Note4Students

From UPSC perspective, the following things are important :

Prelims level: ECB

Mains level: Not Much

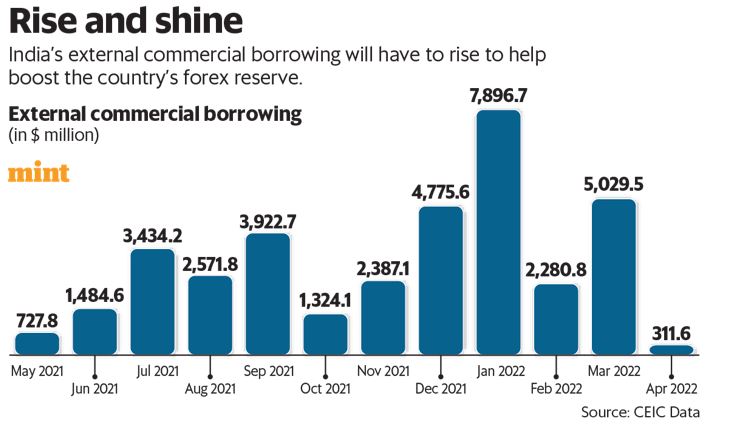

The Reserve Bank of India has relaxed norms for companies raising external commercial borrowings (ECBs), as part of a set of measures to stem the slide in the rupee.

What are ECBs taken by Indian companies?

- ECBs are commercial loans that eligible resident entities can raise from outside India, i.e. from a recognized non-resident entity.

- ECBs can be buyer’s credit, supplier’s credit, foreign currency convertible bonds, foreign currency exchangeable bonds, loans etc.

- ECBs can be raised via the automatic route where cases are examined by the Authorized Category Dealer, or the approval route where borrowers are mandated to forward their request to RBI through their authorized dealers.

- Borrowers must follow norms on minimum maturity period, maximum all-in-cost ceiling, end-uses etc.

What is the relaxation offered by the RBI?

- RBI earlier had raised borrowing limit under the automatic route from $750 million or its equivalent per financial year to $1.5 bn up till up to 31 December, 2022.

Why such move?

- The objective was to increase the supply of foreign exchange reserves.

- This in turn would thereby prevent the fast depreciation of the rupee witnessed over the last few months.

What clarity do foreign lenders want from RBI?

- Lenders want to know whether the investment grade needs to be rated by domestic or international agencies.

- If it is only by global agencies, it would limit the number of potential borrowers.

- This is because companies which might be rated high domestically might not necessarily have made the investment grade when rated by international agencies.

Why do Indian firms go for ECBs?

- Low cost: ECBs give companies the benefit of borrowing abroad at lower interest rates.

- Long term repayment: They are also an avenue to borrow a large volume of funds for a relatively long period of time.

- Surpassing exchange fluctuation: Also, borrowing in foreign currencies enables companies to pay for their machinery import etc., thereby nullifying the impact of varying exchange rate.

- Long term profitability: ECBs can help diversify the investor base and funds available at lower cost, helping improve profitability of companies.

- Better credit ratings: ECB interest rates are also a function of their ratings in the international market.

What are the risks for firms raising ECBs?

- Though companies get attracted to ECBs due to lower interest rates, the comfort level of the borrower depends on how stable the rate of exchange is.

- Depreciation of the rupee will raise debt servicing burden as compared to what has been worked out at the time of availing of the ECB facility.

- Thus, the companies might need to incur hedging costs (amount equal to the aggregate costs, fees, and expenses) to cover the exchange rate risk.

UPSC 2023 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024