Note4Students

From UPSC perspective, the following things are important :

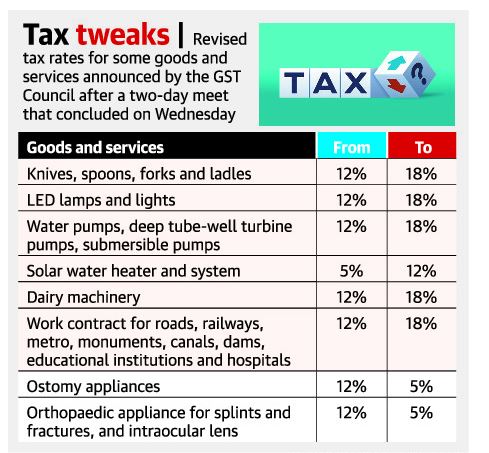

Prelims level: New GST slabs

Mains level: Rationalization of GST

The Goods and Services Tax (GST) Council has decided to hike and lower GST on certain commodities.

What is the news?

- From July 18, tax hikes will kick in for over two dozen goods and services, ranging from unbranded food items, curd and buttermilk to low-cost hotels, cheques and maps.

- Tax rates will be lowered for about half-a-dozen goods and services, including ropeways and truck rentals where fuel costs are included.

- It scrapped GST for items imported by private vendors for use by defence forces.

What is GST?

- GST launched in India on 1 July 2017 is a comprehensive indirect tax for the entire country.

- It is charged at the time of supply and depends on the destination of consumption.

- For instance, if a good is manufactured in state A but consumed in state B, then the revenue generated through GST collection is credited to the state of consumption (state B) and not to the state of production (state A).

- GST, being a consumption-based tax, resulted in loss of revenue for manufacturing-heavy states.

What are GST Slabs?

- In India, almost 500+ services and over 1300 products fall under the 4 major GST slabs.

- There are five broad tax rates of zero, 5%, 12%, 18% and 28%, plus a cess levied over and above the 28% on some ‘sin’ goods.

- The GST Council periodically revises the items under each slab rate to adjust them according to industry demands and market trends.

- The updated structure ensures that the essential items fall under lower tax brackets, while luxury products and services entail higher GST rates.

- The 28% rate is levied on demerit goods such as tobacco products, automobiles, and aerated drinks, along with an additional GST compensation cess.

Why rationalize GST slabs?

- From businesses’ viewpoint, there are just too many tax rate slabs, compounded by aberrations in the duty structure through their supply chains with some inputs are taxed more than the final product.

- These are far too many rates and do not necessarily constitute a Good and Simple Tax.

- Multiple rate changes since the introduction of the GST regime in July 2017 have brought the effective GST rate to 11.6% from the original revenue-neutral rate of 15.5%.

- Merging the 12% and 18% GST rates into any tax rate lower than 18% may result in revenue loss.

Haven’t GST revenues been hitting new records?

- Yes, they have – GST revenues have scaled fresh highs in three of the first four months of 2022, going past ₹1.67 lakh crore in April.

- But there is another key factor — the runaway pace of inflation.

- Wholesale price inflation, which captures producers’ costs, has been over 10% for over a year and peaked at 15.1% in April.

- Inflation faced by consumers on the ground has spiked to a near-eight year high of 7.8% in April.

- The rise in prices was the single most important factor for higher tax inflows along with higher imports.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024