Note4Students

From UPSC perspective, the following things are important :

Prelims level: Unified Pension Scheme (UPS)

Why in the News?

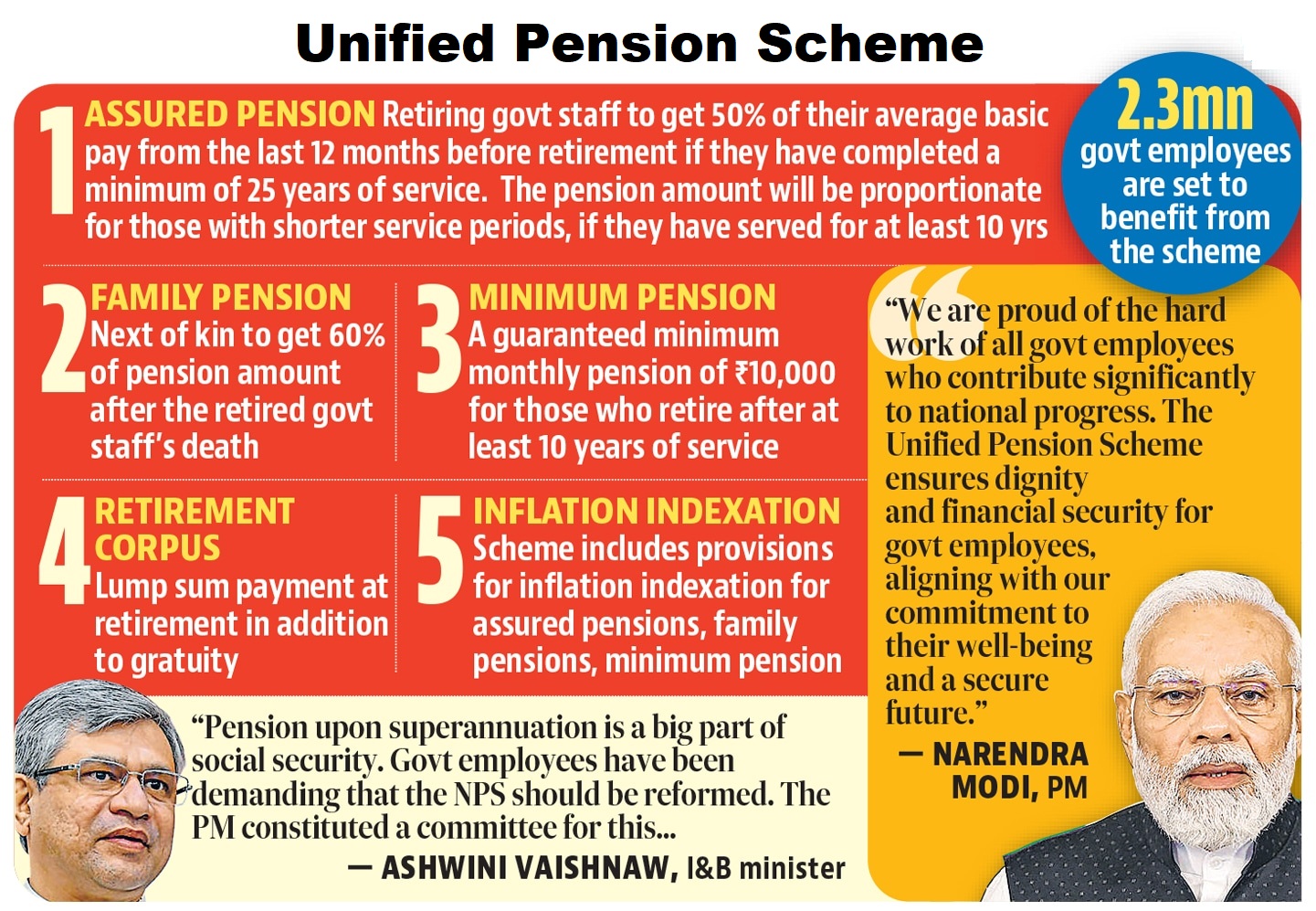

The Union Cabinet approved the Unified Pension Scheme (UPS) for 23 lakh central government employees.

About Unified Pension Scheme (UPS):

| Explanation | |

| Implementation Date | Effective from April 1, 2025. |

| Eligibility | Central government employees with at least 10 years of service. |

| Assured Pension |

|

| Assured Minimum Pension | ₹10,000 per month for employees with at least 10 years of service. |

| Assured Family Pension | 60% of the pension that the employee was drawing before their death. |

| Inflation Protection |

|

| Government Contribution | 18.5% of basic pay and DA, increased from 14% under the National Pension System (NPS). |

| Employee Contribution | 10% of basic pay and DA (same as under NPS). |

| Lump Sum Payment on Superannuation | One-tenth of the last drawn monthly pay (including DA) for every 6 months of completed service, in addition to gratuity. |

| Option to Choose | Employees can choose between UPS and NPS starting from the upcoming financial year; the choice is final once made. |

| Beneficiaries |

|

| Difference from NPS | Unlike the market-dependent NPS, UPS provides a guaranteed pension amount, a minimum pension, increased government contribution, fixed family pension, and a lump sum payment at superannuation. |

Significance of the UPS

- Financial Security: Guarantees a pension and family pension for stable post-retirement income.

- Minimum Pension: Ensures at least ₹10,000 per month for retirees, supporting lower-income employees.

- Inflation Protection: Indexes pensions to inflation, maintaining purchasing power over time.

- Increased Benefits: Raises government contribution to 18.5%, enhancing employee retirement benefits.

- Flexibility: Allows choice between UPS and NPS based on personal financial needs.

- Family Support: Provides 60% of the pension to the spouse if the employee passes away.

- Employee Welfare: Aligns with government goals to improve employee welfare and post-retirement life quality.

PYQ:[2017] Who among the following can join the National Pension System (NPS)? (a) Resident Indian citizens only. (b) Persons of age from 21 to 55 only. (c) All State Government employees joining the services after the date of notification by the respective State Governments. (d) All Central Government employees including those of Armed Forces joining the services on or after 1st April, 2004. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024