Central Idea

- Indian Prime Minister Narendra Modi’s visit to Papua New Guinea (PNG) has strategic importance as it marks the Third Forum for India-Pacific Islands Cooperation (FIPIC), which India is co-hosting along with PNG in Port Moresby. India’s involvement with the region is crucial from a geostrategic perspective as it is viewed by the US as a means to counter China in the Indo-Pacific. In this context, India is gradually tuning itself towards the Pacific Island Countries (PICs) by building development partnerships on critical issues.

Forum for India-Pacific Islands Cooperation (FIPIC)

- The Forum for India-Pacific Islands Cooperation (FIPIC) is a multilateral grouping that aims to enhance India’s relations with the Pacific Islands region. It was launched in November 2014 during Indian Prime Minister Narendra Modi’s visit to Fiji.

- The FIPIC includes 14 Pacific Island countries, namely Cook Islands, Fiji, Kiribati, Marshall Islands, Micronesia, Nauru, Niue, Palau, Papua New Guinea, Samoa, Solomon Islands, Tonga, Tuvalu, and Vanuatu.

- The forum serves as a platform for India to engage with the Pacific Island countries on issues such as climate change, renewable energy, disaster management, health, and education, among others.

- The forum also provides an opportunity for India to strengthen its strategic presence in the Indo-Pacific region and counter China’s growing influence in the region.

Why should India focus on Pacific Island Countries (PICs)?

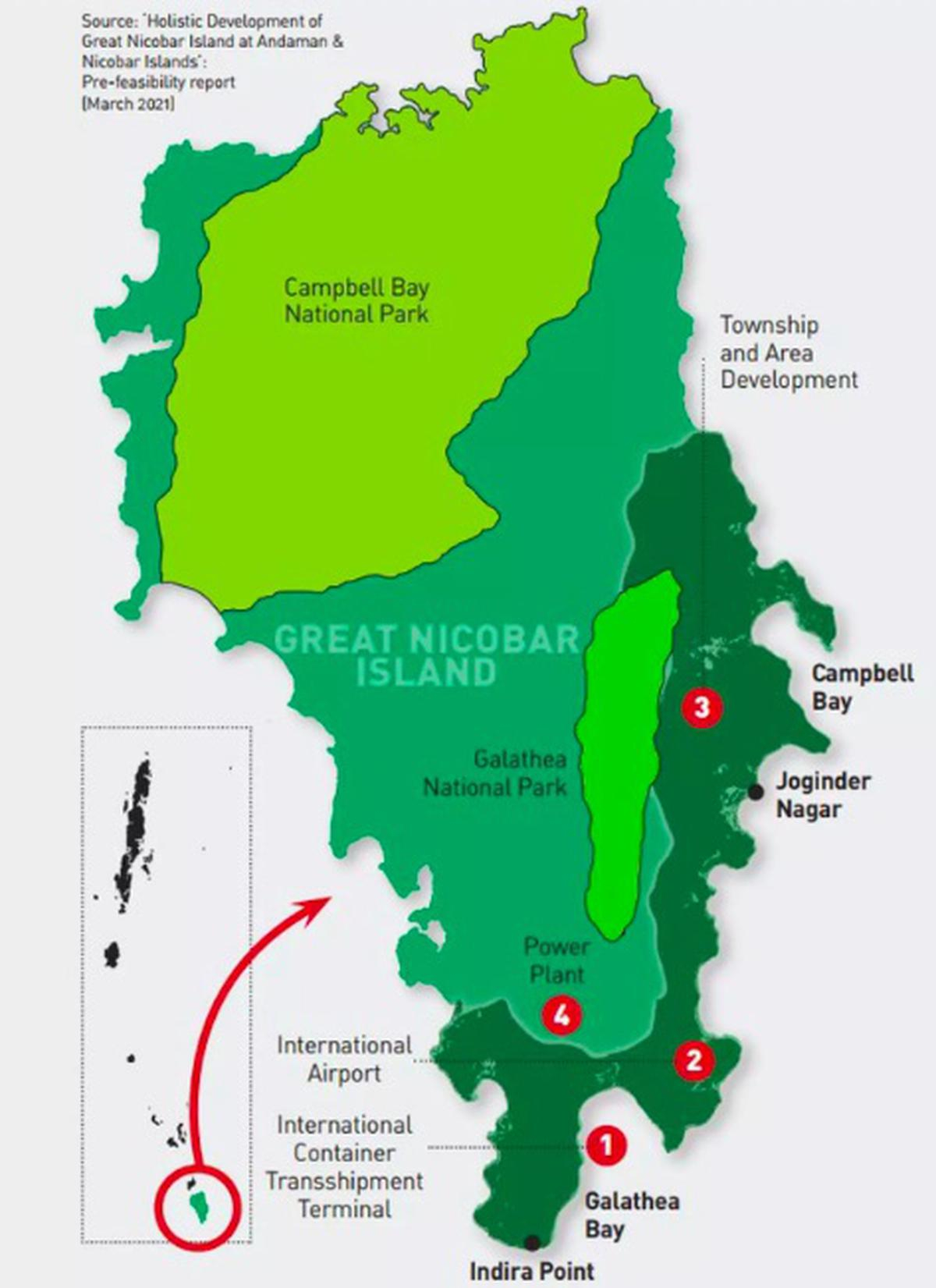

- Strategic location: The PICs are strategically located in the South Pacific and inhabit almost one-sixth of the world’s population. These islands have occupied common spheres of influence and interest for major superpowers like the US, France, Japan, Australia, and the United Kingdom (UK).

- Resource-rich region: The PICs are inherently resource-rich in natural minerals and hydrocarbons. They are known for massive biodiversity, diverse ocean life, and extensive mangroves.

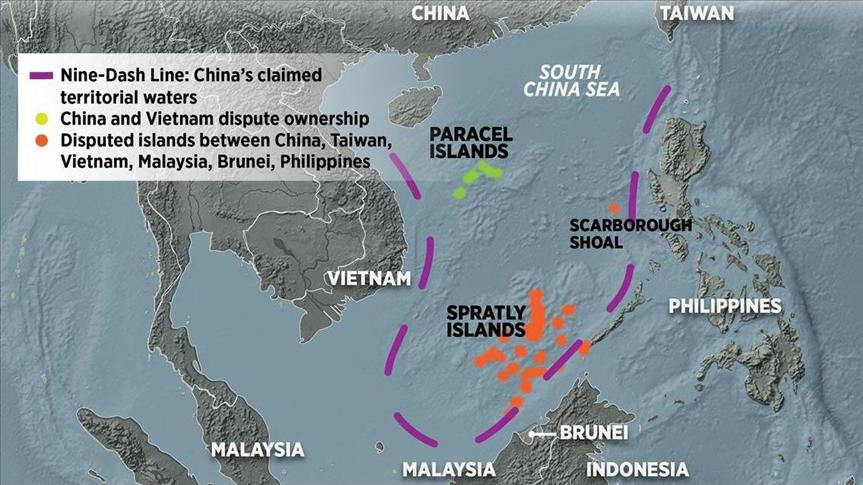

- Countering China: China’s foray into the region in the form of resource extraction, increasing naval presence in the South China Sea, and investments under the Belt and Road Initiative (BRI) has unnerved the neighbourhood. India’s engagement with the Pacific nations is viewed by the US as a means to counter China in the Indo-Pacific.

- Diplomatic importance: India’s engagement with the PICs is significant for diplomatic reasons, as it can increase India’s influence in the Indo-Pacific region. India’s foreign policy considerations are progressively being structured around the notion of diplomacy for development. This India Way of foreign policy fits well for the larger Global South.

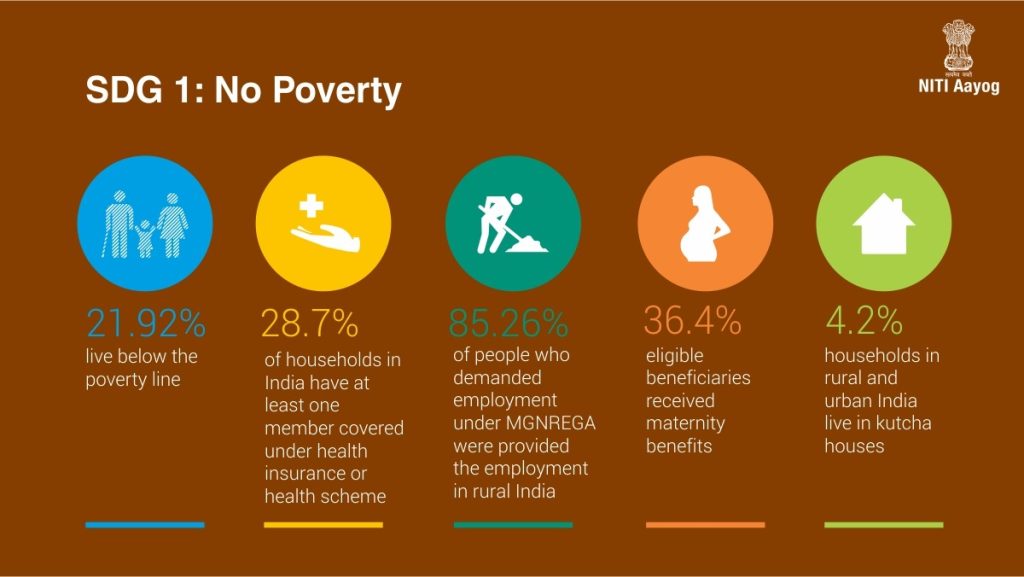

- Development partnerships: India can build development partnerships with PICs on critical issues including climate resilience, digital health, renewable energy, and disaster risk reduction.

- Economic opportunities: The PICs offer economic opportunities for India, especially in the areas of green transition and climate change, technology transfer, capacity building, encouraging trade and commerce, etc.

Facts for prelims: PIC’s

| Region | Countries | Resources | Strategic Importance | Physical Location |

| Melanesia | Fiji, Papua New Guinea, Solomon Islands, Vanuatu | Minerals, timber, fish, gold, copper, oil, gas | Natural resources, biodiversity, proximity to shipping lanes | 1°N to 14°S, 124°E to 168°E |

| Micronesia | Federated States of Micronesia, Kiribati, Marshall Islands, Nauru, Palau | Fish, phosphate, coconut products | Strategic military location, control of the Pacific Ocean, climate change impacts | 1°N to 11°N, 130°E to 176°E |

| Polynesia | American Samoa, Cook Islands, French Polynesia, Niue, Samoa, Tonga, Tuvalu, Wallis and Futuna | Fish, forestry, agriculture, tourism | Tourism, cultural significance, strategic military location | 14°S to 27°S, 123°W to 162°E |

What is Development Diplomacy?

- Development diplomacy is a foreign policy approach that emphasizes cooperation and partnership on development issues with other countries as a means of achieving shared goals and promoting mutual interests.

- The focus is on building relationships with other nations based on shared values and common objectives, rather than on traditional notions of power and influence.

- Development diplomacy recognizes the interdependence of nations in an increasingly globalized world, and seeks to create win-win partnerships that benefit all parties involved.

key initiatives taken by India under Development diplomacy in Papua New Guinea (PNG)

- Line of Credit: India has offered a $100 million Line of Credit (LoC) to Papua New Guinea for infrastructure development.

- Climate resilience: India has partnered with PNG for a project aimed at developing climate-resilient agriculture. Under this project, Indian experts are sharing their expertise on climate-resilient agriculture practices and technology transfer.

- Healthcare: India has offered training for healthcare professionals in PNG, and has also provided medical equipment and supplies.

- Education: India has offered scholarships to students from PNG to study in India, as well as providing vocational training for PNG youth.

- Renewable energy: India has partnered with PNG to promote the use of renewable energy sources such as solar and wind power.

- Capacity building: India has provided training for PNG government officials in areas such as public administration, governance, and disaster management.

- Trade and commerce: India have sought to enhance trade and investment relations with PNG, including through the promotion of Indian businesses and the facilitation of PNG investment in India.

Conclusion

- India’s involvement with the Pacific Island Countries (PICs) is crucial from a geostrategic perspective, as it is viewed by the US as a means to counter China in the Indo-Pacific. India’s unique approach to development cooperation fits well for the larger Global South, and it can be a possible pathway for advancing Southern-driven partnerships in the PICs. With the G20 Presidency giving India leverage as an important economy in world politics, the FIPIC can be viewed as a suitable opportunity for New Delhi to realign itself in the emerging world order.

Mains Question

Q. What do you understand by mean Development diplomacy? Why India should increase its focus on pacific island countries?

Also read:

| The Small Island Developing States (SIDS) in Indian Ocean region (IOR) |