Public Private Partnership Models

PPP Model: Contracting

PPP Model: Build Operate Transfer

PPP Model: Design Build Finance Operate (DBFO) Concessions

PPP Model: Concessions

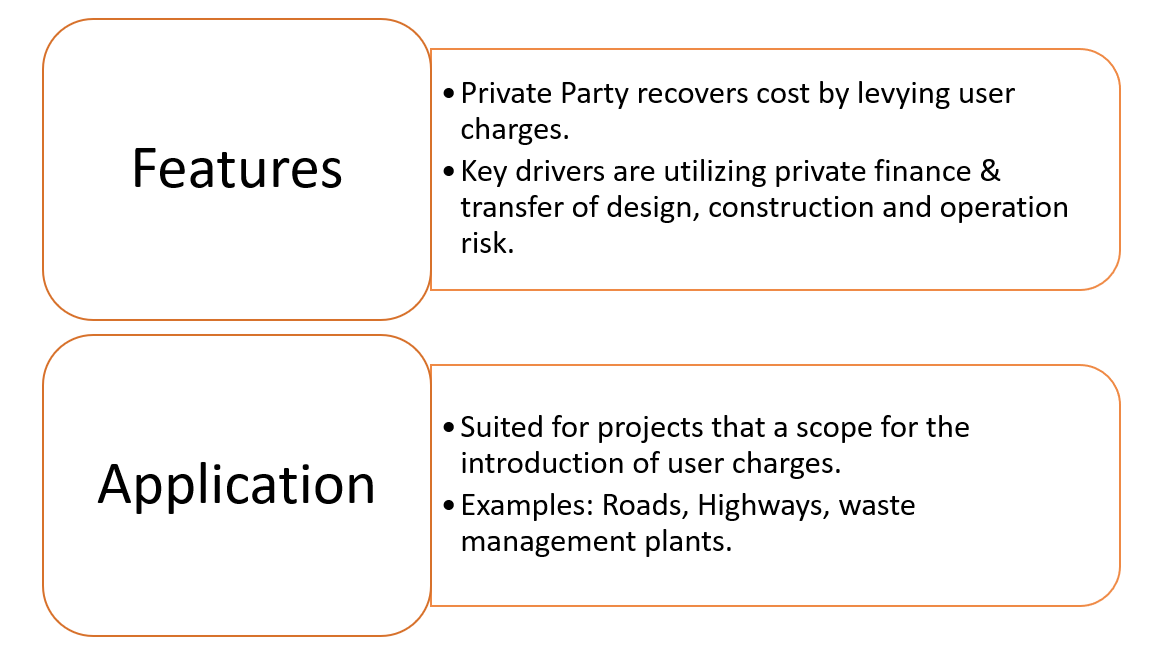

PPP Model: Private ownership of Asset

The private sector remains responsible for design, construction and operation of an infrastructure facility and in some cases the public sector may relinquish the right of ownership of assets to the private sector.

Three main types of PPP models with private ownership of assets:

Model: Build Operate Transfer.

The private sector builds, owns and operates a facility, and sells the product/service to its users or beneficiaries. This is the most common form of private participation in the power sector in many countries (examples are numerous).

For a BOO power project, the Government (or a power distribution company) may or may not have a long-term power purchase agreement (commonly known as off-take agreement) at an agreed price from the project operator.

In many respects, licensing may be considered as a variant of the BOO model of private participation. The Government grants licences to private undertakings to provide services such as fixed line and mobile telephony, Internet service, television and radio broadcast, public transport, and catering services on the railways. However, licensing may also be considered as a form of “concession” with private ownership of assets. Licensing allows competitive pressure in the market by allowing multiple operators, such as in mobile telephony, to provide competing services.

Why BOO may be beneficial?

- It is argued that by aggregating design, construction and operation of infrastructure services into one contract, important benefits could be achieved through creation of synergies.

- As the same entity builds and operates the services, and is only paid for the successful supply of services at a pre-defined standard, it has no incentive to reduce the quality or quantity of services.

- Compared with the traditional public sector procurement model, where design, construction and operation aspects are usually separated, this form of contractual agreement reduces the risks of cost overruns during the design and construction phases or of choosing an inefficient technology, since the operator’s future earnings depend on controlling costs.

- The public sector’s main advantages lie in the relief from bearing the costs of design and construction, the transfer of certain risks to the private sector and the promise of better project design, construction and operation.

Private Finance Initiative (PFI) model:

In this model, the private sector similar to the BOO model builds, owns and operates a facility. However, the public sector (unlike the users in a BOO model) purchases the services from the private sector through a long-term agreement.

PFI projects therefore, bear direct financial obligations to the government in any event. In addition, explicit and implicit contingent liabilities may also arise due to loan guarantees provided to lenders and default of a public or private entity on non-guaranteed loans.

In the PFI model, asset ownership at the end of the contract period may or may not be transferred to the public sector. The PFI model also has many variants.

Divestiture Model:

In this form a private entity buys an equity stake in a state-owned enterprise. However, the private stake may or may not imply private management of the enterprise. True privatization, however, involves a transfer of deed of title from the public sector to a private undertaking. This may be done either through outright sale or through public floatation of shares of a previously corporatized state enterprise.

Major Issues in PPP Development.

Risk is inherent in all PPP projects as in any other infrastructure projects. The main types of risks include:

Recent Advancements in PPP Models

EPC MODEL: Engineering, Procurement and Construction.

EPC is a popular model being adopted globally in many projects like road construction, roof-top solar projects, etc. Before government chose EPC over PPP in 2014, road construction rate had dwindled significantly to around just 3km per day.

Problems faced by private Players under PPP(BOT) leading to inefficient implementation:

- Delay in land acquisition by the govt and institutional clearances like forest clearance, defence land handovers hampered pace of construction.

- Under PPP, capital completely or partly was to be raised by private player through issuing private equity bonds and borrowing from banks. But –

- Due to delayed implementation, private players weren’t able to pay back loan in time adding to NPA in banks, eventually instigating many banks to stop lending loans

- Delayed implementation also affected fund raising through private equities as they couldn’t find investors for new ventures

- Another area where private players faced difficulty was in assessing the traffic on roads and subsequent designing of roads.

- Due to Above mentioned problems the balance sheets of builders were over stretched and thus forced them to exit projects.

Highway sector in India is responsible for job creation for millions of people and has a multiplier effect on the economy. Hence government took immediate measures to boost the sector by adopting EPC Model and the acronym stands for Engineering, Procurement and Construction.

How is EPC different and better than PPP?

- Govt here bears the entire financial burden and funds the project. Capital is either raised by issuing bonds like NHAI bonds or by taking steps to secure road toll receivables post construction. Note that the fund here is not raised through banks.

- Govt now takes care of clearances, acquiring land and estimating the traffic a very huge exercise that had to be done by private parties earlier.

- With decreased risk on private builders and increased incentives for early road construction, it creates comfortable base to lure investors to carry on the EPC work i.e. the contractor now designs the installation, procures the necessary materials and builds the project, either directly or by subcontracting part of the work.

- Timeline required to construct reduces remarkably.

- In a nutshell, while the government takes responsibility of raising capital, procuring clearances and such, the private builder constructs roads. Thus, significant surge in road construction pace is expected.

Recent decision of NDA govt in Mar 2016 to develop, operate and maintain the wayside amenities alongside National highways across India through EPC model is another example for an EPC project.

HAM MODEL

What is Hybrid annuity model?

- HAM is a Combination of EPC model and BOT-Annuity model. Under this model. The government will provide 40 percent of the project cost to the developer to start work while the remaining investment has to be made by the developer.

Why do we require HAM?

- Most of the earliest highway projects allocated through PPP mode were implemented through BOT –TOLL MODE. under this model the private party is selected to build, maintain and operate the road based on the fact that which private bidder offered maximum sharing of toll revenue to the government. Here, all the risks- land acquisition and compensation risk, construction risk (i.e risk associated with cost of project), traffic risk and commercial risk lies with the private party. The private party is dependent on toll for its revenues. The government is only responsible for regulatory clearances.

- To reduce the risk for private player, and to attract private players, The second model of PPP i.e. BOT-ANNUITY model was introduced under which the private player would built, maintain and operate the Project and government would pay the private player annually fixed amount of annuity. Though it was a better model than BOT-TOLL because it reduced traffic and commercial risk however cost risk remained as private player was solely responsible for the cost incurred in the project.

- In last few years many of the highway projects were stuck due to various reasons like Loss of promoter’s interest, Land acquisition issue, environmental reasons, excessive and unrealistic bidding by the private players and Lack of fund availability for private players due to high NPAs of the banks and lack of long term financing options in India.

- To counter this and to remove the deficiencies of government brought in EPC model. EPC stands for engineering, procurement and construction. It is a model of contract b/w the government and private contractor. The EPC entails the contractor build the project by designing, installing and procuring necessary labour and land to construct the infrastructure, either directly or by subcontracting. Under this system the entire project is funded by the government rather than the PPP model where there is cost sharing. The project is awarded via bidding. Thus, it shifts all the risk from the private players to the government and is the other extreme of BOT model where all risk was borne by the private player

Key features Of HAM MODEL

- Under this the government will pay 40 per cent of the project cost to the concessionaire during the construction phase in five equal installments of 8 per cent each.

- . Revenue collection would be the responsibility of the National Highways Authority of India (NHAI); developers will be paid in annual instilments over a specified period of time.

- An important feature of the hybrid annuity model is allocation of risks between the partners—the government and the developer/investor. While the private partner continues to bear the construction and maintenance risks as in BOT (toll) projects, it is required only to partly bear the financing risk. The developer is insulated from revenue/traffic risk and inflation risk, which are not within its control.

- In the hybrid annuity model, one need not bring 100 per cent of finance upfront and since 40 per cent is available during the construction period, only 60 per cent is required to be arranged for the long term. This makes it attractive and viable for the private player to invest in Highway projects. It also reduces burden on the Government as unlike EPC, the government has to provide only 40% of the project cost.

Conclusion

- By adopting the Model as the mode of delivery, all major stakeholders in the PPP arrangement – the Authority, lender and the developer, concessionaire would have an increased comfort level resulting in revival of the sector through renewed interest of private developers/investors in highway projects and this will bring relief thereby to citizens / travelers in the area of a respective project.It will facilitate uplifting the socio-economic condition of the entire nation due to increased connectivity across the length and breadth of the country leading to enhanced economic activity.

Swiss Challenge Model

What is Swiss Challenge model?

A ‘Swiss Challenge’ is a way to award a project to a private player on an unsolicited proposal. Such projects may not be in the bouquet of projects planned by the state or a state-owned agency, but are considered given the gaps in physical or social infrastructure that they propose to fill, and the innovation and enterprise that private players bring.

The government may enter into direct negotiations with a private player who submits a proposal and, if they cannot agree on the terms of the project, consider calling for bids from other interested players. In one variant of the Challenge, the government awards bonus points to the project’s ideate; in another, it calls for comparative bids, but gives the first right of refusal to the original player. All this is generally disclosed upfront.

Swiss Challenge model in India

At least half-a-dozen states have used the Swiss Challenge to award projects in sectors including IT, ports, power and health. Gujarat included it in the Gujarat Infrastructure Development Act, 1999, and in 2006, amended the Act to provide for direct negotiation. It was subsequently made part of the Andhra Pradesh Infrastructure Development Enabling Act and Punjab Infrastructure (Development & Regulation) Act. Rajasthan and Madhya Pradesh have included it in their guidelines for infra projects. At the central level, the Draft Public Private Partnership Rules, 2011, allow the Swiss Challenge only in exceptional circumstances — that too in projects that provide facilities to predominantly rural areas or to BPL populations.

What are the advantages?

Globally, there aren’t too many good examples of Swiss Challenge projects. South Africa, Chile, Korea, Indonesia, the Philippines and Taiwan have seriously considered, awarded and implemented unsolicited projects. The obvious advantages are that it cuts red tape and shortens timelines, and promotes enterprise by rewarding the private sector for its ideas. The private sector brings innovation, technology and uniqueness to a project, and an element of competition can be introduced by modifying the Challenge.

And what are the problems?

The biggest concerns are the lack of transparency and competition while dealing with unsolicited proposals. Governments need to have a strong legal and regulatory framework to award projects under the Swiss Challenge method. It can potentially foster crony capitalism, and allow companies space to employ dubious means to bag projects. Given that governments sometimes lack an understanding of risks involved in a project, direct negotiations with private players can be fraught with downsides. In general, competitive bidding is the best method to get the most value on public-private partnership projects. The government might also end up granting significant concessions in the nature of viability gap funding, commercial exploitation of real estate, etc., without necessarily deriving durable and long-term social or economic benefits.

Is the Swiss Challenge suited to India?

The jury is still out on the success of public-private partnership (PPP) in infra projects. There have been several controversies around large scale PPP projects. Construction costs jumped significantly in the case of the Mumbai Metro, and then Chief Minister Prithviraj Chavan did some loud thinking on whether the government should take over the company promoted by Anil Ambani after it sought a threefold increase in fares just before commencement last year. There were serious issues related to the international airport and the Airport Metro line in Delhi. The government has now brought PPP projects under the ambit of the CAG, so there is some scrutiny of projects where significant concessions including land at subsidised rates, real estate space, viability gap funding, etc. are granted by the government. But there is still no strong legal framework at the national level, and such projects may be challenged in case of a lack of transparency or poor disclosures. Bureaucrats, who ultimately sign off on such projects, continue to be afraid to take calls that might face an investigation later. In the absence of transparency, and a strong element of competition, such projects may be prone to legal challenges. Smaller projects are better off in this respect.

Government of India Initiatives for Revamping of PPP Models.

Viability Gap Funding.

Viability Gap Funding (VGF) Means a grant one-time or deferred, provided to support infrastructure projects that are economically justified but fall short of financial viability. The lack of financial viability usually arises from long gestation periods and the inability to increase user charges to commercial levels. Infrastructure projects also involve externalities that are not adequately captured in direct financial returns to the project sponsor. Through the provision of a catalytic grant assistance of the capital costs, several projects may become bankable and help mobilise private investment in infrastructure.

Government of India has notified a scheme for Viability Gap Funding to infrastructure projects that are to be undertaken through Public Private Partnerships. It will be a Plan Scheme to be administered by the Ministry of Finance with suitable budgetary provisions to be made in the Annual Plans on a year-to- year basis.

The quantum of VGF provided under this scheme is in the form of a capital grant at the stage of project construction. The amount of VGF will be equivalent to the lowest bid for capital subsidy, but subject to a maximum of 20% of the total project cost. In case the sponsoring Ministry/State Government/ statutory entity propose to provide any assistance over and above the said VGF, it will be restricted to a further 20% of the total project cost.

Support under this scheme is available only for infrastructure projects where private sector sponsors are selected through a process of competitive bidding. The project agreements must also adhere to best practices that would secure value for public money and safeguard user interests. The lead financial institution for the project is responsible for regular monitoring and periodic evaluation of project compliance with agreed milestones and performance levels, particularly for the purpose of grant disbursement. VGF is disbursed only after the private sector company has subscribed and expended the equity contribution required for the project.

India Infrastructure Finance Company Limited.

IIFCL was set up in 2006 to provide long term debt for infrastructure projects. Infrastructure projects are typically long gestation projects and require debt of longer maturity. The provision of long term funds from commercial banks is restricted due to their asset-liability mismatch. IIFCL tries to address the above constraints in long term debt financing of infrastructure.

IIFCL provides financial assistance to commercially viable projects, which includes projects implemented by a public sector company; a private sector company; or a private sector company selected under a Public Private Partnership (PPP) initiative. Priority is given to those PPP projects awarded to private companies, which are selected through competitive bidding process.

Only projects pertaining to following sectors are eligible for financing from IIFCL:

- Road and bridges, railways, seaports, airports, inland waterways and other transportation projects;

- Power;

- Urban transport, water supply, sewage, solid waste management and other physical infrastructure in urban areas;

- Gas pipelines;

- Infrastructure projects in Special Economic Zones;

- International convention centres and other tourism infrastructure projects;

- Cold storage chains;

- Warehouses;

- Fertilizer Manufacturing Industry

IIFCL raises funds from domestic as well as external markets on the strength of government guarantees. The mode of lending is either long term debt; refinance to banks and financial institutions for loans granted by them to infrastructure companies; takes out finance; subordinate debt and any other mode approved by Government from time to time. The total lending by IIFCL is limited to 20% of the Total Project Cost.

In 2008, a wholly owned subsidiary of IIFCL, IIFCL (UK) Ltd, was established in London with the objective of utilising the foreign exchange reserves of RBI to fund off-shore capital expenditure of Indian companies implementing infrastructure projects in India.

Infrastructure Debt Funds.

The term Debt Fund is generally understood as an investment pool which invests in debt securities of companies. However, an Infrastructure Debt Fund(IDF) registered in India refers to a company or a Trust constituted for the purpose of investing in the debt securities of infrastructure companies or Public Private Partnership Projects. Thus, in contrast to the general understanding of the term, IDF does not refer to a Scheme floated by a mutual fund or such other organizations but to the Company or Trust who is investing in debt securities. An IDF can float various Schemes for financing infrastructure projects.

Purpose

IDF is a distinctive attempt to address the issue of sourcing long term debt for infrastructure projects in India. Union Finance Minister in his Budget Speech of 2011-12 had announced setting up of IDFs to accelerate and enhance the flow of long term debt in infrastructure projects. IDFs are meant to

- supplement lending for infrastructure projects

- provide a vehicle for refinancing the existing debt of infrastructure projects presently funded mostly by commercial banks

Structure& Regulation

These Funds can be established by Banks, Financial Institutions and Non- Banking Financial Companies (NBFCs).

IDFs can be set up either as a company or as a trust. A trust based IDF would normally be a Mutual Fund (MF) that would issue units while a company based IDF would normally be a form of NBFC that would issue bonds. Further, a trust based IDF (MF) would be regulated by SEBI; and an IDF set up as a company (NBFC) would be regulated by RBI.

IDF –MF can be sponsored (sponsor is akin to a promoter) by any NBFC which includes an Infrastructure Finance Company(IFC). However, IDF-NBFC can be sponsored only by an IFC.

Investors

The investors in IDFs would primarily be domestic and off-shore institutional investors, especially Insurance and Pension Funds who have long term resources. Banks and Financial Institutions would only be allowed to invest as sponsors / promoters of an IDF subject to certain conditions. The foreign investors eligible to invest in IDFs include FIIs/Sub-accounts, NRIs, HNIs, QFIs and long term foreign investors such as Sovereign Wealth Funds, Multilateral Agencies, Pension Funds, Insurance Funds and Endowment Funds. To attract funds, an exemption from income tax for IDF has been provided and also the withholding tax has been reduced to 5% from 20% on the interest payment on the borrowings of IDFs.

An IDF-MF would raise resources through issue of rupee denominated units of minimum 5-year maturity, which would be listed in a recognized stock exchange and tradable among investors. It would have to invest minimum 90% of its assets in the debt securities of infrastructure companies or SPVs across all infrastructure sectors, project stages and project types. The returns on assets of the IDF will pass through to the investors directly, less the management fee. The credit risks associated with the underlying projects will be borne by the investors and not by the IDF. This structure is focused on investors who can afford to take risk. An existing mutual fund can also launch an IDF Scheme.

An IDF-NBFC would raise resources through issue of either rupee or dollar denominated bonds of minimum 5-year maturity, which would be tradable among investors. It would invest in debt securities of only Public Private Partnership projects which have a buyout guarantee and have completed at least one year of commercial operation.

Buyout guarantee implies compulsory buyout by the Project Authority (which refers to the government agency who is awarding the contract or who is entering into a concession agreement with the private party) in the event of termination of concession agreement.

Refinance (essentially means replacing an older loan issued by a financial institution with a new loan offering better terms) by IDF would be up to 85% of the total debt covered by the concession agreement. Senior lenders would retain the remaining 15% for which they could charge a premium from the infrastructure company. Here, the credit risks associated with the underlying projects will be borne by the IDF. This structure is focused on investors who are risk-averse.