From UPSC perspective, the following things are important :

Prelims level: IRDAI and its composition

Mains level: The recent rules highlighted by IRDAI

Why in the news?

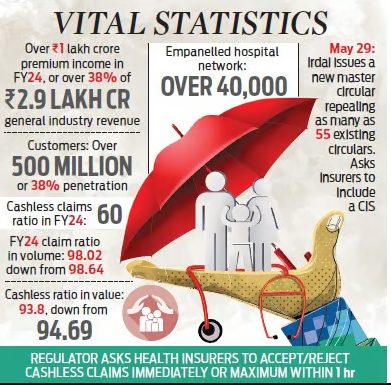

Recently, the Insurance Regulatory and Development Authority (IRDAI) introduced a set of reforms in the health insurance sector aimed at significantly enhancing service standards for policyholders.

The recent rules highlighted by IRDAI (Insurance Regulatory and Development Authority of India) include:

- Cashless processing: Insurers are mandated to accept or reject cashless claims immediately, within one hour, and settle such claims on discharge within three hours. Any delay beyond this period would result in the insurer bearing the additional costs, if any.

- Claim settlement: Insurers cannot repudiate a claim without the approval of their claims review panel. Documents for claim settlement must be collected from hospitals or third-party administrators, not from the insured.

- Policyholders with multiple health policies: They can select the policy under which they want to make a claim, with the primary insurer coordinating the settlement of the balance amount from other insurers.

- Reward for No claims: Policyholders with no claims during the policy period may receive either an increased sum insured or discounted premium amounts.

- Renewal policies: All individual health policies are renewable and cannot be denied based on previous claims, except in cases of fraud, non-disclosures, or misrepresentation. No fresh underwriting is required for renewal policies unless there is an increase in the sum insured.

- Portability requests: Stricter timelines are imposed on portability requests via the Insurance Information Bureau of India portal.

- Customer information sheet: Insurers are required to include a customer information sheet as part of the policy document, explaining all customer-facing details such as policy type, sum assured, coverage details, exclusions, deductibles, and waiting periods.

Challenges related to health insurance in India

- Opaque Policy Details and Claim Processes: Policyholders often struggle to understand the intricacies of insurance contracts, leading to uncertainty about coverage entitlements and reimbursement procedures.

- Claim Rejections: Policyholders frequently face claim rejections due to inadequate documentation and ambiguous claims processes.

- Delays in Claim Settlement: Insurance companies often take a long time to process claims, causing inconvenience and financial stress for policyholders

IRDAI and its composition:

|

Conclusion: IRDAI’s recent health insurance reforms aim to improve service standards by mandating timely cashless claim processing, transparent claim settlement, and policyholder rewards for no claims. These changes address challenges like opaque policies and claim rejections, enhancing customer trust. IRDAI plays a vital role in ensuring a fair and efficient insurance sector.

Mains PYQ:

Q Public health system has limitation in providing universal health coverage. Do you think that private sector can help in bridging the gap? What other viable alternatives do you suggest? (UPSC IAS/2015)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024