source

Understanding Demonetization

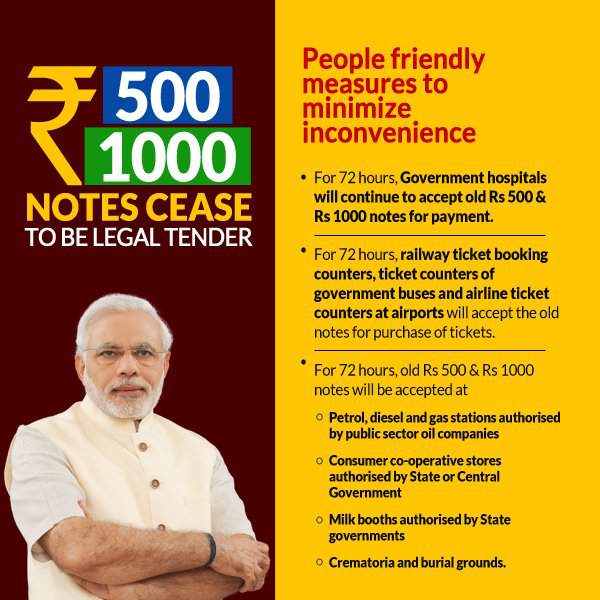

Demonetization is the act of stripping a currency unit of its status as legal tender. Demonetization is necessary (this happened when Euro was introduced) whenever there is a change of national currency. The old unit of currency must be retired and replaced with a new currency unit.

What is legal tender?

The coins issued under the authority of Section 6 of The Coinage Act, 2011, shall be legal tender in payment or on account i.e. provided that a coin has not been defaced and has not lost weight so as to be less than such weight as may be prescribed in its case: –

(a) coin of any denomination not lower than one rupee shall be legal tender for any sum,

(b) half rupee coin shall be legal tender for any sum not exceeding ten rupees,

Every banknote issued by Reserve Bank of India ( ₹ 2, ₹ 5, ₹ 10, ₹ 20, ₹ 50, ₹ 100, ₹ 500 and ₹ 1000) shall be legal tender at any place in India.

What India witnessed on 8th november 2016 was the not the first time we plugged and play the demonetization game.

1946: Rs1,000, Rs5,000, and Rs10,000 notes were taken out of circulation in January 1946. The Rs10,000 notes were the largest currency denomination ever printed by the Reserve Bank of India, introduced for the first time in 1938. All three notes were reintroduced in 1954

1977: The Wanchoo committee (set up in 1970s), a direct tax inquiry committee, suggested demonetization as a measure to unearth and counter the spread of black money. However, the public nature of the recommendation sparked black money hoarders to act fast and rid themselves of high denominations before the government was able to clamp down on them!

The High Denomination Bank Notes (Demonetisation) Act deemed the Rs 1,000, Rs 5,000 and Rs 10,000 notes illegal for the second time. At the time, then-RBI governor I.G. Patel disagreed with the measure.

2016: Recommendations of SIT on Black Money as Contained in the Fifth SIT Report

Cash transactions : The SIT has felt that large amount of unaccounted wealth is stored and used in form of cash. Having considered the provisions which exist in this regard in various countries and also having considered various reports and observations of courts regarding cash transactions the SIT felt that there is a need to put an upper limit to cash transactions. Thus, the SIT has recommended that there should be a total ban on cash transactions above Rs. 3, 00,000 and an Act be framed to declare such transactions as illegal and punishable under law.

Cash holding : The SIT has further felt that, given the fact of unaccounted wealth being held in cash which are further confirmed by huge cash recoveries in numerous enforcement actions by law enforcement agencies from time to time, the above limit of cash transaction can only succeed if there is a limitation on cash holding, as suggested in its previous reports. SIT has suggested an upper limit of Rs. 15 lakhs on cash holding. Further, stating that in case any person or industry requires holding more cash, it may obtain necessary permission from the Commissioner of Income tax of the area.

With full backing, for the third time, India participated in the process of demonetization. RBI governor, Urjit Patel applauded Modi’s “very bold step” which addresses concerns about the “growing menace of fake Indian currency notes.”

How big is the impact of this announcement?

A better sense of this can be gauged from this graph below. As you can see, the monetary value of Rs500 and Rs1,000 notes in circulation far outstrips any other denomination.

Putting it simply, at the stroke of midnight, a little over 80% of the cash in India (by value) will be worthless pieces of paper.

When a currency has notes of higher denomination, it is easier to launder money i.e. store black money, as it takes less space and weighs less as well.

– (Very) Short-term liquidity squeeze could be severe and hence economic activity could suffer

3 Important Steps taken before this announcement was made

1. Jan Dhan scheme, under which 22-crore new bank accounts were opened in one-and-a-half years (May 2016), was the first truly game-changing move. Most of these accounts brought those people into the network who were outside the ambit.

According to the Economic Survey for 2015-16 released in February this year, leakages in LPG subsidy transfers fell 24 percent and the exclusion of beneficiaries had been greatly reduced, thanks to the infrastructure created by Jan Dhan accounts, Aadhaar and mobile networks, or the JAM trinity.

2. The next step was to bring back black money stashed away in tax havens or foreign banks abroad and here.

3. Then came the Income Declaration Scheme. By 30 September, all illegal asset holders had the chance to declare their holdings and pay 45 % tax and a penalty in exchange for anonymity and immunity from criminal proceedings.

The tax department has reported Rs 65,250 crore worth of black money from 64,275 declarations. This means about Rs 30,000 crore will flow into the government’s tax kitty.

Challenges ahead

#3. Prepare for the challenges of cashless economy: The UPI (unified payment interface) system is likely to be fully operationalised only by January 2017. India was recently hit by one of its biggest financial security breaches compromising hundreds of thousands of debit cards. Read more about Cyber Security challenges from here

Reference:

http://thewire.in/78694/paper-money-ban-rs-500-rs-1000-notes-explained/

http://www.firstpost.com/politics/rs-500-1000-notes-ban-jam-trinity-overseas-haul-how-pm-modi-is-winning-the-war-against-graft-3097176.html

http://indianexpress.com/article/business/economy/ambit-capital-black-economy-shrinking-pegged-at-20-per-cent-of-gdp-2835783/