Note4Students

From UPSC perspective, the following things are important :

Prelims level: PMMVY

Mains level: Maternity healthcare

The government’s maternity benefit scheme, or Pradhan Mantri Matru Vandana Yojana, has crossed 1.75 crores, eligible women, till the financial year 2020, the Centre informed Parliament.

PMMVY

- The PMMVY is a maternity benefit program introduced in 2017 and is implemented by the Ministry of Women and Child Development.

- It is a conditional cash transfer scheme for pregnant and lactating women of 19 years of age or above for the first live birth.

- It provides partial wage compensation to women for wage-loss during childbirth and childcare and to provide conditions for safe delivery and good nutrition and feeding practices.

- Under the scheme, pregnant women and lactating mothers receive ₹5,000 on the birth of their first child in three instalments, after fulfilling certain conditionalities.

- In 2013, the scheme was brought under the National Food Security Act, 2013 to implement the provision of cash maternity benefit stated in the Act.

- The direct benefit cash transfer is to help expectant mothers meet enhanced nutritional requirements as well as to partially compensate them for wage loss during their pregnancy.

Eligibility Conditions and Conditionalities

The first transfer (at pregnancy trimester) of ₹1,000 requires the mother to:

- Register pregnancy at the Anganwadi Centre (AWC) whenever she comes to know about her conception

- Attend at least one prenatal care session and taking Iron-folic acid tablets and TT1 (tetanus toxoid injection), and

- Attend at least one counselling session at the AWC or healthcare centre.

The second transfer (six months of conception) of ₹2,000 requires the mother to:

- Attend at least one prenatal care session and TT2

The third transfer (three and a half months after delivery) of ₹2,000 requires the mother to:

- Register the birth

- Immunize the child with OPV and BCG at birth, at six weeks and at 10 weeks

- Attend at least two growth monitoring sessions within three months of delivery

Additionally, the scheme requires the mother to:

- Exclusively breastfeed for six months and introduce complementary feeding as certified by the mother

- Immunize the child with OPV and DPT

- Attend at least two counselling sessions on growth monitoring and infant and child nutrition and feeding between the third and sixth months after delivery

Before judging this factual information, take this PYQ form 2019:

Q.Which of the following statements is/are correct regarding the Maternity Benefit (Amendment) Act, 2017?

- Pregnant women are entitled to three months pre-delivery and three months post-delivery paid leave.

- Enterprises with creches must allow the mother a minimum of six crèche visits daily.

- Women with two children get reduced entitlements.

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Jal Jeevan Mission

Mains level: Drinking water scarcity in Urban India

The urban water supply mission under the Jal Jeevan Mission announced in the Budget would include rejuvenation of water bodies as well as 20% of supply from reused water.

Access to safe drinking water has been a grave problem for India, especially in rural areas where lack of usable water has resulted in decades-old sanitation and health problems.

Jal Jeevan Mission

- Jal Jeevan Mission, a central government initiative under the Ministry of Jal Shakti, aims to ensure access of piped water for every household in India.

- The mission’s goal is to provide to all households in rural India safe and adequate water through individual household tap connections by 2024.

- The Har Ghar Nal Se Jal programme was announced by FM in Budget 2019-20 speech.

- This programme forms a crucial part of the Jal Jeevan Mission.

- The programme aims to implement source sustainability measures as mandatory elements, such as recharge and reuse through greywater management, water conservation, and rainwater harvesting.

Urban component of the mission

- The mission is meant to create a people’s movement for water, making it everyone’s priority.

- There are an estimated gap of 2.68 crore urban household tap connections that the Mission would seek to bridge in all 4,378 statutory towns.

- The Mission would also aim to bridge the gap of 2.64 crore sewer connections in the 500 cities under the existing Atal Mission for Rejuvenation and Urban Transformation (AMRUT).

- The mission would include rejuvenation of water bodies to boost the sustainable freshwater supply and the creation of green spaces.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: MITRA scheme

Mains level: Textile sector of India

The Finance Minister has proposed setting up of a scheme of Mega Investment Textiles Parks (MITRA) Scheme in her budget speech.

Do not get confused over Sahakar Mitra Scheme and this one.

MITRA Scheme

- MITRA aims to enable the textile industry to become globally competitive, attract large investments, and boost employment generation and exports.

- It will create world-class infrastructure with plug and play facilities to enable create global champions in exports.

- It will be launched in addition to the Production Linked Incentive Scheme (PLI).

- It will give our domestic manufacturers a level-playing field in the international textiles market & pave the way for India to become a global champion of textiles exports across all segments”.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Ayushman Bharat

Mains level: Universal health coverage

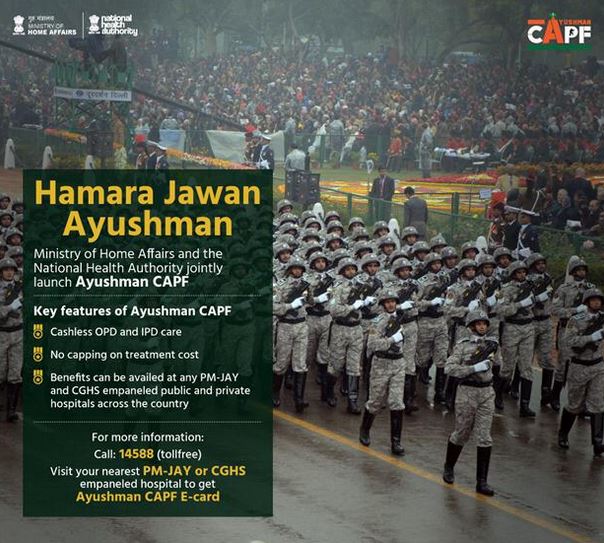

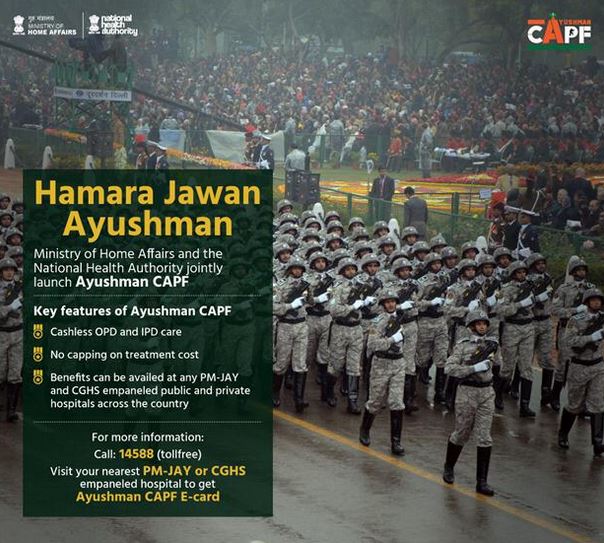

Union Home Minister has rolled out the ‘Ayushman CAPF’ scheme, extending the benefit of the central health insurance programme to the personnel of all Central Armed Police Forces (CAPFs) in the country.

Who are the CAPFs?

- The CAPFs refers to uniform nomenclature of five security forces in India under the authority of the Ministry of Home Affairs.

- Their role is to defend the national interest mainly against the internal threats.

- They are the Border Security Force (BSF), Central Reserve Police Force (CRPF), Central Industrial Security Force (CISF), Indo-Tibetan Border Police (ITBP), Sashastra Seema Bal (SSB)

Ayushman CAPF

- Under this scheme, around 28 lakh personnel of CAPF, Assam Rifles and National Security Guard (NSG) and their families will be covered by ‘Ayushman Bharat: PM Jan Arogya Yojana’ (AB PM-JAY).

- For the CAPF, the existing health coverage was not comprehensive as compared to other military forces.

Do you know?

The goal of universal health coverage (UHC) as stated in the UN Sustainable Development Goals (SDGs no. 3) is one of the most significant commitments to equitable quality healthcare for all.

About Ayushman Bharat

- PM-JAY aims to provide free access to healthcare for 40% of people in the country.

- It is a centrally sponsored scheme and is jointly funded by both the union government and the states.

- It was launched in September 2018 by the Ministry of Health and Family Welfare.

- The ministry has later established the National Health Authority as an organization to administer the program.

Key features:

- Providing health coverage for 10 crores households or 50 crores Indians.

- It provides a cover of 5 lakh per family per year for medical treatment in empanelled hospitals, both public and private.

- Offering cashless payment and paperless recordkeeping through the hospital or doctor’s office.

- Using criteria from the Socio-Economic and Caste Census 2011 to determine eligibility for benefits.

- There is no restriction on family size, age or gender.

- All previous medical conditions are covered under the scheme.

- It covers 3 days of pre-hospitalization and 15 days of post-hospitalization, including diagnostic care and expenses on medicines.

- The scheme is portable and a beneficiary can avail medical treatment at any PM-JAY empanelled hospital outside their state and anywhere in the country.

Note these features. They cannot be memorized all of sudden but can be recognized if a tricky MCQ comes in the prelims.

Must read:

[Burning Issue] Ayushmaan Bharat

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PMKVY

Mains level: Skill Development

The Ministry of Skill Development and Entrepreneurship (MSDE) has launched Pradhan Mantri Kaushal Vikas Yojana (PMKVY) 3.0.

Note the differences between all three versions of PMKVY.

PMKVY 3.0

- PMKVY 3.0 envisages training of eight lakh candidates over the scheme period of 2020-2021.

- This phase three will focus on new-age and COVID-related skills.

- The 729 PM Kaushal Kendras (PMKKs), empanelled non-PMKK training centres and more than 200 industrial training institutes under Skill India will be rolling out under it.

- On the basis of the learning gained from PMKVY 1.0 and PMKVY 2.0, the MSDE has improved the newer version of the scheme to match the current policy doctrine and energize the skilling ecosystem.

Implementation

- PMKVY 3.0 will be implemented in a more decentralized structure with greater responsibilities and support from States/UTs and Districts.

- District Skill Committees (DSCs), under the guidance of State Skill Development Missions (SSDM), shall play a key role in addressing the skill gap and assessing demand at the district level.

- The new scheme will be more trainee- and learner-centric addressing the ambitions of aspirational Bharat.

- PMKVY 2.0 broadened the skill development with the inclusion of Recognition of Prior Learning (RPL) and focus on training.

- With the advent of PMKVY 3.0, the focus is on bridging the demand-supply gap by promoting skill development in areas of new-age and Industry 4.0 job roles.

Back2Basics: PMKVY 1.0

- PMKVY is a skill development initiative scheme of the Government of India for recognition and standardization of skills launched on16 July 2015;.

- The aim of the scheme is to encourage aptitude towards employable skills and to increase the working efficiency of probable and existing daily wage earners, by giving monetary awards and rewards and by providing quality training to them.

- For this qualification plans and quality, plans have been developed by various Sector Skill Councils (SSC) created with the participation of Industries.

- National Skill Development Council (NSDC) has been made coordinating and driving agency for the same.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PMFBY

Mains level: Success of PMFBY

The Pradhan Mantri Fasal Bima Yojana (PMFBY) has completed 5 Years of successful operations.

It has become vital these days to remember and recognize every detail of government schemes.

What is PMFBY?

- 5 years ago, on 13th January 2016, the GoI took a historic step towards strengthening risk coverage of crops for farmers of India and approved the flagship crop insurance scheme – the PMFBY.

- The scheme was conceived as a milestone initiative to provide a comprehensive risk solution at the lowest uniform premium across the country for farmers.

- Premium cost over and above the farmer share is equally subsidized by States and GoI.

- However, GoI shares 90% of the premium subsidy for the North Eastern States to promote the uptake in the region.

- The average sum insured per hectare has increased from ₹15,100 during the pre-PMFBY Schemes to ₹40,700 under PMFBY.

Coverage of Risks and Exclusions:

Following stages of the crop and risks leading to crop loss are covered under the scheme.

- Prevented Sowing/ Planting Risk: The insured area is prevented from sowing/ planting due to deficit rainfall or adverse seasonal conditions

- Standing Crop (Sowing to Harvesting): Comprehensive risk insurance is provided to cover yield losses due to non-preventable risks, viz. Drought, Dry spells, Flood, Inundation, Pests and Diseases, Landslides, Natural Fire and Lightening, Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane and Tornado.

- Post-Harvest Losses: Coverage is available only up to a maximum period of two weeks from harvesting for those crops which are allowed to dry in cut and spread condition in the field after harvesting against specific perils of a cyclone and cyclonic rains and unseasonal rains.

- Localized Calamities: Loss/ damage resulting from the occurrence of identified localized risks of hailstorm, landslide, and Inundation affecting isolated farms in the notified area.

Try this question from CSP 2020:

Q.Under the Kisan Credit Card Scheme, short-term credit support is given to farmers for which of the following purposes? (CSP 2020)

- Working capital for maintenance of farm assets

- Purchase of combine harvesters, tractors and mini trucks

- Consumption requirements of farm households

- Construction of family house and setting up of village cold storage facility

- Construction of family house and setting up of village cold storage facility

Select the correct answer using the code given below:

(a) 1,2 and 5 only

(b) 1,3 and 4 only

(c) 2,3,4 and 5 only

(d) 1, 2, 3 and 4

Progress till date

- The Scheme covers over 5.5 crore farmer applications year on year.

- Till date, claims worth Rs 90,000 crores have already been paid out under the Scheme.

- Aadhar seeding has helped in speedy claim settlement directly into the farmer accounts.

- Even during COVID lockdown period, nearly 70 lakh farmers benefitted and claims worth Rs. 8741.30 crores were transferred to the beneficiaries.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PM-KISAN

Mains level: Not Much

PM-KISAN payments worth ₹1,364 crores have been wrongly made to more than 20 lakh ineligible beneficiaries and income tax payer farmers.

Try this PYQ:

Q.Under the Kisan Credit Card Scheme, short-term credit support is given to farmers for which of the following purposes? (CSP 2020)

- Working capital for maintenance of farm assets

- Purchase of combine harvesters, tractors and mini trucks

- Consumption requirements of farm households

- Construction of family house and setting up of village cold storage facility

- Construction of family house and setting up of village cold storage facility

Select the correct answer using the code given below:

(a) 1,2 and 5 only

(b) 1,3 and 4 only

(c) 2,3,4 and 5 only

(d) 1, 2, 3 and 4

PM-KISAN

- The Pradhan Mantri Kisan Samman Nidhi Yojana (PM-Kisan Yojana) is a government scheme through which, all small and marginal farmers will get up to Rs 6,000 per year as minimum income support.

- Under the PM-KISAN scheme, all landholding farmers’ families shall be provided with the financial benefit of Rs. 6000 per annum per family payable in three equal instalments of Rs. 2000 each, every four months.

- The definition of the family for the scheme is husband, wife, and minor children.

- State Government and UT administration will identify the farmer families which are eligible for support as per scheme guidelines.

- The fund will be directly transferred to the bank accounts of the beneficiaries.

Why in news?

- When it was launched just before the general election in 2019, it was meant to cover only small and marginal farmers who owned less than two hectares.

- Later that year, large farmers were included in the scheme as the government removed land size criteria.

Certain exclusions

- However, certain exclusions remained.

- If any member of a farming family paid income tax, received a monthly pension above ₹10,000, held a constitutional position, or was a serving or retired government employee, they were not eligible for the scheme.

- Professionals and institutional landholders were also excluded.

Who are NOT eligible for PM-KISAN?

The following categories of beneficiaries of higher economic status shall not be eligible for benefit under the scheme.

- All Institutional Landholders.

Farmer families that belong to one or more of the following categories:

- Former and present holders of constitutional posts

- Former and present Ministers/ State Ministers and former/present Members of Lok Sabha/ Rajya Sabha/ State Legislative Assemblies/ State Legislative Councils, former and present Mayors of Municipal Corporations, former and present Chairpersons of District Panchayats.

- All serving or retired officers and employees of Central/ State Government Ministries

- All superannuated/retired pensioners whose monthly pension is Rs.10,000/-or more. (Excluding Multi-Tasking Staff / Class IV/Group D employees) of the above category

- All Persons who paid Income Tax in the last assessment year

- Professionals like Doctors, Engineers, Lawyers, Chartered Accountants, and Architects registered with Professional bodies and carrying out the profession by undertaking practices.

Note: It is not so easy to remember all such exclusions. But one must be able to recognize them by applying pure logic and thumb rule. This can be well understood from the PYQ given.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: JK IDS, 2021

Mains level: Development of JK region

The Union Govt. has formulated the New Industrial Development Scheme for Jammu & Kashmir (J&K IDS, 2021).

Tap to read more about: Reorganization of J&K

J&K IDS, 2021

- It is a new Central Sector Scheme for the development of Industries in the UT of Jammu & Kashmir.

- The main purpose of the scheme is to generate employment which directly leads to the socio-economic development of the area.

Incentives available

- Capital Investment Incentive at the rate of 30% in Zone A and 50% in Zone B on the investment made in Plant & Machinery (in manufacturing) or construction of the building is available.

- Capital Interest subvention: At the annual rate of 6% for a maximum of 7 years on loan amount up to Rs. 500 crore for investment in plant and machinery (in manufacturing) or construction of the building.

- GST Linked Incentive: 300% of the eligible value of actual investment made in plant and machinery (in manufacturing) or construction in building for 10 years.

- Working Capital Interest Incentive: All existing units at an annual rate of 5% for a maximum of 5 years. Maximum limit of incentive is Rs 1 crore.

Key features:

- The scheme is made attractive for both smaller and larger units.

- Smaller units with an investment in plant & machinery upto Rs. 50 crore will get a capital incentive upto Rs. 7.5 crore and get capital interest subvention at the rate of 6% for a maximum of 7 years

- The scheme aims to take industrial development to the block level in UT of J&K, which is the first time in any Industrial Incentive Scheme of the GoI.

- The scheme has been simplified on the lines of ease of doing business by bringing one major incentive- GST Linked Incentive- that will ensure less compliance burden without compromising on transparency.

- It is not a reimbursement or refund of GST but gross GST is used to measure eligibility for industrial incentive to offset the disadvantages that the UT of J&K face

Major Impact and employment generation potential:

- The scheme is to bring about a radical transformation in the existing industrial ecosystem of J&K with emphasis on job creation, skill development and sustainable development.

- It is anticipated that the proposed scheme is likely to attract unprecedented investment and give direct and indirect employment to about 4.5 lakh persons.

- Additionally, because of the working capital interest subvention, the scheme is likely to give indirect support to about 35,000 persons.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: ICDS, Matru Sahyogini Samitis Scheme

Mains level: Not Much

The MP government has issued an order for the appointment of committees led by mothers to ensure better monitoring of services delivered at Anganwadi or day-care centres across the State.

Try this PYQ:

Q.Which of the following are the objectives of ‘National Nutrition Mission’?

- To create awareness relating to malnutrition among pregnant women and lactating mothers.

- To reduce the incidence of anaemia among young children, adolescent girls and women.

- To promote the consumption of millets, coarse cereals and unpolished rice.

- To promote the consumption of poultry eggs.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 1, 2 and 3 only

(c) 1, 2 and 4 only

(d) 3 and 4 only

Matru Sahyogini Samitis

- Called ‘Matru Sahyogini Samiti’ or Mothers’ Cooperation Committees, these will comprise 10 mothers at each Anganwadi centres.

- They would be representing the concerns of different sets of beneficiaries under the Integrated Child Development Services, or National Nutrition Mission.

- Beneficiaries’ would include children between six months to three years, children between three years and six years, adolescent girls and pregnant women and lactating mothers.

- These mothers will keep a watch on weekly ration distribution to them as well as suggest nutritious and tasteful recipes for meals served to children at the centres.

- The move is being taken as per the mandate of the National Food Security Act, 2013 (NFSA).

Its’ functioning

- The committees will include mothers of beneficiary children as well as be represented by pregnant women and lactating mothers who are enrolled under the scheme.

- The Anganwadi scheme includes a package of six services delivered at the centres, including supplementary nutrition, health services including vaccination, early education, among others.

- The Committees will also include a woman panch, women active in the community and eager to volunteer their support to the scheme, teachers from the local school, and women heads of self-help groups (SHG).

Why such a move?

- This is in a move that is aimed at strengthening community response to the problem of hunger and malnutrition in the State.

- With the help of mothers, we will be able to turn anganwadis into a community health system, a nutrition management centre, and spread awareness against social evils.

- These will turn into a model for local governance as well as allow for greater engagement between communities and the State government.

Back2Basics: Integrated Child Development Services (ICDS)

- The ICDS aims to provide food, preschool education, primary healthcare, immunization, health check-up and referral services to children under 6 years of age and their mothers.

- The scheme was launched in 1975, discontinued in 1978 by the government of Morarji Desai, and then relaunched by the Tenth Five Year Plan.

- The tenth FYP also linked ICDS to Anganwadi centres established mainly in rural areas and staffed with frontline workers.

- The ICDS provide for anganwadis or day-care centres which deliver a package of six services including:

- Immunization

- Supplementary nutrition

- Health checkup

- Referral services

- Pre-school education (Non-Formal)

- Nutrition and Health information

Implementation

- For nutritional purposes, ICDS provides 500 kilocalories (with 12-15 grams of protein) every day to every child below 6 years of age.

- For adolescent girls, it is up to 500-kilo calories with up to 25 grams of protein every day.

- The services of Immunisation, Health Check-up and Referral Services delivered through Public Health Infrastructure under the Ministry of Health and Family Welfare.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PM-FME Scheme

Mains level: Food processing industry and the required reforms

Union Minister for Food Processing Industries has inaugurated the capacity building component of the Pradhan Mantri Formalization of Micro food processing Enterprises scheme (PM-FME Scheme).

The event also sought the launch of the GIS One District One Product (ODOP) Digital Map of India.

Practice question for mains:

Q.What is the PM FME Scheme? Discuss its potential to neutralize various challenges faced by India’s unorganized food industries

PM-FME Scheme

- Launched under the Aatmanirbhar Bharat Abhiyan, the PM-FME Scheme is a centrally sponsored scheme.

- It aims to enhance the competitiveness of existing individual micro-enterprises in the unorganized segment of the food processing industry and promote formalization of the sector.

- It seeks to provide support to Farmer Producer Organizations, Self Help Groups, and Producers Cooperatives along their entire value chain.

- Under the PM-FME scheme, capacity building is an important component.

- The scheme envisages imparting training to food processing entrepreneurs, various groups, viz., SHGs / FPOs / Co-operatives, workers, and other stakeholders associated with the implementation of the scheme.

Features of the scheme

- The Scheme adopts One District One Product (ODODP) approach to reap the benefit of scale in terms of procurement of inputs, availing common services and marketing of products.

- The States would identify food product for a district keeping in view the existing clusters and availability of raw material.

- The ODOP product could be a perishable produce based product or cereal-based products or a food product widely produced in a district and their allied sectors.

- An illustrative list of such products includes mango, potato, litchi, tomato, tapioca, kinnu, bhujia, petha, papad, pickle, millet-based products, fisheries, poultry, meat as well as animal feed among others.

- The Scheme also place focus on waste to wealth products, minor forest products and Aspirational Districts.

About ODOP Digital Map

- The GIS ODOP digital map of India provides details of ODOP products of all the states to facilitate the stakeholders.

- The digital map also has indicators for tribal, SC, ST, and aspirational districts.

- It will enable stakeholders to make concerted efforts for its value chain development.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Viability Gap Funding

Mains level: Not Much

The government has expanded the provision of financial support by means of viability gap funding for public-private partnerships (PPPs) in infrastructure projects to include critical social sector investments in sectors such as health, education, water and waste treatment.

Note the minutes of VGF, its meaning, funding mechanism, various sectors included and its nodal ministry etc. UPSC can ask static statements based question.

What is the move?

- Now, under this scheme, private sector projects in areas like wastewater treatment, solid waste management, health, water supply and education, could get 30% of the total project cost from the Centre.

- Separately, pilot projects in health and education, with at least 50% operational cost recovery, can get as much as 40% of the total project cost from the central government.

- The Centre and States would together bear 80% of the capital cost of the project and 50% of operation and maintenance costs of such projects for the first five years.

Viability Gap Funding (VGF) Scheme

- Viability Gap Finance means a grant to support projects that are economically justified but not financially viable.

- The scheme is designed as a Plan Scheme to be administered by the Ministry of Finance and amount in the budget are made on a year-to-year basis.

- Such a grant under VGF is provided as a capital subsidy to attract the private sector players to participate in PPP projects that are otherwise financially unviable.

- Projects may not be commercially viable because of the long gestation period and small revenue flows in future.

- The VGF scheme was launched in 2004 to support projects that come under Public-Private Partnerships.

Its’ funding

- Funds for VGF will be provided from the government’s budgetary allocation. Sometimes it is also provided by the statutory authority who owns the project asset.

- If the sponsoring Ministry/State Government/ statutory entity aims to provide assistance over and above the stipulated amount under VGF, it will be restricted to a further 20% of the total project cost.

VGF grants

- VGF grants will be available only for infrastructure projects where private sector sponsors are selected through a process of competitive bidding.

- The VGF grant will be disbursed at the construction stage itself but only after the private sector developer makes the equity contribution required for the project.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PLI scheme and various sectors

Mains level: Moves for Atmanirbhar Bharat

The Union Cabinet has unveiled the Production-Linked Incentive (PLI) Scheme to encourage domestic manufacturing investments in ten key sectors.

PLI Scheme

- The PLI scheme aims to boost domestic manufacturing and cut down on imports by providing cash incentives on incremental sales from products manufactured in the country.

- Besides inviting foreign companies to set shop in India, the scheme aims to encourage local companies to set up or expand, existing manufacturing units.

UPSC can directly as the sectors included in the PLI scheme. Earlier it was only meant for Electronics manufacturing (particulary mobile phones).

What was the earlier PLI Scheme?

- As a part of the National Policy on Electronics, the IT ministry had notified the PLI scheme on April 1 this year.

- The scheme will, on one hand, attract big foreign investment in the sector, while also encouraging domestic mobile phone makers to expand their units and presence in India.

- It would give incentives of 4-6 per cent to electronics companies which manufacture mobile phones and other electronic components.

- A/c to the scheme, companies that make mobile phones which sell for Rs 15,000 or more will get an incentive of up to 6 per cent on incremental sales of all such mobile phones made in India.

- In the same category, companies which are owned by Indian nationals and make such mobile phones, the incentive has been kept at Rs 200 crore for the next four years.

10 new sectors added

The ten sectors have been identified on the basis of their potential to create jobs and make India self-reliant, include:

- Food processing

- Telecom

- Electronics

- Textiles

- Speciality steel

- Automobiles and auto components

- Solar photo-voltaic modules and

- White goods such as air conditioners and LEDs

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Fortified rice, Biofortification, ICDS

Mains level: Various facets of hunger and malnutrition in India

In a bid to combat chronic anaemia and undernutrition, the government is planning to distribute fortified rice through the Integrated Child Development Services and Mid-Day Meal schemes across the country.

What is Fortified Rice?

- Rice can be fortified by adding a micronutrient powder to the rice that adheres to the grains or spraying of the surface of ordinary rice grains with a vitamin and mineral mix to form a protective coating.

- Rice can also be extruded and shaped into partially precooked grain-like structures resembling rice grains, which can then be blended with natural polished rice.

- Rice kernels can be fortified with several micronutrients, such as iron, folic acid and other B-complex vitamins, vitamin A and zinc.

- These fortified kernels are then mixed with normal rice in a 1:100 ratio, and distributed for consumption.

Note: Biofortification is the process by which the nutritional quality of food crops is improved through agronomic practices, conventional plant breeding, or modern biotechnology. It differs from conventional fortification in that Biofortification aims to increase nutrient levels in crops during plant growth rather than through manual means during the processing of the crops.

What was the earlier initiative?

- The centrally-sponsored pilot scheme was approved in February 2019 for a three-year period from 2019-20 onwards.

- However, only five States — Andhra Pradesh, Gujarat, Maharashtra, Tamil Nadu and Chhattisgarh — have started the distribution of fortified rice in their identified pilot districts.

Need for expansion

- Currently, there are only 15,000 tonnes of these kernels available per year in the country.

- To cover PDS, anganwadis and mid-day meals in the 112 aspirational districts, annual supply capacity would need to be increased to about 1.3 lakh tonnes.

- To cover PDS across the country, 3.5 lakh tonnes of fortified kernels would be needed.

Regulating fortification

- FSSAI has formulated a comprehensive regulation on fortification of foods namely ‘Food Safety and Standards (Fortification of Foods) Regulations, 2016’.

- These regulations set the standards for food fortification and encourage the production, manufacture, distribution, sale and consumption of fortified foods.

- The regulations also provide for the specific role of FSSAI in promotion for food fortification and to make fortification mandatory.

- WHO recommends fortification of rice with iron, vitamin A and folic acid as a public health strategy to improve the iron status of population wherever rice is a staple food.

Back2Basics: Integrated Child Development Services (ICDS)

- The ICDS aims to provide food, preschool education, primary healthcare, immunization, health check-up and referral services to children under 6 years of age and their mothers.

- The scheme was launched in 1975, discontinued in 1978 by the government of Morarji Desai, and then relaunched by the Tenth Five Year Plan.

- The tenth FYP also linked ICDS to Anganwadi centres established mainly in rural areas and staffed with frontline workers.

- The ICDS provide for anganwadis or day-care centres which deliver a package of six services including:

- Immunization

- Supplementary nutrition

- Health checkup

- Referral services

- Pre-school education (Non-Formal)

- Nutrition and Health information

Implementation

- For nutritional purposes, ICDS provides 500 kilocalories (with 12-15 grams of protein) every day to every child below 6 years of age.

- For adolescent girls, it is up to 500-kilo calories with up to 25 grams of protein every day.

- The services of Immunisation, Health Check-up and Referral Services delivered through Public Health Infrastructure under the Ministry of Health and Family Welfare.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Ayushman Sahakar Scheme

Mains level: Impact of coronovirus outbreak

The Agriculture Ministry has rolled out the Ayushman Sahakar Scheme to assist cooperatives in the creation of healthcare infrastructure in the country.

Can you find the peculiarity of this scheme? Yes. It’s the Agriculture and not the Health Ministry.

Ayushman Sahakar Scheme

- The scheme is formulated by the National Cooperative Development Corporation (NCDC), the apex autonomous development finance institution under the Ministry of Agriculture and Farmers Welfare.

- The scheme would give a boost to the provision of healthcare services by cooperatives.

- It specifically covers establishment, modernization, expansion, repairs, renovation of hospital and healthcare and education infrastructure.

Why need such a scheme?

- There is a huge need for medical and nursing education in rural areas. But the problem is a lack of infrastructure.

- Co-ops find it difficult to access credit for such projects as banks may not give them loans for non-agricultural purposes.

Financing the scheme

- NCDC would extend term loans to prospective cooperatives to the tune of Rs 10000 Crore in the coming years.

- Any Cooperative Society with a suitable provision in its byelaws to undertake healthcare-related activities would be able to access the NCDC fund.

- NCDC assistance will flow either through the State Governments/ UT Administrations or directly to the eligible cooperatives.

- Apart from working capital and margin money to meet operational requirements, the scheme will also provide interest subvention of 1% to women majority cooperatives.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: SVAMITVA

Mains level: Land records management in India

Our PM has launched the physical distribution of Property Cards under the SVAMITVA Scheme.

Try this MCQ:

Q.The SVAMITVA Scheme sometimes seen in news is related to:

Urban Employment/ Land records management/ Child Adoption/ None of these

About SVAMITVA

- SVAMITVA stands for Survey of Villages and Mapping with Improvised Technology in Village Areas.

- Under the scheme, the latest surveying technology such as drones will be used for measuring the inhabited land in villages and rural areas.

- The mapping and survey will be conducted in collaboration with the Survey of India, State Revenue Department and State Panchayati Raj Department under the Ministry of Panchayati Raj.

- The drones will draw the digital map of every property falling in the geographical limit of each Indian village.

- Property Cards will be prepared and given to the respective owners.

Significance of the scheme

- The scheme paves the way for using the property as a financial asset by villagers for taking loans and other financial benefits.

- Also, this is the first time ever that such a large-scale exercise involving the most modern means of technology is being carried out to benefit millions of rural property owners.

Various benefits

- The scheme will create records of land ownership in villages and these records will further facilitate tax collection, new building plan and issuance of permits.

- It will enable the government to effectively plan for the infrastructural programs in villages.

- It would help in reducing the disputes over property.

Back2Basics: E-Gramswaraj Portal

- E Gram Swaraj portal is the official portal of central govt for the implementation of Swamitva scheme.

- By visiting this portal people can check their Panchayat profile easily. It will also contain the details of ongoing development works and the fund allocated for them.

- Any citizen can create his or her account on the portal and can know about the developmental works of villages.

- The user of E Gram Swaraj portal can also access all work of the Ministry of Panchayati Raj.

- This single interface will help speed-up the implementation of projects in rural areas from planning to completion.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: MANF Scheme

Mains level: Not Much

The Ministry of Minority Affairs has provided information about the progress of MANF Scheme in the Parliament.

Note: As the name suggests, the scheme particularly aims to target the Minority community. Here, six major groups are considered a minority. Statement based questions often create bluffs on such conditions.

MANF Scheme

- The Ministry of Minority Affairs implements MANF Scheme for educational empowerment of students belonging to six notified minority communities i.e. Buddhist, Christian, Jain, Muslim, Sikh, Zoroastrian (Parsi).

- The Scheme is implemented through the University Grants Commission (UGC) and no waiting list is prepared under the Scheme by UGC.

- Candidates belonging to the Six centrally notified minority are considered for award of fellowship under the MANF Scheme.

- The selection of candidates is done through JRF-NET (Junior Research Fellow- National Eligibility Test) examination conducted by the National Testing Agency.

- Prior to 2019-20, the merit list was prepared on the basis of marks obtained by the candidates in their Post Graduate examination.

- However, in 2018-19, only the candidates who had qualified CBSE-UGC-NET/JRF or CSIR-NET/JRF were eligible to apply.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Schemes covered under the initiaitive

Mains level: Not Much

The Department of Posts has launched a scheme called Five Star Villages, to ensure universal coverage of flagship postal schemes in rural areas of the country.

The Five Star Villages Scheme sounds typically among the most commons types say, Swachh Bharat, Financial Inclusion and Literacy or Infrastructure amenities. Here is the caution for preventing a blunder.

Five Star Villages Scheme

- The scheme seeks to bridge the gaps in public awareness and reach of postal products and services, especially in interior villages.

- The initiatives covered under the scheme include:

- Savings Bank accounts, Recurrent Deposit Accounts, NSC / KVP certificates,

- Sukanya Samridhi Accounts/ PPF Accounts,

- Funded Post Office Savings Account linked India Post Payments Bank Accounts,

- Postal Life Insurance Policy/Rural Postal Life Insurance Policy and

- Pradhan Mantri Suraksha Bima Yojana Account / Pradhan Mantri Jeevan Jyoti Bima Yojana Account.

- If a village attains universal coverage for four schemes from the above list, then that village gets four-star status; if a village completes three schemes, then that village gets three-star status and so on.

Its implementation

- The scheme will be implemented by a team of five Gramin Dak Sevaks who will be assigned a village for the marketing of all products, savings and insurance schemes of the Department of Posts.

- This team will be headed by the Branch Post Master of the concerned Branch Office. Mail overseer will keep personal watch on the progress of the team on daily basis.

- The teams will be led and monitored by concerned Divisional Head, Assistant Superintendents Posts and Inspector Posts.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PMMSY, E Gopala

Mains level: Fisheries sector of India

PM will digitally launch the PM Matsya Sampada Yojana (PMMSY) today.

PM Matsya Sampada Yojana

- The PMMSY aims to bring about the Blue Revolution through sustainable and responsible development of the fisheries sector in India.

- It has an estimated investment of Rs. 20,050 crores for its implementation during a period of 5 years from FY 2020-21 to FY 2024-25 in all States/UTs, as a part of AatmaNirbhar Bharat Package.

- PMMSY aims at enhancing fish production by an additional 70 lakh tonne by 2024-25, increasing fisheries export earnings to Rs.1,00,000 crore by 2024-25.

- Thus it aims doubling of incomes of fishers and fish farmers, reducing post-harvest losses from 20-25% to about 10% and generation of gainful employment opportunities in the sector.

Aims and objectives of PMMSY

- Harnessing of fisheries potential in a sustainable, responsible, inclusive and equitable manner

- Enhancing of fish production and productivity through expansion, intensification, diversification and productive utilization of land and water

- Modernizing and strengthening of the value chain – post-harvest management and quality improvement

- Doubling fishers and fish farmers incomes and generation of employment

- Enhancing contribution to Agriculture GVA and exports

- Social, physical and economic security for fishers and fish farmers

- Robust fisheries management and regulatory framework

Implementation strategy

The PMMSY will be implemented as an umbrella scheme with two separate components namely:

(a) Central Sector Scheme and

(b) Centrally Sponsored Scheme

- Majority of the activities under the Scheme would be implemented with the active participation of States/UTs.

- A well-structured implementation framework would be established for the effective planning and implementation of PMMSY.

- For optimal outcomes, ‘Cluster or area-based approach’ would be followed with requisite forward and backward linkages and end to end solutions.

Other inaugurations: e-Gopala App

- e-Gopala App is a comprehensive breed improvement marketplace and information portal for direct use of farmers.

- At present no digital platform is available in the country for farmers managing livestock including buying and selling of disease-free germplasm in all forms (semen, embryos, etc); availability of quality breeding services and guiding farmers for animal nutrition etc.

- There is no mechanism to send alerts (on the due date for vaccination, pregnancy diagnosis, calving etc) and inform farmers about various government schemes and campaigns in the area.

- The e-Gopala App will provide solutions to farmers on all these aspects.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Mission Karmayogi

Mains level: Civil services reforms

The Union Cabinet gave its approval for Mission Karmayogi, a new national capacity building and performance evaluation programme for civil servants.

Try this MCQ:

Q.The Mission Karmayogi recently seen in news is related to:

a) EPFO reforms

b) Labour laws reforms

c) Civil Services reforms

d) Artisans and Handicrafts

Mission Karmayogi

- The mission is established under the National Programme for Civil Services Capacity Building (NPCSCB).

- It is aimed at building a future-ready civil service with the right attitude, skills and knowledge, aligned to the vision of New India.

- It is meant to be a comprehensive post-recruitment reform of the Centre’s human resource development, in much the same way as the National Recruitment Agency approved last week is pre-recruitment reform.

Why such a mission?

- The capacity of Civil Services plays a vital role in rendering a wide variety of services, implementing welfare programs and performing core governance functions.

Major undertakings of the scheme

- The scheme will cover 46 lakh, Central government employees, at all levels, and involve an outlay of ₹510 crores over a five-year period, according to an official statement.

- The programme will support a transition from “rules-based to roles-based” HR management so that work allocations can be done by matching an official’s competencies to the requirements of the post.

- Apart from domain knowledge training, the scheme will focus on “functional and behavioural competencies” as well, and also includes a monitoring framework for performance evaluations.

- Eventually, service matters such as confirmation after probation period, deployment, work assignments and notification of vacancies will all be integrated into the proposed framework.

- The capacity building will be delivered through iGOT Karmayogi digital platform, with content drawn from global best practices rooted in Indian national ethos.

Apex bodies under the mission

- The Prime Minister’s Public Human Resource Council will be set up as the apex body to direct the reforms.

- There will be an autonomous Capacity Building Commission to be established to manage the reformed system and harmonize training standards across the country so that there is a common understanding of India’s aspirations and development goals.

- A wholly government-owned, not-for-profit special purpose vehicle will be set up to own and operate the digital platform and its content.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: AIF

Mains level: Economic stimulus for Agri sector

PM has launched a new financing scheme under the ₹1 lakh crore AIF.

Note the following things about AIF:

1) It is a Central Sector Scheme

2) Duration of the scheme

3)Target beneficiaries

Agriculture Infrastructure Fund (AIF)

- It is a Central Sector Scheme meant for setting up storage and processing facilities, which will help farmers, get higher prices for their crops.

- It will support farmers, PACS, FPOs, Agri-entrepreneurs, etc. in building community farming assets and post-harvest agriculture infrastructure.

- These assets will enable farmers to get greater value for their produce as they will be able to store and sell at higher prices, reduce wastage and increase processing and value addition.

What exactly is the AIF?

- The AIF is a medium – long term debt financing facility for investment in viable projects for post-harvest management infrastructure and community farming assets through interest subvention and credit guarantee.

- The duration of the scheme shall be from FY2020 to FY2029 (10 years).

- Under the scheme, Rs. 1 Lakh Crore will be provided by banks and financial institutions as loans with interest subvention of 3% per annum.

- It will provide credit guarantee coverage under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) for loans up to Rs. 2 Crore.

Target beneficiaries

The beneficiaries will include farmers:

- PACS, Marketing Cooperative Societies, FPOs, SHGs, Joint Liability Groups (JLG), Multipurpose Cooperative Societies, Agri-entrepreneurs, Startups, and Central/State agency or Local Body sponsored Public-Private Partnership Projects

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now