From UPSC perspective, the following things are important :

Prelims level: UPI

Mains level: Paper 3- Examining the success of UPI

The UPI sets the template for India in its journey toward digitalisation. This article by WhatsApp head Will Cathcart explains the success story of UPI and the future scope to build on its success.

The success story of UPI

- The UPI system set a national open standard for all of India’s banks, more than 155 of which have adopted it.

- UPI is open standard that technology companies can adopt on an equal and level-playing field.

- This means that no one company, foreign or domestic, can write the rules for the other.

- Since its launch, the UPI system has grown to manage a 100 million-strong user base.

- NPCI has also set a goal to increase UPI’s user base to 500 million by 2022, which if achieved, would be a true game-changer for Digital India.

What the success of UPI means

- UPI has set important new frameworks around security and efficiency.

- Because of the strong rules that India has put in place, payment transaction information remains with the banks and within the country.

- And as a platform built on Indian technology and governed by Indian rules, UPI benefits Indians now and holds great potential for further innovation and commerce.

Future scope for UPI

- It is imperative more tech companies are able to leverage the power of UPI to expand the digital ecosystem to accelerate financial inclusion.

- UPI can also anchor a broader suite of fintech applications like micro-pensions, digital insurance products, and flexible loans.

- These are custom solutions created by Indian technology companies, on the public infrastructure of UPI.

- These solutions will first solve large social, business and financial problems in India and then become templates for other countries to deploy.

- COVID-19 has only underscored the importance of these tools that will serve as critical lifelines for small and micro-enterprises and individuals as they look to recover.

Consider the question “Within a short period from its launch the UPI has transformed the payment landscape in India. Examine the factors that contributed to the success of UPI and elaborate on its future scope.”

Conclusion

With courage, ambition, and boundless potential, India can emerge from this pandemic stronger than ever before — a leading democratic digital powerhouse that will lead the world in the 21st century.

B2BASICS

What is Unified Payments Interface (UPI)?

- It was launched in April 2016 and in the last two years, the platform has emerged as a popular choice among users for sending and receiving money.

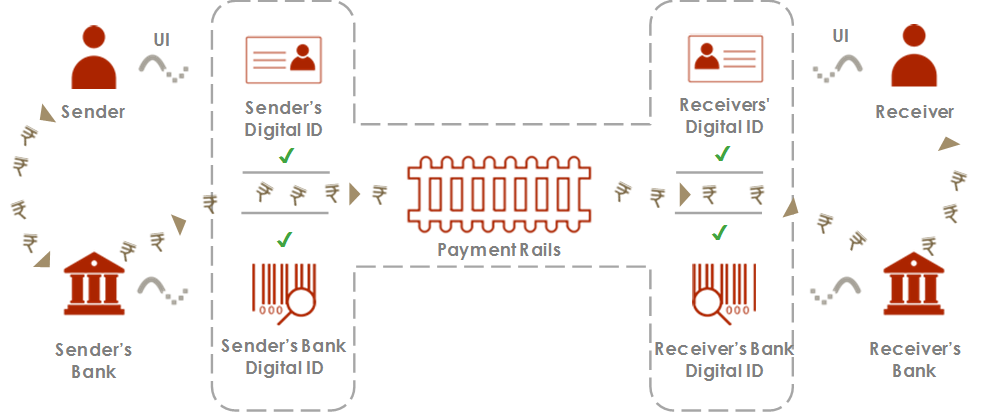

- UPI is a payment system that allows money transfer between any two bank accounts by using a smartphone.

- UPI allows a customer to pay directly from a bank account to different merchants, both online and offline, without the hassle of typing credit card details, IFSC code, or net banking/wallet passwords.

- It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

Original article:

https://indianexpress.com/article/opinion/columns/coronavirus-india-economy-poverty-digital-payment-bhim-upi-6533171/

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024