Capital Markets: Challenges and Developments

Why rupee challenges are primarily external

Why in the News?

The Indian rupee touched a historic low of around ₹91.98 per US dollar in early 2026, prompting concerns over macroeconomic stability. The Economic Survey 2025-26 identifies this episode as part of a broader global capital reallocation rather than a domestic crisis. This is significant because the Survey explicitly rejects the “currency underperformance equals weak fundamentals” assumption, even as India records strong growth, controlled inflation, and stable agricultural output. The issue is large in scale: foreign portfolio investors withdrew about $41 billion in January alone, pushing total outflows in 2025 close to $11.8 billion, making external capital volatility a first-order macroeconomic risk.

Why Has the Rupee Been Underperforming Despite Strong Fundamentals?

- External Capital Outflows: Sustained withdrawal of foreign portfolio investments in equity and debt segments exerts downward pressure on the rupee despite stable domestic indicators.

- Magnitude of Outflows: Portfolio investors withdrew nearly $41 billion in January 2026, with cumulative outflows of $11.8 billion in 2025, indicating scale rather than episodic volatility.

- Domestic Counterbalancing: Mutual funds and insurance companies provided partial support, but domestic flows were insufficient to neutralise foreign exits.

- Investor Risk Perception: Global uncertainty induces portfolio rebalancing away from emerging markets, irrespective of individual country performance.

How Do Capital Inflows Shape Rupee Stability?

- Balance of Payments Dependence: India relies on foreign capital inflows to maintain a manageable balance of payments position.

- Liquidity Transmission: Sudden contraction in inflows tightens dollar liquidity, amplifying exchange rate volatility.

- Capital Flight Risk: The Survey flags capital flight as a key near-term risk, especially during periods of global financial stress.

- US Dollar Dominance: Heightened demand for dollar assets during uncertainty weakens emerging market currencies uniformly.

What Role Do Global Trade and Tariff Shocks Play?

- US Tariff Escalation: Steep tariff increases by the US, including potential 50% duties, create uncertainty for exporters.

- Export Disruption: While outbound shipments remain resilient so far, exporters face order delays and price renegotiations.

- Inflation Transmission: Higher tariffs on Indian goods may indirectly affect investment sentiment rather than immediate inflation.

- Investor Hesitation: Trade uncertainty discourages long-term capital commitments, increasing exchange-rate sensitivity.

Why Is Manufacturing Not Enough to Stabilise the Currency?

- Limited Export Offset: Manufacturing strength alone cannot fully compensate for trade deficits in goods.

- Structural Gap: Services exports and remittances provide support but do not substitute industrial export depth.

- Industrial Capacity Constraint: Currency resilience requires diversified, complex manufacturing with scale.

- Policy Sequencing: Export competitiveness must precede exchange-rate stability, not follow it.

What External Risks Dominate the 2026 Outlook?

- Global Scenario Volatility: The Survey outlines three global scenarios, baseline recovery, disorderly breakdown, and systemic shock.

- Capital Flow Sensitivity: Even moderate global shocks trigger disproportionate capital outflows from emerging markets.

- Institutional Fragility: Weaker global shock absorbers increase contagion risk across trade, finance, and currencies.

- Strategic Sobriety: The Survey calls for preparedness rather than optimism, given external uncertainty.

What Policy Response Does the Survey Advocate?

- Liquidity Planning: Strengthens preparedness for sudden capital outflows through buffer creation.

- FDI Expansion: Prioritises stable long-term capital over volatile portfolio flows.

- Import Financing Resilience: Ensures uninterrupted financing for essential imports.

- Payment Diversification: Encourages diversification of trade routes and settlement systems.

Conclusion

The Economic Survey 2025-26 reframes rupee depreciation as an externally induced phenomenon rooted in global capital cycles rather than domestic macroeconomic weakness. Currency stability, therefore, depends less on short-term exchange-rate management and more on long-term structural resilience, particularly stable capital inflows, diversified exports, and robust external buffers.

PYQ Relevance

[UPSC 2018] How would the recent phenomena of protectionism and currency manipulations in world trade affect macroeconomic stability of India?

Linkage: This PYQ directly tests how global protectionism and currency manipulation transmit external shocks into India’s exchange rate. The Economic Survey 2025-26 reinforces this by showing that rupee weakness is driven mainly by global trade tensions and volatile foreign capital flows.

Capital Markets: Challenges and Developments

Why silver prices surfed at 160% wave in 2025

Introduction

Silver’s price escalation in 2025 reflects a transformation from a quasi-precious metal into a critical industrial and financial asset. Unlike gold, silver’s value is increasingly driven by its role in energy transition technologies, electronics, and advanced manufacturing, compounded by global supply constraints and portfolio diversification strategies amid macroeconomic uncertainty.

Why in the News?

Silver prices recorded an unprecedented 160% rise in 2025, crossing ₹1,00,000 per kg for the first time in December and extending gains into early 2026. This surge marks a sharp departure from earlier years when silver lagged behind gold despite industrial relevance. The rally is significant due to the simultaneous occurrence of global supply shortages, rising industrial demand, financial market inflows, and policy-driven monetary easing, indicating a structural rather than speculative price shift.

Why did silver prices rise steadily through 2025?

- Price escalation trend: Silver spot prices rose from ₹85,913 per kg in January 2025 to ₹2,46,889 per kg by January 2026, reflecting sustained monthly gains rather than episodic spikes.

- Contrast with gold: While gold reached record highs, silver outperformed gold in percentage terms, breaking its traditional role as a lagging asset.

How did monetary policy fuel silver’s rally?

- Interest rate expectations: Anticipation of rate cuts by the US Federal Reserve reduced opportunity costs of holding non-yielding assets.

- Liquidity expansion: Easing global monetary conditions increased capital flows into commodities as inflation hedges.

- Debasement trade: Weakening of the US dollar revived investor preference for hard assets, including silver.

What role did industrial demand play in driving prices?

- Energy transition demand: Silver usage expanded in solar panels, batteries, and electronics, making it integral to climate-transition infrastructure.

- Artificial Intelligence applications: AI-driven data centres and electronics increased silver consumption across high-conductivity components.

- Demand breadth: Unlike gold, silver’s value is supported by simultaneous investment and consumption demand, amplifying price momentum.

Why did global supply fail to keep pace with demand?

- By-product mining constraint: Silver production depends largely on extraction alongside other metals, limiting supply responsiveness.

- Supply-demand imbalance: Global silver output did not rise proportionately despite demand expansion in renewables and electronics.

- Critical mineral status: The US Geological Survey added silver to its critical minerals list, highlighting strategic vulnerability.

- Geopolitical signalling: China’s inclusion of silver in its critical minerals list reinforced scarcity perceptions.

How did physical shortages in global markets amplify prices?

- London market disruption: Physical silver shortages emerged in London, a key global trading hub.

- Inventory depletion: Stockpiles in the US declined sharply as inventories were drawn down to meet rising demand.

- Delivery constraints: Supply mismatches reduced confidence in paper silver contracts, increasing preference for physical holdings.

What role did financialisation and ETFs play?

- ETF inflows: Silver Exchange Traded Funds attracted strong inflows, especially after September 2025.

- Passive investment growth: Low-cost ETFs expanded retail and institutional exposure to silver.

- Momentum reinforcement: ETF buying converts price expectations into actual market demand.

Why did fear psychology matter in this rally?

- Stockpiling behaviour: US inventory accumulation triggered expectations of prolonged shortages.

- Self-fulfilling cycle: Fear of missing out encouraged accelerated buying, pushing prices higher.

- Market signalling: Rising prices validated scarcity narratives, reinforcing investor confidence.

Conclusion

The 2025 silver rally represents a structural realignment driven by industrial indispensability, constrained supply, financialisation, and macroeconomic easing. Unlike past speculative cycles, silver’s price surge reflects deeper shifts in global production systems and energy priorities. Managing such strategic commodities will be central to future economic resilience and sustainable growth.

PYQ Relevance

[UPSC 2024] What are the causes of persistent high food inflation in India? Comment on the effectiveness of the monetary policy of the RBI to control this type of inflation.

Linkage: The silver rally shows how global liquidity and supply constraints drive commodity inflation beyond the reach of monetary policy. It helps explain limits of RBI tools in controlling cost-push inflation, strengthening GS-III answers on inflation management.

Capital Markets: Challenges and Developments

RBI Announces ₹1 Trillion OMO Purchase

Why in the News?

The Reserve Bank of India announced a ₹1 trillion Open Market Operation purchase along with a 5 billion dollar rupee swap to inject durable liquidity into the banking system amid rupee weakness beyond 90 per dollar and foreign capital outflows.

What is an Open Market Operation Purchase

- An OMO purchase is when the RBI buys government securities from banks and financial institutions

- Objective is to inject durable and long term liquidity into the financial system

- Leads to an increase in bank reserves and eases short term interest rates

Purpose of OMO Purchases

- Inject durable liquidity into the banking system

- Improve monetary policy transmission so lending rates align with repo rate changes

- Stabilise money market rates such as the Weighted Average Call Rate

- Support financial stability during periods of currency and capital flow stress

Significance of the Recent OMO

- Offsets rupee liquidity drain caused by foreign portfolio outflows

- Supports monetary transmission during external sector stress

- Prevents sharp spikes in government bond yields

- Strengthens lending capacity of banks for businesses and households

Prelims Pointers

- OMO is a quantitative monetary policy tool

- OMO purchase injects liquidity while OMO sale absorbs liquidity

- Operation Twist reshapes the yield curve

- Durable liquidity differs from short term tools like repo and reverse repo

| [2013] In the context of Indian economy, ‘Open Market Operations’ refers to

(a) borrowing by scheduled banks from the RBI (b) lending by commercial banks to industry and trade (c) purchase and sale of government securities by the RBI (d) None of the above |

Capital Markets: Challenges and Developments

Savings shift reshapes India’s markets

Introduction

India’s markets are being reshaped by a decisive movement from volatile foreign capital to sticky domestic savings. Mutual funds, SIPs, and household equity ownership are expanding rapidly, providing stability. But they also reveal problems linked to market asymmetry, inexperienced investors, uneven access, promoter dominance, and structural vulnerabilities. The issue is now central to India’s economic trajectory as the country moves toward Viksit Bharat 2047.

Why in the news?

India’s equity markets have reached a turning point as domestic household savings now overshadow foreign institutional flows, marking the largest shift in market behaviour in years. SIPs continue hitting record highs, household equity ownership has reached ₹2.6 lakh crore, and over 1 lakh crore raised this fiscal through IPOs. Yet this boom masks rising risks, making it a defining moment for investor protection and financial governance.

How is domestic money reshaping India’s markets?

- Rise of domestic inflows: Household savings, SIPs, and direct retail investments now comprise nearly 19% of the market, rising consistently even as FPI flows decline.

- Record equity ownership: Households’ net equity wealth grew to ₹2.6 lakh crore, reducing dependence on volatile foreign capital.

- Lower FPI share: FPI ownership has fallen to a 15-month low, shifting market stability foundations from external to internal investors.

- Policy spillover: Lower inflation, RBI’s monetary stance, and reduced FPI volatility allow India to prioritise consumption-led growth over external vulnerability.

What explains the boom in India’s primary markets?

- Strong domestic confidence: Primary market fundraising crossed ₹1 lakh crore, aligning with new retail enthusiasm.

- High retail participation: Retail share of IPO applications rose to over 7%, showing deeper democratization of access.

- High valuation appetite: Companies like Lenskart and Nykaa drew investors despite expensive valuations.

- Promoter behaviour as signal: Promoter holdings in NIFTY 50 at a 23-year low of 40%, raising questions on whether selling reflects real capital raising or opportunistic exits.

Why are structural risks rising despite more participation?

- Performance problem: More activity does not guarantee better returns, especially for new investors entering during market highs.

- Unequal outcomes: Loss concentration among inexperienced investors undermines long-term trust.

- Access asymmetry: Limited access to low-cost passive funds, low indexing literacy, and inadequate disclosures weaken investor protection.

- Volatility exposure: New investors face market corrections without adequate safeguards or financial education.

What issues stem from unequal participation and distribution?

- Wealth concentration: Financial returns skewed toward higher-income groups widen inequality.

- Market capture: A small segment of active managers disproportionately influences market outcomes.

- IPO valuation asymmetry: Over-enthusiasm coupled with limited financial capability poses downside risks to retail wealth.

- Regional inequality: Lack of location-specific strategies excludes women and underrepresented groups from financial markets.

How can India strengthen investor protection and market stability?

- Fixing access asymmetry: Better disclosure norms, low-fee passive investing, and indexing education are essential.

- Regulatory nudges: Incentivising low-cost funds and transparent product design protects everyday investors.

- Deep structural reforms:

- Strengthening promoter governance

- Ensuring capital raising reflects business expansion

- Disincentivising opportunistic disinvestment

- Targeted inclusion: Gender- and region-specific interventions can bridge participation gaps and widen financial deepening.

Conclusion

India’s market shift toward domestic savings presents both opportunity and risk. Stability rises when markets rely less on foreign capital, but without strong investor protection, transparency, and inclusive access, democratization may turn into vulnerability. For India’s financial deepening and long-term economic resilience, governance reforms, structured investor education, and asymmetry correction must accompany rising participation.

PYQ Relevance

[UPSC 2017] Among several factors for India’s potential growth, the savings rate is the most effective one. Do you agree? What are the other factors available for growth potential?

Linkage: Rising domestic household savings reshaping India’s capital markets directly connects to the role of savings in economic growth, stability, and financial deepening.

Capital Markets: Challenges and Developments

Why the rupee has a capital account problem

Why in the news

The rupee’s recent fall is not driven by a widening current account deficit, as traditionally believed, but by an unprecedented decline in net foreign capital inflows, which have turned sharply negative for the first time in years. During April-September 2025, India saw a net outflow of $7.6 billion, a stark reversal from the $25.3 billion net inflow in the same period of 2024. This contrast signals a structural shift where India’s strong services surplus can no longer offset the sharp rise in the goods deficit alongside shrinking foreign investments, making this a serious macroeconomic turning point

Introduction

India’s external sector is undergoing a structural change where the merchandise trade deficit continues to expand, the invisibles surplus remains strong, but the capital account, especially foreign investment inflows, has weakened significantly. As a result, the rupee’s pressure today arises primarily from capital account weakness, not the current account alone, reshaping India’s macroeconomic stability narrative.

Why is India’s current account under persistent pressure?

- Widening Merchandise Trade Deficit: India’s goods trade deficit more than doubled from $91.5 bn (2007-08) to $191 bn (2022-23) and is expected to cross $300 bn in 2024-25.

- Strong but Insufficient Invisibles Surplus: Remittances, software exports and professional services push invisibles surplus to record highs, yet not enough to neutralise the merchandise gap.

- Sticky Imports & Slow Exports: Energy, electronics, and gold imports remain elevated; global demand conditions weaken export earnings.

How have invisibles cushioned the external sector so far?

- Record Remittances: Private transfers and remittances remain robust—India continues as a top global recipient.

- Soaring Software & IT Services Surplus: Services exports support the current account and contribute to India’s “invisible strength.”

- Investment Income Outflows: Rising payments on interest/dividends reduce the net benefit of the invisibles surplus.

What explains India’s capital account problem today?

- Sharp Fall in Net Capital Inflows: April-September 2025 saw $7.6 bn net outflow vs $25.3 bn inflow in 2024, the biggest recent reversal.

- Weakening Foreign Investment: FDI inflows into new factories, infrastructure, and physical assets have dropped sharply.

- FDI: $43 bn (2020-21), $22 bn (2022-23), $8 bn (2023-24) till December.

- Portfolio Flows Turning Volatile: FY23-24 saw equity outflows of $23 bn, reversing the earlier inflow phase.

- India’s Relative Growth Advantage Narrowing: High global interest rates and stronger USD attract capital away.

Why does the rupee weaken despite manageable CAD?

- Capital Outflows Overpower CAD Position: Even a moderate CAD becomes hard to finance when capital inflows dry up.

- Pressure from USD Shift: Rupee slid from ₹83.47 to ₹89.39 per USD within the year as yen, won, and yuan also weakened.

- Financing Gap: CAD remains dependent on capital inflows, weak capital flows lead to excess demand for foreign currency.

What are the macroeconomic consequences of the capital account strain?

- External Financing Stress: Lower FDI and portfolio inflows reduce India’s ability to fund domestic growth.

- Exchange Rate Volatility: Persistent rupee pressure increases import costs, especially energy and intermediate goods.

- Growth Impact: Rupee weakness raises inflationary pressures and complicates monetary policy management.

- Policy Trade-offs: RBI must balance FX stability, inflation control, and capital flow management.

CONCLUSION

India’s external account stresses now stem less from trade imbalances and more from capital inflow shortages. A resilient services surplus continues to stabilise the CAD, but declining foreign investments, both FDI and portfolio, expose the currency to sharper volatility. Addressing this requires strengthening domestic manufacturing competitiveness, improving investment climate, and ensuring predictable macroeconomic policies that reclaim India’s attractiveness for global capital.

UPSC Relevance

[UPSC 2021] Do you agree that the Indian economy has recently experienced V-shaped recovery? Give reasons in support of your answer.

Linkage: Capital account inflows, forex stability, and investment revival are key determinants of macroeconomic recovery. The article’s data on shrinking capital inflows and rupee pressures directly challenge the sustainability of a V-shaped path.

Capital Markets: Challenges and Developments

Raajmarg Infra Investment Trust (RIIT) – NHAI Public InvIT

Why in the news?

SEBI has granted in-principle approval to National Highways Authority of India (NHAI) for registering Raajmarg Infra Investment Trust (RIIT) as an Infrastructure Investment Trust (InvIT) under SEBI (InvIT) Regulations, 2014. It will support asset monetisation of national highways.

What is an InvIT

- A collective investment structure similar to REITs but for infrastructure

- Allows ownership of income-generating infrastructure assets

- Investors receive regular returns from toll/usage revenues

- Regulated by SEBI

About RIIT

- Sponsored by NHAI

- Part of NHAI’s Public InvIT strategy to attract wider retail and domestic participation

- Operated through Raajmarg Infra Investment Managers Pvt Ltd (RIIMPL)

- RIIMPL ownership: SBI, PNB, NaBFID, Axis Bank, Bajaj Finserv Ventures, HDFC Bank, ICICI Bank, IDBI Bank, IndusInd Bank, Yes Bank

InvITs and SARFAESI Act, 2002

Infrastructure Investment Trusts (InvITs) are considered borrowers under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002.

What this means

- When InvITs raise debt from banks or financial institutions, the lenders receive enforceable security

- If InvITs default on repayment, lenders can:

- Take over the secured assets

- Manage or sell the assets to recover dues

- Enforce security interest without court intervention

SEBI (Infrastructure Investment Trusts) Regulations, 2014Objective Key Features

|

| Consider the following statements : (2023)

Statement-I : Interest income from the deposits in Infra-structure Investment Trusts (InvITs) distributed to their investors is exempted from tax, but the dividend is taxable. Statement-II : InvITs are recognized as borrowers under the ‘Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002’. Which one of the following is correct in respect of the above statements? (a) Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I (b) Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I (c) Statement-I is correct but Statement-II is incorrect (d) Statement-I is incorrect but State-ment-II is correct |

Capital Markets: Challenges and Developments

Capital Gains Accounts (Second Amendment) Scheme, 2025

Why in the news?

The Ministry of Finance has notified the Capital Gains Accounts (Second Amendment) Scheme, 2025, introducing major changes to the existing Capital Gains Account Scheme (CGAS), 1988. The amendments aim to modernise processes, expand banking access, and increase clarity for taxpayers seeking capital gains exemptions.

About Capital Gains Account Scheme (CGAS), 1988

- Launched by the Central Government in 1988.

- Objective: To help taxpayers claim exemptions on long-term capital gains when reinvestment cannot be completed before the ITR filing due date.

- Linked mainly to Section 54, 54F, and related provisions of the Income Tax Act.

Why CGAS is Needed?

- Exemption requires reinvestment of capital gains within:

- 2 years (purchase of property)

- 3 years (construction of property)

- If this period extends beyond the ITR filing deadline, the taxpayer can temporarily deposit unutilised gains in CGAS to keep the exemption claim valid.

Important Conditions

- Deposit must be made before filing Income Tax Return.

- Money deposited is treated as reinvested for exemption.

- If the amount is not utilised within the stipulated period, it becomes taxable long-term capital gains in that year.

- Only long-term capital gains qualify — short-term gains are NOT eligible.

Who Can Deposit in CGAS?

- Any person with long-term capital gains, including: Individuals, HUFs, Companies, Firms, Trusts, and Any eligible taxpayer seeking exemption

- Mainly used by property sellers who need more time to reinvest.

Capital Gains Accounts (Second Amendment) Scheme, 2025 — Key Changes

- Expansion of Authorized Banks: Previously limited mostly to Public Sector Banks + IDBI Bank.

- Now extended to 19 private and small finance banks at all non-rural branches.

- Non-rural branch condition: Branch must be located in an area with population ≥ 10,000 (2011 Census).

- Rural branches cannot open CGAS accounts.

- Wider Definition of Electronic Payments: Electronic deposits can now be made through: Credit cards, Debit cards, Net banking, IMPS, UPI, RTGS, NEFT and BHIM Aadhaar Pay.This modernises the earlier narrow definition of “electronic mode”.

- Online Closure of CGAS Accounts (From April 1, 2027): Closure requests can be submitted electronically using:

- Digital Signature (DSC)

- Electronic Verification Code (EVC)

- Earlier: Closure only through physical branches.

- Clarification on Effective Date of Deposit: For cheque/DD/electronic transfers, the date of receipt of the payment instrument along with account application at the Deposit Office is treated as the effective date.Removes ambiguity around last-day deposits for tax exemption.

- Electronic Statements Permitted: Banks can now issue electronic statements instead of physical passbooks.

- Aligns CGAS with general digital banking norms.

- Extension of CGAS to Section 54GA: CGAS can now be used for exemptions under Section 54GA:

- Relates to capital gains arising from shifting an industrial undertaking from an urban area to a Special Economic Zone (SEZ).

- Broadens applicability beyond property-related reinvestments.

- Relates to capital gains arising from shifting an industrial undertaking from an urban area to a Special Economic Zone (SEZ).

| Consider the following statements: (2025)

I. Capital receipts create a liability or cause a reduction in the assets of the Government. II. Borrowings and disinvestment are capital receipts. III. Interest received on loans creates a liability of the Government. Which of the statements given above are correct? (a) I and II only (b) II and III only (c) I and III only (d) I, II and III |

Capital Markets: Challenges and Developments

RBI draft norms on Capital Market Exposure (CME)

Why in the News?

The Reserve Bank of India released draft “Capital Market Exposure Directions, 2025” to overhaul rules on banks’ exposure to capital markets.

What is Capital Market Exposure (CME)?It simply means how much a bank is involved in the stock market and related financial activities. When banks deal with the capital market, they can do this in two main ways:

Because the stock market goes up and down, these activities are riskier than normal banking (like giving home or business loans). So, the Reserve Bank of India (RBI) keeps a close watch and sets limits on how much banks can invest or lend in the capital market. |

About Draft Norms on Capital Market Exposure, 2025:

- Objective: To modernise, unify, and simplify rules on banks’ capital-market lending and investment exposures.

- Expanded Scope: Permits acquisition-finance lending for corporates and higher credit limits for individuals participating in Initial Public Offerings (IPOs), Follow-on Public Offerings (FPOs), and Employee Stock Option Plans (ESOPs).

Key Features of the Draft CME Norms:

- Exposure Limits:

- Direct exposure (investments + acquisition finance) capped at 20 percent of Tier-1 capital on solo and consolidated bases.

- Aggregate exposure (direct + indirect) capped at 40 percent of consolidated Tier-1 capital.

- Acquisition Finance:

- Banks may finance up to 70 percent of acquisition cost, with borrowers contributing 30 percent equity from own funds.

- Permitted only for listed companies with sound financials and independent valuations compliant with Securities and Exchange Board of India (SEBI) norms.

- Aggregate acquisition-finance exposure limited to 10 percent of Tier-1 capital; not allowed for Non-Banking Financial Companies (NBFCs), Alternative Investment Funds (AIFs), or related parties.

- Individual Market-Participation Loans:

- Maximum loan per individual increased to ₹ 25 lakh; up to 75 percent of subscription value may be financed with a 25 percent margin.

- Shares allotted under IPOs, FPOs, or ESOPs must be pledged and lien-marked to the lending bank.

- Loans Against Securities:

- Capped at ₹ 1 crore per individual for eligible securities (government securities, mutual-fund units, listed shares, or high-rated corporate debt).

- Banks must maintain prudent LTV ratios and adopt internal risk-control systems for valuation and monitoring.

Need for Such Norms:

- Modernisation: Replaces fragmented rules with a unified prudential framework.

- Corporate Expansion: Enables M&A financing, supporting Indian firms’ global competitiveness.

- Retail Participation: Encourages individual investment and deepens equity-market access.

- Risk Containment: Exposure caps and buffers ensure stability and discipline in bank lending.

- Global Alignment: Harmonises with Basel III and international acquisition-finance standards.

- Economic Impact: Enhances financial depth, liquidity, and investment-led growth in capital markets.

| [UPSC 2023] Which one of the following activities of the Reserve Bank of India is considered to be part of ‘sterilisation?

Options: (a) Conducting ‘Open Market Operations’ * (b) Oversight of settlement and payment systems (c) Debt and cash management for the Central and State Governments (d) Regulating the functions of Non-banking Financial Institutions |

Capital Markets: Challenges and Developments

Minimum Public Shareholding (MPS)

Why in the News?

SEBI has released a consultation paper proposing changes in Minimum Public Shareholding (MPS) and Minimum Public Offer (MPO) norms for listed companies.

What is Minimum Public Offer (MPO)?

|

What is Minimum Public Shareholding (MPS)?

- Concept: A company is like a cake. Promoters (founders/owners) usually keep most of it, but SEBI mandates at least 25% must be shared/sold with the public.

- Purpose:

- Broader ownership and participation.

- Fairer prices by reducing manipulation.

- Greater accountability of companies.

What SEBI is proposing?

- Flexibility: Large companies find it difficult to release big chunks of shares at once; rules will be eased.

- Extended Timelines:

- Companies valued at ₹50,000–1,00,000 crore now get up to 10 years (instead of 5) to meet 25% MPS.

- They must reach 15% in 5 years first, then 25% in 10 years.

- Reduced Burden: For very large companies, the initial Minimum Public Offer (MPO) will be lowered.

Significance of the Move:

- Market Stability: Selling too many shares too quickly is like flooding the market — prices may fall even if the company is strong.

- Benefits:

- More big companies will list in India.

- Investors can enter gradually without sudden shocks.

- Encourages fund-raising while maintaining fair trading.

| [UPSC 2024] Consider the following statements:

I. India accounts for a very large portion of all equity option contracts traded globally, thus exhibiting a great boom. II. India’s stock market has grown rapidly in the recent past, even overtaking Hong Kong’s at some point in time. III. There is no regulatory body either to warn small investors about the risks of options trading or to act on unregistered financial advisors in this regard. Which of the statements given above are correct?” Options: (a) I and II only * (b) II and III only (c) I and III only (d) I, II and III |

Capital Markets: Challenges and Developments

Asset Under Management (AUM)

Why in the News?

India’s Mutual Fund (MF) industry has witnessed exponential growth, with Assets Under Management (AUM) reaching ₹74.40 lakh crore as of June 2025, a sevenfold increase over the past decade.

What are Assets Under Management (AUM)?

- Definition: AUM refers to the total market value of financial assets (stocks, bonds, etc.) managed by an investment firm on behalf of clients.

- Growth Drivers:

- Net investor inflows and redemptions

- Market performance

- Dividend reinvestments

- Importance:

- Indicates fund size, investor confidence, and fund stability

- Reflects fund manager performance and popularity

- Higher AUM allows better liquidity and portfolio diversification

- Impacts management fees and minimum investment limits

What is a Mutual Fund?

Classification of Mutual Fundsa. Based on Asset Class:

b. Based on Investment Objective:

c. Based on Structure:

|

| [UPSC 2025] Consider the following statements:

I. India accounts for a very large portion of all equity option contracts traded globally, thus exhibiting a great boom. II. India’s stock market has grown rapidly in the recent past, even overtaking Hong Kong’s at some point in time. III. There is no regulatory body either to warn small investors about the risks of options trading or to act on unregistered financial advisors in this regard. Which of the statements given above are correct? Options: (a) I and II only * (b) II and III only (c) I and III only (d) I, II and III |

Capital Markets: Challenges and Developments

What are Passively Managed Funds?

Why in the News?

Passively Managed Funds—those that track a market index without active stock selection—have become increasingly popular among investors seeking low-cost, predictable returns.

About Passively Managed Funds:

- Passively managed funds, commonly known as passive funds, are investment vehicles designed to replicate the performance of a specific market index, such as the Nifty Fifty or the Sensex.

- Unlike actively managed funds, the fund manager in a passive fund does not select stocks or make frequent buy-and-sell decisions.

- Instead, the fund holds the same stocks in the same proportion as the underlying index.

- How Passive Funds Work?

-

- These funds track a benchmark index by investing in all or a representative sample of the securities in that index.

- The objective is to mirror the index’s returns, not to outperform it.

- As a result, they incur lower management costs and have minimal portfolio turnover.

Types of Passive Funds:

- Index Funds:

-

- These are mutual funds that can be purchased or redeemed directly from the fund house.

- Transactions are processed only once a day, based on the day’s closing Net Asset Value.

- They offer ease of use and are suitable for systematic investment plans and long-term investors.

- Exchange Traded Funds:

-

- These are funds listed on stock exchanges, like the National Stock Exchange or the Bombay Stock Exchange.

- Investors buy or sell units during trading hours through brokers, just like stocks.

- They require a dematerialised account and are suitable for investors seeking intraday trading flexibility.

Advantages of Passive Funds:

- Low Expense Ratios: Because no active research or trading is involved.

- Transparency: Holdings closely follow a well-known index.

- Diversification: Spreads investment risk across multiple securities.

- No Human Bias: Avoids mistakes due to the fund manager’s poor decisions.

Limitations:

- No Outperformance: Returns will always be close to the index and cannot exceed it.

- Tracking Error: Slight variation between the fund’s performance and the index due to operational reasons.

- Limited Flexibility: Cannot adapt to sudden market downturns.

| [UPSC 2025] Consider the following statements:

Statement I: As regards returns from an investment in a company, generally, bondholders are considered to be relatively at lower risk than stockholders. Statement II: Bondholders are lenders to a company, whereas stockholders are its owners. Statement III: For repayment purposes, bondholders are prioritised over stockholders by a company. Which one of the following is correct in respect of the above statements? (a) Both Statement II and Statement III are correct, and both of them explain Statement I * (b) Both Statement I and Statement II are correct, and Statement I explains Statement II (c) Only one of the Statements II and III is correct and that explains Statement I (d) Neither Statement II nor Statement III is correct |

Capital Markets: Challenges and Developments

Consultative regulation-making that should go further

Why in the News?

India’s main financial regulators — the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) — have, for the first time, created clear step-by-step procedures for how they will create and update their rules.

What procedural reforms have the RBI and SEBI recently introduced in regulation-making?

- Mandatory Public Consultation: Both RBI and SEBI now require a 21-day window for public feedback before finalizing regulations. Eg: When SEBI proposes changes to investment guidelines, stakeholders can submit suggestions during this consultation period.

- Introduction of Impact Analysis and Regulatory Objectives: RBI must conduct an impact analysis to assess the effect of new regulations. SEBI must state the regulatory intent and objectives behind any proposed rule. Eg: Before introducing digital lending norms, RBI must assess how it affects NBFCs and consumers.

- Periodic Review of Existing Regulations: Both regulators are now required to periodically review existing laws to ensure relevance and effectiveness. E.g.: SEBI may revisit earlier mutual fund rules to assess if they align with current market dynamics.

Why is identifying economic rationale important for regulatory interventions?

- Targets Actual Market Failures: Ensures that regulations are introduced to solve real economic issues, not just perceived ones. Eg: RBI introducing regulations on digital lending platforms to tackle predatory lending practices.

- Improves Resource Allocation: Helps in the efficient use of regulatory capacity and government resources by focusing only where intervention is necessary. Eg: SEBI focusing surveillance on high-risk investment products rather than low-risk ones.

- Enables Evidence-Based Policy Making: Economic rationale demands data-backed decision-making, leading to more robust and defensible policies. Eg: Mandating minimum capital buffers after analysing risk exposure in banks post-2008 crisis.

- Strengthens Cost-Benefit Analysis: Clarifies whether the expected benefits outweigh the compliance and administrative costs. Eg: Before enforcing stricter disclosure norms, SEBI can evaluate if the benefits to investors justify the burden on companies.

- Increases Public and Stakeholder Trust: When the rationale is transparent, it builds confidence in the regulator’s objectivity and fairness. Eg: Clearly stating economic reasoning behind banning front-running in trading enhances credibility.

How do international practices like those in the US and EU guide regulatory impact assessment?

- Mandatory Cost-Benefit Analysis: US regulators must evaluate the economic impact of any regulation before adoption to ensure benefits outweigh costs. Eg: The Office of Information and Regulatory Affairs (OIRA) reviews federal regulations to minimize economic burdens.

- Problem Identification and Alternatives Assessment: The EU’s Better Regulation Framework requires identifying the core problem, evaluating alternative policy options, and selecting the most effective one. Eg: EU energy efficiency regulations involved assessing multiple alternatives before finalizing appliance labeling norms.

- Monitoring and Evaluation Frameworks: Both the US and EU emphasize post-implementation reviews to check if regulations achieve intended goals. Eg: The EU conducts ex-post evaluations as part of its regulatory cycle to ensure continuous improvement.

When should regulations be reviewed and why?

- At Pre-defined and Regular Intervals: Regulations should be reviewed periodically (e.g., every 3 years) to assess continued relevance. Eg: The IFSCA mandates review of its regulations every 3 years to align with changing market needs.

- After Significant Economic or Sectoral Changes: Major changes like market failures, technological advancements, or crises should trigger a regulatory review. Eg: The COVID-19 pandemic led to a re-evaluation of financial sector norms to support liquidity and credit flow.

- To Evaluate Effectiveness and Stakeholder Impact: Reviews help assess whether regulations have achieved their intended goals and consider public feedback. Eg: SEBI may review listing regulations based on feedback from companies and investors to enhance market transparency.

Who can ensure uniform regulatory standards in India?

- Parliament through Enactment of a Common Law: Parliament can introduce a standardised law (similar to the U.S. Administrative Procedure Act) to ensure consistent regulatory practices like impact assessments, public consultations, and periodic reviews across all regulators. Eg: A central Regulation-Making Procedure Act could mandate that all financial regulators follow uniform protocols.

- Government Agencies Issuing Common Guidelines: The Central Government or NITI Aayog can issue model guidelines or frameworks to harmonise regulation-making procedures among regulators. Eg: Like the UK and Canada, India can adopt unified regulatory guidelines to promote transparency and accountability across SEBI, RBI, IFSCA, etc.

Way forward:

- Enact a Unified Regulatory Procedure Law: Parliament should legislate a comprehensive framework for regulation-making that mandates impact analysis, public consultation, and periodic review across all regulators to ensure transparency and consistency.

- Strengthen Institutional Capacity and Oversight: Build the capacity of regulatory bodies through training, digital tools, and staffing, and set up an independent oversight mechanism to monitor compliance with procedural norms and ensure accountability.

Mains PYQ:

[UPSC 2018] “Citizens’ Charter is an ideal instrument of organizational transparency and accountability, but it has its own limitations. Identify the limitations and suggest measures for greater effectiveness or the Citizens Charter.”

Linkage: The theme of “consultative regulation-making that should go further” as discussed in “Crafting India’s Regulatory Future”. In the article primarily discusses financial regulators and the PYQ addresses the Citizens’ Charter, both embody the fundamental principle of existing governance mechanisms needing to evolve and be strengthened to achieve their stated objectives of transparency, accountability, and more effective public engagement, moving beyond a “nascent stage” or “welcome start” to truly “go further.”

Capital Markets: Challenges and Developments

Why has net FDI inflow plummeted?

Why in the News?

The RBI Bulletin (May 2025) reports that India received a record-breaking $81 billion in gross FDI inflows in FY 2024-25, but retained only $353 million in net FDI, revealing a dramatic divergence in the investment narrative.

What do gross and net FDI trends indicate about India’s investment climate?

- Gross FDI inflows are high: India received a record $81 billion in gross FDI in 2024-25, indicating strong headline interest from foreign investors. Eg: Media and government reported this as a sign of a robust investment climate.

- Net FDI is drastically low: Net FDI dropped to only $353 million, showing that much of the incoming investment is offset by capital outflows, weakening the real impact on the economy. Eg: Rising outward FDI and disinvestment reduced net foreign capital retained in India.

- Declining FDI-to-GDP ratio: The gross inflow-to-GDP ratio fell from 3.1% (2020-21) to 2.1% (2024-25), and net FDI-to-GDP fell from 1.6% to near zero, reflecting a slowing domestic investment environment despite high gross inflows. Eg: This signals tepid corporate investment and cautious investor sentiment in India.

What is Private Equity (PE) and Venture Capital (VC)?

|

Why is the rise in Private Equity (PE)/Venture Capital (VC) driven FDI a concern for long-term investment?

- PE/VC-driven FDI focuses on brownfield investments: These funds mainly acquire existing firms rather than creating new production capacity, limiting contributions to capital formation and technology acquisition. Eg: Investments by Blackstone in Care Hospitals and ChrysCapital in Lenskart.

- Short investment horizon: PE/VC funds typically have a 3-5 year exit strategy, often selling holdings during stock market booms, which leads to disinvestment rather than sustained growth. Eg: The spike in disinvestment in FY25 was partly due to PE/VC funds liquidating their positions.

- Limited impact on long-term industrial growth: Since these funds focus on services like fintech and retail rather than manufacturing or infrastructure, they contribute less to enhancing India’s productive capacity. Eg: The declining share of FDI in greenfield projects shows limited greenfield capital formation.

How does outward FDI suggest India is used for tax arbitrage?

- High correlation between inward and outward FDI: India shows a strong link between the money flowing in and out, suggesting that funds often enter and exit quickly rather than being invested long-term. Eg: Similar volumes of FDI both coming into and going out of India.

- Use of tax havens as intermediaries: A significant portion of both inward and outward FDI involves countries like Singapore and Mauritius, known for tax concessions and treaty benefits. Eg: Many Indian companies route investments through these jurisdictions to reduce tax liabilities.

- ‘Treaty shopping’ for tax benefits: Global investors move capital through India to exploit variations in tax laws, a practice called tax arbitrage, which may not contribute to domestic economic growth. Eg: Research shows India ranked 6th among emerging markets for such correlated FDI flows, indicating use as a conduit for tax optimization.

What are the effects of declining FDI-to-GDP and GFCF ratios?

- Reduced contribution to economic growth: Declining FDI-to-GDP and FDI-to-GFCF (Gross Fixed Capital Formation) ratios indicate that foreign investments are becoming a smaller part of India’s overall economy and capital investment, potentially slowing down industrial expansion and technology adoption. Eg: Gross FDI inflows peaked at 7.5% of GFCF in FY21 but have declined sharply since then.

- Weakening investor confidence: The downward trend signals tepid domestic corporate investment and reduced foreign investor interest, which can affect job creation and long-term economic stability. Eg: Net FDI relative to GDP has declined from 1.6% in 2020-21 to nearly zero in 2024-25, showing declining investor enthusiasm.

Why should India reform its foreign capital regulations?

- To curb tax arbitrage and ‘hot money’ flows: Current regulations allow large volumes of inward and outward FDIthrough tax havens, enabling tax optimization rather than genuine investment, which undermines domestic economic goals. Eg: High FDI flows involving Singapore and Mauritius reflect such practices.

- To promote long-term, productive investments: Reform is needed to encourage FDI that contributes to capital formation, technology acquisition, and industrial growth rather than short-term PE/VC-driven disinvestment. Eg: The rising share of alternative investment funds in FDI has led to increased disinvestment, affecting sustainable growth.

Way forward:

- Strengthen Regulatory Frameworks: Implement stricter rules to curb tax arbitrage and limit quick inflows and outflows via tax havens, ensuring FDI supports genuine, long-term economic growth.

- Promote Greenfield and Productive Investments: Encourage FDI in new capacity building, manufacturing, and technology sectors over short-term PE/VC deals to boost capital formation, industrial growth, and sustainable development.

Mains PYQ:

[UPSC 2013] Though India allowed Foreign Direct Investment (FDI) in what is called multi-brand retail through the joint venture route in September 2012, the FDI, even after a year, has not picked up. Discuss the reasons.

Linkage: The net FDI-to-GDP ratio has steadily fallen from 1.6% in 2020-21 to zero in 2024-25. This ongoing decline is worrying, even though policymakers continue to make optimistic claims.

Capital Markets: Challenges and Developments

Initial Public Offering (IPO)

Why in the News?

OpenAI has announced its readiness for a future Initial Public Offering (IPO).

Laws Governing IPOs in India:

|

What is an IPO?

- Definition: An IPO is when a private company offers its shares to the public for the first time.

- Objective: It marks the company’s move to become a publicly listed company on a stock exchange.

- End Goal: Through an IPO, companies raise money from investors, and the public gets a chance to become shareholders.

How is an IPO Listed in India?

- Regulatory Filing: A company must file an offer document with SEBI (Securities and Exchange Board of India).

- Offer Document Includes:

- Details of the company and promoters.

- Financial history and business goals.

- The reason for raising capital and IPO structure.

- SEBI Approval: After review, SEBI gives permission for the listing process to begin.

IPO Eligibility & Pricing:

- Eligibility Criteria (SEBI Rules):

- Minimum Rs 3 crore in tangible assets in the last 3 years.

- Minimum Rs 1 crore in net worth each year for 3 years.

- Rs 15 crore average pre-tax profit in at least 3 out of the last 5 years.

- Who sets the Price:

- The company and its merchant banker decide the price based on valuation.

- Factors include assets, profits, and future growth.

- SEBI does NOT fix IPO prices.

Who can invest in an IPO?

- Eligibility: Anyone 18 years or older with a brokerage account can apply.

- Investor Categories:

-

- Qualified Institutional Buyers (QIBs): Mutual funds, banks, insurance firms, FPIs, etc.

- Retail Investors: Individuals investing up to Rs 2 lakh.

- High Net Worth Individuals (HNIs): Investing more than Rs 2 lakh.

| [UPSC 2025] Consider the following statements:

I. India accounts for a very large portion of all equity option contracts traded globally, thus exhibiting a great boom. II. India’s stock market has grown rapidly in the recent past, even overtaking Hong Kong’s at some point in time. III. There is no regulatory body either to warn small investors about the risks of options trading or to act on unregistered financial advisors in this regard. Which of the statements given above are correct? Options: (a) I and II only* (b) II and III only (c) I and III only (d) I, II and III |

Capital Markets: Challenges and Developments

Short Selling and Associated Risks

Why in the News?

The Securities and Exchange Board of India (SEBI) is considering a proposal to ease restrictions on short selling in most stocks.

SEBI’s January 2024 proposal to bar short-selling in stocks that are not in the futures and options segment had caused uncertainty.

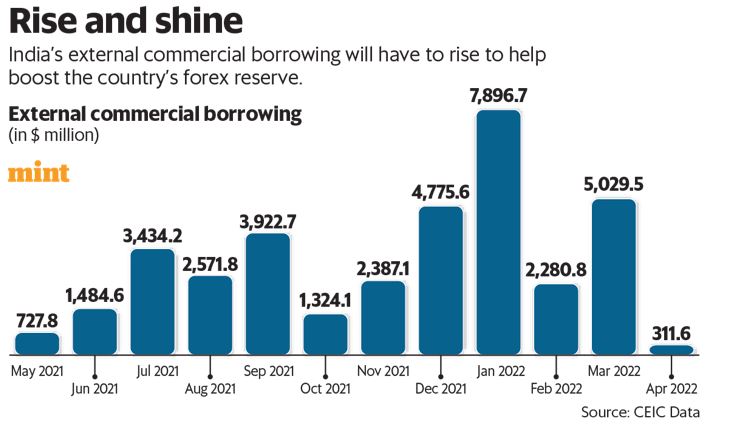

What is Short Selling?

- Definition: Short selling is a strategy where an investor sells a stock first and buys it later, aiming to profit from a price drop.

- Opposite of Normal Trade: Unlike regular buying (buy low, sell high), short selling works on selling high and buying low.

- How It Works: You borrow the stock from a broker, sell it at the market price, and later buy it back at a lower price to return it.

- Example: If a stock is sold at ₹2,100 and later bought at ₹1,900, the profit is ₹200. If the price rises to ₹2,300 instead, the loss is ₹200.

Types of Short Selling:

- Short Selling in the Spot Market (Cash Segment):

- Shorting is allowed only for intraday trading (buying and selling financial instruments (like stocks) on the same day).

- You must square off the position (buy back the stock) before 3:30 p.m. on the same day.

- If not squared off, it leads to short delivery, where the exchange settles the trade through an auction.

- There may be heavy penalties if the position is not closed on time.

- Short Selling in the Futures Market:

- Here, you can hold your short position overnight or even roll it over to the next month.

- You must deposit margin money, which is generally higher.

- Futures shorting is riskier and is mostly used by experienced traders.

- This type allows more flexibility but involves greater financial commitment.

Risks Associated with Short Selling:

- Unlimited Losses: If the stock price rises sharply, losses are unlimited.

- Short Delivery Risk: Failing to buy back in the spot market can lead to penalties.

- Liquidity Risk: Hard-to-trade stocks may lead to delayed buybacks and losses.

- Margin Requirements: High margin costs in futures trading limit retail participation.

- Market Volatility: Sudden movements may cause unexpected losses.

- Not for Beginners: Due to complexity and high risk, short selling is unsuitable for new investors.

| [UPSC 2025] Consider the following statements:

Statement I: As regards returns from an investment in a company, generally, bondholders are considered to be relatively at lower risk than stockholders. Statement II: Bondholders are lenders to a company whereas stockholders are its owners. Statement III: For repayment purpose, bondholders are prioritized over stockholders by a company. Which one of the following is correct in respect of the above statements? (a) Both Statement II and Statement III are correct and both of them explain Statement I (b) Both Statement I and Statement II are correct and Statement I explains Statement II (c) Only one of the Statements II and III is correct and that explains Statement I (d) Neither Statement II nor Statement III is correct |

Capital Markets: Challenges and Developments

RBI revises rules for investment in Alternative Investment Funds (AIFs)

Why in the News?

The RBI has released revised draft guidelines for investments made by Regulated Entities (REs) in Alternative Investment Funds (AIFs) to ensure better regulatory oversight, prevent misuse of funds, and align with the rules already set by SEBI.

What are Alternative Investment Funds (AIFs)?

- Definition: They are unique investment vehicles that are privately pooled and invested in alternative asset classes such as venture capital, private equity, hedge funds, commodities, real estate, and derivatives.

- Regulation: They are governed by SEBI under the SEBI (Alternative Investment Funds) Regulations, 2012.

- Working: It can be formed as a trust, company, Limited Liability Partnership (LLP), or any other SEBI-permitted structure.

- Legal Structure: They can be set up as trusts, companies, Limited Liability Partnership (LLP), or other legally permitted forms.

- Investor Base:

- AIFs are meant for High Net-Worth Individuals (HNIs) and institutional investors, NOT small retail investors.

- Resident Indians, NRIs, and foreign nationals can invest.

- Minimum Investment Requirement:

- The minimum investment size is ₹1 crore (SEBI, May 2024), except for accredited investors as defined by SEBI.

- For employees or directors of the AIF or its manager, the minimum investment is ₹25 lakh.

- An AIF must have a minimum corpus of ₹20 crore (₹10 crore for Angel Funds).

Types of AIFs:

- Category I: These funds invest in early-stage unlisted companies in the form of equity or debt (venture capital). These alternative asset funds can also invest in infrastructure-based projects or social ventures.

- Category II: These types of funds invest in equity or debt of unlisted companies that are in the mid or late stage of growth and are known as private equity or pre-IPO, respectively.

- Category III: This category of funds invests in the shares of listed companies. These alternative strategy funds can be for any period, long only or a combination of long and short.

| [UPSC 2014] What does Venture Capital mean?

Options: (a) A short-term capital provided to industries. (b) A long-term start-up capital provided to new entrepreneurs* (c) Funds provided to industries at times of incurring losses. (d) Funds provided for replacement and renovation of industries. |

Capital Markets: Challenges and Developments

India rolls over $50M Treasury Bill to help Maldives

Why in the News?

India extended critical financial assistance to the Maldives by rolling over a $50 million Treasury Bill, continuing its support under a government-to-government arrangement since 2019.

About Treasury Bill:

- A T-Bill is a short-term debt instrument issued by the GoI through the Reserve Bank of India (RBI).

- They are part of Government Securities (G-Secs) and are used to raise short-term funds.

- They are zero-coupon securities, meaning they do not carry periodic interest payments.

- Instead, they are issued at a discount and redeemed at face value upon maturity.

- They were first introduced in India in 1917.

- They are ideal for investors seeking safety and liquidity over short periods.

Features of the T-Bills:

- Tenures Available: 91-day, 182-day, and 364-day maturity periods.

- Issued at a Discount: T-Bills are sold at a lower price than their face value. The return (yield) is the difference between purchase price and face value.

- Minimum Investment: Starts at ₹25,000, and in multiples of ₹25,000 thereafter.

- Zero-Coupon Nature: No interest payments during the tenure. Investors earn via the discounted purchase price.

- Risk-Free Investment: Backed by the Government of India, making it virtually risk-free.

- High Liquidity: Due to short tenure, T-Bills can be easily converted to cash.

- Auction Mechanism: Sold through competitive and non-competitive bidding at RBI auctions.

- Taxable Gains: Returns are treated as short-term capital gains and are taxable.

- Sensitive to Inflation: Fixed returns can be impacted by rising inflation, reducing real returns.

| [UPSC 2018] Consider the following statements:

1.The Reserve Bank of India manages and services GoI Securities but not any State Government Securities. 2.Treasury bills are issued by the GoI and there are no treasury bills issued by the State Governments. 3.Treasury bills offer are issued at a discount from the par value. Which of the statements given above is/are correct? Options: (a) 1 and 2 only (b) 3 only (c) 2 and 3 only * (d) 1, 2 and 3 |

Capital Markets: Challenges and Developments

The SEC and Hague Service Convention

From UPSC perspective, the following things are important :

Prelims level: Hague Service Convention;

Why in the News?

On February 18, 2025, the U.S. Secuirty and Exchange commission asked the Indian government under the Hague Service Convention, to serve summons on Gautam Adani and Sagar Adani in a securities and wire fraud case.

What is the Hague Service Convention?

How does it work?

|

How is the U.S. Securities and Exchange Commission attempting to serve summons on the Adanis?

- Invoking the Hague Service Convention: The SEC has requested assistance from India’s Ministry of Law and Justice under Article 5(a) of the Hague Service Convention to officially deliver the summons to Gautam Adani and Sagar Adani.

- Exploring Alternative Service Methods: The SEC is considering alternative methods under Rule 4(f) of the U.S. Federal Rules of Civil Procedure, which allows service through means like email or social media, if conventional methods face delays.

- Proceeding Despite FCPA Suspension: Although the Trump administration has temporarily paused the Foreign Corrupt Practices Act (FCPA) enforcement for 180 days, the SEC argues that the pause does not apply retroactively, allowing their investigation into the Adanis to continue.

What are India’s reservations under the Convention?

|

How long does the service process typically take?

- The service process under the Hague Service Convention in India typically takes six to eight months. After receiving a request, India’s Ministry of Law and Justice verifies and forwards it to the appropriate authority. Upon completion, an acknowledgement is issued to the requesting country, confirming successful service.

Way forward:

- Expedite Processing Mechanisms: Implement digital tracking and streamlined workflows within the Ministry of Law and Justice to reduce delays in handling service requests.

- Strengthen Bilateral Cooperation: Enhance legal cooperation with key countries through bilateral agreements to complement the Hague Service Convention and facilitate faster document service.

Capital Markets: Challenges and Developments

SEBI proposed Retail Algo Trading Framework

From UPSC perspective, the following things are important :

Prelims level: Algo Trading

Why in the News?

Initially exclusive to institutional investors, Securities and Exchange Board of India (SEBI) now has proposed to allow retail participation in Algorithmic trading (algo trading) to ensure market stability and allow retail participation.

What is Algo Trading?

- Algo Trading, or Algorithmic Trading, is the process of using computer programs and pre-defined rules to execute financial market trades at high speed and efficiency.

- It eliminates human intervention and emotions, allowing trades based on mathematical models, historical data, and market conditions.

- How Does Algo Trading Work?

-

- It follows pre-coded algorithms to identify trading opportunities and execute orders.

- It uses technical indicators, price movements, volume, and other data to determine trade entry and exit points.

- The system can scan multiple markets simultaneously and execute trades in milliseconds.

- High-Frequency Trading (HFT) is a subset of algo trading that involves executing thousands of trades per second.

- It reduces market impact, transaction costs, and slippage compared to manual trading.

Key Highlights of Regulatory Framework:

- Broker Responsibility: Only registered brokers can offer algo trading services to retail investors. Direct retail algo trading without broker approval is not permitted.

- Market Surveillance: Exchanges must monitor algorithmic trades to prevent market manipulation and excessive order placement.

- Latency and Co-location Rules: SEBI has set rules to ensure fair access to low-latency trading infrastructure and avoid unfair advantages.

- Risk Management: Traders must maintain adequate margins, and there are circuit breakers to prevent excessive market volatility.

- Pre-Approval for Strategies: Algo trading strategies must be tested and approved before deployment to minimize market disruption.

- Algo vs. Non-Algo Identification: SEBI mandates separate tagging of algo trades for better transparency and oversight.

- Ban on Self-Trading: Algorithms must not execute self-trades to manipulate market prices.

PYQ:[2019] Which of the following is issued by registered foreign portfolio investors to overseas investors who want to be part of the Indian stock market without registering themselves directly? (a) Certificate of Deposit (b) Commercial Paper (c) Promissory Note (d) Participatory Note |

Capital Markets: Challenges and Developments

SEBI proposes sachetization of mutual funds to boost financial inclusion

From UPSC perspective, the following things are important :

Mains level: Capital Market;

Why in the News?

SEBI is collaborating with the mutual fund industry to find ways to make monthly SIPs of just Rs 250 possible, aiming to encourage more people from lower-income groups to invest in mutual funds.

What is Sachetisation?

|

What are the significances of Sachetisation?

- Affordable Financial Products: Just as small sachets of consumer goods made them accessible to lower-income groups, small-ticket SIPs in mutual funds can make investment opportunities available to a larger section of the population, particularly those who may not have the financial capacity to invest larger amounts.

- Promoting Financial Empowerment: By lowering the entry barrier for mutual fund investments, sachetisation can help empower underserved communities and individuals by enabling them to participate in the growing financial markets and benefit from the potential returns.

- Expanding Reach: This approach would encourage mutual fund companies to expand their reach to remote locations, helping them penetrate rural and low-income markets, and promote a wider culture of saving and investing.

- Financial Inclusion for the Bottom of the Pyramid: The primary target of sachetisation in mutual funds is low-income groups that have limited access to traditional investment products. By offering small, regular investments, SEBI aims to promote financial inclusion at the grassroots level.

How does it work?

- SEBI has proposed introducing small ticket SIPs at Rs 250 per month, which would allow new investors from low-income groups to participate in mutual funds without the burden of higher minimum investment requirements. This contrasts with existing schemes that often require a minimum SIP of Rs 500 or more.

- Investors can commit to a small ticket SIP for a duration of five years (60 installments), although they have the flexibility to withdraw or stop their investments without restrictions if needed. This structure encourages consistent investment while providing an exit option for investors.

- To facilitate the success of small ticket SIPs, SEBI plans to implement discounted rates for intermediaries and reimburse certain costs from the Investor Education and Awareness Fund. This will help asset management companies (AMCs) break even more quickly on their investments in these small ticket offerings.

- The sachetised SIPs will be available under specific mutual fund schemes, excluding high-risk options like small-cap and mid-cap equity schemes, which are deemed unsuitable for new investors from lower-income backgrounds. This targeted approach aims to safeguard these investors while still encouraging their entry into the market.

- To further promote financial inclusion, SEBI proposes incentives for distributors who successfully guide investors through 24 instalments of the small ticket SIP, thereby enhancing participation and support for new investors in mutual funds.

Conclusion: The strategy could result in a significant increase in domestic investor participation, contributing to the resilience of India’s equity market and fostering long-term financial stability.

Mains PYQ:

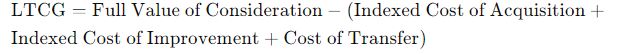

Q Comment on the important changes introduced in respect of the Long term Capital Gains Tax (LCGT) and Dividend Distribution Tax (DDT) in the Union Budget for 2018-2019. (UPSC IAS/2018)

Capital Markets: Challenges and Developments

On the need for a different framework for passive Mutual Funds

From UPSC perspective, the following things are important :

Prelims level: Passive mutual fund;

Mains level: Liberalisation of mutual funds;

Why in the News?

On September 30, the Securities and Exchange Board of India (SEBI) launched the liberalized Mutual Funds Lite (MF Lite) framework specifically for passively managed schemes.

What is a Passive Mutual Fund?

|

Key highlights of the liberalized Mutual Funds Lite (MF Lite) framework:

- Separate Framework for Passive Funds: It is tailored for passively managed schemes, which are less risky and require minimal active management.

- Relaxed Entry Requirements: Lowered net worth requirement (₹35 crore), simplified criteria for sponsor eligibility (profitability, track record).

- Encouraging New Players: It provides easier entry for new AMCs (Asset management companies) and market players in the passive fund segment.

- Governance Flexibility: It has reduced oversight for trustees; operational responsibilities shifted to AMC boards, focusing on fees, expenses, and tracking error.

- Cost Efficiency Focus: It emphasizes on lowering Total Expense Ratio (TER) and minimizing tracking error for better returns.

- Simplified Disclosures: The Scheme Information Documents (SID) are simplified to focus on key metrics like benchmark index, TER, and tracking error.

- Risk Management: Audit committees of AMCs can handle risk management duties due to the lower risk profile of passive funds.

Why a Separate Framework for MF Lite is Needed?

- Lower Risk Profile: Passively managed funds are generally less risky because they track established benchmarks like BSE Sensex or Nifty50, reducing the need for active decision-making.

- Minimal Asset Manager Discretion: Unlike actively managed funds, asset managers of passive funds have limited discretion in asset allocation and investment objectives. They simply mirror the performance of the benchmark index.

- Inapplicability of Existing Regulations: The current framework is designed primarily for actively managed funds, which involve more risks and require more oversight. It is less suitable for passive funds, which operate with predefined, transparent rules.

- Cost-Effective Market Entry: To encourage new players and make the passive fund industry more competitive, SEBI introduced relaxed regulations regarding eligibility, net worth, and profitability.

What about risks and disclosures?

- Success depends on Total Expense Ratio (TER) and tracking error. Lower costs and minimal deviation from the benchmark are crucial for performance.

- Scheme Information Documents (SID) focus on key metrics like the benchmark name, TER, and tracking error, leaving out complex strategies.

- Risk management responsibilities are streamlined, allowing the audit committee of the AMC to handle oversight, reflecting the lower risks of passive funds.

Way forward:

- Enhance Investor Education: Develop targeted educational initiatives to inform retail investors about the benefits, risks, and operational aspects of passive mutual funds, fostering informed investment decisions.

- Ongoing Regulatory Evaluation: Establish a framework for periodic assessment and adaptation of the MF Lite regulations to ensure they remain effective and relevant, promoting competition while safeguarding investor interests.

Capital Markets: Challenges and Developments

F&O: How will Sebi’s new rules affect traders and brokers?

From UPSC perspective, the following things are important :

Prelims level: FandO Trading

Why in the News?

SEBI has introduced a six-step framework to protect investors and curb speculative trading, specifically targeting futures and options (F&O) trading by reducing volumes on expiry days and limiting retail participation.

What are the Future and Options (F&O)?

- Futures are contracts to buy or sell an asset (like stocks, indexes, or commodities) at a predetermined price on a future date.

- Options give the right, but not the obligation, to buy or sell an asset at a set price before a certain date.

SEBI’s Six-Step F&O Framework (Effective November 2024 – April 2025):In response to concerns about rising speculative trading, SEBI has outlined six key measures aimed at reducing retail interest in F&O trading:

|

Key Changes for Retail Investors:

- Upfront Collection of Options Premiums: Retail investors must now pay the full premium upfront, limiting their ability to use high leverage in options trading.

- Increased Contract Size: The minimum contract size for index derivatives is raised to ₹15 lakhs, reducing speculative retail participation by making it costlier to enter.

- Rationalization of Weekly Expiries: Only one benchmark index per exchange can have weekly expiries, lowering speculative trading opportunities and intraday volatility.

- Removal of Calendar Spread Benefits: Calendar spreads are no longer allowed on expiry days, discouraging aggressive trading strategies.

Impact on Brokers and Revenue:

- Decline in Trading Volumes: Brokers reliant on F&O trading will see reduced volumes due to fewer retail participants and higher barriers to entry.

- Revenue Drop in Options Trading: Firms like Zerodha may face a 30-50% revenue drop as retail participation in options decreases.

- Shift to Equity Trading: Retail investors may move towards equity trading, causing brokers to adapt their offerings.

- Adaptation for Brokers: Brokers with a balanced mix of cash and derivatives will be less impacted, while those focused on F&O need to shift strategies.

PYQ:[2021] With reference to India, consider the following statements: 1. Retail investors through demat account can invest in ‘Treasury Bills’ and ‘Government of India Debt Bonds’ in primary market. 2. The ‘Negotiated Dealing System-Order Matching’ is a government securities trading platform of the Reserve Bank of India. 3. The ‘Central Depository Services Ltd.’ Is jointly promoted by the Reserve Bank of India and the Bombay Stock Exchange. Which of the statements given above is/are correct? (a) 1 only (b) 1 and 2 only (c) 3 only (d) 2 and 3 only |

Capital Markets: Challenges and Developments

House Panel includes SEBI review in agenda, likely to summon Buch

From UPSC perspective, the following things are important :

Prelims level: Market Economy; SEBI; Public Accounts Committee (PAC)

Mains level: Market Economy; Issues related to regulatory bodies;

Why in the News?

The Public Accounts Committee (PAC) has included a review of SEBI’s performance, amid political controversy surrounding chairperson Madhabi Puri Buch following Hindenburg Research’s allegations.

What are the allegations against SEBI?

- Conflict of Interest: SEBI chairperson Madhabi Puri Buch faces conflict of interest allegations due to her past ICICI Bank role amid Adani investigations.

- Toxic Work Environment: Reports have surfaced from approximately 500 SEBI employees claiming that the work culture at the regulatory body is “toxic and fearful.” This has led to demands for an impartial inquiry into the alleged workplace issues and the overall management of SEBI.

- Response to Allegations: Buch and SEBI have denied wrongdoing, asserting that all necessary disclosures and recusal norms have been followed diligently.

Significance and Functions of the Public Accounts Committee (PAC)The PAC was introduced in 1921 after its first mention in the Government of India Act, 1919 (Montford Reforms).

|

How SEBI can improve its regulation considering recent challenges? (Way forward)

- Enhanced Disclosure Regulations: SEBI has already made progress with the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2023, but further refinement is needed.

- It should focus on clarifying the scope of disclosures required from companies, particularly regarding financial irregularities and conflicts of interest.

- Bolstering Whistleblower Protections: SEBI should strengthen its whistleblower protection framework to encourage the reporting of internal issues or malpractices, ensuring accountability and protection for informants.

- Improving Internal Governance and Work Culture: SEBI can address concerns about a toxic work environment by conducting independent reviews of its internal governance, improving employee welfare, and fostering a transparent, positive work culture.

- Collaborating with Global Regulatory Bodies: SEBI can work more closely with global financial regulators to align with international best practices and enhance cross-border market oversight, ensuring that India’s markets remain resilient and transparent.

Capital Markets: Challenges and Developments

On the allegations against the SEBI chief

From UPSC perspective, the following things are important :

Mains level: Applicability of Office of Profit on SEBI Chairperson;

Why in the News?

Hindenburg Research has alleged SEBI Chairperson Madhabi Puri Buch and her husband held stakes in Adani-linked offshore funds, implying bias in SEBI’s Adani investigation.

Accusations Against SEBI Chairman Madhabi Puri Buch