Note4Students

From UPSC perspective, the following things are important :

Prelims level: Hot Money

Mains level: Read the attached story

Introduction

- India’s recent inclusion into JPMorgan’s emerging market debt index marks a significant milestone for its financial markets.

- However, with this inclusion comes the risk of volatile capital flows, particularly ‘hot money,’ which can exert pressure on currency and bond markets.

What is ‘Hot Money’?

- Definition: ‘Hot money’ refers to funds controlled by investors seeking short-term returns. It is the flow of funds from one country to another to earn a short-term profit on interest rate differences.

- Typical Investments: Investors often seek high-interest, short-term opportunities like certificates of deposit (CDs).

- Foreign portfolio investment (FPI): FPI is often referred to as “hot money” because it tends to flee at the first signs of trouble in an economy.

Mechanics of ‘Hot Money’

- Attracting ‘Hot Money’: Banks offer short-term CDs with above-average interest rates to attract ‘hot money.’

- Rapid Movement: Investors swiftly withdraw funds and transfer them to institutions offering higher rates when interest rates change.

- Cross-Border Movements: Investors may shift funds between countries to capitalize on favorable interest rates.

Economic hazards posed by Hot Money

- Volatility: Hot money causes rapid price swings, risking market stability.

- Speculative Bubbles: Inflated asset prices lead to market crashes when bubbles burst.

- Currency Depreciation: Hot money influxes can cause currency value swings, harming exports.

- Interest Rate Volatility: Central banks may struggle to stabilize rates due to hot money flows.

- Financial Instability: Herd behavior from hot money can cause market panics.

- Capital Flight: Short-term hot money exits strain a nation’s financial reserves.

- Speculative Attacks: Hot money inflows attract attacks from profit-driven investors.

- Macroeconomic Imbalances: Over-reliance on hot money leads to unsustainable economic patterns.

RBI’s position

- Monitoring Foreign Fund Flows: India will closely monitor inflows of foreign funds to prevent excessive ‘hot money’ influx.

- Regulating Interest Rates: Measures will be taken to manage interest rates to discourage short-term speculative investments.

- Maintaining Financial Stability: Proactive measures aim to prevent excessive volatility in currency and bond markets.

Back2Basics: Hot Money vs. Cold Money

|

Hot Money |

Cold Money |

| Nature |

Short-term capital that flows in and out of markets quickly. |

Long-term investments that remain stable and less volatile. |

| Movement |

Rapid movement, often driven by short-term profit opportunities. |

Relatively stable movement, focused on long-term returns. |

| Risk |

High risk due to volatility and susceptibility to market changes. |

Lower risk as it is less influenced by short-term market fluctuations. |

| Purpose |

Often seeks quick returns, capitalizing on market trends and speculation. |

Invested with long-term objectives, such as retirement planning or wealth preservation. |

| Impact on Markets |

Can create volatility and instability, leading to sudden market fluctuations. |

Provides stability and liquidity, contributing to long-term economic growth. |

| Examples |

Hedge funds, currency traders, speculative investors. |

Pension funds, mutual funds, long-term investors. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: FRBM Act, 2003

Mains level: Fiscal mismanagement by states

Introduction

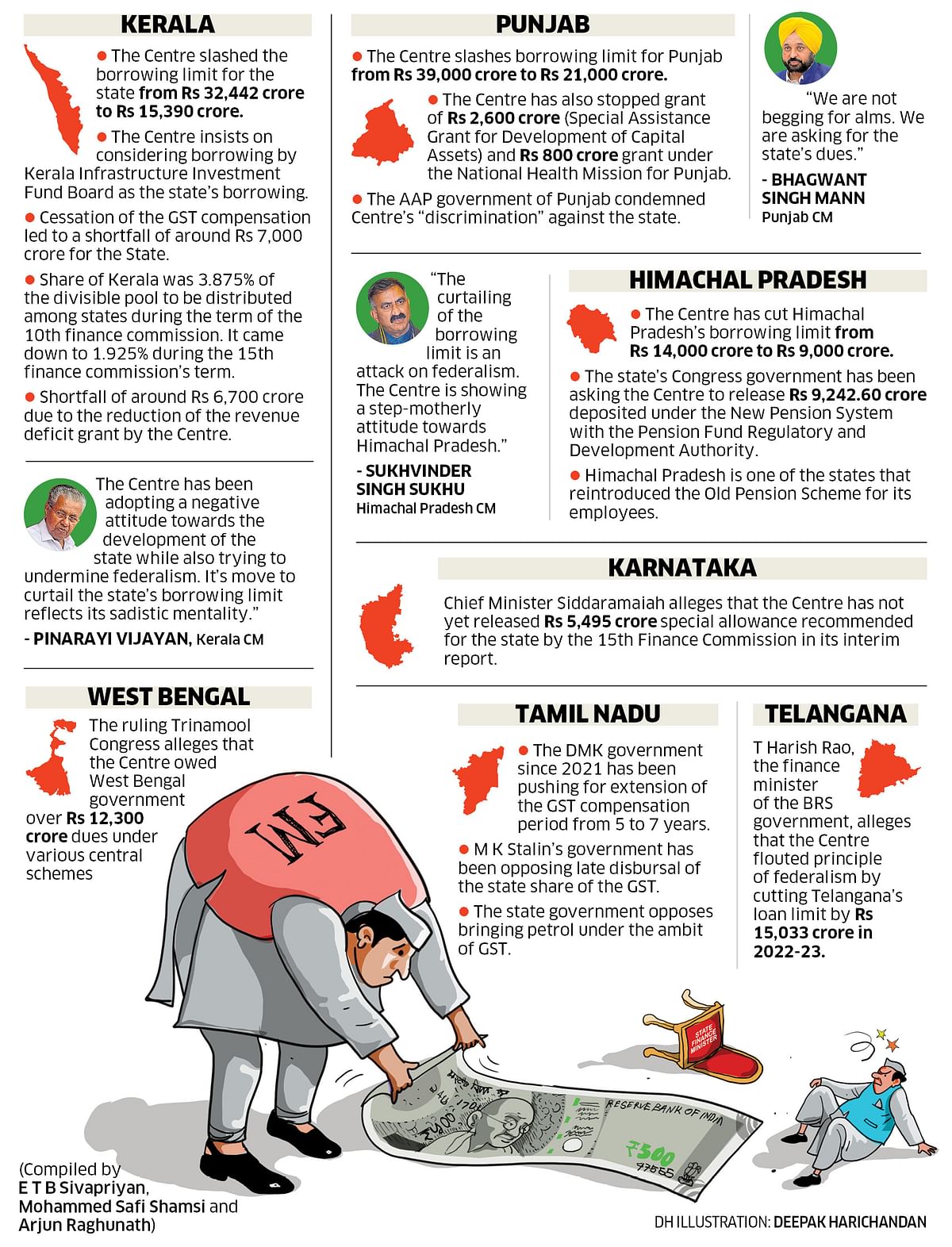

- The ongoing dispute between the Centre and the Kerala government regarding fiscal management has sparked debates on financial health, resource allocation, and federal governance.

Financial Mismanagement in Kerala

- Poor Fiscal Health: The Centre contends that Kerala’s fiscal condition is precarious, attributing it to inadequate management of public finances.

- Financial Assistance: Despite substantial financial support provided by the Centre, including additional funds beyond the recommendations of the 15th Finance Commission, Kerala continues to face financial stress.

- Mismanagement: Kerala’s alleged reckless borrowing, financing of unproductive expenditure, and poorly targeted subsidies exacerbate its financial woes, impacting both state and national economies.

What data has to say?

- Rising Liabilities: Kerala’s outstanding liabilities, as a percentage of its Gross State Domestic Product (GSDP), have consistently increased from 31% in 2018-19 to 39% in 2021-22, exceeding the national average.

- Implications of High Liability Ratio: The Centre warns that the elevated outstanding liability ratio results in heightened interest payments, exacerbating fiscal deficits and potentially leading to a debt trap.

- Increased Committed Expenditure: Kerala’s committed expenditure as a percentage of revenue receipts has risen from 74% in 2018-19 to 82.40% in 2021-22, surpassing that of any other state. This trend limits the state’s capacity for productive government spending, negatively impacting long-term growth.

Kerala’s Defence

- Federal Structure: Kerala asserts its rights under the federal system to regulate its finances independently, highlighting the Centre’s infringement on its fiscal autonomy.

- Economic Damage: The state argues that the Centre’s actions, such as imposing arbitrary borrowing ceilings, threaten Kerala’s economic stability, jeopardizing its ability to meet developmental goals.

Legal Response

- Court Proceedings: The Attorney General’s submission to the Supreme Court forms part of the legal battle initiated by Kerala against the Centre’s alleged interference in state finances.

- Protection of Federalism: Kerala seeks judicial intervention to safeguard the federal structure, emphasizing the state’s authority over budgetary management and borrowing decisions.

- FRBM Rescue: While the FRBM Act of 2023 primarily applies to the central government, some states have enacted their own FRBM legislation to maintain fiscal discipline at the state level. Kerala doesn’t have its own version yet.

Implications

- National Ramifications: The outcome of this dispute holds significance beyond Kerala, impacting the broader framework of fiscal federalism and intergovernmental relations.

- Developmental Concerns: The protracted legal battle could impede Kerala’s developmental agenda and exacerbate financial strains, affecting the welfare of its citizens.

Conclusion

- The Centre-State fiscal dispute underscores the complexities inherent in federal governance and fiscal management.

- As legal proceedings unfold, the resolution of this conflict will shape the contours of intergovernmental relations and define the boundaries of fiscal autonomy within India’s federal structure.

Back2Basics: Fiscal Reduction and Management Act (FRBM Act), 2003

|

Description |

| Objectives |

To ensure fiscal discipline, transparency, and accountability in government spending. |

| Fiscal Deficit Targets |

Mandates the government to reduce its fiscal deficit to a specified target over a period of time.

Fiscal deficit target aims to be below 4.5 per cent by 2025-26. |

| Elimination of Revenue Deficit |

Requires the government to eliminate its revenue deficit, which is the excess of government’s total expenditure over its total revenue. |

| Medium-term Fiscal Strategy |

Mandates the government to formulate and implement a medium-term fiscal strategy outlining plans for reducing fiscal deficit over three years. |

| Annual Fiscal Reports |

Requires the government to present an annual fiscal responsibility statement to Parliament, detailing progress in achieving fiscal consolidation targets. |

| Penalties for Non-compliance |

Imposes penalties on the government for non-compliance, including fines and disqualification of elected members from holding public office. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Tax-to-GDP Ratio

Mains level: NA

Introduction

- India’s tax landscape is anticipated to witness significant growth in the coming fiscal year, with the tax-to-GDP ratio expected to reach a historic high of 11.7%.

- Revenue Secretary Sanjay Malhotra highlights the role of direct taxes in driving this uptick and emphasizes the government’s commitment to streamlining the tax regime for enhanced efficiency and reduced disputes.

Why ‘Tax-to-GDP’ Ratio matters?

- The tax-to-GDP ratio measures a nation’s tax revenue relative to the size of its economy.

- This ratio is used with other metrics to determine how well a nation’s government directs its economic resources via taxation.

- Developed nations typically have higher tax-to-GDP ratios than developing nations.

- Higher tax revenues mean a country can spend more on improving infrastructure, health, and education—keys to the long-term prospects for a country’s economy and people.

- According to the World Bank, tax revenues above 15% of a country’s gross domestic product (GDP) are a key ingredient for economic growth and poverty reduction.

Forecasted Rise in Tax-to-GDP Ratio

- Expected Surge: India’s tax-to-GDP ratio is projected to hit 11.7% in 2024-25, showcasing a steady increase from 11.6% in the preceding year and 11.2% in 2022-23.

- Dominance of Direct Taxes: The surge in the tax ratio is primarily attributed to the growth of direct taxes, which are deemed more equitable.

What led to this growth?

[A] Direct Tax Collection

- Optimistic Outlook: Revenue Secretary anticipates a rise in the adoption of the new tax regime, characterized by simplified tax structures and a higher tax-free income threshold.

- Growth in Personal Income Tax: Personal income tax collections have witnessed a substantial 28% growth, with a projected moderation to 20%-22% by the fiscal year-end.

[B] Rationalizing GST Rates

- Ongoing Review: A Group of Ministers (GoM) appointed by the GST Council is reviewing the rate structure, aiming to rationalize GST rates on various items.

- Quarterly Meetings: The GST Council is expected to convene regularly to address rate rationalization, although no fixed date has been announced yet.

[C] Projected Revenue Growth

- Modest Projections: Despite a buoyant revenue growth of 1.4% this year, projections for the following fiscal year aim for a 1.1% buoyancy, aligning with an anticipated nominal GDP growth of 10.5%.

- Corporate Tax Dynamics: The deadline for availing the reduced corporate tax rate ends in March 2023, with a significant proportion of companies already benefitting from it.

- Enforcement Measures: While the Department of Revenue focuses on tax administration, the Enforcement Directorate intervenes in cases related to money laundering, ensuring comprehensive enforcement mechanisms.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Election Symbols Allotment

Mains level: Split in a Political Party

Introduction

- A faction within a political party led by the Maharashtra Deputy CM has been officially recognized as the legitimate group by the Election Commission of India retaining its election symbol.

Also read:

How are Symbols allotted to Political Parties in India?

Election Symbol and its Significance

- Electoral Impact: Election symbols play a crucial role in shaping the electoral fortunes of political parties, influencing voter perception and identification.

- Transparency Concerns: The current system of symbol allotment warrants review to ensure transparency and fairness in the electoral process.

EC’s Powers in Symbol Disputes

- Legal Framework: Para 15 of the Symbols Order, 1968, empowers the ECI to adjudicate disputes arising from splits within political parties.

- Test of Majority: The ECI conducts a test of majority, considering all available facts and circumstances, to determine the legitimate faction.

- Binding Decision: The decision of the ECI is binding on all rival sections or groups emerged after the split, applicable to recognized national and state parties.

Historical Precedents

- Pre-1968 Era: Before the Symbols Order, 1968, the ECI addressed disputes through notifications and executive orders under the Conduct of Election Rules, 1961.

- High-profile Cases: Notable cases include the split of the Communist Party of India (CPI) in 1964 and the first split in the Indian National Congress in 1969.

Options for Resolution

- Symbol Freeze: The ECI may freeze the symbol to prevent either faction from using it until a final decision is reached, a process that typically involves lengthy hearings.

- Legal Proceedings: Parties may resort to legal recourse if internal resolution or EC intervention fails to resolve the dispute.

Alternate Resolution Mechanisms

- Majority Test: EC primarily relies on testing the support within the party organization, particularly among elected MPs and MLAs, to determine faction legitimacy.

- Registration as Separate Party: Splinter groups not recognized by the parent party may register themselves as separate entities and seek national or state party status based on electoral performance post-registration.

Conclusion

- The recognition of political factions by the Election Commission underscores the complexities of symbol allotment and intra-party disputes.

- As the EC navigates these challenges, ensuring procedural fairness and upholding democratic principles remain paramount in fostering trust and integrity in the electoral process.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Delimitation Commission, Article 82 and Article 170

Mains level: Representativeness in Democracy and the role of Delimitiation

Introduction

- The impending delimitation exercise for Lok Sabha and State Legislative Assemblies, based on the first Census after 2026, has sparked discussions and raised pertinent questions.

Understanding Delimitation

- Definition: Delimitation entails fixing the number of seats and boundaries of territorial constituencies, including the reservation of seats for Scheduled Castes (SC) and Scheduled Tribes (ST), based on census data.

- Constitutional Mandate: Article 82 (Lok Sabha) and Article 170 (State Legislative Assemblies) mandate readjustment of seats after each Census, performed by the Delimitation Commission.

- Historical Precedent: Delimitation exercises were conducted post the 1951, 1961, and 1971 Censuses, highlighting its periodic nature.

About Delimitation Commission

- The Delimitation Commission is a high-powered committee entrusted with the task of drawing and redrawing of boundaries of different constituencies for state assembly and Lok Sabha election.

- It is appointed by the President and works in collaboration with the Election Commission.

- The Commission consists of –

- A retired or working Supreme Court Judge (chairperson)

- Election Commissioner

- Concerned State Election Commissioners

- DC’s orders have the force of law and CANNOT be called in question before any court.

- The orders are laid before the Lok Sabha and the legislative assemblies concerned, but they cannot effect any modifications in the orders.

Need for Delimitation

- Democracy and Representation: The essence of democracy mandates ‘one citizen-one vote-one value,’ necessitating periodic readjustment of seats to reflect population changes.

- Freezing of Seats: Seats have been frozen since 1971 to encourage population control, with the freeze extended until 2026 through the 84th Amendment Act.

Why is this exercise problematic?

- Uneven Population Growth: Population disparities among states pose challenges, with some states experiencing rapid growth while others stagnate.

- Options Discussed: Options include redistributing existing seats among states or increasing the total seats to reflect population changes.

- Constituency Shrinkage: Electorates often lose their representation due to the merger of constituencies.

International Perspectives

- United States: The U.S. redistributes seats among states after each Census to maintain proportionality, ensuring minimal disruption.

- European Union: EU Parliament uses a principle of ‘degressive proportionality,’ where seats are allocated based on population ratios.

Way forward

- Harmonizing Principles: Balancing democratic representation and federal principles is crucial. Capping Lok Sabha seats at the current 543 ensures continuity, while increasing State Legislative Assembly seats aligns with democratic representation.

- Empowering Local Bodies: Strengthening democracy involves empowering grassroots institutions like panchayats and municipalities, enhancing citizen engagement and governance.

Conclusion

- The delimitation exercise presents a delicate balance between democratic representation and federal principles.

- By adopting a nuanced approach that respects constitutional mandates while empowering local governance, India can navigate the complexities of delimitation, ensuring inclusive and effective representation for its diverse populace.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Juno Mission, Deimos and Phobos

Mains level: NA

Introduction

- Juno, a spacecraft launched by NASA in 2011, embarked on a mission to unravel the secrets of Jupiter and its moons.

- En route to Jupiter, Juno encountered fast-moving dust particles, resulting in significant damage to its solar panels.

About NASA’s Juno Mission

|

Description |

| Launch Year |

2011 |

| Mission Objective |

Study Jupiter, the largest planet in the solar system, to gain insights into the origin and evolution of Earth. |

| Focus Areas |

- Investigate Jupiter’s atmosphere composition and isotopic ratios.

- Study Jupiter’s magnetic field and its interaction with the atmosphere, leading to aurora formation.

- Explore Jupiter’s structure, atmosphere, and interior to understand early solar system conditions.

|

| Earth Insights |

- Juno mission’s advanced instruments include the Microwave Radiometer, which measures atmospheric temperature and water content.

- By comparing Jupiter’s composition with Earth’s, scientists infer similarities and differences in planetary origins.

- Understanding the magnetic field and auroras on Jupiter contributes to knowledge about Earth’s own magnetic field and auroras.

- Studying Jupiter’s structure provides clues about early solar system conditions and Earth’s evolutionary processes.

|

Dusts in Interplanetary Space

- Calculating Dust Flux: Scientists harnessed Juno’s data to estimate the flux of dust particles encountered between 1 and 5 Astronomical Units (AU), shedding light on the density and distribution of interplanetary dust.

- Exploring Dust Sources: Analysis suggested Mars’s moons, Deimos and Phobos, as potential sources of interplanetary dust, offering tantalizing clues to unraveling the enigmatic origins of these celestial particles.

How Martian Moons, Deimos and Phobos produce this Dust?

- Micrometeorite Impacts: Micrometeorites, tiny yet potent dust particles, bombard Mars’s moons, creating ephemeral clouds of dust upon impact due to the absence of atmospheres.

- Escape into Space: Deimos and Phobos, characterized by low gravity, facilitate the escape of dust particles into space, contributing to the formation of a dusty ring around Mars.

Insights from Observations

- Gravitational Dynamics: This models incorporated gravitational effects, lunar shapes, and dust particle velocities, offering a comprehensive understanding of the dust dynamics within the Martian system.

- Validation through Future Missions: Prospective missions to Deimos and Phobos hold the promise of validating the recent findings, shedding further light on the dusty realms of these enigmatic moons.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Water (Prevention and Control of Pollution) Act, 1974 and its provisions

Mains level: Preventing River Water Pollution

Introduction

- The Water (Prevention and Control of Pollution) Amendment Bill, 2024 was tabled in the Rajya Sabha on February 5, 2024, aiming to amend the Water (Prevention and Control of Pollution) Act, 1974.

- This legislation, instrumental in establishing central and state pollution control boards (CPCB and SPCBs), undergoes significant modifications under the proposed Bill, primarily concerning penalties and regulatory mechanisms.

About Water (Prevention and Control of Pollution) Act, 1974

|

Description |

| Objective |

To prevent and control water pollution and maintain or restore the wholesomeness of water resources |

| Applicability |

Applies to the entire territory of India, including streams, rivers, lakes, inland water bodies, subterranean waters, and territorial waters of the country |

| Establishments |

Establishes Central Pollution Control Board (CPCB) at the central level and State Pollution Control Boards (SPCBs) at the state level |

| Standards and Regulations |

Empowers Pollution Control Boards to prescribe standards for the discharge of pollutants and quality of water for various purposes |

| Consent Mechanism |

Requires industries and establishments to obtain prior consent from Pollution Control Boards before discharging pollutants into water bodies |

| Penalties and Enforcement |

Specifies penalties for contravention, including fines and imprisonment; authorizes officers to inspect premises, take samples, and issue directives for compliance |

Key Amendments Proposed:

[A] Consent Exemptions for Establishing Industries

- Prior Consent Requirement: Currently, the Act mandates obtaining consent from SPCBs for setting up industries or treatment plants likely to discharge sewage into water bodies.

- Bill Provisions: The Bill empowers the central government, in consultation with the CPCB, to exempt certain industrial categories from seeking consent. It also authorizes the central government to issue guidelines for the grant, refusal, or cancellation of such consent.

- Penalties: Violating the consent requirement or tampering with monitoring devices incurs penalties ranging from Rs 10,000 to Rs 15 lakh.

[B] Chairman of State Board

- Nomination Process: While the Act vests state governments with the authority to nominate SPCB chairpersons, the Bill introduces central government-prescribed nomination procedures and terms of service.

[C] Discharge of Polluting Matter

- Regulatory Measures: The SPCBs can issue directives to halt activities leading to the discharge of harmful substances into water bodies.

- Penalties: Contraventions against pollution standards attract penalties ranging from Rs 10,000 to Rs 15 lakh, replacing the previous imprisonment provisions.

- Amended Provisions: The Bill replaces imprisonment with penalties between Rs 10,000 and Rs 15 lakh for unspecified offences under the Act.

[D] Adjudication Mechanism

- Appointment of Officers: It allows the central government to designate adjudication officers, with appeals against their decisions to be lodged before the National Green Tribunal.

- Penalty Utilization: Fines collected are directed to the Environment Protection Fund established under the Environment (Protection) Act, 1986.

[E] Cognizance of Offences

- Expanded Scope: The Bill extends the entities empowered to file complaints to include adjudication officers, alongside CPCB and SPCB.

- Penalization: Heads of departments are subject to penalties equal to one month’s basic salary if their departments violate the Act, reinforcing accountability within government bodies.

Challenges with the Bill

- Lack of Oversight: Granting exemptions for certain industrial categories from seeking consent may lead to increased pollution levels if not properly regulated.

- Risk of Unchecked Discharge: Lack of oversight could result in unchecked discharge of pollutants into water bodies, compromising water quality and public health.

- Centralized Nomination Process: Central government-prescribed nomination procedures for the appointment of State Pollution Control Board (SPCB) chairpersons may undermine the autonomy of state governments.

- Reduced Deterrence: Replacing imprisonment provisions with penalties for contraventions against pollution standards may reduce the deterrence effect.

- Questionable Adjudication Process: Allowing the central government to designate adjudication officers may raise questions about the impartiality and independence of the adjudication process.

- Potential Administrative Inefficiencies: Extending the entities empowered to file complaints may lead to overlapping jurisdictions and administrative inefficiencies, resulting in delays and bureaucratic hurdles.

Way Forward

- Enhanced Regulation: Implement stringent monitoring and regulatory mechanisms to ensure compliance with pollution standards and prevent unauthorized discharge of pollutants into water bodies.

- Stakeholder Consultation: Conduct extensive consultations with environmental experts, industry representatives, and civil society organizations to address concerns and refine the proposed amendments.

- Capacity Building: Provide training and capacity-building programs for Pollution Control Boards to enhance their skills in enforcing environmental regulations effectively.

- Transparency and Accountability: Ensure transparency in the exemption process and establish accountability mechanisms to uphold the integrity of regulatory decisions.

- Public Awareness: Conduct public awareness campaigns to educate industries and the general public about the importance of water conservation and pollution prevention measures.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Ancient geographical division of India, ex. Madhyadesa, Udicya, Pracya etc.

Mains level: Maritime Geography and historic references to it

Introduction

- India’s coastal geography, often overshadowed in educational curricula, holds profound historical and cultural significance.

- While India’s connection with its southern seas is acknowledged, the broader implications of its maritime heritage remain underexplored.

Irony of India’s Maritime Geography

- Distance from the Sea: While some might remember that India is bound by sea all along the south, the connections with the sea do not consciously register — for a great many people even today, the sea is a very distant object.

- Impact of Natural Events: It may perhaps impinge on the consciousness a little more when there are reports of cyclones or storms (or the tsunami that hit some years ago in 2004), but the expanse of the sea, the links with the oceans, and the historical and geographical connections are typically rather hazy.

Historical Perspectives on Indian Geography

- School Definition: Moreover, children are mostly taught about only two parts of India — the plains to the north, and the peninsula to the south.

- Sanskrit Texts: But historically, India was defined slightly differently. In early Indian Sanskrit texts, the subcontinent is seen as divided into five major regions

- Madhyadesa (middle country),

- Udicya or Uttarapatha (northern India),

- Pracya (eastern India),

- Dakshinapatha (Deccan) and

- Aparanta (western India)

- Different Interpretations: The term Dakshinapatha came to be used in two ways: the entire peninsula, or more commonly, a more limited area from the Narmada to the Tungabhadra and Krishna rivers. To the south of this lay the Dravidadesa or Tamilakam.

- Imperial Gazetteer’s Definition: On the other hand, as defined in the Imperial Gazetteer, the ‘Deccan’ has also been understood as referring to the entire landmass south of the Vindhya mountains and the great Gangetic plain, and so it can be taken to mean the entire peninsular region of India.

Geographical Features of the Indian Subcontinent

- Demarcated Regions: Within the peninsula itself are five clearly demarcated regions — the Western Ghats skirting the Arabian Sea, the northern Deccan plateau, the eastern plateau, the Eastern Ghats towards the Bay of Bengal and the coastal strip between the ghats on either side and the sea itself.

- Plateau Considerations: While studies have traditionally tended to focus on only the western part of the plateau as the ‘Deccan’, it is to be remembered that the plateau region covers much of the northern peninsula.

- Extent of Ghats: Furthermore, the ghats bordering it extend almost down to Kanyakumari. The western coastal strip is generally narrow, being indented and segmented by spurs from the Western Ghats or by small rivers flowing to the sea from the hills.

- Eastern Ghats Description: The Eastern Ghats are less continuous, with a wider and more fertile coastal strip, containing, as it does, the deltaic plains of the two major river systems of the Deccan plateau, the Krishna and Godavari.

Coastal Divisions and Sub-regions

- Distinct Names for Ghats: On both coasts, the ghats are given different names in various regions. So, for example, the Western Ghats up to Karnataka are also often referred to as the Sahyadri ranges.

- Plateau Description: What is normally understood as the Deccan plateau proper is a broad quadrangle covering most of the present-day Maharashtra state, with a topography typical of plateau land.

- Transition to Plains: As it begins to give way to the plains in Andhra Pradesh and Karnataka (the south-eastern and southern plateaus), the geography becomes rougher and rockier, and is interspersed with forest land and riverine stretches.

- Coastal Strip Description: The western coastal strip is a narrow strip of land, very rarely extending more than eighty kilometres inwards from the sea. This strip is particularly narrow from the Tapi river to Goa, after which it widens a little on the Karnataka coast and finally includes all of present-day Kerala, for the ghats here form the demarcation between Kerala and modern Tamil Nadu.

Coastal Features and Subdivisions

[A] Western Coast

- Technical Divisions: This coast is technically divided into three parts, excluding Gujarat. The northernmost section is called the Konkan, which is further subdivided into two segments — the northern one running approximately from the Tapi to Chaul (modern Revdanda) and the southern from Chaul to Goa.

- Coastal Divisions: South of Goa is the Canara coast, stretching till Mount Eli (Ezhimala) in modern-day Kerala, known to early travellers as Mount Dilli or Dely. The Malabar coast begins here and extends to Kanyakumari, the tip of the peninsula.

- Maritime Economic Considerations: However, in maritime economic terms, it is rather difficult to limit oneself only to this western stretch of the coastline, for connections extend northwards into the Gujarat coast and eastwards across the ghats into the plateau region.

[B] Eastern Coast

- Ease of Access: The Eastern Ghats, as mentioned earlier, are not continuous, which means that access to the interior from the coast (or vice versa) is much easier.

- Water Bodies: The eastern coastal strip features deltas and various other water bodies, including, in the northernmost part of the region, Chilika Lake in modern-day Odisha; Kolleru Lake between the Krishna and the Godavari deltas, approximately in the centre of the coast; and Pulicat Lake, which lies towards the southern edge of the Deccan region.

- Historical Significance: All these lakes used to be hubs for trade and fishing, with Pulicat also being the heart of a thriving weaving industry through most of India’s medieval era.

Port Dynamics

- Abundance of Ports: Both coasts are, of course, marked by innumerable ports. A brief survey of these ports is enough to indicate the ever-present climatic and natural hazards they faced.

- Western Coast Considerations: The physical geography of the west coast, given its numerous indentations, offers ample natural shelters all along its length, with the two largest natural harbours being Mumbai (Bombay) and Goa.

- Importance of Smaller Ports: However, throughout the medieval and early modern period (approximately the eighth to eighteenth century), the harbours of ports like Mangalore, Honawar, Bhatkal or Chaul were no less important in terms of the traffic they handled.

Challenges and Hazards on the Coasts

- Monsoon Challenges: Western ports face closures during the southwest monsoon, with shifting sandbanks and shoals posing dangers to ships.

- Lack of Natural Harbours: The east coast lacks natural harbors, with ports vulnerable to silting near river deltas.

- Unstable Delta Mouths: Delta mouths are prone to instability, potentially rendering established channels unusable after monsoon cycles.

- Cyclone Vulnerability: The Bay of Bengal presents cyclone risks due to its enclosed nature, leading to higher possibilities of circular winds compared to the west coast.

- Open Roads for Ports: East coast ports operate as open roads, requiring ships to navigate high surf, rolling waters, and random winds while loading and unloading goods.

Trade Routes and Cultural Exchange

- Port Competitiveness: Ports rely on their immediate interior areas, often shared by multiple ports, for sustenance and trade.

- Political and Economic Factors: Port prosperity hinges on political stability and economic conditions in their vicinity.

- Trade Patterns: West coast ports primarily trade with the Arabian Sea littoral, while east coast ports engage in trade across the Bay of Bengal.

- Cross-Coastal Trading: Merchants from both coasts trade extensively across the Indian Ocean world, transcending geographical boundaries.

- Established Routes: Trade routes across the Indian Ocean have existed for centuries, with changes in rulership but continuity in trade activities.

Conclusion

- The multitude of functional ports, diverse trade patterns, and established trade routes highlight the resilience and adaptability of India’s maritime regions.

- As India continues to navigate its maritime heritage into the future, understanding and appreciating its maritime geography remain crucial for fostering sustainable development and cultural preservation.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Visa Free travel for Indians

Mains level: NA

Introduction

- The recent announcement of visa-free travel to Iran for Indian passport holders has garnered significant attention, marking a significant milestone in bilateral travel facilitation.

Iran’s Visa-Free Regime for India

- Tourism Purposes: Indian citizens holding ordinary passports can avail of the visa-free travel privilege but must intend to visit Iran solely for tourism purposes.

- Mode of Entry: The relaxation applies exclusively to travelers entering Iran via air routes.

- Maximum Duration: Travelers under this scheme can stay in Iran for a maximum of 15 days during each visit.

- Re-entry Provisions: Re-entry into Iran is permissible after a gap of six months from the previous departure.

- Extended Stay or Multiple Entries: Individuals desiring prolonged stays, frequent visits within six months, or seeking alternative visa categories must obtain requisite visas from the Iranian diplomatic missions in India.

Visa Trends for Indians beyond Iran

- Current Visa-Free Countries: 27 countries now offer visa-free entry to Indian citizens, with recent additions including Kenya, Indonesia, Malaysia, Thailand, and Sri Lanka.

- Global Outreach: Beyond immediate neighbors, countries like Barbados, Bhutan, Maldives, Mauritius, and Nepal offer visa-free entry to Indian citizens, reflecting evolving global travel dynamics.

- Popular Destinations for Indian Citizens: The top five travel destinations are the UAE, the USA, Saudi Arabia, Singapore, and Thailand, with many visiting as part of the diaspora.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Fertility rates

Mains level: India's demographic challenges

Central Idea:

The article discusses India’s demographic transformation and the need for proactive policies to address opportunities and challenges arising from changing population dynamics.

Key Highlights:

- India’s population growth trends are being studied to align policies with the Viksit Bharat goal by 2047.

- Fertility rates have decreased, and family planning is becoming more prevalent.

- The workforce is changing, with an increase in middle-aged workers projected by 2047.

- Dependency burdens vary between states, requiring tailored policy interventions.

- There is an opportunity to enhance women’s workforce participation by providing better childcare support.

- Lessons from China’s one-child policy caution against drastic measures.

Key Challenges:

- Varying demographic trends between states pose challenges for policy formulation.

- Ensuring equitable workforce development and gender-inclusive policies.

- Addressing the needs of the growing elderly population while maintaining economic sustainability.

- Avoiding the negative consequences of drastic population control measures.

Key Terms:

- Demographic transformation

- Fertility rates

- Family planning

- Workforce dynamics

- Dependency burdens

- Women’s workforce participation

- One-child policy

Key Phrases:

- Changing population dynamics

- Tailored policy interventions

- Workforce inclusivity

- Sustainable economic development

- Lessons learned

Key Quotes:

- “Today, we are studying India’s population growth to align policies with the Viksit Bharat goal by 2047.”

- “There’s an opportunity to enhance women’s workforce participation by providing better childcare support.”

- “Lessons from China’s one-child policy caution against drastic measures.”

Anecdotes/Case Studies:

- The comparison with China’s one-child policy illustrates the importance of cautious policy measures in managing population dynamics.

Key Statements:

- “India’s population growth trends are being studied to align policies with the Viksit Bharat goal by 2047.”

- “There’s an opportunity to enhance women’s workforce participation by providing better childcare support.”

Key Examples and References:

- Comparative data on workforce demographics and dependency burdens between states provide concrete examples of demographic variations.

- The reference to China’s one-child policy serves as a cautionary example.

Key Facts/Data:

- India’s fertility rates have decreased significantly in recent years.

- Dependency burdens vary significantly between states.

- Women’s workforce participation rates could be improved with better childcare support.

Critical Analysis:

The article provides a balanced assessment of India’s demographic challenges and opportunities, cautioning against drastic measures while advocating for proactive policies.

Way Forward:

- Tailored policy interventions should address varying demographic trends between states.

- Gender-inclusive policies and better childcare support can enhance women’s workforce participation.

- Lessons from global best practices should inform India’s approach to demographic management.

- Caution should be exercised to avoid the negative consequences of drastic population control measures.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Debt-to-GDP ratio

Mains level: Balancing fiscal consolidation with the need for increased government expenditure to address developmental challenges

Central Idea:

The article analyzes the recent interim Union budget in India, focusing on its macroeconomic policy objectives and the challenges facing the Indian economy. It discusses the government’s efforts to reduce the debt-to-GDP ratio and stimulate GDP growth, particularly by prioritizing capital expenditure over revenue expenditure. However, it questions the effectiveness of these objectives in addressing India’s developmental challenges, especially regarding employment generation and structural transformation.

Key Highlights:

- The budget presents a fiscally conservative approach with minimal increases in total expenditure, emphasizing capital expenditure over revenue expenditure.

- The government aims to reduce the debt-to-GDP ratio, primarily by limiting expenditure growth rates and increasing capital expenditure.

- The article raises concerns about the adequacy of these objectives in addressing India’s developmental challenges, particularly the need for employment generation and structural transformation.

- It highlights the stagnation in regular wages and the dominance of self-employment, indicating a worsening income distribution and weak improvements in welfare.

Key Challenges:

- Balancing fiscal consolidation with the need for increased government expenditure to address developmental challenges.

- Promoting structural transformation to shift workers from self-employment to modern sectors.

- Achieving inclusive growth that benefits all sections of society, especially marginalized groups.

- Enhancing the effectiveness of government spending to stimulate economic growth and employment generation.

Key Terms:

- Debt-to-GDP ratio: The ratio of a country’s total debt to its gross domestic product, indicating its ability to repay debt.

- Capital expenditure: Spending on acquiring or maintaining physical assets such as infrastructure, machinery, and buildings.

- Revenue expenditure: Day-to-day spending on government operations and services, including salaries, pensions, and subsidies.

- Primary deficit: The fiscal deficit excluding interest payments on government debt.

- Structural transformation: The process of shifting resources, including labor, from traditional sectors like agriculture to modern sectors such as manufacturing and services.

Key Phrases:

- Fiscally conservative approach

- Debt stability

- Structural change

- Employment generation

- Inclusive growth

Key Quotes:

- “The budget reflects a fiscally conservative approach with minimal increases in total expenditure.”

- “The government aims to reduce the debt-to-GDP ratio, primarily by limiting expenditure growth rates and increasing capital expenditure.”

- “The dominance of self-employment indicates a worsening income distribution and weak improvements in welfare.”

Key Examples and References:

- Comparison of expenditure growth rates and GDP growth rates to illustrate the government’s strategy in reducing the debt-to-GDP ratio.

- Analysis of employment data to highlight the challenges of structural transformation and income distribution.

Key Facts and Data:

- Total budgeted expenditure, with minimal increase over the previous year.

- Debt-to-GDP ratio currently at a certain level, targeted to be reduced to another level.

- Stagnation in regular wages and dominance of self-employment in the workforce.

- GDP growth rates and expenditure growth rates used to analyze the effectiveness of fiscal policies.

Critical Analysis:

The article provides a critical assessment of the interim Union budget’s macroeconomic policy objectives, highlighting potential shortcomings in addressing India’s developmental challenges. It questions the effectiveness of targeting a specific debt-to-GDP ratio and emphasizes the need for broader strategies to promote inclusive growth and structural transformation.

Way Forward:

- Reevaluate fiscal policies to ensure a balance between debt reduction and addressing developmental challenges.

- Prioritize investments in infrastructure and human capital to stimulate economic growth and employment generation.

- Implement targeted interventions to support marginalized groups and promote equitable income distribution.

- Enhance monitoring and evaluation mechanisms to assess the impact of government spending on welfare and economic development.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Fiscal deficit

Mains level: Net Borrowing Ceiling (NBC)

Central Idea:

The article discusses Kerala’s protest against the imposition of a Net Borrowing Ceiling (NBC) by the Central Government, which restricts the state’s ability to borrow funds. It argues that this imposition undermines fiscal federalism and challenges the constitutional authority of the state legislature over financial matters.

Key Highlights:

- Kerala Chief Minister Pinarayi Vijayan leads a protest against the Central Government’s imposition of a financial embargo on Kerala.

- The NBC limits states’ borrowings, including those from state-owned enterprises like the Kerala Infrastructure Investment Fund Board (KIIFB), leading to a severe financial crisis in Kerala.

- The article questions the constitutionality of including state-owned enterprises’ debt in the state’s total debt, arguing that it encroaches on the state legislature’s authority over financial matters.

- Kerala’s Fiscal Responsibility Act, 2003, aims to reduce fiscal deficit, demonstrating the state’s commitment to fiscal discipline.

- The article criticizes the move towards “annihilative federalism,” where the central government’s actions detrimentally affect states’ ability to meet welfare obligations.

Key Challenges:

- Balancing fiscal discipline with the need for states to fund development projects and welfare schemes.

- Addressing the erosion of fiscal federalism and the encroachment of central authority over state finances.

- Resolving the conflict between the powers of the central government and state legislatures regarding financial matters.

- Mitigating the impact of borrowing restrictions on states’ ability to fulfill their financial obligations.

Key Terms:

- Net Borrowing Ceiling (NBC): Limit imposed on states’ borrowings from all sources.

- Kerala Infrastructure Investment Fund Board (KIIFB): State-owned body responsible for funding infrastructure projects.

- Fiscal Responsibility Act: Legislation aimed at reducing fiscal deficit and promoting financial discipline.

- Fiscal Federalism: Distribution of financial powers and responsibilities between the central government and states.

- Annihilative Federalism: Central government actions that undermine states’ financial autonomy and welfare obligations.

Key Quotes:

- “The wide array of constitutional issues…point at the severe erosion of fiscal federalism in the country.”

- “The borrowing restrictions are an example of ‘annihilative federalism’ at play.”

Key Examples and References:

- Kerala’s protest led by Chief Minister Pinarayi Vijayan against the financial embargo imposed by the Central Government.

- The inclusion of KIIFB’s debt in Kerala’s total debt, leading to funding constraints for welfare schemes.

- Comparison of Kerala’s fiscal deficit reduction efforts with the central government’s fiscal deficit estimates.

Key Facts and Data:

- Kerala’s fiscal deficit reported to have reduced to 2.44% of the GSDP.

- Central government’s fiscal deficit estimated to be 5.8% for 2023-2024.

Critical Analysis:

The article underscores the tension between central authority and state autonomy in financial matters, highlighting the constitutional ambiguity surrounding the imposition of borrowing restrictions. It argues for a balanced approach that acknowledges states’ fiscal responsibilities while ensuring fiscal discipline.

Way Forward:

- Reevaluate the imposition of borrowing restrictions to ensure they do not unduly impede states’ ability to meet financial obligations.

- Enhance dialogue and cooperation between the central government and states to address fiscal challenges while respecting constitutional principles.

- Clarify the division of financial powers between the central government and state legislatures to mitigate conflicts and promote fiscal federalism.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now