WTO and India

[11th March 2025] The Hindu Op-ed: An India-U.S. trade agreement and the test of WTO laws

PYQ Relevance:Q) Quadrilateral Security Dialogue (Quad) is transforming itself into a trade bloc from a military alliance, in present times Discuss. (UPSC CSE 2020) |

Mentor’s Comment: UPSC mains have always focused on the Quadrilateral Security Dialogue (Quad) is transforming itself into a trade bloc (2020) and WTO has to survive in the present context of ‘Trade War’ (2018).

During Prime Minister Narendra Modi’s U.S. visit on February 13, 2025, India and the U.S. agreed to begin talks on a multi-sector Bilateral Trade Agreement (BTA) by fall 2025. As both countries are WTO members, the agreement must follow WTO rules. While details remain unclear, the agreement’s content matters more than its label.

Today’s editorial discusses how the ongoing Bilateral Trade Agreement (BTA) negotiations may affect both countries. This information is useful for GS Paper 3 in the UPSC Mains exam.

_

Let’s learn!

Why in the News?

Since both the U.S. and India are members of the World Trade Organization, their trade agreements must follow WTO rules.

What are the key legal challenges India and the U.S. may face while negotiating a Bilateral Trade Agreement (BTA) under WTO law?

- Violation of the Most Favoured Nation (MFN) Principle: WTO law mandates that any trade advantage granted to one member must be extended to all members (Article I of GATT). A BTA providing preferential tariffs only to India or the U.S. may violate this principle.

- Example: If the U.S. lowers tariffs on Indian textiles under the BTA without extending the same benefit to other WTO members like China, it breaches the MFN principle.

- Meeting the “Substantially All Trade” Requirement: Article XXIV.8(b) of GATT requires that Free Trade Agreements (FTAs) must cover “substantially all trade.” A limited-scope BTA focusing only on select sectors (e.g., pharmaceuticals or agriculture) may not satisfy this condition.

- Example: If the India-U.S. BTA only includes technology and defense products while excluding key areas like agriculture, it may not qualify as a valid FTA under WTO law.

- Notification and Transparency Obligations: WTO members must notify the organization of any new regional trade agreements (RTAs) or BTAs and demonstrate compliance with Article XXIV of GATT. Failure to provide transparent schedules may lead to legal disputes.

- Example: If India and the U.S. do not submit a clear implementation timeline for tariff reductions under an interim BTA, other WTO members could challenge the agreement.

- Bound Tariff Commitments: Both countries have pre-committed to maximum tariff limits (bound tariffs) under WTO rules. Any preferential treatment exceeding these limits may violate their commitments.

- Example: If India agrees to reduce tariffs on American agricultural imports below its bound tariff rates, it could be accused of breaching its WTO commitments.

- Misuse of the “Interim Agreement” Clause: Article XXIV.5 allows “interim agreements” only if they lead to a full FTA within a reasonable period (usually 10 years). Using an interim BTA to delay full liberalization may face legal scrutiny.

- Example: If the India-U.S. BTA remains a partial agreement for an extended period without progressing toward an FTA, it could be deemed a violation of WTO norms.

Why is the “most favoured nation” (MFN) principle significant in evaluating the legality of the proposed India-U.S. BTA?

- Prevents Discrimination Between Trading Partners: The MFN principle under Article I of GATT ensures that any trade advantage (e.g., lower tariffs) given to one WTO member must be extended to all members. A BTA offering exclusive benefits violates this core principle.

- Example: If the U.S. reduces tariffs on Indian pharmaceuticals but does not extend the same reduction to other countries like Vietnam, it breaches the MFN rule.

- Limits Preferential Bilateral Deals: WTO law only allows exceptions to the MFN rule through comprehensive trade agreements covering “substantially all trade” under Article XXIV of GATT. A narrowly focused BTA risks legal challenges.

- Example: If India and the U.S. sign a BTA that only includes high-tech products while excluding major sectors like agriculture, it may not qualify for an MFN exemption.

- Ensures Transparency and Fair Competition: The MFN principle promotes a transparent, rule-based trading system where no country receives hidden advantages, ensuring fair market access for all WTO members.

- Example: If India provides exclusive tariff cuts on American dairy products without offering similar terms to New Zealand, it would violate WTO transparency obligations.

- Prevents Trade Fragmentation: Upholding the MFN principle avoids trade fragmentation by ensuring consistent rules for all members. Bilateral deals that bypass MFN could undermine the multilateral trade system.

- Example: If the U.S. grants Indian textiles preferential access through a BTA but not to countries like Bangladesh, it could distort global supply chains.

- Requires WTO Notification and Review: Any departure from the MFN principle through a BTA must be notified to the WTO and subjected to legal scrutiny under Article XXIV to confirm its compliance.

- Example: If the India-U.S. BTA is not notified to the WTO or lacks a clear transition plan toward an FTA, it may be legally contested by other members like China or the EU.

How can the proposed BTA be structured as an “interim agreement” under Article XXIV of the GATT without violating WTO norms?

- Commitment to Full Free Trade Area (FTA) or Customs Union: The BTA must outline a clear plan to eventually form a Free Trade Area (FTA) or Customs Union within a reasonable time frame (generally within 10 years).

- Example: The India-Mauritius Comprehensive Economic Cooperation and Partnership Agreement (CECPA) started as an interim agreement with the goal of expanding into a broader trade framework.

- Transparency and Notification to WTO: The parties must notify the WTO of the interim agreement and submit detailed information on trade coverage, timelines, and implementation steps for review by the Committee on Regional Trade Agreements (CRTA).

- Example: The European Union (EU)-UK Trade and Cooperation Agreement was notified to the WTO during the Brexit transition, ensuring compliance with Article XXIV.

- Non-Discriminatory Transition: The interim agreement must not create unjustifiable discrimination against other WTO members, and the removal of trade barriers should cover substantially all trade between the parties.

- Example: The US-Mexico-Canada Agreement (USMCA) complies with this by covering a broad range of goods and services, ensuring that trade barriers are progressively reduced.

Way forward:

- Ensure Comprehensive Coverage and Timely Transition: Design the BTA to cover substantially all trade sectors with a clear roadmap toward a full Free Trade Area (FTA) within the 10-year WTO guideline to comply with Article XXIV.

- Enhance Transparency and Legal Compliance: Notify the WTO promptly, providing detailed schedules on tariff reductions and implementation timelines, ensuring non-discrimination and regular compliance reviews by the Committee on Regional Trade Agreements (CRTA).

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

Settling trade disputes through ‘litigotiation’

From UPSC perspective, the following things are important :

Prelims level: About WTO

Mains level: Trade disputes; India and USA at the WTO

Why in the News?

In March, India and the U.S. settled their last lingering WTO poultry dispute, marking the end of seven trade disputes resolved since Prime Minister Modi’s U.S. visit.

What is ‘Litigotiation’?

|

Trade dispute on poultry products between India and USA at the WTO

- Indian Scenario: India had prohibited the import of various agricultural products from the US because of concerns related to Avian Influenza.

- U.S. argued: The U.S. challenged India’s import restrictions on poultry products, which were imposed due to concerns about avian influenza (bird flu) potentially transmitting to humans.

- It argued that India deviated from internationally recognized standards that were set by the World Organization for Animal Health (formerly OIE) and failed to provide scientific justifications for its measures, violating the WTO’s Sanitary and Phytosanitary (SPS) Agreement.

- The dispute was initiated by the U.S. in 2012 and remained unresolved for over a decade, making it the oldest of the seven trade disputes between India and the U.S. In 2015, India lost a long-pending dispute over poultry imports from the US at the WTO.

- The recent settlement allowed India to avoid a yearly $450 million claim.

- In exchange, India agreed to reduce tariffs on select U.S. products such as cranberries, blueberries, frozen turkey, and premium frozen duck meat, marking a significant diplomatic breakthrough.

What are the standards set by the World Organization for Animal Health?

- The Terrestrial Animal Health Code

- First published in 1968, provides standards for the improvement of terrestrial animal health and welfare and veterinary public health worldwide.

- These standards should be used by Veterinary Services to set up measures for the early detection, reporting, and control of pathogenic agents, including zoonotic agents, and preventing their spread.

- The Aquatic Animal Health Code

- Introduced in 1995, provides standards for the improvement of aquatic animal health and welfare worldwide.

- These standards should be used by Aquatic Animal Health Services to set up measures for the prevention, early detection, reporting, and control of pathogenic agents in aquatic animals (amphibians, crustaceans, fish, and mollusks).

- Implementation of the recommendations in the Aquatic Code ensures the safety of international trade in aquatic animals and aquatic animal products.

About WTO:The World Trade Organization (WTO) is an intergovernmental organization that regulates and facilitates international trade among its member nations. It was established in 1995 and has 164 member countries, representing over 98% of global trade and global GDP. |

Conclusion: The India-U.S. settlement underscores the power of diplomatic negotiations in resolving complex trade disputes, fostering stronger bilateral ties, and promoting a more stable and cooperative international trade environment.

Mains PYQ:

Q WTO is an important international institution where decisions taken affect countries in a profound manner. What is the mandate of WTO and how binding are their decisions? Critically analyse India’s stand on the latest round of talks on Food security. (UPSC IAS/2014)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

India fighting pressure at WTO to allow ‘plurilateral pact’ on investment facilitation

From UPSC perspective, the following things are important :

Prelims level: Plurilateral Agreement/Pact and WTO

Mains level: India's Strong Stand against the IFD at WTO MC13;

Why in the News?

An official stated on Tuesday that India opposes a China-led proposal on investment facilitation at the WTO, arguing that it is a ‘non-trade’ issue beyond the global trade body’s mandate.

About Plurilateral Agreement/Pact:

|

What is the China-led Investment Facilitation for Development Agreement (IFD)?

- The IIFD Agreement is a proposed pact by China, with support from other countries, to streamline and facilitate foreign investment.

- The main objectives of the IFD Agreement include:

- Enhancing transparency of investment measures.

- Streamlining and speeding up investment-related authorization procedures.

- Promoting international cooperation, information sharing, and exchange of best practices.

- Encouraging sustainable investment practices.

- The proponents of the IFD argue that it would bring benefits to all WTO members, especially developing and least-developed countries, by creating a more predictable and transparent investment climate.

India’s Strong Stand against the IFD at WTO MC13

India has taken a firm stance against the inclusion of the IFD Agreement in the WTO framework for several reasons:

- Investment is Not a Trade Issue: India argues that investment does not fall within the traditional purview of the WTO, which primarily focuses on trade issues. It points out that past Ministerial decisions have explicitly kept investment outside the WTO’s scope.

- Sovereignty Concerns: A significant concern for India is the potential impact on its policy space. The IFD Agreement includes provisions that would require the government to consult with investors on policy matters, which India fears could undermine its ability to make sovereign decisions.

- Lack of Consensus: India, along with South Africa, has highlighted the absence of a unanimous consensus among WTO members regarding the inclusion of the IFD as a plurilateral agreement. They argue that without exclusive consensus, it should not be brought onto the formal agenda.

- Policy Autonomy: India is wary that the IFD Agreement’s requirements could constrain its autonomy in regulating investments to align with national development priorities and strategies.

- Procedural Concerns: India contends that the issue should not have been part of the MC13 agenda and instead, should be discussed at the General Council, given the divisive nature of the proposal among WTO members.

Conclusion: India’s opposition to the IFD Agreement at the WTO stems from a combination of concerns about preserving national sovereignty, adhering to established WTO boundaries regarding trade versus investment issues, and ensuring that any significant changes in the WTO framework are backed by broad-based consensus.

Mains PYQ:

Q The broader aims and objectives of WTO are to manage and promote international trade in the era of globalisation. But the Doha round of negotiations seems doomed due to differences between the developed and the developing countries.” Discuss in the Indian perspective. (UPSC IAS/2016)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

India pursues Lowering Cost of Cross Border Remittances at WTO

From UPSC perspective, the following things are important :

Prelims level: Cost of Remittances, Remittances Inflows, WTO

Mains level: NA

What is the news-

- India is strongly pursuing its proposal for lowering the cost of cross-border remittances, which it presented at the WTO’s 13th Ministerial Conference in Abu Dhabi last month.

- It has now requested the WTO’s general council (GC) to initiate a work program to make recommendations for reducing remittance costs.

Why discuss this?

|

What is Cost of Remittances?

- Remittances are financial transfers sent by migrant workers to their families or relatives in their home countries.

- The cost of remittances refers to the expenses incurred by individuals or businesses when sending money from one location to another, typically across international borders.

- The cost components of cross-border payments can include:

- Bank fees,

- Intermediary fees,

- Compliance fees,

- Operational costs, and

- FX (foreign exchange) rate margin

- Innovative technologies like DeFi payment rails are emerging to reduce the total cost of payments for cross-border transactions.

About World Trade Organization (WTO)

| Details | |

| Establishment | 1995, replacing GATT |

| Objective | To regulate international trade |

| Headquarters | Geneva, Switzerland |

| Members |

|

| Objectives |

|

| Principles |

|

| Important Trade Agreements |

|

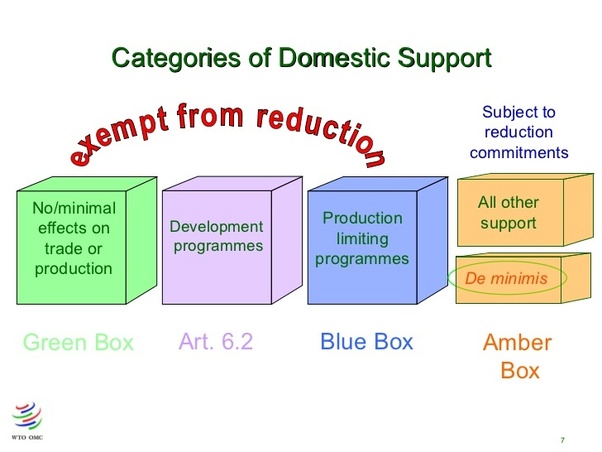

| WTO Agreement on Agriculture (AoA) |

Subsidies Types:

|

| Most Favoured Nation Clause |

|

PYQ:

Q.The terms ‘Agreement on Agriculture’, ‘Agreement on the Application of Sanitary and Phytosanitary Measures’ and Peace Clause’ appear in the news frequently in the context of the affairs of the: (2015)

- Food and Agriculture Organization

- United Nations Framework Conference on Climate Change

- World Trade Organization

- United Nations Environment Programme

Q.Which of the following constitute Capital Account? (2013)

- Foreign Loans

- Foreign Direct Investment

- Private Remittances

- Portfolio Investment

Select the correct answer using the codes given below.

- 1, 2 and 3

- 1, 2 and 4

- 2, 3 and 4

- 1, 3 and 4

Practice MCQ:

Consider the following statements:

- India is the highest recipient of remittances globally.

- UAE is the largest source of remittances to India.

- The current cost of remittances meets the SDG target.

How many of the given statements is/are correct?

- One

- Two

- Three

- None

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

WTO’s 13th Ministerial Conference: A Path Forward for Global Trade

From UPSC perspective, the following things are important :

Prelims level: MC13, WTO

Mains level: Read the attached story

In the news

- The 13th Ministerial Conference (MC13) of the World Trade Organization (WTO) convened in Abu Dhabi, UAE, from February 26 to March 2, drawing participation from 166 member countries.

- The conference culminated in the adoption of a ministerial declaration outlining a reform agenda to bolster the WTO’s role in regulating global trade and facilitating seamless cross-border commerce.

About World Trade Organization (WTO)

| Details | |

| Establishment | 1995, replacing GATT |

| Objective | To regulate international trade |

| Headquarters | Geneva, Switzerland |

| Members |

|

| Objectives |

|

| Principles |

|

| Important Trade Agreements |

|

| WTO Agreement on Agriculture (AoA) |

Subsidies Types:

|

| Most Favoured Nation Clause |

|

Key Decisions at MC13

- Dispute Settlement System: Member countries reaffirmed their commitment to establishing a fully functional dispute settlement system by 2024.

- Special and Differential Treatment (S&DT): Emphasis was placed on enhancing the utilization of S&DT provisions to support the development objectives of developing and least developed countries (LDCs).

Challenges to Multilateral Trading Order

- Rising Protectionism: Developed economies, amid growing domestic pressures, have exhibited a propensity towards protectionist policies, challenging the prevailing globalized trade paradigm.

- Supply Chain Disruptions: Ongoing conflicts and sanctions have disrupted global supply chains, necessitating a reassessment of trade norms to ensure resilience and efficiency.

- Development Disparities: Concerns persist regarding the equitable treatment of nations, with attention directed towards mitigating disparities between richer nations and LDCs.

India’s Approach

- Public Stockholding (PSH) Programme: India advocated for a resolution concerning the PSH program, crucial for ensuring food security. The program enables the procurement and distribution of essential food grains to millions of beneficiaries at subsidized rates.

- Fisheries Subsidies: India proposed measures to regulate fisheries subsidies, advocating for support to poor fishermen within national waters while curbing subsidies for industrial fishing in international waters.

- E-commerce Customs Duties: India pressed for the removal of the moratorium on customs duties for cross-border e-commerce, citing the need to safeguard revenue generation in the digital trade landscape.

Outcomes

- Agriculture: MC13 witnessed the formulation of a text addressing agricultural issues, marking a significant milestone after decades of negotiations.

- Fisheries: Progress towards consensus on fisheries regulations was noted, with expectations of finalization by mid-year.

- E-commerce Duties: Despite efforts, the exemption from customs duties for e-commerce transactions was extended for an additional two years, disappointing several developing economies.

Conclusion

- The outcomes of MC13 underscore the imperative for collaborative efforts to address pressing challenges in global trade.

- While strides were made in certain areas such as agriculture and fisheries, unresolved issues surrounding e-commerce and development disparities persist.

- As nations navigate the evolving trade landscape, sustained dialogue and concerted action are essential to foster inclusive and sustainable economic growth worldwide.

Try this PYQ from CSE Prelims 2015:

The terms ‘Agreement on Agriculture’, ‘Agreement on the Application of Sanitary and Phytosanitary Measures’ and Peace Clause’ appear in the news frequently in the context of the affairs of the:

(a) Food and Agriculture Organization

(b) United Nations Framework Conference on Climate Change

(c) World Trade Organization

(d) United Nations Environment Programme

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

How to restore WTO’s authority

Central Idea:

The ongoing crisis in the World Trade Organisation’s (WTO) dispute settlement mechanism (DSM), particularly the paralysis of the appellate body (AB) due to the US blocking the appointment of new members, poses a significant challenge to the multilateral trading regime. Developing countries like India are pushing for the restoration of the AB to its original form, but alternative options are being considered due to the US’s reluctance.

Key Highlights:

- The DSM, particularly the AB, is crucial for ensuring compliance with WTO rulings and maintaining a rules-based global trading system.

- The US has blocked the appointment of new AB members since 2019, rendering it ineffective and undermining the enforcement of WTO rulings.

- Developing countries, led by India, are advocating for the restoration of the AB to its original form to ensure fairness and predictability in dispute resolution.

- Alternative options include joining interim arrangements led by the European Union or proposing a diluted AB with limited powers, but these may compromise the effectiveness of the DSM.

- Scholars propose a compromise solution where countries can opt out of the AB’s jurisdiction, allowing its restoration while accommodating the US’s concerns.

Key Challenges:

- The deadlock caused by the US’s opposition to the AB’s functioning has led to a crisis in the DSM, undermining the WTO’s authority.

- Developing countries face the challenge of balancing their desire for a fully functioning AB with the need to accommodate the US’s concerns to maintain consensus within the WTO.

- Alternative solutions, such as interim arrangements or diluted AB proposals, may lack the necessary enforceability or compromise the integrity of the DSM.

Key Terms:

- World Trade Organisation (WTO)

- Dispute Settlement Mechanism (DSM)

- Appellate Body (AB)

- Interim Appeal Arbitration Arrangement (MPIA)

- International Court of Justice (ICJ)

Key Phrases:

- “Crisis in the dispute settlement mechanism”

- “Paralysis of the appellate body”

- “Developing countries’ advocacy”

- “Alternative options”

- “Compromise solution”

Key Quotes:

- “The WTO’s DSM — its crown jewel — comprises a binding two-tiered process with a panel and an appellate body (AB).”

- “Consequently, countries have found an easy way to avoid complying with the WTO panel rulings. They appeal into the void, thereby rendering the WTO toothless.”

- “A fully functional dispute settlement, with the checks and balances that the appellate body provides, is the best bet for the developing world.”

- “India and other developing countries should continue striving for the ideal solution: The restoration of the AB in the form it existed till 2019.”

Key Statements:

- “The ongoing crisis in the dispute settlement mechanism (DSM) poses a significant challenge to the multilateral trading regime.”

- “Developing countries are pushing for the restoration of the AB to its original form to ensure fairness and predictability in dispute resolution.”

- “Alternative options may compromise the effectiveness of the DSM and undermine the enforcement of WTO rulings.”

Way Forward:

- Advocate for Restoration: Developing countries should continue advocating for the restoration of the AB to its original form, emphasizing its importance for ensuring fairness and predictability in the global trading system.

- Explore Compromise Solutions: Consider compromise solutions, such as allowing countries to opt out of the AB’s jurisdiction, to accommodate the concerns of key stakeholders like the US while maintaining the integrity of the DSM.

- Strengthen Interim Arrangements: If necessary, explore joining interim arrangements led by entities like the European Union to provide temporary solutions while working towards a more permanent resolution within the WTO framework.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

At World Economic Forum, how India made a mark

From UPSC perspective, the following things are important :

Prelims level: UN World Investment Report:

Mains level: India's notable economic growth, showcased at Davos 2024

Central Idea:

India’s notable economic growth, showcased at Davos 2024, positions it as a global player addressing challenges such as geopolitical incidents, climate change, and technology risks. The country’s achievements in technology-driven governance, active participation in global discussions, and emphasis on socioeconomic aspects contribute to its recognition as a resilient and influential economy.

Key Highlights:

- Technology-driven Governance: India’s effective use of technology for governance solutions at scale is highlighted, especially in the context of Artificial Intelligence (AI).

- Global Participation: India actively engages in global discussions, particularly on socioeconomic issues, reflecting its role as a responsible and influential partner in the world.

- Women Empowerment: Davos discussions spotlight Indian women’s substantial contribution to the economy, managing businesses worth $37 billion annually. Advocacy for financial institution investments in women-owned businesses is emphasized.

- Energy Transition: Amidst the focus on climate change, challenges related to energy transition are discussed, with attention to the importance of non-disruptive processes and policy strategies.

- Equitable Growth: India’s growth trajectory is highlighted as equitable, encompassing infrastructure development, gender inclusivity, and addressing the needs of disadvantaged sections through social security measures.

- Global Recognition: Moody’s recognizes India as a “pocket of resilience” in the face of global economic challenges, acknowledging the country’s stability and receiving attention across economic, social, and political dimensions.

- Favorable Investment Destination: India is presented as a favored destination for global investments, with the government’s mission to achieve developed status by 2047.

Key Challenges:

- Geopolitical Incidents: India’s integration into the global economy makes it susceptible to geopolitical incidents, requiring a responsible approach to maintain trust.

- Energy Transition Challenges: Balancing import dependence on fossil fuels with the need for sustainable alternatives poses challenges in India’s energy transition.

- Inflation Risk: Sticky inflation globally poses a risk to India’s growth trajectory, requiring vigilant economic management.

Key Terms/Phrases:

- AI Leadership: India’s leadership role in adopting and leveraging AI for business solutions.

- Women’s Self-Employment: The substantial contribution of Indian women, managing businesses with credit from financial institutions.

- Green Hydrogen: Highlighting alternative energy sources, like green hydrogen, to address energy transition challenges.

Key Quotes:

- “India can appear as a ‘pocket of resilience’ amid the risk of sticky inflation affecting the growth trajectory of the global economy.” – Moody’s Investors Service

- “India’s economic prowess consistently outshone several large economies, showcasing a robust growth trajectory.”

Key Examples/References:

- UN World Investment Report: Recognizing India as a favored destination for global investments.

- Moody’s Investors Service: Acknowledges India’s resilience in the face of global economic challenges.

Key Facts/Data:

- Indian Women’s Contribution: Ninety million women are self-employed, managing businesses worth $37 billion annually.

- Government’s Mission: Prime Minister’s goal to propel India into developed status by 2047.

Critical Analysis:

- Equitable Growth: The focus on growth reaching every part of the country is critical for inclusive development.

- Global Recognition: Recognition at the global level highlights India’s role in shaping the world’s economic, social, and political landscape.

Way Forward:

- Continued Reforms: India should maintain a proactive approach to governance and reforms, especially in technology adoption and energy transition.

- Global Collaboration: Strengthening collaborations with global partners ensures a more sustainable and inclusive future.

- Inclusive Policies: Continued emphasis on gender inclusivity and social security measures contributes to a more equitable growth trajectory.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

Global dispute settlement, India and appellate review

From UPSC perspective, the following things are important :

Prelims level: WTO and Appellate Review Mechanisms

Mains level: WTO's Dispute Settlement Crisis, ISDS and India's stand on Appellate Review Mechanisms

What’s the news?

- The recently concluded G-20 Declaration, among its many commitments, reiterated the need to pursue reform of the World Trade Organization (WTO).

Central idea

- Reforming international dispute settlement mechanisms is imperative for global trade and investment stability. The G-20 Declaration emphasizes WTO reform by 2024, yet uncertainties persist in the dispute resolution process, given ongoing US opposition.

WTO’s Dispute Settlement System: A Crisis Since 2019

- The WTO’s dispute settlement system, known for its two-tier panel cum appellate body structure, has been in turmoil since 2019 when the United States blocked the appointment of appellate body members.

- Despite being hailed as the crown jewel of the WTO, this system is currently hamstrung, jeopardizing its ability to issue coherent and predictable rulings.

- The G-20’s commitment to improving this system is commendable, but uncertainties persist, especially due to the U.S.’s reluctance towards an appellate review process.

What is Investor-State Dispute Settlement (ISDS)?

- ISDS is a mechanism used to resolve disputes between foreign investors and host countries’ governments in the context of international investment agreements.

- It is a ubiquitous component of bilateral investment treaties (BITs).

- The ISDS today is the principal means to settle international investment law disputes.

- As of January 1, 2023, 1,257 ISDS cases have been initiated. India has had a chequered history with ISDS, with five adverse awards: four in favor and several pending claims.

The Role of Appellate Review in International Trade Law

- An appellate review process is essential at the international level, just as it is in national courts. It acts as a crucial check on the interpretation and application of the law, ensuring consistency.

- The absence of such a mechanism can lead to inconsistencies and incoherent decisions, as seen in international investment law through ISDS.

UNCITRAL’s Working Group III

- Discussions are ongoing at the United Nations Commission on International Trade Law (UNCITRAL) regarding ISDS reforms and the creation of an appellate review mechanism.

- Key issues include the form of the mechanism, review standards, timeframes, and decision effects. These discussions hold the promise of addressing the current deficiencies in ISDS.

Benefits of an appellate review mechanism

- Error Correction: Appellate review corrects legal mistakes in WTO and ISDS decisions, ensuring the accurate application of rules.

- Consistency and Confidence: It maintains a uniform interpretation of trade and investment laws, promoting stability and predictability. A functional appellate body boosts trust in the WTO, encouraging nations to resolve trade disputes peacefully.

- Harmonization and Stability: ISDS appellate review aligns diverse treaty interpretations, reducing legal disparities. It also fosters investor-state predictability, attracts investments, and promotes economic growth.

- Reducing Uncertainty: Appellate review clarifies investment treaty rights and obligations, reducing ambiguity.

- Credibility: Its presence enhances ISDS credibility, making it more appealing for states and investors.

- Rule-Based Order: Supporting appellate review aligns with India’s aim for a rule-based global system, fostering international cooperation.

India’s Position on Appellate Review Mechanisms

- Support for Appellate Review in ISDS:

- Although India has not officially articulated its stance, there is a presumption that India is supportive of the idea of an appellate review mechanism in ISDS.

- This presumption is based on the presence of Article 29 in India’s model Bilateral Investment Treaty (BIT), which appears to endorse the concept of appellate review.

- Alignment with India’s interests:

- India is concerned about the inconsistency and incoherence that currently characterize the ISDS system.

- Supporting an appellate review mechanism is seen as a means to address these concerns and promote greater stability and predictability in international investment law.

- Relevance to Ongoing Negotiations:

- India will likely need to take a formal position on this issue during ongoing investment treaty negotiations with the European Union (EU).

- The EU is advocating for the establishment of an appellate review mechanism for investment disputes, and India’s stance will be crucial in shaping the outcome of these negotiations.

- Quest for a Rule-Based Global Order:

- India’s broader objective is to establish a rule-based global order in international trade and investment. Supporting an appellate review mechanism, both in ISDS and within the World Trade Organization (WTO), is seen as a way to achieve this goal.

- Moreover, India should also advocate for the restoration of the WTO appellate body to ensure a fully functioning dispute settlement system at the WTO.

Conclusion

- The G-20’s commitment to revitalizing the WTO’s dispute settlement system and the ongoing discussions on establishing an appellate review mechanism in ISDS are steps in the right direction. India, as a proponent of a rule-based global order, should actively support these reforms to ensure greater confidence among states and investors in international trade and investment law.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

WTO Reforms: Empowering Developing Countries to Uphold Trade Multilateralism

From UPSC perspective, the following things are important :

Prelims level: WTO and related facts

Mains level: Transparency gaps and challenges withing WTO, Need for reforms and way ahead

Central Idea

- The recently concluded G20 working group meeting on trade and investment placed significant emphasis on the imperative task of reforming the World Trade Organization (WTO). While this issue has long been on the global agenda, it is crucial to consider the broader global context.

What is Special and Differential Treatment (SDT) Principle Enshrined in WTO Agreements?

- SDT principle is a fundamental aspect of the WTO agreements.

- It recognizes the differences in development levels among member countries and aims to provide special rights and treatment to developing countries.

- The principle acknowledges that developing nations face unique challenges and constraints in participating effectively in the global trading system.

Key Elements of SDT

- Longer Transition Periods: Developing countries are granted extended timeframes to implement certain obligations and adjust their domestic policies to comply with WTO rules. This allows them to accommodate their unique circumstances and developmental needs.

- Differential Tariff Reductions: Developing countries may be granted more lenient tariff reduction commitments compared to developed countries. They have the flexibility to reduce tariffs on a selective basis and protect certain sensitive sectors.

- Special Safeguard Measures: Developing countries can employ special safeguard mechanisms to protect domestic industries from import surges or market disruptions caused by increased competition. These measures allow temporary deviations from WTO commitments to mitigate adverse effects on vulnerable sectors.

- Technical Assistance and Capacity Building: Developed countries and international organizations provide technical assistance and capacity-building support to help developing nations enhance their trade-related infrastructure, institutions, and human resources. This assistance aims to strengthen their ability to effectively participate in global trade.

- Preferential Treatment in Regional and Bilateral Agreements: Developing countries are often offered preferential trade agreements or schemes by developed countries, granting them favorable market access and trade preferences. These agreements help stimulate export growth and promote economic development.

- Flexibility in Intellectual Property Rights (IPR): Developing countries may have more relaxed obligations related to intellectual property rights, allowing them to adopt measures that protect public health, promote access to affordable medicines, and support domestic innovation.

- Technical Barriers to Trade (TBT) and Sanitary and Phytosanitary (SPS) Measures: Developing countries may receive technical assistance to comply with TBT and SPS measures, which include regulations related to product standards, labeling, and food safety. This support facilitates their participation in global trade by addressing capacity constraints.

- Special and Differential Treatment Monitoring: The WTO has established mechanisms to monitor and review the implementation of SDT provisions. This ensures that developing countries’ concerns are addressed and that they receive the support they are entitled to under the SDT principle

The Appellate Body Crisis Within the WTO

- Blocking Appointments: The United States has blocked the appointment of new members to the Appellate Body since 2017, preventing it from functioning effectively. This has led to a significant reduction in the number of active members, impeding the body’s ability to hear and resolve trade disputes.

- Depletion of Membership: Due to the lack of appointments, the Appellate Body’s membership has dropped below the minimum required number to constitute a quorum. As a result, pending and future appeals have been left unresolved, leading to a growing backlog of cases.

- Paralysis of Dispute Settlement: The inability of the Appellate Body to hear and decide on trade disputes has resulted in a paralysis of the WTO’s dispute settlement system. Member countries have limited options for resolving disputes, potentially leading to increased trade tensions and the risk of unilateral actions without proper adjudication.

- Concerns Raised by the United States: The US has expressed concerns about the Appellate Body’s perceived overreach, its interpretation of WTO rules, and what it sees as judicial activism. It has called for reforms to address these issues before approving new appointments.

- Implications for the Multilateral Trading System: The absence of a functioning Appellate Body undermines the credibility and effectiveness of the WTO’s dispute settlement system. It raises concerns about the stability of the multilateral trading system and the enforceability of WTO rules.

- Discussions on Reform: WTO members have engaged in discussions to address the concerns raised by the US and find a way to restore the functionality of the Appellate Body. Various proposals and ideas have been put forward to reform the body while ensuring transparency, accountability, and adherence to WTO rules.

- Alternative Dispute Settlement Mechanisms: In light of the Appellate Body crisis, some countries have explored alternative mechanisms for resolving trade disputes. Bilateral or plurilateral agreements and arbitration panels are being considered as possible alternatives to the WTO’s traditional dispute settlement process.

What is Plurilateralism and Multilateral Governance?

- Plurilateralism refers to the approach of negotiating agreements among a subset of countries within the broader framework of multilateralism. In other words, it involves a group of countries voluntarily coming together to establish rules and commitments on specific issues, even if not all WTO members participate.

- Multilateral governance, on the other hand, refers to the process of managing and governing global issues through the participation and collaboration of multiple countries within a multilateral framework. It aims to ensure inclusive decision-making, transparency, and adherence to established rules and principles.

The Relationship Between Plurilateralism and Multilateral Governance

- Plurilateralism as a Complement to Multilateralism: Plurilateral agreements are often seen as a complement to multilateralism. They allow a subset of countries with a common interest or objective to move forward and establish rules or commitments that might be difficult to achieve at the multilateral level due to diverse positions and interests of all WTO members. Plurilateral agreements can serve as building blocks and help facilitate progress within the multilateral trading system.

- Multilateral Governance of Plurilateral Agreements: While plurilateral agreements involve a smaller group of countries, it is important to ensure that they are governed within a multilateral framework. Multilateral governance ensures that the principles of non-discrimination, transparency, and inclusivity are upheld in the negotiation and implementation of plurilateral agreements. It ensures that the outcomes of these agreements are integrated into the broader WTO rulebook and apply equally to all members.

- Inclusivity and Trust in Multilateral Governance: Multilateral governance plays a crucial role in addressing the trust deficit between developed and developing countries. In the context of plurilateral agreements, it is essential to ensure that non-participating members are not forced into agreements they are unwilling to join. Multilateral governance should uphold inclusivity, respect the rights of non-participants, and create mechanisms to bridge the trust gap between countries with varying levels of development and interests.

- Coherence and Consistency with Multilateral Rules: Plurilateral agreements must align with the existing multilateral rules and principles of the WTO. They should not undermine the core principles of non-discrimination, most-favored-nation treatment, and transparency that underpin the multilateral trading system. Multilateral governance ensures that plurilateral agreements are coherent with and contribute to the overall objectives of the WTO.

Facts for prelims

What is the WTO’s Ministerial Conference?

|

The transparency gap within the WTO

- Notification Requirements: WTO member countries are obligated to notify all their laws, regulations, and measures that affect trade to ensure transparency. However, compliance with this obligation has been lacking, leading to a transparency gap. Many countries fail to provide timely and comprehensive notifications, hindering the ability of other members to stay informed about trade-related measures and potential impacts.

- Incomplete or Inaccurate Notifications: Even when notifications are provided, they may be incomplete or inaccurate, further widening the transparency gap. This lack of comprehensive information makes it challenging for other members to assess the potential trade implications of new measures or to effectively engage in consultations and negotiations.

- Lack of Timeliness: Delays in providing notifications contribute to the transparency gap. However, significant delays in notifications limit the ability of other members to respond promptly or seek clarification, undermining the transparency and predictability of the WTO system.

- Lack of Clarity and Understandability: Notifications can sometimes lack clarity, making it difficult for other members to fully comprehend the scope and implications of trade-related measures. Clear and understandable notifications are essential for promoting transparency and facilitating effective engagement among WTO members.

- Compliance Monitoring and Enforcement: The monitoring and enforcement of notification requirements remain weak within the WTO system. The lack of robust mechanisms to ensure compliance with notification obligations hampers efforts to address the transparency gap.

- Capacity Constraints: Some developing countries face capacity constraints in fulfilling their notification obligations effectively. Limited resources and technical expertise may hinder their ability to provide comprehensive and timely notifications.

- Accessibility of Notifications: The accessibility and availability of notifications can also contribute to the transparency gap. Ensuring that notifications are easily accessible to all members, including developing countries, through user-friendly platforms and language accessibility measures can help improve transparency within the WTO.

Way Forward

- Strong Leadership and Engagement: Member countries, particularly middle powers like India, Indonesia, Brazil, and South Africa, should take a leadership role in driving the WTO reform agenda. They can actively engage in discussions, negotiations, and consensus-building to push for meaningful reforms that reflect the interests and concerns of developing countries.

- Strengthening Special and Differential Treatment (SDT): Developing countries should advocate for stronger SDT provisions within the WTO. Developing countries should resist any attempts to weaken SDT provisions under the guise of reform and emphasize the importance of addressing asymmetries in the global trading system.

- Revitalizing the Appellate Body: Member countries, apart from the United States, should explore ways to either persuade the US to change its position or find alternative mechanisms to ensure the effective functioning of the Appellate Body. Reestablishing a fully operational Appellate Body is crucial for maintaining a robust and reliable dispute settlement mechanism within the WTO.

- Balancing Plurilateral and Multilateral Approaches: While plurilateral agreements can offer opportunities for progress on specific issues, it is important to strike a balance with multilateralism. Plurilateral negotiations should be conducted within a framework that upholds multilateral governance principles, ensuring inclusivity, transparency, and consistency with broader WTO rules. Forced participation should be avoided, and efforts should be made to bridge the trust deficit between developed and developing countries.

- Transparency and Compliance: Member countries should prioritize enhancing transparency and compliance with notification requirements. Timely, accurate, and comprehensive notifications of trade-related measures are essential for promoting predictability and understanding among WTO members.

- Inclusive Decision-Making: Decision-making processes within the WTO should be more inclusive, giving developing countries a meaningful voice and ensuring their concerns are taken into account.

- Technical Assistance and Capacity Building: Developed countries should provide technical assistance and capacity-building support to help developing countries strengthen their institutional and human resources to effectively participate in the global trading system.

- Renewed Commitment to Multilateralism: Member countries should reaffirm their commitment to the principles of multilateralism, including non-discrimination, transparency, and cooperation. Emphasizing the importance of the rules-based multilateral trading system and collective problem-solving can help rebuild trust and foster a conducive environment for constructive engagement and negotiations.

Conclusion

- Trade multilateralism, though facing challenges, remains crucial for countries like India. As the current G20 Presidency holder, India should collaborate with other nations to drive the agenda for WTO reforms, focusing on making trade multilateralism more inclusive. By strengthening SDT provisions, revitalizing the appellate body, promoting multilateral governance for plurilateral agreements, and enhancing transparency, developing countries can empower themselves to safeguard their interests and ensure a fair and balanced global trading system.

Also read:

| WTO panel rules against India in IT tariffs dispute |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

Duty-Free Quota Free (DFQF) Scheme

From UPSC perspective, the following things are important :

Prelims level: Duty-Free Quota Free (DFQF) Scheme

Mains level: WTO

Central Idea

- India offers a duty-free quota-free (DFQF) scheme to least developed countries (LDCs) under the World Trade Organisation (WTO).

- A report by the LDC Group reveals that about 85% of the products offered by India remain unutilised under the DFQF scheme.

World Trade Organisation (WTO) |

|

| Establishment | The WTO was established on January 1, 1995, following the Uruguay Round of Negotiations conducted from 1986 to 1994. |

| Nature | The WTO is the only global international organization dedicated to regulating trade rules between nations. |

| Successor to GATT | It is the successor to the General Agreement on Tariffs and Trade (GATT), which was in place from 1948 to 1994. |

| Objectives | To facilitate the smooth, predictable, and unrestricted flow of international trade. |

| Working Principles | Based on the principles of MFN and national treatment, ensuring equal and non-discriminatory treatment. |

| Member-Driven Organization | Governed by its member governments, and decisions are made through consensus among these members. |

| Special and Differential Treatment for Developing Countries | The WTO provides specific flexibilities and rights to least developed countries (LDCs) and developing nations. |

DFQF Scheme

- The DFQF access for LDCs was initially decided at the WTO Hong Kong Ministerial Meeting in 2005.

- India became the first developing country to extend this facility to LDCs in 2008, providing preferential market access on 85% of its total tariff lines.

- The scheme was expanded in 2014, offering preferential market access on about 98.2% of India’s tariff lines to LDCs.

Issues highlighted by WTO

(1) Tariff Line Utilisation Data

- WTO data from 2020 indicates that 85% of the tariff lines offered by India under the DFQF scheme show zero utilisation rate.

- China’s utilisation rate for similar tariff lines is 64%, with only 8% of the lines showing a utilisation rate above 95%.

- Utilisation rates for beneficiary LDCs vary significantly, with Guinea and Bangladesh having low rates (8% and 0% respectively), while Benin reports the highest utilisation rate of 98%.

(2) Non-Preferential Tariff Route

- Similar to China, significant amounts of LDC exports enter India under the non-preferential (most favoured nation) tariff route, despite being covered by the Indian preference scheme.

- The report highlights the importance of preference margins, indicating potential duty savings.

- For example, fixed vegetable oil exported from Bangladesh to India has a preference margin of 77.5 percentage points, implying a potential $74 million duty savings if the preference scheme were utilized.

Challenges and Barriers

- The report suggests that the low utilisation of the preference scheme by LDCs is not due to exporter awareness but rather existing barriers that hinder the effective use of preferences.

- The specific barriers preventing LDCs from fully utilizing the scheme are not mentioned in the article.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

Carbon Border Adjustment Mechanism (CBAM): Balancing Trade and Environment

From UPSC perspective, the following things are important :

Prelims level: ETS, CBAM and FTA's

Mains level: Carbon Border Adjustment Mechanism and associated concerns

Central Idea

- The European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM) has raised concerns in India due to its potential impact on the country’s carbon-intensive exports to the EU. While India has criticized CBAM as protectionist and discriminatory, the debate highlights the delicate relationship between trade and environmental considerations.

Understanding The Carbon Border Adjustment Mechanism (CBAM)

- CBAM is a key climate law introduced by the European Union (EU). It is designed to address the issue of carbon leakage and create a level playing field for EU industries by imposing carbon-related costs on certain imported products.

- In 2005, the EU implemented the Emissions Trading System (ETS), a market-based mechanism aimed at reducing greenhouse gas (GHG) emissions.

- Under the ETS, industries within the EU are allocated allowances for their GHG emissions, which can be traded among themselves.

- However, the EU is concerned that imported products may not account for embedded emissions due to less stringent environmental policies in exporting countries.

- This disparity could put EU industries at a competitive disadvantage and potentially lead to carbon leakage, where European firms relocate to countries with less strict emission norms.

- To address these concerns, the CBAM imposes carbon-related costs on imports of specific carbon-intensive products. The products currently included are cement, iron and steel, electricity, fertilizers, aluminium, and hydrogen.

- The CBAM requires importers to pay a price linked to the average emissions cost under the EU’s ETS. If the imported products have already paid an explicit carbon price in their country of origin, a reduction can be claimed.

Advantages of CBAM in addressing climate-related challenges

- Addressing Carbon Leakage: CBAM helps address the issue of carbon leakage, which occurs when domestic industries relocate to countries with less stringent climate policies, leading to increased global emissions. By imposing carbon-related costs on imported products, CBAM aims to discourage carbon-intensive industries from shifting production to countries with lower environmental standards, thereby reducing carbon leakage.

- Encouraging Global Climate Action: CBAM incentivizes countries with carbon-intensive industries to adopt more stringent climate policies. The mechanism sends a signal that products exported to the EU market should meet similar environmental standards as EU-produced goods. This encourages exporting countries to reduce their greenhouse gas emissions and transition to cleaner production processes, contributing to global climate action.

- Levelling the Playing Field: CBAM aims to create a level playing field for EU industries by ensuring that imported goods face similar carbon costs as domestic products. This helps prevent unfair competition, as it aligns the cost of carbon across different markets. It incentivizes domestic industries to invest in cleaner technologies and processes, knowing that imported goods will also be subject to equivalent carbon-related costs.

- Revenue Generation for Climate Initiatives: CBAM has the potential to generate revenue for the EU, which can be used to fund climate initiatives and support the transition to a low-carbon economy. The funds collected through CBAM can be reinvested in research and development, renewable energy projects, or supporting industries in their decarbonization efforts.

- Aligning Trade and Climate Objectives: CBAM highlights the interlinkage between trade and environmental concerns. It creates an opportunity to align trade policies with climate objectives, fostering greater coherence between economic growth and sustainability. CBAM encourages countries to consider the carbon intensity of their exports and provides an impetus for the adoption of climate-friendly practices in international trade.

Key issues associated with CBAM

- Trade Protectionism: CBAM has been accused of being protectionist in nature. Critics argue that it could create barriers to trade and hinder the export capabilities of countries, particularly those with carbon-intensive industries. By imposing carbon-related costs on imports, CBAM may give an advantage to domestic industries and discriminate against foreign competitors.

- Discrimination and Non-Discrimination Principles: CBAM may face challenges in adhering to the principles of non-discrimination within the WTO. While it is designed to be origin-neutral, in practice, it could potentially discriminate between goods from different countries based on varying carbon pricing policies or reporting requirements. This could lead to disputes and challenges under WTO rules.

- Complexity and Implementation Challenges: CBAM implementation involves complex calculations and mechanisms to determine the carbon-related costs of imported products. Setting up effective monitoring, reporting, and verification systems to ensure compliance could be challenging, both for the EU and exporting countries. The administrative burden and costs associated with implementing CBAM may also pose practical difficulties.

- Potential for Double Regulation: Some argue that CBAM may lead to overlapping regulations and duplicate efforts. Exporting countries may already have their own carbon pricing mechanisms or environmental regulations in place. CBAM’s imposition of additional costs on top of these existing measures could be seen as redundant and burdensome.

- Impact on Developing Countries: Developing countries, which often have carbon-intensive industries, may face disproportionate negative effects from CBAM. These countries might struggle to comply with the stringent requirements and costs associated with CBAM, hindering their economic development and ability to compete in global markets.

- Incomplete Accounting of Emissions: CBAM focuses on explicit carbon prices, which may not fully account for the implicit costs associated with products from different countries. This incomplete accounting could result in arbitrary or unjustifiable discrimination and may not effectively incentivize countries to adopt more stringent environmental policies.

WTO Consistency and CBAM potential discrimination

- WTO’s non-discrimination principle: The World Trade Organization (WTO) operates on the principle of non-discrimination, treating ‘like’ products from different countries equally.

- Origin-neutral CBAM: While CBAM appears origin-neutral in design, its application could potentially discriminate between goods based on inadequate carbon pricing policies or burdensome reporting requirements for importers. Whether the products affected by CBAM are truly ‘like’ is a key consideration.

- For instance: While steel products may seem similar, different production methods lead to varying carbon intensity. This raises the question of whether processes and production methods should be relevant for comparing products. Critics argue that CBAM violates WTO law by discriminating based on embedded emissions

General Exceptions under WTO and potential application for CBAM

- Exceptions allow countries to deviate from trade rules: The General Exceptions, outlined in Article XX of the General Agreement on Tariffs and Trade (GATT), provide a set of policy grounds under which WTO members can justify trade measures that would otherwise violate their WTO obligations. These exceptions allow countries to deviate from certain trade rules for specified policy reasons.

- Justification for exception: Article XX of the GATT lists various policy justifications, including public health, conservation of natural resources, and protection of the environment. The use of these exceptions is subject to meeting specific requirements, known as the chapeau. The chapeau sets out conditions that must be satisfied to justify a trade measure.

- In the context of the CBAM: A WTO member implementing CBAM measures might seek to invoke the General Exceptions in Article XX of the GATT to justify any potential inconsistency with non-discrimination obligations.

- For example: A country might argue that CBAM measures are necessary for the conservation of exhaustible natural resources or the protection of the environment, thereby justifying any deviation from non-discrimination principles.

What are the concerns raised in India?

- Impact on Export of Carbon-Intensive Products: India fears that CBAM implementation could severely affect its export of carbon-intensive products, particularly in sectors like aluminium, iron, and steel. These sectors may face significant challenges in accessing the EU market if they are subjected to additional economic costs due to CBAM.

- Protectionism and Discrimination: India has criticized CBAM as being protectionist and discriminatory. It argues that the mechanism may create trade barriers and hinder the export competitiveness of Indian industries. India fears that CBAM could give an unfair advantage to EU domestic industries at the expense of Indian exporters.

- Potential Economic Disruption: The implementation of CBAM may disrupt India’s trade flows and economic stability. The imposition of additional costs on carbon-intensive products exported to the EU market could lead to reduced demand, loss of market share, and potential negative impacts on employment and economic growth in India.

- World Trade Organization (WTO) Challenge: India has contemplated the possibility of challenging CBAM at the WTO’s dispute settlement body. It raises concerns about the compatibility of CBAM with WTO rules, particularly regarding non-discrimination and trade-related principles

- Interplay between Trade and the Environment: The concerns raised by India highlight the broader issue of the interplay between trade and environmental considerations. While acknowledging the need for environmental protection, India emphasizes the importance of ensuring that environmental measures do not become a smokescreen for trade protectionism.

Facts for prelims

What is Regional Trade Agreement (RTA)?

What is Free Trade Agreement (FTA)?

|

Conclusion

- The implementation of the EU’s CBAM has sparked concerns in India, primarily due to its potential impact on carbon-intensive exports. Analyzing its WTO consistency and potential justifications under the General Exceptions clause is crucial. In the ongoing India-EU free trade agreement negotiations, India should actively engage with the EU to safeguard its interests regarding CBAM while remaining open to the possibility of a WTO challenge.

Also read:

| India-EU Free Trade Agreement |

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

WTO reforms a top priority: India

From UPSC perspective, the following things are important :

Prelims level: WTO

Mains level: Reforms in multilateral institutions

Central Idea

- India has stressed the urgent need for prioritizing reforms within the World Trade Organisation (WTO).

- India has been advocating for WTO reforms and improved dispute settlement mechanisms during G20 discussions.

About WTO

| Functions and Principles | |

| Establishment | 1 January 1995 |

| Functions |

|

| Fundamental principles |

|

| Membership | 164 member countries representing over 98% of global trade |

| Decision-making |

|

Prioritizing WTO Reforms

- India’s Push for Reforms: India has been actively advocating for reforms within the World Trade Organisation.

- Better Dispute Settlement Mechanisms: Alongside reforms, India is pushing for improved dispute settlement mechanisms within the WTO.

- Reaffirming Foundational Principles: The discussions aim to reaffirm the principles enshrined in the Marrakesh Agreement and the multilateral trade agreements, emphasizing the importance of an open, fair, inclusive, and transparent WTO.

Reforms that India is seeking

- Structural Reforms: There is an urgent need for reforms within the WTO to address issues such as transparency, shorter time frames, the establishment of a permanent panel body, and special and differential treatment for developing countries.

- Benefit for Developing Countries: Developing countries, including India, can benefit from these reforms if proposals specific to their needs are accepted.

- Trade Facilitation for Services: While the WTO has made progress with the Trade Facilitation Agreement (TFA) concerning goods, there is a need for reforms in trade facilitation for services. India, as a major service provider, stands to benefit from improved cross-border movement of people.

- Inclusivity: It is crucial to establish procedures and practices that are more inclusive, particularly for developing countries.

- Peace Clauses: Adoption of “peace clauses” for developing countries’ implementation of current agreements can formalize commitments by major trading powers to allow grace periods and exercise due restraint.

- Evolving Negotiation Modes: The single package approach used in the Uruguay Round is not effective in the Doha Round, necessitating the exploration of new negotiation modes.

- Strengthened Dispute Settlement Mechanism: The dispute settlement mechanism within the WTO requires strengthening and expediting to enhance its effectiveness.

- Separation of Political and Human Rights Issues: There is a need to separate political and human rights issues from trade disputes under Sanitary and Phytosanitary (SPS) norms.

Crossroads for WTO

- Stalled Multilateral Trade Negotiations: The multilateral trade negotiations, including the Doha Round, have reached an impasse, with limited progress in overall rule-making.

- Challenges from Alternative Trade Pacts: Alternative trade pacts, such as mega-regional arrangements, have emerged and posed challenges to the position of trade multilateralism.

- Disagreements on Market Access and Protection: The impasse in the Doha Round primarily stems from differences between highly industrialized countries and large developing countries regarding market access and protection of vulnerable economic sectors.

Importance of Addressing WTO Reforms

- Vital Role of WTO: The Minister emphasized that addressing WTO reforms is of utmost importance as the organization plays a crucial role in ensuring fairness and transparency in global trade.

- Backbone of Multilateral Trading System: The WTO forms the backbone of the multilateral trading system and its reforms are necessary to strengthen its functioning.

India’s Aspirations in International Trade

- Global Leadership Ambition: India has expressed India’s aspiration to emerge as a global leader in the international trade landscape.

- E-commerce Market Potential: India is poised to become the world’s second-largest e-commerce market, reflecting its transformation driven by open markets, global integration, and a strong entrepreneurial spirit.

Way Forward

- The urgent need for WTO reforms necessitates concerted efforts and global attention to ensure the fairness, transparency, and effectiveness of the multilateral trading system.

- India’s active participation in advocating for reforms, along with its ambition to become a global leader in international trade, reflects its commitment to fostering a thriving and inclusive global trade environment.

- It is essential for countries to collaborate and engage in constructive dialogue to address the challenges and opportunities in the evolving global trade landscape.

Back2Basics: WTO Agreements and Accords

- General Agreement on Tariffs and Trade (GATT): The GATT is the predecessor to the WTO and was in effect from 1948 to 1994. It aimed to reduce trade barriers and promote international trade through negotiations and tariff concessions.

- Agreement on Agriculture (AoA): This agreement aims to establish fair and market-oriented agricultural trading systems. It addresses issues such as market access, domestic support, and export subsidies related to agricultural products.

- Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS): The TRIPS agreement sets minimum standards for protecting intellectual property rights, including patents, copyrights, trademarks, and trade secrets.

- Agreement on Trade-Related Investment Measures (TRIMs): This agreement prohibits certain investment measures that restrict trade or are inconsistent with the GATT’s principles.

- Agreement on Sanitary and Phytosanitary Measures (SPS): The SPS agreement sets out rules for food safety and animal and plant health standards to ensure that countries do not use sanitary and phytosanitary measures as unjustified trade barriers.

- Agreement on Technical Barriers to Trade (TBT): The TBT agreement aims to ensure that technical regulations, standards, and conformity assessment procedures do not create unnecessary obstacles to trade.

- Agreement on Subsidies and Countervailing Measures (SCM): The SCM agreement regulates the use of subsidies and provides a framework for countervailing measures to address unfair trade practices arising from the use of subsidies.

- Trade Facilitation Agreement (TFA): The TFA aims to simplify and streamline customs procedures, enhance transparency, and improve efficiency in international trade, with a focus on reducing trade costs and facilitating cross-border trade.

Get an IAS/IPS ranker as your personal mentor for UPSC 2024

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

WTO panel rules against India in IT tariffs dispute

From UPSC perspective, the following things are important :

Prelims level: World Trade Organization (WTO)

Mains level: Read the attached story

A World Trade Organization (WTO) panel has ruled that India has violated global trading rules in a dispute with the European Union (EU), Japan, and Taiwan over import duties on IT products.

About World Trade Organization (WTO)

| Details | |

| Purpose | Regulate and facilitate international trade between nations |

| Establishment | 1995 |

| Headquarters | Geneva, Switzerland |

| Membership | 164 member countries as of 2023, representing over 98% of global trade |

| Goal | Promote free and fair trade by negotiating and enforcing rules and agreements governing international trade |

| Agreements | Administers a number of agreements, including GATT, SPS Agreement, and TRIPS Agreement |

| Dispute Resolution | Operates a dispute settlement system to resolve conflicts between member countries |

| Technical Assistance | Provides technical assistance and training to help developing countries participate more effectively in international trade |

| Decision-Making Body | Ministerial Conference, which meets every two years |

| Director-General | Chief executive responsible for overseeing the organization’s operations and activities |

| Criticisms | Some criticize the WTO for being undemocratic, favoring developed countries, and not doing enough to promote labor and environmental standards in international trade |

What was the case?

- The case involved a dispute over India’s introduction of import duties ranging from 7.5% to 20% on a wide range of IT products, including mobile phones, components, and integrated circuits.

- The EU, Japan, and Taiwan challenged these import duties in 2019, arguing that they exceeded the maximum rate allowed under global trading rules.

- The recent ruling by the WTO panel found that India had violated these rules and recommended that India bring its measures into conformity with its obligations.

WTO Panel’s Ruling

- The WTO panel has ruled that India violated global trading rules by imposing these import duties.

- The panel recommended that India bring these measures into conformity with its obligations.

- While the panel broadly backed the complaints against India, it rejected one of Japan’s claims that India’s customs notification lacked “predictability”.

Implications of the ruling

- The EU is India’s third-largest trading partner, accounting for 10.8% of total Indian trade in 2021, according to the European Commission.

- The ruling could have implications for trade relations between India and the EU, as well as Japan and Taiwan.

- India may be required to lower or eliminate the challenged import duties.

- It remains to be seen whether India will appeal against the ruling.

- If it does, the case will sit in legal purgatory since the WTO’s top appeals bench is no longer functioning due to US opposition to judge appointments.

Conclusion

- The panel recommended that India bring such measures into conformity with its obligations, and it remains to be seen whether India will appeal against the ruling.

- The case highlights the importance of complying with global trading rules and the role of the WTO in resolving trade disputes between countries.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

WTO and India

India’s WTO Challenge on MSP Programs for Food Grain

From UPSC perspective, the following things are important :

Prelims level: WTO subsdies, Bali Peace Clause

Mains level: India-WTO row over agricultural subsidies

Central idea: India has been criticized at the World Trade Organization (WTO) for not adequately addressing questions raised by members regarding its Minimum Support Price (MSP) programs for food grain, particularly rice.

Minimum Support Price (MSP)

|

Genesis of the row

- WTO members such as the US, Australia, Canada, the EU, and Thailand have alleged that India did not provide sufficient responses during consultations.

- The MSP programs have breached prescribed subsidy limits and are under scrutiny at the WTO argued these countries.

- With this, India became the first country to invoke the Bali ‘peace clause’ to justify exceeding its 10% ceiling for rice support in 2018-2019 and 2019-2020.

What is ‘Bali Peace Clause’?

- India’s minimum support price (MSP) falls under the amber box subsidies category.

- India has exceeded its limits for amber box subsidies for rice for two consecutive years, which is why it has been challenged at the WTO.

- The Bali ‘peace clause’ allows developing countries to exceed their 10% ceiling without facing legal action by other members.

- However, it is subject to numerous conditions, such as not distorting global trade and not affecting food security of other members.

- India’s MSP programs are subject to the ‘peace clause’, but some WTO members have accused India of habitually not including all required information in its notifications.

Allegations of Inadequate Reporting by India

- WTO members have been accusing India of not reporting all public stockholding programs under the ‘peace clause’.

- Some members have pointed out that India also lacks an adequate monitoring mechanism to ensure that no stocks are exported.

- India, on the other hand, argues that it is not obligated to notify any public stockholding programs other than for the crop where the subsidy limits were breached.

Impact on India’s MSP Programs

- The criticism from WTO members could have an impact on India’s MSP programs for food grain, particularly rice.

- The conditions set under the ‘peace clause’ could limit India’s ability to exceed the subsidy limits and support its farmers.

- India may have to provide more detailed notifications and monitoring mechanisms to address the concerns of other members and ensure compliance with WTO regulations.

Why is India defending its stance on MSPs?

- India faces several challenges in the agricultural sector, including climate change, soil degradation, and water scarcity.

- The country also has to deal with farmers’ distress due to low prices for their produce, which is why the MSP program was introduced in the first place.

- The challenge posed by the WTO to the MSP program could further exacerbate the problems faced by Indian farmers.

Back2Basics: WTO and its Subsidies Boxes

The World Trade Organization (WTO) is an intergovernmental organization that is responsible for regulating international trade between nations.

- Establishment: It was established on January 1, 1995, and currently has 164 member countries.

- Objective: To ensure that trade flows as smoothly, predictably, and freely as possible.