Dear Aspirants,

This Spotlight is a part of our Mission Nikaalo Prelims-2023.

You can check the broad timetable of Nikaalo Prelims here

Session Details

YouTube LIVE with Parth sir – 1 PM – Prelims Spotlight Session

Evening 04 PM – Daily Mini Tests

Telegram LIVE with Sukanya ma’am – 06 PM – Current Affairs Session

Join our Official telegram channel for Study material and Daily Sessions Here

10th Mar 2023

Inflation, Banking and Monetary Policy

Inflation

Understanding Inflation

Inflation: Inflation is when the overall general price level of goods and services in an economy is increasing. As a consequence, the purchasing power of the people are falling.

Inflation Rate: Inflation Rate is the percentage change in the price level from the previous period.

Inflation Rate= {(Price in year 2 – Price in year 1)/ Price in year 1} *100

Whole sale Price Index: WPI is used to monitor the cost of goods and services bought by producer and firms rather than final consumers. The WPI inflation captures price changes at the factory/wholesale level.

GDP Deflator: GDP Deflator is the ratio of nominal GDP to real GDP. The nominal GDP is measured at the current prices whereas the real GDP is measured at the base year prices.

The Difference

| Consumer Price Index | GDP Deflator |

| CPI reflects the price of goods and services bought by the final consumers. | GDP deflator reflects the price of all the goods and services produced domestically. |

| Example: Suppose the price of a satellite to be launch by ISRO increases. Even though the satellite is part of the GDP of India, but it is not a part of normal CPI index, since we don’t consume satellite. | The price rise of the ISRO satellite will be reflected in GDP deflator. |

| Similarly, India produces some crude oil, but most of the oil/petroleum is imported from the West Asia, as a result, when the price of oil/petroleum product changes, it is reflected in CPI basket as petroleum products constitute a larger share in CPI. | The price change of oil products is not reflected much in the GDP deflator since we do not produce much crude oil. |

| The CPI compares the price of a fixed basket of goods and services to the price of the basket in the base year. | The GDP deflator compares the price of currently produced goods and services to the price of the same goods and services in the base year. Thus, the group of goods and services used to compute the GDP deflator changes automatically over time. |

Producer Price Index

PPI measures the average change in the sale price of goods and services either as they leave the place of production or as they enter the place of production. Moreover, PPI includes services also.

The PPI measure the price changes from the perspective of the seller and differs from CPI which measures price changes from buyer perspective.

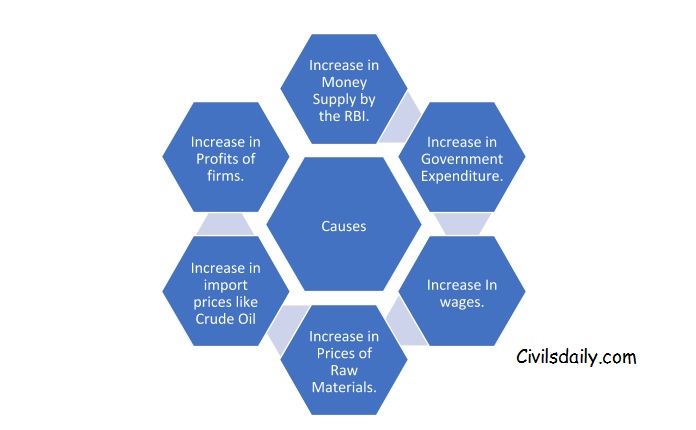

Causes of Inflation

Inflation is mainly caused either by demand Pull factors or Cost Push factors. Apart from demand and supply factors, Inflation sometimes is also caused by structural bottlenecks and policies of the government and the central banks. Therefore, the major causes of Inflation are:

- Demand Pull Factors (when Aggregate Demand exceeds Aggregate Supply at Full employment level).

- Cost Push Factors (when Aggregate supply increases due to increase in the cost of production while Aggregate demand remains the same).

- Structural Bottlenecks (Agriculture Prices fluctuations, Weak Infrastructure etc.)

- Monetary Policy Intervention by the Central Banks.

- Expansionary Fiscal Policy by the Government.

Demand and Supply factors can be further sub divided into the following:

Inflationary Gap: the Inflationary gap is a situation which arises when Aggregate demand in an economy exceeds the Aggregate supply at the full employment level.

Deflationary Gap: Deflationary Gap is a situation which arises when Aggregate demand in the economy falls short of Aggregate Supply at the full employment level.

Stagflation: The falling growth along with rising prices makes cost push inflation more dangerous than the demand-pull inflation. The situation of rising prices along with falling growth and employment is called as stagflation.

Hyperinflation: Hyperinflation is a situation when inflation rises at an extremely faster rate. The rate of inflation can increase from 50 times to 300 times. The major causes of the hyperinflation are; government issuing too much currency to finance its deficits; wars and political instabilities and unexpected increase in people’s anticipation of future inflation.

Structural Inflation

- Structuralist Inflation is another form of Inflation mostly prevalent in the Developing and Low-Income Countries.

- The Structural school argues that inflation in the developing countries are mainly due to the weak structure of their economies.

Deflation: Deflation is when the overall price level in the economy falls for a period of time.Deflation is when, for instance, the price of a basket of goods has fallen from Rs 100 to Rs 80. It’s the reduction in overall prices of goods.

Disinflation: Disinflation is a situation in which the rate of inflation falls over a period of time. Remember the difference; disinflation is when the inflation rate is falling from say 5% to 3%.

Headline versus Core Inflation

The headline inflation measure demonstrates overall inflation in the economy. Conversely, the core inflation measures exclude the prices of highly volatile food and fuel components from the inflation index.

Core inflation excludes the highly volatile food and fuel components and therefore represents the underlying trend inflation.

Banking and Monetary Policy

What is monetary policy?

As the name suggests it is policy formulated by monetary authority i.e. central bank which happens to be RBI in case of India.

It deals with monetary i.e money matters i.e. affects money supply in the economy.

Eg. CRR,SLR,OMO,REPO etc

What is fiscal policy then?

It is formulated by finance ministry i.e. government. It deals with fiscal matters i.e. matters related to government revenues and expenditure.

Revenue matters- tax policies, non tax matters such as divestment, raising of loans, service charge etc

Expenditure matters– subsidies, salaries, pensions, money spent on creation of capital assets such as roads, bridges etc.

Monetary policy and fiscal policy together deal with inflation.

Let us now understand how RBI formulates monetary policy to control inflation

It’s clear from what we have learnt so far that to control inflation, RBI will have to decrease money supply or increase cost of fund so that people do not demand goods and services.

Tools available with RBI

- Quantitative tools or general tools- they affect money supply in entire economy- housing, automobile, manufacturing, agriculture- everything.

They are of two types

- Cash Reserve Ratio (CRR)– as the name suggests, banks have to keep this proportion as cash with the RBI. Bank cannot lend it to anyone. Bank earns no interest rate or profit on this.Bank cannot lend it to anyone.

- Statutory Liquidity Ratio (SLR)- As the name indicates banks have to set aside this much money into liquid assets such as gold or RBI approved securities mostly government securities. Banks earn interest on securities but as yield on govt securities is much lower banks earn that much less interest.

RBI Tools for Controlling Credit/Money Supply

Broadly speaking, there are two types of methods of controlling credit.

Measure of Money Supply in India

| M1 | M2 | M3 | M4 |

| It is also known as Narrow Money. | It is a broader concept of the money supply. | It is also known as Broad Money. | M4 includes all items of M3 along with total deposits of post office saving accounts. |

| M1= C+DD+OD

C= Currency with Public. DD= Demand Deposit with the public in the Banks. OD= Other Deposits held by the public with RBI. |

M2= M1 + Saving deposits with the post office saving banks.

M1 is distinguished from M2 because the post office saving deposits are not as liquid as Bank deposits. |

M3 = M1+ Time Deposits with the Bank.

Time deposits serve as a store of wealth and represent a saving of the people and are not as liquid as they cannot be withdrawn through cheques or ATMs as compared to money deposited in Demand deposits. |

M4= M3+Total Deposits with Post Office Saving Organisations.

M4 however, excludes National Saving Certificates of Post Offices. |

| It is the most liquid form of the money supply. | M3 is the most popular and essential measure of the money supply. The monetary committee headed by late Prof Sukhamoy Chakravarty recommended its use for monetary planning in the economy. M3 is also called Aggregate Monetary Resource |