Banking Sector Reforms

RBI revises Priority Sector Lending (PSL) guidelines

From UPSC perspective, the following things are important :

Prelims level: Priority Sector Lending (PSL)

Why in the News?

The RBI has issued revised guidelines for Priority Sector Lending (PSL), effective from April 1, 2025, to improve the targeting of bank credit to key sectors of the economy.

About Priority Sector Lending (PSL)

| What is it? |

Origin of PSL:

|

| Which Banks are Covered Under PSL? | 1. Domestic Scheduled Commercial Banks, Cooperative Banks, and Foreign Banks: 40% of Adjusted Net Bank Credit (ANBC) or Credit Equivalent Amount of Off-Balance Sheet Exposure (CEOBSE), whichever is higher.

2. Small Finance Banks and Regional Rural Banks (RRBs): 75% of ANBC or CEOBSE, whichever is higher. 3. Payment Banks: NOT subject to PSL targets. |

| Priority Sector Categories | • Agriculture • Micro, Small, and Medium Enterprises (MSMEs) • Export Credit • Education • Housing • Social Infrastructure • Renewable Energy

• Others, including Scheduled Castes, Scheduled Tribes, and Persons with Disabilities. • Micro Finance Institutions (MFIs) offering loans to individuals and Self-Help Groups (SHGs) are also eligible for PSL classification. |

| Consequences of Failing to Meet PSL Norms | 1. Investment in Rural Infrastructure Development Fund (RIDF): Banks falling short of PSL targets may be required to invest in the Rural Infrastructure Development Fund (RIDF), managed by NABARD, or other designated funds like those managed by SIDBI and NHB.

2. Purchase of PSL Certificates: Banks can purchase Priority Sector Lending Certificates (PSLCs) to meet their PSL targets. |

| Priority Sector Lending Certificates (PSLCs) |

|

Revised PSL Guidelines for 2025:

- Revised PSL guidelines for 2025 will enhance the targeting of bank credit to priority sectors.

- Loan limits for housing have been increased, with differentiated limits based on population size: ₹50 lakh (population ≥ 50 lakh), ₹45 lakh (population 10-50 lakh), and ₹35 lakh (population < 10 lakh).

- Renewable energy loans: Up to ₹35 crore for power generators and public utilities, and ₹10 lakh for individual households.

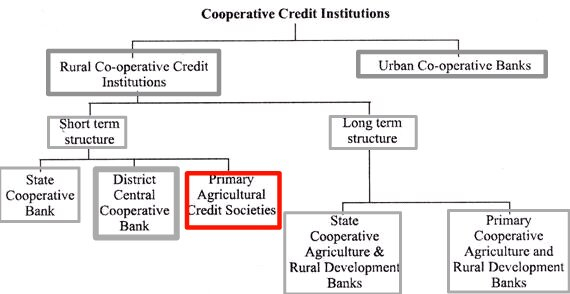

- Urban Cooperative Banks (UCBs) have a revised PSL target of 60% of Adjusted Net Bank Credit (ANBC).

- Weaker Section borrowers expanded and the cap on loans to individual women beneficiaries has been removed.

| [UPSC 2012] The basic aim of Lead Bank Scheme is that the –

(a) big banks should try to open offices in each district (b) there should be stiff competition among the various nationalized banks (c) individual banks should adopt particular districts for intensive development (d) all the banks should make intensive efforts to mobilize deposits |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

Sarthi and Pravaah Systems of RBI

From UPSC perspective, the following things are important :

Prelims level: Sarthi and Pravaah Systems of RBI

Why in the News?

The Reserve Bank of India (RBI) was recently awarded the prestigious Digital Transformation Award 2025 by Central Banking, a recognition of its groundbreaking digital initiatives, Sarthi and Pravaah.

About Sarthi System

- The Sarthi system was launched in January 2023 by the RBI with the goal of digitizing all internal workflows within the organization.

- This initiative aimed to reduce the reliance on paper-based processes and enhance operational efficiency across the RBI.

- Key features include:

- It can securely store and share documents among the 13,500 employees spread across 40+ locations.

- It also improves record management and provides enhanced data analysis capabilities through reports and dashboards.

- Additionally, Sarthi automates internal processes such as task tracking, approvals, and document management, streamlining operations and improving collaboration between departments.

- To ensure that employees are proficient in using the system, an online training platform, called Sarthi Pathshala, was launched alongside in-person training.

- Sarthi Mitras, who are designated experts within RBI offices, assist colleagues in navigating and resolving issues related to the system.

About Pravaah System

- Building on the success of Sarthi, the RBI introduced the Pravaah system in May 2024.

- Its primary purpose is to facilitate external users in submitting regulatory applications digitally to the RBI.

- This platform has greatly enhanced the efficiency and transparency of the application submission process.

- Key features include:

- It integrates seamlessly with the Sarthi database, enabling smooth processing of regulatory documents.

- It supports more than 70 different regulatory applications, significantly improving the speed and accuracy of submissions.

- It is equipped with centralized cybersecurity measures and digital tracking capabilities, which provide real-time monitoring of applications for both applicants and RBI managers.

- It has contributed to an 80% increase in monthly applications, marking a significant achievement in reducing delays associated with traditional, paper-based systems and streamlining the overall process.

PYQ:[UPSC 2024] Consider the following statements in respect of the digital rupee: 1. It is a sovereign currency issued by the Reserve Bank of India (RBI) in alignment with its monetary policy. 2. It appears as a liability on the RBI’s balance sheet. Which of the statements given above is/are correct? (a) Only one (b) Only two (c) All three (d) None |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

What is Deposit Insurance?

From UPSC perspective, the following things are important :

Prelims level: Deposit Insurance

Why in the News?

The Centre is actively considering increasing the deposit insurance cover beyond the current ₹5 lakh limit, as confirmed by Financial Services Secretary.

What is Deposit Insurance?

- Deposit Insurance is a financial protection mechanism for depositors if a bank fails or faces restrictions imposed by the RBI.

- It ensures compensation up to a set limit, even if the bank cannot return the money.

- It is provided by Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of RBI.

- Coverage & Exclusions:

- Covers: Savings accounts, fixed deposits (FDs), recurring deposits (RDs), current accounts (both principal & interest).

- Does NOT cover: Deposits from foreign governments, central/state governments, inter-bank deposits, and primary cooperative societies.

History of Deposit Insurance in India:

|

About DICGC & Its Functions

- DICGC was established in 1961, a wholly-owned RBI subsidiary under the DICGC Act, 1961.

- It covers all commercial banks, regional rural banks, foreign banks in India, and cooperative banks.

- Banks pay the insurance premium; depositors do not pay any charges.

- It ensures timely compensation within 90 days of a bank’s collapse.

How does Deposit Insurance work?

- DICGC insures deposits up to ₹5 lakh per depositor per bank.

- The ₹5 lakh limit includes both principal and interest amounts.

- If a bank is facing financial distress or RBI-imposed restrictions, depositors are eligible to claim insurance under Section 18A of the DICGC Act, 1961.

- Payout Timeline:

- Within 45 days: The troubled bank must submit a list of depositors to DICGC.

- Within 90 days: DICGC processes and pays depositors up to ₹5 lakh.

- If a bank goes into liquidation, DICGC pays the insured amount within two months of receiving a claim list from the bank’s liquidator.

- When RBI restricts withdrawals from a bank, depositors are eligible to receive their insured deposits.

PYQ:[2013] Which of the following grants/grant direct credit assistance to rural households? (2013)

Select the correct answer using the codes given below: (a) 1 and 2 only |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

Bank Bill passes LS, allows one account, 4 nominees

From UPSC perspective, the following things are important :

Mains level: Banking Sector Reforms;

Why in the News?

The Lok Sabha passed the Banking Laws (Amendment) Bill, 2024, marking the first piece of legislation to be approved during the Winter Session after the resolution of a week-long impasse.

What are the key features of the Banking Laws (Amendment) Bill, 2024?

- Nomination Provisions: The Bill allows bank account holders to nominate up to four individuals for their accounts, with options for either successive or simultaneous nominations. However, locker holders will only have the option for successive nominations.

- Redefinition of “Substantial Interest”: The threshold for defining “substantial interest” for directorships is proposed to increase from ₹5 lakh to ₹2 crore, reflecting current economic conditions.

- Tenure of Directors: The tenure of directors (excluding chairpersons and whole-time directors) in cooperative banks will be extended from eight years to ten years, aligning with provisions in the Constitution (Ninety-Seventh Amendment) Act, 2011.

- Common Directorships: The Bill permits directors of Central Cooperative Banks to serve on the boards of State Cooperative Banks under certain conditions.

- Auditor Remuneration: It grants banks greater flexibility in determining the remuneration for statutory auditors, which was previously regulated by the Reserve Bank of India (RBI) and the central government.

- Reporting Dates: The reporting dates for regulatory compliance will shift from the second and fourth Fridays to the 15th and last day of every month, streamlining oversight processes.

What are the reasons for this amendment?

- Enhancing Governance: The amendments aim to strengthen governance standards within banks, ensuring better protection for depositors and investors while improving audit quality in public sector banks.

- Customer Convenience: By allowing multiple nominations, the Bill intends to simplify inheritance processes related to bank deposits and reduce instances of unclaimed deposits after an account holder’s demise.

- Alignment with Constitutional Provisions: Increasing director tenures in cooperative banks aligns banking regulations with constitutional amendments that govern cooperative societies.

What would be the significant impact of this amendment?

- Improved Customer Experience: The ability to nominate multiple individuals enhances customer convenience and ensures smoother transitions in account management after an account holder’s death.

- Strengthened Governance Framework: By redefining substantial interest and increasing director tenures, the Bill aims to foster a more robust governance framework within cooperative banks, potentially leading to better decision-making and accountability.

- Regulatory Compliance Efficiency: Changing reporting dates is expected to improve compliance efficiency, allowing banks to better align their reporting practices with regulatory requirements.

What is the criticism faced by the Banking Laws (Amendment) Bill, 2024?

- Concerns Over Financial Practices: Opposition leaders raised concerns regarding rising imports from China amid strained relations and questioned broader financial practices like demonetization and electoral bonds.

- Banking Fees and Cybersecurity Risks: Critics highlighted issues related to fees for basic banking services such as ATM withdrawals and SMS alerts, particularly emphasizing vulnerabilities faced by senior citizens concerning cyber fraud.

- Economic Context: Some opposition members criticized the timing of the Bill against a backdrop of economic challenges such as inflation exceeding growth rates, potentially leading to stagflation. They expressed skepticism about whether these amendments would effectively address underlying economic issues.

Way forward:

- Addressing Broader Economic Concerns: The government should focus on macroeconomic reforms to manage inflation and foster sustainable growth. The Banking Laws Amendment should be complemented by policies that address the root causes of economic challenges, ensuring the banking sector thrives amidst broader financial stability.

- Strengthening Cybersecurity and Customer Protection: Banks should enhance security measures, especially for senior citizens, to safeguard against rising cyber fraud.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

[pib] India Post Payments Bank (IPPB)

From UPSC perspective, the following things are important :

Prelims level: India Post Payments Bank (IPPB)

Why in the News?

The Minister of State for Communications has provided crucial information about the India Post Payments Bank (IPPB).

About India Post Payments Bank (IPPB):

| Details | |

| What is it? | Division of India Post under the Ministry of Communications, launched in 2018.

Operates as payments bank. |

| Vision and Principles | • Objective: Promote financial inclusion by providing accessible and affordable financial services. • Customer-Centric: Focuses on delivering secure and affordable banking to rural and underserved areas. |

| Empowerment Initiatives by IPPB | • Financial Inclusion: Offers savings accounts, current accounts, money transfers, bill payments, and insurance. • Aadhaar-Linked Services: Implements Aadhaar-enabled Payment System (AePS) for easy and secure transactions. • Doorstep Banking: Provides banking services through 3 lakh postmen and Grameen Dak Sewaks. • Rapid Expansion: Reached 4 crore customers by December 2020 and crossed 8 crore customers by January 2022, with over 9 crore customers as of March 2024. |

Back2Basics: Payments Bank

|

PYQ:[2018] Which one of the following links all the ATMs in India? (a) Indian banks’ Association (b) National Securities Depository Limited (c) National Payments Corporation of India (d) Reserve Bank of India |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

RBI released list of Domestic Systemically Important Banks (D-SIBs)

From UPSC perspective, the following things are important :

Prelims level: Domestic Systemically Important Banks (D-SIBs)

Why in the News?

The RBI designated SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks (D-SIBs) for 2024.

Current D-SIBs in India:

|

What are Domestic Systemically Important Banks (D-SIBs)?

- D-SIBs are banks that are critical to the stability of a country’s financial system.

- They are often termed “Too Big To Fail” (TBTF) because their failure could lead to significant disruptions in the economy.

- The RBI identifies D-SIBs annually.

- The framework for recognizing these banks was issued in July 2014.

- The RBI has been publishing an annual list of D-SIBs since 2015.

D-SIBs are placed in different buckets based on systemic importance scores. Higher bucket rankings require greater capital requirements to absorb losses.

- SBI is in Bucket 4.

- HDFC Bank is in Bucket 3.

- ICICI Bank is in Bucket 1.

D-SIBs must maintain additional Common Equity Tier 1 (CET1) capital based on their bucket.

- SBI: 0.80% of Risk Weighted Assets (RWAs).

- HDFC Bank: 0.40%

- ICICI Bank: 0.20%

Global Systemically Important Banks (G-SIBs):

|

Benefits of D-SIB Classification

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

NBFC sector resilient under scale-based regulations framework: RBI bulletin

From UPSC perspective, the following things are important :

Mains level: Significance of NBFC sector;

Why in the News?

During the transition to the Scale-Based Regulation (SBR) framework, the NBFC sector experienced double-digit credit growth, maintained adequate capital levels, and saw a reduction in delinquency ratios.

What is Scale-Based Regulation (SBR)?

|

What are the key points presented by RBI on the resilience of the NBFC sector?

- Improvement in Asset Quality: Since the introduction of the Scale-Based Regulation (SBR) framework in October 2022, the asset quality of NBFCs has improved, with lower gross non-performing asset (GNPA) ratios.

- By December 2023, GNPA ratios had decreased to 2.4% for government-owned NBFCs and 6.3% for non-government NBFCs, reflecting enhanced risk management.

- Double-Digit Credit Growth: The NBFC sector maintained strong credit growth throughout 2023, driven by a diversified funding base, including retail credit (gold loans, vehicle loans, and housing loans) and expanding into industrial and service sectors.

- Improved Profitability: The sector witnessed a rise in profitability, as evidenced by better returns on assets (RoA) and equity (RoE).

- Net NPA (NNPA) Performance: Upper layer NBFCs had lower GNPA ratios than middle layer NBFCs, but the latter maintained sufficient provisions for riskier portfolios, ensuring that their NNPA ratios were also controlled.

- Compliance with SBR: Major NBFCs in the “Upper Layer” identified by the RBI under the SBR framework, such as LIC Housing Finance, Bajaj Finance, and L&T Finance, have complied or initiated steps to comply with listing requirements.

Regulatory measures taken up by the NBFC sector

- Scale-Based Regulation (SBR) Framework: Introduced in October 2022, the SBR framework categorizes NBFCs into different layers based on their size, systemic importance, and risk profile. For instance, strengthen asset quality, capital requirements, and risk management.

- Prompt Corrective Action (PCA) Norms: Effective from October 2024, PCA norms will apply to government-owned NBFCs. These measures aim to enhance financial discipline, focusing on capital adequacy and asset quality.

- Diversification of Funding Sources: Due to rising risk weights on bank lending, NBFCs have diversified their funding base by reducing dependence on bank borrowings and expanding into secured retail credit.

- Listing Compliance: Many NBFCs in the upper layer have complied or are in the process of complying with listing requirements as part of regulatory mandates.

What are the emerging risks that NBFCs need to cater? (Way forward)

- Cybersecurity Risks: With the increasing use of digital platforms, NBFCs need to enhance cybersecurity measures to safeguard against evolving cyber threats.

- Climate Risk: The financial impact of climate change poses a new risk. NBFCs must integrate climate-related risks into their risk management frameworks to mitigate potential disruptions.

- Financial Assurance Functions: The RBI emphasizes that assurance functions like risk management, compliance, and internal audit are critical in maintaining resilience in the face of rapid changes in the financial landscape.

- Evolving Regulatory Environment: As the financial sector continues to evolve, NBFCs must stay ahead of regulatory changes and ensure that their risk management practices are aligned with emerging threats and new regulations.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

Why US Fed cut interest rates, how India could be impacted?

From UPSC perspective, the following things are important :

Mains level: Implications of Global Markets on India; Implication of interest rate;

Why in the News?

The United States Federal Reserve, responsible for the country’s monetary policy, announced on Wednesday that it will lower its key interest rate, called the Federal Funds Rate, by 0.5%, or 50 basis points.

Why did the Fed cut interest rates?

- The Federal Reserve cut the benchmark interest rate by 50 basis points to address rising unemployment concerns while inflation was stabilizing.

- After a series of aggressive rate hikes to counter inflation that surged due to post-COVID recovery and the Russia-Ukraine war, inflation began to moderate, nearing the Fed’s target of 2%.

- Rising unemployment data signaled that the restrictive monetary policy might harm the labor market, prompting the Fed to act.

Will the US economy achieve a soft landing?

- Optimistic Projections: Despite earlier predictions that high inflation would lead to a recession, the Fed’s strategy may succeed in achieving a soft landing, reducing inflation without crashing the economy.

- GDP Growth: The Summary of Economic Projections (SEP) estimates GDP growth to remain around 2% for the next few years, indicating a stable economy.

- Unemployment: While the unemployment rate has risen slightly to 4.4%, it remains manageable, with expectations of improvement.

- Risks: Potential policy shifts, especially related to the upcoming presidential election, could disrupt the economic outlook, particularly if trade tariffs are imposed.

How will India be affected?

- Increased Foreign Investments: Lower US interest rates could encourage foreign investors to borrow in the US and invest in India through stocks, bonds, or foreign direct investment (FDI), benefiting capital inflow.

- Rupee Strengthening: With falling US interest rates, the US dollar may weaken against the Indian rupee, potentially strengthening the rupee. This would negatively affect Indian exporters but benefit importers.

- RBI’s Interest Rate Decisions: While the Fed’s rate cuts influence global markets, India’s central bank, the RBI, may not directly follow suit due to differing inflation targets and mandates. The RBI prioritizes inflation control and GDP growth over unemployment figures.

Way forward:

- Encourage Capital Inflows: India should take advantage of lower US interest rates by attracting foreign investments through improved ease of doing business, fostering growth in key sectors like infrastructure, technology, and manufacturing.

- Maintain Monetary Stability: The RBI should carefully assess global trends but prioritize domestic conditions when adjusting interest rates, focusing on inflation control, financial stability, and sustained GDP growth.

Mains PYQ:

Q Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (UPSC IAS/2016)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

What is Basel III Endgame?

From UPSC perspective, the following things are important :

Prelims level: Basel Norms, Endgame

Mains level: NA

Why in the news?

The US Federal Reserve recently announced stricter bank capital requirements known as the “Basel III endgame” proposal.

What is Bank Capital?

|

What are Basel Norms?

- Basel, Switzerland, hosts the Bureau of International Settlement (BIS), fostering collaboration among central banks to establish global banking standards.

- The Basel Committee on Banking Supervision (BCBS), established in 1974 formulates broad supervisory guidelines known as the Basel framework.

- Its purpose is to ensure banks maintain adequate capital to meet obligations and absorb losses.

- India has adopted Basel standards to align its banking practices with global norms.

| Description | |

| Basel I |

|

| Basel II |

|

| Basel III |

|

| *Basel IV

|

|

Proposed Changes under Basel III Endgame

- Expansion of Scope: The proposal aims to extend the strictest risk-based capital approach to more banks, lowering the asset threshold from $700 billion to $100 billion. This would encompass around 37 large banks in the U.S.

- Standardized Measure for Capital Requirements: Regulators propose curtailing banks’ use of internal models to calculate capital requirements for loans, advocating for a standardized measure for all banks to ensure uniform risk assessment.

- Increased Capital for Trading and Operational Risks: The proposal mandates higher capital reserves for risks linked to trading activities and operational challenges, requiring banks to utilize standard models for risk assessment instead of internal ones.

- Changes to Capital Calculations for Portfolios: Banks with assets exceeding $100 billion must reflect gains and losses in portfolios categorized as “available for sale” in their capital calculations, aiming for a more precise depiction of a bank’s risk exposure.

Challenges created by the new Norms

- Operational Risks: A substantial portion of the proposed capital increment targets banks’ operational risks, encompassing potential losses arising from internal processes, people, systems, or external events.

- Non-Traditional Banking Activities: Entities engaged in trading, market-making, wealth management, and investment banking, will face more pronounced capital requirements due to altered risk assessment and operational risk calculations.

- Industry-specific Concerns: Additionally, specific industries, like renewable energy, anticipate repercussions, fearing that increased capital requirements could undermine the effectiveness of tax incentives for projects targeting climate change.

Arguments in Favor of Increasing Capital

- Financial Stability: Proponents argue that heightened capital requirements are imperative for safeguarding financial stability, averting bank failures, and minimizing the need for government bailouts.

- Prudent Banking Practices: They contend that current standards inadequately address bank risks and that increased capital incentivizes prudent banking practices.

- Resilient Banking System: Economists suggests that the social costs of higher capital requirements are minimal compared to the benefits of a more resilient financial system.

PYQ:2015: ‘Basel III Accord’ or simply ‘Basel III’, often seen in the news, seeks to: (a) Develop national strategies for the conservation and sustainable use of biological diversity (b) Improve banking sector’s ability to deal with financial and economic stress and improve risk management (c) Reduce the greenhouse gas emissions but places a heavier burden on developed countries (d) Transfer technology from developed countries to poor countries to enable them to replace the use of chlorofluorocarbons in refrigeration with harmless chemicals

Practice MCQ:What is the primary objective of “Basel III Endgame” in the banking sector? (a) To encourage speculative investments by banks to boost short-term profits. (b) To ensure the stability of the global financial system by strengthening the regulation, supervision, and risk management practices of banks. (c) To encourage banks to invest more in less-risky assets to stimulate economic growth. (d) To limit the role of central banks in regulating commercial banks and promote market-driven banking practices. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

NUCFDC: Umbrella Body for Urban Co-op Banks established

From UPSC perspective, the following things are important :

Prelims level: NUCFDC, Urban Cooperative Banks and their regulations, NBFCs

Mains level: NA

In the news

- The Union Home Minister and Minister of Cooperation officially inaugurated the National Urban Cooperative Finance and Development Corporation Limited (NUCFDC), marking a significant milestone in the development of urban cooperative banking.

About NUCFDC

- Regulatory Approval: NUCFDC has obtained approval from the RBI, authorizing it to function as a Non-Banking Finance Company (NBFC) and serve as the apex body for the urban cooperative banking sector.

- Self-Regulatory Status: Additionally, NUCFDC has been granted the status of a Self-Regulatory Organisation (SRO) for the sector, empowering it to oversee and regulate various aspects of urban cooperative banking operations.

- Capital Enhancement: NUCFDC aims to augment its capital base, with ambitions to achieve a capitalization level of Rs. 300 crores, facilitating its mission to support and strengthen Urban Cooperative Banks (UCBs).

Functions of NUCFDC

- Utilization of Funds: The organization intends to deploy its capital resources towards bolstering the financial capabilities of UCBs, including the development of a shared technology infrastructure to enhance service delivery and reduce operational costs.

- Comprehensive Support: Apart from providing financial liquidity and capital assistance, NUCFDC will establish a collaborative technology platform accessible to all UCBs, enabling them to expand their service offerings efficiently and affordably.

- Advisory Services: NUCFDC will also extend advisory and consultancy services to UCBs, assisting them in areas such as fund management, regulatory compliance, and strategic planning.

About Urban Cooperative Banks (UCBs)

- Origins: UCBs trace their roots to cooperative credit societies, offering financial services to members within specific community groups.

- Regulations: Regulated by the RBI under the Banking Regulation Act of 1949, UCBs adhere to stringent prudential norms and guidelines to ensure financial stability.

- Operational Classification: UCBs are categorized into urban and rural cooperative banks based on their geographic scope. They operate under the governance of State Registrars of Cooperative Societies (RCS) or the Central Registrar of Cooperative Societies (CRCS) and the RBI.

- Historical Evolution: The journey of UCBs dates back to the establishment of the first Cooperative Credit Society of Haryana in 1904, evolving over time with regulatory amendments and institutional reforms.

Reforming the UCBs

- Narasimham Committee Report (1998): It suggest subsequent regulatory interventions aimed at enhancing the governance, capitalization, and operational efficiency of UCBs.

- Structural Recommendations Committee (2021): The formation of a 4-tier structure for UCBs, proposed by a committee appointed by the RBI in 2021, seeks to streamline their operations and ensure effective regulatory oversight based on deposit size tiers:

- Tier 1 with all unit UCBs and salary earner’s UCBs (irrespective of deposit size) and all other UCBs having deposits up to Rs 100 crore.

- Tier 2 with UCBs of deposits between Rs 100 crore and Rs 1,000 crore,

- Tier 3 with UCBs of deposits between Rs 1,000 crore and Rs 10,000 crore, and

- Tier 4 with UCBs of deposits more than Rs 10,000 crore.

Challenges Faced by UCBs

- Capital Constraints: UCBs encounter limitations in capital mobilization due to regulatory restrictions on dividend payouts and limited avenues for raising external funds.

- Diversification Hurdles: The lack of operational diversification and dependence on member contributions for capital infusion pose challenges to UCBs’ financial resilience and expansion prospects.

- Funding Alternatives: Access to alternative funding sources remains constrained for UCBs, necessitating innovative approaches to address liquidity requirements.

- Profit Distribution Dynamics: Incentives for profit distribution are subdued in UCBs, impacting their attractiveness to investors and hindering their growth trajectory.

- Solvency Pressures: Expansion initiatives and acquisitions can strain UCBs’ solvency and liquidity positions, necessitating prudent risk management practices and strategic planning.

Try this PYQ from CSP 2021:

With reference to ‘Urban Cooperative Banks’ in India, consider the following statements:

- They are supervised and regulated by local boards set up by the State Governments.

- They can issue equity shares and preference shares.

- They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

RBI Directs NPCI to Assess Paytm’s TPAP Request

From UPSC perspective, the following things are important :

Prelims level: TPAP

Mains level: Payments banks operations in India

Introduction

- The Reserve Bank of India (RBI) has instructed the National Payment Council of India (NPCI) to evaluate One97 Communications’ (OCL) plea to become a Third-Party Application Provider (TPAP) for its Paytm application’s Unified Payments Interface (UPI) operations.

Understanding TPAP

- Role: TPAPs facilitate UPI-based transactions by providing compliant applications to end-users, ensuring adherence to security protocols and regulatory standards.

- Infrastructure: They leverage NPCI’s UPI framework and collaborate with payment service providers (PSPs) and banks to enable seamless transactions.

Implications of TPAP Approval

- Operational Continuity: TPAP approval is vital for Paytm to sustain UPI-based transactions, ensuring uninterrupted service for customers.

- Migration Process: If approved, Paytm’s ‘@paytm’ handles will transition seamlessly to designated banks to prevent service disruptions, with OCL prohibited from adding new users until successful migration.

- Risk Mitigation: RBI mandates certification of multiple banks as PSPs to manage high-volume UPI transactions, minimizing risk and enhancing system resilience.

Recent Developments

- PPBL Closure: Following RBI’s directive to shut Paytm Payments Bank (PPBL) operations by March 15, 2024, Paytm’s existing TPAP registration for UPI transactions faces uncertainty.

- RBI Intervention: In response to PPBL’s impending closure, RBI has tasked NPCI with evaluating OCL’s request to maintain TPAP status, crucial for Paytm’s UPI operations continuity.

Current Landscape

- Presently, 22 NPCI-approved third-party UPI apps, including Google Pay, PhonePe, and Whatsapp, facilitate peer-to-peer transactions via UPI IDs.

- RBI’s directive underscores the regulatory focus on maintaining stability and security in India’s digital payments ecosystem.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

Exposing India’s financial markets to the vultures

From UPSC perspective, the following things are important :

Prelims level: Fully accessible route (FAR) bonds

Mains level: India's efforts in integrating government bonds into global indices

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

The banking sector is leading the journey towards an Atmanirbhar Bharat

From UPSC perspective, the following things are important :

Prelims level: Banking sector updates

Mains level: India's banking sector growth, reforms, opportunities, challenges and way forward

What’s the news?

- Despite facing numerous challenges in the past quarter-century, including economic crises, pandemics, and geopolitical tensions, India’s banking and financial sector has continued to evolve and adapt.

Central idea

- India’s remarkable growth and stability over the past 25 years have placed the country at the forefront of global optimism. This shift is attributed to the nation’s governance structures and policy apparatus, which have fostered innovation and positioned India as a hub of novel public goods. Among the sectors driving this transformation, banking and finance stand out as key contributors.

The Banking Evolution

- Maturation of Banking in India: Over a period of 75 years, India’s banking sector has matured and grown into a vibrant and robust industry.

- Reforms and Critical Enablers: The past 30 years have seen critical reforms that have played a pivotal role in enabling the growth and transformation of the banking sector.

- Diversity in Banking: India’s banking sector now boasts a diverse landscape that includes public sector banks, private banks, non-banking financial companies (NBFCs), and a burgeoning fintech ecosystem. This diversity has made the financial sector more inclusive and dynamic.

- Addressing Legacy Issues: Reforms and changes in the sector have addressed legacy issues such as non-performing assets (NPAs), making the banking system more resilient.

- Internal Accruals: The internal accruals have become a significant source of growth capital for banks, enhancing their financial stability.

- Technological Advancements: Banks in India have moved away from traditional, brick-and-mortar models to embrace advanced technology. Products such as mobile banking apps, UPI, Aadhaar e-KYC, and digital payment systems have transformed the banking landscape.

The role of artificial intelligence (AI)

- Knowledge-Based Regime: India’s banking system is undergoing a transition toward a knowledge-based regime, primarily driven by AI and cognitive computing technologies. This shift represents a move away from traditional banking practices toward more data-driven and intelligent operations.

- Personalization of Customer Engagement: AI is enabling banks to personalize customer engagement. Through AI-powered capabilities, banks can gain a deeper understanding of individual customer preferences and needs. This personalization enhances the overall customer experience.

- Deeper Understanding of Customers: AI facilitates a more profound insight into customers’ behaviors and financial needs. By analyzing data and utilizing machine learning algorithms, banks can develop a comprehensive understanding of their customers, allowing for more targeted services.

- Adaptation to a Changing Business Environment: In a landscape characterized by constant change, AI serves as a valuable tool for ensuring banks remain agile and responsive to shifting demands.

- Challenges and Opportunities: While AI presents significant opportunities for banks, it also poses challenges. Banks must address issues related to data privacy, ethical considerations, and the potential biases inherent in AI algorithms.

- Key to Future Success: AI will be a pivotal factor in differentiating successful banks in the coming years. Banks that effectively harness AI technologies are likely to maintain their competitiveness and adapt to the changing demands of customers and the business landscape.

What are the Challenges?

- Digitalization Challenges: The digitalization of banking services has introduced several challenges. These include the proliferation of unregulated digital lending apps, the emergence of cryptocurrencies, and the risk of cyberattacks.

- Cybersecurity Risks: There is a need to address cybersecurity risks. As digitalization advances, banks are increasingly vulnerable to cyber threats and attacks.

- Critical Support Infrastructure: With the increasing reliance on digital banking channels, ensuring the availability of critical support infrastructure becomes paramount. This encompasses maintaining secure payment settlement systems, safeguarding ATMs, and ensuring the continuity of internet and mobile banking services.

- Data Challenges: As banks increasingly rely on data for decision-making and personalization, addressing methodological and data challenges is essential. Ensuring data accuracy, security, and compliance with privacy regulations is a responsibility that banks must prioritize.

Way forward

- Customer Grievances: The digital banking era comes with added responsibilities related to addressing customer grievances efficiently. Banks must establish mechanisms to handle and resolve customer complaints promptly to ensure the uninterrupted delivery of banking services.

- Regulator frameworks: These digitalization-related challenges require banks to adopt robust security measures and regulatory frameworks to protect both customers and the financial system.

- Climate Change Imperative: Initiatives for decarbonization present opportunities in renewables, green hydrogen, and green goods trade. Banks are expected to be major financiers in combating climate change, necessitating robust risk management practices.

- Investment in Human Resources: In an ever-changing environment, the quality of human resources becomes a critical differentiator. Banks and financial institutions must attract, train, and retain talent while fostering adaptability and upskilling.

- Innovation and Governance: Financial services must invest in research and embrace out-of-the-box ideas for seamless service delivery and product personalization. Governance remains the backbone of institutions and is crucial for financial stability.

Conclusion

- India’s banking sector has endured and evolved, emerging from a challenging decade more resilient and adaptable. With a focus on robust governance, innovation, and a growing domestic market, it is poised to play a crucial role in India’s journey towards an Atmanirbhar Bharat, promoting equitable and sustainable development.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

Self-Regulatory Organizations (SROs) in the Fintech Sector

From UPSC perspective, the following things are important :

Prelims level: Self-Regulatory Organizations (SROs)

Mains level: Not Much

Central Idea

- In the rapidly evolving landscape of the fintech sector, the Reserve Bank of India (RBI) Governor has called upon fintech entities to establish Self-Regulatory Organizations (SROs).

What is an SRO (Self-Regulatory Organization)?

- An SRO is a non-governmental entity entrusted with the task of formulating and enforcing rules and standards governing the behaviour of participants within a specific industry.

- The primary objective of an SRO is to safeguard consumer interests, uphold ethical practices, promote equality, and nurture professionalism within the industry.

- Typically, SROs collaborate with all industry stakeholders to establish and administer regulations.

Key Characteristics of an SRO

- Impartial Governance: SROs maintain impartial mechanisms to oversee self-regulatory processes, ensuring that industry members operate within a disciplined framework and accept penalties when necessary.

- Beyond Industry Interests: SROs extend their concerns beyond the narrow interests of the industry itself. They aim to protect not only industry players but also workers, customers, and other participants in the ecosystem.

- Supplement to Existing Regulations: While SROs formulate regulations, standards, and mechanisms for dispute resolution and enforcement, they do not replace applicable laws or government regulations. Instead, they complement existing legal frameworks.

Functions of an SRO

- Communication Channel: SROs serve as intermediaries between their members and regulatory authorities like the RBI, facilitating two-way communication.

- Establishment of Standards: SROs work to establish minimum benchmarks and industry standards, fostering professionalism and healthy market behavior among their members.

- Training and Awareness: SROs provide training to their members’ staff and conduct awareness programs to promote industry best practices.

- Grievance Redressal: They establish uniform grievance redressal and dispute management frameworks to resolve issues within the industry.

Why is an SRO Necessary?

- As the fintech sector continues to evolve, SROs can play a pivotal role in ensuring the industry’s responsible growth and maintaining ethical standards.

- They address critical issues such as market integrity, conduct, data privacy, cybersecurity, and risk management.

- SROs contribute to building trust among consumers, investors, and regulators.

RBI’s Expectations from Fintech Players

- The Reserve Bank of India expects fintech companies to:

- Evolve industry best practices and privacy/data protection norms in compliance with local laws.

- Set standards to prevent mis-selling and promote ethical business practices.

- Ensure transparency in pricing.

- RBI Governor has encouraged fintechs to establish an SRO voluntarily.

Benefits of an SRO

- Industry Expertise: SROs possess deep industry knowledge, making them valuable contributors to industry discussions and educational initiatives.

- Standardized Conduct: SROs promote a standardized code of conduct that encourages ethical business practices, ultimately boosting confidence in the industry.

- Watchdog Role: SROs act as watchdogs, preventing unprofessional and unethical practices within the industry.

Conclusion

- In the dynamic fintech sector, Self-Regulatory Organizations (SROs) emerge as indispensable entities.

- Their role in shaping industry behaviour, promoting ethical conduct, and safeguarding consumer interests cannot be overstated.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

Urban Cooperative Banks (UCBs): Concerns and Considerations

From UPSC perspective, the following things are important :

Prelims level: Urban Cooperative Banks (UCBs)

Mains level: Not Much

Central Idea

- The Reserve Bank of India (RBI) Governor recently addressed the issues and vulnerabilities surrounding Urban Cooperative Banks (UCBs), highlighting the importance of addressing these concerns.

What are Urban Cooperative Banks (UCBs)?

- UCBs are primary cooperative banks primarily situated in urban and semi-urban areas, catering to the financial needs of small borrowers and businesses.

- They are governed by the Banking Regulations Act, 1949, the Banking Laws (Cooperative Societies) Act, 1955, and registered under the Cooperative Societies Act of the respective State.

- Initially, UCBs were permitted to lend exclusively for non-agricultural purposes; however, they have diversified their size and operations since 1996.

- Approximately 79% of UCBs are concentrated in five states: Andhra Pradesh, Gujarat, Karnataka, Maharashtra, and Tamil Nadu.

Types of UCBs

UCBs are categorized into different tiers by the RBI based on their deposit size:

- Tier 1: Deposits up to Rs 100 crore.

- Tier 2: Deposits ranging from Rs 100 to 1,000 crore.

- Tier 3: Deposits between Rs 1,000 to Rs 10,000 crore.

- Tier 4: Deposits exceeding Rs 10,000 crore.

Key concerns/addresses raised by RBI

(1) Operational Stability

- UCBs must enhance their financial and operational resilience to contribute to the overall stability of the financial and banking sector.

- The quality of governance within UCBs plays a pivotal role in ensuring the stability of these individual banks.

(2) Setting up right priorities

- Boards and directors of UCBs must prioritize integrity and transparency in financial reporting, refraining from innovative accounting practices that obscure the actual financial position.

- Proactive management of Asset Liability is essential to manage liquidity risk systematically.

- Establishing robust IT and cybersecurity infrastructure, along with the availability of necessary skills at the bank level, is crucial.

- Governance practices, especially those related to Compliance, Risk Management, and Internal Audit, need strengthening.

(3) Functioning of Boards

- Ensuring directors possess adequate skills and expertise.

- Constituting a professional board of management.

- Considering the diversity and tenure of board members.

- Promoting transparent and participatory board discussions.

- Ensuring the effective functioning of board-level Committees.

(4) Credit Risk Management

- Upholding risk management through robust underwriting standards.

- Implementing effective post-sanction monitoring.

- Timely recognition and mitigation of emerging stress.

- Pursuing follow-ups with large Non-Performing Asset (NPA) borrowers to facilitate recovery and maintain adequate provisioning.

Conclusion

- Addressing the concerns and vulnerabilities in Urban Cooperative Banks is vital for the overall stability and resilience of the banking sector.

- The RBI’s recommendations highlight the importance of governance, risk management, and transparency in ensuring the health of UCBs.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

How NBFCs can be used to address the problem of credit inadequacy in India

From UPSC perspective, the following things are important :

Prelims level: NBFCs and other related concepts

Mains level: credit inadequacy and the role of NBFCs

What’s the news?

- India’s Non-Banking Financial Company (NBFC) sector is on a path of recovery after a turbulent period following the collapse of IL&FS and the challenges posed by the COVID-19 pandemic.

Central idea

- India’s NBFC sector’s revival aids credit flow in tandem with banks, bolstered by upgraded outlooks from ICRA due to enhanced oversight, wider bank credit, robust market performance, reduced NPAs, and higher provisions. However, Ind-Ra and Fitch’s caution highlights concerns over certain NBFCs’ unsecured credit exposures.

Non-Banking Financial Company (NBFC)

- A NBFC is a financial institution that offers various financial services similar to those offered by traditional banks, but it does not hold a banking license and cannot accept deposits from the public.

- NBFCs provide services such as loans and credit, investment and wealth management, insurance services, money market operations, and other financial products.

- They play a crucial role in extending credit to sectors of the economy that might not be served by traditional banks, contributing to financial inclusion and overall economic growth.

What is credit inadequacy?

- Credit inadequacy refers to the insufficiency of available credit or loans to meet the financial needs and investment requirements of various sectors within an economy.

- In the context of India, it signifies a situation where the amount of credit available from traditional banking sources is limited and falls short of what is required to support economic growth, business expansion, and other investment activities.

What are credit sources?

- Credit sources refer to the origins or channels through which funds are made available for lending or borrowing purposes.

Credit sources within the Indian financial system

- Credit Flow through Financial Intermediaries (Banks and NBFCs):

- This channel involves banks and Non-Banking Financial Companies (NBFCs) acting as intermediaries between savers and borrowers.

- Banks collect deposits from individuals and businesses and then lend these funds to borrowers in the form of loans.

- NBFCs, while similar to banks, cannot accept deposits but can still provide credit by borrowing from other financial institutions or markets and lending those funds to borrowers.

- Market credit through bond markets:

- This channel involves borrowing and lending directly through the financial markets.

- Various participants, like mutual funds, insurance companies, and banks, engage in the bond market.

- Borrowers issue bonds, which are essentially debt instruments, and investors purchase these bonds, effectively lending money to the issuers in return for interest payments.

Evolution of credit and banking sector challenges

- Historical Credit Growth:

- Between 1991 and the early 2000s, annual bank credit expanded by 15% on average.

- From 2003 to 2008, the growth rate surged to 28%, driven by optimistic disbursements for the commercial sector due to positive growth outlook.

- Challenges and Non-Performing Assets (NPAs):

- The rapid credit expansion of 2003-2008 led to an increase in non-performing assets (NPAs) during the early 2010s.

- The Reserve Bank of India (RBI) introduced asset quality reviews in 2016 as NPAs rose from 3.4% to 10% between 2013 and 2017.

- The rise in bad assets hampered banks appetite for commercial sector exposure, leading to a shift towards retail loans.

- Credit Slowdown and NBFC Emergence:

- Bank credit growth declined after 2016, reaching 10% annually pre-Covid, and further dropping to 7% during the pandemic.

- This slowdown created an opportunity for Non-Banking Financial Companies (NBFCs) to step in and bridge the credit gap.

- NBFCs compensated for reduced bank credit, particularly in MSMEs and real estate, where they contributed 60% of incremental credit flows between 2014 and 2018.

- Disruption and Liquidity Crisis:

- A major infrastructural lending-focused NBFC’s collapse in 2018 created a sector-wide contagion.

- Both commercial banks and NBFCs experienced a sharp decline in incremental credit, resulting in liquidity challenges.

- This crisis highlighted the vulnerability of NBFCs due to concentrated liability books and disrupted funding sources.

Significance of NBFCs in a capital-constrained nation like India?

- Filling the Credit Gap: In a country where credit flow is limited, NBFCs step in to bridge the credit gap, particularly in sectors like MSMEs and real estate. They contribute 60% of incremental credit flows to these sectors, supporting their growth and development.

- Niche Expertise: NBFCs possess specialized sectoral expertise and flexibility in underwriting. They can evaluate borrowers based on unconventional parameters, extending credit to segments that traditional banks might consider riskier.

- Financial Inclusion: NBFCs extend credit to underserved and remote regions where traditional banks have limited reach. This contributes to financial inclusion by providing loans to individuals and businesses that might otherwise be excluded from the formal credit system.

- Timely Investment: With quick and efficient loan processing, NBFCs enable timely investment and economic activity. This agility is crucial in addressing credit needs promptly, supporting growth in various sectors.

- Alternative Funding: NBFCs raise funds through diverse channels such as bank borrowings, market issuances, and commercial papers. This alternative funding approach ensures that credit is available even when traditional banking sources face limitations.

- Complementary Role: NBFCs complement traditional banks by extending credit and financial services. They serve as an alternative credit avenue, ensuring a broader spectrum of borrowers can access the funds needed for their ventures.

- MSME and Real Estate Focus: NBFCs’ emphasis on MSME and real estate financing fills a critical gap. These sectors, vital for India’s growth, often face challenges in accessing credit from traditional banks due to perceived risks or constraints.

- Sectoral Growth: NBFCs, with their specialized approach, contribute to sectoral growth. For instance, they supported 60% of incremental credit flows to MSMEs and real estate developers between 2014 and 2018, facilitating expansion in these key sectors.

- Diversified Credit Landscape: NBFCs enhance the overall credit landscape by offering an alternative credit channel. Their presence helps distribute credit more evenly across sectors, promoting balanced economic growth.

How can NBFCs be used to address the problem of credit inadequacy in India?

- Targeted Credit Access: NBFCs can cater to segments that traditional banks might find riskier or less viable, such as MSMEs and real estate developers. Their specialized approach, nimbleness, and sectoral expertise allow them to provide tailored credit solutions to these underserved sectors.

- Financial Inclusion: NBFCs extend credit to areas where traditional banks have limited reach, fostering financial inclusion. They can provide loans to individuals and businesses in remote and underserved regions, contributing to economic growth across the nation.

- Flexibility in Underwriting: NBFCs often adopt innovative and tech-enabled approaches for assessing creditworthiness. This enables them to evaluate borrowers based on unconventional parameters, extending credit to those who might not meet traditional banking criteria.

- Quick and Efficient Processes: NBFCs, with streamlined operations, can offer faster loan approvals and disbursements. This agility in processing loans can bridge the credit gap more rapidly, supporting timely investment and economic activities.

- Sectoral Focus: NBFCs can concentrate on specific sectors or niches, catering to unique credit requirements. For instance, they can offer specialized real estate financing or support to micro and small businesses, contributing to sectoral growth.

- Liquidity Channels: NBFCs can raise funds through various channels, including bank borrowings, market issuances, and commercial papers. This diversity in funding sources enables them to overcome liquidity challenges more effectively.

- Diversification of Funding Sources: For sustainable growth, NBFCs can diversify their funding sources to reduce reliance on specific channels, reducing vulnerability to liquidity shocks, as highlighted in the article.

- Complementing the Banking System: NBFCs complement traditional banks in extending credit and financial services. Their presence provides an alternative credit avenue, ensuring that credit is available to a wider spectrum of borrowers.

Conclusion

- In a country where financial inclusion and access to bank credit remain challenges, NBFCs play a vital role in reaching underserved segments. Learning from the crisis of 2018–2021, diversifying funding sources, and implementing short-term liquidity buffers can fortify NBFCs against future shocks.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

De-dollarisation: Is it a gateway to rupeefication?

From UPSC perspective, the following things are important :

Prelims level: Key concepts: rupeefication, Dollarisation, De-dollarisation

Mains level: De-dollarisation, rupeefication advantages and challenges

What’s the news?

- Countries worldwide are pursuing de-dollarisation to reduce reliance on the US dollar in international trade, exploring bilateral currency agreements and strategies like rupeefication.

Central idea

- In the past century, a single currency has dominated the global economy, transitioning from the pound sterling to the US dollar, now comprising 59.02% of COFER. The US dollar’s prevalence is due to its pivotal role in international trade. India’s push for the Indian Rupee’s use in trade showcases this trend, aiming at bolstering economic autonomy.

What is meant by Dollarisation?

- US dollar as a substitute for domestic currency: Dollarisation refers to the phenomenon where countries adopt the US dollar as a substitute for their domestic currency to varying degrees.

- This practice can take several forms:

- Financial dollarisation (substituting domestic assets/liabilities with foreign ones)

- Real dollarisation (pegging domestic transactions to exchange rates)

- Transactional dollarisation (using the US dollar for domestic transactions)

- Poor performance of the domestic currency:

- Dollarisation typically arises due to the poor performance of the domestic currency, caused by factors such as political instability or economic uncertainty.

- It can also result from financial market liberalization and economic integration, leading to reduced exchange rate risk and increased capital inflow.

- The US dollar’s dominance: The US dollar’s dominance as an anchor currency for international trade contributes to its widespread acceptance and high demand, thereby driving dollarisation trends.

What is meant by De-dollarisation?

- De-Dollarisation refers to the global trend of countries reducing their reliance on the US dollar in international trade and financial transactions.

- This movement involves shifting towards bilateral currency agreements, using domestic currencies for trade, and promoting alternatives to the dollar.

- The aim is to achieve greater economic autonomy, reduce risks associated with dollar fluctuations, and challenge the dominance of the US dollar in the global financial system.

What is meant by Rupeefication?

- Rupeefication refers to the process of internationalizing the Indian Rupee (INR) by promoting its use in international trade and financial transactions.

- This strategy involves enabling trade partners to transact in INR, issuing financial instruments denominated in INR to foreign entities, and facilitating greater access to the INR in global markets.

- The objective of rupeefication is to enhance the INR’s status as a global currency, reduce dependence on the US dollar, and strengthen India’s economic resilience and autonomy on the global stage.

De-dollarisation in motion

- Brazil’s Bilateral Currency Trade: Brazil is expanding bilateral currency trade agreements, notably with Japan and China. These agreements involve using domestic currencies for trade, reducing reliance on the US dollar.

- China’s Leadership in De-Dollarisation: Following sanctions against Russia, China has been at the forefront of reducing dollar reliance. China’s actions have prompted other BRICS nations to follow suit in decreasing dollar usage.

- Indonesia’s Local Currency Trade System: Indonesia has adopted a Local Currency Trade (LCT) system to lower the role of the US dollar in its current account transactions. This shift aims to promote greater usage of domestic currency.

- Africa’s Consideration for Intra-Africa Trade: African nations are contemplating replacing the US dollar with domestic currencies for intra-Africa trade. This approach aligns with the broader global trend of de-dollarisation.

- BRICS Summit and Integrated Payment System: The upcoming BRICS Summit will address the challenges of de-dollarising trade and establishing an integrated payment system. This reflects the growing global emphasis on reducing dollar dependence.

- India’s Multi-Faceted Approach: India, while pursuing de-dollarisation, also considers bilateral currency agreements. However, it might opt out of a common BRICS currency due to existing trade commitments with the US and Europe

How is India actively advancing its systems to bypass the US dollar and fortify the INR?

- Bilateral Currency Agreements: India is engaging in bilateral currency agreements with multiple nations. These agreements encourage trade partners to transact in INR instead of the US dollar, reducing the reliance on the dollar in international trade transactions.

- Special Rupee Vostro Accounts (SRVAs): India has established Special Rupee Vostro Accounts with various countries, including the UK, Russia, Sri Lanka, and Germany. These accounts enable foreign entities to transact in INR directly with Indian banks, promoting the use of the Indian currency.

- Currency Internationalization: By promoting the use of INR in international transactions, India aims to increase the acceptance of its currency in global markets. This strategy involves initiatives to make INR more widely recognized and used beyond its borders.

- Reducing Dollar Dependency: India’s efforts to develop systems that bypass the dollar aim to reduce the country’s dependence on the US dollar for international trade and financial transactions. This can enhance India’s economic autonomy and mitigate the risks associated with fluctuations in the value of the dollar.

- Enhancing the INR’s Global Role: Strengthening the INR involves making it a viable alternative to the US dollar in global transactions. By creating systems that support the use of INR in trade and finance, India aims to increase the currency’s global significance.

Advantages of rupeefication

- Risk Mitigation for Exporters: Rupeefication provides exporters with a means to limit their exposure to exchange rate risks. By invoicing trade in INR, exporters can avoid the uncertainties associated with fluctuating US dollar exchange rates, enhancing predictability in their earnings.

- Deepened Markets and Wider Access: The adoption of rupeefication can lead to increased market access and deeper trade relationships. As the INR gains wider acceptance, exporters can tap into new markets and expand their customer base.

- Lower Borrowing Costs for the Private Sector: Rupeefication enables the private sector to access international financial markets with reduced borrowing costs. This can result in enhanced profitability and investment opportunities for businesses.

- Public Sector Financing Flexibility: The public sector benefits from the ability to issue international debt denominated in INR. This provides an alternative source of financing for government projects without depleting official US dollar reserves.

- Strengthened Economic Autonomy: By promoting rupeefication, India can gradually reduce its reliance on the US dollar, leading to increased economic autonomy. This reduces vulnerability to external economic shocks and fluctuations in the value of the dollar.

- Microeconomic Growth and Livelihoods: A focus on rupeefication encourages the growth of the private sector, leading to increased economic activities and job opportunities. This approach can contribute to the improvement of livelihoods across various sectors.

- Enhanced Monetary Policy Autonomy: As rupeefication gains traction, India can exercise more control over its domestic monetary policy. This autonomy allows for tailored economic measures that align with the country’s specific needs.

Potential challenges associated with its implementation

- Exchange Rate Volatility: Shifting towards rupeefication could expose businesses to exchange rate volatility if the INR’s value fluctuates significantly against other major currencies. This could impact the predictability of earnings and increase risks for exporters.

- Limited Acceptance in International Markets: Achieving widespread acceptance of the INR in global markets might be challenging. Many international transactions are still predominantly conducted in the US dollar, which could hinder the seamless adoption of rupeefication.

- Global Economic and Political Factors: External economic and political events can impact the feasibility of rupeefication. Global factors such as economic crises or geopolitical tensions could influence the willingness of other nations to engage in transactions using the INR.

- Trade Balance and Reserves: A swift shift to rupeefication might impact India’s trade balance and foreign exchange reserves, potentially necessitating greater reserves of foreign currencies to manage trade deficits.

- Gradual Implementation: Rapidly transitioning to rupeefication might lead to economic disruptions.

Way forward

- Gradual Transition: To address the challenges and uncertainties associated with shifting towards rupeefication, a gradual and phased approach is recommended. This allows businesses, financial institutions, and the economy as a whole to adapt to the changes smoothly.

- Macroeconomic Stability: Maintaining macroeconomic stability is crucial. Efforts should be directed toward ensuring the stability of the INR’s value to inspire confidence among trade partners and investors.

- Promoting INR Use: Initiatives to promote the use of the INR in international transactions should be continued. This could involve diplomatic efforts to foster bilateral agreements, increasing awareness about the benefits of INR invoicing, and addressing concerns about exchange rate risk.

- Collaborative Approach: Collaborating with other nations and international organizations is essential. The adoption of rupeefication requires cooperation and coordination among various stakeholders to establish the INR as a viable global currency.

- Balancing Trade and Reserves: Balancing trade and managing foreign exchange reserves remain crucial. Gradual rupeefication should align with maintaining a stable trade balance and adequate reserves to manage potential deficits.

Conclusion

- While the journey towards de-dollarisation and rupeefication is multifaceted and not devoid of challenges, India’s persistent efforts to limit dollar reliance while nurturing the international status of the INR underscore its commitment to greater economic autonomy. By gradually integrating the INR into the global financial landscape, India aims to bolster its economic resilience, promote growth, and enhance its position as a global economic player.

Also read:

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

Full-Reserve Banking vs. Fractional-Reserve Banking

From UPSC perspective, the following things are important :

Prelims level: Full-Reserve Banking

Mains level: Not Much

Central Idea

- Full-reserve banking, also known as 100% reserve banking, and fractional-reserve banking are two different systems of banking that determine how banks handle customer deposits and lending practices.

- This article discusses the key differences between these two banking systems and the arguments put forth by proponents of each approach.

What is Full-Reserve Banking?

- Custodian Role: In a full-reserve banking system, banks hold all money received as demand deposits from customers in their vaults, acting as safekeepers of depositors’ funds.

- Limited Lending: Banks can only lend money from time deposits, which customers can withdraw after an agreed-upon period.

- Preventing Bank Runs: The full reserve ensures banks can meet depositor demands even if all customers seek to withdraw their money simultaneously, reducing the risk of a bank run.

- Restricted Money Supply: Banks cannot create money through loans, limiting their influence on the economy’s money supply and potentially preventing artificial booms and busts.

Contrary Idea: Fractional-Reserve Banking

- Lending with Electronic Money: Banks in a fractional-reserve system predominantly lend in the form of electronic money, allowing them to lend more than the physical cash they have in vaults.

- Risk of Bank Runs: Although electronic money minimizes cash withdrawals, excessive loans can lead to a bank run if depositors demand cash that exceeds the actual cash reserves.

- Supporting Economic Growth: Proponents argue that fractional-reserve banking fuels investment and economic growth by allowing banks to create loans without relying solely on customer savings.

Arguments for both systems

- Fractional-Reserve Banking: Supporters believe fractional-reserve banking frees the economy from the constraints of real savings, stimulating investment and growth.

- Full-Reserve Banking: Supporters argue that full-reserve banking is more natural, prevents bank runs, and limits banks’ ability to create money, which could prevent economic instability.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Banking Sector Reforms

Bad loans at record low, but write-offs still in the mix

From UPSC perspective, the following things are important :

Prelims level: NPA, Writ off, its direct and indirect impact on financial stability

Mains level: NPA's, implications for banks and economy as a whole

What is the news?

- The latest financial stability report released by the Reserve Bank of India (RBI) shows a continuous decline in both Gross Non-performing assets (GNPAs) and Net NPAs, reaching their lowest levels since 2015.

Central Idea

- In recent years, the Indian banking sector has witnessed a remarkable turnaround in its non-performing assets (NPA) ratio, marking a significant improvement in its overall health. Just four years ago, Indian banks grappled with the highest NPA ratio among emerging economies.

What are Bad loans/ Non-Performing Assets (NPA’s)?

- Bad loans refer to loans that are classified as non-performing assets

- NPA is a term used to classify loans or advances that are in default. It indicates the inability of borrowers to fulfill their repayment obligations to the lender.

- In general, a loan is classified as an NPA when the borrower fails to make payments for a specified period, typically 90 days or more.

There are two key classifications related to NPAs:

- Gross Non-Performing Assets (GNPA): This refers to the total amount of loans or advances that have been defaulted by borrowers.

- Net Non-Performing Assets (NNPA): NNPA is derived by deducting the provision amount from the GNPA. Provision refers to the amount set aside by banks or financial institutions as a precautionary measure to cover potential losses arising from NPAs.

Background and Current Situation

- During the second quarter of 2019, the NPA ratio in Indian banks stood at a worrisome 9.2%, signifying that nearly one in ten loans had become bad.

- The severity of the problem was unveiled when the RBI conducted an expansive Asset Quality Review in 2016, exposing the true extent of bad loans.

- From 2016 to 2019, the NPA ratio remained high, causing apprehension among stakeholders.

- However, subsequent years witnessed a decline in the NPA ratio, a trend that persisted even during the challenging times of the COVID-19 pandemic.

Factors contributing to the decline in NPAs

- Insolvency and Bankruptcy Code (IBC): The implementation of the Insolvency and Bankruptcy Code in 2016 played a crucial role in the recovery of sick loans. It provided a structured and time-bound framework for resolving distressed assets, leading to improved NPA management and recovery.

- Shift towards personal loans: Banks shifted their lending focus from industries to personal loans. This strategic move reduced the exposure to sectors heavily impacted by the pandemic, potentially mitigating the risks of loan defaults and lowering the NPA ratio.

- Impact of COVID-19-related moratoriums: There were concerns about the potential increase in NPAs resulting from the COVID-19-related moratoriums. However, the data indicated that the moratoriums did not lead to a significant bump in NPAs, as initially expected. This suggests that the measures implemented to support borrowers during the pandemic were effective in preventing a major NPA crisis.

- Write-offs: The reduction in NPAs, particularly in FY20, can be attributed to the practice of writing off bad loans. Banks voluntarily wrote off NPAs to maintain healthy balance sheets, which had a positive impact on the overall NPA ratio. However, the continued reliance on write-offs raises concerns about the sustainability of this approach in the long run.

What are Write-Offs?

- Write-offs refer to the practice of removing non-performing assets (NPAs) from a bank’s balance sheet. When a loan becomes irrecoverable and the borrower is unable to repay, the bank may decide to write off the loan as a loss.

- This means that the bank no longer considers the loan as an asset and removes it from its books.

- Write-offs are typically done to maintain accurate financial records and reflect the true value of the bank’s assets

Concerns highlighted regarding write-offs

- Sustainability of NPA Reduction: Write-offs may artificially lower NPAs, but heavy reliance raises doubts about sustainable NPA reduction without effective recovery measures.

- Adequacy of Provisioning: Insufficient provisions to cover losses due to write-offs can weaken a bank’s financial position and ability to absorb future shocks.

- Transparency and Accountability: Ensuring transparent and accountable write-off processes is crucial to prevent misuse and maintain trust in the banking system.

- Impact on Lending Capacity: Write-offs reduce available capital, limiting a bank’s ability to lend and support economic growth. Inadequate replenishment may further constrain lending.

Decline in NPAs: Implications for the banks

- Improved Asset Quality: A decrease in NPAs indicates an improvement in the asset quality of banks. It suggests that a lower proportion of loans are in default or arrears, reflecting healthier lending practices and reduced credit risk. Banks with lower NPAs are better positioned to maintain stability and profitability in their loan portfolios.

- Enhanced Financial Health: Declining NPAs contribute to the overall financial health of banks. As the burden of bad loans decreases, banks can allocate resources more efficiently and utilize capital for productive purposes. This improves the banks’ ability to generate profits and strengthens their financial position.

- Increased Profitability: Lower NPAs positively impact banks’ profitability. When the proportion of bad loans decreases, banks experience fewer loan write-offs and provisioning requirements. This results in lower expenses associated with NPA resolution and provisioning, thereby enhancing profitability and improving the bottom line.

- Strengthened Capital Position: A decline in NPAs can lead to a strengthened capital position for banks. As they recover or resolve NPAs, banks can allocate capital more effectively and build buffers against potential losses. A stronger capital position provides resilience and stability to the banks, ensuring they can absorb shocks and maintain sustainable lending practices.

- Improved Investor Confidence: Decreasing NPAs can boost investor confidence in the banking sector. It demonstrates efficient risk management and sound lending practices, attracting investors and potentially leading to increased investments in banks. Enhanced investor confidence can contribute to the stability and growth of the banking sector.

- Enhanced Lending Capacity: With lower NPAs, banks can allocate more funds towards fresh lending and credit expansion. As the burden of bad loans reduces, banks have more capital available to extend credit to productive sectors of the economy, supporting economic growth and development

Conclusion