Note4Students

From UPSC perspective, the following things are important :

Prelims level: Economic indicators and related facts

Mains level: Indias Growth story, Status of Growth drivers amidst the challenge of slowing economies

Context

- As the COVID-19 pandemic fades and hopes to rise for nations and societies to return to some kind of normalcy, there is effort all around to take stock of where we stand and what our prospects look like. A look back over the last few years at how India performed in terms of its economy.

Present situation of India’s economic growth

- Mixed growth story: One group of experts argues, India’s growth story is more mixed. In 2021-22, its GDP growth was 8.7%, which was among the highest in the world. This is good but, against this, we must offset the fact that much of this is the growth of climbing out of the pit into which we had fallen the previous year.

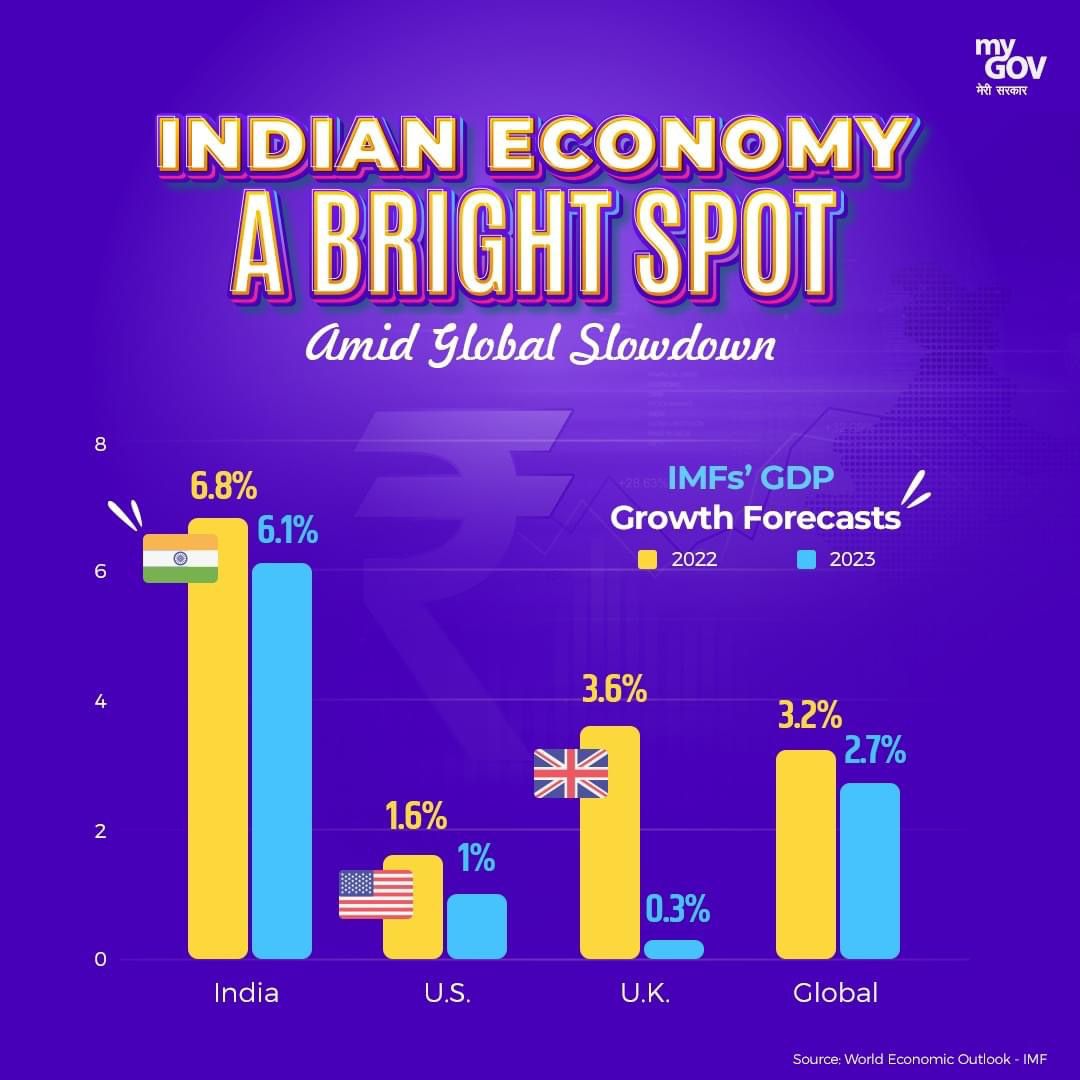

- IMF reduced the growth forecast: In 2020-21, India’s growth was minus 6.6%, which placed the country in the bottom half of the global growth chart. For 2022-23, the International Monetary Fund has cut India’s growth forecast to 6.1%.

Structural assessment of India’s growth

- Rising inequality and high unemployment: Most of India’s growth is occurring at the top end, with a few corporations raking in a disproportionate share of profits, and unemployment is so high, it is likely that large segments of the population are actually witnessing negative growth.

- Slowdown in previous years: What makes India’s growth story worrying is that the slowdown began much before the COVID19 pandemic. It began in 2016, after which, for four consecutive years, the growth rate each year was lower than in the previous year. Growth in 2016-17 was 8.3%. After that it was, respectively, 6.9%, 6.6%, 4.8%, and minus 6.6%.

- Status of unemployment: India’s unemployment rate is high. In October, it stood at 7.8%. However, what is really worrying is youth unemployment. According to International Labour Organization (ILO) data, collated and presented by the World Bank, India’s youth unemployment, that is, from among people aged 15 to 24 years who are looking for work, the percent that does not find any, stands at 28.3%.

Know the basics-What is Unemployment?

- Definition: Unemployment is a phenomenon that occurs when a person who is capable of working and is actively searching for the work is unable to find work.

- Those who are excluded: People who are either unfit for work due to physical reason or do not want to work are excluded from the category of unemployed.

- Unemployment rate: The most frequent measure of unemployment is unemployment rate. The unemployment rate is defined as a number of unemployed people divided by the number of people in the labour force.

- Labour Force: Persons who are either working (or employed) or seeking or available for work (or unemployed) during the reference period together constitute the labour force.

Other perspectives on Indian economy

- The latest GDP numbers suggest: For Q1 FY2022–23 suggest that economic growth is on a healthy track. Consumers, after a long lull, have started to step out confidently and spend private consumption spending went up 25.9% in Q1.

- On the production side: the contact-intensive services sector also witnessed a strong rebound of 17.7%, thanks to improving consumer confidence.

- Healthy agriculture sector: The only sector that consistently performed well throughout the pandemic, remained buoyant.

- Industrial growth: Industrial growth boosted from accelerating growth in construction and electricity, gas, water supply and other utility services sectors.

- Manufacturing is not doing well: A sector that has not yet taken off sustainably is manufacturing, which witnessed modest growth of 4.5% in Q1. Higher input costs, supply disruptions, and labor shortages due to reverse migration have weighed on the sector’s growth. According to the Reserve Bank of India’s (RBI’s) data on nonfinancial firms, surging raw material costs have stressed the profitability and margins of companies.

What are the Challenges for the growth of economy?

- High inflation: The biggest worry is that of high inflation (which has persisted for way too long) and all the challenges that come along with it. Inflationary environments increase the costs of doing business, impact profitability and margins, and reduce purchasing power. In short, inflation thwarts both supply and demand. Central banks’ monetary policy actions, in response to rising inflation, can impede credit growth and economic activity, thereby intensifying the probability of a recession in a few advanced nations.

- Rising current account deficit: The other challenge is the rising current-account deficit and currency depreciation against the dollar. While a rebounding domestic economy is resulting in higher imports, moderating global demand is causing exports to slow. The US dollar’s unrelenting rise and global inflation are further causing India’s import bills to rise.

- Declining forex: The RBI had to intervene to contain volatility and ensure an orderly movement of the rupee. The RBI’s intervention is leading to a drawdown in foreign exchange reserves. Consequently, the import cover from reserves has reduced to nine months from a high of 19 months at the start of 2021 (although, it remains above the benchmark of three months).

The economy’s growth drivers are improving

- Exports: Exports, the first growth driver are slowing down and are likely to moderate along with the probable global economic slowdown.

- Government spending: Government spending, the second driver, is already at an elevated level, thanks to the pandemic, and the government will likely focus on its prudence in utilizing limited resources. The good news is the share of capital expenses is going up even as the government is reducing revenue expenses. Multiplier effects of this spending will aid in growth in income, assets, and employment for years to come. Strong tax revenues may support further capital spending in the future.

- Capital expenditure: According to experts, prospects for capex investments the third growth driver by companies are brighter. Sustained demand growth may be the most-awaited cue for a sustained push for investment.

- Consumer demand: Consumer Demand, the fourth, and perhaps the most important, growth driver has improved significantly in recent quarters. However, spending has not grown sustainable despite improving consumer confidence. For instance, retail sales are growing but the pace is patchy, and auto registrations have remained muted. We expect that receding pandemic fears and the upcoming festive season could give a much-needed boost to the consumer sector.

Conclusion

- Indian economy should not be looked from isolation. It is very much integrated in global economy. Pandemic, Ukraine war, US- China trade war have given a successive shock to global and Indian economy. Despite that Indian has done well than rest of the world. Our focus should be on curbing inequality, not to allow people to descend into extreme poverty and employment generation.

Mains Question

Q. Analyse the present economic macro-indicators of Indian economy. What are the challenges for growth story of India in the context of global uncertainty?

Click and Get your FREE copy of Current Affairs Micro notes

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024