2uyjeekruj.cloudfront.net/wp-content/uploads/2020/05/jud-300x188.jpg)