Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 3- Agri-GDP

Context

The United Nations latest report, “Population Prospects” forecasts that India will surpass China’s population by 2023, reaching 1.5 billion by 2030 and 1.66 billion by 2050.

Poverty eradication: Lessons from China

- China’s story since 1978 is unique – the country has achieved the fastest decline in poverty.

- Its experiences hold some important lessons for India, especially because in 1978, when China embarked on its economic reforms, its per capita income at $156.4 was way below that of India at $205.7.

- Today, China is more than six times ahead of India in terms of per capita income – China’s per capita income in 2021 was $12,556, while that of India was $1,933 in 2020.

- China started its economic reforms in 1978 with a primary focus on agriculture.

- Contribution of agriculture: It broke away from the commune system and liberated agri-markets from myriad controls.

- Increase in agri-GDP: As a result, during 1978-84, China’s agri-GDP grew by 7.1 per cent per annum and farmers’ real incomes grew by 14 per cent per annum with the liberalisation of agri-prices.

- Creation of demand: Enhanced incomes of rural people created a huge demand for industrial products, and also gave political legitimacy for pushing further the reform agenda.

- The aim of China’s manufacturing through Town and Village Enterprises (TVEs) was basically to meet the surging demand from the hinterlands.

- Population factor: China introduced the one-child per family policy in September 1980, which lasted till early 2016.

- It is this strict control on population growth, coupled with booming growth in overall GDP over these years, that led to a rapid increase in per capita incomes.

- Chinese population growth today is just 0.1 per cent per annum compared to India’s 1.1 per cent per annum.

Growth story of Indian agriculture

- Over a 40-year period, 1978-2018, China’s agriculture has grown at 4.5 per cent per annum while India’s agri-GDP growth ever since reforms began in 1991 has hovered at around 3 per cent per annum.

- Market and price liberalisation in agriculture still remains a major issue, and at the drop of any hint of food price rise, the government clamps down exports, imposes stock limits on traders, suspends futures markets, and pushes other measures that strangle markets.

- Implicit taxation of farmers: The net result of all this is reflected in the “implicit taxation” of farmers to favour the vocal lobby of consumers, especially the urban middle class.

Way forward

- Population control: The only way is through effective education, especially that of the girl child, open discussion and dialogue about family planning methods and conversations about the benefits of small family size in society.

- Effective education: As per the National Family Health Survey-5 (2019-21), of all the girls and women above the age of 6 years, only 16.6 per cent were educated for 12 years or more.

- Based on unit-level data of NFHS5 (2019-21), it is found that women’s education is the most critical determinant of the status of malnutrition amongst children below the age of five.

- Unless a focused and aggressive campaign is launched to educate the girl child and provide her with more than 12 years of good quality education, India’s performance in terms of the prosperity of its masses, and the human development index may not improve significantly for many more years to come

- If government can take up this cause in sync with state governments, this will significantly boost the labour participation rate of women, which is currently at a meagre 25 per cent, and lead to “double engine” growth.

- Nutrition interventions: The NFHS-5 data shows that more than 35 per cent of our children below the age of five are stunted, which means their earning capacity will remain hampered throughout life. They will remain stuck in a low-level income trap.

Conclusion

From a policy perspective, if there is any subsidy that deserves priority, it should be for the education of the girl child. This policy focus can surely bring a rich harvest, politically and economically, for many years to come.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: 74th Constitutional Amendment Act

Mains level: Paper 2- Municipal finances

Context

Recently, the Indian Institute for Human Settlements (IIHS) analysed data from 80 urban local bodies (ULBs) across 24 States between 2012-13 and 2016-17 to understand ULB finance and spending, and found some key trends.

Health of municipal finances

- The 74th Constitution Amendment Act was passed in 1992 mandating the setting up and devolution of powers to urban local bodies (ULBs) as the lowest unit of governance in cities and towns.

- Constitutional provisions were made for ULBs’ fiscal empowerment.

- Challenges in fiscal empowerment: Three decades since, growing fiscal deficits, constraints in tax base expansion, and weakening of institutional mechanisms that enable resource mobilisation remain challenges.

- Revenue losses after implementation of the Goods and Services Tax (GST) and the pandemic have exacerbated the situation.

Analysing the trends in municipal finances

Recently, the Indian Institute for Human Settlements (IIHS) analysed data from 80 ULBs across 24 States between 2012-13 and 2016-17 to understand ULB finance and spending, and found some key trends.

1] Own sources of revenue less than half of total revenue

- Key sources of revenue: The ULBs’ key revenue sources are taxes, fees, fines and charges, and transfers from Central and State governments, which are known as inter-governmental transfers (IGTs).

- Important indicator of financial health: The share of own revenue (including revenue from taxes on property and advertisements, and non-tax revenue from user charges and fees from building permissions and trade licencing) to total revenue is an important indicator of ULBs’ fiscal health and autonomy.

- The study found that the ULBs’s own revenue was 47% of their total revenue.

- Of this, tax revenue was the largest component: around 29% of the total.

- Property tax, the single largest contributor to ULBs’ own revenue, accounted for only about 0.15% of the GDP.

- Figures for developing countries: The corresponding figures for developing and developed countries were significantly higher (about 0.6% and 1%, respectively) indicating that this is not being harnessed to potential in India.

2] High dependence on IGTs

- Most ULBs were highly dependent on external grants — between 2012-13 and 2016-17, IGTs accounted for about 40% of the ULBs’ total revenue.

- Transfers from the Central government are as stipulated by the Central Finance Commissions and through grants towards specific reforms, while State government transfers are as grants-in-aid and devolution of State’s collection of local taxes.

3] Tax revenue is largest revenue for larger cities, while smaller cities are more dependent on grants

- here are considerable differences in the composition of revenue sources across cities of different sizes.

- Class I-A cities (population of over 50 lakh) primarily depend on their own tax revenue, while Class I-B cities and Class I-C cities (population of 10 lakh-50 lakh and 1 lakh-10 lakh, respectively) rely more on IGTs.

- Own revenue mobilisation in Class I-A cities increased substantially.

- It was primarily driven by increases in non-tax revenue

4] Increasing operations and maintenance (O&M) expenses

- Operations and maintenance (O&M) expenses are on the increase but still inadequate.

- While the expenses were on the rise, studies (such as ICRIER, 2019 and Bandyopadhyay, 2014) indicate that they remained inadequate.

- For instance, O&M expenses incurred in 2016-17 covered only around a fifth of the requirement forecast by the High-Powered Expert Committee for estimating the investment requirements for urban infrastructure services.

- O&M expenses should ideally be covered through user charges, but total non-tax revenues, of which user charges are a part, are insufficient to meet current O&M expenses.

- The non-tax revenues were short of the O&M expenditure by around 20%, and this shortfall contributed to the increasing revenue deficit in ULBs.

Way forward

- Improving own revenue: It is essential that ULBs leverage their own revenue-raising powers to be fiscally sustainable and empowered and have better amenities and quality of service delivery.

- Stability in IGT: Stable and predictable IGTs are particularly important since ULBs’ own revenue collection is inadequate.

- O&M expenses: Increasing cost recovery levels through improved user charge regimes would not only improve services but also contribute to the financial vitality of ULBs.

- Measures need to be made to also cover O&M expenses of a ULB for better infrastructure and service.

- Tapping into property taxes, other land-based resources and user charges are all ways to improve the revenue of a ULB.

Conclusion

The health of municipal finances is a critical element of municipal governance which will determine whether India realises her economic and developmental promise.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: National Coal Index

Mains level: Paper 3- Need for increasing the domestic production of coal

Context

With inflation at unprecedented levels in many countries, concerns over energy security have gained centre stage.

National Coal Index to factor in the increased price of imported coal

- This index was created to provide a benchmark for revenue-sharing contracts being executed after the auctions for commercial mining of coal.

- The NCI had to be introduced as the wholesale price index (WPI) for coal has no component of imported coal.

- For the last six months, the WPI for Coal has been stable at around 131.

- Over the same period, the NCI has jumped from about 165 to about 238 reflecting the sharp increase in international coal prices.

Needs to increase domestic coal production

- High prices of coal and coal-based generation will only encourage imported coal and expose the country to price risks from international energy prices.

- The domestic coal industry has responded to increasing internation prices with an increase of over 30 per cent in coal production from April to June this year.

- Anticipating these problems, a big effort toward permitting commercial mining has been made to get the private sector to produce more coal.

- Gradual transition: Looking at coal from a singular focus on GHG emissions will give a myopic view of energy requirements for a growing economy like India.

- The path to achieving 500 GW of renewables needs to be gradual, ensuring an orderly transition as coal is unavoidable in the near future.

- Reducing coal imports and increasing domestic production of coal needs focused attention

Suggestions to increase domestic production of coal

1] Sensitising the financial community

- The financial community has to be sensitised to the need of increasing domestic coal production to meet the growing energy demand.

- The draft National Electricity Policy released in May 2021, recognised the need to increase coal-based generation.

- This policy has not yet been finalised.

- It should clearly articulate the importance of domestic coal-based generation.

- Holistic approach in ESG criteria: Apart from the government, the industry should also take up this issue with the financial community in adopting a more holistic approach toward environmental, social, and governance (ESG) criteria.

2] The regulator needs to facilitate greater role of private sector

- There is the need for a regulator to address the issues arising from a greater role of the private sector.

- The current arrangements were put in place at a time when the public sector dominated.

- There are several issues where new private commercial miners would need help.

- Single point of contact: A single point of contact for the industry in the form of a dedicated regulator would give great comfort to private players and would help to overcome problems that could arise in due course.

3] Diversifying the production base

- Increasing domestic production of coal and diversifying the production base are both needed.

- This must be complemented with efforts to improve the quality of the coal produced.

4] Remove financial burden due to cross subsidies

- The undue financial burden on the coal sector due to various cross subsidies needs attention.

- The regime needs to be reformed.

Conclusion

Action on the issues discussed above will only help to deepen and strengthen these reforms which are needed to overcome the challenges that have resurfaced over the past few months.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Treaty of Friendship

Mains level: India-Bhutan Relations

After over two years of the COVID-19-induced lockdown, Bhutan will open its doors to tourists on September 23 with a new expensive policy for Indians and other foreign tourists.

India-Bhutan Relations: A backgrounder

- India and Bhutan have had long-standing diplomatic, economic and cultural relations

- Bhutan and India relations are governed by a friendship treaty that was renegotiated only in 2007, subjecting the Himalayan nation’s security needs to supervision.

- Treaty of Friendship in 2007, which brought into the India-Bhutan relationship “an element of equality.”

- The Treaty provides for perpetual peace and friendship, free trade and commerce, and equal justice to each other’s citizens.

What is the Treaty of Friendship?

- On August 8, 1949, Bhutan and India signed the Treaty of Friendship, calling for peace between the two nations and non-interference in each other’s internal affairs.

- India re-negotiated the 1949 treaty with Bhutan and signed a new treaty of friendship in 2007.

- The new treaty replaced the provision requiring Bhutan to take India’s guidance on foreign policy with broader sovereignty and not require Bhutan to obtain India’s permission over arms imports.

- Under the 2007 India-Bhutan Friendship Treaty, the two sides have agreed to “cooperate closely with each other on issues relating to their national interests.”

- Neither Government shall allow the use of its territory for activities harmful to the national security and interest of the other

Various facets of ties

(1) Commercial Relations

- India is Bhutan’s largest trading partner.

- India and Bhutan have signed an Agreement on Trade, Commerce and Transit on in 2016, which provides for a free trade regime between the two countries.

- Tourism is another point of convergence.

(2) Energy Cooperation

- A scheme titled “Comprehensive Scheme for Establishment of Hydro-meteorological and Flood Forecasting Network on rivers Common to India and Bhutan” is in operation.

- The network consists of 32 Hydro-meteorological/ meteorological stations located in Bhutan and being maintained by the Royal Government of Bhutan with funding from India.

- The data received from these stations are utilized in India for formulating flood forecasts.

Significance of Bhutan to India

- Buffer to China: Bhutan is a buffer state between India and China. Bhutan shares a 470 km long border with China.

- Vital connectivity through chicken’s neck: The Chumbi Valley is situated at the tri-junction of Bhutan, India and China and is 500 km away from the “Chicken’s neck” in North Bengal.

- Security in North-East: Bhutan has in the past cooperated with India and helped to flush out militant groups in NE.

- Chinese inroad in Bhutan: China is interested in establishing formal ties with Thimphu, where it does not yet have a diplomatic mission.

China factor in ties: China predates on small neighbours

- Bhutan is strategically important for both India and China. Chinese territorial claims in western Bhutan are close to the Siliguri Corridor.

- Beijing is reportedly insisting on Bhutan establishing trade and diplomatic relations as a quid pro quo for a border settlement.

- Bhutan is currently India’s only neighbour who has stayed away from joining China’s Belt and Road Initiative (BRI), but that may change if India can’t make itself an attractive ally and neighbour.

Why does India need Bhutan?

- Bhutan has always been India’s most trusted ally in South Asia and has often put India’s security at the forefront.

- Come to think of it, in December 2003, Bhutan’s fourth king personally led the army to throw out Indian militants living in Bhutan’s jungles.

- Bhutan was also the only South Asian country besides India not to attend China’s Belt and Road Initiative forum in May 2017.

- In other words, land-locked Bhutan has held its end of the bargain.

Various cooperation developments

- Maitri Initiative: Bhutan is the first country to receive the Covishield vaccines under India’s Vaccine Maitri Initiative.

- Financial connectivity: It has touched new heights through the launch of the RuPay card and the BHIM app.

- Start-Up ecosystem: Both nations successfully linked up the Start-Up systems of our two countries via structured workshops; through the National Knowledge Network & the Druk-REN connection.

- E-Library project: It has opened up new vistas of education and knowledge sharing between two countries.

Irritants in ties

- India has not invested in significantly in Bhutan and other smaller neighbours that modicum of trust which is critical in building genuine goodwill.

- This means not only increasing people-to-people contact but also being sensitive to Bhutan’s desire for a wider engagement beyond India’s borders. This means respecting Bhutan as an equal, sovereign nation-state.

Conclusion

- The Indo-Bhutan friendship is built on shared values and aspirations, trust and mutual respect.

- Bhutan’s foreign policy framework holds the relationship with India as being integral to its national interest.

- The Indian approach to Bhutan has necessarily to be tailored while being sensitive to the growing Bhutanese aspirations of being considered equal.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: ECB

Mains level: Not Much

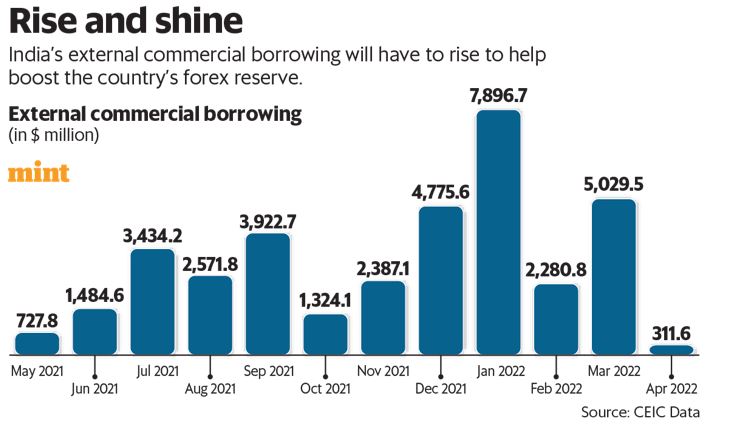

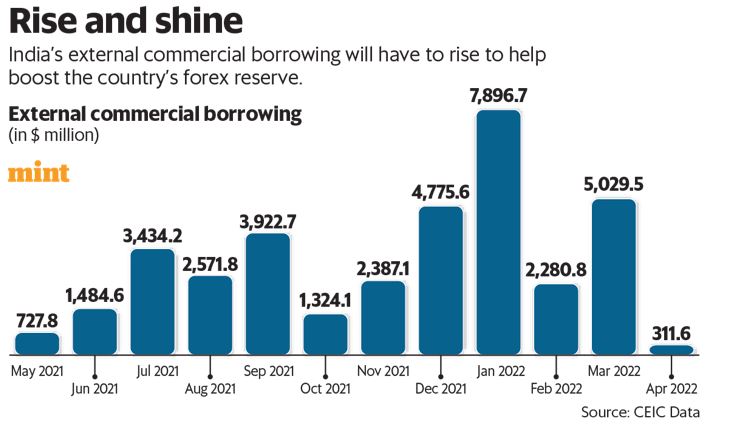

The Reserve Bank of India has relaxed norms for companies raising external commercial borrowings (ECBs), as part of a set of measures to stem the slide in the rupee.

What are ECBs taken by Indian companies?

- ECBs are commercial loans that eligible resident entities can raise from outside India, i.e. from a recognized non-resident entity.

- ECBs can be buyer’s credit, supplier’s credit, foreign currency convertible bonds, foreign currency exchangeable bonds, loans etc.

- ECBs can be raised via the automatic route where cases are examined by the Authorized Category Dealer, or the approval route where borrowers are mandated to forward their request to RBI through their authorized dealers.

- Borrowers must follow norms on minimum maturity period, maximum all-in-cost ceiling, end-uses etc.

What is the relaxation offered by the RBI?

- RBI earlier had raised borrowing limit under the automatic route from $750 million or its equivalent per financial year to $1.5 bn up till up to 31 December, 2022.

Why such move?

- The objective was to increase the supply of foreign exchange reserves.

- This in turn would thereby prevent the fast depreciation of the rupee witnessed over the last few months.

What clarity do foreign lenders want from RBI?

- Lenders want to know whether the investment grade needs to be rated by domestic or international agencies.

- If it is only by global agencies, it would limit the number of potential borrowers.

- This is because companies which might be rated high domestically might not necessarily have made the investment grade when rated by international agencies.

Why do Indian firms go for ECBs?

- Low cost: ECBs give companies the benefit of borrowing abroad at lower interest rates.

- Long term repayment: They are also an avenue to borrow a large volume of funds for a relatively long period of time.

- Surpassing exchange fluctuation: Also, borrowing in foreign currencies enables companies to pay for their machinery import etc., thereby nullifying the impact of varying exchange rate.

- Long term profitability: ECBs can help diversify the investor base and funds available at lower cost, helping improve profitability of companies.

- Better credit ratings: ECB interest rates are also a function of their ratings in the international market.

What are the risks for firms raising ECBs?

- Though companies get attracted to ECBs due to lower interest rates, the comfort level of the borrower depends on how stable the rate of exchange is.

- Depreciation of the rupee will raise debt servicing burden as compared to what has been worked out at the time of availing of the ECB facility.

- Thus, the companies might need to incur hedging costs (amount equal to the aggregate costs, fees, and expenses) to cover the exchange rate risk.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Read the attached story

Mains level: NA

This article provides a quick summary of what has been happening in the global economy. These are few key terms that one is likely to hear repeatedly in the coming days and weeks:

- Yield Inversion

- Soft-landing and

- Reverse Currency War

Here’s a quick look at what they mean and why they are significant at present.

(1) Bond Yield Inversion

What is Bond Yeild?

- Bonds are essentially an instrument through which governments (and also corporations) raise money from people.

- Typically government bond yields are a good way to understand the risk-free interest rate in that economy.

- This 2019 piece provides an introduction to government bonds and explains how yields are calculated.

What is Yield Curve?

- The yield curve is the graphical representation of yields from bonds (with an equal credit rating) over different time horizons.

- In other words, if one was to take the US government bonds of different tenures and plot them according to the yields they provide, one would get the yield curve.

The chart below provides a sense of the different types of yield curves one could have.

How to see this?

- Under normal circumstances, any economy would have an upward sloping yield curve.

- That is to say, as one lends for a longer duration — or as one buys bonds of longer tenure — one gets higher yields. This makes sense.

- If one is parting with money for a longer duration, the return should be higher.

- Moreover, a longer tenure also implies that there is a greater risk of failure.

- An inversion of the yield curve essentially suggests that investors expect future growth to be weak.

Inversion of bond yield

- However, there are times when this bond yield curve becomes inverted.

- For instance, bonds with a tenure of 2 years end up paying out higher yields (returns/ interest rate) than bonds with a 10 year tenure.

- Such an inversion of the yield curve essentially suggests that investors expect future growth to be weak.

Here’s how to make sense of this?

- When investors feel buoyant about the economy they pull the money out from long-term bonds and put it in short-term riskier assets such as stock markets.

- In the bond market, the prices of long-term bonds fall, and their yield (effective interest rate) rises.

- This happens because bond prices and bond yields are inversely related.

- However, when investors suspect that the economy is heading for trouble, they pull out money from short-term risky assets (such as stock markets) and put them in long-term bonds.

- This causes the prices of the long-term bonds to rise and their yields to fall.

Why use inversion curve?

- Over the years, inversion of the bond yield curve has become a strong predictor of recessions. Of course, for it to be taken seriously, such an inversion has to last for several months.

- Over the past few weeks, such inversion is happening repeatedly in the US, suggesting to many that a recession is in the offing.

- In the current instance, the US Fed (their central bank) has been raising short-term interest rates, which further bumps up the short-end of the yield curve while dampening economic activity.

(2) Soft-Landing

- The process of monetary tightening that the US is currently unveiling involves not just reducing the money supply but also increasing the cost of money (that is, the interest rate).

- US is doing this to contain soaring inflation.

- Ideally, the US Fed or any central bank doing this would like to bring about monetary tightening in such a manner that slows down the economy but doesn’t lead to a recession.

- When a central bank is successful in slowing down the economy without bringing about a recession, it is called a soft-landing — that is, no one gets hurt.

- But when the actions of the central bank bring about a recession, it is called hard-landing.

(3) Reverse Currency War

- A flip side of the US Fed’s action of aggressively raising interest rates is that more and more investors are rushing to invest money in the US.

- This, in turn, has made the dollar become stronger than all the other currencies. That’s because the dollar is more in demand than yen, euro, yuan etc.

- On the face of it, this should make all other countries happier because a relative weakness of their local currency against the dollar makes their exports more competitive.

- For instance, a Chinese or an Indian exporter gets a massive boost.

- In fact, in the past the US has often accused other countries of manipulating their currency (and keeping its weaker against the dollar) just to enjoy a trade surplus against the US.

- This used to be called the currency war.

What explains this reverse currency war unfolding at the moment?

- The important thing to understand is that a stronger dollar has had a key benefit — importing cheaper crude oil.

- A currency which is losing value to the dollar, on the other hand, finds that it is getting costlier to import crude oil and other commodities that are often traded in dollars.

- But raising the interest rate is not without its own risks.

- Just like in the US, higher interest rates will decrease the chances of a soft-landing for any other economy.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Vice President of India

Mains level: Not Much

A major political party has declared that West Bengal Governor Jagdeep Dhankhar would be the candidate for the post of Vice-President.

About Vice President of India

- The VP is the deputy to the head of state of the Republic of India, the President of India.

- His/her office is the second-highest constitutional office after the president and ranks second in the order of precedence and first in the line of succession to the presidency.

- The vice president is also a member of the Parliament as the ex officio Chairman of the Rajya Sabha.

Qualifications

- As in the case of the president, to be qualified to be elected as vice president, a person must:

- Be a citizen of India

- Be at least 35 years of age

- Not hold any office of profit

- Unlike in the case of the president, where a person must be qualified for election as a member of the Lok Sabha, the vice president must be qualified for election as a member of the Rajya Sabha.

- This difference is because the vice president is to act as the ex officio Chairman of the Rajya Sabha.

Roles and responsibilities

- When a bill is introduced in the Rajya Sabha, the vice president decides whether it is a money bill or not.

- If he is of the opinion that a bill introduced in the Rajya Sabha is a money bill, he shall refer it to the Speaker of the Lok Sabha.

- The vice president also acts as the chancellor of the central universities of India.

Election procedure

- Article 66 of the Constitution of India states the manner of election of the vice president.

- The vice president is elected indirectly by members of an electoral college consisting of the members of both Houses of Parliament and NOT the members of state legislative assembly.

- The election is held as per the system of proportional representation using single transferable votes.

- The voting is conducted by Election Commission of India via secret ballot.

- The Electoral College for the poll will comprise 233 Rajya Sabha members, 12 nominated Rajya Sabha members and 543 Lok Sabha members.

- The Lok Sabha Secretary-General would be appointed the Returning Officer.

- Political parties CANNOT issue any whip to their MPs in the matter of voting in the Vice-Presidential election.

Removal

- The Constitution states that the vice president can be removed by a resolution of the Rajya Sabha passed by an Effective majority (majority of all the then members) and agreed by the Lok Sabha with a simple majority( Article 67(b)).

- But no such resolution may be moved unless at least 14 days’ notice in advance has been given.

- Notably, the Constitution does not list grounds for removal.

- No Vice President has ever faced removal or the deputy chairman in the Rajya Sabha cannot be challenged in any court of law per Article 122.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: GST Slabs

Mains level: Rationalization of GST

Customers will have to pay a 5% Goods and Services Tax (GST) on pre-packed, labelled food items such as atta, paneer and curd, besides hospital rooms with rents above ₹5,000.

What is GST?

- GST launched in India on 1 July 2017 is a comprehensive indirect tax for the entire country.

- It is charged at the time of supply and depends on the destination of consumption.

- For instance, if a good is manufactured in state A but consumed in state B, then the revenue generated through GST collection is credited to the state of consumption (state B) and not to the state of production (state A).

- GST, being a consumption-based tax, resulted in loss of revenue for manufacturing-heavy states.

What are GST Slabs?

- In India, almost 500+ services and over 1300 products fall under the 4 major GST slabs.

- There are five broad tax rates of zero, 5%, 12%, 18% and 28%, plus a cess levied over and above the 28% on some ‘sin’ goods.

- The GST Council periodically revises the items under each slab rate to adjust them according to industry demands and market trends.

- The updated structure ensures that the essential items fall under lower tax brackets, while luxury products and services entail higher GST rates.

- The 28% rate is levied on demerit goods such as tobacco products, automobiles, and aerated drinks, along with an additional GST compensation cess.

Why rationalize GST slabs?

- From businesses’ viewpoint, there are just too many tax rate slabs, compounded by aberrations in the duty structure through their supply chains with some inputs taxed more than the final product.

- These are far too many rates and do not necessarily constitute a Good and Simple Tax.

- Multiple rate changes since the introduction of the GST regime in July 2017 have brought the effective GST rate to 11.6% from the original revenue-neutral rate of 15.5%.

- Merging the 12% and 18% GST rates into any tax rate lower than 18% may result in revenue loss.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Anayoottu

Mains level: Not Much

Anayoottu, an annual ritual at the Sree Vadakkunnathan Temple, Thrissur was recently held.

Why in news?

- There is a history behind this annual ritual at the temple.

- Kerala’s elephant pooram was selected, along with other cultural forms of the country, for display at the opening ceremony of the Asian Games held in Delhi in 1982.

- Elephants were transported all throughout the country to New Delhi.

What is Anayoottu?

- The Aanayoottu (gaja pooja/ feeding of elephants) is a festival held in the precincts of the Vadakkunnathan temple in City of Thrissur, in Kerala.

- The festival falls on the first day of the month of Karkkidakam (timed against the Malayalam calendar), which coincides with the month of July.

- It involves a number of unadorned elephants being positioned amid a multitude of people for being worshipped and fed.

- Crowds throng the temple to feed the elephants.

Mythology behind

- It is believed that offering poojas and delicious feed to the elephants is a way to satisfy Lord Ganesha—the god of wealth and of the fulfillment of wishes.

- The Vadakkunnathan temple, which is considered to be one of the oldest Shiva temples in southern India, has hosted the Aanayottoo event for the past few years.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Article 21

Mains level: Paper 2- Consolidation of multiple FIRs

Context

The Supreme Court’s (SC) refused to consolidate multiple FIRs filed in several states against former BJP spokesperson.

When are multiple FIRs clubbed?

- In 2001, the SC, in TT Antony vs. State of Kerala, made it clear that only the earliest information in regard to the commission of an offence could be investigated and tried.

- In Babubhai vs. State of Gujarat (2010), the Court explained that the test to determine the sameness of the offence is to identify whether “the subject matter of the FIRs is the same incident, same occurrence or are in regard to incidents which are two or more parts of the same transaction”.

- the SC extensively relied upon TT Antony while granting similar relief to two journalists.

Reasons given by the SCs for refusal to club the FIRs

- The bench said that party spokespersons and journalists cannot be treated identically.

- The Constitution creates no hierarchical difference between journalists and ordinary citizens when it comes to the enforcement of fundamental rights.

- The right to approach the SC under Article 32 is in itself a fundamental right.

- Nor did the SC craft any distinction on the basis of the status or affiliation of the accused in TT Antony.

- Second, the bench said that she has not unconditionally apologised for her remarks and her political clout is apparent from the fact that she has not been arrested despite an FIR being filed against her.

- This view is again misplaced. Whether or not the person has tendered an apology is not germane to the issue at hand.

- Seeking or tendering an apology may be a mitigating factor while deciding punishment but only after the guilt is proved.

Why the multiple FIRs should be consolidated

- Abuse of statutory power of investigation: Filing of successive FIRs amounts to an abuse of statutory power of investigation and is a fit case for the SC to exercise its writ powers under Article 32 because high courts cannot transfer cases from one state to another.

- Wastage of state resources and judicial time: Prudence demands that state resources and judicial time are not spent on a multiplicity of proceedings.

- The multiplicity of proceedings would result in violation of fundamental rights under Article 21 as parallel investigations would result in her being forced to join investigations in different police stations in different states.

- This serves no practical purpose because ultimately it is only one of the police reports that would be tried by a court of law.

Conclusion

In the absence of strict guidelines, some degree of caution is necessary on the part of judges to work within the confines of judicial propriety.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Return of Euro-centrism

Context

The Russian aggression against Ukraine has led to an unmissable feeling of insecurity in Europe, particularly in Germany.

Euro-centric world order and new security consciousness

- For centuries, Europe imagined itself to be the centre of the world — its order, politics and culture.

- What contributed to its decline? Decolonisation, the emergence of the United States as the western world’s sole superpower, and the rise of the rest dramatically diminished the centuries old domination of the European states and their ability to shape the world in their own image.

- The political and military aftermath of Russia’s war on Ukraine could potentially tilt the current global balance and take us back to a Euro-centric world order.

- US dominance: For sure, the U.S. continues to dominate the trans-Atlantic security landscape and this is likely to remain so.

- And yet, the new security consciousness in Europe will reduce Washington’s ability to continue as the fulcrum of the trans-Atlantic strategic imagination.

- If wars have the potential to shape international orders, it is Europe’s turn to shape the world, once again.

- The United States, fatigued from the Iraq and Afghan wars, does not appear to be keen on another round of wars and military engagements.

- A pervasive sense of what some described as “existential insecurity” has brought about a renewed enthusiasm about the future of the European Union and the North Atlantic Treaty Organization (NATO).

- The European Union (EU) Commission has backed Kyiv’s bid for EU candidature.

- This new military unity is not just words, but is backed with political commitment and financial resources from the world’s richest economies.

- Berlin, for instance, has decided to spend an additional €100 billion for defence over and above its €50 billion annual expenditure on defence.

Implications

1] Weakened faith in the institutions and globalisation

- Germany, the engine of this new security thinking in Europe, is coming out of its self-image of being a pacifist nation.

- There appears little faith in the United Nations or the UN Security Council anymore in Berlin, they have decided to put their faith in a revitalised EU and NATO.

- European states are deeply worried about globalisation-induced vulnerability and this has set in a rethink about the inherent problems of indiscriminate globalisation.

- The combined effect of European re-militarisation (however modest it may be for now), its loss of faith in multilateral institutions, and the increased salience of the EU and NATO will be the unchecked emergence of Europe as an even stronger regulatory, norm/standard-setting superpower backed with military power.

2] Unilateral and Euro-centric decision making

- The EU already has a worryingly disproportionate ability to set standards for the rest of the world.

- Instruments such as the Digital Services Act and the Digital Assets Act or its human rights standards will be unilaterally adopted, and will be unavoidable by other parts of the world.

- While these instruments and standards may in themselves be progressive and unobjectionable for the most part, the problem is with the process which is unilateral and Euro-centric.

3] Euro-centric worldview

- A euro-centric worldview of ‘friends and enemies’ will define its engagement with the rest of the world.

- India is a friend, but its take on the Ukraine war is not friendly enough for Europe.

- The EU will lead the way in setting standards for the rest of us and we will have little option but to follow that.

- For sure, Europe will seek partners around the world: to create a Euro-centric world order, not a truly global world order.

4] Dilemma for India

- This unilateral attempt to ‘shape the world’ in its image will also be portrayed as an attempt to counter Chinese attempts at global domination.

- To oppose or not? When presented as such, countries such as India will face a clear dilemma: to politically and normatively oppose the setting of the global agenda by Europeans or to be practical about it and jump on the European bandwagon.

Conclusion

The key message from the European narratives about the Ukraine war is that European states would want to see their wars and conflicts as threatening international stability and the ‘rules-based’ global order.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Ozone, Ozone Hole

Mains level: Read the attached story

A new ozone hole has been detected over the tropics, at latitudes of 30 degrees South to 30 degrees North, a recent study claimed. But some experts are divided over this.

Do you know?

The Antarctic ozone hole — one of the deepest, largest gap in the ozone layer in the last 40 years — has closed, according to the World Meteorological Organization (WMO).

What is Ozone and Ozone Layer?

- An ozone molecule consists of three oxygen atoms instead of the usual two (the oxygen we breathe, O2, makes up 21% of the atmosphere).

- It only exists in the atmosphere in trace quantities (less than 0.001%), but its effects are very important.

- Ozone molecules are created by the interaction of ultra-violet (UV) radiation from the Sun with O2 molecules.

- Because UV radiation is more intense at higher altitudes where the air is thinner, it is in the stratosphere where most of the ozone is produced, giving rise to what is called the ‘ozone layer’.

- The ozone layer, containing over 90% of all atmospheric ozone, extends between about 10 and 40km altitude, peaking at about 25km in Stratosphere.

Why need Ozone Layer?

- The ozone layer is very important for life on Earth because it has the property of absorbing the most damaging form of UV radiation, UV-B radiation which has a wavelength of between 280 and 315 nanometres.

- As UV radiation is absorbed by ozone in the stratosphere, it heats up the surrounding air to produce the stratospheric temperature inversion.

What is Ozone Hole?

- Each year for the past few decades during the Southern Hemisphere spring, chemical reactions involving chlorine and bromine cause ozone in the southern polar region to be destroyed rapidly and severely.

- The Dobson Unit (DU) is the unit of measure for total ozone.

- The chemicals involved ozone depletion are chlorofluorocarbons (CFCs for short), halons, and carbon tetrachloride.

- They are used for a wide range of applications, including refrigeration, air conditioning, foam packaging, and making aerosol spray cans.

- The ozone-depleted region is known as the “ozone hole”.

Tropical Ozone Hole

- According to the study, the ozone hole is located at altitudes of 10-25 km over the tropics.

- This hole is about seven times larger than Antarctica, the study suggested.

- It also appears across all seasons, unlike that of Antarctica, which is visible only in the spring.

- The hole has become significant since the 1980s. But it was not discovered until this study.

What caused an ozone hole in the tropics?

- Studies suggested another mechanism of ozone depletion: Cosmic rays.

- Chlorofluorocarbon’s (CFC) role in depleting the ozone layer is well-documented.

- The tropical stratosphere recorded a low temperature of 190-200 Kelvin (K).

- This can explain why the tropical ozone hole is constantly formed over the seasons.

Significance of the finding

- The tropical ozone hole, which makes up 50 percent of Earth’s surface, could cause a global concern due to the risks associated with it.

- It is likely to cause skin cancer, cataracts and other negative effects on the health and ecosystems in tropical regions.

Back2Basics: Antarctic Ozone Hole

- The Antarctic “ozone hole” was discovered by British Antarctic Survey scientists Farman, Gardiner and Shanklin in 1985.

- It was caused by the chemical reactions on polar stratospheric clouds (PSCs) in the cold Antarctic stratosphere caused a massive.

- Though localized and seasonal, an increase in the amount of chlorine present in active, ozone-destroying forms.

Role of PSCs

- The polar stratospheric clouds in Antarctica are only formed when there are very low temperatures, as low as −80 °C, and early spring conditions.

- In such conditions, the ice crystals of the cloud provide a suitable surface for the conversion of unreactive chlorine compounds into reactive chlorine compounds, which can deplete ozone easily.

Try this PYQ

Q.Consider the following statements:

Chlorofluorocarbons, known as ozone-depleting substances are used:

- In the production of plastic foams

- In the production of tubeless tyres

- In cleaning certain electronic components

- As pressurizing agents in aerosol cans

Which of the statements given above is/are correct?

(a) 1, 2 and 3 only

(b) 4 only

(c) 1, 3 and 4 only

(d) 1, 2, 3 and 4

Post your answers here.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: SCO

Mains level: Read the attached story

Iran and Belarus are likely to be the two newest additions to the China and Russia-backed Shanghai Cooperation Organisation (SCO) grouping.

What is SCO?

- After the collapse of the Soviet Union in 1991, the then security and economic architecture in the Eurasian region dissolved and new structures had to come up.

- The original Shanghai Five were China, Kazakhstan, Kyrgyzstan, Russia and Tajikistan.

- The SCO was formed in 2001, with Uzbekistan included. It expanded in 2017 to include India and Pakistan.

- Since its formation, the SCO has focused on regional non-traditional security, with counter-terrorism as a priority.

- The fight against the “three evils” of terrorism, separatism and extremism has become its mantra. Today, areas of cooperation include themes such as economics and culture.

India’s entry to the SCO

- India and Pakistan both were observer countries.

- While Central Asian countries and China were not in favor of expansion initially, the main supporter — of India’s entry in particular — was Russia.

- A widely held view is that Russia’s growing unease about an increasingly powerful China prompted it to push for its expansion.

- From 2009 onwards, Russia officially supported India’s ambition to join the SCO in 2017.

- China then asked for its all-weather friend Pakistan’s entry.

Why expand now?

- China and Russia are looking to frame the grouping as a counter to the West — particularly after Russia’s invasion of Ukraine.

- China wishes to draw a sharp contrast between the SCO and NATO.

Changing narrative of SCO

- There has been discussion in the international arena that the trend of non-alignment is back.

- NATO is based on Cold War thinking.

- The logic of NATO is creating new enemies to sustain its own existence.

- However, SCO is a cooperative organisation based on non-alignment and not targeting a third party.

India and SCO: Present status

- India will host the SCO summit next year, and Varanasi has been selected as the SCO region’s first “Tourism and Cultural Capital”.

- India will also be chairing the summit.

Try this PYQ now:

In the context of the affairs of which of the following is the phrase “Special Safeguard Mechanisms” mentioned in the news frequently?

(a) United Nations Environment Programme

(b) World Trade Organization

(c) ASEAN- India Free Trade Agreement

(d) G-20 Summits

Post your answers here.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Capital expenditure

Mains level: Read the attached story

Finance Minister said India’s long-term growth prospects were embedded in public capital expenditure programs.

What is the news?

- FM has raised capital expenditure (capex) by 35.4% for the financial year 2022-23 to ₹7.5 lakh crore to continue the public investment-led recovery of the pandemic-battered economy.

- The capex last year was ₹5.5 lakh crore.

What is Capital Expenditure (Capex)?

- The government’s expenditure is categorized into two:

- The one which results in asset development or acquisition known as CAPEX,

- Another is utilized to cover operating costs and obligations but does not result in asset creation known as Revenue expenditure.

- Capex is defined the as money spent on the acquisition of assets such as land, buildings, machinery, and equipment, as well as stock investments.

What attributes to capex?

- The portion of government payments that goes toward the construction of assets such as schools, colleges, hospitals, roads, bridges, dams, railway lines, airports, and seaports amounts to capex.

- The acquisition of new weaponry and weapon systems, such as missiles, tanks, fighter planes, and submarines, necessitates a significant financial outlay.

- The defense sector receives over a third of the central government’s capital spending, primarily for armament acquisitions.

- Despite the fact that defense spending is classified as a capital expenditure, it does not result in the development of infrastructure to support economic growth.

- Also includes investments that will produce earnings or dividends in the future.

Significance of Capex

- Economic recovery: This action is crucial in light of the economic slowdown induced by the Covid-19 epidemic, as well as a dip in the employment ratio.

- Value creation: Capital asset formation provides future cash flows for the economy and contributes to value creation.

- Multiplier Effect: Capex is expected to have a Multiplier Effect (a change in rupee value of output with respect to a change in rupee value of expenditure).

- Increased employment: Capital spending creates jobs and improves labor productivity as a result of the multiplier effect.

- Macroeconomic Stabilizer: Capital Expenditure serves as a macroeconomic stabilizer and is an excellent instrument for countercyclical fiscal policy.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Mission Indradhanush

Mains level: Read the attached story

The number of children in India who were unvaccinated or missed their first dose of diphtheria-tetanus-pertussis (DTP) combined vaccine doubled due to the pandemic, rising from 1.4 million in 2019 to 2.7 million in 2021, according to official data published by the WHO and UNICEF.

Why in news?

- This data signifies that the world recorded the largest sustained decline in childhood vaccinations in approximately 30 years.

- There was an increase in zero dose.

- This is the first time ever there has been a decline in evaluated coverage in immunisation for India as a whole.

Vaccination measures in India

- Intensified Mission Indradhanush (IMI) 4.0: India started IMI 4.0 from February 2022, which is expected to further reduce the number of unvaccinated children.

- India’s Universal Immunisation Programme (UIP): It provide free vaccines to all children across the country to protect them against Tuberculosis, Diphtheria, Pertussis, Tetanus, Polio, Hepatitis B, Pneumonia and Meningitis due to Haemophilus Influenzae type b (Hib), Measles, Rubella, Japanese Encephalitis (JE) and Rotavirus diarrhoea. (Rubella, JE and Rotavirus vaccine in select states and districts).

About Intensified Mission Indhradhanush (IMI) 4.0

- IMI 4.0 aims to fill gaps in the routine immunisation coverage of infants and pregnant women hit by the Covid-19 pandemic and also aims to make lasting gains towards Universal Immunization.

- It will have three rounds and will be conducted in 416 districts across 33 states.

- Unlike the past, each round under IMI 4.0 will be conducted for seven days, including Routine Immunization (RI) days, Sundays, and public holidays.

Mission Indradhanush (MI)

- Mission Indradhanush (MI) was launched in 2014 with the goal to ensure full immunization with all available vaccines under Universal Immunization Programme (UIP) for children up to two years of age and pregnant women.

- It targets achieving 90% full immunization coverage in all districts.

- Under MI, all vaccines under the Universal Immunization Program (UIP) are provided as per National Immunization Schedule.

- UIP provides free vaccines against 12 life-threatening diseases, mentioned above.

|

Back2Basics: Universal Immunisation Programme

- The Expanded Programme on Immunization was launched in 1978.

- It was renamed as UIP in 1985 when its reach was expanded beyond urban areas.

- UIP is one of the largest public health programmes targeting close to 2.67 crore newborns and 2.9 crore pregnant women annually.

- Under UIP, Immunization is provided free of cost against 12 vaccine-preventable diseases.

- The two major milestones of UIP have been the elimination of polio in 2014 and maternal and neonatal tetanus elimination in 2015.

- To speed up the coverage, Mission Indradhanush was planned and implemented to rapidly increase the full coverage to 90%.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Podu, Rythu Bandhu

Mains level: Shifting Cultivation prevalent in India

Activists have taken up the issue of Podu cultivation of adivasis and tribals in forest areas in Telangana.

What one means by Podu?

- Podu is a traditional system of cultivation used by tribes in India, whereby different areas of jungle forest are cleared by burning each year to provide land for crops.

- It is a form of shifting agriculture using slash-and-burn methods. The word comes from the Telugu language.

- Traditionally used on the hill-slopes of Andhra Pradesh, it is similar to the jhum method found in north-east India and the bewar system of Madhya Pradesh.

What is the ‘Podu’ Land Issue?

- The Telangana government had decided in 2021 to move landless, non-tribal farmers engaged in shifting cultivation inside forests to peripheral areas in an effort to combat deforestation.

- It ensured that all steps would be taken to ensure that forest land was not encroached upon.

- It is observed that podu progressively degrades large areas of the forest.

Shifting cultivation in India

- In this type of agriculture, first of all a piece of forest land is cleared by felling trees and burning of trunks and branches.

- After the land is cleared, crops are grown for two to three years and then the land is abandoned as the fertility of the soil decreases.

- The farmers then move to new areas and the process is repeated.

- Dry paddy, maize, millets and vegetables are the crops commonly grown in this type of farming.

This practice is known by different names in different regions of India:

1. Jhum in Assam,

2. Ponam in Kerala,

3. Podu in Andhra Pradesh and Odisha and

4. Bewar masha penda and Bera in various parts of Madhya Pradesh. |

What TS has to offer as alternative to Podu?

- To stop this deforestation, the government wants to move out cultivators from deep inside forests to the periphery by allotting them land for cultivation.

- Tribal farmers who have been traditionally cultivating for decades would not be affected by this drive against illegal encroachers.

- The land ownership titles have been given to tribals and more than 3 lakh acres have been allocated to tribal farmers state-wide.

And what about non-tribal farmers?

- These farmers can apply to the state government to allocate them land outside the forests.

- Those who are moved out of the forests would be given land ownership certificates, power and water supplies and Rythu Bandhu benefits.

Back2Basics: Rythu Bandhu

- Rythu Bandhu is a scheme under which the state government extends financial support to land-owning farmers at the beginning of the crop season through direct benefit transfer.

- The scheme aims to take care of the initial investment needs and do not fall into a debt trap.

- This in turn instills confidence in farmers, enhances productivity and income, and breaks the cycle of rural indebtedness.

DBT under the Scheme

- Each farmer gets Rs 5,000 per acre per crop season without any ceiling on the number of acres held.

- So, a farmer who owns two acres of land would receive Rs 20,000 a year, whereas a farmer who owns 10 acres would receive Rs 1 lakh a year from the government.

- The grant helps them cover the expenses on input requirements such as seeds, fertilizers, pesticides, and labor.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Incheon commitment

Mains level: Paper 2- Political inclusion of persons with disability

Context

The Department of Empowerment of Person with Disabilities (DoEPwD) recently released the draft of the national policy for persons with disabilities.

Why new policy?

- Signing of UN convention: The necessity for a new policy which replaces the 2006 policy was felt because of multiple factors such as India’s signing of the United Nations Convention on Rights of Persons with Disabilities.

- Increased number of disabilities: Enactment of Rights of Persons with Disabilities Act 2016, which increased the number of disabilities from seven conditions to 21 necessitated the change.

- Incheon Strategy: Being a party to the Incheon Strategy for Asian and Pacific Decade of Persons with Disabilities, 2013-2022 (“Incheon commitment”).

- Changed discourse from medical model to human right: These commitments have changed the discourse around disability by shifting the focus from the individual to society, i.e., from a medical model of disability to a social or human rights model of disability.

- The principle of the draft policy is to showcase the Government’s commitment to the inclusion and empowerment of persons with disabilities by providing a mechanism that ensures their full participation in society.

Absence of commitment to political uplift

- Article 29 of the Convention on Rights of Persons with Disabilities mandates that state parties should “ensure that persons with disabilities can effectively and fully participate in political and public life on an equal basis with others, directly or through freely chosen representatives….”

- The Incheon goals also promote participation in political processes and in decision making.

- The Rights of Persons with Disabilities Act 2016 embodies these principles within its fold.

- India does not have any policy commitment that is aimed at enhancing the political participation of disabled people.

- The exclusion of disabled people from the political space happens at all levels of the political process in the country, and in different ways.

- Section 11 of the Rights of Persons with Disabilities Act prescribes that “The Election Commission of India and the State Election Commissions shall ensure that all polling stations are accessible to persons with disabilities and all materials related to the electoral process are easily understandable by and accessible to them”.

- Although this mandate has been in existence for a few years, the disabled people still report accessibility issues before and on election day.

- There is often a lack of accessible polling booths in many locations.

- Lack of aggregate data: The lack of live aggregate data on the exact number of the disabled people in every constituency only furthers their marginalisation.

Lack of representation

- Representation plays an imperative role in furthering the interests of the marginalised community.

- Disabled people are not represented enough at all three levels of governance.

- However, few States have begun the initiative at local levels to increase participation.

- For instance, Chhattisgarh started the initiative of nominating at least one disabled person in each panchayat.

- If a disabled person is not elected then they are nominated as a panchayat member as per changes in the law concerned.

- This is a step that has increased the participation of the disabled in the political space at local level.

- The goal of the policy document — of inclusiveness and empowerment — cannot be achieved without political inclusion.

Suggestions: Follow four pronged approach

- The policy can follow a four-pronged approach:

- 1] Capacity building: Building the capacity of disabled people’s organisations and ‘empowering their members through training in the electoral system, government structure, and basic organisational and advocacy skills’;

- 2] Legal and regulatory framework: The creation, amendment or removal of legal and regulatory frameworks by lawmakers and election bodies to encourage the political participation of the disabled;

- 3] Participation of civil society: Inclusion of civil societies to ‘conduct domestic election observation or voter education campaigns’;

- 4] Framework for outreach by political parties: A framework for political parties to ‘conduct a meaningful outreach to persons with disabilities when creating election campaign strategies and developing policy positions’.

Conclusion

The document lays emphasis on the point that central and State governments must work together with other stakeholders to “make the right real”. This right can be made real only when it includes political rights/political participation within it.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Language in legislature

Context

Language not only changes across region but also profession. Similarly, Parliament, too, has its own list of absurd and archaic phrases.

Debate over expunged words

- Today there is much debate on language again after the Lok Sabha Secretariat compiled a list of 151 words, which have been expunged in 2021 and 2020 in Parliaments across the Commonwealth countries and State Assemblies in India.

- Many of these words may look harmless, but in a heated exchange between parliamentarians, they may not exactly be virtuous.

- The current compilation has especially caused consternation among Opposition parties which see this as an attempt to restrict their vocabulary.

- The government argues that this list is at best only “instructive” and not “definitive”.

- The preface of the document states that the context in which these words were used is far more important than the words themselves.

- Ultimately, the final call of whether a word is “unparliamentary” or not lies with the presiding officer of the House.

- In the first two decades of the Indian Parliament, English was the primary language used for parliamentary work.

- This changed as the social composition of Parliament changed from the 1970s onwards.

- At present, as many as 30 languages are used by parliamentarians during speeches, with many insisting on speaking their mother tongue during crucial debates.

- Perhaps, the next such compilation will also have words expunged from different regional languages.

Challenges in digital age

- The proceedings of both Houses of Parliament are relayed in real time on TV channels and YouTube.

- There have been instances where live transmission has been halted on the Chair’s orders.

- To circumvent this, many members have recorded the proceedings on their mobile phone cameras.

- There are many instances of the Chair intervening and expunging words or phrases that it finds “objectionable”.

- Herein lies the problem. The order of the Chair is often relayed by late evening to reporters, but by then, the video clip would have already been circulated many times over.

- Print reporters are careful and abide by the orders, but in a digital ecosystem, this is not easy.

Conclusion

The problems posed to the Parliament in terms of language and words should be dealt with keeping in focus the freedom of speech of the members.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Fundamental Duties

Mains level: Read the attached story

The Supreme Court has allowed the Centre’s request for two months’ time to file a reply to a petition seeking the enforcement of fundamental duties of citizens, including patriotism and unity of nation, through “comprehensive, and well-defined laws”.

Why in news?

- The need to enforce fundamental duties arises due to new illegal trend of protest by protesters in the garb of freedom of speech and expression.

- Vandalism, blocking of road and rail routes in order to compel the government to meet their demands is a sheer violation of the FDs which are generally not enforceable.

What are Fundamental Duties?

- The fundamental duties of citizens were added to the constitution by the 42nd Amendment in 1976, upon the recommendations of the Swaran Singh Committee.

- It basically imply the moral obligations of all citizens of a country and today, there are 11 fundamental duties in India, which are written in Part IV-A of the Constitution, to promote patriotism and strengthen the unity of India.

- The FDs obligate all citizens to respect the national symbols of India, including the constitution, to cherish its heritage, preserve its composite culture and assist in its defence.

- They also obligate all Indians to promote the spirit of common brotherhood, protect the environment and public property, develop scientific temper, abjure violence, and strive towards excellence in all spheres of life.

Judicial interpretation of FDs

- The Supreme Court has held that FDs are not enforceable in any Court of Law.

- It ruled that these fundamental duties can also help the court to decide the constitutionality of a law passed by the legislature.

- There is a reference to such duties in international instruments such as the Universal Declaration of Human Rights and International Covenant on Civil and Political Rights, and Article 51A brings the Indian constitution into conformity with these treaties.

Total FDs

- Originally ten in number, the fundamental duties were increased to eleven by the 86th Amendment in 2002.

The 10 fundamental duties are as follows:

- To oblige with the Indian Constitution and respect the National Anthem and Flag

- To cherish and follow the noble ideas that inspired the national struggle for freedom

- To protect the integrity, sovereignty, and unity of India

- To defend the country and perform national services if and when the country requires

- To promote the spirit of harmony and brotherhood amongst all the people of India and renounce any practices that are derogatory to women

- To cherish and preserve the rich national heritage of our composite culture

- To protect and improve the natural environment including lakes, wildlife, rivers, forests, etc.

- To develop scientific temper, humanism, and spirit of inquiry

- To safeguard all public property

- To strive towards excellence in all genres of individual and collective activities

The 11th fundamental duty which was added to this list is:

- To provide opportunities for education to children between 6-14 years of age, and duty as parents to ensure that such opportunities are being awarded to their child. (86th Amendment, 2002)

Try this PYQ:

Which of the following is/are among the Fundamental Duties of citizens laid down in the Indian Constitution?

- To preserve the rich heritage of our composite culture

- To protect the weaker sections from social injustice

- To develop the scientific temper and spirit of inquiry

- To strive towards excellence in all spheres of individual and collective activity.

Select the correct answer using the codes given below:

(a) 1 and 2 only

(b) Only 2

(c) 1, 3 and 4 only

(d) 1, 2, 3 and 4

Post your answers here.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PMFBY, Beed Model of Crop Insurance

Mains level: Crop insurance

Andhra Pradesh has decided to rejoin the crop insurance scheme Pradhan Mantri Fasal Bima Yojana (PMFBY) from the ongoing kharif season.

Why in news?

- Andhra Pradesh was one of six states that have stopped the implementation of the scheme over the last four years.

- The other five, which remain out, are Bihar, Jharkhand, West Bengal, Jharkhand, and Telangana.

What is PMFBY?

- The PMFBY was launched in February 2016. It is being administered by Ministry of Agriculture.

- It provides a comprehensive insurance cover against failure of the crop thus helping in stabilising the income of the farmers.

- It is implemented by general insurance companies.

Its functioning

- PMFBY insures farmers against all non-preventable natural risks from pre-sowing to post-harvest.

- Farmers have to pay a maximum of 2 per cent of the total premium of the insured amount for kharif crops, 1.5 per cent for rabi food crops and oilseeds as well as 5 per cent for commercial / horticultural crops.

- The balance premium is shared by the Union and state governments on a 50:50 basis and on a 90:10 basis in the case of northeastern states.

Farmers covered

- All farmers growing notified crops in a notified area during the season who have insurable interest in the crop are eligible.

- Earlier to Kharif 2020, the enrolment under the scheme was compulsory for following categories of farmers:

- Farmers in the notified area who possess a Crop Loan account/KCC account (called as Loanee Farmers) to whom credit limit is sanctioned/renewed for the notified crop during the crop season. and

- Such other farmers whom the Government may decide to include from time to time.

Risks covered under the scheme

- Comprehensive risk insurance is provided to cover yield losses due to non-preventable risks, such as Natural Fire and Lightning, Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane, Tornado.

- Risks due to Flood, Inundation and Landslide, Drought, Dry spells, Pests/ Diseases also will be covered.

- Post-harvest losses coverage will be available up to a maximum period of 14 days from harvesting for those crops which are kept in “cut & spread” condition to dry in the field.

- For certain localized problems such as loss/damage resulting from the occurrence of identified localized risks like hailstorm, landslide, and Inundation affecting isolated farms in the notified area would also be covered.

Why many states has opted out?

The opting-out states had mentioned several reasons:

- The scheme should be voluntary.

- States should be given options to choose the risks covered and the scheme should be universal.

- State should be given option to use their own database of E-crop, an application used by the state government to collect information about crops.

- Many state government wanted zero premium for farmers (meaning the entire premium should be paid by the government.

- The non-payment of the State Share of premium subsidy within the prescribed timelines as defined in the seasonality discipline lea to the disqualification of the State Government.

- The reason for West Bengal not implementing the PMFBY is purely “political” as it wants to implement the scheme without mentioning Pradhan Mantri in the name.

How was the scheme structured, and what has changed since?

- Initially, the scheme was compulsory for loanee farmers; in February 2020, the Centre revised it to make it optional for all farmers.

- Now states and UTs are free to extend additional subsidy over and above the normal subsidy from their budgets.

- In February 2020, the Centre decided to restrict its premium subsidy to 30% for unirrigated areas and 25% for irrigated areas (from the existing unlimited). Earlier, there was no upper limit.

- Food crops (cereals, millets and pulses); oilseeds; and annual commercial / annual horticultural crops are broadly covered under the scheme.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now