Note4Students

From UPSC perspective, the following things are important :

Prelims level: Inflation targeting mechanism

Mains level: Paper 3- Issues with the inflation targeting mechanism of the RBI

The article analyses the recent changes signalled by the RBI in its policymaking.

Changes in the economic policymaking

- Recently the U.S. Fed declared that the Fed will not let inflation stand in the way of maximising employment.

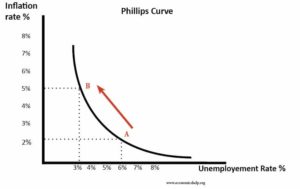

- The reason for this was that the Phillips Curve, the relationship between inflation and unemployment, may no longer hold in the U.S. economy.

- This is significant, given that the Anglo-American economics has been dominated by Phillips Curve.

Why there was need for change in inflation targeting

- Data show that the model that currently guides India’s inflation control strategy may be quite irrelevant.

- This is seen in the recent behaviour of inflation.

- We know that output contracted by more than 23% in the first quarter of this year.

- Despite this staggering decline the inflation rate did not change,

- This was contrary to experience that inflation reflects an ‘over heating’ economy, one growing too fast in relation to its potential.

- This view represents the RBI’s official understanding of inflation, and presumably forms the basis of its policy of inflation targeting.

- It was endorsed by the Government of India when it legislated the modern monetary policy framework to enable the RBI to pursue inflation targeting.

- If the Phillips Curve, which the RBI’s approach internalises, exists, inflation should have decreased as India’s economy contracted during the lockdown.

- The current inflation targeting mechanism had been imagined with developing economies in mind.

- Inflation targeting mechanism is based on the idea that food prices are an important determinant of inflation along with imported inflation.

- Accordingly, a macroeconomic contraction need not lower inflation.

Role of food prices in India

- A recent working paper of the RBI’s research department suggested that a more eclectic model than the one that underlies inflation targeting does a better job of forecasting inflation in India.

- This model accepts a role for food prices, a possibility that is missed when embracing economic models developed in the western hemisphere, where food prices have stopped trending upwards over half a century ago.

Conclusion

The RBI shifting away from its rigid inflation targeting policy is in tune with the time and signals that the central bank is finally alive to India’s economy.

Back2Basics: What is Philips Curve?

- The Phillips curve is an economic concept, stating that inflation and unemployment have a stable and inverse relationship.

- The theory claims that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment.

- However, the original concept has been somewhat disproven empirically due to the occurrence of stagflation in the 1970s, when there were high levels of both inflation and unemployment.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024