Digital India Initiatives

Gyan Bharatam Mission

From UPSC perspective, the following things are important :

Prelims level: Gyan Bharatam Mission

Why in the News?

The Union Budget 2025-26 has introduced the Gyan Bharatam Mission, a comprehensive initiative for surveying, documenting, and conserving India’s manuscript heritage.

What is Gyan Bharatam Mission?

- It is a nationwide initiative launched in the Union Budget 2025-26 to survey, document, and conserve India’s manuscript heritage.

- The mission aims to cover over one crore manuscripts, ensuring the systematic preservation of ancient texts housed in academic institutions, museums, libraries, and private collections.

- It is a revival and expansion of the National Manuscripts Mission (NMM), which was originally established in 2003 but had limited impact due to inadequate funding and structural challenges.

- The mission aligns with India’s broader cultural conservation goals and is expected to create a centralized repository for India’s rich textual and intellectual heritage.

- Aims and Objectives:

-

- Survey and document manuscripts across institutions and private collections.

- Digitize rare texts and create a centralized repository for research and preservation.

- Restore and conserve fragile manuscripts using modern preservation techniques.

- Features and Significance:

-

- Budget Allocation Increased: Funding for NMM raised from ₹3.5 crore to ₹60 crore.

- Digital Preservation: AI-driven archiving, metadata tagging, and translation tools for easy access.

PYQ:[2023] With reference to Indian History, Alexander Rea, A. H. Longhurst, Robert Sewell, James Burgess and Walter Elliot were associated with (2023) (a) archaeological excavations (b) establishment of English Press in Colonial India (c) establishment of Churches in Princely States (d) construction of railways in Colonial India |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

[pib] Internet Governance Internship and Capacity Building (IGICB) Scheme

From UPSC perspective, the following things are important :

Prelims level: IGICB Scheme, NIXI

Why in the News?

The National Internet Exchange of India (NIXI) has introduced the Internet Governance Internship and Capacity Building Scheme, aiming to enhance awareness and develop expertise in Internet Governance (IG) among Indian citizens.

About Internet Governance Internship and Capacity Building (IGICB) Scheme:

| Details | |

| About the Scheme |

Aims and Objectives:

|

| Structural Mandate |

|

| Features of the Scheme |

|

What is National Internet Exchange of India (NIXI)?

|

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

Enhancing governance the digital way

From UPSC perspective, the following things are important :

Mains level: Digital Governance;

Why in the News?

Recently, India has started a big effort to move towards digital governance which aims to make services better for citizens and improve the skills of government workers.

What are the key challenges facing the implementation of digital governance in India?

- Resistance to Change: Some segments of the government workforce are hesitant to adopt new technologies, leading to slow adaptation within bureaucratic structures. This resistance can hinder the overall effectiveness of digital initiatives.

- Digital Divide: There is a significant disparity in internet access and digital literacy between urban and rural areas. Many rural employees lack the necessary infrastructure and skills to engage with digital platforms, potentially leaving them behind in the digital transformation process.

- Incentive Structures: Current initiatives, such as the iGOT Karmayogi platform, risk becoming mere attendance trackers without meaningful outcomes. The lack of incentives for employees to apply new skills can undermine the effectiveness of training programs.

- Cybersecurity Risks: As government operations increasingly move online, the risk of data breaches and cyberattacks escalates. Ensuring robust cybersecurity measures is essential to protect sensitive information and build trust in digital governance.

- Need for Continuous Learning: The rapid evolution of technology necessitates ongoing training and upskilling opportunities for government employees to keep pace with new tools and platforms.

How can technology be leveraged to improve public service delivery and citizen engagement?

- Streamlined Workflows: Initiatives like e-Office digitize workflows, reducing reliance on paperwork and enhancing operational efficiency, which leads to faster service delivery.

- Enhanced Communication: Digital platforms facilitate real-time communication between government officials and citizens, improving transparency and responsiveness to public needs.

- Data-Driven Decision Making: Technologies such as data analytics enable informed decision-making by providing insights into citizen needs and service effectiveness.

- Citizen-Centric Platforms: Tools like MyGov allow for direct interaction between citizens and the government, fostering greater engagement and participation in governance processes.

- Online Procurement Systems: Platforms like the Government e-Marketplace (GeM) streamline procurement processes, making them more transparent and efficient.

What role does collaboration play in successful digital governance?

- Multi-Stakeholder Engagement: Effective digital governance requires collaboration among various stakeholders, including government bodies, NGOs, community leaders, and citizens, to ensure that diverse perspectives are considered.

- Capacity Building: Collaborative efforts in training and capacity building can help equip government employees with the necessary skills to navigate digital tools effectively.

- Sharing Best Practices: Partnerships with private sector entities can facilitate knowledge sharing and the adoption of innovative solutions that enhance public service delivery.

- Policy Development: Collaborative frameworks can aid in developing policies that address challenges such as the digital divide and cybersecurity threats, ensuring a comprehensive approach to digital governance.

- Feedback Mechanisms: Establishing channels for citizen feedback enhances accountability and allows for continuous improvement in digital governance initiatives.

Way forward:

- Strengthening Digital Infrastructure and Training: Invest in improving digital infrastructure, especially in rural areas, and provide continuous, targeted training to government employees to bridge the skill gap and ensure effective use of technology.

- Enhancing Collaboration and Incentives: Foster stronger collaboration between government, private sector, and communities while creating incentive structures that encourage employees to apply newly acquired skills, ensuring the tangible impact of digital governance initiatives.

Mains PYQ:

Q “The emergence of the Fourth Industrial Revolution (Digital Revolution) hasinitiated e-Governance as an integral part of government”. Discuss. (UPSC IAS/2020)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

[pib] CPGRAMS 3 Years, 70 Lakh Grievances Solved

From UPSC perspective, the following things are important :

Prelims level: CPGRAMS

Why in the News?

According to the Department of Administrative Reforms and Public Grievances (DARPG), the Centralized Public Grievance Redress and Monitoring System (CPGRAMS) resolved over 70 lakh grievances from 2022 to 2024.

About Centralized Public Grievance Redress and Monitoring System (CPGRAMS)

- CPGRAMS is an online platform that allows citizens to register grievances related to government service delivery, functioning 24×7.

- It was established in June 2007 by the Department of Administrative Reforms & Public Grievances (DARPG); the National Informatics Centre (NIC) developed the technical framework.

- The Prime Minister serves as the supreme head of CPGRAMS.

Key Functions

- Grievance Lodging & Tracking: Each complaint gets a unique registration number for monitoring.

- Role-Based Access: Ministries and states can access and resolve relevant grievances.

- Appeal Facility: Citizens can appeal if they are not satisfied with the resolution.

- Feedback Mechanism: Complainants can rate the resolution; a “Poor” rating reopens the case for further appeals.

Exclusions: Subjudice cases, personal/family disputes, RTI queries, matters affecting national/international integrity, and government employees’ service issues.

Key Reforms to Improve CPGRAMS

- Reduced Timelines: Grievance resolution deadlines shortened from 30 days to 21 days, with mandatory interim updates.

- Integrated Platform: A unified portal for all ministries, departments, and states; accessible via web, mobile apps, and UMANG.

- Feedback & Appeals: Citizens can provide feedback through SMS/email; a “Poor” rating escalates unresolved issues.

- AI-Driven Process Improvements: Tools like the Tree Dashboard help identify problems and streamline grievance handling.

- Training & Monitoring: Under SEVOTTAM (Service Excellence through Total Quality Management), Grievance Officers get specialized training, with regular performance reviews to enhance service delivery.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

UPI duopoly’s rise and market vulnerabilities

From UPSC perspective, the following things are important :

Mains level: Digital transactions;

Why in the News?

In just eight years, UPI now handles nearly 80% of India’s digital transactions which valued at ₹20.60 lakh crore in August, despite challenges like PhonePe and Google Pay’s market dominance.

What are the implications of market concentration in the UPI ecosystem?

- Systemic Vulnerability: The dominance of two Third Party App Providers (TPAPs) for online transactions like UPI PhonePe and Google Pay, which together control over 85% of the market share, creates a risk of systemic failure.

- Any disruption in their services could significantly impact the entire UPI ecosystem, given that nearly 80% of transactions occur through these platforms.

- Reduced Competition and Innovation: The high market concentration discourages competition, leading to fewer incentives for innovation among existing players. Smaller or new entrants face significant barriers to entry due to the scale and resources of the dominant TPAPs, stifling diversity in service offerings.

- Foreign Dominance Risks: Both leading TPAPs are foreign-owned, raising concerns about data security and sovereignty. This foreign dominance can lead to potential vulnerabilities in terms of data protection and access to sensitive information about Indian users.

How effective are regulatory measures in addressing duopoly issues?

- Regulatory Challenges: The National Payments Corporation of India (NPCI) has attempted to address market concentration by capping TPAP market shares at 30%. However, this measure has not been effectively enforced, with extensions granted that allow dominant players to maintain their substantial market positions.

- Limited Impact of Existing Regulations: Despite regulatory intentions, the continued growth of PhonePe and Google Pay indicates that existing measures have not sufficiently mitigated the risks associated with a duopoly. The potential increase in market share cap from 30% to 40% may further entrench the dominance of these platforms rather than promote a competitive landscape.

What strategies can smaller players adopt to compete in this landscape?

- Innovation and Niche Services: Smaller players can focus on niche markets or specialized services that cater to specific user needs, differentiating themselves from larger competitors. This could include unique features or localised services that appeal to underserved populations.

- Collaboration and Partnerships: Forming alliances with banks, fintech companies, or other service providers can help smaller players leverage resources and technology to enhance their offerings and reach a broader audience.

- User Education and Trust Building: Investing in user education about digital payments and building trust through transparent practices can attract users who may be hesitant to switch from established platforms. Emphasizing security features and customer support can also enhance user confidence.

What should the Indian Government do to reduce the dependency? (Way forward)

- Enforce and Strengthen Regulatory Caps: Mandate strict enforcement of market share caps for TPAPs and ensure timely compliance to prevent excessive concentration. Introduce penalties for non-compliance and avoid extensions to foster a competitive ecosystem.

- Promote Indigenous Development: Provide financial incentives, subsidies, and grants to Indian TPAPs to enhance their competitiveness. Encourage innovation through dedicated programs and regulatory frameworks that support startups in the payments space.

Mains PYQ:

Q Is inclusive growth possible under market economy? State the significance of financial inclusion in achieving economic growth in India. (UPSC IAS/2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

[pib] Digital Agriculture Mission (DAM)

From UPSC perspective, the following things are important :

Prelims level: Digital Agriculture Mission

Why in the News?

The Ministry of Agriculture & Farmers’ Welfare has provided details of the progress and implementation of Digital Agriculture Mission (DAM).

Progress as of December 2024:

|

About the Digital Agriculture Mission (DAM):

| Details | |

| Overview and Launch |

|

| Aims and Objectives |

|

| Provisions and Features | AgriStack: Includes 3 foundational registries: 1. Farmers’ Registry: A database recording information about farmers. 2. Geo-referenced Village Maps: Digital maps providing geographical data related to agricultural areas. 3. Crop Sown Registry: A digital registry tracking crops sown by farmers.

|

| Structural Mandate |

|

PYQ:[2017] What is/are the advantage/advantages of implementing the ‘National Agriculture Market’ scheme?

Select the correct answer using the code given below: (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

|

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

What is the Google ‘monopoly’ antitrust case and how does it affect consumers?

From UPSC perspective, the following things are important :

Mains level: Impact of monopoly in the market

Why in the news?

US Federal court ruled Google’s $26 billion payments to default on smartphone browsers violated US antitrust law, blocking competitors and benefiting the Justice Department.

About Google’s Antitrust Case

- The U.S. Department of Justice (DOJ) brought an antitrust case against Google, accusing it of maintaining a monopoly in the online search and advertising sectors.

- The DOJ argued that Google’s dominance was achieved through exclusive distribution agreements, which prevented competitors from succeeding in the market.

What Did the Ruling State?

- Google Monopolistic Practices: Google broke antitrust laws to keep its monopoly on “general search services” and “general search text ads.”

|

- Advantageous position due to the “default” search engine: The Google company has an unseen advantage over its competitors where it’s search engine processes an estimated 8.5 billion queries per day worldwide.

- The present judgment by US District of Colombia limits itself to the relevant geographic market of the US.

- Paying billions to smartphone makers: Google was accused of paying billions to smartphone makers like Apple and Samsung to ensure Google was the default search engine on their devices and browsers.

How Do Monopolistic Practices Harm Consumer Experience?

- Impact on Competition: Monopolistic practices, like those exhibited by Google, stifle competition by preventing rivals from entering the market and can lead to higher prices and reduced innovation.

- Unfair Platform for Start-ups: The new start-ups would have to surmount the entry barriers to create a GSE of comparable quality to Google. These barriers would cost high capital, access to distribution channels, and brand recognition.

- Quality Degradation: A monopolist may lose the incentive to improve the quality of its products, as there is little risk of losing customers to competitors.

- The ruling highlighted that Google conducted a study in 2020 that showed it would not lose search revenue even if it significantly reduced the quality of its search product.

- Limites the choices of consumer: When a company holds a monopoly, consumers are often left with few alternatives, allowing the monopolist to exploit its position.

Government Initiatives taken in India for similar line:The Draft Competition Bill 2024: The Ministry of Corporate Affairs’ Bill prevents giant tech companies/ Systemically Significant Digital Enterprises (SSDEs) from participating in anti-competitive practices.

|

Way forward:

- Encouraging Innovation: Governments and regulatory bodies should support the development of alternative search engines and platforms through incentives, grants, and support for startups.

- Banning Exclusive Agreements: Prohibit exclusive distribution agreements that make one product or service the default, ensuring that consumers have a choice and that competitors can fairly compete.

Mains question for practice:

Q Discuss the significance of India’s Competition Act, 2002 in regulating anti-competitive practices and promoting a fair market environment. 10M

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

What is the draft Digital Competition Bill?

From UPSC perspective, the following things are important :

Prelims level: How is an ex-post framework different from an ex-ante framework?

Mains level: Why does the draft Bill encourage an ex-ante competition regulation?

Why in the news?

In February 2023, the Ministry of Corporate Affairs (MCA) established a Committee on Digital Competition Law (CDCL) to assess the necessity for distinct legislation concerning competition within digital markets.

What is an ex-post framework?

- An ex-post framework refers to a regulatory approach where authorities intervene and enforce regulations after potentially harmful activities or behaviors have already occurred.

- In the context of competition law, it means that enforcement actions are taken against anti-competitive practices only after they have been observed or reported.

How is an ex-post framework different from an ex-ante framework?

Timing of Intervention:

- Ex-post framework: Intervenes after anti-competitive conduct has occurred and its effects are observed. It relies on retrospective enforcement based on complaints or identified issues.

- Ex-ante framework: Proactively sets rules and obligations before anti-competitive behavior happens, aiming to prevent market distortions and protect competition from potential harms.

Nature of Regulation:

- Ex-post framework: Reactive in nature, focusing on remedial measures and enforcement actions against established instances of anti-competitive behavior.

- Ex-ante framework: Proactive in nature, establishing upfront rules and obligations to guide behavior and prevent market abuses by dominant players before they occur.

Focus and Objectives:

- Ex-post framework: Focuses on addressing past harms to competition, ensuring fair market practices, and correcting market distortions post-occurrence.

- Ex-ante framework: Focuses on maintaining competitive markets, promoting innovation, and protecting consumer choice by setting clear rules and preventing anti-competitive behavior from developing in the first place.

Why does the draft Bill encourage an ex-ante competition regulation?

- Proactive Prevention: Digital markets exhibit characteristics such as rapid growth, network effects, and economies of scale that can lead to quick and irreversible market dominance. An ex-ante framework allows regulatory authorities to preemptively set rules and obligations to prevent anti-competitive practices before they occur, thereby maintaining market competition and ensuring consumer choice.

- Timely Intervention: The existing ex-post framework under the Competition Act, 2002 is considered inadequate for digital markets, where traditional enforcement mechanisms may be too slow to effectively address evolving market dynamics and prevent potential harms to competition. An ex-ante approach enables timely intervention and regulatory oversight to curb monopolistic tendencies and promote a level playing field for all market participants.

What framework does the European Union follow?

- The European Union follows an ex-ante competition framework under the Digital Markets Act (DMA). It regulates large digital platforms identified as gatekeepers, imposing specific obligations to ensure fair competition.

- Objectives: To promote competition, innovation, and consumer choice in digital markets by proactively addressing potential market distortions caused by dominant players.

What are systemically significant digital enterprises (SSDEs)?

- SSDEs are digital enterprises identified as dominant in specific digital market segments under the draft Digital Competition Bill.Identified through quantitative tests based on financial strength and user reach in India, or qualitatively based on significant influence and market impact.

- SSDEs are required to operate transparently, refrain from anti-competitive practices like self-preferencing and data misuse, and ensure fair access to their platforms for other businesses.

Conclusion: Ensure that the criteria used to designate SSDEs are well-defined and balanced. Conduct periodic reviews to adjust these criteria based on market dynamics and technological advancements to accurately capture entities with significant market power without overly burdening smaller players.

Mains PYQ:

Q Examine the impact of liberalization on companies owned by Indians. Are they competing with the MNCs satisfactorily? Discuss. (UPSC IAS/2013)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

PM WANI Wi-Fi Scheme: All you need to know

From UPSC perspective, the following things are important :

Prelims level: PM WANI Wi-Fi Scheme

Mains level: NA

Why in the News?

- Under the PM-WANI scheme, India witnesses a swift rise in public Wi-Fi hotspots, reaching approximately 1,99,896 hotspots nationwide, according to government data.

What is the PM WANI Initiative?

- PM Modi launched the Prime Minister Wi-Fi Access Network Interface (PM WANI) in December 2020.

- It is an initiative under the Department of Telecommunications (DoT).

- It takes forward the goal of the National Digital Communications Policy, 2018 (NDCP) of creating a robust digital communications infrastructure.

- Objective: To democratize internet access, particularly in remote and underserved areas.

- Implementation: Leverages Public Data Offices (PDOs) established in public spaces like railway stations, banks, post offices, and more. Users can access the internet via Wi-Fi at these locations without requiring a SIM card.

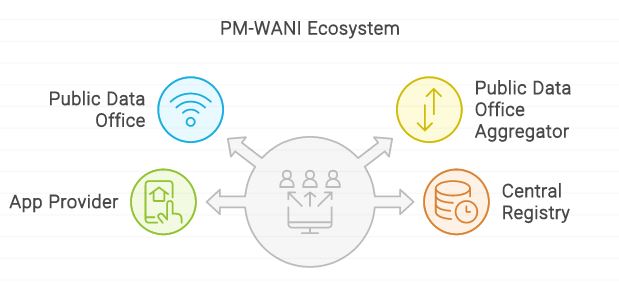

PM-WANI ecosystem consists of four parts:

- Public Data Office (PDO): It establishes the Wi-Fi Hotspots and provides internet access to users

- Public Data Office Aggregator (PDOA): It provides authorisation and accounting services to PDOs.

- App Provider: It displays the available hotspots in the phone’s proximity.

- Central Registry: This overseen by the Centre for Development of Telematics maintains details of App Providers, PDOs, and PDOAs.

How to Utilize PM WANI?

- To access PM WANI services, users must install the Data PM WANI app on their smartphones.

- Through the app, users can connect to nearby public Wi-Fi PDOs.

- This application facilitates seamless connectivity to PM-WANI-compliant Wi-Fi hotspots, empowering users to access broadband services conveniently.

Data Plans Offered

PM WANI offers various data plans to suit different usage needs:

- Rs 6 plan: 1GB data for 1 day

- Rs 9 plan: 2GB data for 2 days

- Rs 18 plan: 5GB data for 3 days

- Rs 25 plan: 20GB data for 7 days

- Rs 49 plan: 40GB data for 14 days

- Rs 99 plan: 100GB data for 30 days

Role of Public Data Offices (PDOs)

- The PM-WANI scheme includes a provision for establishing Public Data Offices (PDOs) by rural entrepreneurs in remote regions.

- These PDOs procure internet bandwidth from telecom service providers or ISPs to offer Wi-Fi services at minimal charges.

- This model enables individuals to access the internet even in areas with limited or no data connectivity.

PYQ:[2018] Which of the following is/are the aim/aims of “Digital India” Plan of the Government of India?

Select the correct answer using the codes given below: (a) 1 and 2 only (b) 3 only (c) 2 and 3 only (d) 1, 2 and 3 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

[PREMIUM] An Overview of the Digitalization in Indian Economy

From UPSC perspective, the following things are important :

Prelims level: Schemes related to digitisation in India

Mains level: Status of Digitalization in the Indian Economy

Why in the news?

As per RBI findings, India’s core digital economy saw a rise from constituting 8.5% of GVA in 2019 to 12.5% in 2023, marking a growth rate of 15.6% over the span of 2019-2023.

What is digitisation?

- Digitization refers to the process of converting information, data, or physical objects into digital format. Digitization enables information to be stored, accessed, and manipulated electronically, often leading to increased efficiency, accessibility, and flexibility compared to traditional analog methods.

Origin in World

- The origin of digitalization can be traced back to the late 19th century when Herman Hollerith developed a punch card system for tabulating data.

- Alan Turing’s theoretical work on computation in the early 20th century laid the foundation for the development of the first electronic computers in the 1940s, which were pivotal in digitizing various forms of information.

Origin in India

- Late 20th century: The origins of digitalization in India can be traced back to the late 20th century, with the advent of personal computers and the internet.

- Early 2000s:The government’s concerted efforts to drive digital transformation in the country began in the early 2000s with the launch of the National e-Governance Plan (NeGP) in 2006

- 2015: The NeGP aimed to make government services available to citizens electronically by improving online infrastructure and connectivity. This laid the foundation for the more comprehensive “Digital India” initiative, which was launched by Prime Minister Narendra Modi in 2015

Status of Digitalization in the Indian Economy

- Enhancement of E-Governance: The Digital India initiative has brought about substantial enhancements in e-governance services. Programs such as e-visas and the Digital Locker system have effectively modernized government services, leading to a reduction in paperwork and greater accessibility for citizens.

- E-Commerce market: India’s e-commerce market is expected to reach $200 billion by 2026. Major players like Flipkart and Amazon have expanded their reach, with the COVID-19 pandemic accelerating online shopping adoption.

- Digital transaction: The BHIM (Bharat Interface for Money) app, utilizing the Unified Payments Interface (UPI), has garnered immense popularity, enabling secure peer-to-peer transactions. By August 2023, UPI had processed more than 10 billion monthly transactions, amounting to INR 18 trillion ($204.77 billion).

- Startup Ecosystem in India: India’s rapidly growing startup ecosystem currently encompasses 110 unicorns valued at $347 billion, featuring prominent companies such as Paytm, Ola, and Zomato. These unicorns exemplify India’s prowess as a technology-driven entrepreneurial center.

- Digital Financial Inclusion: Digital financial services, propelled by programs such as Jan Dhan Yojana, have advanced financial inclusion by facilitating the opening of millions of bank accounts for those previously excluded from or underrepresented in the banking system.

- Surge in Broadband and Internet Usage: India has experienced a notable surge in broadband adoption, boasting 825 million mobile broadband subscribers as of July 2023. This uptick has resulted in heightened data consumption and escalated online engagement, especially among Generation Z.

Key challenges related to digitalisation in India:

- Lack of skills: Rapid technological change increase the demand of skilled workforce. Only 42% of India’s workforce possesses digital skills, highlighting the need for digital literacy and upskilling.

- Regulatory challenges: For businesses, especially startups, grappling with intricate digital regulations, e-commerce taxation, and intellectual property matters continues to present significant challenges.

- Privacy issues:The surge in digital transactions and data exchange has sparked notable concerns regarding privacy and data security. These concerns are being tackled by the Personal Data Protection Bill, which introduces regulatory intricacies.

- Cybersecurity: As digitization increases, the risk of cyber threats and attacks grows. India faced 91 lakh cybersecurity incidents in 2022, ranking third globally in the average cost of data breaches.

- Digital Divide: Despite advancements, there remains a digital gap, with rural areas experiencing restricted internet and technology accessibility, resulting in approximately 50% of the population being offline.

Measures to address these challenges:

- Digital Skills Development: Implement comprehensive digital literacy programs to enhance the skills of the workforce.

- Regulatory Simplification:Streamline digital regulations, especially for startups, to reduce complexities and facilitate smoother operations.Provide guidance and support to businesses on e-commerce taxation and intellectual property matters.

- Privacy and Data Security: Enforce the Personal Data Protection Bill to address privacy concerns and ensure data security.Enhance awareness campaigns to educate the public about data privacy and protection measures.

- Cybersecurity Measures: Strengthen cybersecurity infrastructure to combat the increasing cyber threats and attacks.Invest in advanced cybersecurity technologies and training programs to build a resilient defense system.

- Closing the Digital Divide:Expand digital infrastructure in rural areas to improve internet and technology accessibility.

Steps taken by government:

- Cybersecurity Framework: Enhance cybersecurity infrastructure and awareness, emphasizing collaboration between government agencies and the private sector under National Cyber Security Policy of 2021.

- Data Protection Laws: Enacted data protection laws and regulations, like the Digital Personal Data Protection Act, of 2023, to ensure privacy and responsible data handling.

- Expansion of Broadband : Accelerate efforts to expand broadband connectivity in rural and remote areas, leveraging public-private partnerships like the BharatNet project.

- Digital initiative: Comprehensive digital literacy initiatives targeting both urban and rural communities, exemplified by programs like the Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA).

Conclusion:

Need to Implement widespread digital literacy programs to equip individuals with the necessary skills to navigate the digital landscape and emphasize upskilling and reskilling initiatives to meet the demands of rapid technological advancements.Encourage collaboration between the government and the private sector to drive digitization initiatives.

Mains PYQ

Q Implementation of Information and Communication Technology (ICT) based projects/programmes usually suffers in terms of certain vital factors. Identify these factors and suggest measures for their effective implementation. (UPSC IAS/2019)

Q Has digital illiteracy, particularly in rural areas, coupled with lack of Information and Communication Technology (ICT) accessibility hindered socio-economic development? Examine with justification.(UPSC IAS/2021)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

State-level DPI Adoption Index

From UPSC perspective, the following things are important :

Prelims level: Digital Public Infrastructure (DPI), DPI Adoption Index Mains: NA

Mains level: NA

Why in the news?

The World Bank, in collaboration with the Ministry of Electronics & Information Technology (MEITY), is spearheading the development of a state-level Digital Public Infrastructure (DPI) adoption index.

About State-Level DPI Adoption Index

- World Bank confirmed that the project was in its preparatory stages.

- The envisioned state-level DPI index aims to identify gaps and opportunities for strengthening the DPI for the digital economy, promoting financial inclusion, and fostering public-private innovation.

- The index will assess different states based on their adoption levels of DPIs, intending to incentivize increased utilization of these digital systems.

What is Digital Public Infrastructure (DPI)?

- DPI refers to the foundational digital infrastructure that enables the delivery of digital services and facilitates digital interactions between citizens, businesses, and governments.

- It encompasses various technological components, policies, and frameworks aimed at enhancing digital connectivity, accessibility, and efficiency in public service delivery.

| DPI, as defined by the G20 New Delhi Leaders’ Declaration (September 2023) “is a set of shared digital systems that are secure and interoperable, built on open technologies, to deliver equitable access to public and/or private services at a societal scale”. |

Three Pillars of DPI:

- DPI primarily focuses on three key pillars: identity, payments, and data management.

- India has pioneered the development of all three DPI pillars through its India Stack Platform, setting a global benchmark.

- Identity: Aadhar serves as India’s digital ID system.

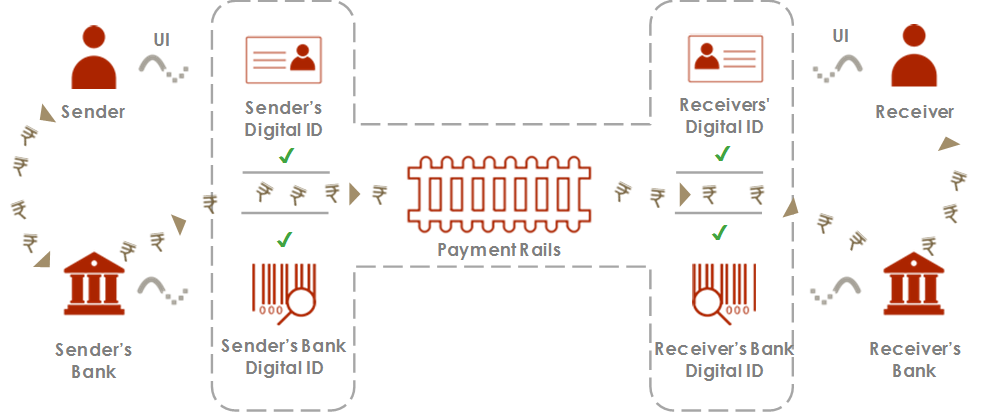

- Payment: The Unified Payments Interface (UPI) facilitates real-time fast payments.

- Data Management: The Data Empowerment and Protection Architecture (DEPA) ensures consent-based data sharing.

India’s Initiatives Leveraging DPI

- Digital India: Initiatives like Digital Locker, e-sign framework, and the National Scholarship Portal are integral parts of the Digital India campaign.

- BharatNet: This project aims to provide affordable internet connectivity to rural India, leveraging high-speed broadband networks.

- National Health Stack: Designed to revolutionize healthcare, this infrastructure facilitates health data exchange and interoperability.

- National Knowledge Network (NKN): Facilitating collaborative research and innovation, NKN promotes knowledge sharing.

- UMANG: The Unified Mobile Application for New-age Governance offers access to various government services and schemes.

- Government e-Marketplace (GeM): An online platform streamlining procurement processes for government agencies.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

[pib] India showcases CPGRAMS at 3rd Biennial Pan-Commonwealth Meeting in London

From UPSC perspective, the following things are important :

Prelims level: Commonwealth of Nations, CPGRAMS

Mains level: NA

Why in the news?

India’s Centralised Public Grievance Redress and Monitoring System (CPGRAMS) received global recognition during the 3rd Biennial Pan-Commonwealth Heads in London.

What is CPGRAMS?

Key functions of CPGRAMS include:

Issues that are NOT taken up under CPGRAMS:

|

What is the Commonwealth of Nations?

- The Commonwealth of Nations is an intergovernmental organization of 53 member states that are mostly former territories of the British Empire.

- It dates back to the first half of the 20th century with the decolonization of the British Empire through increased self-governance of its territories.

- It was originally created as the British Commonwealth of Nations through the Balfour Declaration at the 1926 Imperial Conference.

- It was formalized by the UK through the Statute of Westminster in 1931.

- The symbol of this free association is Queen Elizabeth II, who is the Head of the Commonwealth.

- Membership: Based on free and equal voluntary cooperation.

History of its creation

- The Commonwealth was created in the early 1900s when nations that were formerly a part of the British Empire began to secede.

- India is one of the founding members of the modern Commonwealth.

- India’s first Prime Minister, Jawaharlal Nehru, played a key role in the creation of the modern Commonwealth in 1949, Indian policy-makers over the years have considered it as a relic of empire and steeped in colonial legacy.

Working of Commonwealth

- Commonwealth members have no legal obligations to one another.

- Instead, they are united by language, history, culture and their shared values of democracy, human rights and the rule of law.

Actual functioning: Commonwealth Heads of Government Meeting (CHOGM)

- CHOGM which takes place every two years is a platform for all Commonwealth leaders to meet and discuss issues about the Commonwealth.

- The motto behind the meeting is to reaffirm common values, address the shared global challenges and agree on how to work to create a better future.

PYQ:[2012] With reference to consumers rights/privileges under the provisions of law in India, which of the following statements is/are correct? 2. When a consumer files a complaint in any consumer forum, no fee is required to be paid. 3. In case of death of a consumer, his/her legal heir can file a complaint in the consumer forum on his/her behalf. Select the correct answer using the codes given below: (a) 1 only (b) 2 and 3 only (c) 1 and 3 only (d) 1, 2 and 3 [2016] The plan of Sir Stafford Cripps envisaged that after the Second World War, (a) India should be granted complete independence (b) India should be partitioned into two before granting independence (c) India should be made a republic with the condition that it will join the Commonwealth (d) India should be given Dominion status |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

Krishi Integrated Command and Control Centre (ICCC)

From UPSC perspective, the following things are important :

Prelims level: Krishi ICCC

Mains level: NA

Why in the news?

Agriculture Minister has recently inaugurated the Krishi Integrated Command and Control Centre (ICCC) at Krishi Bhavan in New Delhi.

What is Krishi ICCC?

- The ICCC incorporates multiple IT applications and platforms to provide actionable insights and aid informed decision-making.

- 8 large LED screens display crucial information such as crop yields, production, drought situation, cropping patterns, and relevant trends in graphical format.

- The dashboard offers insights, alerts, and feedback on agriculture schemes, programs, projects, and initiatives, empowering stakeholders with comprehensive information.

Data used by Krishi ICCC

The ICCC will enable comprehensive monitoring of the farm sector by making available at one place geospatial information received from multiple sources such as:

- Plot-level data received through Soil Survey;

- Weather data from the India Meteorological Department (IMD);

- Sowing data from Digital Crop Survey;

- Farmer- and farm-related data from Krishi MApper, an application for geo-fencing and geo-tagging of land;

- Market intelligence information from the Unified Portal for Agricultural Statistics (UPAg); and

- Yield estimation data from the General Crop Estimation Survey (GCES).

Objectives and Functionality

- Comprehensive Monitoring: The ICCC aims to enable comprehensive monitoring of the farm sector by consolidating geospatial information from various sources, including remote sensing, weather data, soil surveys, and market intelligence.

- Decision Support: Integrated visualization facilitates quick and efficient decision-making by policymakers and stakeholders, supported by real-time data and analysis.

Farmer-Specific Advisories and Practical Applications

- Individual Farmer Advisories: The ICCC has the potential to generate individual farmer-specific advisories through apps like Kisan e-Mitra (a chatbot developed for PM-Kisan beneficiaries), leveraging AI and machine learning to customize recommendations based on farmer data.

Practical Applications:

-

- Farmer’s Advisory: Visualizations of GIS-based soil mapping, soil health card data, and weather-related information enable customized advisories on crop selection and agricultural practices.

- Drought Actions: Correlation of yield data with weather patterns allows proactive measures to mitigate the impact of droughts.

- Crop Diversification: Analysis of crop diversification maps helps identify regions suitable for diversified cropping, optimizing agricultural productivity.

- Farm Data Repository: The Krishi Decision Support System (K-DSS) acts as an agriculture data repository, facilitating evidence-based decision-making and the preparation of customized advisories for farmers.

- Validation of Yield: The ICCC enables the validation of yield data captured through different applications, ensuring accuracy and reliability.

PYQ:

2018: With reference to the ‘Global Alliance for Climate-Smart Agriculture (CACSA)’, which of the following statements is/are correct?

- GACSA is an outcome of the Climate Summit held in Paris in 2015.

- Membership of GACSA does not create any binding obligations.

- India was instrumental in the creation of GACSA.

Select the correct answer using the codes given below:

- 1 and 3 only

- 2 only

- 2 and 3 only

- 1, 2 and 3

Practice MCQ:

What is the primary objective of the Krishi ICCC (Integrated Command and Control Centre)?

- To provide real-time market prices of agricultural products.

- To consolidate geospatial information from various sources for comprehensive monitoring of the farm sector.

- To offer financial support to farmers through direct benefit transfer schemes.

- To facilitate the construction of irrigation projects in rural areas.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

Data marketplaces: the next frontier

From UPSC perspective, the following things are important :

Prelims level: Digital Architecture, Ministry of Electronics and Information Technology

Mains level: National Data Governance Framework Policy

Why in the news?

The Ministry of Electronics and Information Technology (MeiTY) released the National Data Governance Framework Policy (NPD Framework) which was touted as the first building block of the digital architecture being conceived to maximize data.

Context:

- The role of digitization in realizing India’s vision of becoming a $5 trillion economy cannot be overstated.

- As per a NASSCOM report, data and artificial intelligence (AI) can add approximately $450-500 billion to India’s GDP by 2025.

Types of data:

- Personal Data – Data containing identifiers that can be used to identify specific individuals.

- Non-Personal Data (NPD)- data excluding personal data. It constitutes the primary type of citizen data obtained by the government and holds the potential to serve as a ‘public good’.

Significance of Non-personal data-

- NPD as a Public Good: NPD (Non-Personal Data) is considered the primary type of citizen data collected by the government. It holds the potential to serve as a ‘public good’, implying its utility and value to society as a whole.

- Integration of NPD in Public Services: Advocates for integrating NPD into the delivery of public services to create synergies and scalable solutions. Integration aims to enhance the effectiveness and efficiency of public service delivery.

- Application of Advanced Analytics and AI: Utilizing high-value advanced analytics and artificial intelligence (AI) on NPD can lead to predicting socially and economically beneficial outcomes. Such applications can span across various sectors of the economy.

- Key Sectors for Data-Driven Insights: Meteorological and disaster forecasts: Utilizing NPD to enhance predictions and preparedness for weather-related events and disasters. Infrastructure capacity and citizen use patterns: Understanding how citizens interact with infrastructure to optimize usage and planning.

- Mobility and housing patterns: Analyzing data to inform transportation and housing policies.

- Employment trends: Using NPD to predict and address changes in employment patterns and workforce needs.

- Informing Governance and Public Functions: NPD-driven insights can better inform decision-making in governance and public functions. Data analytics can provide valuable information for policy formulation and resource allocation.

Challenges related to NDP:

- Privacy and Security Concerns: The unprotected inter-flow of NPD across government departments, third parties, and citizens can lead to privacy breaches and make sensitive data vulnerable. This vulnerability can disproportionately benefit capacity-carrying actors such as Big Tech.

- Risk of Faulty Decision-making: Imperfect analysis of crucial public trends resulting from the exchange of NPD can lead to faulty decision-making. The inefficient exchange of data fails to unlock the power of interdisciplinary legislative and policy-making.

- Gaps in the NPD Framework: The NPD Framework lacks actionable guidance and practical operationalization, focusing on abstract high-level principles and objectives. It overlooks mechanisms for pricing data, appropriate legal structures for data exchange, and standardized governance tools.

- Lack of Legislation and Operationalization: While legislation is expected, the practical implementation and operationalization of the NPD Framework are overlooked. Questions remain unanswered regarding stakeholder rights and obligations across sectors.

Steps by Government:

- Agriculture Data Exchange in Telangana: Telangana State has developed an agriculture data exchange platform. The platform aims to facilitate the exchange of agricultural data among various stakeholders. It is likely designed to enhance decision-making, productivity, and innovation in the agriculture sector.

- India Urban Data Exchange (IUDX): The Ministry of Housing & Urban Affairs, in collaboration with the Indian Institute of Science, has established the India Urban Data Exchange (IUDX).

- IUDX enables better urban planning, infrastructure development, and governance through data-driven insights.

- Data Exchanges for Geospatial Policy: The Department of Science & Technology has announced plans to establish data exchanges to implement aspects of the National Geospatial Policy.

Measures to address these challenges:

- Need for Critical Evaluation and Enhancement: A critical evaluation of the NPD Framework is necessary to address existing gaps. Enhancements to the framework can supplement MeiTY’s efforts to regulate NPD and facilitate interoperability across sectors.

- Learn from International practice: countries like Australia, the UK, and Estonia highlight the adoption of data exchange frameworks and protocols. These frameworks have been applied across various sectors such as housing, employment, aged care, and agriculture to address specific issues like unemployment.

- Regulatory Design for Data Exchanges: Creating a regulatory design for data exchanges in India can digitize and automate public welfare functions. It can reduce administrative burden, facilitate inter-sectoral integration, and build safeguards for using and sharing NPD, making civic functions more participatory.

- Stakeholder Consultation: Engage stakeholders from government, industry, academia, and civil society in the evaluation process. Gather feedback on practical challenges faced in implementing the framework and areas needing clarification or enhancement.

Conclusion: A comprehensive evaluation and enhancement of the NPD Framework are imperative. Learning from international practices, establishing regulatory designs for data exchanges, and fostering stakeholder consultations will pave the way for effective governance of non-personal data.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

[pib] NIXI and MeitY to unveil BhashaNet Portal

From UPSC perspective, the following things are important :

Prelims level: BhashaNet Portal, Universal Acceptance Principle

Mains level: NA

What is the news-

- The National Internet Exchange of India (NIXI) is proud to announce the launch of the BhashaNet portal for the upcoming Universal Acceptance (UA) Day.

| Universal Acceptance is the principle that all domain names and email addresses should be treated equally, regardless of the characters used in them. |

What is BhashaNet Portal?

- The Bhasha-Net Portal is a digital platform launched by NIXI, aimed at promoting Universal Acceptance (UA).

- The portal specifically focuses on ensuring that individuals, regardless of the language or script they use, can fully participate in the digital world.

- The portal is designed to provide resources, tools, and information to support the integration of diverse languages and scripts into online platforms, websites, and applications.

Objectives:

- To provide a truly multilingual internet, where local language website name and local language email id, work everywhere seamlessly.

- To foster digital inclusivity by addressing linguistic barriers and promoting the use of local languages and scripts in digital communication.

About National Internet Exchange of India (NIXI)

Four key services include- 1. Setting up Internet Exchange Points, 2. Managing the .IN Registry, 3. Promoting IPv4 and IPv6 address adoption through IRINN, and 4. Offering data center services under NIXI-CSC. |

Back2Basics:

| IPv4 | IPv6 | |

| Address Format | 32-bit address format (e.g., 192.0.2.1) | 128-bit address format (e.g., 2001:0db8:85a3:0000:0000:8a2e:0370:7334) |

| Address Representation | Decimal dotted notation (e.g., 192.0.2.1) | Hexadecimal colon-hex notation (e.g., 2001:0db8:85a3:0000:0000:8a2e:0370:7334) |

| Address Space | Limited address space (~4.3 billion addresses) | Vast address space (approximately 3.4×10^38 addresses) |

| Header Length | Fixed-length header (20 bytes) | Variable-length header (40 bytes or more) |

| Header Options | Limited options | Expanded options for quality of service, security, and mobility |

| Broadcast | Uses broadcast addresses for network discovery and ARP (Address Resolution Protocol) | Uses multicast addressing for efficient communication |

| Security | Limited built-in security features | Built-in IPsec (Internet Protocol Security) support for end-to-end encryption and authentication |

| Adoption Status | Widely deployed and used | Increasing adoption but not yet fully ubiquitous |

PYQ:

2011: What is “Virtual Private Network”?

- It is a private computer network of an organization where the remote users can transmit encrypted information through the server of the organization

- It is a computer network across a public internet that provides users access to their organization’s network while maintaining the security of the information transmitted

- It is a computer network in which users can access a shared pool of computing resources through a service provider

- None of the statements (A), (B) and (C) given above is a correct description of Virtual Private Network

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

[pib] Government e Marketplace (GeM)

From UPSC perspective, the following things are important :

Prelims level: Government e Marketplace (GeM)

Mains level: NA

Why in the news-

- The government’s procurement portal, GeM (Government e-Marketplace), is looking to encourage more and more start-ups and small and micro enterprises to list themselves as sellers.

About Government e-Marketplace (GeM)

- The GeM is a one-stop National Public Procurement Portal to facilitate online procurement of common use Goods & Services required by various Government Departments / Organizations / PSUs.

- It was launched in 2016 by the Ministry of Commerce and Industry.

- It has been developed by the Directorate General of Supplies and Disposals (under MCI) with technical support from the National e-governance Division (MEITy).

Functions for GeM

- Enhancement of Public Procurement: GeM aims to enhance transparency, efficiency, and speed in public procurement processes.

- Paperless and Cashless Transactions: It is a completely paperless, cashless, and system-driven e-marketplace that enables procurement of common-use goods and services with minimal human interface.

- Facilitation of Best Value: GeM provides the tools of e-bidding, reverse e-auction, and demand aggregation to facilitate government users in achieving the best value for their money.

- Mandatory Purchases by Government Users: The purchases through GeM by Government users have been authorized and made mandatory by the Ministry of Finance by adding a new Rule No. 149 in the General Financial Rules, 2017.

Key Developments on GeM:

- GeM Outlet Stores: GeM has introduced outlet stores for various product categories like SARAS, Ajeevika, Tribes India, Startup Runway, Khadi India, India Handloom, India Handicraft, Divyangjan, etc.

- Bamboo Market Window: GeM, in collaboration with the National Bamboo Mission, has introduced a dedicated window on its portal for marketing Bamboo Goods.

- Country of Origin Tag: Since 2020, the government has made it mandatory for sellers on the GeM portal to clarify the country of origin of their goods when registering new products.

PYQ:

Q.‘SWAYAM’, an initiative of the Government of India, aims at (2016) –

- Promoting the Self Help Groups in rural areas

- Providing financial and technical assistance to young start-up entrepreneurs

- Promoting the education and health of adolescent girls

- Providing affordable and quality education to the citizens for free

Practice MCQ:

With reference to the Government e-Marketplace (GeM), consider the following statements:

- It is a one-stop National Public Procurement Portal launched in 2016.

- It is developed by the Department for Promotion of Industry and Internal Trade (DPIIT)

Select the correct option:

- Only 1

- Only 2

- Both 1 and 2

- Neither 1 nor 2

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

4 Portals for Modernized Media Landscape

From UPSC perspective, the following things are important :

Prelims level: Various portals mentioned in the newscard

Mains level: NA

Introduction

- Minister of Information and Broadcasting unveiled four groundbreaking portals poised to reshape India’s media landscape, promising efficiency, transparency, and accessibility.

[1] Press Sewa Portal:

- Objective: The Press Sewa Portal is designed to streamline the process of newspaper registration and related activities under the Press and Registration of Periodicals Act, 2023 (PRP Act, 2023).

- Key Features:

- Online Application: Publishers can submit applications for title registration online, utilizing Aadhar-based e-signatures for authentication.

- Probability Meter: Indicates the likelihood of title availability, offering publishers insight into the registration process.

- Real-time Tracking: Allows users to track the status of their applications through an intuitive dashboard, facilitating transparency and efficiency.

- District Magistrate Module: Enables District Magistrates to manage applications received from publishers in a centralized dashboard.

- Benefits of Automation: The portal offers online services for title registration, paperless processes with e-sign facilities, integration of a direct payment gateway, issuance of QR code-based digital certificates, and a module for Press Keepers/owners to provide online intimation about printing press activities.

- Impact: Simplifies the cumbersome registration procedures prevalent under the colonial PRB Act, 1867, and modernizes the registration landscape for publishers, enhancing efficiency and transparency.

[2] Transparent Empanelment Media Planning and eBilling System:

- Objective: This system aims to revolutionize media planning processes, enhance transparency, and provide an end-to-end ERP solution for the media industry, particularly for the Central Bureau of Communication (CBC).

- Key Features:

- Streamlined Empanelment Process: Offers an online system for empanelment of various media channels (newspapers, periodicals, TV, radio, and digital media), ensuring transparency and efficiency.

- Automated Media Planning: Enhances tools and features for online generation of media plans, reducing manual intervention and preparation time.

- Automated Billing: Integration of an eBilling processing system for seamless and transparent bill submission, verification, and payment.

- Mobile App: Provides a comprehensive mobile app for partners with timestamp and geo-tagging functionality for organized monitoring.

- Promoting Ease of Doing Business: Facilitates faster empanelment, a hassle-free business environment, automated compliance, and swifter payment processing, thereby enhancing the ease of doing business in the media industry.

- Reliable Solution: The portal is integrated with the latest technology to generate real-time analytical reports, enabling data-driven decisions and efficient media planning.

[3] NaViGate Bharat Portal:

- Objective: The NaViGate Bharat portal serves as the National Video Gateway of Bharat, offering a unified bilingual platform for hosting videos on government’s development initiatives and welfare-oriented measures.

- Key Features:

- Dedicated Pages: Offers dedicated pages for ministries, sectors, schemes, and campaigns, providing detailed descriptions and advanced search functionalities.

- Easy Navigation & Search: Provides easy access for users to find relevant videos through categorization, tagging, and advanced search functionalities.

- Seamless Video Playback & Streaming: Enables seamless video playback and streaming for a user-friendly viewing experience.

- Download & Sharing Options: Allows users to download and share videos through social media platforms, promoting widespread dissemination of information.

- Empowering Citizens: Empowers citizens by providing a single platform for accessing authentic government videos, fostering transparency, and promoting awareness about government initiatives.

- Comprehensive Coverage: Offers comprehensive coverage of government schemes, initiatives, and campaigns, ensuring that no one is left behind in understanding the initiatives shaping the nation’s future.

[4] National Register for LCOs:

- Objective: The National Register for Local Cable Operators (LCOs) aims to centralize the registration process for LCOs, bringing them under a centralized registration system.

- Key Features:

- Web Form: A web form is designed to collect information from local cable operators for the purpose of the National Register.

- Online Publication: The National Register for LCOs is published online and regularly updated, offering a more organized approach to cable sector registration.

- Impact: Promises a more organized cable sector with a National Registration Number for LCOs, facilitating the formulation of new policies for responsible service and convenience for cable operators.

- Aligning with Vision: The initiative aligns with India’s vision of a developed and organized cable sector, contributing to the countries overall development and welfare.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

RuPay and UPI rolled out in Mauritius, Sri Lanka

From UPSC perspective, the following things are important :

Prelims level: RuPay and UPI

Mains level: Rupee as regional and global currency

Introduction

- RBI has announced the establishment of RuPay card and Unified Payments Interface (UPI) connectivity between India and Mauritius, as well as UPI connectivity between India and Sri Lanka.

- This initiative aims to deepen financial integration and facilitate digital payments among citizens of the three countries.

Discussion: Rupee Integration with Neighbours

- UPI in Mauritius: Indian travellers visiting Mauritius can now pay merchants in Mauritius using UPI, while Mauritian travellers can utilize the Instant Payment System (IPS) app for payments in India.

- RuPay Adoption: The MauCAS card scheme in Mauritius will leverage RuPay technology, allowing banks to issue RuPay cards domestically. These cards can be used at ATMs and Point of Sale (PoS) terminals in Mauritius and India.

- First Adoption: Mauritius becomes the first country outside Asia to implement RuPay technology, enabling acceptance of Indian RuPay cards at ATMs and PoS terminals within Mauritius.

- QR Code Payments in SL: Indian travellers can make QR code-based payments at merchant locations in Sri Lanka using their UPI apps.

About RuPay and UPI

[A] RuPay Debit Cards

| Details | |

| Launch Year | 2012 |

| Conceived by | National Payments Corporation of India (NPCI) |

| Key Features | First global card payment network of India

Wide acceptance at ATMs, POS devices, and e-commerce websites |

| Security Measures | Highly secure network against anti-phishing

Supports electronic payments at all Indian banks and financial institutions |

| International Acceptance | NPCI maintains ties with Discover Financial, JCB for international acceptance |

| Issuers | More than 1100 banks including public sector, private, regional banks, and cooperatives |

| Core Promoter Banks | SBI, PNB, Canara Bank, BOB, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank, HSBC |

[B] Unified Payments Interface (UPI)

| Details | |

| Launch | April 11, 2016 |

| Developed by | National Payments Corporation of India (NPCI) |

| Key Features | Enables simple, easy, and quick transactions using Unified Payments Interface (UPI) |

| Payment Methods | Direct bank payments using UPI ID or QR code scanning

Requesting money from a UPI ID |

| Working | Transfers using UPI ID, mobile number, QR code, or Virtual Payment Address.

Offers consistent transaction PIN across apps, enhancing cross-operability. Supports push and pull transactions, over-the-counter payments, and recurring payments such as utility bills and subscriptions. |

Countries where UPI works

| Details | |

| Bhutan | Launched in July 13, 2021.

Partnership between NPCI International Payments Ltd (NIPL) and the Royal Monetary Authority (RMA) of Bhutan. First country to adopt UPI. |

| Oman | Launched on October 4, 2022.

Enables acceptance of Indian RuPay cards at all OmanNet network ATMs, POS & E-commerce sites. Allows reciprocal acceptance of Oman cards/MPCSS in the networks of NPCI in India. |

| Mauritius | Connectivity allows Indian visitors in Mauritius to use UPI for local payments, and vice versa for Mauritian tourists in India using the Instant Payment System (IPS) app.

Enables issuance of RuPay cards by banks in Mauritius through the MauCAS card network. |

| Sri Lanka | Digital payments connectivity enables Indian travellers to make QR code-based payments at merchant locations in Sri Lanka using their UPI apps. |

| Nepal | Nepali users can make bank transfers to India using a unified payment interface (UPI) ID through mobile banking. |

| France | UPI service launched at the Eiffel Tower in Paris, France this year.

Partnership between NPCI International Payments Limited (NIPL) and Lyra, a French leader in securing e-commerce and proximity payments. |

| Southeast Asia | Agreement signed between NIPL and Liquid Group to enable QR-based UPI payments in 10 countries: Malaysia, Thailand, Philippines, Vietnam, Singapore, Cambodia, South Korea, Japan, Taiwan, and Hong Kong. |

Why such move?

- Tourism Promotion: Facilitating digital payments through RuPay and UPI encourages tourists from India to visit Mauritius and Sri Lanka by providing them with convenient payment options.

- Financial Integration: The rollout of RuPay and UPI fosters closer economic ties between India, Mauritius, and Sri Lanka by enabling cross-border transactions and financial services.

- Diversification (away from Maldives): By providing modern payment infrastructure and options comparable to those in popular tourist destinations like Mauritius and Sri Lanka can attract more tourists and diversify their tourism sectors.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

[pib] DigiReady Certification for MSMEs and Small Retailers

From UPSC perspective, the following things are important :

Prelims level: DigiReady Certification

Mains level: Read the attached story

Introduction

- The Quality Council of India (QCI) and Open Network for Digital Commerce (ONDC) announced the launch of the DigiReady Certification (DRC) portal.

What is DigiReady Certification?

- Objective: QCI, in collaboration with ONDC, aims to assess and certify the digital readiness of Micro, Small, and Medium Enterprises (MSMEs).

- Self-Assessment Tool: MSMEs can utilize this online self-assessment tool to evaluate their preparedness to onboard as sellers on the ONDC platform, enhancing their digital capabilities and business potential.

- Streamlined Seller Journey: The portal is designed to facilitate a smooth seller journey, ensuring seamless integration into existing digitized workflows for MSMEs and small retailers.

- Certification Process: Evaluates various aspects of digital readiness, including documentation for online operations, proficiency in technology usage, integration with existing workflows, and efficient order and catalogue management.

- Significance: Provides additional business prospects for sellers, enabling them to become integral participants in the digital ecosystem.

Back2Basics: Quality Council of India (QCI):

- Establishment: Founded in 1997 jointly by the Department for Promotion of Industry & Internal Trade (DPIIT), the Ministry of Commerce & Industry, and the Indian industry.

- Legal Status: Registered as a non-profit organization under the Societies Registration Act XXI of 1860.

- Operational Structure: Managed through constituent Boards, primarily the National Accreditation Board for Certification Bodies (NABCB) and the National Accreditation Board for Testing & Calibration Laboratories (NABL).

- Composition:

-

- Governed by a Council comprising 38 members with equal representations from government, industry, and consumers.

- The Chairman of QCI is appointed by the Prime Minister based on industry recommendations to the government.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

The regulator’s challenge in the age of AI

From UPSC perspective, the following things are important :

Prelims level: algorithmic auditing

Mains level: challenge of developing capabilities for AI regulation

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

Norwegian perspective of India’s digital journey

From UPSC perspective, the following things are important :

Prelims level: Digital Public Infrastructure

Mains level: digital public goods in shaping international development frameworks

Central idea

India’s digital journey, marked by Digital Public Infrastructure (DPI), exemplifies a commitment to inclusivity. The article underscores global collaboration, with MOSIP impacting millions, and highlights Norway’s role, advocating for the 50-in-5 campaign. It emphasizes the balance between openness and security in navigating the digital domain.

Key Highlights:

- DPI Transforming India: Digital Public Infrastructure (DPI) has transformed India, providing digital identities and access to services for its vast population.

- Global Recognition and Frameworks: India’s G-20 presidency gained global recognition for DPI, setting frameworks for digital public goods and highlighting its development benefits.

- Digital Inclusion Success Stories: MOSIP, developed in Bengaluru, serves as a global blueprint, benefiting over 97 million citizens in diverse countries, showcasing achievements in digital inclusion.

- Comprehensive Development Framework: DPI is a comprehensive framework aligning with Sustainable Development Goals (SDGs), emphasizing development, inclusion, innovation, trust, and global competition.

Challenges:

- South-South Cooperation Dynamics: The article explores the dynamics of South-South cooperation, especially in the context of MOSIP, showcasing organic global organization.

- Financial Considerations and Privacy: Financial challenges in developing digital protocols and concerns about data privacy are highlighted as critical challenges for the future.

- Safeguarding Digital Sovereignty: Governments and businesses must navigate challenges, ensuring digital sovereignty without compromising an open, free, and secure Internet.

- Balancing Openness and Security: Balancing openness and security is crucial, emphasizing the importance of DPGA’s compass in certifying and pooling digital public goods.

Key Phrases:

- “Leaving no one behind” – Emphasizes the commitment to inclusivity and the challenge in achieving the Sustainable Development Goals (SDGs).

- “Digital Public Infrastructure (DPI)” – Highlights the transformative role of DPI in providing digital identities and access to services.

- “South-South cooperation” – Signifies the collaborative efforts among countries in the global South, exemplified by MOSIP’s impact.

- “Global development architecture” – Describes the role of digital public goods in shaping international development frameworks.

Analysis:

- Global Recognition of DPI: The article analyzes India’s G-20 presidency and its impact on recognizing DPI as part of the international development architecture.

- Challenges in Digital Domain: The challenges of financial considerations, data privacy, and safeguarding digital sovereignty are critically examined.

- Norway’s Digital Contributions: The analysis delves into Norway’s contributions to the digital domain, showcasing its commitment to the 50-in-5 campaign.

- Balancing Openness and Security: The article emphasizes the need to balance openness and security, considering the complexities of the digital domain.

Key Data:

- MOSIP’s Global Reach: Over 97 million people in various countries, including Morocco, Togo, Sri Lanka, and the Philippines, have received IDs through MOSIP.

- Norwegian Digital Goods: Examples include weather services (Yr), health information systems (DHIS2), and contributions targeting SDG2 on ending food hunger.

- 50-in-5 Campaign: Norway pledges to make at least one national digital good available globally in the next five years as part of the 50-in-5 campaign.

- Digital Public Goods Alliance (DPGA): The article highlights the DPGA’s role as a registry of certified digital public goods, shaping the global digital landscape.

Key Facts:

- Digital Inclusion in India: DPI has played a pivotal role in providing digital identities to almost all of India’s 1.4 billion citizens.

- G-20 Framework for DPI: India’s achievement in getting all G-20 countries to agree to the G-20 Framework for Systems of Digital Public Infrastructure is emphasized.

- Norway’s Role in DPGA: Norway is a co-founder and member of the DPGA, contributing to the certification and pooling of digital public goods.

- Digital Goods Addressing Global Challenges: Digital goods like VIPS and DHIS2 contribute to addressing global challenges such as food insecurity and health management.

Key Terms for enriching answer quality:

- Digital Public Infrastructure (DPI)

- South-South Cooperation

- MOSIP (Modular Open Source Identity Platform)

- G-20 Framework for Systems of Digital Public Infrastructure

- 50-in-5 Campaign

- Digital Public Goods Alliance (DPGA)

- Sustainable Development Goals (SDGs)

The Way Forward:

- Collaborative Frameworks with India: Encouraging closer collaboration with India within DPGA frameworks is seen as a positive step for advancing global digital initiatives.

- Learning from India’s Digital Journey: Leveraging lessons from India’s digital journey is crucial for inclusive global development, offering insights into effective transformation strategies.

- Balancing Sovereignty and Collaboration: Collaborating with India within the DPGA framework requires a delicate balance, ensuring digital sovereignty while fostering successful global digital initiatives.

- Certification and Pooling for Global Good: Certification and pooling of digital public goods under DPGA’s global leadership provide a compass for future collaborations, emphasizing global cooperation for mutual benefit.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

The U.S.’s signal of a huge digital shift

Central idea

The U.S. changed its digital trade stance, wanting more control over Big Tech and AI. China’s rise influenced this, creating a possible digital Cold War. Developing nations should make strong digital rules but avoid depending too much on the U.S. or China.

Key Highlights:

- The U.S. withdrawal from key digital trade positions at the WTO signifies a shift in global digital dynamics.

- The move is prompted by the recognition of the need for domestic policy space to regulate Big Tech and AI, impacting data flows, source code, and computing facilities.

- The China factor emerges as a significant reason behind the U.S. decision, as a digital Cold War scenario looms between the U.S. and China.

Challenges:

- The potential split of the global digital space into U.S. and China-led blocs poses challenges for countries caught in the crossfire.

- Developing nations must navigate the risk of digital dependencies on either the U.S. or China, avoiding entanglement in a new form of digital Cold War.

Key Phrases:

- Digital colonisation and extractive nature.

- Digital trade proposals as an agenda at plurilateral trade negotiations and the WTO.

- The flat world concept and its evolution into a split digital world.

Analysis:

- The withdrawal is seen as a shift from the flat world narrative, with the U.S. adapting to a more complex digital landscape influenced by the rise of China.

- The U.S. emphasis on preserving policy space for domestic regulation highlights the recognition of the importance of digital control in the era of Big Tech and AI.

Key Data:

- The U.S. withdrawal in late October from digital trade positions at the WTO.

- China’s active participation in global digital trade negotiations and its potential to outsmart the U.S. digitally

Key Terms to enrich your upsc mains answer:

- Digital colonisation.

- ICT4D (Information and Communication Technologies for Development).

- Digital Cold War.

- Digital industrial policies.

- Global-scale interoperability.

Way Forward:

- Developing countries should leverage the global consensus on the need for strong digital regulations to shape new paradigms for national digital regulation.

- Resistance against falling into a digital Cold War trap, emphasizing the creation of open global standards and digital public infrastructures for genuine global interoperability.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Digital India Initiatives

A telco double dip attempt that threatens Net neutrality

From UPSC perspective, the following things are important :

Prelims level: TRAI

Mains level: Net Neutrality

Central idea