Why in the News

The Central Board of Direct Taxes disclosed through an RTI reply that ₹14,601 crore worth of undisclosed offshore investments, revealed in the Panama, Paradise and Pandora Papers investigations, have been “brought to tax” by the Income Tax Department.

Background: Global Offshore Investigations

The investigations were conducted by The Indian Express in collaboration with the International Consortium of Investigative Journalists and global media partners.

1. Panama Papers

- Published in 2016

- ₹13,800 crore brought to tax

2. Paradise Papers

- Published in 2017

- ₹115 crore brought to tax

3. Pandora Papers

- Published in 2021

- ₹686 crore brought to tax

- Total: ₹14,601 crore

What Does “Brought to Tax” Mean?

- In taxation terminology, “brought to tax” means that income, assets, or investments that were previously undisclosed or underreported have been formally assessed by tax authorities and subjected to tax liability under the law.

- It does not automatically mean that the tax has already been collected.

Enforcement Action Taken

- 1,255 tax cases filed in total

- 426 Panama

- 494 Paradise

- 335 Pandora

- Multi Agency Group formed after Pandora Papers revelations

- Financial Intelligence Unit India sent requests to foreign jurisdictions regarding 482 persons

- Seven meetings of the Multi Agency Group held

Legal and Institutional Framework

- Income Tax Act, 1961

- Black Money Undisclosed Foreign Income and Assets Act, 2015

- Information exchange under international tax treaties

- Global cooperation to tackle tax havens

| [2021] Which one of the following effects of the creation of black money in India has been the main cause of worry to the Government of India?

(a) Diversion of resources to the purchase of real estate and investment in luxury housing

(b) Investment in unproductive activities and purchase of precious stones, jewelry, gold, etc.

(c) Large donations to political parties and the growth of regionalism

(d) Loss of revenue to the State Exchequer due to tax evasion |

Why in the News?

India’s direct tax system has recorded sustained expansion in both individual and non-individual taxpayers. India’s taxpayer base has more than doubled over the last decade, with individual taxpayers rising from 3.26 crore in AY2013-14 to nearly 7.26 crore in AY2024-25, while the total base expanded to about 4.8 crore. Simultaneously, the cost of collecting direct taxes declined to 0.41% in FY2024-25 (provisional), the lowest in available data.The increase reflects administrative reforms, digitalisation of filing systems, and structural strengthening of compliance mechanisms.

What is the scale of expansion in the taxpayer base?

- Individual taxpayers: Increased from 3.26 crore (AY2013-14) to nearly 7.26 crore (AY2024-25), more than doubling in a decade.

- Total taxpayer base: Expanded from about 2.9 crore in AY2013-14 to nearly 4.8 crore in AY2024-25.

- Growth rate: Registered a CAGR of approximately 5% over the period.

- Peak annual growth: 7.89% CAGR observed during the period.

- Pandemic disruption: Growth slowed sharply in FY2020-21 due to COVID-19-related economic disruption.

- Recovery phase: Growth rebounded in subsequent years, indicating durability of expansion.

How has the composition of taxpayers evolved?

- Dominance of individuals: Individual taxpayers continue to dominate the system.

- Non-individual taxpayers: Includes firms, companies, LLPs, Association of Persons (AOPs), Body of Individuals (BOIs), local authorities, and artificial juridical persons.

- Steady growth in non-individuals: Growth remained more stable compared to individuals, without major pandemic volatility.

- Broader base expansion: Evidence suggests increasing formalisation across business entities.

What institutional changes supported this expansion?

- Digital filing systems: Increased reliance on online return filing.

- Pre-filled returns: Reduced compliance burden and errors.

- Expanded third-party reporting: Strengthened information matching.

- Reduced face-to-face interactions: Enhanced transparency and minimised discretion.

- Compliance friction reduction: Enabled smoother onboarding of taxpayers.

- Administrative strengthening: Indicated by consistent year-on-year improvements.

What does the cost of collection indicate?

- Declining cost of collection: Reduced from 0.61% of gross direct tax collections (FY2000-01) to 0.41% (FY2024-25 provisional).

- Lowest in available data series: Reflects sustained administrative efficiency.

- Pandemic spike: Temporary rise in FY2020-21 due to disruptions.

- Post-pandemic correction: Returned to declining trajectory.

- Efficiency gain: Indicates improved revenue mobilisation per rupee spent.

What does this imply for fiscal capacity and governance?

- Structural strengthening: Evidence suggests durable expansion, not a one-time compliance surge.

- Formalisation of economy: Broader cross-section of taxpayers entering formal net.

- Revenue resilience: Supports fiscal planning and long-term budgeting.

- Administrative modernisation: Reflects digital governance success.

- Compliance culture: Indicates deeper tax participation.

Conclusion

The sustained expansion of the taxpayer base alongside declining cost of collection signals structural strengthening of India’s direct tax system. The evidence suggests institutional reform, digitalisation, and broader formalisation have enhanced fiscal resilience and administrative efficiency.

PYQ Relevance

[UPSC 2019] Enumerate the indirect taxes which have been subsumed in the goods and services tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017.

Linkage: This question tests understanding of how tax reforms expand the revenue base and strengthen fiscal capacity, a core GS3 theme. The article shows how widening the taxpayer base and improving compliance are part of the same structural shift that GST triggered in India’s tax ecosystem.

Why in the News?

The Supreme Court of India has agreed to examine a petition challenging the constitutional validity of the Securities Transaction Tax (STT) imposed under the Finance Act, 2004.

Legal Context of this Case:

Petitioner: Aseem Juneja – contends that STT violates fundamental and economic rights.

Bench: Headed by Justice J.B. Pardiwala; formal notice issued to Union Ministry of Finance.

- The plea invokes Article 265 — “No tax shall be levied or collected except by authority of law.”

- The Court will assess reasonableness, equity, and proportionality in transaction-based taxation.

- A ruling against STT may impact ₹30,000-crore annual revenue and require redesign of securities taxation.

|

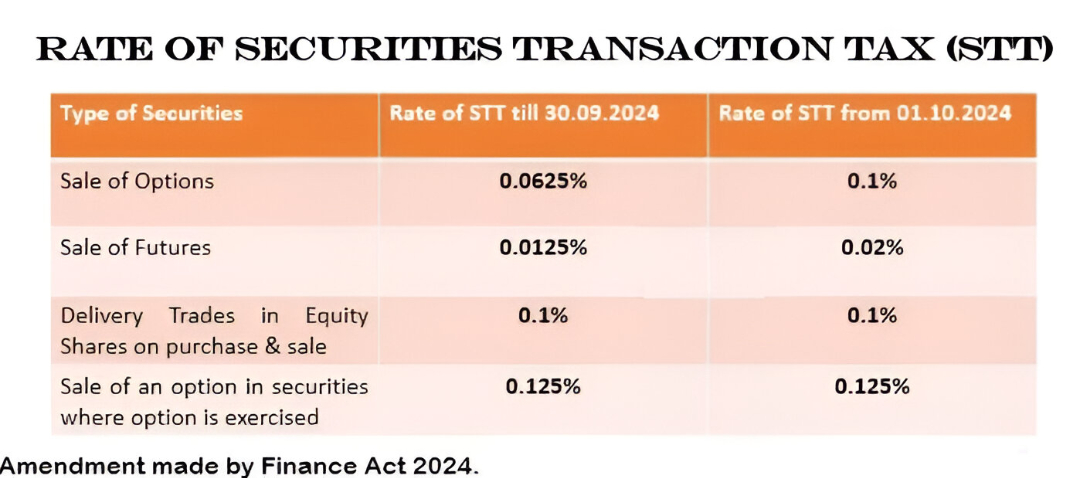

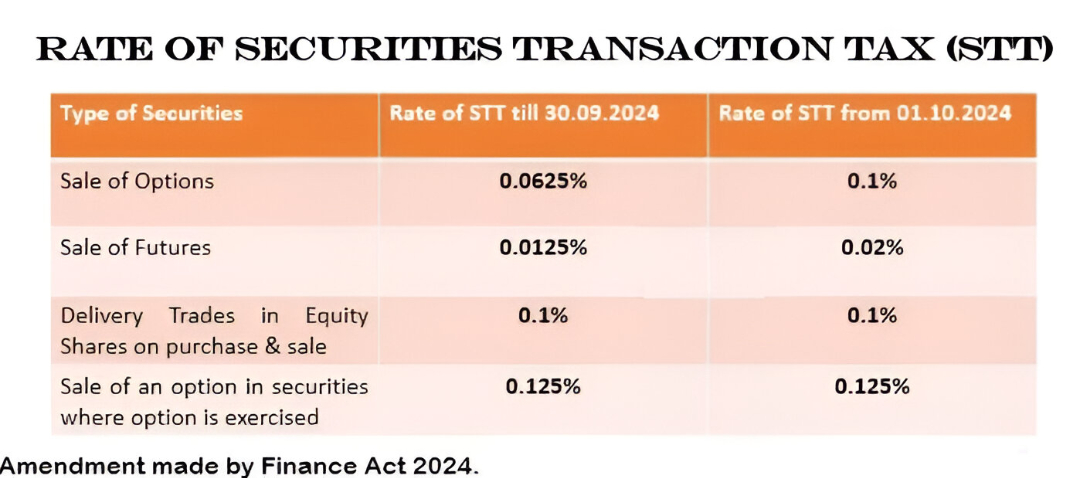

What is the Securities Transaction Tax (STT)?

- About: A direct tax levied on purchase and sale of securities through recognised stock exchanges.

- Introduction: Under the Finance Act, 2004, to ensure transparency and curb tax evasion in capital markets.

- Objective: Replace complex capital-gains tracking with a small, upfront levy to counter under-reporting and increase tax buoyancy.

- Administered by: Central Board of Direct Taxes (CBDT), Ministry of Finance.

- Scope: Applies to-

-

- Equity shares of listed companies

- Derivatives (futures & options)

- Equity-oriented mutual funds and ETFs.

- Purpose:

- Simplify tax collection from capital market participants.

- Create a traceable, automated tax mechanism.

- Generate steady revenue while discouraging speculative trading.

- Nature: A transaction-based tax (TBT) collected automatically at the time of trade, irrespective of overall profit or loss.

-

-

- Applies even on loss-making trades payable merely for conducting a transaction.

- Non-refundable and non-adjustable, unlike TDS.

- Raises transaction costs for high-frequency traders.

-

- Mode of collection: Automatically deducted by stock exchanges on every taxable trade and deposited into the government account; Ensures near-universal compliance and minimal evasion.

- Rate & coverage: Varies across instruments and between buy/sell transactions; Periodically revised through Union Budgets.

Key Grounds of Challenge:

- Violation of Fundamental Rights:

-

- Article 14 (Equality): Unequal treatment; tax imposed irrespective of gain or loss.

- Article 19(1)(g) (Right to Trade): Penalises the act of trading itself.

- Article 21 (Livelihood & Dignity): Non-refundable levy burdens small traders.

- Double Taxation: Traders already pay Capital Gains Tax on profits; STT adds a second layer on the same transaction.

- Arbitrariness / Lack of Proportionality: Taxing even unprofitable transactions violates the principle of reasonable classification and fiscal fairness.

- No Refund or Adjustment Mechanism: Absence of provision similar to TDS refunds; creates permanent loss even when income is negative.

- Changed Circumstances: With digital audit trails, PAN-linked demat accounts, and near-complete transparency, the original rationale (to curb evasion) may no longer hold.

| [UPSC 2009] Consider the following:

1. Fringe Benefit Tax 2. Interest Tax 3. Securities Transaction Tax

Which of the above is/are Direct Tax/Taxes?

Options: (a) 1 only (b) 1 and 3 only (c) 2 and 3 only (d) 1,2 and 3* |

Why in the News?

NITI Aayog has released a working paper recommending the introduction of an optional presumptive taxation scheme for foreign companies operating in India.

What is Presumptive Taxation?

- Overview: Presumptive taxation allows taxpayers to declare income at a fixed percentage (presumed rate) of total turnover or receipts without maintaining detailed books of accounts.

- Purpose: Simplifies taxation for small businesses or specific sectors by reducing compliance and administrative burden.

- Domestic Example: Under the Income Tax Act, Sections 44AD, 44ADA, and 44AE permit presumptive taxation for small businesses, professionals, and transporters.

- Key Feature:

- Tax is levied on deemed profits instead of actual income.

- Taxpayers opting for this scheme are exempt from detailed audits or complex record-keeping.

What has NITI Aayog Proposed?

- Scope: Extend the presumptive taxation concept to foreign companies operating in India.

- Objective: To reduce litigation related to Permanent Establishment (PE) status and profit attribution in cross-border taxation.

- Main Features:

- Optional Scheme: Foreign companies can either choose the presumptive scheme for certainty or file regular returns if actual profits are lower.

- Sector-Specific Rates: Different deemed profit rates for sectors such as manufacturing, digital services, and logistics.

- Safe Harbour Clause: Once a company opts in, tax authorities cannot separately litigate the PE existence for that activity.

- Alignment with Global Norms: Codify PE and attribution principles in domestic law consistent with OECD standards.

- Administrative Reforms: Training of tax officials to ensure consistent application in digital and cross-border cases.

Significance:

- Provides tax certainty and simplicity for foreign investors.

- Reduces disputes and promotes ease of doing business.

- Balances India’s sovereign tax rights with the need for a predictable, investor-friendly regime.

- Positions India as a more attractive FDI destination, aligned with its economic and tax reform agenda.

| [UPSC 2020] With reference to India’s decision to levy an equalization tax of 6% on online advertisement services offered by non-resident entities, which of the following statements is/are correct?

1. It is introduced as a part of the Income Tax Act.

2. Non-resident entities that offer advertisement services in India can claim a tax credit in their home country under the “Double Taxation Avoidance Agreements”.

Select the correct answer using the code given below:

Options: (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 * |

Introduction

In August 2025, Parliament passed the Income Tax Bill, 2025, a shorter and simplified legislation with 23 chapters (down from 47) and 536 sections (down from 819). The Bill aims to reduce discretion with clearer provisions, introduce taxpayer-friendly reforms like longer timelines for return updation, and curb harassment. However, it has also expanded the powers of tax officials, especially over digital information and personal data, raising concerns about privacy and misuse.

Need for Overhauling the 1961 Income Tax Framework

- Obsolete framework: The Income Tax Act, 1961 had become outdated, riddled with amendments, and difficult for laypersons to interpret.

- Harassment potential: Excessive discretion allowed officials to harass taxpayers.

- Structural reform: New law cuts down chapters from 47 to 23 and sections from 819 to 536, simplifying compliance.

- Greater clarity: More tables (57, up from 18) and formulae (46, up from 6), along with examples to aid understanding.

From Draft Bill to Final Law: The Legislative Journey

- Initial draft (Feb 2025): Introduced in Parliament but referred to a Select Committee given the Bill’s significance.

- Committee review: Headed by Baijayant Panda, with MPs across parties; submitted a detailed report in July 2025.

- Withdrawal & replacement: Government withdrew the earlier version on August 8, 2025, to incorporate committee recommendations.

- Final Bill (Aug 11, 2025): Introduced and passed the same day, avoiding confusion through multiple versions.

Key Reforms and Structural Simplifications:

- No slab changes: Finance Minister clarified tax rates and slabs remain unchanged.

- Technical refinements: Clearer provisions for Minimum Alternate Tax (MAT) and Alternate Minimum Tax (AMT), separated into sub-sections.

- Taxpayer-friendly features: Returns can be updated up to 4 years from the end of the relevant assessment year without penalty; Assessment reopening period reduced to 5 years.

Simplification Gains and Emerging Concerns

- Expanded search powers: Tax officers can now demand passwords of electronic devices, emails, and social media accounts.

- Override access: Officials may bypass access codes to computer systems if passwords are not shared.

- Privacy concerns: Unlike earlier provisions (limited to inspection and lock-breaking), the new law extends to personal digital data, raising red flags.

Government’s Rationale for Expanding Digital Powers

- Rationale: Much of financial data today is exchanged via messaging apps, emails, or stored digitally.

- Committee stance: Though some dissent was recorded, the Select Committee accepted the government’s view that these provisions are essential for effective investigation.

Conclusion

The Income Tax Bill, 2025 is a watershed reform, simplifying one of India’s most complex laws. While the codification of taxpayer-friendly provisions marks a progressive step, the enhanced surveillance powers granted to tax authorities highlight the thin line between efficiency and overreach. The challenge ahead lies in ensuring that simplification does not come at the cost of citizens’ trust and constitutional rights.

Value Addition for UPSC

|

- Governance angle (GS-II): Balancing simplification of laws with citizen rights and privacy.

- Economic reforms (GS-III): Tax rationalisation improves compliance and ease of doing business.

- Ethics (GS-IV): Dilemma of state surveillance vs. individual liberty; Kantian duty-based ethics vs. utilitarian approach.

- Comparative context: Similar debates exist globallye.g., U.S. IRS’s digital access powers vs. EU’s stricter GDPR protections.

|

PYQ Relevance

| [UPSC 2020] Explain the rationale behind the Goods and Services Tax (Compensation to States) Act of 2017.How has COVID-19 impacted the GST compensation fund and created new federal tensions?

Linkage: The GST Compensation Act, 2017 aimed to build Centre–State trust during the GST transition but COVID-19 strained revenues, sparking federal tensions. Similarly, the Income Tax Bill, 2025 seeks to simplify direct taxes to build citizen trust but raises concerns over state overreach in digital surveillance. Both show that taxation is ultimately about trust and legitimacy in governance. |

Practice Mains Question

The Income Tax Bill, 2025 seeks to simplify India’s tax regime but also introduces stronger surveillance powers for officials. Discuss the balance between efficiency, transparency, and taxpayer rights. (250 words)

Mapping Microthemes for GS Papers

- GS-I: Evolution of economic policies post-Independence.

- GS-II: Governance, legislative reforms, fundamental rights (privacy).

- GS-III: Fiscal reforms, tax policy, ease of doing business.

- GS-IV: Ethics of surveillance, transparency, accountability.

Introduction

In August 2025, Parliament passed the Income Tax Bill, 2025, a shorter and simplified legislation with 23 chapters (down from 47) and 536 sections (down from 819). The Bill aims to reduce discretion with clearer provisions, introduce taxpayer-friendly reforms like longer timelines for return updation, and curb harassment. However, it has also expanded the powers of tax officials, especially over digital information and personal data, raising concerns about privacy and misuse.

Need for Overhauling the 1961 Income Tax Framework

- Obsolete framework: The Income Tax Act, 1961 had become outdated, riddled with amendments, and difficult for laypersons to interpret.

- Harassment potential: Excessive discretion allowed officials to harass taxpayers.

- Structural reform: New law cuts down chapters from 47 to 23 and sections from 819 to 536, simplifying compliance.

- Greater clarity: More tables (57, up from 18) and formulae (46, up from 6), along with examples to aid understanding.

From Draft Bill to Final Law: The Legislative Journey

- Initial draft (Feb 2025): Introduced in Parliament but referred to a Select Committee given the Bill’s significance.

- Committee review: Headed by Baijayant Panda, with MPs across parties; submitted a detailed report in July 2025.

- Withdrawal & replacement: Government withdrew the earlier version on August 8, 2025, to incorporate committee recommendations.

- Final Bill (Aug 11, 2025): Introduced and passed the same day, avoiding confusion through multiple versions.

Key Reforms and Structural Simplifications:

- No slab changes: Finance Minister clarified tax rates and slabs remain unchanged.

- Technical refinements: Clearer provisions for Minimum Alternate Tax (MAT) and Alternate Minimum Tax (AMT), separated into sub-sections.

- Taxpayer-friendly features: Returns can be updated up to 4 years from the end of the relevant assessment year without penalty; Assessment reopening period reduced to 5 years.

Simplification Gains and Emerging Concerns

- Expanded search powers: Tax officers can now demand passwords of electronic devices, emails, and social media accounts.

- Override access: Officials may bypass access codes to computer systems if passwords are not shared.

- Privacy concerns: Unlike earlier provisions (limited to inspection and lock-breaking), the new law extends to personal digital data, raising red flags.

Government’s Rationale for Expanding Digital Powers

- Rationale: Much of financial data today is exchanged via messaging apps, emails, or stored digitally.

- Committee stance: Though some dissent was recorded, the Select Committee accepted the government’s view that these provisions are essential for effective investigation.

Conclusion

The Income Tax Bill, 2025 is a watershed reform, simplifying one of India’s most complex laws. While the codification of taxpayer-friendly provisions marks a progressive step, the enhanced surveillance powers granted to tax authorities highlight the thin line between efficiency and overreach. The challenge ahead lies in ensuring that simplification does not come at the cost of citizens’ trust and constitutional rights.

Value Addition for UPSC

|

- Governance angle (GS-II): Balancing simplification of laws with citizen rights and privacy.

- Economic reforms (GS-III): Tax rationalisation improves compliance and ease of doing business.

- Ethics (GS-IV): Dilemma of state surveillance vs. individual liberty; Kantian duty-based ethics vs. utilitarian approach.

- Comparative context: Similar debates exist globallye.g., U.S. IRS’s digital access powers vs. EU’s stricter GDPR protections.

|

PYQ Relevance

| [UPSC 2020] Explain the rationale behind the Goods and Services Tax (Compensation to States) Act of 2017.How has COVID-19 impacted the GST compensation fund and created new federal tensions?

Linkage: The GST Compensation Act, 2017 aimed to build Centre–State trust during the GST transition but COVID-19 strained revenues, sparking federal tensions. Similarly, the Income Tax Bill, 2025 seeks to simplify direct taxes to build citizen trust but raises concerns over state overreach in digital surveillance. Both show that taxation is ultimately about trust and legitimacy in governance. |

Practice Mains Question

The Income Tax Bill, 2025 seeks to simplify India’s tax regime but also introduces stronger surveillance powers for officials. Discuss the balance between efficiency, transparency, and taxpayer rights. (250 words)

Mapping Microthemes for GS Papers

- GS-I: Evolution of economic policies post-Independence.

- GS-II: Governance, legislative reforms, fundamental rights (privacy).

- GS-III: Fiscal reforms, tax policy, ease of doing business.

- GS-IV: Ethics of surveillance, transparency, accountability.

Why in the News?

Parliament has passed the Income-tax Bill, 2025, replacing the 1961 law with a leaner, simpler version free of redundant provisions and archaic language, effective April 1, 2026.

About New Income Tax Bill, 2025:

- Purpose: Replaces the Income Tax Act, 1961 after more than 60 years to simplify the law, remove redundant provisions, and modernise tax administration.

- Effective Date: Comes into effect from April 1, 2026.

- Structural Changes: Sections reduced from 819 to 536; chapters from 47 to 23.

- Conciseness: Word count cut from 5.12 lakh to 2.6 lakh, with 39 tables and 40 formulas for clarity.

- New Concept: Introduces “tax year” defined as April 1 to March 31.

Key Features:

- Refunds: Restores refund claims on belated returns by removing the earlier restriction.

- Tax Collected at Source (TCS) Clarity: Nil TCS for Liberalised Remittance Scheme (LRS) remittances for education funded by financial institutions.

- Corporate Tax: Corrects errors in inter-corporate dividend deduction for companies opting for concessional tax rates.

- Alternate Minimum Tax (AMT) Alignment: Aligns AMT provisions for Limited Liability Partnerships (LLPs) with existing rates.

- Nil-Tax Deducted at Source (TDS) Certificate: Permits taxpayers with no liability to obtain a nil-TDS certificate.

- Transfer Pricing: Clarifies transfer pricing provisions, set-off of losses, and alignment with Section 79 on “beneficial owner.”

- Non-Profit Organisation (NPO) Benefit: Expands exemption to 5% of total donations, instead of only anonymous donations.

- House Property Income: Clarifies 30% standard deduction after municipal taxes.

- Search Definition: Retains “virtual digital space” definition to include cloud storage, email, and social media accounts.

- Data Handling: Standard Operating Procedure (SOP) to be issued for handling personal digital data seized in searches.

| [UPSC 2025] Consider the following statements: Statement I: In India, income from allied agricultural activities like poultry farming and wool rearing in rural areas is exempted from any tax. Statement II: In India, rural agricultural land is not considered a capital asset under the provisions of the Income-tax Act, 1961.

Which one of the following is correct in respect of the above statements?

(a) Both Statement I and Statement II are correct and Statement II explains Statement I

(b) Both Statement I and Statement II are correct but Statement II does not explain Statement I*

(c) Statement I is correct but Statement II is not correct

(d) Statement I is not correct but Statement II is correct |

Why in the News?

The proposed changes in the Income-Tax Bill, 2025 allowing tax officials to access a person’s “virtual digital space” during search and seizure have sparked strong debate about privacy, government surveillance, and misuse of power.

What is the current legal framework for tax-related search and seizure?

- Under Section 132 of the Income-Tax Act, 1961, search and seizure powers are currently restricted to physical spaces like houses, offices, and lockers.

- These powers are exercised based on a reasonable suspicion of undisclosed income or assets, and apply only to the person under investigation.

What does the new proposal change?

- Expansion to digital realm: The new proposal includes access to emails, cloud storage, social media accounts, digital applications, and vaguely “any other space of similar nature.”

- Override of access barriers: Authorities can override access codes of devices to enter these digital spaces.

- Open-ended scope: The vague phrasing leaves room for nearly any digital platform to fall under scrutiny, exposing data beyond the individual concerned.

What are the privacy risks of allowing tax access to digital spaces?

- Deep intrusion into personal life: Digital spaces like emails, social media, and cloud drives contain private, non-financial information. Their access exposes not just the individual but also their family, friends, and professional networks.

- Risk to confidentiality: Professionals like journalists and lawyers could have confidential sources and sensitive data compromised, affecting freedom of expression and legal rights.

- Lack of oversight: The provision allows tax authorities to bypass judicial warrants, violating principles of transparency, accountability, and privacy.

What is the Proportionality Principle?

Proportionality Principle is a legal doctrine that ensures any action taken by the State—especially those that limit fundamental rights—must be reasonable, necessary, and least restrictive in achieving a legitimate aim. |

How does the proposal violate the proportionality principle?

- Absence of judicial safeguards: The proposal allows tax authorities to access an individual’s digital data without prior judicial approval or warrant. In contrast, the U.S. Supreme Court in Riley vs California mandated warrants before accessing digital content due to the sensitive nature of personal data.

- No relevance filter for accessed data: The provision lacks a clear distinction between financial and non-financial data, enabling authorities to access personal content unrelated to tax evasion. For instance, a journalist’s device could reveal confidential sources and communications, compromising press freedom.

- Fails the least intrusive means test: The measure does not explore less invasive options to meet enforcement goals and grants sweeping powers without ensuring necessity. The Supreme Court in the Puttaswamy case clearly stated that any restriction on privacy must be necessary and adopt the least intrusive method.

Which global safeguards can India adopt for digital searches?

- Judicial Authorization Before Search: In Canada, Section 8 of the Charter of Rights and Freedoms mandates that searches (including digital) must be pre-approved by a neutral and impartial judge, based on reasonable and probable grounds. This ensures accountability and protects citizens from arbitrary intrusions.

- Warrant Requirement for Digital Devices: In the United States, the Supreme Court ruling in Riley v. California (2014) held that law enforcement must obtain a warrant before accessing data on cell phones, given the deeply personal nature of digital information. This aligns digital privacy with Fourth Amendment protections against unreasonable searches.

- Taxpayer Bill of Rights: The U.S. Internal Revenue Service (IRS) enforces the Taxpayer Bill of Rights, which guarantees that searches are not more intrusive than necessary and are conducted with due process. It emphasizes that digital investigations must follow legal safeguards, respecting taxpayer privacy.

Way forward:

- Mandate Judicial Oversight and Clear Warrants: Any access to an individual’s digital space must require prior approval from a neutral judicial authority, based on tangible evidence and specific relevance to the tax investigation.

- Define ‘Virtual Digital Space’ Narrowly and Precisely: The term should be clearly limited to platforms directly linked to financial transactions, excluding unrelated personal data, to prevent excessive intrusion and ensure proportionality.

Mains PYQ:

[UPSC 2024] Right to privacy is intrinsic to life and personal liberty and is inherently protected under Article 21 of the Constitution. Explain. In this reference discuss the law relating to D.N.A. testing of a child in the womb to establish its paternity.

Linkage: This question directly addresses the fundamental right to privacy, which is the central concern raised by the proposed digital search powers in the Income-Tax Bill, 2025. The article explicitly states that the Bill “raises significant concerns about privacy, overreach, and surveillance” and emphasizes that “The right to privacy cannot and must not be eroded under the garb of regulatory action”.

Note4Students

From UPSC perspective, the following things are important:

Prelims level: Equalization Levy

Why in the News?

The Centre is considering the withdrawal of the 6% Equalization Levy on online advertisement services provided by offshore digital economy firms to Indian businesses.

What is Equalization Levy?

- The Equalization Levy was introduced in 2016 under Section 165A of the Finance Act, primarily to tax digital transactions conducted by foreign e-commerce companies with Indian businesses.

- It was designed to ensure that foreign companies, particularly in the digital economy, pay taxes for benefiting from Indian markets without a physical presence in the country.

- It was primarily aimed at business-to-business (B2B) transactions, which is why it is often referred to as the “Google Tax”.

- The levy mechanism involves withholding the tax at the time of payment made by the Indian service recipient to a non-resident service provider.

- The annual payment threshold for the levy is ₹1,00,000 for a single service provider in a financial year.

- Services covered under the levy:

- Online advertisement services (effective from June 1, 2016).

- Provision of digital advertising space or sale of goods to Indian residents (effective from April 1, 2020).

- Tax Rates:

- 6% of the gross consideration is levied on online advertisement services.

- 2% of the gross consideration is levied on e-commerce transactions like the sale of goods or services.

- Exclusions:

- The levy does not apply if the non-resident has a permanent office in India related to the service.

- The payment for the service is below ₹1 lakh.

- Tax Withholding: The tax is withheld by the Indian service recipient at the time of payment.

Why it is being Abolished?

- This move is part of India’s attempt to reduce tensions with the US, which raised concerns over such taxes.

- Similarly, the UK is considering the abolition of its digital services tax by April 2025.

- In August 2024, the Indian government removed the 2% levy applied to offshore tech firms (e.g., cloud services, e-commerce).

- The 6% levy on online advertisements remained, impacting companies like Google and Meta.

- The Finance Bill 2025 proposes a sunset clause to phase out the 6% levy on online advertisements by April 1, 2025.

| [UPSC 2012] What is/are the recent policy initiative(s)of Government of India to promote the growth of manufacturing sector? Setting up of:

1. National Investment and Manufacturing Zones

2. Providing the benefit of ‘single window clearance’

3. Establishing the Technology Acquisition and Development Fund

Select the correct answer using the codes given below:

(a) 1 only (b) 2 and 3 only (c) 1 and 3 only (d) 1, 2 and 3 |

PYQ Relevance:

Q) Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (UPSC CSE 2019) |

Mentor’s Comment: UPSC mains have always focused on the Long-term Capital Gains Tax (2018) and indirect taxes (2019).

In February 2025, the Union Finance Minister introduced the Income-Tax Bill, 2025, to replace the Income-Tax Act, 1961. The government claims it will simplify tax laws and reduce disputes. However, despite some structural changes, many complexities remain, and the Bill grants even more authoritarian powers than the current law.

Today’s editorial discusses the newly introduced Income-Tax Bill, 2025, which is important for the GS III Mains paper.

_

Let’s learn!

Why in the News?

Recently, Finance Minister Nirmala Sitharaman introduced the Income Tax Bill, 2025, in the Lok Sabha, while opposition parties protested against it.

What are the key objectives of the Income-Tax Bill, 2025?

- Simplifying Tax Laws: To make the tax code easier to understand for both taxpayers and professionals. Example: Replacing complex legal phrases like “notwithstanding anything contained to the contrary” with simpler terms like “irrespective of anything to the contrary”.

- Reducing Litigation and Ambiguity: To minimize legal disputes by providing clearer definitions and reducing interpretative confusion. Example: Consolidating compliance timelines into tables and schedules to avoid multiple interpretations of deadlines.

- Modernizing Tax Compliance: To align tax administration with technological advancements and changing business environments. Example: Allowing the use of a “risk management strategy” to identify tax evasion through data analysis.

- Ensuring Policy Continuity with Structural Reform: To retain core tax policies while improving the law’s structure for better efficiency. Example: Definitions like “income” still refer to the 1961 Act but are presented in a more structured format.

- Expanding Digital Oversight: To empower tax authorities to investigate digital transactions and virtual assets. Example: Permitting access to digital platforms (e.g., email servers and social media) during tax investigations.

|

Why did the government previously amend the criteria for a reassessment of tax?

The government previously amended the criteria for reassessment of tax through the Finance Act, 2021, which came into effect on April 1, 2021. This marked a significant shift in the reassessment framework under the Income Tax Act, 1961.

- Shift from “Reason to Believe” to “Information”: The previous requirement for reassessment was based on the assessing officer having a “reason to believe” that income had escaped assessment. Example: After 2021, tax authorities could reopen assessments if they had “information” suggesting unreported income, including data from third-party reports.

- Introduction of Risk Management Strategy: The amendment introduced the use of a “risk management strategy” as a basis for reopening tax assessments. Example: Tax authorities can now reopen cases based on algorithm-driven data analysis without needing detailed justification.

- Time Limit Reduction for Reopening Assessments: The time limit for reassessment was reduced from 6 years to 3 years for most cases, with a 10-year limit for cases involving income above ₹50 lakh. Example: If concealed income exceeds ₹50 lakh, tax authorities can reopen cases up to 10 years later, enhancing scrutiny in high-value matters.

- Legal Challenges and Judicial Interpretations: The vague definition of “information” and the undefined “risk management strategy” led to concerns over arbitrary use of power. Example: Courts have intervened to limit reassessment powers, demanding stricter adherence to procedural safeguards to protect taxpayer rights.

What are the main concerns regarding their implementation?

- Increased Administrative Burden: The new system requires detailed procedures and prior approvals, leading to delays and increased workload for tax authorities. Example: Obtaining approval from senior officers before issuing notices can slow down reassessment, especially in cases involving large volumes of data.

- Ambiguity in “Information” Definition: The term “information” used to trigger reassessment is broad and vague, allowing subjective interpretations. Example: Data from social media activity or third-party reports can be used for reopening cases, raising concerns about the reliability and accuracy of such information.

- Risk of Harassment and Overreach: Despite safeguards, there is concern that taxpayers may still face unwarranted scrutiny under the new rules. Example: Cases where income exceeds ₹50 lakh can be reopened for up to 10 years, leading to prolonged uncertainty for taxpayers.

- Challenges in Data Privacy and Security: Accessing digital platforms and using technology-based triggers raises privacy concerns for individuals and businesses. Example: Tax authorities can now access electronic records from email servers and financial platforms, increasing the risk of data misuse.

- Legal Uncertainty and Litigation: Despite reforms, there is still a risk of judicial challenges due to the interpretive flexibility in the law. Example: Taxpayers may challenge reassessment notices on the grounds of insufficient evidence or procedural lapses, leading to further litigation.

Way forward:

- Enhancing Clarity and Transparency: Clearly define terms like “information” and “risk management strategy” to prevent subjective interpretation and ensure uniform application. Example: Establish detailed guidelines on acceptable data sources and the procedure for using digital evidence.

- Strengthening Safeguards and Oversight: Implement independent reviews for high-value reassessments and ensure data privacy through robust security protocols. Example: Mandate third-party audits to monitor the use of digital platforms and safeguard taxpayer rights.

Note4Students

From UPSC perspective, the following things are important:

Mains level: Issues related to the Judiciary;

Why in the News?

The Union Budget offers a major tax cut, benefiting taxpayers earning above ₹7 lakh. Rebates and exemptions have increased to reduce liabilities, though it may lead to an estimated ₹1 lakh crore revenue loss.

What is the logic behind the tax rebates?

- Boosting Household Consumption: Taxpayers earning ₹7–12 lakh/year now qualify for a full rebate (earlier limited to sub-₹7 lakh earners), saving ₹70,000–₹1.1 lakh annually.

- This exemption limit was raised from ₹3 lakh to ₹4 lakh for those earning above ₹12 lakh, reducing tax burdens across income groups.It will Increase disposable income to drive consumption, savings, and private investment.

- With weak private investment and uncertain global demand, tax rebates are aimed at stimulating domestic consumption.

- Leveraging Tax Buoyancy for Revenue Growth: Despite an 8% tax rate reduction, the government anticipates a 14% rise in direct tax revenue (₹14.3 lakh crore), requiring a 24% income growth among taxpayers. It Simplified tax slabs and phased out the old regime to improve compliance and widen the taxpayer base.

- Focus on Middle-Class Welfare: The overarching goal of these tax rebates is to support the middle class, which constitutes a significant portion of the electorate and plays a vital role in the economy. By alleviating their tax burden, the government seeks to enhance their financial well-being and foster a more equitable economic environment.

|

What are the implications if tax buoyancy does not work out?

- Revenue Shortfalls: A failure in tax buoyancy would lead to lower than expected tax revenues, resulting in budget deficits. This could force the government to cut essential services and social programs, negatively impacting the welfare of vulnerable populations.

- Pro-Cyclical Fiscal Policy: Insufficient tax revenue may compel the government to adopt a pro-cyclical fiscal policy, reducing public spending during economic downturns instead of stimulating growth. This can exacerbate economic slowdowns and hinder recovery efforts.

- Increased Tax Burden on Compliant Taxpayers: To compensate for revenue shortfalls, the government might increase taxes on those who continue to pay taxes, placing a heavier burden on compliant taxpayers and potentially discouraging further compliance and economic activity.

Is it ‘Fiscal Consolidation’ or ‘Fiscal Contraction’?

- The current approach appears to lean more towards fiscal contraction rather than fiscal consolidation. The Finance Minister has set a lower deficit target of 4.4% for 2025-26, down from 4.8% in the previous year. This suggests a tightening of fiscal policy rather than an expansion aimed at stimulating growth.

- Critics argue that such contractionary measures are ill-timed given the current economic slowdown, as they limit the government’s ability to invest in growth-promoting initiatives. The expectation seems to hinge on corporate investment and export growth to drive recovery, which may not be sufficient if domestic demand remains weak due to reduced government spending.

| Aspect |

Consolidation Argument |

Contraction Criticism |

| Deficit Target |

Lowered to 4.4% of GDP (from 4.8% in FY24), aiming for 3% by FY29 |

Aggressive deficit cuts during slowing growth (projected 10.1% nominal GDP) risk stifling recovery |

| Revenue Strategy |

Bank on ₹28.37 trillion net tax receipts (+11% YoY) via compliance gains and income growth |

No compensatory taxes for high earners (30% slab unchanged) or wealth assets, risking ₹1.26 lakh crore shortfall |

| Expenditure Focus |

Capital expenditure raised to ₹11.2 lakh crore (+17.4% YoY) for infrastructure multipliers |

Social sector allocations remain stagnant, with FY24 revised spending 15% below initial estimates. |

Way forward:

- Balanced Fiscal Approach – Instead of aggressive fiscal contraction, the government should adopt a gradual deficit reduction strategy while maintaining targeted public spending, especially in infrastructure and social sectors, to sustain domestic demand and economic growth.

- Enhancing Revenue without Burdening Taxpayers – Strengthen tax compliance through digital tracking, rationalize subsidies, and explore progressive taxation on wealth and high-income segments to ensure fiscal stability without increasing the burden on the middle class.

Mains PYQ:

Q Comment on the important changes introduced in respect of the Long-term Capital Gains Tax (LCGT) and Dividend Distribution Tax (DDT) in the Union Budget for 2018-2019. (UPSC IAS/2018)

Note4Students

From UPSC perspective, the following things are important:

Prelims level: Customs Duty

Why in the News?

The Budget proposes to remove 7 customs tariff rates for industrial goods, following a similar step in Budget 2023-24. This will leave only 8 tariff rates, including a zero rate, making customs duty structure more transparent and predictable.

What is Customs Duty?

- Customs Duty is a tax imposed on goods that cross international borders to regulate their movement.

- It helps protect a country’s economy, jobs, environment, and residents by controlling imports and exports.

- It prevents illegal trade, ensures fair competition, and generates government revenue.

- The Customs Act, 1962, which defines and regulates customs duty in India.

- The Central Board of Indirect Taxes and Customs (CBIC) under the Ministry of Finance manages customs duties.

- Types of Customs Duties in India:

- Basic Customs Duty (BCD): Levied on imported goods (0-100%).

- Countervailing Duty (CVD): Imposed to balance foreign subsidies (0-12%).

- Social Welfare Surcharge (SWS): 10% surcharge to support welfare projects.

- Anti-Dumping Duty: Imposed on goods sold below market price to prevent unfair trade.

- Compensation Cess: Levied on items like tobacco and pollution-causing goods.

- Integrated GST (IGST): Imposed on imports at 5%, 12%, 18%, or 28% rates.

- Safeguard Duty: Applied when excessive imports harm domestic industries.

- Customs Handling Fee: 1% charge for customs processing.

- Customs Duty Calculation: Based on product value, origin, composition, and international trade agreements.

|

Key Changes Announced to Customs Tariffs:

- Tariff rates reduced from 15 to 8, Social Welfare Surcharge was removed on 82 items.

- 36 new life-saving medicines exempted, 5% duty on six more drugs.

- Full BCD exemption on 35 EV battery capital goods, 28 mobile battery items, and key minerals like cobalt & lithium.

- 10-year duty exemption for shipbuilding materials; Ethernet Switch duty cut from 20% to 10%.

- 20% export duty on crust leather removed, handicraft export timeline extended to 1 year.

- Frozen fish paste duty cut from 30% to 5% to boost seafood exports.

- Customs assessments limited to 2 years, quarterly importer reporting instead of monthly.

How India is Protecting Its Economy from Trade War Impact?

- Rupee-based trade settlements with Russia, UAE & Sri Lanka to reduce dollar dependence.

- Stockpiling essential imports like semiconductors, rare earth metals, and crude oil.

- Attracting companies shifting from China with PLI incentives for manufacturing.

- Paperless customs clearance, AI-driven trade monitoring, and blockchain documentation for smoother trade.

- Strengthening global trade alliances like IPEF (Indo-Pacific Economic Framework) and Supply Chain Resilience Initiative (SCRI) (Japan-Australia) for supply chain stability.

PYQ:

[2018] Consider the following statements

1. The quantity of imported edible oils is more than the domestic production of edible oils in the last five years.

2. The Government does not impose any customs duty on all the imported edible oils a special case.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2 |

Note4Students

From UPSC perspective, the following things are important:

Mains level: Wealth tax;

Why in the News?

At a New Delhi panel, economist Thomas Piketty proposed taxing India’s super-rich to fund health and education, while Chief Economic Advisor Anantha Nageswaran cautioned against potential fund outflows from higher taxes.

What are the potential benefits of reinstating a wealth tax?

- Funding Public Services: A wealth tax could provide significant revenue that could be allocated to critical sectors such as health and education, addressing inequalities in access to these services. This funding could help create a more educated and healthier workforce, ultimately benefiting the economy.

- Addressing Wealth Inequality: With wealth concentration at historically high levels, a wealth tax could serve as a tool to mitigate inequality, which is increasingly viewed as a fundamental development issue that affects opportunities for many individuals.

- Encouraging Productive Investments: By taxing unproductive assets like real estate and gold while promoting investments in productive assets such as equities and bonds, a wealth tax could potentially shift capital towards more economically beneficial uses.

What challenges and criticisms exist regarding the implementation of a wealth tax?

- Measurement Difficulties: Accurately measuring wealth poses significant challenges. The complexities of defining what constitutes wealth and ownership can lead to loopholes and evasion, as individuals may shift their assets to avoid taxation.

- Capital Flight Concerns: There is apprehension that high taxation on the wealthy could lead to capital outflows, as individuals may relocate their assets or themselves to countries with lower tax burdens. This concern is particularly pronounced in India, where the public infrastructure may not be sufficient to retain high-net-worth individuals.

- Historical Ineffectiveness: Previous implementations of wealth tax in India resulted in low collection rates (less than 1% of gross tax collections). The high cost of collection and the challenges of enforcement contributed to its abolishment in 2016-17.

- Misallocation of Resources: Critics argue that simply imposing a wealth tax does not guarantee effective use of the revenue generated. There are concerns about whether additional funds would improve sectors like education, which already face management inefficiencies.

How would a wealth tax impact India’s economy and social structure?

- Economic Growth vs. Redistribution: Proponents argue that addressing inequality through a wealth tax can enhance overall economic growth by expanding opportunities for disadvantaged groups.

- However, opponents maintain that focusing on growth alone is more beneficial, suggesting that redistribution efforts may not lead to improved outcomes for the economy.

- Social Cohesion: A wealth tax could potentially foster greater social cohesion by addressing stark disparities in wealth and opportunity.

- However, if perceived as punitive or ineffective, it might exacerbate tensions between different socioeconomic groups.

- Investment Climate: A wealth tax could change how people invest in India. Some investors might hesitate because of higher costs, but if the money is used well for public services. It could improve living standards and infrastructure, making India a better place for investment over time.

Case study:

- Norway is often cited as a successful case study for wealth tax implementation. Norway imposes a wealth tax on individuals with a net worth exceeding a certain threshold, which includes various asset classes such as real estate, stocks, and bonds.

- For 2022, a new step for the state rate is introduced. For net wealth in excess of NOK 20 million (NOK 40 million for married couples), the rate is 0.4%. Thus, the maximum wealth tax rate is 1.1%.

|

Way forward:

- Efficient Tax Design and Implementation: Develop a clear and transparent framework for wealth taxation to minimize evasion, ensure equitable enforcement, and balance revenue generation with economic growth.

- Focus on Public Infrastructure: Prioritize effective allocation of tax revenue to critical sectors like health and education, addressing inefficiencies to build trust and maximize social and economic benefits.

Mains question for practice:

Q “Reinstating a wealth tax in India could be a tool for reducing inequalities and funding critical public services. However, its implementation poses several economic and administrative challenges.” Critically analyse this statement in the context of India’s socio-economic landscape. (250 words) 15M

Mains PYQ:

Q Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (UPSC IAS/2019)

Note4Students

From UPSC perspective, the following things are important:

Mains level: Impact of tax cut on the economy;

Why in the News?

Before the pandemic, the U.S. and India reduced corporate taxes to boost growth but we now we can evaluate their effects.

Case Study on the Effects of Tax Cuts in the U.S.

The Tax Cuts and Jobs Act (TCJA), enacted in December 2017, significantly reduced the corporate tax rate from 35% to 21%. A recent analysis by economists Gabriel Chodorow-Reich, Owen Zidar, and Eric Zwick highlights several key findings:

- Investment Increase: The TCJA led to an estimated increase in investment of approximately 8% to 14%.

- GDP Growth: The long-term increase in GDP is projected to be modest, around 0.9%, which is substantially lower than initial expectations.

- Wage Impact: The increase in annual wages due to the tax cuts was less than $1,000 per worker, contrasting sharply with earlier claims of increases between $4,000 and $9,000.

- Tax Revenue Decline: The TCJA is expected to result in a long-term reduction in tax revenue of nearly 41%, raising concerns about the fiscal health of the U.S. economy.

|

Tax Cuts in India

In September 2019, India also implemented corporate tax cuts, reducing the rate for existing companies from 30% to 22% and for new companies from 25% to 15%. The primary reason for this move was to stimulate economic growth and attract investment, particularly in the manufacturing sector.

Impact of the Tax cuts:

- Revenue Loss: The tax cuts resulted in a revenue loss of approximately ₹1 lakh crore in 2020-21.

- Gig workers (insecure forms of work): Although unemployment has decreased since the pandemic, much of the new employment is in insecure forms of work.

- Decline in Regular Employment: According to the Periodic Labour Force Survey (PLFS) in India, the share of regular wage employment fell from 22.8% in 2017-18 to 20.9% in 2022-23.

- Tax Burden Shift: There has been a notable shift in the tax burden from corporate taxes to individual income taxes. The share of corporate taxes in gross tax revenues fell from about 32% in 2017-18 to 26.5% in 2024-25.

What must be the next step? ( Way forward)

- Focus on Future Investment: Policymakers should consider implementing high taxes on existing profits while providing incentives for future investments to stimulate economic activity.

- Addressing Income Inequality: Tax policies should be designed to ensure that the benefits of tax cuts do not disproportionately favour wealthier individuals or corporations at the expense of wage earners.

- Evaluating Economic Conditions: Need to evaluate the tax cuts to ensure they are not merely providing short-term benefits without addressing long-term growth and fiscal stability.

Mains PYQ:

Q Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (UPSC IAS/2019)

Note4Students

From UPSC perspective, the following things are important:

Prelims level: Indexation, Capital Gains Tax Regime.

Why in the News?

The withdrawal of the indexation benefit from the long-term capital gains (LTCG) tax regime has emerged as a contentious decision in the Union Budget for 2024-25.

What is Indexation?

- Indexation is a method used to adjust the purchase price of an asset to account for inflation over the period it was held.

- This reduces the taxable capital gain, as it reflects the increase in the asset’s value due to inflation.

- Purpose: To ensure that the taxpayers are taxed only on the real gains and not on the inflationary increase in the value of the asset.

Changes in the LTCG Regime

- The new LTCG regime removes the indexation benefit for property, gold, and other unlisted assets.

- The LTCG tax rate is reduced from 20% to 12.5%.

- For assets purchased before 2001, the fair market value as of April 1, 2001, is considered the cost of acquisition.

Implications of the Changes

- The government claims the changes simplify the capital gains tax structure without causing a loss to most taxpayers.

- The uniform tax rate for various asset classes is intended to benefit both taxpayers and tax authorities.

Concerns for Taxpayers

- There was significant concern, particularly in the residential real estate sector, about increased LTCG tax liabilities.

- The government clarified that the new regime would be beneficial in most cases, as real estate returns typically outpace inflation.

- The Income Tax Department explained that:

- For properties held for 5 years, the new regime is beneficial if the value has appreciated 1.7 times or more, and

- For 10 years, if the value has increased to 2.4 times or more.

Back2Basics: Capital Gains Tax Overview

|

Details |

| Definition |

Tax on profit from the sale of a capital asset. |

| Launch |

Introduced in 1956, as part of the Income Tax Act, 1961. |

| Types |

Short-Term Capital Gains (STCG): Held for ≤36 months (≤12 months for specified assets).

Long-Term Capital Gains (LTCG): Held for >36 months (>12 months for specified assets). |

| Tax Rates (STCG) |

With STT: 15%

Without STT: Applicable income tax slab rates. |

| Tax Rates (LTCG) |

Listed Equity Shares & Equity-Oriented Funds: 10% on gains >₹1 lakh without indexation.

Other Assets: 20% with indexation (proposed 12.5% without indexation from FY 24-25). |

| Indexation |

Adjusts purchase price for inflation using Cost Inflation Index (CII). |

| Purpose of Indexation |

To tax only the real gains, accounting for inflation. |

| Formula (Indexation) |

Indexed Cost of Acquisition: (Cost of Acquisition × CII of sale year) / CII of purchase year

Indexed Cost of Improvement: (Cost of Improvement × CII of sale year) / CII of improvement year |

PYQ:

[2012] Under which of the following circumstances may ‘capital gains’ arise?

1. When there is an increase in the sales of a product

2. When there is a natural increase in the value of the property owned

3. When you purchase a painting and there is a growth in its value due to increase in its popularity

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3 |

Note4Students

From UPSC perspective, the following things are important:

Prelims level: Angel Tax

Why in the News?

Finance Minister announced the abolition of the angel tax, aiming to strengthen the startup ecosystem and support innovation in India.

What is Angel Investment?

- An angel investor is an individual who provides financial backing to early-stage startups or entrepreneurs, typically in exchange for equity in the company.

- Angel investors are typically high-net-worth individuals who invest their own personal funds, rather than investing on behalf of a firm or institution.

- Features of Angel Investing: Early-stage funding, equity investment, high-risk, high-reward, active involvement,personal investment,f lexible terms and shorter investment horizon.

|

What is Angel Tax?

- Referred to as Angel Tax, this rule is described in Section 56(2)(vii)(b) of the Income Tax Act, 1961.

- Essentially it’s a tax on capital receipts, unique to India in the global context.

- This clause was inserted by the Finance Act in 2012 to prevent laundering of black money, round-tripping via investments with a large premium into unlisted companies.

- The tax covers investment in any private business entity, but only in 2016 was it applied to startups.

Why was angel tax introduced?

- The complicated nature of VC fundraising with offshore entities, multiple limited partners and blind pools is contentious.

- There has been some element of money laundering or round-tripping under guise.

Details of its levy

- The Angel Tax is being levied on startups at 9% on net investments in excess of the fair market value.

- For angel investors, the amount of investment that exceeds the fair market value can be claimed for a 100% tax exemption.

- However, the investor must have a net worth of ₹2 crores or an income of more than ₹25 Lakh in the past 3 fiscal years.

Key Issues with Angel Tax

- Share Valuation: The tax impacted the valuation of shares, causing complications for startups in raising funds.

- Discounted Cash Flow (DCF) Method: Issues arose with the treatment of estimated figures in the DCF method, leading to disputes.

- Scrutiny of Funding Sources: The scrutiny of funding sources and investor credibility added another layer of complexity for startups.

- Retrospective Application: The retrospective application of the tax and its effect on the conversion of convertible instruments into equity were also significant points of dispute.

Significance for the Startup Community

- Startups has long advocated for a more supportive and less restrictive environment for fundraising.

- With this change, the government aims to create a more favourable atmosphere for innovation and investment in India.

| PYQ:

[2014] What does venture capital mean?

(a) A short-term capital provided to industries.

(b) A long-term start-up capital provided to new entrepreneurs.

(c) Funds provided to industries at times of incurring losses.

(d) Funds provided for replacement and renovation of industries. |

Note4Students

From UPSC perspective, the following things are important:

Prelims level: Inheritance Tax and Land Value Tax (LVT)

Mains level: Taxation system in India;

Why in the news?

A remark by Chairman of Indian Overseas Congress Sam Pitroda on implementing an inheritance tax as a tool of wealth redistribution has sparked massive debates.

The Negative Impact of Inequality:

- Growth affected: Inequality harms growth in the medium-to-long run by reducing firm productivity, lowering labor income, and diverting resources away from essential rights like education.

- Inequal Opportunity: In unequal countries like India, where one is born greatly influences lifetime outcomes, with almost a third of consumption variation being explained by the place of residence (state, city, or village).

- Concentration of Wealth: The richest 1% holding 40% of India’s wealth underscores the vast wealth disparities that exacerbate inequality.

- Skewed Distribution of Gains: Research indicates that the gains from India’s growth over the last two decades have disproportionately benefited high-income urban residents, further exacerbating inequality.

What is Inheritance Tax?

- An inheritance tax is a tax levied on the assets or wealth passed down from one generation to another upon the death of the owner.

- Unlike a wealth tax, which is recurring and applied to all physical and financial assets an individual owns, an inheritance tax is a one-time tax specifically targeting intergenerational transfers of wealth.

|

How an Inheritance Tax could help reduce Inequality?

The Constitution mandates equality of status and opportunity, obliging the government to take steps to reduce disparities arising from accidents of birth.

- Reduction of Wealth Concentration: By taxing large inheritances, an inheritance tax helps to redistribute wealth from the wealthiest individuals and families to the broader society.

- Encouragement of Productive Investments: Inheritance taxes can encourage wealthy individuals to invest their wealth in productive activities rather than simply passing it down to heirs.

- Incentive for Innovation: Critics may argue that inheritance taxes disincentivize innovation by reducing the incentive to accumulate wealth to pass on to future generations.

- Funding for Public Expenditure: Revenue generated from inheritance taxes can be used to fund essential public services and social programs, such as education, healthcare, infrastructure, and poverty alleviation initiatives.

- Historical Effectiveness: Historical examples, such as the estate duty in India between 1953 and 1985. It reduced the top 1% personal wealth share from 16% to 6% between 1966 and 1985.

| Another approach is the Land Value Tax (LVT): The Land Value Tax (LVT) is a tax system that levies charges on the unimproved value of land. Unlike traditional property taxes, which take into account both the value of the land and the value of any buildings or improvements on the land, the LVT focuses solely on the value of the land itself. |

Conclusion: Tackling wealth inequality requires a multifaceted approach that includes measures such as inheritance taxation, wealth taxation, and the Land Value Tax (LVT). These measures not only help to redistribute wealth and promote economic fairness but also contribute to fostering a more inclusive and prosperous society where opportunities are more evenly distributed.

Mains PYQ:

Q Comment on the important changes introduced in respect of the Long term Capital Gains Tax (LCGT) and Dividend Distribution Tax (DDT) in the Union Budget for 2018-2019.

Note4Students

From UPSC perspective, the following things are important:

Prelims level: Trend related to Taxes in India

Mains level: Concerns due to the rising share of personal income tax and indirect tax

Why in the news?

Recent data show that Personal Income Tax Collections have increased, while collections from Corporate Taxes have reduced.

The present context of the rising share of Personal Income Tax and Indirect Tax:

- Shift in Tax Composition: The data illustrates a significant shift in the composition of tax revenue, with personal income tax forming a larger share compared to corporate tax. This trend is accentuated by the sharp decline in corporate tax following the 2019 tax cuts.

- Progressive vs. Regressive Taxation: Direct taxes, such as personal income tax, are considered progressive as they are based on income levels, whereas indirect taxes, like GST, are regressive, impacting all consumers uniformly regardless of their income.

- The increasing share of indirect taxes implies a heavier burden on lower-income individuals.

- Trend in Tax Composition: Chart 2 demonstrates a historical trend where indirect taxes had been decreasing since the 1980s, whereas direct taxes were on the rise. However, recent years have witnessed a reversal of this trend, with indirect taxes increasing and direct taxes declining.

- International Comparison: Comparisons with BRICS economies indicate that India’s effective personal income tax rate is among the highest. This implies that Indian taxpayers may face relatively higher tax rates compared to individuals in other emerging economies.

Concerns due to rising share of Personal Income Tax and Indirect Tax:

- Impact on Middle and Lower Income Groups: The rising share of personal income tax and indirect taxes places a greater burden on poorer citizens and the middle class. This is particularly concerning as the majority of personal income tax filers fall within the ₹1 lakh-₹5 lakh annual income bracket, indicating that middle-income earners are disproportionately affected.

- Comparison with BRICS Economies: Data comparisons with BRICS economies reveal that India’s effective personal income tax rate is among the highest. This suggests that individuals in India may be facing relatively higher tax rates compared to their counterparts in other emerging economies.

- Concern for Equity and Economic Stability: The data underscores a growing concern regarding the equitable distribution of the tax burden. The heavier reliance on personal income tax and indirect taxes may exacerbate income inequality and strain the finances of middle and lower-income households.

Way Forward:

- Progressive Tax Reforms: Implementing progressive tax reforms can help alleviate the burden on middle and lower-income groups. This could involve revising tax brackets and rates to ensure that higher-income individuals contribute proportionally more to tax revenue.

- Enhanced Direct Tax Compliance: Improving direct tax compliance measures, such as increasing tax enforcement efforts and reducing tax evasion loopholes, can help enhance revenue collection from high-income individuals and corporations.

Mains PYQ

Q What is the meaning of the term ‘tax expenditure’? Taking housing sector as an example, discuss how it influences the budgetary policies of the government. (UPSC IAS/2013)

Note4Students

From UPSC perspective, the following things are important:

Prelims level: 16th Finance Commission

Mains level: inclusion of tax contribution, particularly from Goods and Services Tax (GST) and petroleum consumption, as a significant efficiency indicator in the distribution formula used by Finance Commissions to allocate Union tax revenue among states.

Central Idea:

The article advocates for the inclusion of tax contribution, particularly from Goods and Services Tax (GST) and petroleum consumption, as a significant efficiency indicator in the distribution formula used by Finance Commissions to allocate Union tax revenue among states. The authors argue that these measures provide a fair and stable representation of a state’s economic contribution to the national exchequer.

Key Highlights:

- Finance Commissions play a crucial role in recommending the distribution of Union tax revenues among states.

- Historically, tax contribution had less weight in the distribution formula, but it was completely dropped since the 10th Finance Commission.

- The article contends that tax contribution, especially under the GST regime, is a reliable measure of efficiency, unlike other indicators like tax effort and fiscal discipline.

- The authors propose that GST and petroleum consumption, being stable and indicative of income, should be given a substantial weight in the distribution formula.

Key Challenges:

- Resistance from states that may perceive a potential shift in their shares based on tax contribution.

- The stability of indicators like tax effort and fiscal discipline is questioned, making it challenging to assign them higher weights.

- The need to ensure that the inclusion of tax contribution does not lead to unfair outcomes or discourage states from adopting progressive tax policies.

Key Terms:

- Goods and Services Tax (GST): A unified consumption-based destination tax equally divided between the State and Central governments.

- Tax Contribution: The amount of revenue generated by a state through taxes, considered as an efficiency indicator.

- Finance Commission: A body responsible for recommending the distribution of Union tax revenues among states in India.

Key Phrases:

- “Equity and efficiency in tax revenue transfers.”

- “Tax contribution as an efficiency indicator.”

- “GST and petroleum consumption as fair measures of states’ contributions to the national exchequer.”

Key Quotes:

- “Tax contribution is an efficiency indicator because a State’s level of development and economic structure decides its tax contribution.”

- “GST satisfies the criterion of stability in tax structure, making it an ideal efficiency indicator.”

- “There is a persuasive case for the 16th Finance Commission to debate and include these ratios as a measure of efficiency.”

Key Statements:

- “Since the 10th Finance Commission, tax contribution was dropped from the distribution formula.”

- “GST is a consumption-based destination tax that is equally divided between the State and Central governments.”

- “The Finance Commissions have always favored assigning more than 75% weight to equity indicators.”

Key Examples and References:

- The article references the 15th Finance Commission’s distribution formula, which included tax effort, fiscal discipline, and demographic performance.

- The stability of GST as an efficiency indicator is supported by calculations presented by the authors.

Key Facts:

- The share of personal and corporate income taxes is 64% in Central tax revenue in 2021-22.

- Finance Commissions historically assigned 10% to 20% weight to tax contribution in the distribution formula.

Key Data:

- The weightage of tax effort in the 15th Finance Commission’s distribution formula was 2.5%, with demographic performance receiving a weight of 12.5%.

- The recommended weight for equity indicators in the same formula was 85%.

Critical Analysis:

The article provides a compelling argument for the inclusion of tax contribution in the distribution formula, highlighting the stability and fairness of GST as an efficiency indicator. However, potential challenges such as resistance from states and the need for careful consideration to prevent unintended consequences are acknowledged.

Way Forward:

The authors suggest that the 16th Finance Commission should actively debate and consider including GST and petroleum consumption with a substantial weight in the distribution formula. This, they argue, would better represent states’ contributions to the national exchequer and promote efficiency in resource allocation.

Note4Students

From UPSC perspective, the following things are important:

Prelims level: Direct Taxes

Mains level: Read the attached story

Introduction

- India’s net direct tax collections have achieved a significant milestone, reaching ₹14.7 lakh crore by January 10, which is over four-fifths of the fiscal year’s target.

- This performance indicates a robust growth of 19.4% compared to the same period in the previous fiscal year, showcasing the country’s strong economic recovery and efficient tax administration.

Overview of Tax Collection Performance

- Total Collections: The net direct tax collections stood at ₹14.7 lakh crore, marking an achievement of 80.61% of the budget estimates for the fiscal year 2023-24.

- Growth Rate: This represents a 19.41% increase over the net collections for the corresponding period of the last year.

- Gross Collection Growth: The gross direct tax collections rose by 16.77% to ₹17.18 lakh crore, with Personal Income Tax (PIT) inflows increasing by 26.11% and Corporate Income Tax (CIT) by 8.32%.

Detailed Analysis of Tax Collection

- Post-Refund Growth: After adjusting for refunds, the net growth in CIT collections was 12.37%, and PIT collections saw a rise of 27.26%.

- Increase in PIT and STT Receipts: Net of refunds, PIT and Securities Transaction Tax receipts were up by 27.22%.

What are Direct Taxes?

- A type of tax where the impact and the incidence fall under the same category can be defined as a Direct Tax.

- The tax is paid directly by the organization or an individual to the entity that has imposed the payment.

- The tax must be paid directly to the government and cannot be paid to anyone else.

Types of Direct Taxes

The various types of direct tax that are imposed in India are mentioned below:

(1) Income Tax:

- Depending on an individual’s age and earnings, income tax must be paid.

- Various tax slabs are determined by the Government of India which determines the amount of Income Tax that must be paid.

- The taxpayer must file Income Tax Returns (ITR) on a yearly basis.

- Individuals may receive a refund or might have to pay a tax depending on their ITR. Penalties are levied in case individuals do not file ITR.

(2) Wealth Tax:

- The tax must be paid on a yearly basis and depends on the ownership of properties and the market value of the property.

- In case an individual owns a property, wealth tax must be paid and does not depend on whether the property generates an income or not.

- Corporate taxpayers, Hindu Undivided Families (HUFs), and individuals must pay wealth tax depending on their residential status.

- Payment of wealth tax is exempt for assets like gold deposit bonds, stock holdings, house property, commercial property that have been rented for more than 300 days, and if the house property is owned for business and professional use.

(3) Estate Tax:

- It is also called Inheritance Tax and is paid based on the value of the estate or the money that an individual has left after his/her death.

(4) Corporate Tax:

- Domestic companies, apart from shareholders, will have to pay corporate tax.

- Foreign corporations who make an income in India will also have to pay corporate tax.

- Income earned via selling assets, technical service fees, dividends, royalties, or interest that is based in India is taxable.

- The below-mentioned taxes are also included under Corporate Tax:

- Securities Transaction Tax (STT): The tax must be paid for any income that is earned via taxable security transactions.

- Dividend Distribution Tax (DDT): In case any domestic companies declare, distribute, or are paid any amounts as dividends by shareholders, DDT is levied on them. However, DDT is not levied on foreign companies.

- Fringe Benefits Tax: For companies that provide fringe benefits for maids, drivers, etc., Fringe Benefits Tax is levied on them.

- Minimum Alternate Tax (MAT): For zero-tax companies that have accounts prepared according to the Companies Act, MAT is levied on them.

(5) Capital Gains Tax:

- It is a form of direct tax that is paid due to the income that is earned from the sale of assets or investments. Investments in farms, bonds, shares, businesses, art, and homes come under capital assets.

- Based on its holding period, tax can be classified into long-term and short-term.

- Any assets, apart from securities, that are sold within 36 months from the time they were acquired come under short-term gains.

- Long-term assets are levied if any income is generated from the sale of properties that have been held for a duration of more than 36 months.

Advantages of Direct Taxes