Note4Students

From UPSC perspective, the following things are important :

Prelims level: Asset Reconstruction Companies, SARFAESI Act, 2002;

Mains level: NA

Why in the News?

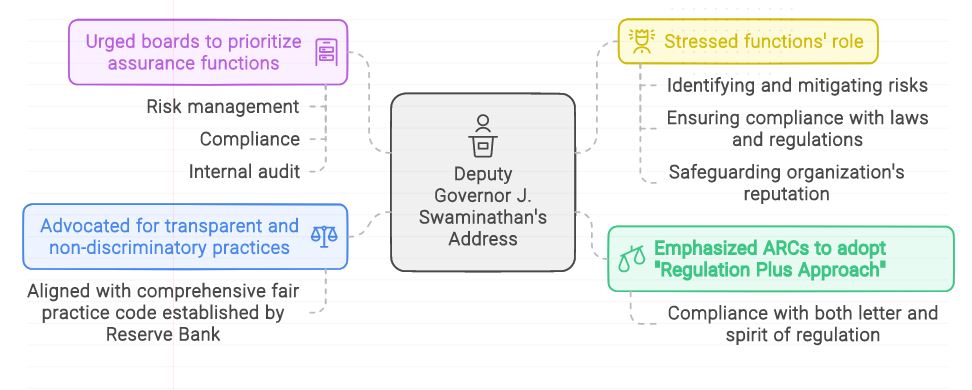

- After the allegations of ‘unethical practices’ by ARCs, including aiding defaulting promoters, the RBI intervened, with the Deputy Governor urging integrity and ethical conduct in their operations.

|

The new guidelines laid out by the RBI:

- Enhanced Capital Requirements:

- Minimum Capital Requirement Increase: ARCs are now mandated to maintain a minimum capital requirement of Rs 300 crore, a significant increase from the previous Rs 100 crore stipulation established on October 11, 2022.

- Transition Period for Compliance: Existing ARCs are granted a transition period to reach the revised Net Owned Fund (NOF) threshold of Rs 300 crore by March 31, 2026.

- Interim Requirement: However, by March 31, 2024, ARCs must possess a minimum capital of Rs 200 crore to comply with the new directives.

- Supervisory Actions for Non-Compliance:

- ARCs failing to meet the prescribed capital thresholds will face supervisory action, potentially including restrictions on undertaking additional business until compliance is achieved.

- Expanded Role for Well-Capitalized ARCs:

- Empowerment of Well-Capitalized ARCs: ARCs with a minimum NOF of Rs 1000 crore are empowered to act as resolution applicants in distressed asset scenarios.

- Investment Opportunities: These ARCs are permitted to deploy funds in government securities, scheduled commercial bank deposits, and institutions like SIDBI and NABARD, subject to RBI specifications. Additionally, they can invest in short-term instruments such as money market mutual funds, certificates of deposit, and corporate bonds commercial papers.

- Investment Cap: Investments in short-term instruments are capped at 10% of the NOF to mitigate risk exposure.

About Asset Reconstruction Company (ARC):

| Description | |

| About | ARC is a special financial institution that acquires debtors from banks at a mutually agreed value and attempts to recover the debts or associated securities. |

| Regulation |

(Note: For reading more details on SARFAESI Act you can visit on our article named “RBI asks for SARFAESI Act Compliance” of Sept 2023) |

| Objective | ARCs take over a portion of the bank’s non-performing assets (NPAs) and engage in asset reconstruction or securitization, aiming to recover the debts. |

| Functions |

|

| Foreign Investment | 100% FDI allowed in ARCs under the automatic route. |

| Limitiations |

|

| Working |

|

| Security Receipts | Issued to Qualified Institutional Buyers (QIBs) for raising funds to acquire financial assets. |

| Significance |

|

PYQ:[2018] With reference to the governance of public sector banking in India, consider the following statements:

Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024