Note4Students

From UPSC perspective, the following things are important :

Prelims level: Short selling of stocks

Mains level: Stock prices volatility: Various causative factors

The stock exchanges have clarified that the Securities and Exchange Board of India (SEBI) was not considering any proposal regarding a ban on short selling to curb the ongoing volatility and equity sell-off.

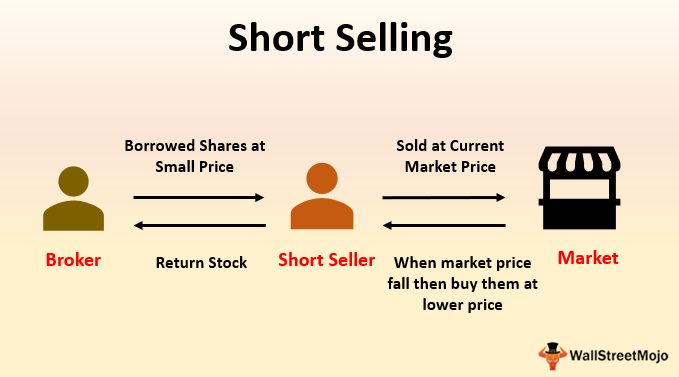

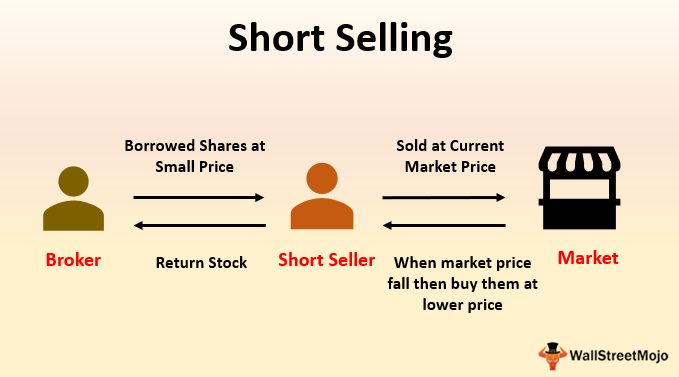

What is Short Selling?

- Short-selling allows investors to profit from stocks or other securities when they go down in value.

- In order to do a short sale, an investor has to borrow the stock or security through their brokerage company from someone who owns it.

- The investor then sells the stock, retaining the cash proceeds.

- The short-seller hopes that the price will fall over time, providing an opportunity to buy back the stock at a lower price than the original sale price.

- Any money left over after buying back the stock is profit to the short-seller.

When does short-selling makes sense?

- Most investors own stocks, funds, and other investments that they want to see rise in value.

- Over time, the stock market has generally gone up, albeit with temporary periods of downward movement along the way.

- For long-term investors, owning stocks has been a much better bet than short-selling the entire stock market.

- Sometimes, though, you’ll find an investment that you’re convinced will drop in the short term (as in case of COVID 19 outbreak).

- In those cases, short-selling can be the easiest way to profit from the misfortunes that a company is experiencing.

- Even though short-selling is more complicated than simply going out and buying a stock, it can allow making money when others are seeing their investment portfolios shrink.

The risks of short-selling

- Short-selling can be profitable when one makes the right call, but it carries greater risks than what ordinary stock investors experience.

- When we buy a stock, the most we can lose is what you pay for it. If the stock goes to zero, we suffer a complete loss, but will never lose more than that.

- By contrast, if the stock soars, there’s no limit to the profits one can enjoy. With a short sale, however, that dynamic is reversed.

Example:

- For instance, say you sell 100 shares short at a price of $10 per share. Your proceeds from the sale will be $1,000.

- If the stock goes to zero, you’ll get to keep the full $1,000. However, if the stock soars to $100 per share, you’ll have to spend $10,000 to buy the 100 shares back.

- That will give you a net loss of $9,000 — nine times as much as the initial proceeds from the short sale.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Various diseases mentioned and their vaccines

Mains level: Epidemics and their containment

India has witnessed widespread illnesses and virus outbreaks in parts of the country, including the SARS outbreak between 2002 and 2004. However, statistics show that they were nowhere as widespread as the COVID-19 that has now reached almost every part of the country and almost every country in the world.

What is an Epidemic?

- The WHO defines epidemics as “the occurrence in a community or region of cases of an illness, specific health-related behaviour, or other health-related events clearly in excess of normal expectancy.

- The community or region and the period in which the cases occur are specified precisely.

- The number of cases indicating the presence of an epidemic varies according to the agent, size, and type of population exposed, previous experience or lack of exposure to the disease, and time and place of occurrence.

- Epidemics are characterized by the rapid spread of the specific disease across a large number of people within a short period of time.

Epidemics in India

- Many Indian citizens born at the start of the 21st century have not fully witnessed or experienced circumstances surrounding the mass outbreak of epidemics.

- This is not to say however, that as a nation, India is completely unfamiliar with dealing with epidemics and public health crises, some with exceptional success such as:

1915-1926 — Encephalitis lethargica

- Encephalitis lethargica, also known as ‘lethargic encephalitis’ was a type of epidemic encephalitis that spread around the world between 1915 and 1926.

- The disease was characterized by increasing languor, apathy, drowsiness and lethargy and by 1919, had spread across Europe, the US, Canada, Central America and India.

- It was also called encephalitis A and Economo encephalitis or disease.

- Approximately 1.5 million people are believed to have died due to this disease.

1918-1920 — Spanish flu

- This epidemic was a viral infectious disease caused due to a deadly strain of avian influenza.

- The spread of this virus was largely due to World War I which caused mass mobilization of troops whose travels helped spread this infectious disease.

- In India, approximately 10-20 million people died due to the Spanish flu that was brought to the region a century ago, by Indian soldiers who were part of the war.

1961–1975 — Cholera pandemic

- Vibrio cholerae, one type of bacterium, has caused seven cholera pandemics since 1817.

- In 1961, the El Tor strain of the Vibrio cholerae bacterium caused the seventh cholera pandemic when it was identified as having emerged in Makassar, Indonesia.

- In a span of less than five years, the virus spread to other parts of Southeast Asia and South Asia, having reached Bangladesh in 1963 and India in 1964.

1974 — Smallpox epidemic

- According to WHO, smallpox was officially eradicated in 1980. The infectious disease was caused by either of the two virus variants Variola major and Variola minor.

- Although the origins of the disease are unknown, it appears to have existed in the 3rd century BCE.

- This disease has a history of occurring in outbreaks around the world and it is not clear when it was first observed in India. India was free of smallpox by March 1977.

1994 — Plague in Surat

- In September 1994, pneumonic plague hit Surat, causing people to flee the city in large numbers. Rumours and misinformation led to people hoarding essential supplies and widespread panic.

- This mass migration contributed to the spread of the disease to other parts of the country. Within weeks, reports emerged of at least 1,000 cases of patients afflicted with the disease and 50 deaths.

2002-2004 — SARS

- SARS was the first severe and readily transmissible new disease to have emerged in the 21st century.

- In April 2003, India recorded its first case of SARS, severe acute respiratory syndrome, that was traced to Foshan, China.

- Similar to COVID-19, the causative agent of SARS was a type of coronavirus, named SARS CoV that was known for its frequent mutations and spread through close person-to-person contact and through coughing and sneezing by infected people.

2014-2015 — Swine flu outbreak

- In the last few months of 2014, reports emerged of the outbreak of the H1N1 virus, one type of influenza virus, with states like Gujarat, Rajasthan, Delhi, Maharashtra and Telangana being the worst affected.

- By March 2015, according to India’s Health Ministry, approximately 33,000 cases had been reported across the country and 2,000 people had died.

2018 — Nipah virus outbreak

- In May 2018, a viral infection attributed to fruit bats was traced in the state of Kerala, caused by the Nipah virus that had caused illness and deaths.

- The spread of the outbreak remained largely within the state of Kerala, due to efforts by the local government and various community leaders who worked in collaboration to prevent its spread even inside the state.

- Between May and June 2018, at least 17 people died of Nipah virus and by June, the outbreak was declared to have been completely contained.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Herd Immunity

Mains level: Coronovirus outbreak and its mitigation

As Europe was declared the epicentre of the novel coronavirus outbreak last week, Britain announced a different strategy to tackle the situation. Officials said that Britain would contain the spread of the virus but would not suppress it completely to build up a degree of ‘herd immunity’.

Herd Immunity

- Herd immunity is when a large number of people are vaccinated against a disease, lowering the chances of others being infected by it.

- When a sufficient percentage of a population is vaccinated, it slows the spread of disease.

- It is also referred to as community immunity or herd protection.

- The decline of disease incidence is greater than the proportion of individuals immunized because vaccination reduces the spread of an infectious agent by reducing the amount and/or duration of pathogen shedding by vaccines, retarding transmission.

- The approach requires those exposed to the virus to build natural immunity and stop the human-to-human transmission. This will subsequently halt its spread.

Can it work?

- Globally, this strategy has been criticized.

- COVID-19 is a new virus to which no one has immunity. More people are susceptible to infection.

- The goal seems to have been delaying urgent action to allow an epidemic to infect large numbers of people.

- To combat COVID-19, there is an urgent need to implement social distancing and closure policies.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Unnat Bharat Abhiyan 2.0

Mains level: Various initiaitves for rural transformation

The Union Minister for Human Resource Development has informed Lok Sabha about the progress of the Unnat Bharat Abhiyan (UBA).

Unnat Bharat Abhiyan 2.0

- Unnat Bharat Abhiyan 2.0 is the upgraded version of Unnat Bharat Abhiyan 1.0.

- The scheme is extended to all educational institutes; however, under UBA 2.0 Participating institutes are selected based on the fulfilment of certain criteria.

About UBA

- It is a flagship programme of the Ministry of HRD, which aims to link the Higher Education Institutions with a set of at least 5 villages so that these institutions can contribute to the economic and social betterment of these village communities using their knowledge base.

- It is a significant initiative where all Higher Learning Institutes have been involved for participation in development activities, particularly in rural areas.

- It also aims to create a virtuous cycle between the society and an inclusive university system, with the latter providing knowledge base; practices for emerging livelihoods and to upgrade the capabilities of both the public and private sectors.

- Currently under the scheme UBA, 13072 villages have been adopted by 2474 Institutes.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: EPS Scheme

Mains level: Scope and benefits of EPS

The Union Ministry of Labour & Employment has informed about the total enrollments under EPS.

Employees Pension Scheme (EPS)

- EPS is a social security scheme that was launched in 1995 and is facilitated by EPFO.

- The scheme makes provisions for pensions for the employees in the organized sector after retirement at the age of 58 years.

- Employees who are members of EPFO automatically become eligible for EPS.

- Both employer and employee contribute 12% of employee’s monthly salary (basic wages plus dearness allowance) to the Employees’ Provident Fund (EPF) scheme.

- EPF scheme is mandatory for employees who draw a basic wage of Rs. 15,000 per month.

- Of the employer’s share of 12 %, 8.33 % is diverted towards the EPS.

Features of the 2020 Amendment

- EPS pensioners will get normal pension even after getting a reduced pension due to commutation.

- On retirement, if the employee opts for commutation of pension, a portion is paid as a lump sum based on the commutation factor while on the balance the pension begins.

- In simple terms, commutation means a lump sum payment in lieu of periodic payments of pension.

- In such a case, the amount of pension will be lower than the amount of pension without any commutation.

- The amendment seeks to restore the original amount of pension as per the commutation table, after 15 years equal to the same amount as it would have been without commutation.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 3- Is cryptocurrency solution to bad governance in the banking system in India?

Context

There’s an opportunity to stabilize the financial system and prevent a rival power from widening its lead.

The backdrop of YES bank failure time for cryptocurrency

- Perfect time for cryptocurrency: Confidence in the Indian financial system has been breaking down for some time. Instead of trying to restore trust, it may be time to require less of it — with the help of an official rupee cryptocurrency.

- The last straw: The collapse of corporate lender Yes Bank Ltd. was the last straw, which failed in slow motion in full view of authorities.

- Depositors have been assured that their $20 billion-plus in stuck funds will be released after a rescue by the government-controlled State Bank of India.

- What could be the impact on the sentiment of the people? While that may help prevent widespread panic, even temporarily stopping people from accessing their funds would mean that from now on, not all savings and current accounts will be treated by individuals and businesses as a perfect substitute for cash.

Why it would be costly and difficult to revive the public faith?

- It will be both difficult and costly to revive the public’s dwindling faith.

- Nationalisation not an option: A nuclear option is to nationalize the banks and non-bank finance firms that provide $1.75 trillion in annual funding. Doing so would be a doomed throwback to the late 1960s when India lurched toward stultifying socialist-style state controls.

- Corruption in banking won’t go away: Similarly, it would be unrealistic to assume that the Yes Bank embarrassment would trigger an improvement in the status quo.

- Deep crony-capital relationship: The crony-capital relationships between financiers and borrowers in India are steeped in its colonial history.

- Basel III won’t solve the problem: Putting on the gloss of Basel III capital requirements, which are supposed to make lenders less prone to failure, doesn’t make corruption in banking go away.

Can cryptocurrency be an answer?

- It offers hope: Blockchain technology, which the Indian establishment is trying to snuff out in finance, offers hope. Government should consider official crypto to obviate the need for trusted intermediaries, which are in short supply, anyway.

- China expected to launch digital currency: Before the coronavirus outbreak, China was widely expected to start its own central bank digital currency this year.

- But India’s need is greater, and its motivation very different from Beijing’s desire to shake the hegemony of the dollar.

- After the Yes Bank debacle and botched rescue, deposits in India will probably gravitate toward four or five large lenders, whose managers may be emboldened to make risky bets with other people’s money. The remaining banks will struggle for liquidity. A perennially unstable credit delivery network will always be one misstep away from the next blowup. While every country has its share of manias, panics and crashes, to be gripped by absolute financial mistrust every few years is not an environment where growth can flourish.

- Opportunity to think afresh: Earlier this month, India’s highest court set aside the Reserve Bank of India’s directive that asked banks to not offer services to cryptocurrency traders and exchanges.

- A legal defeat has provided the opportunity to think afresh.

- But in parallel, the government is considering a blanket ban on private virtual tokens. The crypto activity could get slammed again.

- Possibility of misuse: To be sure, one popular use of technology is money laundering.

- But to kill the industry and send practitioners packing would be to lose out on a valuable innovation at a time when India needs to build on the globally recognized successes of its digital payments industry, which has gained users’ trust just as banks and shadow banks have lost it.

Implications for deposit in the aftermath of Yes bank debacle

- Deposits may gravitate towards big banks: After the Yes Bank debacle and botched rescue, deposits in India will probably gravitate toward four or five large lenders, whose managers may be emboldened to make risky bets with other people’s money.

- The remaining banks will struggle for liquidity.

- Next blowup: A perennially unstable credit delivery network will always be one misstep away from the next blowup.

- Impact on growth: While every country has its share of manias, panics and crashes, to be gripped by absolute financial mistrust every few years is not an environment where growth can flourish.

Possible pathways for central banks digital currency

- Pathways suggested by BIS: After surveying 17 projects around the world — from Norway and Sweden to China, Cambodia and South Africa — the Bank for International Settlements (BIS) has identified four possible pathways for a central bank digital currency.

- Starting point- Rupee token: Of the pathways suggested by the BIS, a rupee token that doesn’t require the holder to have an account with anyone but has value guaranteed by the Reserve Bank of India could be a starting point.

- Who should enable the fund transfer? Cryptography (“I know a secret, therefore I own the funds”) rather than an account relationship (“I am who I say I am, therefore I own the funds”) would be used to enable transfers.

- Later, the RBI can open up the validation of transactions to authorized parties on distributed ledgers.

- What is the current system and issues with it? Currently, a deposit holder has to rely on everyone from the bank’s management and board to the auditors, the rating firms and the regulator to do their jobs.

- When they all fail, as in the case of Yes, the bank’s chequebook, ATM card, and online banking password cease to generate liquidity.

- Deposits stop being the same as cash, even if the state guarantees their safety.

- It would be far less painful if deposit owners only had to trust the RBI, not as a banking regulator but as a money-printing authority that could never run out of resources to settle its IOUs.

Conclusion

- China’s ambition challenge dollars position as a reserve currency: China wants the yuan to take over from the dollar as the world’s reserve currency. A tech-enabled global alternative to the greenback — of the kind that Facebook Inc.’s proposed Libra had threatened to be — would have been an obstacle. Hence, Beijing accelerated its tokenized currency initiative.

- India should jump the bandwagon: India needs to jump on the bandwagon for self-preservation. If the RBI doesn’t make easy-to-transact digital rupees available and leaves ordinary folks at the mercy of poorly run and supervised banks like Yes, people would rather store their wealth in Silicon Valley-sponsored tokenized money — or Beijing’s digital yuan — whenever they arrive.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 3- Role of agri-growth in inclusive growth and reforms in PDS.

Context

Last month, Montek Singh Ahluwalia’s book, Backstage: The Story Behind India’s High Growth Years, was released. Which tilt in favour of consumer in food policy reduces incentives for farmers, makes it difficult to unlock resources for growth.

What is covered in the book

- Besides some very interesting episodes pertaining to author’s personal and professional life, the book is full of useful insights into policy debates and their complexities.

- At many places, it provides evidence of the impact of these policies.

- This can be extremely useful as we try to rejuvenate the country’s sluggish economy and abolish poverty.

Inclusive growth and agriculture

- Growth in agriculture must for inclusive growth: During the UPA period, from 2004-05 to 2013-14, it was believed that inclusive growth is not feasible unless agriculture grows at about 4 per cent per year while the overall economy grows at about 8 per cent annually.

- The reason was simple: More than half of the working force at that time was engaged in agriculture and much of their income was derived from agriculture.

- But many political heavyweights, did not believe that agri-growth could reduce poverty fast enough.

- Main instrument of agricultural strategy: The main instrument of agricultural strategy was the Rashtriya Krishi Vikas Yojana (RKVY), which gave more leverage to states to allocate resources within agriculture-related schemes.

What was the impact of strategy?

- Agri-growth increased: The agricultural strategy, along with other infrastructure investments in rural areas, had a beneficial impact on agri-growth.

- Agri-growth increased from 2.9 per cent during the Vajpayee period (1998-99 to 2003-04) to 3.1 per cent during the UPA-1 period (2004-05 to 2008-09) and further to 4.3 per cent during UPA-2 (2009-10 to 2013-14).

- The agri-GDP growth during UPA-2 was driven not as much by RKVY as it was by high agri-prices in the wake of the global economic crisis of 2007-08.

- Impact on poverty reduction: Agri-GDP growth had a significant impact on poverty reduction, whichever way it was measured — the Lakdawala poverty line or Tendulkar poverty line, which is higher.

- At what rate poverty reduced? The rate of decline in poverty (headcount ratio), about 0.8 per cent per year during 1993-94 to 2004-05, accelerated to 2.1 per cent per year, and for the first time, the absolute number of the poor declined by a whopping 138 million during 2004-05 to 2013-14.

- Interestingly, this holds even on the basis of the international poverty line of $1.9 per capita per day (on 2011 purchasing power parity, PPP, also see graphs).

Right to food and debate around it

- Scepticism over the success of agriculture support to food subsidy: Instead of celebrating this success of the growth strategy in alleviation of poverty, several NGOs and even Congress stalwarts remained sceptical.

- They advocated food subsidy under the Right to Food Campaign.

- National Advisory Council (NAC) came up with a proposal to subsidise 90 per cent of people by giving them rice and wheat at Rs 3/kg and Rs 2/kg.

What were the arguments put forward by Montek Singh Ahluwalia?

- Burden on exchequer: He tried to convince them that this was likely to create an unsustainable burden on the exchequer.

- India could end up importing food: He also argued that India could end up importing grains to the tune of 13-15 million tonnes per year.

- Cap the population coverage at 40%: He favoured a cap at 40 per cent of the population to be covered under the Food Security Act as the poverty ratio (HCR) in 2011-12 was 22 per cent.

- Smart card to beneficiaries: He also favoured providing smart cards to the beneficiaries so that they could opt for buying more nutritious food rather than just relying on rice and wheat.

- Chance for diversification of agriculture: Smart card with beneficiaries would have also allowed diversification of agriculture and augmented farmers’ incomes.

- But he could not win over the NAC — although the coverage for food subsidy was reduced from the original proposal of 90 per cent to 67 per cent of the population.

- Against the ban on agri. export: Montek also argued against export bans on agricultural commodities as these impacted farmers’ incomes adversely.

- Government siding with consumers: But the government of the day often ended up taking the consumer’s side, as that was considered pro-poor.

- This reduced the incentives for farmers, who then had to be compensated by increasing input subsidies.

What are the result of this strategy adopted by the government?

- Negative PSE: No wonder, years later, when we estimated the producer support estimates (PSEs), as per the OECD methodology — used by countries that produce more than 70 per cent of the global agri-output — we found a deeply negative PSE.

- What negative PSE indicates? This indicates implicit taxation of agriculture through trade and marketing policies, even when one has accounted for large input subsidies going to farmers (see graph on PSE).

- Consumer bias in the system: Today, the food subsidy is the biggest item in the Union budget’s agri-food space. In the current budget, it is provisioned at Rs 1,15,570 crore.

- Borrowing by FCI not factored in: But this factor hides more than it reveals. Lately, the government has been asking the Food Corporation of India (FCI) to borrow from myriad sources, and not fully funding the food subsidy, which should logically be a budgetary item.

- The outstanding dues of the FCI are more than the provisioned subsidy, and if one adds these dues to the budgeted food subsidy, the effective amount of food subsidy comes to Rs 3,57,688 crore.

- This displays the consumer bias in the system.

Conclusion

- Restrict the population coverage of food subsidy: The Economic Survey of 2019-20 makes a case for restricting food subsidy to 20 per cent of the population — the headcount poverty in 2015 as per the World Bank’s $1.9/per capita per day (PPP) definition was only 13.4 per cent.

- For the others, the issue prices of rice and wheat need to be linked to at least 50 per cent of the procurement price or, even better, 50 per cent of the FCI’s economic cost.

- Unless we make progress on this front, it is difficult to unlock resources for the growth of agriculture, which slumped from 4.3 per cent during UPA-2 to 3.1 per cent during Modi 1.0.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 2- Strategies to deal with the COVID-19 pandemic.

Context

Currently, India has entered Stage 2 of the COVID 19 epidemic, but can we do something urgently to halt it before Stages 3 and 4, and prevent it from becoming another China or Italy? Let’s look at what COVID 19 is doing globally and what it has already done in India.

Nature and characteristics of COVID-19

- It belongs to a simple family of cold viruses: Coronavirus 19, which emerged from China but has now spread globally, belongs to a simple family of common cold viruses which look innocent and harmless, unlike the sinister flu.

- Footprints of similar epidemics: It has footprints of two similar epidemics: SARS (2002) and MERS (2012) apart from Ebola, which were contained well globally in the last two decades.

- They are the group of viruses: Coronaviruses are large groups of viruses seen in humans as well as animals like camels, bats, cats, and even cattle, which India should take note of.

- The current COVID 19 appears to be a bat-originated beta variant of the coronavirus.

- Who is the most vulnerable? The human COVID disease is fatal predominantly in elderly or vulnerable groups, such as people with a chronic disease like hypertension, diabetes, cancer or people with suppressed immune systems.

- How it is spread? It is spread via airborne droplets (sneeze or cough) or contact with the surface. It is possible that a person can get COVID-19 by touching a surface or an object that has the virus on it and then touching their own nose, eyes or mouth.

Susceptibility and the measures needed to contain the spread

- Mode of spread: The way virus spreads creates vulnerability and susceptibility of the spread of the virus through airborne droplets and contact surfaces — which are now, therefore, targets of public hygiene for preventing the spread.

- Why India is more vulnerable? We are vulnerable due to the large population constantly travelling and working: This needs immediate containment to halt the virus spread. We are a ticking time bomb now with less than 30 days to explode in Stage 3, which will be the virus getting deeper into communities, and which will then be impossible to contain.

- Poor public hygiene in India: Public hygiene in India is poor despite the “Swachh Bharat (Clean India)” movements. We need to have legislation with a penalty to stop spitting in public as well as private spaces.

- Past performance: India has done very well to contain both SARS and the novel Nipah viral spread very well.

Should India shut down the cities?

- From China to global spread: The COVID 19 virus possibly came from the Wuhan epicentre of central China. Subsequent it assumed a large enough proportion to be called a pandemic. It rapidly transitioned across different geographies of the world including Korea, Japan, Iran, Italy and others for the WHO to declare it as a pandemic.

- Neighbouring countries shutting down the cities: neighbouring countries like Thailand and Singapore shut down their major cities and towns for a few weeks to stop it from moving onto the next stages.

- Should India shut down the cities? The big question today is, should the Indian government and the state governments stop the virus spread from Stage 2 to 3 by totally shutting down cities and towns when the economy is already fragile and on the brink?

- From cluster to community spread: India had its first case diagnosed on January 30, from a student who returned from China. Later, it had a very slow spread despite the global transit involved. Such individual cases will become small clusters.

- These clusters will then spread to communities.

- We must halt the community-wide spread: Currently, we have just moved from case to clusters, but we must halt the community-wide spread.

- Biphasic or dual-phase infection: COVID 19 usually follows what is known as a biphasic or dual-phase infection, which means the virus persists and causes a different set of symptoms than observed in the initial bout.

- Also, sometimes, the recovered person can relapse.

- The possibility of “super spreader”: Currently, the cases and clusters in India are simple spreaders which means an infected person with normal infectivity.

- What is it? But COVID 19 can also have a “super spreader”, which means an infected person with high infectivity who can infect hundreds in no time.

- This was reportedly seen in Wuhan where a fringe group spread the virus via a place of worship in Korea, infecting almost 51 cases.

- India saw a mini spurt of cases on March 4, and then again between March 10 and 13, when cases jumped from 23 to 35, yet no super spreader was present.

- We need to halt transition from stage 2 to stage 3: Now we have almost crossed a hundred cases and we must be vigilant.

- As we enter Stage 2, we will now see a geometric jump in the number of cases which will put us at risk of rapidly transitioning from Stage 2 to 3 like Italy, which we need to halt urgently.

Conclusion

The ICMR has rightly advised the government to go into partial shutdown but is it too little too late now? It’s time to halt COVID 19 by smartly locking the country at home so that we can have a better tomorrow. This needs a political will which we currently have.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: SDRF/NDRF

Mains level: Coronovirus outbreak and its mitigation

The Ministry of Home Affairs has decided to treat COVID-19 as a notified disaster for the purpose of providing assistance under the State Disaster Response Fund (SDRF).

What is a Disaster?

According to the Disaster Management Act, 2005 a disaster is defined as-

- A catastrophe, mishap, calamity or grave occurrence in any area, arising from natural or manmade causes, or by accident or negligence which results in substantial loss of life or human suffering or damage to, and destruction of, property, or damage to, or degradation of, environment, and is of such a nature or magnitude as to be beyond the coping capacity of the community of the affected area.

- The MHA has defined a disaster as an “extreme disruption of the functioning of a society that causes widespread human, material, or environmental losses that exceed the ability of the affected society to cope with its own resources.

What is the State Disaster Response Fund?

- The SDRF is constituted under the Disaster Management Act, 2005 and is the primary fund available with state governments for responses to notified disasters.

- The Central government contributes 75 per cent towards the SDRF allocation for general category states and UTs, and over 90 per cent for special category states/UTs (which includes northeastern states, Sikkim, Himachal Pradesh and Uttarakhand).

- For SDRF, the Centre releases funds in two equal instalments as per the recommendation of the Finance Commission.

- The disasters covered under the SDRF include cyclones, droughts, tsunamis, hailstorms, landslides, avalanches and pest attacks among others.

The NDRF

The National Disaster Response Fund, which is also constituted under the Disaster Management Act, 2005 supplements the SDRF of a state, in case of a disaster of severe nature, provided adequate funds are not available in the SDRF.

Categories of disaster

- A High Power Committee on Disaster Management was constituted in 1999 to identify disaster categories.

- It identified 31 disaster categories organised into five major subgroups, which are: water and climate-related disasters, geological related disasters, chemical, industrial and nuclear-related disasters and biological related disasters, which includes biological disasters and epidemics.

Have there been such instances in the past?

- In 2018, in view of the devastation caused by the Kerala floods, political leaders in Kerala demanded that the floods be declared a “national calamity”.

- As of now, there is no executive or legal provision to declare a national calamity.

- In 2001, the National Committee on Disaster Management under then PM was mandated to look into the parameters that should define a national calamity.

- However, the committee did not suggest any fixed criterion.

- In the past, there have been demands from states to declare certain events as natural disasters, such as the Uttarakhand flood in 2013, Cyclone Hudhud in Andhra Pradesh in 2014, and the Assam floods of 2015.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Essential commodities

Mains level: Regulation of essential commodities

Following reports of shortage and irrational pricing of hand sanitisers and masks, the union government has declared these items “essential commodities” until the end of June. It has notified an Order under the Essential Commodities Act to declare these items as Essential Commodities up to 30th June, 2020 by amending the Schedule of the Essential Commodities Act, 1955.

Why such move?

- The coronavirus pandemic has triggered panic buying of masks and hand sanitisers at many places around the world, including in India.

- The government’s order has come in the wake of reports of a shortage of these commodities and a sudden and sharp spike in their prices, and the alleged hoarding of stocks by manufacturers.

What does the government’s declaration mean?

- The Essential Commodities Act provides, “in the interest of the general public, for the control of the production, supply and distribution of, and trade and commerce, in certain commodities”.

- The law was passed in 1955 to essentially protect consumers from unreasonable and exploitative increases in prices of commodities in times of shortage.

- It has been amended several times over the years, and made more stringent.

- Under the Act, the government can also fix the maximum retail price (MRP) of any packaged product that it declares an “essential commodity”.

What kinds of items or products are generally classified as essential commodities?

- The government has sweeping powers in this regard. The Act defines an “essential commodity” as simply “a commodity specified in the Schedule”.

- The Act empowers the central government to add new commodities to the list of Essential Commodities as and when the need arises, and to remove them from the list once the crisis is over or the situation improves.

- Over the years, a long list of items has been designated as essential commodities, including various drugs, fertilisers, cereals, pulses, sugar, edible oils, petroleum and petroleum products, and certain crops.

- In the present situation, the government can intervene to regulate the supply and pricing of masks and hand sanitisers, and also notify their stock-holding limits.

How do states and UTs implement these orders?

- They act on the notification issued by the Centre and implement the regulations.

- Anybody trading or dealing in the essential commodity, including wholesalers, retailers, manufacturers, and importers, is barred from stocking it beyond the specified quantity.

What if the retailers/traders/manufacturers do not comply?

- The purpose of designating any commodity as “essential” is to prevent profiteering at a time of extraordinary demand.

- Violators are, therefore, termed as illegal hoarders or black-marketeers who can be prosecuted.

- Besides penalties, the violation may lead to imprisonment for a maximum period of seven years.

- Agencies of state governments and UT administrations are empowered to conduct raids to catch violators.

- The government can confiscate excess stock hoarded by retailers/traders/manufacturers, and either auction it or sell it through fair-price shops.

Impact on Corona curbing

- It is important to note that the designation of masks and hand sanitisers as “essential commodities” does not mean that the government considers them to be ‘essential’, in the literal sense, in the fight against COVID-19.

- Doctors and health experts have underlined that the use of masks is helpful only if you have symptoms yourself, or if you are caring for someone who has symptoms.

- The infection is spreading mostly through infected surfaces — and masks, especially the cheap surgical ones, can’t actually block the virus out.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Excise duty

Mains level: Changes in taxation after GST regime

The Central levies on petrol and diesel were hiked amid sliding global crude oil prices. But the price of petrol and diesel registered a decline after oil companies further cut auto fuel prices in light of the substantial fall in global crude oil prices.

What is Excise Duty?

- Excise duty is a form of tax imposed on goods for their production, licensing and sale.

- It is the opposite of Customs duty in sense that it applies to goods manufactured domestically in the country, while Customs is levied on those coming from outside of the country.

- At the central level, excise duty earlier used to be levied as Central Excise Duty, Additional Excise Duty, etc.

- Excise duty was levied on manufactured goods and levied at the time of removal of goods, while GST is levied on the supply of goods and services.

Purview of excise duty

- The GST introduction in July 2017 subsumed many types of excise duty.

- Today, excise duty applies only on petroleum and liquor.

- Alcohol does not come under the purview of GST as exclusion mandated by constitutional provision.

- States levy taxes on alcohol according to the same practice as was prevalent before the rollout of GST.

- After GST was introduced, excise duty was replaced by central GST because excise was levied by the central government. The revenue generated from CGST goes to the central government.

Types of excise duty in India

Before GST kicked in, there were three kinds of excise duties in India.

Basic Excise Duty

- Basic excise duty is also known as the Central Value Added Tax (CENVAT). This category of excise duty was levied on goods that were classified under the first schedule of the Central Excise Tariff Act, 1985.

- This duty was levied under Section 3 (1) (a) of the Central Excise Act, 1944. This duty applied on all goods except salt.

Additional Excise Duty

- Additional excise duty was levied on goods of high importance, under the Additional Excise under Additional Duties of Excise (Goods of Special Importance) Act, 1957.

- This duty was levied on some special category of goods.

Special Excise Duty

- This type of excise duty was levied on special goods classified under the Second Schedule to the Central Excise Tariff Act, 1985.

- Presently the central excise duty comprises of a Basic Excise Duty, Special Additional Excise Duty and Additional Excise Duty (Road and Infrastructure Cess) on auto fuels.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Torreites sanchezi, Leap Year

Mains level: Evolution in the spin of earth and various factors affecting it

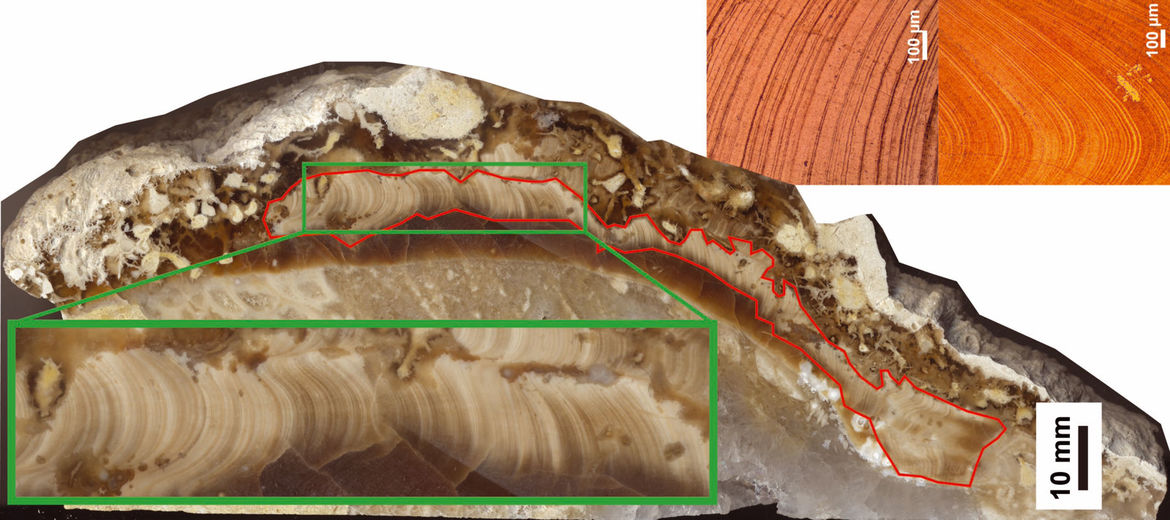

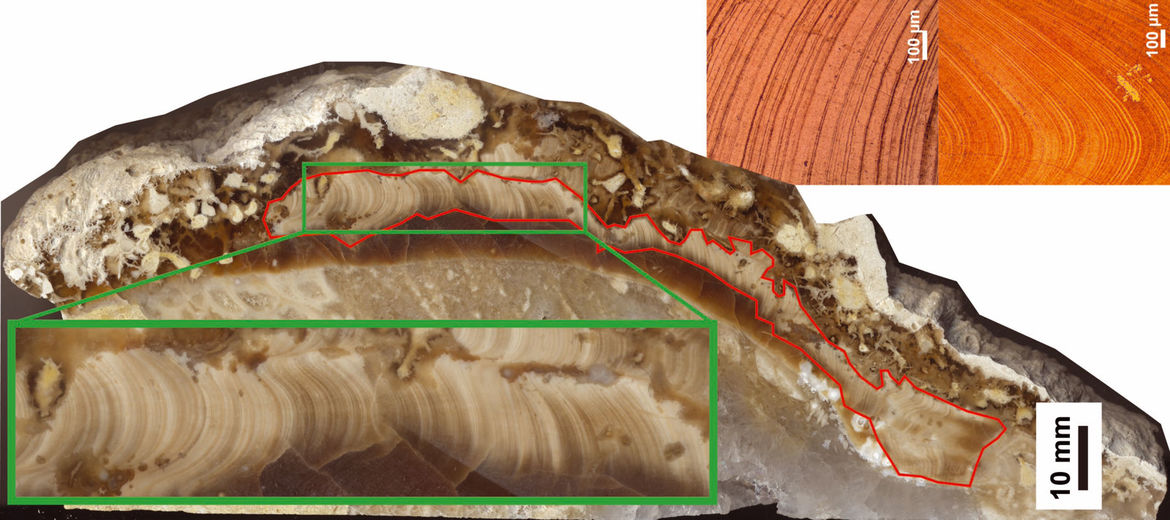

Earth spun 372 times a year 70 million years ago, compared to the current 365. This means the day was 23½ hours long, compared to 24 today.

Faster Earth in the olden days

- It has long been known that Earth’s spin has slowed over time.

- Previous climate reconstructions, however, have described long-term changes over tens of thousands of years.

- The new study looked at daily and annual variations in the mollusc shell.

About the Mollusc

- A mollusc is an invertebrate of a large phylum which includes snails, slugs, mussels, and octopuses. They have a soft unsegmented body and live in aquatic or damp habitats, and most kinds have an external calcareous shell.

- The ancient mollusc, Torreites Sanchez, belonged to an extinct group called rudist clams.

- At 70 million years ago, it belonged to the Late Cretaceous — it was around the time this epoch ended, some 65 million years ago, that dinosaurs went extinct.

How did researchers conclude this variation?

- Torreites sanchezi grew very fast, laying down daily growth rings.

- Using lasers on a single individual, scientists sampled tiny slices and counted the growth rings accurately.

- This allowed them to determine the number of days in a year 70 million years ago, and more accurately calculate the length of a day.

Significance of the research

- It is important to note that the period of Earth’s orbit has remained the same. In other words, one year 70 million years ago was as long as one year today.

- However, if there were a calendar then, the year would have been 372 “days” long, with each “day” half-an-hour shorter than one day today.

- Today, Earth’s orbit is not exactly 365 days, but 365 days and a fraction, which is why our calendars have leap years, as a correction.

The Moon’s retreat

- Friction from ocean tides, caused by the Moon’s gravity, slows Earth’s rotation and leads to longer days.

- And as Earth’s spin slows the Moon moves farther away at 3.82 cm per year.

- If this rate is projected back in time, however, the Moon would be inside the Earth only 1.4 billion years ago.

- This new measurement, in turn, informs models of how the Moon formed and how closes it has been to Earth over their 4.5-billion-year gravitational relationship.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: SIRT1

Mains level: NA

A study by researchers from the Tata Institute of Fundamental Research, Mumbai (TIFR) has revealed that glucose in the body controls the function of SIRT1 enzymes directly.

What is SIRT1?

- SIRT1 is an enzyme that deacetylates (removal of acetyl) proteins which contribute to cellular regulation.

- A shortage or absence of the control by glucose may lead to a diabetic-like state, while excess feeding and sustained low levels of SIRT1 can lead to obesity and enhanced ageing.

- This information is expected to tackle lifestyle disorders and ageing-related diseases.

How do they function?

- In normal healthy individuals, SIRT1 protein levels are known to increase during fasting and decrease during the feed, which is essential to maintain a balance between glucose and fat metabolism.

- The glucose controls the functions of a protein SIRT1 which in turn maintains everyday feed-fast cycles and is also associated with longevity.

- The feed-fast cycle is a basic pattern and the metabolism-related to this is largely taken care of by the liver.

- Thus, the study shows that both over-activation and under-activation of SIRT1 can lead to diseases.

- Glucose puts a check on the activity of SIRT1 in the fed state. In the absence of this check, SIRT1 activity increases and results in hyperglycemia in a fasted state, mimicking diabetic state.

- The constant feeding or high-calorie intake that leads to a sustained reduction in the levels of SIRT1 by glucose which is associated with ageing and obesity.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Ro-Pax Ferry

Mains level: Not Much

Mumbai – the first metropolitan city in India has introduced Ro-Pax service to its transport infrastructure. M2M1 Ferry Vessel has commenced operations between Mumbai and Mandwa.

Ro-Pax Ferry

- Ro-Pax Ferry is a ferry that combines the features of a cruise ship and a roll-on/roll-off service.

- This service has brought much to the relief of daily commuters, job seekers and holiday-goers travelling between Mumbai and Mandwa and also other parts of Alibaug.

- Ro-Pax service enables people to ferry along with their vehicles on board, between Mumbai and Mandwa.

- With this, Mumbai, Alibaug and the adjoining Konkan region will experience a boost in tourism, hinterland connectivity and also job opportunities.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 2- Indian diaspora and limits on its ability to influence.

Context

It is necessary for New India to look at the political choices of Indian migrants abroad through a more realistic lens.

Indian diaspora

- Largest diaspora and highest remittances: India has the world’s largest diaspora, about 17.5 million and receives the highest remittance of $78.6 billion from Indians living abroad (Global Migration Report 2020).

- Impact of the diaspora back home: Members of the diaspora, often seen as more “successful” and therefore more influential, can have a big impact on their relatives back home.

Certain wrong premises: The promise of the diaspora’s dual power is based on certain faulty premises.

1. Transferability of vote: To start with, the transferability of votes has not yet been proven conclusively.

-

- It is necessary and timely that the government re-analyses the benefits accrued from the diaspora’s political presence through a more realistic lens.

- One obvious reason is that the Indian community isn’t large enough to make a difference in the voting patterns in any of these countries.

- The second is that the population that comes out for the rallies doesn’t represent the entire diaspora.

2. Not necessarily support the government: The second issue is that politically active members of the Indian diaspora don’t necessarily support the Indian government’s actions, and often because they are of Indian origin, hold the government in New Delhi to higher standards than they do others.

- Concern over CAA and Kashmir Issue: The U.S. House Foreign Affairs Committee Chairperson for Asia, Ami Bera, voiced his concerns quite plainly about Kashmir and Citizenship (Amendment) Act (CAA) during a visit to India last month.

- Criticism of the government actions: The sponsor of the U.S. House resolution on Kashmir (HR745) Pramila Jayapal; co-chair of U.S. Presidential candidate Bernie Sanders’s campaign Ro Khanna; and former presidential contender Kamala Harris, have all been openly critical of the government’s actions.

What should the government do? The conclusion for the government is that it cannot own only that part of the diaspora that supports its decisions, and must celebrate the fact that members of the Indian diaspora, from both sides of the political divide, are successful and influential.

3. Diaspora as a factor in bilateral relation: The government must ensure that its focus on the diaspora doesn’t become a factor in its bilateral relations.

- While it is perfectly legitimate and laudable to ensure the safety and well-being of Indian citizens in different parts of the world, it must tread more lightly on issues that concern foreign citizens of Indian origin.

4.Introduction of India’s internal politics:

- The introduction of India’s internal politics into this equation is another new angle, one that led the British Foreign Office to remonstrate with India about interference last December.

- Politically affiliated Indian diaspora chapters are now also playing old India-Pakistan fault-lines amongst immigrants, which in the past were fuelled by Pakistani agencies.

- In California primaries this month, local “Hindu-American” groups protested against Democratic candidates like Ro Khanna for joining the Congressional Pakistan caucus and for criticising New Delhi’s actions.

5. Impact on diaspora:

- Conflating POI with citizens of India: The government must consider the impact that policies conflating the PIOs with Indian citizens could have on the diaspora itself.

- Ability to assimilate: Most immigrant Indian communities have been marked by their ability to assimilate into the countries they now live in.

- Much of that comes from a desire to be treated as equal citizens, not as immigrants, while a few also have bad memories of anti-immigrant sentiments in the 1960s and 1970s in Europe and the U.S. when they were targeted and accused of “divided loyalties”.

Conclusion

Laying claim to diasporas kinship and culture and taking pride in their success is one thing. It would be a mistake to lay claim to their politics, however.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Mains level: Paper2- India has shown that it has political will, technical capacity and financial resource to control the infectious diseases it need to marshal these resou.rce to eradicate TB

Context

India needs to take TB at the same level of seriousness at which it is dealing with the Covid-19.

Contrast and between the response

- Tuberculosis in India: Indians will still have to contend with other deadly respiratory tract infections which spread via airborne transmission. We will still have to contend with one particular bug which kills millions of us and which has been around for millennia. Tuberculosis.

- But all comparisons between COVID-19 and TB end with the superficial observation that they are both deadly respiratory tract infections.

- Speedy tackling of COVID-19: COVID-19 began its march through humankind barely half a year ago and, in record time, scientists have identified the virus and hundreds of millions of dollars have been allocated to controlling its spread, developing vaccines (at last count, more than a dozen candidates) and testing medication regimens for those infected.

- Waning of the epidemic: While the virus has spread to over 100 countries, the epidemic already shows signs of waning in the Asian countries where it hit first and hardest.

Response to the TB

- How long has the TB infected us? On the other hand, TB is as old as humanity itself, infecting us for at least 5,000 years.

- The infecting agent, a bacterium, was identified way back in 1882, by Robert Koch, signalling one of the landmark discoveries which laid the foundation of modern medicine.

- How was the response to TB? The subsequent response to this disease, which was infamously called the White Plague and was a leading cause of death globally at the start of the 20th century, is similar to what we see today for COVID-19, but played out over decades rather than months.

- Measures taken: TB was made a notifiable disease, campaigns were launched to prohibit spitting and containment policies, including sequestering infected persons, were implemented.

- The first vaccine was produced over a hundred years ago, and the first curative treatments available by the 1950s.

- Divide between rich and poor in TB infections: TB was largely beaten in the rich world, not only because of these medical miracles but also thanks to the dramatic reduction in poverty and improvement in living standards.

- There is compelling evidence that addressing these social determinants was even more impactful than medical interventions in the war against TB.

- The disease of squalor: TB has always been, and this is even more true now than ever before, a disease of poverty and squalor. And no country is more affected than India.

- Every TB statistic is grim:

- We are home to 1 in 4 of the world’s TB patients.

- Over 2.5 million Indians are infected.

- In 2018, over 4,00,000 Indians died of the disease.

- To put this in stark perspective, more people died of TB in India last week than the entire global death toll of COVID-19 to date.

- Contrast with the response to COVID-19: Given our urgent, energetic and multifaceted response to the latter Covid-19, one is left wondering why we have failed so miserably for another bug, particularly one which has been around for so long, which has been exquisitely studied and characterised, which is preventable and treatable, and which most of the world has conquered.

Why TB has not been given such attention?

- It is because those who suffer from TB are not likely to be boarding international flights or passing through swanky airports to attend conferences.

- It is because TB infects people in slower tides, slow enough for industries to replace the sick with healthier recruits without endangering the bottom line.

- It is because TB does not threaten the turbines that keep the global economy throbbing.

- It is because TB no longer poses a threat to rich and powerful countries.

- It is because those who have TB live on the margins and have little political influence.

- It is because TB control requires society to address the squalid environments, which shroud the daily lives of hundreds of millions of Indians.

- It is because TB is a medieval scourge that reminds us of our shameful failure to realise a just, humane and dignified life for all our people.

Conclusion

If there is one lesson from COVID-19, it is that India, and the global community, has the political will, technical capacity and financial resources to act in a committed and concerted way to control infectious diseases. It needs to marshal these assets to eradicate TB, the most pernicious and pervasive infection of all, both through addressing its social determinants and scaling up effective biomedical interventions. But, for this to happen, we will have to be as concerned about the health needs of those who travel by foot and bicycle as we do for those who board cruise ships and international flights.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much.

Mains level: Paper 3-How IBC has fared so far?

Context

The IBC has started emerging stronger as it delivered on its promise, passed the constitutional muster, earned global recognition and became the preferred option for stakeholders in case of default.

Demystifying the myths surrounding IBC

Myths about recovery:

Most of the myths surround recovery. Consider the following example for quick appreciation.

- M/s. Synergies Dooray was the first company to be resolved under the IBC. It was with the Board of Industrial and Financial Reconstruction (BIFR) for over a decade.

- The realisable value of its assets was Rs 9 crore when it entered the IBC process. It, however, owed Rs 900 crore to the creditors.

- How much did IBC recover? The resolution plan yielded Rs 54 crore for them.

- Some condemned IBC because the resolution plan yielded a meagre 6 per cent of the claims of the creditors, disregarding the fact that they recovered 600 per cent of the realisable value of the company, which had been in the sick bed for over a decade.

- If the company was liquidated, assuming no transaction costs, the creditors would have got at best Rs 9 crore — 1 per cent of their claims.

The myth that recovery under IBC is dismal

- Let’s examine the myth that the recovery through resolution plans is dismal.

- Two hundred companies had been rescued till December 2019 through resolution plans.

- They owed Rs 4 lakh crore to creditors. However, the realisable value of the assets available with them, when they entered the IBC process, was only Rs 0.8 lakh crore.

- The IBC maximises the value of the existing assets, not of the assets which do not exist. Under the IBC, the creditors recovered Rs 1.6 lakh crore, about 200 per cent of the realisable value of these companies.

- Why creditors had to take a haircut? Despite the recovery of 200 per cent of the realisable value, the financial creditors had to take a haircut of 57 per cent as compared to their claims. This only reflects the extent of value erosion that had taken place when the companies entered the IBC process.

- What is the conclusion? As compared to other options, banks are recovering much better through IBC, as per RBI data.

The myth that IBC is sending companies for liquidation:

-

- What is the primary objective of IBC: Recovery is incidental under the IBC. Its primary objective is rescuing companies in distress.

- More number of companies sent for liquidation: There is a myth that although the IBC process has rescued 200 companies, it has sent 800 companies for liquidation. The number of companies getting into liquidation is thus four times that of the companies being rescued.

- The context for the numbers: Numbers, however, to be seen in context. The companies rescued had assets valued at Rs 0.8 lakh crore, while the companies referred for liquidation had assets valued at Rs 0.2 lakh crore when they entered the IBC process.

- Looking from the value term angle: In value terms, assets that have been rescued are four times those sent for liquidation. It is important to note that of the companies rescued, one-third were either defunct or under BIFR, and of the companies sent for liquidation, three-fourths were either defunct or under BIFR.

The myth that IBC is resulting in huge job losses

- The next myth is that the IBC is resulting in huge job losses through liquidation. It is misconstrued that 600 companies — for which data are available and which have proceeded for liquidation — have assets (and consequently employment) at least equal to the aggregate claim of the creditors — Rs 4.6 lakh crore.

- Unfortunately, they have assets on the ground valued only at Rs 0.2 lakh crore.

- Take the examples of Minerals Limited and Orchid Healthcare Private Limited, which have been completely liquidated. They owed Rs 8,163 crore, while they had absolutely no assets and employment.

- What matters in this context is the assets a company has or the employment it provides — not how much it owes to creditors.

- The IBC process would release the idle or under-utilised assets valued at Rs 0.2 lakh crore, which would have dissipated with time, for business and employment.

- One also needs to consider the jobs saved through the rescue of 80 per cent of the distressed assets, and the job being created by these companies, post-rescue.

What changes IBC has brought?

- Changed the behaviour of debtors: A distressed asset has a life cycle. Its value declines with time if the distress is not addressed.

- The credible threat of the IBC process, that a company may change hands, has changed the behaviour of debtors.

- Debtors are settling debt at an early stage: Thousands of debtors are settling defaults at the early stages of the life cycle of a distressed asset.

- They are settling when the default is imminent, on receipt of a notice for repayment but before filing an application, after filing the application but before its admission, and even after admission of the application.

- These stages are akin to preventive care, primary care, secondary care, and tertiary care with respect to sickness. Only a few companies, who fail to address the distress in any of these stages, reach the liquidation stage.

- Value erosion at the liquidation stage: The value of the company is substantially eroded, and hence some of them would be rescued, while others are liquidated.

- The recovery may be low at this stage, but in the early stages of distress, it is much higher — primarily because of the IBC.

- The percentage of companies or distressed assets getting into liquidation is insignificant.

- Stakeholders should increasingly address the distress in the early stages and the best use of the IBC would be not using it all.

Conclusion

Stakeholders who understand business and have the backing of sophisticated professionals are using IBC with open eyes after evaluating all options. There is no reason to doubt their commercial wisdom. The 25,000 applications filed so far under IBC indicate the value and trust that stakeholders place on the law — the ultimate test of its efficacy.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

The stock markets in India are witnessing historic single-day falls with an increase in the number of COVID-19 cases. Since the indexes plunged more than 10 per cent each day earlier, a circuit breaker was triggered for the first time since 2009 halting trading.

What are circuit breakers?

- In June 2001, the SEBI implemented index-based market-wide circuit breakers.

- Circuit breakers are triggered to prevent markets from crashing, which happens when market participants start to panic induced by fears that their stocks are overvalued and decide to sell their stocks.

- This index-based market-wide circuit breaker system applies at three stages of the index movement, at 10, 15 and 20 per cent.

- When triggered, these circuit breakers bring about a coordinated trading halt in all equity and equity derivative markets nationwide.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Scientists have found the skull of a 99-million-year-old flying dinosaur that is tinier than the tiniest bird known to humans.

- The bird-like dinosaur was found stuck in a gob of tree resin that eventually hardened into amber, preserving it for millions of years to come.

- The fossil was dug up in 2016 from a mine in Myanmar. It was so slight; it likely weighed just 2 grams.

- The dinosaur skull holds around 100 sharp teeth, which hints at its ferocious nature despite its small size.

- It even had teeth in the back of its jaw, under its eye.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

The last two days, a number of states in India have enforced measures aimed at reducing public gatherings. This is called “social distancing”.

How does social distancing work?

- To stem the speed of the coronavirus spread so that healthcare systems can handle the influx, experts are advising people to avoid mass gatherings.

- Offices, schools, concerts, conferences, sports events, weddings, and the like have been shut or cancelled around the world, including in a number of Indian states.

- An advisory by the US Centers for Disease Control recommends social distancing measures such as: reducing the frequency of large gatherings and limiting the number of attendees; limiting inter-school interactions; and considering distance or e-learning in some settings.

What is the objective of such restrictions?

- Compared to deadlier diseases such as bird flu, or H5N1, coronavirus is not as fatal —which ironically also makes it more difficult to contain.

- With milder symptoms, the infected are more likely to be active and still spreading the virus.

- For example, more than half the cases aboard a cruise ship that has docked in California did not exhibit any symptoms.

- In a briefing on March 11, WHO officials said, “Action must be taken to prevent transmission at the community level to reduce the epidemic to manageable clusters.”

- The main question for governments is to reduce the impact of the virus by flattening the trajectory of cases from a sharp bell curve to an elongated speed-bump-like curve.

- This is being called “flattening the curve”. How does ‘flattening the curve’ help?

- Limiting community transmission is the best way to flatten the curve.

What was the curve like in China?

- The numbers show that the virus spread within Hubei exponentially but plateaued in other provinces.

- Some say it’s because many of these countries learnt from the 2003 SARS epidemic.

- Just as Chinese provinces outside of Hubei effectively stemmed the spread in February, three other countries —South Korea, Italy, and Iran — were not able to flatten the curve.

Flattening The Curve

- In epidemiology, the idea of slowing a virus’ spread so that fewer people need to seek treatment at any given time is known as “flattening the curve.”

- It explains why so many countries are implementing “social distancing” guidelines — including a “lockdown” order that affects 1.3 billion people in India, even though COVID-19 outbreaks in various places might not yet seem severe.

What is the curve?

- The “curve” researchers are talking about refers to the projected number of people who will contract COVID-19 over a period of time.

- To be clear, this is not a hard prediction of how many people will definitely be infected, but a theoretical number that’s used to model the virus’ spread. Here’s what one looks like:

- The curve takes on different shapes, depending on the virus’s infection rate.

- It could be a steep curve, in which the virus spreads exponentially (that is, case counts keep doubling at a consistent rate), and the total number of cases skyrockets to its peak within a few weeks.

- Infection curves with a steep rise also have a steep fall; after the virus infects pretty much everyone who can be infected, case numbers begin to drop exponentially, too.

- The faster the infection curve rises, the quicker the local health care system gets overloaded beyond its capacity to treat people.

- As we’re seeing in Maharashtra or Ahmedabad, more and more new patients may be forced to go without ICU beds, and more and more hospitals may run out of the basic supplies they need to respond to the outbreak.

- A flatter curve, on the other hand, assumes the same number of people ultimately get infected, but over a longer period of time.

- A slower infection rate means a less stressed health care system, fewer hospital visits on any given day and fewer sick people being turned away.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now