Pension Reforms

Centre notifies Unified Pension Scheme for Government Staff

From UPSC perspective, the following things are important :

Prelims level: Unified Pension Scheme

Why in the News?

The Finance Ministry has announced the operationalization of the Unified Pension Scheme (UPS) for Central Government employees under the National Pension System (NPS), effective from April 1, 2025.

Salient features of the Unified Pension Scheme (UPS)

- Effective from April 1, 2025.

- Eligibility: Applicable to Central Government employees with at least 10 years of service.

- Assured Pension:

- 50% of average basic pay over the last 12 months before retirement for employees with 25+ years of service.

- Proportionate benefits for employees with 10–25 years of service.

- Assured Minimum Pension: ₹10,000 per month for eligible employees.

- Assured Family Pension: 60% of the pension drawn by the employee prior to their death.

- Inflation Protection:

- Pensions indexed to inflation.

- Dearness Relief (DR) linked to the All India Consumer Price Index for Industrial Workers (AICPI-IW).

- Government Contribution: Increased to 18.5% of basic pay and DA (up from 14% under NPS).

- Employee Contribution: 10% of basic pay and DA (same as NPS).

- Lump Sum Payment:

- One-tenth of last drawn pay (including DA) for every six months of completed service, in addition to gratuity.

- Choice of Scheme: Employees can choose between UPS and NPS starting from the upcoming financial year, with the choice being final once made.

- Beneficiaries: Initially benefits 23 lakh Central Government employees, with potential extension to 90 lakh employees if adopted by state governments.

Differences between UPS, NPS and OPS (Old Pension Scheme)

| Unified Pension Scheme (UPS) | National Pension Scheme (NPS) | Old Pension Scheme (OPS) | |

| Pension Amount | 50% of average basic pay over last 12 months; proportional for service <25 years. | Market-linked, dependent on contributions and market performance. | 50% of last drawn salary, increases with DA hikes. |

| Family Pension | 60% of employee’s pension after their death. | Based on accumulated corpus and annuity plans. | Continued benefits to family after retiree’s death. |

| Employee Contribution | 10% of basic salary. | 10% of basic salary. | None; entirely government-funded. |

| Government Contribution | 18.5% of basic salary. | 14% of basic salary. | Entire cost borne by the government. |

| Inflation Indexation | Linked to AICPI-IW. | Not applicable (market-linked returns). | Indexed; pension increases with DA hikes. |

PYQ:[2017] Who among the following can join the National Pension System (NPS)? (a) Resident Indian citizens only (b) Persons of age from 21 to 55 only (c) All State Government employees joining the services after the date of notification by the respective State Governments (d) All Central Government employees including those of Armed Forces joining the services on or after 1st April, 2004 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Pension Reforms

[pib] SECL launches Post-Retirement Benefit (PRB) Cell

From UPSC perspective, the following things are important :

Prelims level: PRB Cell

Why in the News?

South Eastern Coalfields Limited (SECL), a Chhattisgarh-based subsidiary of Coal India Limited (CIL) has established a Post-Retirement Benefit (PRB) Cell.

About Coal India Limited (CIL)

|

What are the aims and objectives?

- Provide a centralized platform for retired employees to access all post-retirement benefits and services under one roof.

- Simplify and expedite the resolution of issues related to pensions, provident funds, medical benefits, and other entitlements.

- Eliminate the need for retirees to coordinate with multiple departments, minimizing delays and miscommunication.

- Reinforce Mission Sambandh, SECL’s initiative to build stronger connections and improve communication with stakeholders.

What are the key benefits of the PRB Cell?

- Acts as a one-stop solution for all post-retirement benefit queries and services.

- Consolidates services like pensions, medical benefits, and financial queries, making it convenient for retirees.

- Dedicated personnel ensure faster response times and seamless service delivery.

- Officers from key departments, including Personnel, Finance, and Medical, are stationed at the PRB Cell to provide specialized support.

PYQ:[2019] Consider the following statements:

Which of the statements given above is/are correct? (a) 1 only (b) 2 and 3 only (c) 3 only (d) 1, 2 and 3 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Pension Reforms

Employees’ Pension Scheme (EPS)

From UPSC perspective, the following things are important :

Prelims level: Employees’ Pension Scheme (EPS)

Why in the News?

The Parliamentary Standing Committee on Labour has recommended increasing the minimum pension of ₹1,000 paid by the Employees’ Provident Fund Organisation (EPFO) under the Employees’ Pension Scheme (EPS).

About the Employees’ Pension Scheme (EPS):

| Details |

|

| Aims and Objectives |

|

| Features and Significance |

|

| Structural Mandate and Implementation | Supreme Court in November 2022, the court upheld the Employees’ Pension (Amendment) Scheme, 2014, extending the deadline for opting for the new scheme by 4 months.

|

| Eligibility Criteria |

|

PYQ:[2021] With reference to casual workers employed in India, consider the following statements: 1. All casual workers are entitled for Employees Provident Fund coverage. 2. All casual workers are entitled for regular working hours and overtime payment. 3. The government can by a notification specify that an establishment or industry shall pay wages only through its bank account. Which of the above statements are correct? (a) 1 and 2 only (b) 2 and 3 only (c) 1 and 3 only (d) 1, 2 and 3 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Pension Reforms

[pib] Pradhan Mantri Kisan Maan Dhan Yojana (PMKMY)

From UPSC perspective, the following things are important :

Prelims level: Pradhan Mantri Kisan Maan Dhan Yojana

Why in the News?

- The Ministry of Agriculture & Farmers Welfare has provided state-wise details of farmers registered under the Pradhan Mantri Kisan Maan Dhan Yojana (PMKMY).

- Top Three States: Haryana (5,74,467), Bihar (3,45,038), Chhattisgarh (2,02,734).

- Bottom Three States/UT: Lakshadweep (72), Ladakh (114), Goa (150).

- Recently, the PMKMY (launched on 12th September 2019) has completed 5 successful years.

About Pradhan Mantri Kisan Maan Dhan Yojana (PMKMY)

| Details | Type: Central Sector Scheme Objective: To provide a voluntary, contributory pension scheme for farmers aged 18–40 years, ensuring ₹3,000/month pension after they turn 60 years of age. |

| Implementation & Structural Mandate | Implemented by: Ministry of Agriculture and Farmers Welfare Pension Fund Manager: Life Insurance Corporation (LIC) of India State-wise Registration: Registered farmers are managed by the respective state governments in collaboration with LIC. The scheme encourages a structured approach involving the collection of contributions and government matching funds. Contribution: Farmers contribute between ₹55 and ₹200 per month, depending on their entry age. |

| Beneficiaries & Benefits | Beneficiaries: Farmers aged 18–40 years. Benefits: Assured pension of ₹3,000 per month post-60 years, matching contribution by the Government of India, administered by LIC. Exclusions: Income taxpayers, members of government pension schemes, and those already enrolled in other pension schemes. |

PYQ:[2020] In India, which of the following can be considered as public investment in agriculture? (2020)

Select the correct answer using the code given below: (a) 1, 2 and 5 only (b) 1, 3, 4 and 5 only (c) 2, 3 and 6 only (d) 1, 2, 3, 4, 5 and 6 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Pension Reforms

NPS Vatsalya Scheme

From UPSC perspective, the following things are important :

Prelims level: NPS Vatsalya Scheme

Why in the News?

The Finance Ministry has launched the “NPS Vatsalya scheme” as per the Union Budget 2024-25 announcement.

About NPS Vatsalya Scheme:

| Details | |

| Objective | To secure children’s financial future by allowing parents to invest in a pension account early on. |

| Nodal Agency | Managed by Pension Fund Regulatory and Development Authority (PFRDA) |

| Eligibility |

|

| Contributions | ₹500 per month or ₹6,000 annually |

| Benefits offered |

|

PYQ:[2017] Who among the following can join the National Pension System (NPS)? (a) Resident Indian citizens only (b) Persons of age from 21 to 55 only (c) All State Government employees joining the services after the date of notification by the respective State Governments (d) All Central Government employees including those of Armed Forces joining the services on or after 1st April, 2004 |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Pension Reforms

Why did the Centre alter its pension plan?

From UPSC perspective, the following things are important :

Prelims level: Unified Pension Scheme;

Mains level: Reason behind the need for a Unified Pension Scheme;

Why in the News?

The Union Cabinet approved a new Unified Pension Scheme for Central government employees, set to launch on April 1, 2025, benefiting 23 lakh employees.

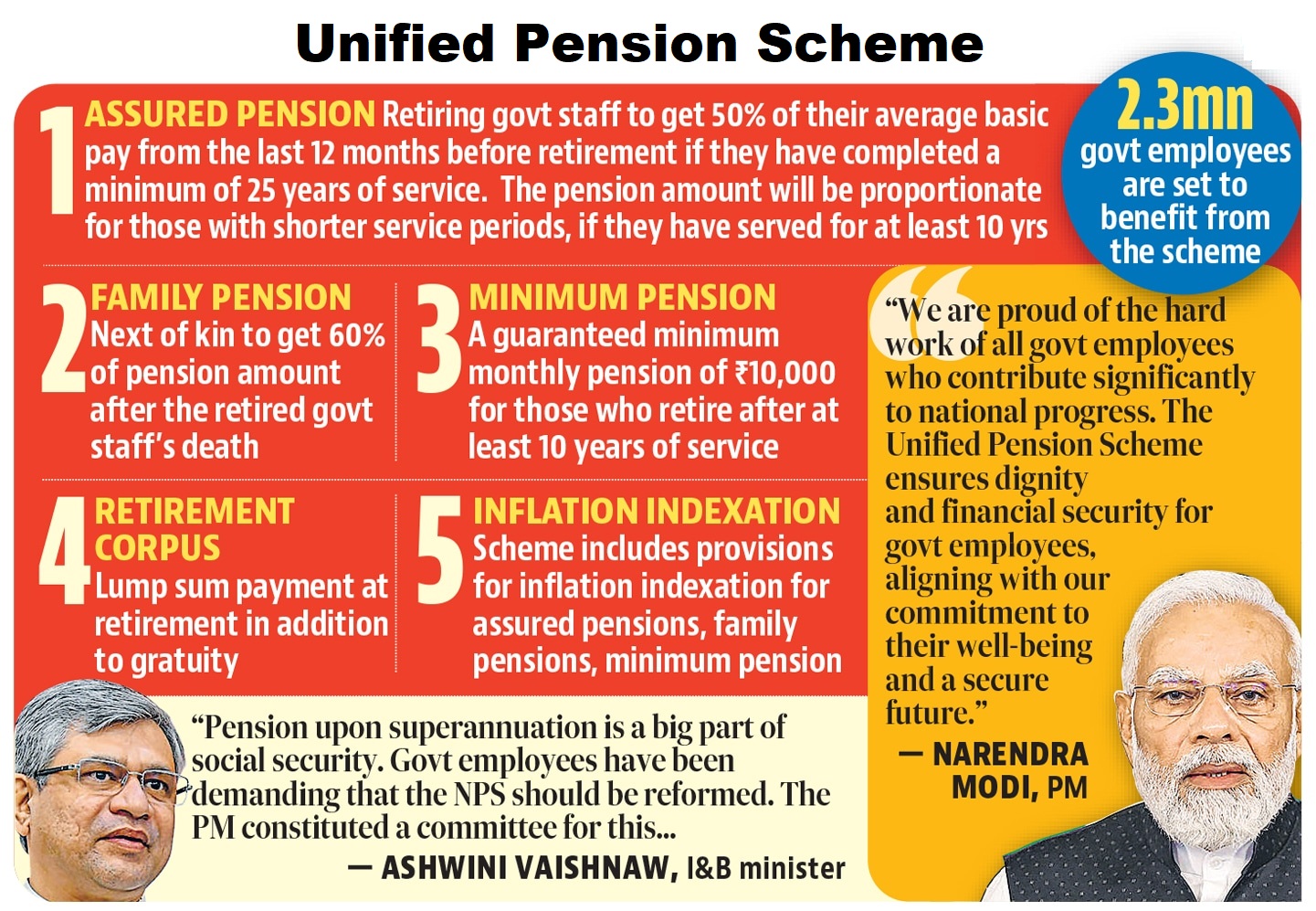

What are the main features of the Unified Pension Scheme?

- Assured Pension: Employees will receive half of their average basic pay from the last 12 months of service as a monthly pension, provided they have served at least 25 years. A minimum pension of ₹10,000 is guaranteed for those with at least 10 years of service.

- Family Pension: Dependents will receive 60% of the government worker’s pension upon their demise (death of a person).

- Inflation Adjustment: Pension incomes will be adjusted for inflation, similar to the dearness relief provided to current employees.

- Lump Sum Superannuation Payout: A lump sum equivalent to 1/10th of an employee’s salary and dearness allowance for every six months of service, in addition to gratuity benefits.

- Contributory Mechanism: Employees will contribute 10% of their salary to the pension pool, while the government will contribute 18.5%.

How is it different from the current pension system?

- Old Pension Scheme (OPS): Provided an assured pension at 50% of the last drawn salary with no contributions required from employees.

- It also offered an additional pension for pensioners above 80 years and adjustments based on Pay Commission recommendations.

- National Pension System (NPS): Introduced in 2004, it was a defined contribution scheme with 10% contributions from both employees and the government, but without guaranteed pension amounts.

- Unified Pension Scheme (UPS): Combines the assured pension model of OPS with the contributory mechanism of NPS, but with a higher government contribution (18.5%) and a guarantee of certain pension benefits.

Why did the government feel the need to bring about this change?

- Employee Dissatisfaction with NPS: Government employees, especially those who joined post-2004 under the NPS, were dissatisfied with the uncertainty in pension incomes compared to their predecessors under the OPS.

- Political and Electoral Considerations: The issue became politically sensitive, with opposition parties promising to revert to OPS in some states, prompting the central government to address these concerns.

- Balancing Aspirations with Fiscal Prudence: The government aimed to find a middle ground that would satisfy employees while maintaining fiscal discipline.

How have government employees responded?

- Positive Reception: Government employees have largely welcomed the UPS as it addresses concerns with the NPS by reintroducing assured pension benefits and increasing the government’s contribution, offering greater financial security in retirement.

- Reservations: Despite the positive aspects, there are concerns about the continued contributory nature of the scheme and the absence of a commutation option, with employees seeking more clarity on these issues.

What will be the cost to the exchequer?

- Immediate Costs: The UPS is expected to cost an additional ₹7,050 crore this year due to the higher government contribution and arrears for some employees.

- Future Financial Impact: While the initial impact will be the additional 4.5% contribution from the government, the assured pensions will increase future government liabilities. However, economists believe this can be managed through higher revenue growth and can be compared to the impact of Pay Commission revisions.

Way forward:

- Ensure Clear Communication and Transparency: The government should provide detailed guidelines and clarify any remaining ambiguities about the Unified Pension Scheme (UPS).

- Plan for Long-Term Fiscal Sustainability: To manage the increased financial burden from the UPS, the government should incorporate these commitments into its fiscal planning, potentially exploring new revenue sources to maintain fiscal prudence while ensuring the long-term sustainability of the pension scheme.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Pension Reforms

What is the Unified Pension Scheme?

From UPSC perspective, the following things are important :

Prelims level: Unified Pension Scheme (UPS)

Why in the News?

The Union Cabinet approved the Unified Pension Scheme (UPS) for 23 lakh central government employees.

About Unified Pension Scheme (UPS):

| Explanation | |

| Implementation Date | Effective from April 1, 2025. |

| Eligibility | Central government employees with at least 10 years of service. |

| Assured Pension |

|

| Assured Minimum Pension | ₹10,000 per month for employees with at least 10 years of service. |

| Assured Family Pension | 60% of the pension that the employee was drawing before their death. |

| Inflation Protection |

|

| Government Contribution | 18.5% of basic pay and DA, increased from 14% under the National Pension System (NPS). |

| Employee Contribution | 10% of basic pay and DA (same as under NPS). |

| Lump Sum Payment on Superannuation | One-tenth of the last drawn monthly pay (including DA) for every 6 months of completed service, in addition to gratuity. |

| Option to Choose | Employees can choose between UPS and NPS starting from the upcoming financial year; the choice is final once made. |

| Beneficiaries |

|

| Difference from NPS | Unlike the market-dependent NPS, UPS provides a guaranteed pension amount, a minimum pension, increased government contribution, fixed family pension, and a lump sum payment at superannuation. |

Significance of the UPS

- Financial Security: Guarantees a pension and family pension for stable post-retirement income.

- Minimum Pension: Ensures at least ₹10,000 per month for retirees, supporting lower-income employees.

- Inflation Protection: Indexes pensions to inflation, maintaining purchasing power over time.

- Increased Benefits: Raises government contribution to 18.5%, enhancing employee retirement benefits.

- Flexibility: Allows choice between UPS and NPS based on personal financial needs.

- Family Support: Provides 60% of the pension to the spouse if the employee passes away.

- Employee Welfare: Aligns with government goals to improve employee welfare and post-retirement life quality.

PYQ:[2017] Who among the following can join the National Pension System (NPS)? (a) Resident Indian citizens only. (b) Persons of age from 21 to 55 only. (c) All State Government employees joining the services after the date of notification by the respective State Governments. (d) All Central Government employees including those of Armed Forces joining the services on or after 1st April, 2004. |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Pension Reforms

Andhra Pradesh’s Guaranteed Pension System

From UPSC perspective, the following things are important :

Prelims level: Guaranteed Pension System

Mains level: Not Much

Central Idea

- Andhra Pradesh’s Guaranteed Pension System (GPS) blends elements from both old and new pension schemes, offering the advantages of a guaranteed pension while not overly straining the state’s finances.

- This innovative system holds the potential to preserve India’s hard-won pension reforms.

What is the Andhra Pension System?

- A Hybrid Approach: The Andhra Pradesh Guaranteed Pension System Bill, 2023, recently approved by the state assembly, introduces a unique blend of the Old Pension Scheme (OPS) and the New Pension Scheme (NPS) implemented in 2004.

- Contributory Guarantee: This system ensures government employees a monthly pension equivalent to 50% of their last-drawn salary, including dearness allowance relief.

- Reason for Introduction: Andhra Pradesh introduced GPS as a response to resistance against NPS, which was viewed by many as inferior to the earlier scheme. The return to OPS was considered fiscally unsustainable, with the potential to drive the state’s fiscal deficit to 8% by 2050.

Breakthrough created

- Long-standing Pension Reforms: India struggled for over a decade to implement pension reforms that led to the introduction of NPS in 2004.

- Growing Discontent: Over time, public sentiment favored those receiving pensions under the old scheme, leading to discontent.

- Political Promises: Political parties capitalized on this discontent, pledging to return to the old scheme if elected.

- Andhra’s Middle Path: Andhra Pradesh’s GPS offers a middle ground, preventing a regressive return to the old scheme while addressing concerns about NPS.

How does the Andhra System work?

- Enhancing Attractiveness: The contributory system guarantees a pension equivalent to 50% of the last drawn salary.

- Balancing Financial Burden: Any shortfall in NPS returns is covered by the government.

- Current NPS Pensions: Presently, NPS pensions amount to around 40% of an employee’s last drawn salary. Therefore, the government only has to fund the remaining balance.

Alternative to NPS

- Contributory Nature: NPS is a contributory scheme, with both employees and employers contributing to a corpus invested for returns.

- Uncertainty: In NPS, the pension amount is not guaranteed, as it depends on corpus returns influenced by market conditions.

- Ignoring Inflation: NPS does not consider inflation or pay commission recommendations.

- Market Dependency: Opposition to NPS is fueled by fears of further reductions in pension due to adverse market conditions.

Why not revert to the Old Pension Scheme?

- Budgetary Constraints: Under OPS, pensions were financed through the budget.

- Unsustainable Growth: Pension liabilities for all states saw a compound annual growth rate of 34% for a 12-year period ending in 2021-22.

- Budgetary Impact: In 2020-21, pension outgo accounted for 29.7% of states’ revenues.

- Development Challenges: A return to OPS would strain government funds, hindering development efforts and operational financing.

- Competitiveness Concerns: Such a shift could negatively impact India’s ease of doing business and overall competitiveness.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Pension Reforms

SC backs Centre’s OROP scheme

From UPSC perspective, the following things are important :

Prelims level: One rank one pension Scheme

Mains level: OROP Policy

The Supreme Court has upheld the Centre’s one rank, one pension (OROP) scheme for the armed forces.

What is the news?

- The Supreme Court has ruled that there was “no constitutional infirmity” in the way the government had introduced ‘one rank, one pension’ (OROP) among ex-service personnel.

- The scheme, notified by the Defence Ministry on November 7, 2015, was challenged by Indian Ex-Service Movement, an association of retired defence personnel.

What is OROP Scheme?

- OROP means that any two military personnel retiring at the same rank, with the same years of service, must get an equal pension.

- While this might appear almost obvious, there are several reasons why two military personnel who may have retired at the same rank with the same years of service, may get different pensions.

Need for the scheme

Military personnel across the three services fall under two categories, the officers and the other ranks.

- Early age of retirement: The other ranks, which are soldiers, usually retire at age 35.

- No benefits from pay commissions: Unlike government employees who retire close to 60, soldiers can thus miss out on the benefits from subsequent pay commissions.

- Salary based pension: And since pensions are based on the last drawn salary, pensions too are impacted adversely.

- Ranks based discrimination: The age when officers in the military retire depends upon their ranks. The lower the rank, the earlier they superannuate.

- Liability against the sacrifice: It was argued that early retirement should not become an adverse element for what a soldier earns as pension, compared with those who retire later.

Earlier pension mechanism

- From 1950 to 1973, there was a concept known as the Standard Rate of Pension, which was similar to OROP.

- In 1974, when the 3rd Pay Commission came into force, certain changes were effected in terms of weightage, additional years of notion service, etc., with regard to pensions.

- In 1986, the 4th Pay Commission’s report brought further changes.

- What ultimately happened was that the benefits of the successive pay commissions were not passed to servicemen who had retired earlier.

- Pensions differed for those who had retired at the same rank, with the same years of service, but years apart.

Demand for OROP

- Ex-servicemen demanded OROP to correct the discrepancy.

- Over the decades, several committees looked into it.

- The Brig K P Singh Deo committee in 1983 recommended a system similar to Standard Rate of Pension, as did Parliament’s standing committees on defence.

- The Narendra Modi government notified the current OROP scheme in November 2015, and it was made applicable from July 1, 2014.

Issues with OROP

- During the OROP protests of 2013-15, it was argued repeatedly that meeting the demand would be financially unsustainable.

- Because soldiers retire early and remain eligible for pension for much longer than other employees, the Defence Ministry’s pension budget is very large, impacting capital expenditure.

- The total defence pensioners are 32.9 lakh, but that includes 6.14 lakh defence civilian pensioners.

- The actual expenditure of the Defence Ministry on pensions was Rs 1.18 lakh crore in 2019-2020.

- The Defence Ministry’s pension-to-budget ratio is the highest among all ministries, and pensions are more than one-fifth of the total defence budget.

- When the late Manohar Parrikar was Defence Minister, it was estimated that a one-time payout of Rs 83,000 crore would be needed to clear all past issues.

Challenge to OROP

- The petitioners contended that the principle of OROP had been replaced by ‘one rank multiple pensions’ for persons with the same length of service.

- They submitted that the government had altered the initial definition of OROP and, instead of an automatic revision of the rates of pension.

- Under this, any future raising of pension rates would be passed on to past pensioners — the revision would now take place at periodic intervals.

- According to the petitioners, this was arbitrary and unconstitutional under Articles 14 and 21.

What has the SC ruled now?

- The court did not agree with the argument that the government’s 2015 policy communication contradicted the original decision to implement OROP.

- It said that “while a decision to implement OROP was taken in principle, the modalities for implementation were yet to be chalked out.

- The court also said that while the Koshyari Committee report furnishes the historical background of the demand, and its own view on it, it cannot be construed as embodying a statement of governmental policy.

- It held that the OROP policy “may only be challenged on the ground that it is manifestly arbitrary or capricious”.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Pension Reforms

One Rank One Pension (OROP) Policy

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: OROP Policy

The Supreme Court has said that the Centre’s hyperbole on the One Rank One Pension (OROP) policy presented a much “rosier picture” than what is actually given to the pensioners of the armed forces.

What is OROP Policy?

- OROP means the same pension, for the same rank, for the same length of service, irrespective of the date of retirement.

- The concept was provoked by the then decision by Indira Gandhi-led government, in 1973, two years after the historic victory in the 1971 Bangladesh war.

How did the issue escalate?

- The Rank pay was a scheme implemented by the Rajiv Gandhi-led govt in 1986, in the wake of the 4th Central Pay Commission.

- It reduced the basic pay of seven armed officers’ ranks of 2nd Lieutenant, Lieutenant, Captain, Majors, Lt. Colonel, Colonels, Brigadiers, and their equivalent by fixed amounts designated as rank pay.

How was it reviewed?

- In 2008, Manmohan Singh led Government in the wake of the Sixth Central Pay Commission (6CPC), which discarded the concept of rank-pay.

- Instead, it introduced Grade pay, and Pay bands, which instead of addressing the rank, pay, and pension asymmetries caused by ‘rank pay’ dispensation, reinforced existing asymmetries.

Issues with this pension policy

- The causes that inform the OROP protest movement are not pension alone, as armed forces veterans have often tried to make clear, and the parliamentary committee recorded.

- The issues, veterans emphasize, are of justice, equity, honor, and national security.

- The failure to address the issue of pay-pension equity, and the underlying issue of honor, is not only an important cause for the OROP protest movement but its escalation.

Present status

- PM Modi-led government has accepted the OROP.

- It has already released Rs. 5500 crores to serve the purpose, but still, there are some grievances from the veterans’ side.

- It refined Pensions for all pensioners retiring in the same rank as the average of the minimum and maximum pensions in 2013.

- The veterans noted governments’ proposal as one rank many pensions since the review of 5 years would lead to differences in pension between senior and a junior.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Everything That You Need to Know on OROP

- It is a pension scheme for the armed forces personnel which was in existence till 1973.

- This scheme provided same pension for same rank and for the same length of service irrespective of the date of retirement which was the basis for determining the pension and benefits of the Indian Armed Forces till 1973.

- OROP was terminated by the government in 1973.

Which government was in power at that time and who was the PM of India?

Then came the Koshiyari committee –

Bhagat Singh Koshiyari headed a committee which comprised 10 members (an all party parliamentary panel). It was formed in 2011.

What were the recommendations of the committee?

- OROP should be implemented in the defence forces at the earliest and a separate commission should be formed to take decisions on pay allowances, pension, family pension etc. in respect of the defence personnel should be taken into the account by that committee.

- The committee recommended to absorb the Armed Forces personnel after their military engagement into other services of government which is a custom in countries like U.S. and China.

What would be the financial Implications?

- Early estimates were around 3000crores for OROP.( by Ministry of Defence)

- Revised estimates vary between 8000 to 9000 crores.

- According to the Koshiyari committee the estimates for implementation of OROP were around 12000 crores.

Is OROP expensive for the government?

- OROP is affordable by the government as it is a small fraction of the military pension budget.

- It includes about 4,00,000 defence civilians.

- Defence civilians, which includes the entire civilian bureaucracy in the ministry of defence ,retire at the age of 60 are mostly based permanently in Delhi and they are not covered by OROP.

- It is alleged that they oppose the OROP due to their exclusion from the scheme.

Government of India on OROP

- The government does not subscribe to the definition of Koshiyari committee, but states that there is a need for a new definition of OROP which should be acceptable to all the other ‘stakeholders’.

- The stakeholders were neither defined nor identified by the government.

- The government stand on the OROP prompted widespread dismay, disappointment and outrage amongst Armed Forces pensioners.

- The ministry of defence recommended the proposal for implementation after the approval of the Defence minister.

- Now it is with the of the Finance ministry which should make a call on the scheme.